Title page

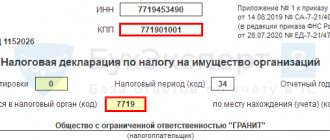

On the title page of the tax return, the organization must fill in all the necessary details.

When filling out the “Adjustment number” in the primary declaration for the tax period, “0” is automatically entered; in the updated declaration for the corresponding tax period, you must indicate the adjustment number (for example, “1”, “2”, etc.).

In the “Tax period” , the tax period code and the year for which the declaration is being submitted are automatically indicated. If the declaration is submitted for the tax period, then the code “34” is indicated - the calendar year; if the declaration is submitted for the last tax period during the reorganization (liquidation) of the organization, the code “50” is entered in the specified field.

When filling out the line “Submitted to the tax authority (code),” you must select from the directory the code of the tax authority to which the tax return is submitted. This code is indicated in the documents on registration with the tax authority (certificate of registration with the tax authority, notice of registration with the tax authority of a legal entity as the largest taxpayer, etc.).

In the “By location (accounting)” , select a code, the list of which is given in the drop-down list. Organizations classified as the largest taxpayers choose code “213”. If the declaration is submitted by Russian organizations that are not the largest taxpayers, then they indicate the code “214”, etc.

When filling out the “Taxpayer” , the name of the organization is reflected, corresponding to the one indicated in the constituent documents.

The fields “Form of reorganization (liquidation)” and “TIN/KPP of the reorganized organization” are filled in only by those organizations that are reorganized during the tax period.

In the “Form of reorganization (liquidation)” , the reorganization code is indicated in accordance with the directory.

Next, indicate the details “TIN/KPP of the reorganized organization” .

When filling out the “Contact phone number” , the organization’s phone number specified during registration is automatically reflected.

In the section of the title page “I confirm the accuracy and completeness of the information:” the following is indicated:

- Manager - if the document is submitted by the taxpayer,

- Authorized representative - if the document is presented by a legal or authorized representative of the taxpayer.

In this case, the full name of the head of the organization or an authorized representative is indicated, as well as the name and details of the document confirming his authority.

The date is also automatically indicated on the title page.

Section 1. Amount of tax to be paid to the budget

Section 1 is completed in relation to the amount of property tax payable to the budget at the location of the organization; the place where the permanent representative office of the foreign organization is registered with the tax authority; location of the real estate.

Section 1 is filled in automatically based on the information reflected in sections 2 and 3.

Line 005 indicates the taxpayer's characteristics:

- “1” - if the organization applied Government resolutions extending the deadlines for payment of advance payments established by regional laws due to COVID-19;

- “2” - if the organization applied regional laws that extended the deadlines for paying taxes and advance payments due to COVID-19;

- “3” - if the organization did not apply legal acts that, due to COVID-19, extended the deadlines for paying taxes and advance payments.

Each block of lines 007-040 reflects the following data:

- line 007 indicates the tax calculation indicator: “1” - if the tax (advance payments) is calculated on real estate objects related to the execution of the agreement on the protection and promotion of investments (SZPK);

- “2” - if the tax (advance payments) is calculated for objects not related to the implementation of the SZPK;

line 021 = ∑ page 260 section. 2 + ∑ page 130 sec. 3 according to the corresponding codes OKTMO, KBK and the sign of calculating tax amounts

line 030 = line 021 – (line 023 + line 025 + line 027) according to the corresponding OKTMO and KBK codes, provided that line 021 – (page 023 + page 025 + page 027) ≥ 0

line 040 = line 021 – (line 023 + line 025 + line 027) according to the corresponding OKTMO and KBK codes, provided that line 021 – (page 023 + page 025 + page 027)

If the successor organization submits a declaration for the last tax period and updated declarations for the reorganized organization, this section indicates the OKTMO code of the municipality in whose territory the reorganized organization (real estate) was located.

Code 03 Type of Property

Team of lawyers - Russlidsurist writes to you.

We share our experience and knowledge, which in total we have more than 43 years, this allows us to give the correct answers to what may be required in various life situations and at the moment we will consider - Code 03 Type of Property.

If in your case you need an instant response in your city or online, then, of course, in this case it is better to use the help on the website. Or ask people who have previously faced the same question.

Attention please, the data may be out of date, laws are updated and supplemented very quickly, so we are looking forward to your subscription to us on social media. networks so that you are aware of all updates.

The decision on how to distribute property taxes between budgets of different levels is made by regional authorities. Therefore, you can find out this procedure in a particular region from local regulatory documents. Or check with your tax office. Typically, such information can be found on inspection information boards.

An example of filling out section 1 of a property tax return. The tax calculated at the end of the year is less than the amount of accrued advance payments. The organization does not have any property located in other states

Title page

The explanation is simple. Despite the fact that the declaration itself has 11 cells for filling out OKTMO, you must indicate the code that corresponds to the final recipient of the tax. That is, OKTMO budgets of municipalities (8 characters) or smaller territorial associations (11 characters). Therefore, there are two options.

The 2022 property tax return for legal entities is a mandatory reporting form for taxpayers. For 2021 you will have to report using a new form. The deadline for submitting the final declaration is March 30, 2021.

Important: we use a new form

The property tax return for 2022 for legal entities is submitted within the deadline established by the Tax Code of the Russian Federation (Article 386). Submit your reports to the Federal Tax Service no later than March 30 of the year following the reporting year. There are no transfers to 2022.

Step No. 1. Fill out the title page

Ordinary citizens and individual entrepreneurs are exempt from reporting. They do not independently calculate property taxes for individuals, nor do they fill out declarations. This category of taxpayers pays obligations under special notifications sent by the Federal Tax Service.

You may like => How to Check When the Scholarship Arrives

This follows from the provisions of Articles 384–386 of the Tax Code of the Russian Federation, paragraphs 1.5, 3.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2022 No. ММВ-7-11/895, and is confirmed by letters of the Federal Tax Service of Russia dated July 18, 2022. No. BS-4-11/13894 and dated September 12, 2022 No. BS-4-11/16569.

They were approved by order of the Federal Tax Service dated March 31, 2022 No. ММВ-7-21/271. KND form – 1152028. Officially, the new form of reporting on advance payments for property tax is valid from June 13, 2021. However, in letter No. BS-4-21/7139 of the Federal Tax Service dated April 14, 2021, officials explained that it can be applied to advances for the first quarter of 2022.

Property Type Code 03 In the Property Tax Declaration 2021

Organizations report on tax, preparing quarterly calculations of advance payments, and when the year ends, a tax return. Advance payments are submitted within 30 days based on the results of each quarter on an accrual basis, and the 2022 corporate property tax declaration is submitted by March 30 of the year following the reporting year (clause

At the next stage, Section 2 is drawn up. There may be several such sheets, for example, if the calculation is filled out separately for property taxed at the location of the company and for assets located outside the location (clause 5.2 of the Filling Out Procedure).

How is property tax calculated on movable property from 2021

The exception is situations where such property became the property of the company as a result of a bilateral transaction between various organizations that carry out joint activities. In addition, the benefit cannot be obtained in the event of a company reorganization.

Deduction mechanism: the base for 2022 was 600,000, of which 78,000 tax was withheld and paid by the employer. Karataev filed documents in 2022 and exercised the right to deduction.

The deduction amount is subtracted from the base (hence the name - subtraction from the base): 600,000 - 2,000,000, but the base cannot be negative and is equal to zero. After applying the deduction, the Federal Tax Service, as it were, makes a recalculation, and the base becomes zero.

If the base is zero, then the tax is zero, which means that the amount withheld and paid last year—78,000—is overpaid. Karataev writes an application for a refund of the overpaid amount, and it is returned to him to the account specified in the application.

Example and example of filling out Appendix 7 of the 3-NDFL declaration for property deduction

Other changes to the form include changing the sheet names. Thus, sheet D1, required by citizens receiving a property deduction, has been renamed “Appendix 7”. This sheet has previously caused difficulties in filling out, especially in the second and subsequent years, when balances are transferred, and now, after the changes, citizens need to learn how to fill it out again.

You may like => Mortgage for Mom and Child

How to fill out Appendix 7 of the 3-NDFL declaration: instructions

If you received a refund for at least 1 year, then for further filling out you will need a declaration from last year. And if you hand over for a return on interest, then filling it out requires even more attention.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

General requirements

The thing is that in such situations, tax deductions are calculated on the basis of the cadastral value.

In addition, local laws must confirm that the residential premises acquired by the organization are subject to taxation.

So, if such regional laws have not been adopted, then, consequently, the acquired property is not taxed and does not need to be included in a declaration of this type.

To whom and where to submit

- objects that are at the disposal of law enforcement agencies and other law enforcement agencies;

- plots of land;

- water resources;

- natural resources;

- cultural heritage of society;

- places where radioactive waste is stored;

- various energy experimental installations;

- nuclear-powered ships, icebreakers;

- objects related to the aerospace industry;

- vessels that were included in a special register of vessels;

- means of depreciation groups that are used for 1 to 3 years.

- Title page

- Information about the type of business activity

- Sheet A. Information about the place of business activity

- Sheet B. Information on vehicles used in carrying out the types of business activities specified in subparagraphs 10, 11, 32 and 33 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation

- Sheet B. Information on each object used in carrying out the types of business activities specified in subparagraphs 19, 45, 46, 47 and 48 of paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation

Place of delivery

Next, create a directory on your workplace in which to place the report template and the executable file PPrintND.exe

Run the executable file PPrintND.exe, in the parameters of which specify the path to the upload file (*.xml).

Section 2. Tax calculation based on average annual cost

Section 2 of the tax return is completed separately for each type of real estate.

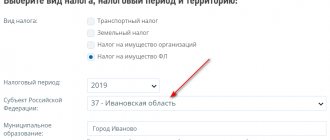

When filling out section 2 in line 001 “Property type code”, you must select the appropriate code:

- in relation to real estate objects that are part of the Unified Gas Supply System - “01”;

- in relation to an object of real estate of a Russian organization that is actually located on the territories of different constituent entities of the Russian Federation or on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation) - “02”;

- for property owned by a Russian organization and located on the territory of another state, the amount of tax on which was paid in accordance with the legislation of another state - “04”;

- for the property of a resident of a special economic zone in the Kaliningrad region - “05”;

- in relation to property located in internal sea waters, in the territorial sea, on the continental shelf, in the exclusive economic zone of the Russian Federation, the Russian part of the Caspian Sea bed and used in the development of offshore hydrocarbon deposits - “07”;

- in relation to main gas pipeline facilities and structures that are their integral technological part, gas production facilities, as well as helium production and storage facilities – “08”.

- in relation to public railway tracks and structures that are their integral technological part - “09”;

- in relation to main pipelines, energy transmission lines, as well as structures that are their integral technological part - “10”;

- in relation to real estate items recorded on the balance sheet of the organization - a participant in the FEZ in Crimea and Sevastopol - “14”.

In all other cases, on the line “Property type code”, o.

Line 002 indicates the sign of the organization’s conclusion of the SZPK:

- “1” - if section 2 is completed for real estate objects related to the execution of the SZPK;

- “2” - if section 2 is filled out for objects not related to the implementation of the SZPK.

Line 010 indicates the code in accordance with the All-Russian Classifier of Municipal Territories (OKTMO), according to which the amount of calculated tax is payable. When filling out this line, the code is selected from the classifier. You can find out your OKTMO code using the electronic service of the Federal Tax Service “Federal Information Address System” (https://nalog.ru, section “All services”).

Further in this section, you must indicate the budget classification code ( KBK ), in accordance with which the organization must transfer the tax. This code is selected from the code book. It should be noted that different BCCs apply to property that is and is not part of the Unified Gas Supply System.

The corresponding lines 020 - 140 in columns 3 and 4 reflect information about the residual value of fixed assets for the tax period as of the 1st day of each month of the tax period and at the end of the tax period (as of December 31).

Thus, column 3 of this section indicates the residual value of fixed assets for the tax period for tax purposes, and column 4 indicates the residual value of preferential (tax-exempt) property.

Line 150 indicates the automatically calculated average annual value of real estate for the tax period. It is calculated as the quotient of dividing by 13 the sum of values in column 3 lines 020 – 140 , i.e.:

page 150 = ∑ page 020-140 gr. 3/13

Line 160 indicates the tax benefit code. It is selected from the code book.

For benefits established by the law of a constituent entity of the Russian Federation in the form of a reduction in the tax rate (benefit code 2012400), in the form of a reduction in the amount of tax payable to the budget (benefit code 2012500), as well as for benefits with codes 2010501-2010508, line 160 is not filled in.

The second part of the indicator on line 160 is filled in only if the first part of the indicator indicates the benefit code 2012000. In the second part of the indicator, you must sequentially indicate the number, paragraph and subparagraph of the article of the law of the subject of the Russian Federation, in accordance with which the benefit is provided. For each of the indicated positions, four sign spaces are allocated. Moreover, if the corresponding attribute has less than four characters, the free spaces to the left of the value are filled with zeros. For example, if the corresponding benefit is established in clause 15.2, clause 2 of Art. 5 of the law of the subject of the Russian Federation, then on line 160 it is indicated:

| 2 | 0 | 1 | 2 | 0 | 0 | 0 | / | 0 | 0 | 0 | 5 | 0 | 0 | 0 | 2 | 1 | 5 | . | 2 |

If the organization does not have benefits, then this line is not filled in.

Line 170 shall indicate the average annual value of non-taxable property for the tax period, calculated as follows:

page 170 = ∑ page 020-140 gr. 4/13

Line 180 is filled in only if in section 2 on the line “Property type code” there is o. In this case, in this line you need to indicate the share of the book value of the real estate property on the territory of the corresponding constituent entity of the Russian Federation, the federal territory "Sirius" (in the form of a simple proper fraction).

Line 190 automatically calculates the tax base as:

1. When filling out section 2 from the line “Property type code” :

page 190 = (page 150 - page 170) * page 180

2. When filling out section 2 with other marks on the line “Property type code” :

page 190 = page 150 - page 170

Line 200 is filled in by organizations using the benefit in the form of a reduction in the tax rate (benefit code 2012400). This code is selected from the directory. For a benefit with code 2012400, the second part of the indicator sequentially indicates the number, clause and subclause of the article of the law of the constituent entity of the Russian Federation, in accordance with which the corresponding benefit is provided. Line 200 is filled in the same way as line 160 .

If the organization does not have a tax benefit in the form of a reduced rate for this property, then line 200 is not filled in.

Line 210 indicates the tax rate established by the law of the constituent entity of the Russian Federation for this organization for the relevant property (types of property). By default, section 2 of the declaration reflects the value on line 210 equal to 2.2%. If the law of a constituent entity of the Russian Federation on property establishes a benefit in the form of a lower tax rate, then line 210 reflects the tax rate taking into account the benefit provided (reduced tax rate). Section 2 is completed separately for each tax rate applied by the taxpayer.

If the line “Property type code” is o, line 210 indicates:

- tax rate of 0% when reflected on line 160 of tax benefit code 2010401;

- tax rate in the amount established by the law of the Kaliningrad region, reduced by 50%, when reflected in the tax benefit code line 2010402.

Line 215 indicates the KZh coefficient in relation to public railway tracks first registered as fixed assets, starting from January 1, 2022.

Line 215 is filled in if the “Property type code” contains o.

Line 220 reflects the automatically calculated amount of tax for the tax period. It is calculated as follows:

- when filling out section 2 with property code “09”:

page 220 = page 190 * page 210 / 100 * page. 215 - when filling out section 2 with other property codes:

page 220 = page 190 * page 210 / 100

Lines 230 and 240 are filled in in case of write-off of tax (advance payment) for the period of ownership of the object from April 1 to June 30, 2022 and (or) the law of a constituent entity of the Russian Federation establishes a tax benefit for certain organizations in the form of a reduction in the amount of tax payable to the budget.

When an organization is exempt from paying tax (advance payment), one of the tax benefit codes is selected of line 230 If an organization is exempt from paying tax (advance payment) and at the same time has the right to a regional benefit, then in the first part of line 230 one of the codes is indicated: 2010505-2010508, and in the second - the number, paragraph and subparagraph of the article of the law of the subject of the Russian Federation, in accordance with which the corresponding benefit is provided. In this case, the indicator is filled in similarly to line 160 . If the organization does not have these benefits, then this line is not filled in.

Line 240 indicates the amount of tax benefit that reduces the amount of tax payable to the budget (including taking into account the amount of the advance payment for the period of ownership of the taxable object from April 1 to June 30, 2022).

If the first part of line 230 only a tax benefit established by the law of a constituent entity of the Russian Federation in the form of a reduction in the amount of tax payable to the budget (benefit code 2012500), the second part reflects the number, clause and subclause of the article of the law in accordance with which the benefit is provided . In this case, the indicator is filled in similarly to line 160 .

Line 240 indicates the amount of the tax benefit.

For example, if the law of a constituent entity of the Russian Federation establishes a benefit in the form of payment to the budget of 60% of the amount of calculated tax, then the value on line 240 should be calculated as follows:

page 240 = page 220 * (100 - 60) / 100

Line 250 shall indicate the amount of corporate property tax paid outside the territory of the Russian Federation, in accordance with the legislation of another state, in respect of property owned by a Russian organization and located on the territory of that state.

Line 250 is filled out by organizations that have selected “Property Type Code” in line 001 .

Line 260 reflects the automatically calculated amount of tax payable to the budget for the tax period. It is calculated as follows:

- when filling out section 2 with property code “04”:

line 260 = 0, if line 250 ≥ line 220 – line 240 line 260 = line 220 – line 240 – line 250, if page 250 - when filling out section 2 with other property codes:

page 260 = page 220 – page 240

If the calculated value on line 260 is less than zero, then a zero value is indicated.

To fill out section 2 in relation to another category of property, you need to create another section 2. To do this, the program provides the option “Add page” .

Property type codes for 2022

As always, we will try to answer the question “Property code 03, what is it?” You can also consult with lawyers for free online directly on the website without leaving your home.

, )1. This Procedure for determining the type of actual use of buildings (structures) and premises was developed in accordance with Article 378.

2 of part two in order to determine the type of actual use of buildings (buildings, structures) and premises (hereinafter referred to as real estate objects) used for: business, administrative or commercial purposes; placement of retail facilities, public catering facilities, consumer services; placement of offices and related office space infrastructure (including centralized reception facilities, meeting rooms, office equipment, parking).2.

Property type code and new property report

Federation or in the Russian part (Russian sector) of the Caspian Sea bottom, used in the implementation of activities for the development of offshore hydrocarbon deposits, including geological study, exploration, and preparatory work. Real estate objects actually located on the territories of different constituent entities of the Russian Federation or on the territory subject of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation) (except for property with code 07) The procedure for filling out the declaration The indicator “Amount of tax payable to the budget” based on the results of the tax period is determined as the difference between the amount of tax calculated for the tax period and the amounts of advance tax payments calculated during the tax period.

Property type code 03 in the 2018 property tax return

Submission at the location of a separate enterprise that has taxable property on its balance sheet. 245 Submission at the place of registration of a foreign company. 281 Filing at the place where the property is located. 01 Submission is carried out in paper form through the post office.

02 Submission is made in paper form in person or through a representative. 03 Submission is carried out in paper form and on any removable media in person. 04 Submission is carried out electronically using an electronic signature. 05 Other.

08 Submission is carried out in paper form and on any removable media through the post office. 09 Submission is carried out on barcoded paper in person. 10 Submission is carried out on barcoded paper through the post office. 21 Reporting period – quarter.

17 Reporting period – half a year. 18 Reporting period – third quarter.

will finally cease to operate in 2022. To take into account advances accrued during established reporting periods, line 230 is filled in. And in line 270 of the property tax declaration, the value (residual) is entered for all fixed assets recorded on the balance sheet, except non-taxable ones. After Sect. 2 is fully formed, you can proceed to compiling Section.

- Line 140 indicates the average value of non-taxable property for 9 months of 2022. It is calculated similarly to the average value of all property on page 120, only the data is taken not from column 3, but from column 4.

- Line 150 is filled in only if the taxable property is located on the territory of several constituent entities of the Russian Federation (property type code 02). This field contains the share of the book value of an object related to a given constituent entity of the Russian Federation.

In one, put the code of the municipality subordinate to the inspectorate in which the organization is registered at its location. And in the other - according to the location of geographically distant property.

Property type code Line 010 - OKATO code Lines 020 - 110 Line 120 - Average value of property for the reporting period Line 130 - Tax benefit code Line 140 - Average value of tax-free property for the reporting period Line 150 - Share of the book value of the real estate property by territory of the corresponding subject of the Russian Federation Line 160 - Tax benefit code (established in the form of a reduction in the tax rate) Line 170 - Tax rate (%) Line 180 - Advance payment amount Line 190 - Tax benefit code (in the form of a reduction in the amount of tax payable to the budget ) Line 200 - The amount of the advance payment benefit, which reduces the amount of the advance tax payment payable to the budget

Property type code in the property tax return 2021 car

Quarterly calculations are submitted for advance payments, and a property tax declaration is submitted at the end of the year. Starting from 2022, the forms of calculation and declaration will change; they were approved by the Order of the Federal Tax Service dated 04.10.

2018 No. ММВ-7-21/ The new forms take into account the termination of taxation of movable property, and they also allow the calculation of tax if the cadastral value was changed during the tax period.

The declaration now includes the field “Address of the real estate property” for objects that do not have a cadastral number, but do have an address.

Property type code in the 2018 property tax return

The declaration and calculation are also supplemented with the field “Address of a real estate property located on the territory of the Russian Federation” (line code 030 of Section 2.1). It is filled out for objects taxed at the average annual value if they do not have cadastral and conditional numbers, but have an address assigned indicating the municipal division.

The objects of the OKFS classification are the forms of ownership established by the Constitution of the Russian Federation, the Civil Code of the Russian Federation, as well as federal laws. OKFS codes are represented by two symbols.

Features of the formation of a declaration and tax calculation for property tax

To generate a single Section 2 of the Report, preferential (Fig. 3) and non-preferential (Fig. 4) property in the property tax rate register (Taxes section) must have the same values in the details:

Filling out a declaration and calculation if the property has no residual value

Section 3 of the declaration (calculation) is not completed by government agencies, since the procedure for calculating the tax base based on the cadastral value of the property does not apply to them. It should be applied by the owners of certain real estate properties, as well as those to whom they are transferred under the right of economic management (clause 2 of Article 375, subclause 3 of clause 12, clause 13 of Article 378.2 of the Tax Code of the Russian Federation).

- Section 1 is consolidated, it reflects the amount of tax payable according to the data from sections 1 and 2;

- Section 2 calculates the tax base from the residual value of the property;

- In Section 3, the tax base for real estate is determined from its cadastral value.

OKFS - all-Russian classifier of forms of ownership

- in relation to real estate objects that are part of the Unified Gas Supply System (hereinafter referred to as the Unified Gas Supply System) in accordance with the Federal Law of March 31, 1999 N 69-FZ “On Gas Supply in the Russian Federation” (Collected Legislation of the Russian Federation, 1999, N 14 , Art. 1667; 2004, N 35, Art. 3607; 2005, N 52, Art.

Property type code 03 what is it

- in relation to property exempted from a specific tax benefit (with the exception of tax benefits in the form of a reduction in the amount of tax payable to the budget, and a tax benefit established in the form of a reduction in the tax rate).

Submit a declaration to the tax office containing:. In each line in the corresponding column of the declaration, indicate only one indicator. If there is no data to fill out the indicator, then put dashes in all cells. For example, like this: All values of the declaration’s cost indicators are indicated in full rubles. Indicator values are less than 50 kopecks.

Property tax: reporting for the year using a new form

The return may not correct errors by corrective or other similar means. This is all stated in paragraphs 1. Fill out the cells allocated for the TIN from left to right.

Since the organization’s TIN consists of 10 digits, in the last two cells that remain free, put a dash:. Please indicate another checkpoint other than that of the organization itself in the following cases:.

This is discussed in paragraphs 2.

Corporate property tax in 2022: what has changed?

Therefore, there are two options. As a result, property taxes can also be redistributed to the budgets of smaller territorial associations that are part of municipalities.

For example, various settlements, towns, districts, auls, uluses, etc. If you put an 8-digit code, put dashes in the cells left empty.

For example, in Moscow property taxes are distributed at the level of municipal districts.

In general, this is ¼ of the difference between the values of lines 20 and 25, multiplied by the tax rate (line 070). If necessary, the payment amount is multiplied by additional adjustment factors from lines 030, 050 and 080.

Property tax return: Corporate property tax return in PDF format can be found at the link below. Property tax declaration: form. Let us remind you that the property tax return can be submitted on paper or in electronic form.

Property Tax Rate Property Type Code 03

Section 2.1. Information about real estate objects

Section 2.1 reflects information about real estate, the tax on which is calculated based on the average annual cost.

For each property, a separate block of lines 010 - 050 .

On line 010 the code number of the real estate object is indicated, taking into account the following conditions:

- if the object has a cadastral number specified in the Unified State Register, code “1” is selected;

- if the object does not have a cadastral number and has a conditional number specified in the Unified State Register of Real Estate, code “2” is selected;

- if a real estate property does not have cadastral and conditional numbers specified in the Unified State Register of Real Estate, and there is an inventory number, as well as an address assigned to this property in the territory of the Russian Federation indicating a municipal entity, code “3” is selected;

- if the object does not have cadastral and conditional numbers specified in the Unified State Register of Real Estate, and if there is an inventory number in the absence of an address assigned to this object, code “4” is indicated;

- when filling out the section regarding a water vehicle, select code “5”;

- When filling out the section for an aircraft, code “6” is selected.

On line 020 , depending on the code specified in line 010 , the number is reflected: cadastral - when choosing code "1", conditional - when choosing code "2", inventory - when choosing codes "3" or "4", identification - when indicating code “5” or serial – when indicating code “6”.

Line 030 is filled in only if code “3” is selected in line 010 . At the same time, in the block “Additional information about the address” the following is indicated: code of the subject of the Russian Federation, index, name and type of municipal entity, settlement, settlement, type and name of the element of the planning structure, road network, number of the land plot, type and number of the building and premises.

On line 040, the code of the real estate object is selected in accordance with OKOF.

Line 050 indicates the residual value of the property as of December 31 of the tax period.

In the event of disposal of a real estate property before December 31 of the tax period (liquidation of an organization before December 31 of the tax period), section 2.1 is not completed in relation to such an object.

Section 1

In section 1 please indicate:

- on line 010 – OKTMO code according to the All-Russian Classifier, approved by order of Rosstandart dated June 14, 2013 No. 159-st. If the OKTMO code value is less than the number of cells allocated for it, put dashes in the empty cells;

- on line 020 – BCC for property tax;

- on line 030 - the amount of tax payable to the budget according to the codes KBK and OKTMO, indicated on lines 010–020 of the corresponding block. The procedure for calculating this indicator is given in subclause 3 of clause 4.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895. If the resulting value is negative, put a dash on line 030;

- on line 040 – the amount of tax to be reduced based on the results of the tax period. This figure represents the difference between the tax for the year and the accrued advance payments. From these amounts, subtract the tax that was paid abroad on the property of a Russian organization located on the territory of another state. If the resulting value is negative, enter it without the minus sign. And when it is positive, then enter zero.

Fill out separate sections 1 for all cases when you pay tax by location:

- a Russian organization or a place where a foreign organization operates through a permanent representative office;

- a separate division with property allocated to a separate balance sheet;

- real estate taking into account the peculiarities of the budget structure of the regions.

Each Section 1 must be signed by the head of the organization or other authorized representative. Don’t forget to include the date you made the declaration:

This procedure is provided for in clause 2.4 and section IV of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

Situation: which OKTMO code – 8-digit or 11-digit – should I indicate in my property tax return?

It all depends on how the tax is distributed between budgets of different levels in a particular region.

The explanation is simple. Despite the fact that the declaration itself has 11 cells for filling out OKTMO, you must indicate the code that corresponds to the final recipient of the tax. That is, OKTMO budgets of municipalities (8 characters) or smaller territorial associations (11 characters). Therefore, there are two options.

Option 1. The property tax can be sent entirely to the regional budget or distributed in whole or in part between municipalities of a constituent entity of the Russian Federation. In this case, indicate OKTMO of eight characters in the declaration.

Option 2. As a result, property taxes can also be redistributed to the budgets of smaller territorial associations that are part of municipalities. For example, various settlements, towns, districts, villages, uluses, etc. Then the 11-digit OKTMO must be entered in the declaration.

This procedure follows from paragraph 1.6 of Appendix 3 to the order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895 and the order of Rosstandart dated June 14, 2013 No. 159-ST.

How is the tax distributed?

The decision on how to distribute property taxes between budgets of different levels is made by regional authorities. Therefore, you can find out this procedure in a particular region from local regulatory documents. Or check with your tax office. Typically, such information can be found on inspection information boards.

How to fill out OKTMO in the declaration

Regardless of how many characters must be indicated in section 1 of the declaration, fill out the line “OKTMO Code” from left to right. If you enter an 8-digit code, put dashes in the cells left empty.

For example, in Moscow property taxes are distributed at the level of municipal districts. In most cases, they correspond to 8-digit OKTMO. And this is what the code entry will look like in the property tax return in Novogireevo:

Situation: how to correctly indicate the amount of tax in section 1 of the property tax return. Is the tax calculated at the end of the year less than the advance payments? The organization does not have property in other countries.

Indicate the tax on line 040 of section 1 of the declaration. There is no need to put a minus sign or fill out line 030.

This is exactly the procedure established by subclause 4 of clause 4.2 of the Procedure for filling out the declaration, approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

An example of filling out section 1 of a property tax return. The tax calculated at the end of the year is less than the amount of accrued advance payments. The organization does not have any property located in other states

The amount of the organization’s property tax for 2016 is 166 rubles. The amount of advance payments for property tax accrued to the budget for nine months of 2016 is 175 rubles.

The amount of tax to be reduced is: 166 rubles. – 175 rub. = 9 rub.

The organization's accountant reflected this amount on line 040 of section 1 of the property tax return. In line 030 of the declaration, the accountant added dashes.

Section 3. Calculation of tax based on cadastral value

Section 3 of the tax return is filled out:

- Russian and foreign organizations for real estate objects, the tax base for which is the cadastral value;

- foreign organizations that do not have permanent representative offices in Russia - for real estate located in Russia;

- foreign organizations that have permanent representative offices in Russia - for real estate objects that are not related to the activities of permanent representative offices.

In the “Property Type Code” , select the appropriate code:

- for the property of a resident of a special economic zone in the Kaliningrad region - “05”;

- in relation to real estate objects included in the list of objects, the tax base of which is determined as cadastral value - “11”;

- in relation to real estate of a foreign organization - “12”;

- in relation to residential buildings and residential premises not accounted for on the balance sheet as fixed assets – “13”;

- in relation to real estate items recorded on the balance sheet of the organization - a participant in the FEZ in Crimea and Sevastopol - “14”.

Line 002 indicates the sign of the organization’s conclusion of the SZPK:

- “1” - if section 3 is filled out for real estate objects related to the execution of the SZPK;

- “2” - if section 3 is filled out for objects not related to the implementation of the SZPK.

Line 010 indicates the code in accordance with the All-Russian Classifier of Municipal Territories (OKTMO), according to which the tax amount is payable. When filling out this line, the code is selected from the classifier. You can find out your OKTMO code using the electronic service of the Federal Tax Service or the “Federal Information Address System” (https://nalog.ru, section “All services”).

Further in this section, you must indicate the budget classification code ( KBK ), in accordance with which the organization must transfer the tax. This code is selected from the code book. It should be noted that different BCCs apply to property that is and is not part of the Unified Gas Supply System.

On line 014, the code of the type of information about the object in respect of which the section is being filled out. In this case, if the section is filled out in relation to a building (structure, structure), code “1” is indicated; in relation to the premises, garage, parking space - code “2”.

On line 015 , the cadastral number of the building (structure, structure) is indicated if code “1” is selected in line 014 , or the cadastral number of the premises if code “2” is selected.

Line 020 indicates the cadastral value of the real estate property as of January 1 of the year that is the tax period, including:

- line 025 indicates the tax-free cadastral value of the real estate property as of January 1 of the year that is the tax period.

Line 020 , filled in for premises whose cadastral value is not determined, indicates the cadastral value of the premises based on the share of the premises' area in the total area of the building ( line 035 ), including:

- line 025 indicates the tax-free cadastral value of the real estate property as of January 1 of the year that is the tax period.

Line 030 reflects the taxpayer’s share in the right to real estate.

Line 030 is filled in only if the property is in common (shared or joint) ownership.

Line 035 indicates the share of the cadastral value of the building in which the premises are located, corresponding to the share of the area of the premises in the total area of the building.

Line 040 indicates the tax benefit code. It is selected from the code book.

For benefits established by the law of a constituent entity of the Russian Federation in the form of a reduction in the tax rate (benefit code 2012400), in the form of a reduction in the amount of tax payable to the budget (benefit code 2012500), as well as for benefits with codes 2010501-2010508, line 040 is not filled in.

The second part of the indicator on line 040 is filled in only if the first part of the indicator indicates the benefit code 2012000. In the second part of the indicator, you must sequentially indicate the number, clause and subclause of the article of the law of the subject of the Russian Federation, in accordance with which the benefit is provided. For each of the indicated positions, four sign spaces are allocated. Moreover, if the corresponding attribute has less than four characters, the free spaces to the left of the value are filled with zeros. For example, if the corresponding benefit is established in clause 15.2, clause 2 of Art. 5 of the law of the subject of the Russian Federation, then on line 040 it is indicated:

| 2 | 0 | 1 | 2 | 0 | 0 | 0 | / | 0 | 0 | 0 | 5 | 0 | 0 | 0 | 2 | 1 | 5 | . | 2 |

If the organization does not have benefits, then this line is not filled in.

Line 050 indicates the share of the cadastral (inventory) value of a real estate property on the territory of a constituent entity of the Russian Federation (in the form of a regular simple fraction).

Line 050 is filled in only if a calculation is submitted for a real estate property that has its actual location on the territories of different constituent entities of the Russian Federation or on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation).

Line 060 indicates the tax base for the real estate property, calculated as follows:

- for an object of real estate that has an actual location on the territories of different constituent entities of the Russian Federation or on the territory of a constituent entity of the Russian Federation and in the territorial sea of the Russian Federation (on the continental shelf of the Russian Federation or in the exclusive economic zone of the Russian Federation):

line 060 = (line 020 – page 025) * page 030 * page 050 - for other real estate assets:

line 060 = (line 020 – line 025) * line 030

Line 070 is filled in if the law of a constituent entity of the Russian Federation establishes a benefit for this property in the form of a reduction in the tax rate (benefit code 2012400). This line indicates a composite indicator: the first part of the indicator reflects the tax benefit code 2012400, and the second part of the indicator sequentially indicates the number, paragraph and subparagraph of the article of the law of the subject of the Russian Federation, in accordance with which the corresponding benefit is provided. This indicator is filled in similarly to line 040 .

If the organization does not have a tax benefit in the form of a reduced rate for this property, then line 070 is not filled in.

Line 080 reflects the tax rate established by the law of the constituent entity of the Russian Federation for this category of organizations and (or) this type of property.

If the law of a constituent entity of the Russian Federation establishes a benefit (benefit code 2012400) for this category of organizations for this property, line 080 reflects the tax rate taking into account the benefit provided.

Line 090 indicates the coefficient Kv, which takes into account the actual period of ownership of the property in the tax period. This line is filled in only if the organization acquires (terminates) ownership of a real estate asset during the tax period. The coefficient Kv is calculated as the ratio of the number of full months during which a given piece of real estate was owned by the organization in the tax period to the number of months in the tax period.

In case of ownership of real estate during the entire tax period, 1 is indicated on line 090 .

Line 095 indicates the Ki coefficient, which is used to calculate tax in the event of a change in the cadastral value of a property during the tax period due to changes in its qualitative and (or) quantitative characteristics. The Ki coefficient is calculated as the ratio of the number of full months during which in a given tax period the property had a cadastral value established for a given qualitative and (or) quantitative characteristic of the property to the number of calendar months in the tax period. In this case, in relation to such an object, 2 sections 3 are filled out.

If it is necessary to simultaneously apply the Kv and Ki coefficients, the value of each of which is different from one, the value of the Ki coefficient must take into account the period of ownership of the property in a given tax period.

Line 100 is calculated as follows:

- in the event that an organization acquires (terminates) ownership of a real estate property during the tax period (in the absence of the Ki coefficient):

page. 100 = page 060 * page 080 / 100 * page 090 - in the event that an organization acquires (terminates) ownership of a property during the tax period (if there is a Ki coefficient):

line 100 = line 060 * line 080 / 100 * line 090 * line 095 - in the case of ownership of a real estate property during the entire tax period (if there is a Ki coefficient):

line 100 = line 060 * line 080 / 100 * line 095 - in other cases:

page 100 = page 060 * page 080 / 100

Lines 110 and 120 are filled in if the organization applies a tax benefit established by law of a constituent entity of the Russian Federation in the form of a reduction in the amount of tax payable to the budget and (or) write-off of tax (advance payment) for the period of ownership of the object from April 1 to June 30, 2022.

If the first part of line 110 only a tax benefit established by the law of a constituent entity of the Russian Federation in the form of a reduction in the amount of tax payable to the budget (benefit code 2012500), the second part reflects the number, clause and subclause of the article of the law in accordance with which the benefit is provided (similar to filling out line 040 ).

When an organization is exempt from paying tax (advance payment), one of the tax benefit codes is selected of line 110 If an organization is exempt from paying tax (advance payment) and at the same time has the right to a regional benefit, then in the first part of line 110 one of the codes is indicated: 2010505-2010508, and in the second - the number, paragraph and subparagraph of the article of the law of the subject of the Russian Federation, in accordance with which the corresponding benefit is provided. In this case, the indicator is filled in similarly to line 040 .

Line 120 indicates the amount of the tax benefit that reduces the amount of tax payable to the budget (including taking into account the amount of the advance payment for the period of ownership of the taxable object from April 1 to June 30, 2022).

Line 130 reflects the automatically calculated amount of tax payable to the budget for the tax period:

page 130 = page 100 – page 120

If the calculated value on line 130 is less than zero, then a zero value is indicated.

A separate section 3 must be filled out for each property. For example, if in the same building the organization has several premises, the tax base for which is the cadastral value, section 3 must be filled out separately for each of these premises. To fill out section 3 in relation to another object, you need to create another section 3. To do this, the program provides the option “Add page” .

Code 03 type of property in the property tax return 2021 instructions for filling out – Legal protection

The accountant must indicate the OKOF code in the property tax return. However, this year the classifier was changed. This raised numerous questions about what OKOF code to use when calculating property taxes.

Urgent news for all accountants: Officials have new requirements for payment orders: with what wording will payments not go through. Read more in the Russian Tax Courier magazine.

Let's figure it out together:

- how to find out the OKOF code using the new classifier;

- how and where to indicate the OKOF code in the property tax return;

- what is the new classifier?

Order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895 approved the form of property tax declaration. One of the mandatory details of the declaration is the OKOF code.

Where to enter the code

Starting this year, an additional section 2.1 “Information on real estate objects taxed at the average annual value” has been added to the declaration. In this section of the property tax calculation you need to enter the OKOF code (see sample).

How to specify the code

Now let’s figure out how to indicate the OKOF code in the property tax return:

- in section 2.1 of the new declaration, indicate the OKOF code only for fixed assets taxed at the average annual cost, the amount of tax in respect of which is calculated in section 2 of the declaration;

- take the code for the property declaration from the All-Russian Classifier of Fixed Assets 2022;

- OKOF code fits into line 040 of section 2.1 of the property tax declaration;

- the code according to the new classifier contains 12 digits, enter it starting from the first cell of line 040;

- for each object calculated at the average annual cost, there is its own line with the OKOF code, that is, no matter how many objects you have, you should have so many lines with OKOF codes in the declaration.

Attention! From January 1, 2022, OKOF was changed, so the codes for the property tax return in 2022 must be taken from the new classifier.

Let us remind you that OKOF codes in the property tax declaration are entered only for property, the tax base of which is calculated from its average annual value. This note applies to the entire section 2.1.

Section line 2.1*What and how we indicate

| 010 | Here we put the cadastral number of the taxable property (if any) |

| 020 | word number, that is, the number of taxable property according to the Unified State Register of Real Estate (if there is one) |

| 030 | Inventory number, filled in only if it is not possible to enter data in lines 010 and 020. If at least one of the above lines is filled in, put a dash |

| 040 | OKOF code according to the 2022 classifier |

| 050 | We enter the remaining amount of the value of the property as of December 31 of the tax period |

*Section 2.1 may not be completed if the property is deregistered:

- before April 1 of the tax period (when filling out section 2.1 for the first quarter);

- before July 1 of the tax period (when filling out section 2.1 for the six months);

- before October 1 of the tax period (when filling out section 2.1 for nine months);

- until December 31 of the tax period (when filling out section 2.1 for the year)

On January 1, 2022, a new All-Russian Classifier of Fixed Assets (OKOF) was put into effect on the territory of the Russian Federation, its official wording is OK 013-2014 (SNA 2008). OKOF of earlier origin has been canceled (Order of the Federal Agency for Technical Regulation and Metrology dated December 12, 2014 No. 2018-st).

Thus, you take the OKOF code for property tax calculations from the OK 013-2014 classifier (you can view it in full at the end of this article). To do this, you need to transfer fixed assets accepted for accounting until 2022 from one depreciation group to another.

To do this, you will need a comparative table of old and new codes of the All-Russian Classifier of Fixed Assets. This transition key is presented in Rosstandart Order No. 458 dated April 21, 2016.

Based on the results of the tax period - calendar year, organizations submit a property tax declaration to the Federal Tax Service in the form (electronic format) approved by order of the Federal Tax Service of Russia dated November 24, 2011 No. ММВ-7-11/895.

One declaration reflects the amount of tax (advance payment) calculated from both the book value and the cadastral value.

in paper form (2 copies) in person or through your representative. When submitted, one copy of the report remains with the Federal Tax Service, and the second is marked with acceptance and returned. A stamp indicating the date of receipt of the declaration in the event of controversial situations will serve as confirmation of the timely submission of the document;

Companies whose average number of employees exceeds 100 people are required to submit calculations electronically (Clause 3, Article 80 of the Tax Code of the Russian Federation).

To submit a declaration through a representative, you must draw up a power of attorney for him, certified by the seal of the organization and the signature of the manager.

declaration file in electronic form; print a special barcode on the declaration that duplicates the information contained in the reporting.

These requirements are not provided for by the Tax Code of the Russian Federation, but are encountered in practice and may lead to refusal to accept the declaration.

The property tax declaration for the year (tax period) must be submitted no later than March 30 of the year following the reporting year (clause 3 of Article 386 of the Tax Code of the Russian Federation).

If March 30 is a weekend or holiday, the deadline for filing the declaration is postponed to the next business day.

Thus, the declaration for 2016 must be submitted no later than March 30, 2022.

in the first part of the indicator, the tax benefit code 2012400 is indicated, and in the second part of the indicator, the number, paragraph and subparagraph of the article of the law of the constituent entity of the Russian Federation, in accordance with which the corresponding tax benefit is provided, are sequentially indicated (for each of the indicated positions, four spaces are allocated, while filling this part of the indicator is carried out from left to right and if the corresponding attribute has less than four characters, the free spaces to the left of the value are filled with zeros).

In this case, the inventory number assigned to the real estate property in accordance with the Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated 13.10.

2010 N 91n “On approval of Methodological Guidelines for Accounting of Fixed Assets”, or the inventory number of a real estate property assigned by bodies (organizations) of technical inventory when conducting technical accounting, technical inventory (for example, in accordance with the order of the Ministry of Economic Development of Russia dated 17.08.

2006 N 244 “On approval of the form of a technical passport of an individual housing construction project and the procedure for its registration by an organization (body) for recording real estate objects”, by order of the State Construction Committee of Russia dated 08/26/2003 N 322 “On approval of the Rules for conducting state technical registration and technical inventory of a complex of structures city cable television network", by order of the State Construction Committee of Russia dated December 29.

2000 N 308 “On approval of the procedure for compiling a set of documents on the technical inventory of property complexes that make up the gas supply systems of the Russian Federation, as well as other real estate objects owned by OJSC Gazprom and its subsidiaries”, Decree of the Government of the Russian Federation dated 04.12.2000 N 921 “On state technical accounting and technical inventory in the Russian Federation of capital construction projects”).

What codes to put in the property tax return for 2019 - 2022?

Today we will look at the topic: “what codes to put in the property tax return for 2022 - 2022 values” and we will analyze them based on examples. You can ask all questions in the x to the article.

No video.

| (click to play). |

Document