What applies to construction work in progress?

Unfinished construction work represents expenses and work on unfinished real estate from the very beginning to delivery, which are the object of accounting for construction in progress and which cannot be depreciated. These include uncommissioned structures, buildings, and individual stages of construction and installation work.

Unfinished construction can be divided into the following groups:

- objects that are in the process of construction and for which documents for acceptance into operation have not been drawn up;

- where construction has been temporarily stopped;

- mothballed construction with unfinished work;

- where all work has stopped.

This is a list of cost items that are associated with the performance of work and which can be classified as production expenses:

- Materials

- Equipment, machinery and its installation

- Production, construction, installation work

- Salary

- Tools, necessary equipment

- Electricity and other resources

In what account are unfinished construction works reflected?

At the stage of construction and installation work, all expenses that are during the construction period are investments in non-current assets.

Accounting for the developer's construction in progress in accounting is reflected in account 08 - “Investments in non-current assets”, which is intended to summarize all construction costs, which will later be transferred to the account with fixed assets to the contractor.

Account 08 is an intermediate element on which the costs for completing a specific project and its delivery are concentrated.

The contractor's expenses are reflected in account 20 “Main production”, the debit of which accrues all expenses. Every month, all materials involved in production are written off from the account at the original price, and if there is a balance in this account, it can be determined that the organization has construction in progress.

Typical wiring

In accounting for enterprises that are not part of public sector business entities, the following standard correspondence for accounting for unfinished construction projects can be used:

- The acquisition of unfinished property is reflected in accounting by placing the object on the balance sheet and reflecting the debt to the seller - D08.3 - K60. The same entry also shows the costs of paying for the services of third-party organizations entrusted with completing construction and putting the asset into operation.

- D01 - K08.3 - work in progress in construction in accounting passes to the status of completed, the facility is put into operation. This operation is carried out if there is a certificate of verification of the readiness of the object.

If the unfinished building is sold to third parties, the following set of transactions is drawn up:

- income is reflected through the debit of account 62 and credit of other income account 91.1;

- VAT must be charged on the cost of the asset being sold, this amount is shown in debit 91.2 and credit 68;

- when selling, it is necessary not only to show income, but also to close the amounts accumulated in the investment account in fixed assets; this is done using posting D91.2 - K08.3.

How to keep track of costs for construction in progress

Correctly maintaining records of work in progress is important for any company. In the future, this can directly affect financial results.

In order to correctly reflect construction in progress, the construction company must approve in its accounting:

- List of cost items associated with production

- The method by which general and production expenses are allocated

- Accounting method (custom or method of accumulating expenses)

- Method by which general business expenses are written off

- Method of introducing costs with the cost of work

- Method for assessing construction in progress

Accounting for production costs where construction and installation work is carried out can be organized in two ways:

- according to custom method

This is the main method in which the accounting object is a separate order, which is opened for each production facility in accordance with the contract. In this case, accounting of costs, income and financial results is carried out separately for each executed agreement.

- according to the method of accumulating expenses for a specific period of time

In this case, the initial cost of the work is determined by calculation, based on a percentage calculated as the ratio of the actual costs of construction of work in progress to their contract value.

The BIT.CONSTRUCTION/Contractor solution allows you to carry out an inventory of work in progress with detail down to cost items and the ability to indicate the percentage of work in progress. Part of the costs of the current period can be taken into account in the cost price, and the remaining part can be transferred to the next period. A special document “Inventory of work in progress” is used for this purpose.

Let's consider a situation where it is necessary to reflect the partial closure of account 20 and leave part of the costs in work in progress.

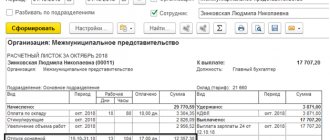

In October, work on the Radost TC facility was actually completed (material costs for production) for 800,000 rubles. Also, wages were calculated and corresponding accruals were made to the funds. We will postpone some of the completed work to November. To do this, we will use the “Production” – “WIP Inventory” tab.

To reflect the inventory, it is necessary to create and post a corresponding document. We select the date at the end of the period when all work has been completed (for example, 10/31), and a time equal to the last second of the reporting period.

You can transfer “work in progress” by indicating the amount, percentage of completed work, or both, with details by cost items and contractors. Accounting can be done both for your own (account 20.01) and for subcontracted work (account 20.05).

Click “Fill” and automatically receive the amounts as in the statement. We will take into account wages and other accruals in full in October, and we will take into account the work partially, indicating the amount (for example, 300,000) that we want to take into account in November. We indicate the amount in Accounting and Tax Accounting. We carry out the document.

Please note that only those amounts that remain for the next period remain in the document.

After closing the month, the balance sheet will look like this. Labor costs were fully accounted for in October, and of the work performed, 500,000 were carried forward to the next month. In the calculation certificate for the cost of production for October, we see the expenses of the main production and the amount of the balance of work in progress.

If you also want to implement automation of accounting and tax accounting for a construction company, leave a request for free demo access to the BIT.CONSTRUCTION system.

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Construction in progress: accounting with the customer, developer

When constructing real estate, the customer (developer) incurs construction costs. Before the objects are accepted into operation, these costs are taken into account as part of construction in progress. Let's consider how the customer (developer) can reflect them in accounting and whether the costs of unfinished construction can be transferred to another legal entity.

1. Accounting for costs of construction in progress at the customer (developer)

Objects of unfinished construction are understood as buildings, structures and other objects, the construction of which is permitted in accordance with the law, the construction work of which has begun, but has not been completed (paragraph 7, paragraph 2 of Instruction No. 10).

The customer (developer) must ensure that construction costs are accounted for for each accounting object (clause 12 of Instruction No. 10):

— for objects of primary, auxiliary and service purposes, energy facilities, transport facilities and communications;

— external networks and structures of water supply, sewerage, heat supply, gas supply and other engineering networks and structures;

— landscaping and other parts of the facility.

For reference, the object of accounting is each separately constructed building, structure, utility networks and other objects, the cost of construction of which is allocated as part of the consolidated estimate and for the construction of which an object estimate has been drawn up, as well as built-in and attached objects (paragraph 2 of clause 2 of Instruction No. 10 ).

It is also necessary to organize separate cost accounting for accounting objects (clause 8, part 1, clause 13 of Instruction No. 10):

— for construction and installation work;

— equipment installation work;

— acquisition of equipment that requires and does not require installation, as provided for in the design and estimate documentation for construction.

Costs for unfinished construction that increase the cost of the object, regardless of the construction method (contract, economic method, shared construction) are reflected by the customer (developer) on account 08 “Investments in long-term assets”. Accounting is carried out based on actual costs on an accrual basis from the date of commencement of construction to the date of acceptance of the object (part of the object) into operation. Costs incurred by the customer, developer before the start of construction are taken into account in the debit of account 97 “Deferred expenses” and from the date of commencement of construction are written off from the credit of this account to the debit of account 08 “Investments in long-term assets” (clause 9 - Instructions No. 10).

The basis for reflecting construction costs in accounting are PUDs confirming the relevant business transactions. With the contract method, the volume and cost of work are confirmed by acceptance certificates for completed construction and other special installation work of the established form (C-2a, C-2b) signed by both parties (customer and contractor) (Part 1, Clause 55 of Rules No. 1450; Part 1 clause 11 of Regulation No. 1553; parts 2 and 3 clause 1, clause 2, paragraph 4, part 1 clause 9, part 1 clause 10 of Instruction No. 29).

With the economic method of construction, costs are reflected by the developer on the basis of the PUD, confirming the costs incurred (cost of materials consumed, amounts of accrued wages, etc.). The list of PUD forms developed by the organization for application should be fixed in the accounting policy. If the construction is carried out on its own, in order to justify and comply with the standards for the consumption of materials for the work, the developer also needs to draw up an act of form C-2a. In particular, when the estimate documentation for the facility is drawn up on the basis of resource consumption standards in kind and during shared construction (paragraph 4, paragraph 4, article 9, paragraphs 1-4, article 10 of Law No. 57-Z; paragraph 9, subclause 14.5 clause 14 of Instruction No. 10; paragraph 3, 5 part 1 clause 9 of Instruction No. 29).

Account correspondence

| Contents of operation | D-t | Kit |

| Costs for the construction of the facility incurred before the start of construction are taken into account | 97 | 60, 26 and other accounts |

| Costs incurred prior to the start of construction are included in the cost of construction in progress. | 08 | 97 |

| The costs of constructing a real estate property when performing the work on our own are reflected. | 08 | 07, 69, 70 and other accounts |

| Reflects the costs of constructing a property when the work is performed by a contractor | 08 | 60 |

| The amount of VAT claimed by the contractor on the work performed is reflected. | 18 | 60 |

| VAT on the contractor’s work is accepted for deduction (if there is a right to deduction) | 68-2 | 18 |

2. Transfer of costs and objects of unfinished construction

In established cases, the customer or developer may initiate the transfer of constructed (constructed) engineering, transport and social infrastructure facilities and their improvement to operating organizations. As a rule, coordination and decision-making on the acceptance/transfer of these objects is carried out by local administrative and executive authorities. The transfer of objects completed by construction, but not registered as real estate objects, is carried out on the basis of the act of transfer of costs form C-17a and documents confirming the completion of their construction and compliance with the design documentation (subclause 5.10 clause 5 of Decree No. 7, subclause 1.9 clause 1 of Decree No. 72, clause 43 of Instruction No. 10).

At the same time, the above procedure does not imply the transfer of costs for unfinished objects. Therefore, if you need to transfer the costs of unfinished construction to another legal entity, you need to take into account some points.

For example, in shared construction, there is a certain procedure for replacing the developer, according to which the new developer, among other things, is transferred the volumes of unfinished construction, design estimates, accounting, contractual and other organizational documentation related to the unfinished object (clause 9 of Regulation No. 1056).

To transfer costs for unfinished construction, in the author’s opinion, it is advisable to register unfinished objects as an unfinished mothballed capital structure. After this, the organization will have an asset that can be transferred or sold to another legal entity (subclause 1.2-1, clause 1, article 3, article 50 of Law No. 133-Z).

In accounting, the transfer of unfinished construction is formalized by the act of transfer of an unfinished construction facility, form C-22 (clauses 1-4 of article 10 of Law No. 57-Z, clause 8 of the list of PUD No. 360).

Read this material in ilex >>*

* following the link you will be taken to the paid content of the ilex service