Tax on real estate of individuals: objects of taxation

The corresponding object for the property tax of individuals may be (clause 1 of Article 401 of the Tax Code of the Russian Federation):

- separate residential building (including country houses);

- separate living space (in the form of an apartment or room);

- garage, parking space;

- building or structure for other purposes;

- unfinished construction;

- a complex of real estate objects of a single purpose.

The common real estate of an apartment building cannot be recognized as an object of taxation (clause 3 of Article 401 of the Tax Code of the Russian Federation).

Tax base for property tax for individuals

In 2022, the base for the tax in question is determined on the basis of the cadastral price of the objects we discussed above, if this is established by the legislative acts of the constituent entity of the Russian Federation (clause 1 of Article 402 of the Tax Code of the Russian Federation). If regional authorities have not adopted norms according to which the base is formed based on the cadastral price of real estate, then it is determined on the basis of the inventory value of objects, as long as this is permitted by law (clause 2 of Article 402 of the Tax Code of the Russian Federation). Since 2015, based only on the cadastral value, the base for the objects mentioned in paragraph 1 of Art. 378.2 of the Tax Code of the Russian Federation, if these objects are intended for use in business activities (clause 8 of Article 408, clause 3 of Article 402 of the Tax Code of the Russian Federation).

How to calculate property tax for individuals based on cadastral value? The answer to this question is in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

In general, the tax base for a particular property is equal to its cadastral value, except for those cases when the tax is paid (Article 403 of the Tax Code of the Russian Federation):

- per apartment - in this case, the cadastral base for it is reduced by the cadastral price of 20 sq. m in it (clause 3);

- room - in this case, the base for it is reduced by the cadastral price of 10 sq. m in it (clause 4);

- residential building - in this case, the base for it is reduced by the cadastral price of 50 square meters. m in it (clause 5);

- a single complex of real estate objects, including at least one residential premises or house - in this case, the base for it is reduced by 1,000,000 rubles. (clause 6).

Municipal legal acts may increase the amounts of the specified deductions that reduce the base for the tax in question (clause 7 of Article 403 of the Tax Code of the Russian Federation). If the use of a deduction leads to the formation of a negative value, the tax base will be equal to 0 (clause 8 of Article 403 of the Tax Code of the Russian Federation).

The base based on the inventory price is equal to the corresponding price multiplied by the deflator coefficient established by law.

Calculation of tax payment

The tax amount for the year is determined by the formula:

TnI = Tax base × Tax rate

If reporting periods and advance payments are established in your region, the payment for the reporting period (for example, for the 1st quarter) must be calculated based on ¼ of the cadastral value (share of cost) of the object (subclause 1, clause 12, article 378.2 of the Tax Code of the Russian Federation):

AP = Tax base × ¼ × Tax rate

In this case, the amount of tax payable at the end of the year will be equal to the difference between the calculated tax amount for the year and the amount of advance payments.

Example

The cadastral value of the property is 10 million rubles. The tax rate is 1.5%. Then:

- The annual tax amount will be 150,000 rubles. (10,000,000 × 1.5%);

- advance payments based on the results of the 1st quarter, half a year and 9 months will be equal to 37,500 rubles. (10,000,000 × ¼ × 1.5%);

- the amount of tax payable at the end of the year is RUB 37,500. (150,000 – 3 × 37,500).

However, if ownership of a real estate item arose or ceased during the reporting period, then the amount of tax for the tax period and advance payment for the reporting period is determined based on the number of full months of ownership. The formulas for calculation are:

- for advance payments:

AP = Tax base × ¼ × Tax rate × Number of full months of ownership of the property in the reporting period/3;

- for the full tax amount for the year:

NnI = Tax base × Tax rate / Number of full months of ownership of the property in a year / 12.

Since 2016, a full month of ownership is considered to be the one in which the right to the object arose before the 15th day or was lost after the 15th day (clause 5 of Article 382 of the Tax Code of the Russian Federation).

EXAMPLE of calculation from ConsultantPlus, if the cadastral value has changed during the year: The organization owns a building that is taxed at the cadastral value. The tax rate in the region where this building is located is 2%. As of January 1, the cadastral value of the building was 100,000,000 rubles. In the spring, the organization dismantled a small part of the building, after which its area decreased. Information about the changed area was entered into the Unified State Register of Real Estate on June 10. After the changes, the cadastral value was determined to be 90,000,000 rubles. The organization will calculate property tax as follows... See . continuation of the example in K+. Trial access to K+ is free.

Personal property tax: rates

To calculate tax based on cadastral and inventory values, different rates are applied. In both cases, they can be established by regional authorities - but within the limits reflected in the Tax Code of the Russian Federation.

According to the cadastral base, rates can be set at no more than (clause 2 of Article 406 of the Tax Code of the Russian Federation):

- 0.1%, if the object of taxation is a house, residential premises, unfinished construction, a single complex in which there is at least one residential premises or house, a garage, a parking space, a building in a country house with an area of up to 50 square meters. m;

- 2%, if the object of taxation is determined in accordance with the conditions of paragraphs. 7, 10 tbsp. 378.2 of the Tax Code of the Russian Federation or has a cadastral value of more than 300,000,000 rubles;

- 0.5% - for any other objects.

Rates based on the cadastral base are accepted in the region in the amount specified in the Tax Code of the Russian Federation, unless other rates are established by the law of the region (subclause 1, clause 6, Article 406 of the Tax Code of the Russian Federation). Moreover, the region has the right to reduce (down to zero) or increase (but no more than 3 times) the rate for objects that, according to the Tax Code of the Russian Federation, are taxed at a rate of 0.1% (clause 3 of Article 406 of the Tax Code of the Russian Federation).

According to the inventory base, rates can be set at no more than (clause 4 of Article 406 of the Tax Code of the Russian Federation):

- 0.1% if the inventory value of the object, taking into account the deflator coefficient, does not exceed 300,000 rubles;

- 0.1–0.3%, if the inventory value of the object, taking into account the deflator coefficient, is 300,000–500,000 rubles;

- 0.3–2%, if the inventory value of the object, taking into account the deflator coefficient, exceeds RUB 500,000.

If the rates for the inventory base are not determined by the law of the region, then their value will be (subclause 2, clause 6, article 406 of the Tax Code of the Russian Federation):

- 0.1% if the inventory value of the object does not exceed 500,000 rubles;

- 0.3% if the inventory value is more than 500,000 rubles.

Regional authorities have the right to differentiate rates for both bases for objects of the same category, but different (clause 5 of Article 406 of the Tax Code of the Russian Federation):

- cadastral (inventory) value;

- type of object;

- location;

- specifics of the territorial zone in which they are located.

Submission of advance payment calculations

Filing quarterly declarations on advance payments of property tax is the responsibility of all its payers (Article 386 of the Tax Code of the Russian Federation). In this case, it does not matter what the value of the declared property is, it may even be zero - you still need to submit calculations (letter of the Federal Tax Service of the Russian Federation dated February 8, 2010 No. 3-3-05/128).

If a taxable object is accounted for not at its residual value, but at its cadastral value, calculations of advance tax payments for it are made on a general basis.

Calculations must be submitted to the tax authority at the place of registration, and if the object is recorded at the cadastral value, then to the tax authority at the location of such objects.

Procedure for calculating property tax for individuals

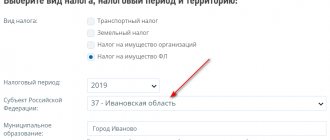

In order to calculate tax in a region where laws on calculating tax based on cadastral prices have been adopted (the majority of such constituent entities of the Russian Federation), you need to know:

- cadastral and inventory price of the property;

- rates - cadastral and inventory;

- deflator value;

- object area;

- values of reduction coefficients;

- Are tax benefits applicable to tax calculation?

Find out what benefits are provided for property tax for individuals in ConsultantPlus. Get free demo access to K+ and get tips from the experts.

When calculating the tax, if for the region it turns out to be the 5th year of the beginning of the application of the calculation from the cadastral value, it will not be necessary to take into account in the formula for its calculation:

- inventory value, as well as the rate that is set for it;

- deflator;

- reduction factor.

Property tax for individuals is calculated using a special formula established by the Tax Code of the Russian Federation. For a full year of property ownership, it looks like this (clause 8 of Article 408 of the Tax Code of the Russian Federation):

H = (H1 - H2) × K + H2,

Where:

N - calculated property tax.

N1 - tax according to the cadastral base.

N2 - tax based on the inventory base, calculated for the year preceding the beginning of the introduction in the region of calculating the tax on the cadastral value. For 2014, it is determined according to the rules of the Law “On Taxes on Personal Property” dated December 9, 1991 No. 2003-I, which ceased to be in effect in 2015, and for later periods of the beginning of the introduction in the region of tax calculation based on cadastral value - according to the rules of the law region that was in effect in the year preceding the start of calculating the tax on the cadastral value.

K is a reduction coefficient, the value of which increases consistently during the first 4 years of the introduction in the region of calculating tax from the cadastral value, amounting to 0.2, respectively; 0.4; 0.6 and 0.8.

That is, from the 5th tax period, tax will be charged on the cadastral value in full. Since tax calculation other than the cadastral value will be discontinued from 2022, regions that started doing it later than 2016 will not be able to use the right to apply reduction factors to the fullest extent.

We can consider how this formula is applied by studying a practical example of calculating the amount of tax.

Tax benefits for the sale of real estate and benefits for “failed” pensioners

Regarding real estate, this year’s amendments affected not only the 2022 personal property tax; the changes also affected benefits for its sale.

On January 1, 2020, Law No. 325-FZ of September 29, 2019 came into force, which reduced the period of ownership of property before its sale from 5 to 3 years for the purpose of exemption from personal income tax. This benefit applies to an individual’s only home. To use it, the owner (clause 4, clause 3, article 217.1 of the Tax Code of the Russian Federation):

- there must be no other home or interest in it at the time of sale;

- or a new home to replace the one being sold was purchased within 90 days from the date of transfer of ownership (of the sold home) to the new owner.

If these conditions are met, then you will not need to pay personal income tax on the sale of housing owned for more than 3 years. This applies not only to houses and apartments, but also to land plots on which residential premises with outbuildings are located (Law No. 210-FZ of July 26, 2019).

The benefit also exists for persons who were supposed to retire, but were subject to an increase in the retirement age as part of the latest pension reform. Law No. 378-FZ of October 30, 2018 provided for the preservation of tax benefits for property tax for persons who were unable to retire on time due to an increase in the retirement age (clause 10.1, clause 1, article 407 of the Tax Code of the Russian Federation). The law came into force on January 1, 2019, and its provisions are also in force this year. If a person, according to all conditions, was eligible for a pension as of December 31, 2018, but was unable to do so due to changes in legislation, then he retains the right to a tax benefit on property tax, on an equal basis with persons who actually retired . One of each type of real estate (house, apartment, garage, etc.) is exempt from taxation.

Thus, the main news for individual owners of real estate will be the calculation of property tax based on the cadastral value (and not the inventory value) throughout the country.

If in 2022, when paying tax for 2022, the majority of owners will follow the new rules, then in 2022 the calculation of cadastral value will affect all regions, with the only exception being the city of Sevastopol. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

An example of calculating the amount of property tax for individuals

Let's assume that you need to calculate taxes for 2022:

- we started paying property taxes in 2022 and have the right to apply a reduction factor of 0.2;

- we do not have tax benefits (we will study their specifics a little later);

- we have an apartment of 70 sq. m;

- the cadastral price of the apartment is 2,000,000 rubles, the inventory price is 300,000 rubles;

- we live in Kazan, where there is a rate of 0.2% for the cadastral base (decision of the Kazan City Duma dated November 20, 2014 No. 3-38) and 0.1% for the inventory base at a cost of less than 500,000 rubles. taking into account the deflator (the norms of the Tax Code of the Russian Federation are in force, the regional normative legal act has not been adopted).

The result of calculations is determined in whole rubles.

First of all, we consider the H1 indicator. For this:

1. Calculate the size of the cadastral tax base:

- divide 2,000,000 (real estate cost) by 70 (apartment area), we get 28,571 rubles;

- subtract from 70 sq. m "apartment" deduction in the amount of 20 sq. m, it turns out 50 sq. m;

- multiply the first result by the second, it turns out 1,428,550 rubles.

2. We determine the H1 indicator by multiplying the cadastral base by a rate of 0.2%. It turns out 2,857 rubles.

Next, we calculate the indicator H2. To do this, we apply a rate of 0.1% to the inventory base, calculated taking into account the deflator coefficient for 2014:

H2 = 300,000 × 1.216 × 0.1% = 365 rubles.

Next we proceed according to the formula:

1. We subtract inventory N2 from the cadastral tax N1, it turns out 2,492 rubles.

2. We multiply the resulting result by the reduction factor established for the first year of application of the calculation in question, and we get 498 rubles.

3. Add inventory tax N2 to it, it turns out 863 rubles.

Thus, the real estate tax payable for 2022 will be 863 rubles.

We noted above that when calculating property taxes for individuals, benefits can be taken into account. Let's study this aspect in more detail.

Reduction factor

Russia has been switching to a new calculation scheme since 2015. To prevent it from hitting the Russians’ pockets too hard, a reduction factor is applied. It is different, depending on the year in which the region began to switch to new tax rules.

- In the first year, a coefficient of 0.2% is used;

- In the second year – 0.4%;

- In the third year – 0.6%.

Then the tax will be calculated based on the full cadastral value, but with the condition that the increase will not be more than 10% per year.

Each property owner needs to find out what reduction factor is currently set in his region. But it is worth considering that it is not applied if the tax on the cadastral value is less than the amount on the property according to the inventory.

For whom personal property tax is not mandatory?

In general, the payers of this tax are all individuals who own the objects we discussed at the beginning of the article. But some categories of citizens have property tax benefits. The list of these categories is fixed in the provisions of paragraph 1 of Art. 407 of the Tax Code of the Russian Federation.

If a citizen has the appropriate status, then he is exempt from paying property tax - but only for one object of taxation of each type (for example, 1 apartment, 1 house, 1 garage). If there are several objects of the same type, the person himself chooses which of them will not be subject to tax. By default, the Federal Tax Service, when calculating tax, selects the most expensive object from several for preferential treatment.

For more information about who is entitled to real estate tax benefits for individuals, as well as about calculating the tax for an incomplete period of ownership of property, read the article “Property tax - an unfinished construction project.”