Who is the tax agent for personal income tax?

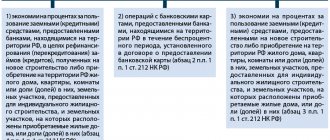

The following persons are recognized as tax agents for personal income tax (clause 1 of Article 226 of the Tax Code of the Russian Federation):

- Russian organizations;

- individual entrepreneurs;

- notaries and lawyers engaged in private practice or having law offices;

- separate divisions of foreign companies.

The tax base for personal income tax is payments to taxpayers at the expense of a tax agent (clause 9 of Article 226 of the Tax Code of the Russian Federation, letters of the Federal Tax Service of the Russian Federation dated 02/06/2017 No. GD-4-8/ [email protected] , Ministry of Finance dated 12/15/2017 No. 03-04 -06/84250).

If a company hires personnel under an employee supply agreement, then the functions of a tax agent for personal income tax remain with the executing organization, since it is the organization that makes direct payments to individuals under employment contracts (letter of the Ministry of Finance of Russia dated November 6, 2008 No. 03-03-06/8/618 ).

Individuals who are not registered as individual entrepreneurs who make payments in favor of individuals who are employees are not recognized as tax agents. In this case, recipients of funds must independently calculate and pay personal income tax (letter of the Ministry of Finance of Russia dated July 13, 2010 No. 03-04-05/3-390).

The list of income subject to personal income tax is presented in Art. 208 Tax Code of the Russian Federation.

Read more about the features of calculating and withholding income tax in the article “Calculation of personal income tax (personal income tax): procedure and formula.”

Who are we talking about?

Not only Russian organizations, but also individual entrepreneurs, representatives of private practices (detectives, notaries, lawyers), as well as ordinary citizens can be recognized as a tax agent (TA).

The current legal status of tax agents is enshrined in Article 24 of the Tax Code of the Russian Federation. Thus, in Russia you can become an RA only for three types of tax obligations:

- Personal income tax. The employer acts as an NA for its employees. That is, when calculating wages and other remuneration for work, the employer is obliged to withhold personal income tax.

- VAT. An entity that has nothing to do with this type of fiscal obligation can become an RA for value added tax. Operations in which an economic entity becomes subject to VAT are named in Art. 146, 161 and 171 of the Tax Code of the Russian Federation. For example, a company that uses the simplified tax system (exempt from VAT) leases or acquires state and/or municipal property. In this case, the company automatically becomes an NA.

- Income tax. A company becomes an NA if it accrues and pays dividends to its founders - legal entities. They are also companies that pay income from the placement of valuable government (municipal) securities. Or companies that pay income to foreign companies that do not have permanent representative offices in Russia become NAs.

Consequently, NAs pay taxes and fees to the budget from other people's income. While taxpayers calculate fiscal payments directly from their funds or income.

Responsibilities of a tax agent – Article 230 of the Tax Code of the Russian Federation

Tax legislation establishes what a personal income tax agent must do. Article number 230 of the Tax Code of the Russian Federation contains a small but comprehensive list from which the responsibilities of a tax agent for personal income tax are visible:

- calculate tax on payments to individuals;

- withhold tax;

- transfer tax amounts to the budget;

- within the prescribed period, report on the calculated, withheld and transferred to the budget income tax in forms 2-NDFL and 6-NDFL. From 2022, 2-NDFL certificates are included in the 6-NDFL calculation.

It is important to perform all the above operations correctly and within the time limit established in the Tax Code of the Russian Federation. ConsultantPlus experts explained in detail how to do this. Full trial access to K+ is available for free. This ready-made solution will help you correctly calculate personal income tax, this material will tell you about the procedure for withholding personal income tax, and this instruction will introduce you to the nuances of transferring personal income tax to the budget.

To fulfill his duties, a tax agent must be able to withhold tax. Payment of tax amounts must be made exclusively on payments to individuals. A tax agent has no right to pay taxes from his own funds. It is also prohibited to include clauses on the payment of tax amounts at the expense of the tax agent for personal income tax in the terms of an employment or civil contract (clause 9 of Article 226 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated July 11, 2017 No. 03-04-06/43981, dated August 30 .2012 No. 03-04-06/9-263). It is also impossible to shift the payment of personal income tax from the agent to the taxpayer himself.

However, the Supreme Court believes that it is impossible to punish a taxpayer for early payment of income tax (see resolution No. 305-KG17-15396 dated December 21, 2017).

The Ministry of Finance allowed the overpayment of personal income tax to be counted against future payments for this tax, but with restrictions. Read more here.

Also, starting from 2022, the tax agent has the right to pay personal income tax from his own funds in the case where the tax was additionally assessed during the audit. See details here.

Settlements with foreign counterparties: who will pay income tax?

The material was provided by the corporate publication for clients of the IRBiS Group of Companies “System of Success”

Foreign organizations, along with Russian organizations, are payers of income tax. However, the obligation to pay this tax arises only if they carry out activities in the Russian Federation through a permanent representative office and receive income from sources in the Russian Federation.

In the case where a foreign company does not have a permanent representative office on the territory of our country, the obligation to calculate, withhold and pay income tax to the budget rests with the Russian organization paying it this income or with a foreign organization that operates in the Russian Federation through a permanent representative office. .

These legal entities will act as tax agents in relation to their foreign partners. In this article we will look at the main responsibilities of such tax agents, their responsibilities, as well as the specifics of the paperwork that they need to submit to the tax authorities at their place of registration.

Did you make a profit? Pay the tax

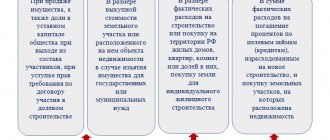

The list of income received by a foreign counterparty that is subject to income tax and in connection with this must be withheld by the tax agent is established in paragraph 1 of Art. 309 of the Tax Code of the Russian Federation. For convenience, we present them in the table, simultaneously indicating the corresponding income tax rates established by Art. 284 Tax Code of the Russian Federation.

| Type of taxable income | Income tax rate, % |

| Dividends paid by a Russian organization (clause 1, clause 1, article 309) | 15 |

| Income received as a result of the distribution of profits in favor of foreign organizations or property, including during their liquidation (clause 2, clause 1, article 309) | 20 |

| Interest income received on debt obligations of any type, including: income received on state and municipal issue-grade securities, the terms of issue and circulation of which provide for the receipt of income in the form of interest; income from other debt obligations of Russian organizations (clause 3, clause 1, article 309) | 15, 20 or 9 (sometimes 0)* |

| Income from the granting of rights to intellectual property in the Russian Federation, in particular: copyrights to works of literature, art, science, patents, trademarks, etc. (Clause 4, Clause 1, Article 309) | 20 |

| Income from the sale of shares (shares) of Russian enterprises, more than 50% of whose assets consist of real estate located on the territory of the Russian Federation, as well as financial instruments derived from such shares (shares) (clause 5, clause 1, article 309) | 20 |

| Income from the sale of real estate located on the territory of the Russian Federation (clause 6, clause 1, article 309) | 20 |

| Income from leasing or subleasing property used on the territory of the Russian Federation, including income from leasing. (Clause 7, Clause 1, Article 309) | 20 |

| Income from the lease or sublease of ships and aircraft and (or) vehicles, as well as containers used in international transport (clause 7, clause 1, article 309) | 10 |

| Income from international transportation, including demurrage and other payments arising during transportation (clause 8, paragraph 1, article 309) | 10 |

| Fine and penalties for violation by Russian persons, government agencies and (or) executive bodies of local self-government of contractual obligations (clause 8, clause 1, article 309) | 20 |

| Other similar income (clause 9, clause 1, article 309) | 20 |

* A 15% rate applies to income received in the form of dividends from Russian organizations by foreign organizations. A rate of 9% is applied to income in the form of interest on municipal securities issued for a period of at least three years before January 1, 2007, as well as on income in the form of interest on mortgage-backed bonds issued before January 1, 2007, and income of the founders trust management of mortgage coverage obtained on the basis of the acquisition of mortgage participation certificates issued by the mortgage coverage manager before January 1, 2007.

The 0% rate applies to income in the form of interest on state and municipal bonds issued before January 20, 1997 inclusive, as well as on income in the form of interest on bonds of the state foreign currency bond loan of 1999, issued during the novation of bonds of the internal state foreign currency loan Series III, issued in order to provide the conditions necessary for the settlement of the internal foreign currency debt of the former USSR and the internal and external foreign currency debt of the Russian Federation. A rate of 20% applies to income from other debt obligations of Russian organizations.

The specified list of income received from sources in the Russian Federation is not exhaustive. Thus, “other similar income,” according to the Ministry of Finance, expressed in Letter No. 03-03-06/1/478 dated July 11, 2007, may include income from the sale of imported goods on the territory of the Russian Federation under the terms of trade intermediation agreements of foreign organizations with Russian organizations and citizens, income for providing a foreign organization with personnel to work on the territory of the Russian Federation in another organization.

Not everything is clear with the rates of income tax payable on such income. They do not apply if the foreign counterparty is a resident of a state with which our country has concluded an international treaty on the avoidance of double taxation, and this treaty specifies reduced rates or even provides for tax exemption. To date, the Russian Federation has concluded with other countries over 80 international treaties on the avoidance of double taxation and the prevention of income tax evasion (hereinafter referred to as international treaties on the avoidance of double taxation). Such countries include, in particular: Brazil, Cuba, Australia, New Zealand, Greece, Austria, Thailand, Georgia, Lithuania, Kyrgyzstan, Spain, Cyprus, Turkmenistan, Turkey, North Korea, Egypt, Azerbaijan, Tajikistan, India, Armenia, The Netherlands, France, Kazakhstan, Germany, Finland, Moldova, Italy, Czech Republic, Switzerland, Canada, Belarus, Ukraine, China, Israel, Hungary, Uzbekistan, England, Sweden, Vietnam, USA, Poland, Japan and others. ( Author’s note : You can find more complete information about these international treaties, as well as the texts of these documents themselves, in the GARANT system).

Another important point: all income received by a foreign organization from sources in the Russian Federation is subject to income tax, regardless of the form in which it was received : in kind, by repaying the obligations of this organization, in the form of forgiveness of its debt or offset of claims to this organization. This rule is provided for in paragraph 3 of Art. 309 of the Tax Code of the Russian Federation. According to paragraph 5 of Art. 309 of the Tax Code of the Russian Federation, the tax base for the above income and the amount of income tax withheld from them are calculated in the currency in which the foreign organization receives such income. In turn, expenses incurred in another currency must also be calculated in the same currency in which the income was received at the official exchange rate of the Bank of Russia on the date of their implementation. Tax on income received by a foreign organization from sources in the Russian Federation is calculated and withheld by tax agents upon each payment of this income and is transferred to the federal budget simultaneously with the payment of income.

If income is paid in kind or other non-monetary form, including in the form of offsets, or if the amount of tax subject to withholding exceeds the amount of income received in cash, the tax agent is obliged to transfer tax to the budget in the calculated amount, while reducing such income for the amount of expenses (paragraph 8, clause 1, article 310 of the Tax Code of the Russian Federation). Please note that not all income received in our country by foreign organizations is recognized as income from sources in the Russian Federation and is subject to income tax.

For example, on the basis of clause 2 of Art. 309 of the Tax Code of the Russian Federation, income by a foreign organization from the sale of goods, other property (with the exception of the sale of shares of Russian companies and real estate located on the territory of Russia), as well as property rights, performance of work, provision of services on the territory of the Russian Federation, which do not lead to the formation of a permanent representative office , are not recognized as income from sources in the Russian Federation and are not subject to withholding by the tax agent. This also includes reinsurance premiums and bonuses ( Author’s note : what bonuses are is a topic for a separate article) paid to a foreign partner.

Russian legislation provides for situations where a tax agent is not required to withhold tax on income paid to foreign organizations. This is possible, in particular, when: 1) the income paid relates to a foreign organization receiving such income that has a permanent establishment in the Russian Federation, subject to notification of this to the tax agent and upon providing him with a notarized copy of the certificate of registration of the income recipient with the tax authorities authorities, issued no earlier than in the previous tax period; 2) income paid to a foreign organization is taxed at a zero profit tax rate; 3) income received during the implementation of production sharing agreements in accordance with our legislation is exempt from withholding tax; 4) income is paid that, on the basis of international treaties, is not taxed in the Russian Federation, provided that the foreign organization presents the relevant confirmation to the tax agent. If we are talking about the payment of income by Russian banks on transactions with foreign banks, then confirmation of the bank’s permanent location in a foreign country is not required if such location is confirmed by information from publicly available information directories; 5) income is paid to organizations that are foreign organizers of the Olympic Games and Paralympic Games.

Contractors, present your documents!

In accordance with paragraph 3 of Art. 310 of the Tax Code of the Russian Federation, if a foreign organization is a resident of a state with which our country has a valid international treaty for the avoidance of double taxation, then the income it receives from a source in the Russian Federation is subject to taxation in the manner established by such treaty, provided that this foreign organization complies with the procedures provided for clause 1 art. 312 of the Tax Code of the Russian Federation. Let's figure out what these procedures are.

So, according to paragraph 1 of Art. 312 of the Tax Code of the Russian Federation , in order to take advantage of the right provided for by an international treaty to apply, in relation to income received from sources in our country, reduced rates of income tax or exemption from taxation, a foreign counterparty must provide the organization paying it with written confirmation of its permanent location in state party to such a treaty. Moreover, this document must be provided before the date of payment of income .

At the moment, current Russian legislation does not establish a mandatory form of such confirmation. Here, clause 5.3 of Section II of the Methodological Recommendations on the application of certain provisions of Chapter 25 of the Tax Code of the Russian Federation concerning the specifics of taxation of profits (income) of foreign organizations, approved. By Order of the Ministry of Taxes and Taxes of Russia dated March 28, 2003 N BG-3-23/150 (hereinafter referred to as the Methodological Recommendations). This regulatory legal act contains clarifications on the form and procedure for registration and presentation of such confirmations.

In particular, it stipulates that documents confirming the permanent residence of a foreign organization are certificates drawn up in any form. In this case, the certificates must contain the following or similar wording: “It is confirmed that the organization __________ (name of organization) is (was) for _________ (period indicated) a person with permanent residence in ________ (state indicated) in the sense of the Agreement (name indicated international treaty) between the Russian Federation and (foreign state indicated).”

The current legislation imposes several mandatory requirements for such a document:

- It must indicate the specific period (calendar year) for which permanent residence is confirmed. This period must correspond to the period for which the income paid to the foreign organization is due.

If the specific period for which residence in a foreign country is confirmed is not specified, then such period, according to Letter of the Federal Tax Service of Russia for Moscow dated December 12, 2006 N 20-12/109629, is recognized as the calendar year in which the specified document was issued . In addition, in the Letter, tax officials expressed the opinion that the Tax Code of the Russian Federation does not contain provisions prohibiting the provision of exemption from withholding of income tax at the source of payment of income when paying income at the beginning of the calendar year if a certificate is submitted dated December of the previous calendar year and translated into Russian before its payment date.

- It must be translated into Russian (clause 1 of Article 312 of the Tax Code of the Russian Federation).

- There must be a seal (stamp) of the competent authority of the foreign state and the signature of an authorized official of this authority.

- The document must be legalized in the prescribed manner or have an apostille affixed to it.

The Methodological Recommendations also indicate that documents confirming the permanent location of a foreign organization abroad can (but should not!) be drawn up according to forms developed earlier for these purposes in accordance with Instruction of the State Tax Service of Russia dated June 16, 1995 N 34 “On Taxation” profits and income of foreign legal entities.”

In this case, the foreign organization does not need to send completed forms to the tax authorities of the Russian Federation and obtain permission to not withhold tax from the Russian tax authorities. Providing the tax agent with the above documents is permitted not in the original, but in notarized copies of such documents. Important addition: certificates of registration in foreign countries, certificates of incorporation, extracts from trade registers, etc. are not documents confirming for tax purposes the permanent location of an organization in a foreign country. The fiscal authorities never tire of reminding us of this (see, for example, letters from the Federal Tax Service of Russia for Moscow dated May 19, 2009 N 16-15/049833 and the Ministry of Finance of the Russian Federation dated July 18, 2008 N 03-03-06/1/411).

Meanwhile, some courts (but not all!) in some cases recognize such documents as adequate confirmation of the organization’s permanent location in a foreign country (see, for example, resolutions of the Federal Antimonopoly Service of the North-Western District dated 01/09/2008 N A56-2953/2007, FAS North-Western District dated 01.08.2007 N A56-44015/2006, FAS North Caucasus District dated 08/24/2009 N A53-18520/2008-C5-14, FAS Moscow District dated 03/05/2009 N KA-A40/13393-08 ). So if you have a desire to compete with the tax authorities in court, go for it, but remember the possible undesirable consequences...

For those who are not in the mood to “quarrel” with fiscal officials, if there are any doubts about the legitimacy of documents confirming the residence of foreign partners, we recommend contacting the Department of International Cooperation and Information Exchange of the Federal Tax Service of Russia. Having a written response from the Federal Tax Service in hand, you can protect yourself from possible claims from tax inspectors. The tax agent is provided with only one confirmation of the permanent location of the foreign organization for each calendar year of payment of income, regardless of the number and regularity of such payments and types of income paid. That is, if you plan to conclude several agreements with the same foreign organization, then you do not need to require it to provide confirmation for each new agreement.

Who is the most competent here?

In practice, very often controversial issues arise regarding which bodies of foreign states are competent to issue confirmation certificates. The answers to these questions are contained in the relevant international treaties on the avoidance of double taxation.

For example, the role of such a competent authority may be:

- in the UK - the Internal Revenue Service or its authorized representative (subclause “i” of paragraph 1 of Article 1 of the Convention between the Government of the Russian Federation and the Government of the United Kingdom of Great Britain and Northern Ireland for the avoidance of double taxation and the prevention of tax evasion with respect to taxes on income and increase in property value (Moscow, February 15, 1994));

- in Germany - the Federal Ministry of Finance or an authorized body (subparagraph “f”, paragraph 1, article 3 of the Agreement between the Russian Federation and the Federal Republic of Germany for the avoidance of double taxation with respect to taxes on income and property (Moscow, May 29, 1996)

- in Norway - the Minister of Finance and Customs or his authorized representative (clause “i” of paragraph 1 of Article 3 of the Convention between the Russian Federation and the Kingdom of Norway for the avoidance of double taxation and the prevention of tax evasion with respect to taxes on income and capital (Oslo, March 26, 1996));

- in China - the State Tax Administration or its authorized representative (clause “h”, paragraph 1, article 3 of the Agreement between the Government of the Russian Federation and the Government of the People’s Republic of China on the avoidance of double taxation and the prevention of tax evasion in relation to income taxes (Beijing, 27 May 1994));

- in Israel - the Minister of Finance or his authorized representative (subparagraph “ii”, paragraph 1, article 3 of the Convention between the Government of the Russian Federation and the Government of the State of Israel for the avoidance of double taxation and the prevention of tax evasion with respect to taxes on income (Moscow, April 25 1994));

- in France - the Minister responsible for the budget or his authorized representative (clause “i” of paragraph 1 of Article 3 of the Convention between the Government of the Russian Federation and the Government of the French Republic for the avoidance of double taxation and the prevention of tax evasion and violation of tax legislation in relation to taxes on income and property (Paris, November 26, 1996)).

As we can see, the wording of these international documents is rather vague, and without a preliminary analysis of the domestic legislation of the relevant state, it is impossible to unambiguously determine which body is such an “authorized representative”.

Moreover, foreign counterparties themselves often find it difficult to do this. In relation to such a situation, the advice given above would be appropriate: if you have any doubts about the competent authority, contact the Federal Tax Service of Russia or the Ministry of Finance of Russia. The latter, being the competent authority in the sense of applying international treaties of the Russian Federation on the avoidance of double taxation, is ready to assist in obtaining the necessary information.

By the way, the financial department has repeatedly demonstrated its readiness to help taxpayers in practice, explaining who has the right to act as the competent authorities of foreign states authorized to sign and seal certificates confirming the residence of a foreign organization. Thus, in its letters dated 04/06/2005 N 03-08-07 and dated 10/08/2008 N 03-08-05/6, the Ministry of Finance dotted the i's regarding the competent persons of Cyprus, Germany and the Netherlands. An analysis of these letters shows that certificates confirming the status of tax residents can be issued by the local tax authorities of these countries.

Apostille: to be or not to be?

As we already wrote above, a document confirming the permanent location of a foreign partner on the territory of another state with which the Russian Federation has concluded a corresponding international treaty must contain an apostille.

The concept of an apostille and the procedure for its application are contained in the Convention Abolishing the Requirement for Legalization of Foreign Public Documents (The Hague, October 5, 1961 (hereinafter referred to as the Hague Convention), ratified by the Russian Federation. According to paragraph 1 of Article 3 of the Hague Convention, the only formality that can be required is to certify the authenticity of the signature and the quality in which the person who signed the document acted, and, in appropriate cases, the authenticity of the seal or stamp with which this document is affixed, is the affixing of the prescribed apostille by the competent authority of the state in which this document was executed.

According to the Annex to the Hague Convention, the apostille has the shape of a square with a side of at least 9 cm and looks like this:

| APOSTILLE (Convention de la Haye du 5 October 1961 1. Country This official document 2. was signed by (last name)__________________________________________ 3. acting as ___________________________________ 4. sealed/stamped with (name of institution)_____________ Certified 5.___________ at 6. (date) _____________________________________ 7. (name of certification body) __________________________ 8. for N_______________________________________________________________ 9. seal/stamp 10. signature __________ |

And now attention: important information! We hasten to please you: there are a number of situations when, in relation to such a valuable document as a written confirmation of the location of a partner organization in the territory of a state party to an international treaty for the avoidance of double taxation, it is not necessary to follow the procedure of legalization or affixing an apostille.

This applies to cases where laws, rules or customs in force in the state in which the document is presented, or an agreement between two or more contracting states, cancel or simplify this procedure or exempt the document from legalization (based on paragraph 2 of Article 3 of the Hague Convention ). The Russian Federation and a number of states have reached mutual agreements on accepting documents confirming the residence of foreign companies without an apostille or consular legalization.

So, remember the list of these states, published in Letter of the Federal Tax Service of Russia dated May 12, 2005 N 26-2-08/5988 “On Confirmation of Permanent Residence”: Belarus, Ukraine, Moldova, Kazakhstan, Uzbekistan, Kyrgyz Republic, Tajikistan, Armenia, Azerbaijan, United States of America, Cyprus, Slovakia . That is, our tax authorities are obliged to accept confirmation certificates from foreign organizations from these countries without legalization and apostille (!).

Refund of previously withheld tax

As you know, the process of putting together a package of necessary papers is a long and troublesome task, and therefore foreign partners do not always have time to provide written confirmation of their residence in a foreign country before the tax agent pays them income from sources in the Russian Federation. In this case, the tax agent must withhold income tax from the income paid in accordance with the provisions established in Art. 284 of the Tax Code of the Russian Federation on rates. If the treasured paper does end up in the possession of a tax agent, but after he withholds and transfers to the Russian budget income tax on income paid to a foreign partner, he will have to carry out a procedure for returning the full (when an international treaty provides for the exemption of these income from taxation) or partial (when reduced tax rates apply) of previously withheld tax. In such a situation, tax refund is carried out according to general rules, taking into account the features provided for in paragraph 2 of Art. 312 of the Tax Code of the Russian Federation. In particular, the provision of this article establishes that a refund is possible only if the foreign organization provides the following documents:

- applications for refund of withheld tax in the form established by the Federal Tax Service of Russia.

( Author’s note: previously, the forms of such applications were approved by Order of the Ministry of Taxes of the Russian Federation of January 15, 2002 N BG-23/13 “On approval of application forms of a foreign organization for the refund of taxes withheld at the source of payment in the Russian Federation.” However, by the Order of the Federal Tax Service of Russia dated 10/21/2008 N MM-3-3/ [email protected] they were excluded from the text of the Order, although the document itself is still valid.)

- written confirmation of the residence of the foreign counterparty in the state party to the international treaty concluded with the Russian Federation, certified by the competent authority of this foreign state;

- copies of the agreement (or other document) in accordance with which income was paid and copies of payment documents confirming the transfer of the amount of tax to be refunded to the Russian budget to the appropriate account of the Federal Treasury.

Please note that tax authorities are prohibited from requiring submissions other than those given in paragraph 2 of Art. 312 of the Tax Code of the Russian Federation, documents. The above documents must be translated into Russian.

At the same time, notarization of contracts, payment documents and their translation into Russian is not required. Documents are submitted by the foreign organization receiving the income to the tax office at the place of registration of the tax agent within three years from the end of the tax period in which such income was paid. Previously withheld and paid tax is returned in the currency of the Russian Federation. Need to notify

Do not forget about such an important duty of the tax agent, provided for in paragraph 4 of Art. 310 of the Tax Code of the Russian Federation, as informing the tax authority at the place of its location about the amounts of income paid to foreign companies and taxes withheld for the past reporting (tax) period. The tax calculation form (information) on the amounts of income paid to foreign organizations and taxes withheld was approved by Order of the Ministry of Taxes of Russia dated January 2, 2002 N BG-3-23/31, and instructions for filling it out are contained in Order of the Ministry of Taxes of Russia dated June 3, 2002 N BG-3 -23/275. We will not dwell on this point in detail, as this is a topic for a separate article. Let us note only one controversial issue regarding whether it is necessary to provide a tax calculation when paying a foreign counterparty income from sources in the Russian Federation, which, on the basis of existing international treaties, are exempt from income tax. There is conflicting judicial practice on this matter. So, some courts , referring to paragraph 1 of Art. 24, art. 310 and paragraph 1 of Art. 312 of the Tax Code of the Russian Federation, they believe that in such a situation a Russian company or a foreign organization that has a permanent representative office in our country is exempt from the obligation to calculate and withhold tax, but not from the status of a tax agent (see resolutions of the Federal Antimonopoly Service of the Ural District dated December 21, 2005 N F09 -5846/05-С7, FAS Moscow District dated 10/17/2006 N KA-A40/9925-06). While remaining a tax agent, they are obliged to fulfill the requirement of clause 4 of Art. 310 of the Tax Code of the Russian Federation and provide tax calculations.

Other courts take the opposite opinion, believing that since income paid to a foreign legal entity with a permanent location abroad is exempt from income tax in the Russian Federation, the organization paying such income is not recognized as a tax agent in relation to these types of income and, accordingly, should not submit a tax calculation (see resolutions of the FAS Volga-Vyatka District dated October 31, 2005 N A82-15312/2004-14, FAS Central District dated November 1, 2006 N A35-1016/06-C15, FAS Volga District dated March 12, 2009 N A72-5266/2008).

Didn't provide documents - pay a fine

And finally, let's talk about liability for violation of the mandatory requirements listed in this article. Now let's talk about everything in order.

- For failure to provide documents confirming the permanent location in foreign countries of foreign partners to whom the tax agent pays income from sources in the Russian Federation, the latter will be brought to tax liability under clause 1 of Art. 126 of the Tax Code of the Russian Federation, in the form of a fine of 50 rubles for each unsubmitted document.

- If a tax agent has provided the inspection with confirmation of the location of his foreign counterparty in another state and this document does not contain an apostille, and the fiscal authorities and judicial authorities come to the conclusion that it needs to be apostilled, then the tax agent may be held tax liable for unlawful non-transfer and / or incomplete transfer of income tax amounts. The fine for this offense is set at 20% of the amount of tax to be transferred to the Russian budget (Article 123 of the Tax Code of the Russian Federation).

- For failure to fulfill the obligation to submit tax calculations (information) on the amounts of income paid to foreign organizations and taxes withheld, the tax agent is also liable under clause 1 of Art. 126 of the Tax Code of the Russian Federation.

For your information , in accordance with paragraph 2 of Art. 11 of the Tax Code of the Russian Federation, foreign organizations are understood as companies and other corporate entities with civil legal capacity, created in accordance with the legislation of foreign states, as well as international organizations and branches and representative offices of these foreign persons and international organizations established on the territory of the Russian Federation.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Responsibility of the tax agent – penalties and fines for non-payment

The duties of the tax agent for personal income tax regarding the transfer of tax amounts may not be fulfilled or partially fulfilled. Such situations often arise if the income is paid in kind or represents a material benefit received by an individual.

Read about the duties of a tax agent when paying an employee income in kind in the material “Did the individual receive income in kind? Perform the duties of a tax agent .

Here it is necessary to deduct money payments due to the person himself or to a third party on behalf of the recipient of the income. The amount of withholding corresponds to the amount of the payment arrears and the newly accrued tax, if any (paragraph 2, paragraph 4, article 226 of the Tax Code of the Russian Federation).

If payments to the debtor under personal income tax will no longer be made or the amount of payments is not enough to cover the debt, the tax agent for personal income tax is obliged to notify the tax authorities and the taxpayer about this. This should be done before March 1 after the end of the tax period (subclause 2, clause 3, article 24, clause 5, article 226 of the Tax Code of the Russian Federation). Sending a message relieves the agent of the obligation to withhold personal income tax amounts from this person. The obligation to pay tax will arise on the taxpayer himself upon receipt of a tax notice from the Federal Tax Service.

It is also noted that if the tax agent did not report the impossibility of withholding personal income tax to either the tax service or the taxpayer or did not lose such an opportunity, then penalties may be assessed on the amount of arrears to the personal income tax agent based on the results of an on-site tax audit (letter from the Federal Tax Service of Russia dated November 22, 2013 No. BS-4-11/20951 and No. SA-4-7/16692 dated August 22, 2014). A message about the impossibility of withholding tax must be sent even if the deadline for its submission is missed (letter of the Federal Tax Service of Russia dated July 16, 2012 No. ED-4-3 / [email protected] ).

Read more about 2-NDFL for 2022 in the materials on our website.

In addition to penalties, tax authorities have the right to impose a fine for non-payment of personal income tax by a tax agent.

For more information about the responsibility of this category of taxpayers and when a fine is imposed for non-payment of personal income tax by a tax agent, read the article “What liability is provided for non-payment of personal income tax”.

But a fine can be avoided if:

1. 6-NDFL was submitted to the Federal Tax Service without delay;

2. The amount of personal income tax is correctly indicated in the form (without underestimation);

3. The tax and penalties are paid before the tax authorities find out about the non-payment.

Such rules are in force from January 28, 2019 and apply to legal relations that arose before this date. We talked about the details here.

Also find out about the innovations in imposing fines on tax agents starting in 2022.

Tax agent when paying dividends

A Russian organization acts as a tax agent for income tax if it pays dividends to a Russian or foreign company.

One of the features of recognizing a Russian organization-issuer as a tax agent is how dividends are paid. If they are paid directly through the issuer, he is obliged to calculate, withhold and transfer the tax amount to the budget. If dividends are paid through certain intermediaries (for example, through depositories), in this case the obligation to act as a tax agent for income tax in accordance with Russian legislation rests with the specified intermediary.

Separately, we should talk about those business entities that apply special tax regimes in their activities. For such organizations, the obligation to act as a tax agent remains, even despite the fact that they are not payers of income tax.

It should also be noted that when organizations receiving dividends apply special tax regimes, the income tax agent remains obligated to pay tax. Thus, if the recipient of dividends uses the simplified tax system or the unified agricultural tax system, the dividends for him will be income subject to income tax in accordance with the provisions of clause 3 of Art. 346.1 and paragraph 2 of Art. 346.11 Tax Code of the Russian Federation.

This rule also applies to organizations using UTII. For them, the dividends received will be income not related to activities that, according to Russian legislation, are subject to UTII, therefore, in this case, it is also necessary to pay income tax on such income. The corresponding clarifications are contained in the letter of the Ministry of Finance of Russia dated May 16, 2005 No. 03-03-02-04/1/121.

However, there are exceptions to this rule. The obligation to calculate and pay tax if organizations receiving dividends apply special tax regimes does not arise for the tax agent in the following cases:

- when paying dividends on shares or shares in them owned by the state or municipality (opinion of the Ministry of Finance of Russia, reflected in letter dated August 30, 2012 No. 03-03-06/4/91);

- when paying dividends to mutual investment funds, the management of which is transferred to management companies (the position of specialists from the Ministry of Finance of Russia, reflected in letter dated November 13, 2010 No. 03-03-06/1/717);

- when paying dividends on shares owned by Vnesheconombank (clarifications of the Ministry of Finance of Russia, set out in letter dated February 22, 2008 No. 03-03-06/2/17).

Interesting information about tax agents can be gleaned from the articles “Features of calculating dividends for calculating income tax” and “Capitalization of interest does not relieve the agent of the obligation to pay income tax”.

KBK for transferring tax amounts

In 2022, the following personal income tax codes are in effect (order of the Ministry of Finance of Russia dated 06/08/2021 No. 75n):

- 182 1 0100 110 - code for transferring personal income tax on income up to 5 million rubles paid by a tax agent to a taxpayer. The exception is income received in accordance with Art. 227, 227.1, 228 Tax Code of the Russian Federation.

- 182 1 0100 110 - code for transferring personal income tax on income over 5 million rubles,

- 182 1 0100 110 - code for transferring personal income tax received by an individual - an individual entrepreneur, a notary or lawyer or a person carrying out other business activities under Art. 227 Tax Code of the Russian Federation.

- 182 1 0100 110 - transfer of tax on personal income received under Art. 228 Tax Code of the Russian Federation.

- 182 1 0100 110 - code for transferring tax on the income of foreign citizens carrying out activities in accordance with the patent. The personal income tax payment in this case is a fixed advance payment and is made on the basis of Art. 227.1 Tax Code of the Russian Federation.

The nuances of paying personal income tax can be found in the section “Time limits and procedures for paying personal income tax.”

How to make a refund of overpaid personal income tax by a tax agent?

If a tax agent overpaid personal income tax, then he, in fact, reduced the income of an individual by such action. The injured employee has the right to apply to the employer for a refund of the overpaid amount of tax. Tax legislation in paragraph 7 of Art. 78 of the Tax Code of the Russian Federation determines that the statute of limitations for such cases is 3 years, during which a statement can be written.

After receiving a written request from the employee, the tax agent writes a statement to his Federal Tax Service and attaches documents that can confirm the fact of the overpayment. The tax authorities will make a decision within 10 days and inform the employer about it. The tax agent is given the right to choose one of two ways to repay the debt:

- Offset the overpayment against future personal income tax payments.

- Transfer the identified amount of overpayment to the taxpayer's account.

If it is not possible to return the tax through the employer, the taxpayer has the right to apply for a tax refund directly to the Federal Tax Service. How to draw up an application for a personal income tax refund in this case, see our article.

Results

The employer has tax agent responsibilities in relation to income tax on payments to employees.

The employer must timely calculate, withhold and transfer personal income tax to the budget, as well as report to the budget on income tax amounts. Failure of a tax agent to fulfill his duties is a reason for a fine from regulatory authorities. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Personal income tax

The obligation to withhold personal income tax arises for any organization. When paying any income to an individual who is not an individual entrepreneur, the company is obliged to withhold personal income tax. Such payments include:

- all remunerations under the employment contract;

- payments under construction contracts and other civil contracts;

- material aid;

- payment for property rental.

The rules for calculating, withholding and transferring personal income tax are prescribed in Chapter 23 of the Tax Code of the Russian Federation. The organization, in addition, is obliged to maintain registers on income paid to individuals and personal income tax amounts withheld and provide reporting to the Federal Tax Service:

- report 6-NDFL - quarterly;

- 2-NDFL certificates - annually.

A special case is brokerage activities. A separate article 226.1 of the Tax Code of the Russian Federation is devoted to the person who withholds personal income tax (broker - tax agent). The broker is obliged to calculate, withhold and transfer to the personal income tax budget when paying income from operations with securities and other derivative financial instruments when carrying out these operations in the interests of the taxpayer on the basis of agreements: for brokerage services, trust management, orders, commissions or agency.