Home — Consultations

The obligation to pay property tax for individuals arises when at least three conditions are simultaneously met. Thus, existing property is recognized as an object of taxation, an individual owns it by right of ownership and a notification has been received from the inspectorate about the payment of tax in relation to this property. At the same time, at the legislative level, an additional obligation has been introduced for individuals, if they are faced with the fact that the property they own is not indicated in the notification received, to notify the tax office about this. The problem is that from January 1, 2015, among the objects of taxation under the property tax for individuals are also objects of unfinished construction. Do tax authorities need to be informed about them and how is such “unfinished construction” taxed in general?

- Let me tell you

- Legal subtleties

- Registered unfinished

From January 1, 2015, the procedure for calculating and paying property tax for individuals on the territory of the Russian Federation is regulated by Chapter. 32 of the Tax Code (hereinafter referred to as the Code). Calculation of tax on the basis of Art. 408 of the Code, as before, is carried out by the tax authority. In this case, tax payment is made by taxpayers on the basis of tax notices, which are sent to taxpayers by tax authorities at the end of the tax period, that is, the year. For 2015, the tax must be paid no later than December 1, 2016 (Article 409 of the Tax Code).

At the same time, the list of taxable objects has been significantly expanded since the beginning of last year. To these in accordance with paragraph 1 of Art. 401 of the Code includes the following property located within a municipal entity (federal city of Moscow, St. Petersburg or Sevastopol):

- House. At the same time, for tax purposes, residential buildings also include residential buildings located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture, and individual housing construction;

- living space (apartment, room);

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other buildings, structures, structures, premises.

Object of taxation

Construction projects that have not yet been put into operation are considered to be construction in progress. Objects in this category include:

- Mothballed construction site.

- At the suspension stage.

- Completely stopped.

- A finished object undergoing safety testing and compliance with technical parameters.

Chapters 30-32 of the Tax Code of the Russian Federation determine the taxation procedure for such objects. The law clearly establishes the requirement to pay property taxes on unfinished construction.

The main nuances of its payment are established by local authorities, since this tax relates to regional fees.

Legal basis of tax

Article 408 of the Tax Code states that property tax is calculated by the tax service. Its employees send notifications about the need to pay taxes to property owners at the end of the tax period. The notice indicates the payment amount.

In addition to Article 406, some aspects of property taxation are regulated by Articles 52, 401, 402, 403, 406 and 407 of the Tax Code of the Russian Federation.

Calculation of property tax on unfinished construction projects

In a situation where property rights have already been registered for unfinished construction, it is necessary to pay property tax in full. Its calculation may vary depending on the region. In particular, in some regions of the Russian Federation, the tax is calculated based on the cadastral value of the property.

The only way to avoid paying tax in this case is not to register ownership of the property until construction is completely completed.

Legal subtleties

So, if we are talking about an object of unfinished construction, then for the common man in the street a picture appears before his eyes - some unfinished object. By the way, many “physicists” have been building something at their dachas for years, or even decades, and never completed it. Does this mean that they are all caught up in property taxes? This is the issue that needs to be addressed.

Let's start with the fact that, according to Art. 400 of the Code, payers of property tax are individuals who own the right of ownership of property recognized as an object of taxation in accordance with Art. 401 of the Code. Moreover, by virtue of the provisions of Art. 130 of the Civil Code, objects of unfinished construction are classified as real estate, the rights to which are subject to state registration. A Art. 25 of the Law of July 21, 1997 N 122-FZ “On state registration of rights to real estate and transactions with it” stipulates that ownership of an unfinished construction project is registered on the basis of documents confirming the ownership (right of use) of the land plot, on which this object is located, as well as on the basis of a construction permit and documents containing a description of the object of unfinished construction. Moreover, the transfer of ownership of the “unfinished property” is also subject to state registration in the prescribed manner.

And finally, if you consider that, according to Art. 219 of the Civil Code, the right of ownership of buildings, structures and other newly created real estate, subject to state registration, arises from the moment of such registration, it turns out that it is from this moment that the object of taxation with the property tax of individuals appears. In other words, if the rights to the “work in progress” are not registered, then there is no object of taxation as such. This means that an individual does not have an obligation to pay tax in relation to this object and does not need to report its existence to the tax authorities.

How to apply for a tax exemption for an unfinished construction project?

Despite the fact that in some cases property tax can indeed be paid at a preferential rate, this does not apply to unfinished properties.

The tax on unfinished construction in all constituent entities of the Russian Federation must be paid in full. Therefore, you can receive the benefit only after completion of construction and registration of the building as a full-fledged real estate object.

It is also worth checking the lists of preferential tax payments with the local administration. Sometimes unfinished objects can also end up there. Lists of benefits for different regions can be found on the website of the Federal Tax Service.

Are benefits possible?

Despite the fact that benefits are also established at the regional level in all regions of the country, no benefits are provided for unfinished construction projects.

It will be possible to receive various privileges only for a completed object if it belongs to the preferential category of real estate (this point needs to be clarified separately in each region).

The only opportunity to receive a tax break is to complete construction and put the facility into operation. Separately, it is worth noting that additional municipalities also have the right to draw up a list of preferential facilities. In some of them, unfinished objects may still be included in the lists of beneficiaries. You can find out this moment in the local administration or on the official website of the tax office.

Find out about property tax on real estate of legal entities. Do I need to pay property tax when donating an apartment to a relative? Information here.

How is personal property tax calculated? Details in this article.

Tax rate

The tax rate may vary in different regions. Certain restrictions are imposed by Article 406 of the Tax Code of the Russian Federation. In particular, according to it, the regional rate cannot exceed the minimum by more than three times. By the way, in most regions the tax rate on unfinished construction is 0.1%, and in Moscow it is 0.3% of the cadastral value of the property.

For individuals, when calculating on the basis of cadastral value, the marginal tax rates are determined by Article 406 of the Tax Code of the Russian Federation:

- 0.1% for residential buildings.

- 2% for administrative, retail facilities and facilities worth more than 300 thousand rubles.

- 0.5% for other objects.

Legal entities do not have to pay tax on unfinished objects at all, since these objects are not used in their commercial activities. The tax will need to be paid only after the facility is put into operation.

From what moment should a completed project be subject to property tax?

Home — Articles

The tax inspectorate assessed the organization additional property tax in relation to the completed construction and reconstruction of a complex of buildings, indicating that their value should be included in the tax base from the moment of receipt of permission to put into operation and state registration of ownership, and not after the issuance of an order from the manager to put the facility into operation exploitation.

For your information. Permission to put the hotel and administrative complex into operation was issued in December 2006, ownership was registered in July 2007, and the manager’s order to put the complex into operation was issued in December 2007.

The company insisted that the inspectors incorrectly determined the date from which the obligation to pay property tax arises. The price of the issue was high (the amount of tax arrears exceeded 11.6 million rubles), arbitrators of various authorities supported either the taxpayer or the inspectors. The decisions made by the courts did not suit one side or the other. Therefore, only the Presidium of the Supreme Arbitration Court could put an end to the protracted dispute, which gave an interpretation of the conditions under which, once present, an object is accepted for accounting as fixed assets and, accordingly, becomes an object of taxation. So, by virtue of clause 4 of PBU 6/01 “Accounting for fixed assets,” an asset is accepted by the organization for accounting as fixed assets if the following conditions are simultaneously met: a) the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization or for provision by the organization for a fee for temporary possession and use or for temporary use; b) the object is intended to be used for a long time, that is, for a period of more than 12 months or the normal operating cycle if it exceeds 12 months; c) the organization does not intend the subsequent resale of this object; d) the object is capable of bringing economic benefits (income) to the organization in the future.

Note! According to the judges, the last of these conditions does not allow recognizing as part of fixed assets those objects in respect of which additional capital investments are still necessary to bring them to a state of readiness and possibility of operation. At the same time, the fact of registration of ownership of an object completed with capital construction does not in itself mean that this object complies with the named condition.

In this case, the case materials confirmed and the courts established that: - according to the contract for construction and reconstruction, the buildings were accepted from the contractors in the following condition: internal partitions (aerated concrete) without finishing, walls and ceilings without plastering and preparation for finishing, floors without cement screed and finishing coatings, premises without installing internal doors, painting, electrical installation and plumbing work; — after registration of ownership rights, finishing work was carried out in the buildings, as a result of which the amount of capital investments (from the date of entry into the Unified State Register until the date of issuance of the order to put the facilities into operation) increased by almost 275 million rubles; - the inspection did not provide evidence that before the issuance of this order, the hotel and administrative complex was used or could be used for its intended purpose. The arbitrators came to the conclusion that construction and subsequent interior decoration should be considered as a single process of creating a building, upon completion of which an object that meets the characteristics of a fixed asset appears.

Note! The Presidium of the Supreme Arbitration Court emphasized that what is issued on the basis of Art. 55 of the Civil Code of the Russian Federation, permission to put a building into operation cannot in itself be considered as evidence of bringing the facility under construction to a state of readiness and the possibility of its operation. This document certifies other characteristics of the object, namely its compliance with the urban planning plan of the land plot and design documentation and the implementation of construction in accordance with the issued building permit. When, after receiving permission to put the building into operation, finishing work is performed to bring the object to a state suitable for use, there are no grounds for qualifying this object as a fixed asset.

The senior arbitrators noted that this conclusion is also based on the application of accounting legislation that regulates the formation of the initial cost of fixed assets when they are accepted for accounting. In particular, according to paragraphs 23, 24, 26, 32 of the Guidelines for accounting of fixed assets, the initial cost also includes the costs of bringing fixed assets into a condition suitable for use. This rule should be applied regardless of the basis for the organization’s right to the relevant object (both in the case of its acquisition and during construction). The possibility of calculating depreciation on real estate objects for which capital investments have been completed, by virtue of clause 52 of the said document, is also conditioned by the fulfillment of the requirement for the actual commissioning of the object.

Final verdict: the property under construction does not meet the characteristics of a fixed asset if it is impossible to use it at the time of receiving permission for commissioning and continuing to carry out finishing work after receiving such permission to bring the building to a condition suitable for use .

* * *

The Presidium of the Supreme Arbitration Court has quite clearly formulated its position on the practical application of clause 4 of PBU 6/01 in relation to real estate under construction. When considering similar cases, lower arbitration courts must be guided by the opinion of the Presidium of the Supreme Arbitration Court. Consequently, taxpayers' chances of winning in a dispute with the tax authority have increased significantly. The position of the court will be determined not by the presence (absence) of permission to put the facility into operation and a certificate of ownership of it, but by the fact of incurring (non-incurring) expenses to bring the building to a state of readiness and its possible operation . If the value of the building has not been finalized and the enterprise does not use it in its business activities, there are no grounds for qualifying it as a fixed asset and an object of taxation.

Property tax

Property tax from cadastral value

Recalculation of taxes paid by individuals

Property tax on holiday buildings

Application of tax benefits for property tax on complex objects

How to reduce property taxes on housing

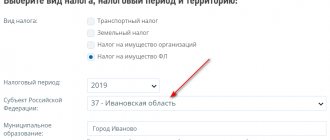

Calculation of tax amount

Tax authorities determine the cadastral value of an unfinished property at the end of the year, and based on this data, they charge tax according to the regional rate. Therefore, the calculation procedure is general, but the tax may differ in different regions.

In the case of shared ownership of a construction project, each owner must pay tax on his share. Accordingly, the debts of one of the shareholders do not concern other owners and cannot be transferred to them.

If the property has been owned by the taxpayer for less than a year, then special rules for calculating property tax apply to it. In this case, the annual tax is divided into 12 months, and then multiplied by the number of months during which the payer is the owner of the unfinished property. Thus, the tax will be less than the annual one.

It is important to take into account that Article 23 of the Tax Code of the Russian Federation obliges the owner of the property to report to the tax office about all objects that he owns and for which tax notifications are not received. But if notifications do not arrive because the owner has the right to tax benefits, then there is no need to report such buildings to the tax office.

They built a building. When to pay property tax?

The criterion for classifying real estate as an object of taxation is the need to record it on the balance sheet as fixed assets in accordance with the established accounting procedure.

From when to pay property tax?

In accordance with paragraphs 4, 5 of PBU 6/01, paragraphs 2, 3 of the guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, as well as PBU 6/01, when accepting assets for accounting As fixed assets, the following conditions must be simultaneously met:

- the object is intended for use in the production of products when performing work or providing services or for the management needs of the organization;

- its use for a long time, that is, a useful life exceeding 12 months or a normal operating cycle if it exceeds 12 months;

- the organization does not intend to subsequently resell these assets;

- the ability to bring economic benefits (income) to the organization in the future.

In addition, the above documents define some features for real estate objects. In particular, paragraph 41 of the Regulations on accounting and financial reporting requires that the costs of acquiring or constructing real estate be taken into account as part of unfinished capital investments (on account 08 “Investments in non-current assets”) until the documents are prepared confirming the state registration of these objects in the established legislation cases.

At the same time, in accordance with paragraph 52 of the Methodological Guidelines for the Accounting of Fixed Assets, it is allowed to accept for accounting as fixed assets actually operated real estate objects for which capital investments have been completed, the corresponding primary accounting documents for acceptance and transfer have been drawn up, the documents have been transferred to the state registration.

From the above it follows that a real estate object that has been put into operation can be included in fixed assets either on the date of filing documents for state registration of rights, or immediately at the time of state registration.

The inclusion of the value of a property in the property tax base is carried out after the acceptance of this property for accounting, that is, after commissioning and submission of documents for registration of property rights (letter of the Ministry of Finance of Russia dated September 6, 2006 No. 03-06-01-02 /35).

If registration is delayed

Due to the fact that Federal Law No. 122-FZ of July 21, 1997 “On state registration of rights to real estate and transactions with it” does not establish deadlines for filing an application for state registration of ownership rights to real estate, the following situations arise in practice.

The construction of the facility has been completed and has actually been put into operation. But for a long time the rights to it are not registered. As a result, all mandatory conditions for transferring the specified object to fixed assets are not met.

Note that the rule on including in the object of taxation only those real estate objects that are accepted for accounting as fixed assets is applicable when the taxpayer fulfills his duties in good faith and his actions do not show any deliberate actions to delay the preparation and submission of documents for registration of property rights .

Additional property tax assessment

In the case when the facility is built, put into operation, and the company does not have objective reasons that explain the failure to submit documents for state registration, a certain risk arises. The tax authorities may regard such inaction by the taxpayer as evasion of property taxes.

In this connection, make an additional assessment of property tax, considering it accepted for accounting from the moment when the object was put into operation. By letter of the Federal Tax Service of Russia dated August 25, 2004 No. ШС-14-21-121, instructions were given to territorial tax authorities in cases where a company does not register the rights to an actually exploited property for a long time.

Property tax is collected from such taxpayers, and they are also held accountable under Article 122 of the Tax Code. This conclusion is confirmed by arbitration practice: resolution of the Federal Antimonopoly Service of the West Siberian District dated July 5, 2006 in case No. F04-3365/2006 (23141-A27-40), dated May 10, 2006 in case No. F04-2395/2006 ( 22105-A27-37), as well as the resolution of the Federal Antimonopoly Service of the North-Western District dated April 5, 2006 in case No. A21-4858/2005-C1.

Basically, the position stated above is consistent with the opinion of the Russian Ministry of Finance (letter of the Russian Ministry of Finance dated September 6, 2006 No. 03-06-01-02/35, dated August 3, 2006 No. 03-06-01-04/151).

The company has no reason to impose property taxes on objects for which documents have not been submitted for state registration. However, this is true provided that the company can prove that the delay in the procedure for registering rights to the property is caused by objective circumstances and is not the fault of the organization itself.

What do you mean by long time?

Financiers in their explanations point to the lack of state registration for a long time. At the same time, neither the legislation nor the official explanations of government bodies clarify what should be understood by a long period of time. According to paragraph 4 of Article 376 of the Tax Code, to calculate the property tax base, the residual value of property recognized as an object of taxation is taken into account on the 1st day of each month of the tax (reporting) period.

From this it can be assumed that an application for state registration of ownership rights to real estate of an organization must be submitted in the same month when the object was put into operation. Please note that for reasonable reasons, deviations from these time frames are acceptable. For example, if this is due to the time required to collect documents for state registration. In this case, the company should document the fact that the process of collecting documents was delayed through no fault of its own.

In each specific case, these can be various documents: requests to government agencies, as well as their official responses, etc. If disagreements arise on this basis with regulatory authorities, the company will have to defend its position in court.

V. Shishkin , Project Manager of the Consulting Department of Audit - New Technologies LLC

Features of property tax under the NZS

Despite the fact that this is a type of property tax, this fee has the following features:

- It is calculated for each region separately, which means it may differ.

- It is calculated according to the cadastral value, although previously it was calculated according to the inventory value.

Also, the tax amount for unfinished construction is always less than for completed and commissioned objects.

Cadastral value of NZS objects

The cadastral value is determined on the basis of the state cadastral valuation. For both finished buildings and unfinished ones, the cadastral value is usually less than the market value. In rare cases, the opposite happens, but this is possible for objects that have already been put into operation, which have increased in price due to the development of infrastructure around them or for other reasons. For unfinished construction, the cadastral value is always lower than the market value.

The Federal Tax Service clarified the specifics of taxation of unfinished construction

In those regions where the tax on unfinished construction is calculated based on the cadastral value, it cannot exceed 0.3% of the cost (for a house) and 0.5% (for other construction projects). In this case, the owner of an unfinished property cannot claim property tax benefits other than those established in the given municipality.

If the inventory value is used to calculate the tax, then no tax is charged at all on unfinished objects (in accordance with the order of the Ministry of Construction of the Russian Federation No. 87 of 1992).

Legislative acts on the topic

The table discusses legislative acts on the topic:

| Resolution of the Arbitration Court of the Ural District dated March 12, 2015 No. F09-9720/14 | A precedent for recognizing that the Federal Tax Service was right in the case of non-payment of property tax on a structure that has been in the stage of trial operation for a long time and, at the same time, is being used in the course of the company’s activities |

| subp. 5 p. 1 art. 401 Tax Code of the Russian Federation | On payment of property tax assessed on unfinished construction projects by individuals and individual entrepreneurs |

| clauses 3-6 art. 403 Tax Code of the Russian Federation | On the determination of tax deductions for the purpose of imposing property tax on unfinished construction projects |

| Art. 402 Tax Code of the Russian Federation | On taking into account the inventory or cadastral value of real estate for calculating property tax |

| clause 2 art. 406 Tax Code of the Russian Federation | On the dependence of tax rates when taking into account the cadastral value of real estate on the purpose and value of taxable objects |

| clause 4 art. 406 Tax Code of the Russian Federation | On the dependence of marginal property tax rates determined by inventory value on the value of the object |

| clause 1 art. 407 Tax Code of the Russian Federation | On property tax benefits for unfinished construction projects |

| clause 2 art. 52 Tax Code of the Russian Federation | On receipt by individuals of notice of payment of property tax 30 days before the due date of payment |

| clause 3 art. 408 Tax Code of the Russian Federation | On payment of tax in proportion to shares or equally by all owners of an unfinished construction project when registering shared or common ownership, respectively |