What should be included in the advance report?

Is it generally necessary to accompany the expense report with any documents?

Clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U states that the corresponding report must be presented to an accountant or manager, but it does not specify which ones. Clause 26 of the regulations on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, states that upon returning from a business trip, a company employee must submit an advance report to the employer and attach to it documents confirming the rental of housing, travel expenses and other items.

It is necessary to attach documents to the advance report that confirm that the employee spent the funds issued correctly. Apart from the specified requirement of the legislator, there are other reasons for this. In particular, amounts issued to an employee on account and used by him for the purposes agreed upon at the time of issuance can be accepted by the employing company to reduce the tax base (if they are available in the completeness required by law, papers are needed confirming both the fact of payment for goods or services and their receipt).

CLARIFICATIONS from ConsultantPlus: Is it possible to take into account an advance report with a sales receipt, but without a cash receipt? Study the material by getting trial access to the K+ system for free.

The main regulations establishing the need to generate advance reports do not say anything about the fact that cash receipts must be attached to the relevant document. At the same time, it should be noted that in the structure of the AO-1 form, proposed by Decree of the State Statistics Committee of the Russian Federation dated 01.08.2001 No. 55 as a unified form for drawing up an advance report (as well as in its analogue used for budgetary institutions - form 0504505, approved by order Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n), there are columns where you need to enter information about documents confirming expenses. In form AO-1 it is necessary to record the name of these documents, their numbers and dates, in form 0504505 - numbers, dates, as well as the content of expenses.

Read more about filling out the AO-1 form in the article .

NOTE! Currently, most sellers must use online cash register systems and issue buyers a cash register receipt that meets all the requirements of the Law “On Cash Register Systems” dated May 22, 2003 No. 54-FZ. Only persons exempt from the use of cash register systems can work without a cash register and issue other payment documents. If the seller ignores his cash obligation, he breaks the law, not the buyer. Therefore, the buyer should not bear the negative consequences of not having a cash register receipt, and is also not obliged (and does not have the opportunity) to check whether the seller does not use the cash register lawfully and issues him another document. Therefore, you can now attach any of the following documents confirming payment to the advance report. But it should be remembered that this is associated with certain risks. Mainly in terms of confirming expenses for tax purposes.

So, the documents that contain the necessary primary details (number, date, content of expenses), in addition to the cash receipt, include:

- strict reporting form (including, for example, an air ticket);

- PKO receipt;

- sales receipt.

Let's consider what the requirements for the execution of each of the mentioned documents are.

How can an employee confirm expenses incurred?

The employee’s obligation to report in the prescribed form on the expenditure of funds issued to him by the enterprise is enshrined in law.

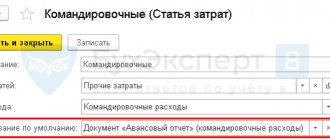

For this procedure, a special form AO-1 was adopted, approved by Resolution of the State Statistics Committee No. 55 of August 1, 2001. Clause 6.3 of Central Bank Directive No. 3210 dated March 11, 2014 states that the specified form is submitted for approval to the manager or accountant along with attachments to the employee’s advance report. The JSC must be accompanied by documents that reflect the fact of payment and a complete list of expenses incurred. Let's determine which checks can be accepted for advance reports from 2022:

- fiscal, generated on cash register;

- form of strict accountability;

- PKO receipt;

- commodity.

If a number of conditions are met, the employee has the right to attach only one of the specified forms to the report.

Advance report without cash receipt: attach PKO receipt

An advance report without a cash receipt can also be supplemented with receipts for cash receipt orders.

The PKO, like the BSO, consists of 2 elements - the main part and the tear-off receipt. The employee who paid for goods or services with accountable funds is given the second element. This is what needs to be attached to the expense report.

It is important that the PKO receipt meets the following basic requirements:

- the supplier's seal (if any) must be affixed simultaneously on both elements of the PQS - thus, approximately half of it will be visible on the receipt;

- in the “Amount” column of the PKO receipt, the amount of funds should be recorded in numbers, in the column below - in words.

One more nuance: PKOs must be drawn up exclusively according to the KO-1 form, which was put into circulation by the State Statistics Committee by Resolution No. 88 dated August 18, 1998. Therefore, before taking the PKO receipt, it is advisable for the employee to make sure that the original order contains a mark indicating that the document complies with the form KO-1.

And most importantly: the receipt for the PKO only confirms the fact of payment. Using it to confirm the type of expenses, for example, the name of purchased goods and materials or services, is problematic. Therefore, in addition to the receipt to the recipient, a document indicating the type of expenses incurred must be attached to the advance report: invoice, act, etc.

For an example of form KO-1, see the material “Cash receipt order - form and sample”.

The goods were purchased by an accountable person

A particular problem can be caused by cases where a taxpayer purchases material assets through an accountable person.

Although the Ministry of Finance, for example, in letters dated December 5, 2019 No. 03-03-06/2/94579, dated November 26, 2019 No. 03-03-06/1/91715, dated November 18, 2019 No. 03-03-07/88709, so that there is no problem here.

He pointed out that the identification of the buyer (client) as an organization occurs on the basis of the power of attorney he presents to make payments on behalf of the organization. The taxpayer (buyer) issues such a power of attorney to the accountable person, and he presents it to the seller.

Based on this power of attorney, when making payments, the cash receipt reflects information about both the seller and the buyer.

However, in practice, it often happens that an accountable person makes purchases promptly without a power of attorney and, as a result, the cash register check does not contain information about the buyer-organization or individual entrepreneur, that is, the check is issued in the same way as if it had been issued to an individual.

On this basis, local tax authorities sometimes refuse to recognize expenses confirmed by such a check.

Let us note that such actions of officials directly contradict the position of the Federal Tax Service, which explains on the website nalog.ru that a cash receipt (CSR) issued to an individual, including an accountable person, is the primary document on the basis of which an organization (IP) can take into account expenses. Even if it does not contain the details provided for in clause 6.1 of Art. 4.7 of the Law on CCP.

And rightly so. After all, the accountable person attaches a cash receipt to the advance report, according to which expenses are reimbursed to this accountable person. That is, as a result, it is obvious that it is the taxpayer who bears the costs corresponding to the amount indicated on the check.

However, it is possible that the taxpayer will have to justify this position in court, and he must be aware of this risk.

We supplement the advance report with a sales receipt

Another possible scenario for justifying expenses for reporting funds is the use of a sales receipt as a document supplementing the expense report. A sales receipt can be made an attachment to the JSC if it confirms the fact of concluding an agreement and the fact of payment (Article 493 of the Civil Code of the Russian Federation, letters of the Ministry of Finance dated 08/16/2017 No. 03-01-15/52653, dated 05/06/2015 No. 03-11-06 /2/26028).

There is no legislatively approved form for a sales receipt, but there are requirements for details. It should contain:

- serial number, date of compilation;

- name of the company or full name of an individual entrepreneur - supplier of goods or services;

- supplier's tax identification number;

- a list of goods and services paid for by the employee with accountable funds, their quantity;

- the amount that the employee deposited into the supplier’s cash desk in rubles;

- position, full name, initials of the employee who issued the sales receipt, his signature.

As a rule, a sales receipt contains a complete statement of paid goods and materials, which means that it is not required to supplement it with an invoice.

Is it possible to take into account the costs of purchasing goods for income tax if the sales receipt attached to the advance report has defects, for example, it is missing a number? You will find the answer to this question from expert practitioners in ConsultantPlus. Get trial access to the system for free and proceed to the material.

Cash receipt as proof of expenses

Can a taxpayer prove expenses for income tax purposes if they only have a cash receipt issued by a supplier?

According to the general provisions of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, the taxpayer reduces the income received by the amount of expenses incurred (except for the expenses specified in Article 270 of the Tax Code of the Russian Federation).

Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred (incurred) by the taxpayer.

Documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory these expenses were incurred, and (or) documents indirectly confirming the expenses incurred. expenses (including customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

At the same time, in order to generate tax accounting data, it is necessary to have properly executed supporting documents confirming the expenses incurred.

By virtue of paragraphs 1 and 5 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”, each fact of economic life is subject to registration as a primary accounting document. It is drawn up on paper and (or) in the form of an electronic document signed with an electronic signature. If the current legislation of the Russian Federation establishes mandatory forms of documents for registration of specific transactions, then the forms of documents established by the current legislation must be used.

Results

The preparation of an advance report must be accompanied by the attachment of documents confirming the expenses incurred. Such documents can be not only cash receipts, but also BSO, receipt for PKO and sales receipts. The registration of the PKO takes place on an approved form, and there are certain requirements for the details of the BSO and sales receipts that do not have such forms.

Sources:

- Federal Law of May 22, 2003 No. 54-FZ

- Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is the seller obliged to issue a sales receipt and in what cases?

The seller has this responsibility. First of all, it is spelled out in Government Decree No. 55 of January 19, 1998 (LINK). Its provisions clearly establish the requirement for issuing a sales receipt, in particular:

- when selling shoes, as well as fur, knitwear, textiles, and clothing products. Here, a sales receipt is required if the cash register receipt forgot to indicate the name of the product, its article number and/or grade (if available) (clause 46 of the resolution);

- when selling consumer electronics, computer equipment, cameras, and other similar devices. Along with the cash receipt and registration certificate, a sales receipt is also issued. Its registration is mandatory if the cash register receipt does not contain information about the grade of the goods (if such data exists), its article number, name (clause 51 of the resolution);

- When selling trailers, cars, motorcycles and other motorized equipment, the seller must give the buyer a sales receipt with the details approved in Resolution No. 55 (clause 60).

In other words, a sales receipt is required:

- when selling a number of goods listed in Regulation 55, in particular cars, ammunition, weapons. In these cases, the sales receipt is issued simultaneously with the cash receipt, regardless of the contents of the latter;

- when selling other product groups from Resolution No. 55. If the sales receipt does not contain the trade name and/or the main indicators characterizing the product (in particular, grade, sample) and other mandatory information, then all this must be written down in the sales receipt.

It is worth recalling that individual entrepreneurs who apply tax regimes such as patent, simplified, for agricultural producers and UTII have the right not to indicate the name and quantity of goods on the cash receipt. This right is valid until January 31, 2021, but does not apply to excisable products (clause 17 of Article 7 of Law 290-FZ). As a result, when selling goods named in Resolution 55, such individual entrepreneurs will always have to issue a PM along with the cash register.

If trading activities are carried out by legal entities applying the above tax regimes and/or OSNO, or individual entrepreneurs under the general regime, then PM will be required from them only if Resolution No. 55 obliges them to do so.

By the way, self-employed entrepreneurs issue sales receipts, selling only those goods that are specified in Resolution No. 55 and at the same time meet the requirements of Law 422-FZ.

Important note : Decree of the Government of the Russian Federation dated January 19, 1998 N 55 loses force on January 1, 2022 due to the publication of Decree of the Government of the Russian Federation dated July 11, 2020 N 1036. After which, issuing a sales receipt ceases to be mandatory when selling a number of goods mentioned in Resolution No. 55.