When to apply the new FSBU 6/2020

By Order of the Ministry of Finance of Russia dated September 17, 2022 No. 204n, the federal accounting standard FSBU 6/2020 “Fixed Assets” was approved.

It defines the requirements for the formation in accounting of information about the organization’s fixed assets. FSBU 6/2020 was developed on the basis of IFRS (IAS) 16 “Fixed Assets”, which was put into effect in the Russian Federation by Order of the Ministry of Finance dated December 28, 2015 No. 217n.

As is clear, the new standard replaces the Accounting Regulations (PBU 6/01) “Accounting for fixed assets”.

In connection with the adoption of this standard, from January 1, 2022, the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance dated October 13, 2003 No. 91n.

to adopt FSBU 6/2020 from January 1, 2022 . That is, from the financial statements for 2022 . However, you can decide to use it now.

OS recovery

Example (continued)

After 2 years of using the aquarium and terrarium, Zoo-land LLC replaced the failed lighting in the aquarium for the amount of 2,620 rubles. (including VAT) and supplied the terrarium with more advanced ventilation and heating systems in the amount of RUB 46,730. (including VAT).

For the aquarium, repair costs excluding VAT are written off as expenses of the organization. For the terrarium, modernization costs are included in its initial cost (clause 14 and clause 27 of the PBU). The SPI for the terrarium has been revised upward for 3 years (clause 20 of the PBU).

The PBU under consideration does not provide explanations for determining the monthly depreciation of fixed assets after its modernization. Recalculation of depreciation is carried out on the basis of the example given in clause 60 of the Methodological Recommendations for Asset Accounting, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n.

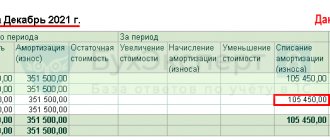

Recalculation of depreciation of modernized equipment at Zoo-land LLC:

| Index | Aquarium | Terrarium |

| Classification of work performed | Repair | Modernization |

| Initial cost after work | RUB 48,175 (without changes) | RUB 259,834 = 220 892 + 46 730 :120 * 100 |

| SPI after work | 132 months (without changes) | 156 months = 144 (original) + 36 (added) – 24 (used) |

| Monthly depreciation after work | 365 rub. (without changes) | RUB 1,430 = (259,834 – 1,534*24 months) : 156 months. |

Important! An increase in the period in NU as a result of modernization of the OS is permissible within the range established by the Classification of OS for a certain depreciation group (Paragraph 2, Clause 1, Article 258 of the Tax Code of the Russian Federation).

Read more about accounting for OS modernization in the article “Modernization of fixed assets – accounting and tax accounting.”

A number of new concepts have been introduced

FSBU 6/2020 introduced certain new concepts and normatively established a number of concepts that have traditionally been used in practice. Among them:

| CONCEPT | EXPLANATION |

| Book value is the original cost of an asset reduced by accumulated depreciation and impairment. | Previously the definition was not formulated |

| A group of fixed assets is a collection of fixed assets of the same type, combined based on the similar nature of their use | Previously the definition was not formulated |

| Investment property is real estate intended to be provided for temporary use for a fee and/or to generate income from an increase in its value. | Previously, the concept of investment real estate was absent. OS intended exclusively for provision for a fee for temporary possession and use or for temporary use for the purpose of generating income were reflected as part of income-generating investments in tangible assets. In connection with the introduction of the concept of “investment real estate”, the concept of “profitable investments in material assets” is not used in relation to OS. |

| Liquidation value is the amount that an organization would receive in the event of disposal of an asset (including the cost of material assets remaining from disposal) after deducting the estimated costs of disposal. Moreover, the fixed asset object is considered as if it had already reached the end of its useful life and was in a state characteristic of the end of its useful life | The concept was not previously used |

| Elements of depreciation - the useful life of an asset, its salvage value and the method of calculating depreciation | The concept was not previously used |

| Revalued value - the value of an asset after its revaluation | Previously – current (replacement) cost |

| Impairment is the condition of an asset such that its carrying amount exceeds the amount that could be received from using the asset or from selling it. | The concept was not previously used |

Objects of fixed assets have been specified

FSBU 6/2020 clarifies the characteristics characterizing fixed assets. In the standard these include:

| SIGN | EXPLANATION |

| The presence of a material form | Not previously formulated |

| Intended for use by an organization in the normal course of business in the production and/or sale of its products (goods), when performing work or providing services, for environmental protection, for temporary use for a fee, for management needs, or for use in non-profit activities organization aimed at achieving the goals for which it was created | Previously there was no indication of the possibility of use for environmental protection |

| Intended for use by an organization for a period greater than 12 months or a normal operating cycle greater than 12 months | Previously, there was also an indication that the organization does not envisage the subsequent resale of the object |

| Able to bring economic benefits (income) to the organization in the future (ensure that the non-profit organization achieves the goals for which it was created) | – |

Long-term assets for sale (previously taken into account as part of fixed assets) are excluded from the scope of application of FAS 6/2020 This type of assets has been taken into account since 2022 in accordance with PBU 16/02 “Information on discontinued activities” (approved by order of the Ministry of Finance dated July 2, 2002 No. 66n).

As part of the operating system, investment real estate objects are separately taken into account and reflected in the financial statements.

What is recognized as the main means

The new provision does not apply to:

- long-term assets for sale;

- capital investments.

Accounting for the latter is regulated by new rules - FSBU 26/2020 “Capital Investments”.

Further resale was removed from the criteria that the fixed asset must meet, but essentially nothing has changed, this condition was simply classified as a limitation.

To the groups of fixed assets (inventory, transport, machinery and equipment), another one was added - investment real estate. It should include real estate that generates income, but does not participate in the operating activities of the organization. For example, land for future construction, a factory hotel or commercial premises available for rent.

PBU 6/01 introduced the concept of “profitable investments in material assets”, i.e. fixed assets intended for generating income by renting them out (leasing, rental). Real estate was not included among them.

The procedure for accounting for low-value items has been changed

FAS 6/2020 establishes a general approach to the definition of low-value assets that have signs of fixed assets, but which can not be taken into account as fixed assets: objects are considered for accounting purposes as low-value based on the materiality of information about them (previously, the value of such assets did not exceed 40,000 rubles for a unit). Based on this approach, the organization independently sets a limit on the value of low-value assets.

Costs for the acquisition and creation of such assets are recognized as expenses of the period in which they were incurred (previously, these assets were reflected as part of inventories). At the same time, the organization is obliged to ensure proper control of their availability and movement.

What is recognized as low-value fixed assets and how to take them into account

According to the old standard, fixed assets worth less than 40,000 rubles were classified as inventories. Now the organization itself sets the minimum cost, which raises the question: can all inventories be written off? There is no answer in the situation. It only says that expenses for the acquisition and creation of fixed assets costing less than the limit established by the organization must be written off in the period in which they were incurred.

The BMC Recommendations Committee tried to resolve the understatement and developed a position on clause 5 of FSBU/2020 - R-126/2021-KpR dated 03/29/2021. an aggregate write-off limit for low-value fixed assets . Such a limit, in the opinion of the committee, should not significantly affect the structure of financial statements.

The total cost of a large number of low-value objects can be significant, although the cost of each individual item is insignificant. Therefore, the committee proposes to take into account all relevant indicators: the service life of the asset, the amount of benefit, the share of depreciation in the cost and the characteristics of the organization.

The procedure for determining inventory objects has been clarified

The traditional approach to determining inventory items of fixed assets is supplemented by recognition as an independent inventory item:

| AN OBJECT | EXPLANATION |

| Each part of one fixed asset, the cost and useful life of which differ significantly from the cost and useful life of the object as a whole | Earlier - with a significant difference only in the useful life |

| Significant expenses of the organization for repairs, technical inspection, maintenance of OS facilities with a frequency of more than 12 months or more than the usual operating cycle exceeding 12 months | Previously – included in period expenses |

Why are shock absorption elements needed?

According to the new rules, at the end of the year the organization is obliged to check depreciation elements for compliance with the conditions for using the fixed assets. If circumstances are established that change the conditions of use of an asset, it is necessary to adjust the corresponding depreciation element.

For example, this year the soil froze more severely in winter than last year—the temperature often dropped below minus 25 degrees. The drilling rig was operated under high load conditions. For this reason, the physical wear and tear of the machine has changed, so the useful life must be reduced.

It is reasonable to consider a product-based depreciation method (volume of work in physical terms, as in the case of a drill rig) for many fixed assets, such as those used in the production of products. This method will best satisfy the requirement of the standard that the depreciation method must reflect the receipt of expected economic benefits from the use of fixed assets.

Depreciation rules changed

Here are the main innovations in matters of depreciation of fixed assets according to FAS 6/2020:

| NEW | EXPLANATION |

| Non-profit organizations charge depreciation of fixed assets in the general manner | Previously, depreciation was not accrued, but depreciation amounts were accrued in off-balance sheet accounting |

| Depreciation calculation | Begins from the moment the object is recognized in accounting and stops from the moment it is deregistered (previously – depreciation began on the 1st day of the month following the month the object was recognized in accounting, and stopped on the 1st day of the month following the month the object was written off from accounting). The previously used approach to determining the point at which depreciation begins and ends is also acceptable. Not suspended in cases of downtime or temporary cessation of use of the OS (previously suspended during the conservation of the object for a period of more than 3 months, as well as for the period of restoration of the object, the duration of which exceeded 12 months). Suspended when the liquidation value of the asset becomes equal to or exceeds its book value. If subsequently the liquidation value of such an object becomes less than its book value, depreciation on it is resumed ( previously, depreciation was accrued until its value was fully paid off or it was written off from accounting). |

| General requirements have been established for the method of depreciation of fixed assets chosen by the organization | Previously, the requirements were not formulated. The chosen depreciation method should:

|

| When applying the reducing balance method of depreciation, the organization independently determines the formula for calculating the amount of depreciation for the reporting period. In this case, the formula should ensure a systematic reduction of this amount as the useful life of this object expires | Previously, the annual amount of depreciation was determined based on the residual value of the object at the beginning of the reporting year and the depreciation rate calculated based on the useful life of this object and the coefficient established by the organization in an amount not exceeding 3 |

| For the depreciation method proportional to the quantity of products (volume of work in kind), a ban on determining the amount of depreciation for the reporting period based on the amount of receipts (revenue or other similar indicator) from the sale of products (work, services) produced (performed, provided) using this OS | Previously the ban was not formulated |

| Depreciation elements of an asset are subject to verification for compliance with the conditions of use of this object. Such a check is carried out at the end of each reporting year, as well as upon the occurrence of circumstances indicating a possible change in the elements of depreciation. Based on the results of the inspection, if necessary, a decision is made to change the relevant depreciation elements. | Previously, the method of calculating depreciation and the useful life, as a rule, were not subject to change |

| The basis for calculating the amount of depreciation for the reporting period has been changed: this amount is calculated based on the book value of fixed assets, remaining useful life, and adjusted liquidation value | Previously – based on the original cost of the fixed asset and the total useful life |

| The amount of depreciation of an asset for the reporting period is determined in such a way that by the end of the depreciation period the book value of this asset becomes equal to its liquidation value | Previously – equal to zero |

Depreciation of fixed assets

According to PBU 6/01 “Accounting for Fixed Assets,” the useful life (abbreviated as SPI) of property is established by organizations based on the planned period of use, depreciation and other time restrictions on the use of fixed assets (clause 20 of PBU). There is no clear division of objects by SPI. To bring together the procedure for reflecting depreciation costs in accounting records with NU, organizations use the Classification of fixed assets by depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1. The use of this classification when establishing SPI is reflected in paragraph 1 of Art. 258 Tax Code of the Russian Federation.

Example (continued)

Aquariums and terrariums purchased by Zoo-land LLC, according to the OS Classification, belong to depreciation group 6 (SPI 10 - 15 years).

When reflecting on April 18 in the BU of the fish aquarium and terrarium, the company entered the SPI as the OS: 132 months for the aquarium and 144 months for the terrarium.

The accounting policy of Zoo-land LLC establishes a linear method for determining the depreciation of fixed assets.

The monthly amount of fixed assets depreciation was:

Aquarium for keeping fish: RUB 48,175. : 132 months = 365 rub.

Terrarium for keeping reptiles: RUB 220,892. : 144 months = 1,534 rub.

The calculated depreciation for the aquarium and terrarium is reflected in the accounting system from May (from the month following the month they were taken into account) (clause 21 of the PBU).

In clause 18 of the PBU under consideration, 4 methods of determining depreciation are recorded:

Linear

Simplest. The calculation algorithm specified in clause 19 of the PBU coincides with the linear method of calculating depreciation, enshrined in Art. 259.1 of the Tax Code of the Russian Federation, which makes it possible to bring closer the NU and BU of depreciation costs. Used by most organizations.

Reducing balance

Complex calculation algorithm. There is no equivalent method of depreciation enshrined in the Tax Code of the Russian Federation, therefore additional difficulties arise in the form of reflecting temporary differences between NU and BU depreciation costs. Designed for accelerated write-off of the cost of the operating system. The use of this method is advisable for equipment that quickly becomes obsolete in moral terms.

By the sum of numbers of years of SPI

A labor-intensive technique in calculus. There is no equivalent depreciation method approved in the Tax Code of the Russian Federation, therefore its use leads to the emergence of temporary differences between the NU and BU depreciation. Refers to accelerated methods of depreciation of fixed assets.

Proportional to the volume of products (works)

Labor-intensive to calculate. There is no equivalent method for calculating depreciation in the Tax Code of the Russian Federation, which leads to differences between the NU and BU depreciation charges. Designed for operating systems for which the planned amount of work for the entire useful life period is known. Used in relation to industrial equipment and transport.

Revaluation rules changed

After recognition, an item of fixed assets can be reflected in accounting at a revalued cost. At the same time, the value of such an object is regularly revalued so that it is equal to or does not differ significantly from its fair value ( previously , the object was revalued at its current (replacement) cost).

Fair value is determined in the manner prescribed by IFRS 13 “Fair Value Measurement”, put into effect in Russia by Order of the Ministry of Finance dated December 28, 2015 No. 217n.

All have the right to revaluate their assets ( previously only commercial organizations).

Revaluation is carried out as the fair value of fixed assets changes ( previously - no more than once a year at the end of the reporting period). At the same time, it is permissible to decide to conduct a revaluation no more than once a year (as of the end of the reporting year).

When carrying out a revaluation, along with a proportional recalculation of the original cost and accumulated depreciation of an asset, a method is acceptable in which the initial cost is first reduced by the amount of depreciation accumulated on it on the date of revaluation, and then the resulting amount is recalculated so that it becomes equal to the fair value of this object ( previously - only proportional recalculation).

The amount of accumulated revaluation can be written off to the organization’s retained earnings in one of two ways :

- One-time when writing off an overvalued asset.

- As depreciation accrues on such an object.

Previously - only at a time when an object is written off.

Revaluation of investment real estate is carried out in a manner different from the procedure for revaluation of other fixed assets. Main differences:

- revaluation is carried out at each reporting date;

- the initial cost of the object (including previously revalued) is recalculated so that it becomes equal to its fair value;

- revaluation or depreciation of an object is included in the financial result of the organization’s activities as income or expense of the period in which the revaluation of this object was carried out;

- revalued objects are not subject to depreciation.

An entity that decides to value investment property at a revalued value must apply this valuation method to all investment properties.

PBU 6/01

7. Fixed assets are accepted for accounting at their original cost.

8. The initial cost of fixed assets acquired for a fee is recognized as the amount of the organization’s actual costs for acquisition, construction and production, excluding value added tax and other refundable taxes (except for cases provided for by the legislation of the Russian Federation).

The actual costs for the acquisition, construction and production of fixed assets are:

amounts paid in accordance with the contract to the supplier (seller), as well as amounts paid for delivering the object and bringing it into a condition suitable for use (paragraph supplemented starting from the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see .previous edition);

amounts paid to organizations for carrying out work under construction contracts and other contracts;

amounts paid to organizations for information and consulting services related to the acquisition of fixed assets;

the paragraph was excluded starting from the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see the previous edition;

customs duties and customs fees (the paragraph has been supplemented since the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see the previous edition);

non-refundable taxes, state duty paid in connection with the acquisition of fixed assets (paragraph supplemented starting from the 2006 financial statements by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see previous edition);

remunerations paid to the intermediary organization through which the fixed asset was acquired;

other costs directly related to the acquisition, construction and production of fixed assets (paragraph as amended, put into effect starting from the 2006 financial statements by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see previous edition).

General and other similar expenses are not included in the actual costs of acquisition, construction or production of fixed assets, except when they are directly related to the acquisition, construction or production of fixed assets.

The paragraph has been excluded from the financial statements since 2007 by Order of the Ministry of Finance of Russia dated November 27, 2006 No. 156n. – See previous edition.

9. The initial cost of fixed assets contributed to the contribution to the authorized (share) capital of the organization is recognized as their monetary value, agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

10. The initial cost of fixed assets received by an organization under a gift agreement (free of charge) is recognized as their current market value on the date of acceptance for accounting as investments in non-current assets (the clause has been supplemented since the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n – see previous edition).

11. The initial cost of fixed assets received under contracts providing for the fulfillment of obligations (payment) in non-monetary means is recognized as the value of the assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets.

If it is impossible to determine the value of assets transferred or to be transferred by the organization, the value of fixed assets received by the organization under contracts providing for the fulfillment of obligations (payment) in non-monetary means is determined based on the cost at which similar fixed assets are acquired in comparable circumstances.

12. The initial cost of fixed assets accepted for accounting in accordance with clauses 9, 10 and 11 is determined in relation to the procedure given in clause 8 of these Regulations (clause as amended, put into effect starting from the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n, - see previous edition).

13. Capital investments in perennial plantings and for radical land improvement are included in fixed assets annually in the amount of costs related to the areas accepted for operation in the reporting year, regardless of the completion date of the entire complex of works.

14. The cost of fixed assets in which they are accepted for accounting is not subject to change, except in cases established by the legislation of the Russian Federation and these Regulations.

A change in the initial cost of fixed assets, in which they are accepted for accounting, is allowed in cases of completion, additional equipment, reconstruction, modernization, partial liquidation and revaluation of fixed assets (paragraph supplemented, starting with the financial statements of 2002, by Order of the Ministry of Finance of Russia dated May 18, 2002 No. 45n, - see previous edition).

15. A commercial organization may no more than once a year (at the beginning of the reporting year) revalue groups of similar fixed assets at current (replacement) cost (paragraph as amended, put into effect starting with the financial statements of 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 year No. 147n, - see previous edition).

When making a decision on revaluation of such fixed assets, it should be taken into account that subsequently they are revalued regularly so that the cost of fixed assets at which they are reflected in accounting and reporting does not differ significantly from the current (replacement) cost.

Revaluation of an object of fixed assets is carried out by recalculating its original cost or current (replacement) cost, if this object was revalued earlier, and the amount of depreciation accrued for the entire period of use of the object (the paragraph was additionally included starting from the financial statements of 2002 by Order of the Ministry of Finance of Russia dated May 18, 2002 year No. 45n).

The results of the revaluation of fixed assets carried out as of the first day of the reporting year are subject to reflection in accounting separately. The results of the revaluation are not included in the financial statements of the previous reporting year and are accepted when generating the balance sheet data at the beginning of the reporting year (the paragraph was additionally included starting from the financial statements of 2002 by Order of the Ministry of Finance of Russia dated May 18, 2002 No. 45n).

The amount of revaluation of an object of fixed assets as a result of revaluation is credited to the additional capital of the organization. The amount of revaluation of an item of fixed assets, equal to the amount of its depreciation carried out in previous reporting periods and attributed to the account for accounting for retained earnings (uncovered loss), is credited to the account for accounting for retained earnings (uncovered loss) (paragraph as amended, put into effect starting from the financial statements 2006 by Order of the Ministry of Finance of Russia dated December 12, 2005 No. 147n - see previous edition).

The amount of depreciation of an item of fixed assets as a result of revaluation is credited to the account of retained earnings (uncovered loss). The amount of depreciation of an object of fixed assets is included in the reduction of the organization’s additional capital formed from the amounts of the additional valuation of this object carried out in previous reporting periods. The excess of the amount of depreciation of an object over the amount of its revaluation, credited to the organization's additional capital as a result of revaluation carried out in previous reporting periods, is charged to the account of retained earnings (uncovered loss). The amount attributed to the account of retained earnings (uncovered loss) must be disclosed in the organization’s financial statements (paragraph as amended, put into effect starting from the 2002 financial statements by Order of the Ministry of Finance of Russia dated May 18, 2002 No. 45n - see previous edition ).

When an item of fixed assets is disposed of, the amount of its revaluation is transferred from the organization's additional capital to the organization's retained earnings.

16. The item has been excluded from the financial statements since 2007 by Order of the Ministry of Finance of Russia dated November 27, 2006 No. 156n. – See previous edition.

The composition of the information disclosed in the reporting has been clarified

FSB 6/2020 supplemented the list of information about fixed assets disclosed in accounting reports with data on:

- the book value of investment property at the beginning and end of the reporting period;

- the result of disposal of fixed assets for the reporting period;

- as a result of revaluation of fixed assets included in income or expenses of the reporting period, capital in the reporting period;

- as a result of impairment of fixed assets and reversal of impairment included in expenses or income of the reporting period; the amount of impairment allocated in the reporting period to reduce the accumulated revaluation result; other information on impairment of fixed assets provided for by IAS 36 “Impairment of Assets”;

- the book value of suitable but not used fixed assets, when this is not related to the seasonal characteristics of the organization’s activities, as of the reporting date;

- the book value of fixed assets in respect of which there are restrictions on property rights, including fixed assets pledged, as of the reporting date;

- methods of valuing fixed assets (by groups);

- elements of depreciation and their changes ( previously - only about useful life and methods of calculating depreciation);

- recognized as income in profit (loss) is the amount of compensation for losses associated with the depreciation or loss of fixed assets provided to the organization by other persons.

additional disclosure have been established for fixed assets measured at revalued amounts In particular:

- date of the last revaluation;

- information about engaging an independent appraiser;

- methods and assumptions adopted in determining fair value, incl. information on the use of observed market prices;

- the book value of the revalued groups of fixed assets, which would be reflected in the accounting records if they were assessed at their historical cost, as of the reporting date;

- methods for recalculating the initial cost of revalued groups of fixed assets;

- the amount of accumulated revaluation of fixed assets not written off to retained earnings, indicating the method of its write-off.

A number of other rules have been clarified

FSBU 6/2020 also clarified a number of rules for accounting for fixed assets:

| WHAT IS SPECIFIED | EXPLANATION |

| Prospective reflection of the consequences of changing the method of assessing fixed assets is provided - that is, without recalculating data for previous periods | Previously – not provided |

| The procedure for reflecting changes in the amount of the estimated liability for future dismantling, disposal of an asset and restoration of the environment, taken into account in the initial cost of this object, has been changed | A change in this amount (without taking into account interest) increases or decreases the original cost of the object. At the same time, if an object is accounted for at a revalued value, then the accumulated revaluation for it (if any) is adjusted by the amount of the change in its initial value. The amount of such adjustment is included in the comprehensive financial result without inclusion in profit or loss. Previously , a change in the amount of an estimated liability was attributed to the financial result of the period and did not change the initial cost and the result of the revaluation. |

| The list of cases of disposal of fixed assets and its inability to bring economic benefits in the future has been supplemented | These are the following cases:

Previously – not formulated |

Simplified methods of accounting for fixed assets

Organizations that, in accordance with the legislation of the Russian Federation, have the right to use simplified methods of accounting, can:

- not to apply the procedure for adjusting the initial cost of fixed assets in connection with a change in the amount of the estimated liability for future dismantling, disposal of the facility and environmental restoration, provided for by FAS 6/2020;

- refuse to test fixed assets for impairment - that is, evaluate them at their book value as of the reporting date;

- disclose information about fixed assets in accounting reports to a limited extent.

Transitional provisions

As the Ministry of Finance notes, the consequences of changes in the accounting policies of an organization in connection with the start of application of FAS 6/2020 are reflected retrospectively - that is, as if this standard had been applied from the moment the facts of economic life affected by it arose.

To facilitate the transition to the new procedure for accounting for fixed assets in the financial statements, starting from which FAS 6/2020 is applied, the organization may not recalculate comparative indicators related to fixed assets for periods preceding the reporting period. To do this, you need to make a one-time adjustment to their book value at the beginning of the reporting period (the end of the period preceding the reporting period). For the purposes of such an adjustment, the carrying value of fixed assets should be considered their original cost (taking into account revaluations), recognized before the application of FAS 6/2020 in accordance with the previously applied accounting policy, less accumulated depreciation.

In this case, accumulated depreciation is calculated in accordance with FAS 6/2020 based on the specified initial cost, liquidation value and the ratio of the expired and remaining useful life, determined in accordance with FAS 6/2020.

The chosen method of reflecting the consequences of changes in accounting policies is disclosed in the first financial statements prepared using FAS 6/2020.

Source: information message of the Ministry of Finance dated November 3, 2020 No. IS-accounting-29.

What is FSBU

The new federal accounting standard cancels PBU 6/01 for accounting for fixed assets from the beginning of 2022. Those who want to try out the new standard can use it in their work right now.

The document has references to IFRS (in particular IAS 36 “Impairment of Assets”, IFRS 13 “Fair Value Measurement”), legalized in our country by Order of the Ministry of Finance No. 217n dated 12/28/15, which indicates the convergence of global and domestic reporting standards.

One of the important points of working with the FSBU is the need to apply it retrospectively (clause 48), in other words, as if the document had already been in force since the beginning of the acquisition and use of a specific OS. The difficulty here is this: depreciation, guided by the provisions of FAS 6/2020, should be calculated according to the updated rules (they will be discussed later in the article), which means that the book value of fixed assets at the beginning of the reporting year will have to be recalculated. For this purpose, the original cost is taken and the amount of depreciation is subtracted. It is obvious that the initial cost should be calculated according to the old rules, and accumulated depreciation - according to the updated standards (clause 49). In this way, you can comply with the new rules at a time, without recalculating for previous years.

Firms that maintain financial statements according to a simplified version have the right to apply the FAS in a limited manner, for example, not to check the fixed assets to see how much they have depreciated (clause 3).

On a note! Budget structures of FSBU 6/2020 are not applied (clause 2 of the Standard).

Let's consider the main innovations regarding fixed assets that the document introduces into the practice of accounting for fixed assets.