On September 29, 2011, the Law “On the National Payment System” came into force, which introduced changes in the relationship of online stores with financial intermediaries between them and customers - courier services and payment systems. Despite the fact that almost three months have passed since then, not all participants in the online commerce market have yet brought their activities into compliance with the new requirements.

In particular, we are talking about the need (or lack thereof) to open a special current account No. 40821. Having learned about the interest in this issue from our readers, we decided to clarify the situation by turning to the primary source in the legislation and taking comments from lawyers and representatives of online business.

To whom and for what?

Article 4, paragraphs 14 and 18, states that when accepting payments, payment agents are required to use a special bank account to make payments. Also, this account should be used by suppliers of goods when making payments to the paying agent.

Let's make a small clarification. A payment agent is a company that acts as an intermediary between an online store and a buyer. It could be, as mentioned above, a courier service, a company that owns a payment terminal, or a money transfer system. In our case, the supplier of goods is understood as none other than an online store.

Advertising on the website

Additional features

Payment Analysis

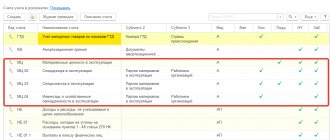

Thanks to the information contained in the document Invoice from supplier , the accountant will automatically generate a report for the manager, located in the section For the manager – Accounts payable:

- report Invoices not paid to suppliers .

Unpaid invoices can also be monitored in the document journal Invoices from suppliers using the Due Date and Payment .

An overdue Payment Date is highlighted in red. Also, the payment status in the Payment if the goods and materials (works, services) on the invoice from the supplier have been received and not paid or partially paid.

If the invoice is paid, but it is not indicated in the payment document ( Payment status is not automatically changed), change it manually in the Invoices from suppliers using the Change status or directly in the document itself in the Payment status .

BukhExpert8 advises filling out the Invoice for payment in payment documents so that the Payment Status of the Invoice from Supplier document changes automatically.

Depending on the payment, you can also configure conditional formatting of the list.

Receipt analysis

In the document journal Invoices from suppliers, the Receipt column controls the receipt of inventory items (works, services) on the invoice.

The receipt status is displayed only in the Invoices from Suppliers Invoice from Supplier document, the Receipt Status even by clicking the More .

Receipt column is highlighted in red if the invoice has been paid, but inventory items (works, services) have not been shipped or have been partially shipped.

For accounts for which goods and materials, works (services) were received, but not indicated in the receipt documents, change the Receipt Status manually in the Invoices from Suppliers using the Change Status .

If an Invoice from the supplier was issued upon receipt of fixed assets, and the receipt was documented using the document Receipt (act, invoice) type of operation Fixed Assets , then the Receipt Status is also changed only manually, since the program does not automatically track the delivery of fixed assets according to the document Receipt (act, invoice) type of operation Basic facilities .

BukhExpert8 advises filling out the Invoice for payment in the delivery documents so that the Receipt Status of document from the supplier changes automatically.

Depending on the Receipt, you can also configure the conditional formatting of the list.

Test yourself! Take a test on this topic using the link >>

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

For what operations?

In paragraph 19 of the same article 4, in relation to online stores, the following information appears: account No. 40821 is the link between the supplier of goods and the payment agent, funds are transferred from it to other accounts of the company, and payments from customers can also be directly credited to it. Moreover, paragraphs 18 and 20 severely limit the freedom of action of online stores. They indicate that you cannot interact with the payment agent except through account No. 40821 and that no other operations other than the above are possible with it.

Important

You can view the status of a special account only in the Internet bank; the functionality of electronic platforms does not provide the ability to display the balance on their personal accounts. Therefore, be careful and periodically check the status of your account, because if at the right time there is no money in the special account, you will not be able to participate in the procurement procedure - the application will be rejected by the electronic signature operator .

There may be several special accounts, you can open them, and at the time of submitting an application, simply select the one you need in a special column.

Some banks charge a fee for inactivity on the account, if such a condition was specified in the agreement. Therefore, if you plan to use a special account not often, we recommend that you check before opening an account whether such a condition is in your agreement. And, if there is one, the period during which the absence of transactions on the account will allow the bank to recognize it as inactive, the amount of the commission and the conditions for activation.

Closer to practice

Experts commented on the effect of the new law: Elena Denisova

, head of commercial practice of the civil law department of legal, and lawyer

Oleg Sukhov

, leading lawyer of the First Capital Legal On the national payment system, suppliers of goods must use a separate bank account (accounts) No. 40821 to interact with legal entities that have entered into an implementation agreement with the supplier activities for accepting cash. Each organization opens this account in its servicing bank.

Elena Denisova calls for attention to the following: if transit account No. 40821 was previously used to transfer funds to a current account, it could only be used until September 29, 2011. After this date, only special bank accounts No. 40821 must be used. Non-cash funds can be transferred to this account from the organization’s own accounts opened with another credit institution and used to deposit cash received from payers or to replenish working capital (security deposit) in the payment system.

At the same time, as Ms. Denisova notes, the provisions of the Federal Law of June 3, 2009 No. 103-FZ do not apply to relations related to the activities of conducting non-cash settlements (clause 4) and in accordance with the legislation on banks and banking activities (clause 5). That is, if all settlements with customers are carried out directly through the bank (non-cash funds are transferred from the client’s current account directly to the online store’s current account), the requirement to open a special account 40821 does not apply to such an online store.

Oleg Sukhov, in turn, commented on the applicability of the provisions of the law to online stores in specific situations.

If the online store has full-time couriers

and accepts cash payment from customers upon delivery, then he is an ordinary business entity and should not open this account, since in this case there is no intermediary agent.

If an online store sends goods with a third-party courier service

and receives cash from the client through it, then in this case the courier service is an intermediary, therefore for settlements with this intermediary you must have a special current account.

If the online store accepts payment through intermediaries

(QIWI and other payment systems), then a special current account is required for settlements with them.

If the online store is an intermediary agent

, that is, he is not selling his own goods (he is not its owner until the moment of sale), then he is obliged to open such an account for settlements with buyers and suppliers, since he acts as a paying agent.

Important nuances in connection with props

Users who intend to open 40821 need to know the following: Article 86 of the Tax Code of the Russian Federation states that a financial institution is obliged to notify the tax service about the opening and closing of special accounts, as well as about the replacement of details by tax subjects.

Tax authorities have the right to receive this information directly from the bank without contacting the online store.

Important! Accounting for funds placed at details 40821 is also organized in a special way: the plan provides for a special account 55 for this.

Now let's move on to considering the specifics of operation and the problem of liability.

Features of use

How does a special account differ from, for example, a current account?

To summarize the above, we can conclude that the special one is used for the payment agent to credit buyer money in favor of the supplier of goods/services. This is provided for by the terms of the agency agreement.

Note 1.

The law prohibits the use of other types of accounts for such purposes. This is stated in Article 4 of Federal Law No. 103-FZ of June 3, 2009 - “On the activities of accepting payments from individuals carried out by payment agents.”

The special account involves carrying out such operations as:

- crediting funds from individuals - to offset the fulfillment of their obligations to the supplier;

- crediting money from other special agent details;

- writing off money to the CC of another paying agent or supplier of goods and services;

- debiting funds to current accounts (for example, as an agent’s fee).

Any other actions are not permitted. There are reasons for this:

- Protecting the interests of the seller

(supplier). The agent does not have the opportunity to use the money at his own discretion. - Protecting the interests of individuals

making a purchase. The agent cannot help but transfer the payment to the store. - Control.

The turnover of payments and their further use are subject to strict accounting. - Simplification of accounting measures in connection with the income

of legal entities and individual entrepreneurs. Making a profit out of all the money they receive becomes more efficient.

40821 thus solves both fiscal and economic-legal problems.

Note 2.

Fiscal – financial, tax. Relating to the accumulation of government revenues.

Responsibility

If a paying agent carries out his activities without opening a special account, he will incur administrative penalties. According to paragraph 2 of Article 15.1 of the “Code of the Russian Federation on Administrative Offenses” this is a fine:

- from 40,000 to 50,000 rub. – for companies;

- from 4,000 to 5,000 rubles. - for officials.

The same sanction applies when violations are discovered during the operation of 40821. For example, when not the entire amount that the agent received from the buyer for the supplier is transferred.

Opening order

The procedure for opening account No. 40821 does not differ significantly from opening a regular current account. The following documents must be attached to the application for opening this account:

- Special bank account agreement in two copies (executed by the bank);

- a copy of the Agreement for accepting payments from individuals or another document confirming the status of the payment agent/bank payment agent;

- a copy of the Charter with all amendments and certificates of registration of amendments (if the amendments were registered before July 1, 2002) or Certificates of entry into the Unified State Register of Legal Entities;

- a copy of the Memorandum of Association / Agreement on the establishment of the company (if any);

- a copy of the Certificate of state registration of a legal entity;

- a copy of the Certificate of registration with the tax authority;

- a copy of the Extract from the Unified State Register of Legal Entities;

- a copy of the Information Letter from the statistical authorities on registration in the Unified State Register of Industrial Organizations (assignment of OKVED codes);

- a copy of the decision (Protocol) on the creation of a legal entity (certified by the seal of the organization and the signature of the director);

- Card with sample signatures and seal imprint (notarized or issued by a bank);

- Bank client questionnaire, as well as questionnaires of individuals who have access (authority to dispose) to a bank account, including the authority to dispose of a bank account using remote banking technologies (Bank-Client, Internet banking) (on bank letterhead) and in an appropriate manner certified copies of their passports;

- a copy of the Certificate of Ownership (Lease Agreement) for the occupied premises;

- Orders on the appointment of a manager and chief accountant (certified by the seal of the organization and the signature of the manager);

- powers of attorney for persons who, on an equal basis with the manager, have the right of first signature (if the latter’s powers to manage the account are not specified in the Charter), a copy of the proxy’s passport;

- An order (instruction) on the implementation of accounting personally by the head of the enterprise and the submission of payment documents to the bank with one signature (if there is no position of chief accountant on the staff of the enterprise);

- power of attorney to submit payment documents to the Bank and receive account statements, a copy of the authorized person’s passport.

Opening date and service features

The deadline for opening a special account, subject to the provision of a complete package of documents, is 1 business day from the date of receipt of the application by the bank.

The bank's obligation to charge interest on the balance in a special account is legally established; however, the legislator did not indicate the amount of interest, so it differs greatly from bank to bank. For example, at Sberbank it is 0.01%, and at Tochka Bank it is from 0.5 to 4.5% on the minimum balance.

Opening and maintaining a special account is free, however, the law does not prohibit banks from charging a commission for transactions carried out on a special account . For example, Sberbank charges 50 rubles for each blocking.

During the period when funds are blocked by the operator of the electronic platform to secure an application for participation in the procurement, the participant does not have the right to dispose of these funds. In addition, regulatory authorities, for example, the Federal Tax Service, do not have the right to foreclose on such funds.

You may also be interested in:

What is a current account and where to open one

A current account is a bank account of a legal entity or individual.

As a rule, it is used as a kind of “wallet” - that is, for intermediate or permanent... Read more→

What are the requirements for printing for LLCs and individual entrepreneurs?

In Soviet times, the production of clichés and seals was strictly controlled by the relevant government agencies (Order of the Ministry of Internal Affairs of the USSR No. 34 of 02.13.78), then, starting from 1994, this instruction was lost...

Read more→

Strict reporting forms: pros and cons of use

If the company’s activities fall under Article 2 of Federal Law No. 54 of May 22, 2003, individual entrepreneurs and legal entities are allowed not to use cash register systems in their work.

In some situations, ... Read more→