VAT

This tax is considered indirect. VAT is a form of withdrawal to the state budget of part of the price of a product, service or work. It is created at all stages of the production process and is paid as it is sold. When applying VAT, the final buyer pays the seller tax on the entire price of the purchased good.

But it starts coming into the budget earlier. This is due to the fact that the amount from its part of the price added to the cost of purchased raw materials, services/work required for production is paid to the state by each participant in production at different stages. The VAT rate in the Russian Federation is 18%. It is used by default if the transaction is not classified as taxable at 10% or 0%. In the Russian Federation, VAT was introduced on January 1, 1992. The rules for its calculation and payment were first determined by the relevant Federal Law “On Value Added Tax”. Since 2001, the procedure has been regulated by Ch. 21 NK. For certain categories of payers and transactions, VAT is not established. For example, enterprises may not pay tax if the amount of their revenue for the previous three consecutive months did not exceed a certain limit (2 million rubles according to paragraph 1 of Article 145 of the Tax Code).

Subaccounts 19 accounts

The article can be accessed by:

- Subaccount 19.1. It reflects VAT when purchasing OS. This takes into account the amounts of tax due or paid related to the purchase and construction of fixed assets, including individual land use facilities, etc.

- Subaccount 19.2. This article applies to VAT on purchased intangible assets.

- Subaccount 19.3. It shows VAT on purchased inventories. This article covers tax amounts assigned for payment or paid by an enterprise relating to the acquisition of materials, raw materials, semi-finished products and other types of inventories and goods.

What subaccounts are used?

The chart of accounts recommends opening the following subaccounts for account 19:

- 19 subaccount 1 - VAT on acquired fixed assets;

- 19 subaccount 2 – VAT on acquired intangible assets;

- 19 subaccount 3 – VAT on purchased inventories.

By analogy, if necessary, an accountant can also open additional sub-accounts:

- 19 subaccount 4 – VAT on services received;

- 19 subaccount 5 - VAT transferred when importing goods into the territory of the Russian Federation from abroad;

- 19 subaccount 6 – VAT on goods at a rate of 0%;

- 19 subaccount 7 – VAT on the construction of non-current assets;

- 19 subaccount 8 - VAT on a decrease in sales value;

- 19 subaccount 9 – VAT on imports of goods from the countries of the Customs Union

- and many others.

Attention! All additional sub-accounts used by the organization must be assigned to the working Chart of Accounts.

Decor

When selling work, goods, or services, in addition to their actual cost, the buyer must pay VAT to the seller at the established rate. The latter must issue an invoice to the purchaser for its amount within five days. The calculation of the period begins from the date of shipment of products or provision of services/performance of work. In the settlement documentation and invoices of the supplier, VAT must be highlighted as a separate line. If transactions involving the sale of any services, products, or works are not subject to taxation or the seller is exempt from the obligation to pay tax, paperwork is completed without allocating it.

In this case, the payment documents must contain a corresponding entry “excluding VAT”. In the process of selling work, products or services to the public for cash, the requirements for drawing up documents and issuing invoices will be considered fulfilled if the seller has handed over a cash receipt to the buyer. He may submit other supporting paper in the prescribed form.

Invoice

This is a document that serves as the basis for accepting tax amounts for reimbursement or deduction. Mandatory invoice details are established in paragraph 5 of Art. 169 NK. The document must be signed by the chief accountant and director of the enterprise or other persons authorized by them. The invoice is certified by a seal. The seller must have a journal for recording these documents and a sales book. The acquirer, accordingly, must also record received invoices in the appropriate catalogue. A purchase book is also required. The procedure in accordance with which these journals are maintained is approved by government decree.

Account 19: postings

After accepting the purchased goods, the buyer pays VAT to account 19. In accounting, this item also includes tax amounts paid on business trip expenses. The calculation is carried out at a rate of 16.67% of the specified expenses (excluding sales tax). For the amount entered into account 19, the buyer, in accordance with the information from the invoices issued by the sellers, as well as documents confirming the payment of tax, has the right to reduce the mandatory deduction to the budget. This opportunity is available to those acquirers who use the received values for production purposes. In this case, it is necessary to make an entry: “Db 68 CD 19.”

Account characteristics

To answer the question which account 19 is active or passive, you need to know where it is reflected in the balance sheet.

You might be interested in:

Account 20 in accounting “main production”: what is it used for, characteristics, subaccounts, postings

Since the account reflects the amount of VAT paid upon acquisition, it is reflected in the balance sheet as part of inventories and costs, which are reflected in the active part of the above report. Therefore, according to the Chart of Accounts, account 19 is active, which has a balance reflected in the debit of the account.

Let's take a closer look at what is accounted for in this account. The debit of the account reflects the amount of VAT paid on purchased goods, works, and services. For the credit of account 19, it is necessary to take into account the write-off of previously recorded VAT either on account of the output tax, or in special modes its inclusion in expenses.

The balance at the end of the month is determined based on the following rule. The turnover on the debit of the account should be added to the initial balance and the amount of VAT passed on the credit of account 19 should be subtracted.

Attention! As a rule, account 19 is closed at the time of writing off material assets in production, transferring them into operation, etc.

The account balance at the end of the year is to be reflected in the balance sheet. For this, line 1220 is used. If the requirements of tax legislation are met, this amount can be included in the VAT deduction in the next period.

Inclusion of VAT in buyer's expenses

The tax amounts that are presented to the purchaser are included in his costs when using products, works, services:

- In the manufacture/sale of objects, operations for the sale of which are not subject to taxation (exempt) under paragraphs 1-3 of Art. 149 NK.

- The production/transfer of products, services, works, operations for which for one’s own needs are considered subject to taxation under Ch. 21, but are not subject to tax accounting under paragraphs 2, 3 of Art. 149 NK.

- Sales outside the territory of the Russian Federation.

For the VAT amounts presented to the buyer, the following entry is made: “Db 20 (44, 23, 26, 25, etc.) Kd 19.”

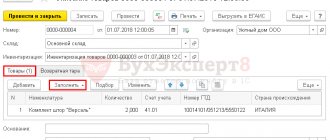

how to close account 19 in 1s8

We have 1s 8.1 Enterprise Accounting, ed.2

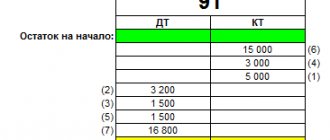

When registering goods and services, the program makes entries on the account. 19 for VAT amounts, BUT I can not deduct all VAT (due to certain circumstances) and I need to write it off from 19 not to 68.02, but to 91 accounts. How to do it? I didn't find anything. In 1C 7.7 it was possible to create a separate section of the purchase book and indicate the account there, but in 8 I did not find such an opportunity... Please tell me a way out!

General rules

Count 19 should be maintained while observing a number of requirements:

- The debit reflects the amounts that are payable to contractors and suppliers for acquired material assets, as well as accepted services/work.

- The item balance should not contain VAT charged to counterparties.

- The paid amounts are presented to the budget in accordance with the rules established in the Tax Code.

- VAT allocated to contractors/suppliers, but not presented to the budget according to the Tax Code, must be reflected in the accounts of valuables, costs or other expenses.

Important point

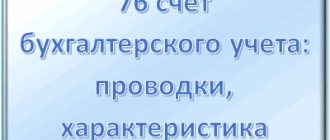

According to a number of experts, in DB account 19 the accrued VAT should be included in the budget for adopted fixed assets, completed capital construction, and implemented in an economic way. But other authors recognize this proposal as unfounded. Account 19 reflects the amounts of VAT that must be paid to contractors and suppliers, that is, legal entities (organizations). When an enterprise has budgetary tax obligations, it is necessary to take into account the circumstances under which they arose. In the process of construction, a taxable object is created using an economic method. In the absence of the possibility of presenting this tax to the budget, the accrued VAT amounts would have to increase the initial cost of the fixed assets. But according to tax legislation, enterprises show tax. It follows from this that these VAT amounts represent a certain amount of budget obligations to the payer. The latter, if the requirements are met, will present them to the budget subsequently. Thus, these amounts should be reflected in settlement accounts, in particular in accounts. 76.

How to close a month in 1C: Accounting 8

Created 07/18/2014 21:04 Published 07/18/2014 21:04 Author: Administrator “My month does not close in 1C,” I hear this phrase very often, and the closer the reporting time, the more panic in my voice. Let's figure out how to properly close a month in 1C? And we will discuss some of the mistakes that may prevent you from doing this.

We will consider an example of closing a month in the program in 1C: Accounting 8 edition 3.0.

To start the procedure for closing the month, you need to go to the “Accounting, taxes, reporting” tab and select the “Closing the month” item.

Or the “Operations” tab in the new “Taxi” interface.

Select the organization, month, transfer the documents and click on the “Close the month” button.

If all the points turn green, then the procedure is completed successfully. But quite often the program reports some errors.

1) The nomenclature group of income is not specified - this error occurs very often and does not mean any serious problems. As a rule, the subconto column, which is mandatory for correct operation, is simply not filled out in the document for the sale of goods or services.

The program tells you which document contains the error, so you just need to open it and fill in the correct column.

After making the corrections, you will need to re-post the documents for the month again and perform the closing again.

2) Account 25 cannot be closed: for some divisions it was not possible to calculate the distribution base - such an error is also not uncommon. But here different options are already possible.

To make it easy for you to understand why this error appears, I’ll tell you a little about the mechanism for closing account 25 in the 1C: Accounting 8 program.

25 account is closed on 23 and 20 accounts. In all these accounts, accounting is maintained by division and, what is very important, costs are distributed within one division according to a certain base, which is set in the accounting policy. It follows from this that those divisions that are on account 25 must necessarily be present on account 20 or 23.

Also, to close account 25, you need a distribution base, this could be wages, material or direct costs, etc. What does this mean? Only that if, for example, the distribution base “salary” is selected, then for each of the divisions that are on account 25, the salary accounted for in accounts 20 or 23 should be accrued.

Let's look at a similar error using an example. When closing the month, the program produced the following message

As we can see, the problem arose with the Main division, the distribution base is “Material costs”. In order to check what the difficulty is, let’s create a balance sheet for account 20 and see if any materials were written off this month as expenses of the main department.

The figure clearly shows that there are no expenses at all for the main division on account 20; accounting for account 23 is not maintained in this organization. This means that to close account 25, it is necessary to either write off materials to the main division (perhaps in one of the existing invoice requirements the division is indicated incorrectly and therefore there are no costs), or change the distribution base for overhead costs and add the corresponding costs. As soon as the required amounts for the main division appear on account 20, closing the month will be completed without problems.

3) Analytics for other income and expenses are not specified - such an error may occur when closing 91 accounts. It is connected with the fact that in one of the documents the sub-account “Other income and expenses” is not filled in; most often these are documents “Write-off from the current account”, which reflect the costs of bank services. As a rule, a list of such documents is given when describing the error.

In this example, there is a slight discrepancy - the error description states that it is recommended to fill out the “Subconto” column, but in this particular case, it is not the column that should be filled in, but the “Other income and expenses” field.

4) The sequence of processing documents is broken - after you have corrected errors for some time, filled out fields and restarted the closing procedure, the following notice may appear. This only means that it is necessary to post all documents again from the date indicated on the screen.

If you still have questions about closing the month in 1C: Accounting 8, you can write about it in the comments to the article or on our forum.

And if you need more information about working in 1C: Enterprise Accounting 8, then you can get our book for free using the link.

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #43 Olga 01/14/2020 1:43 pm I’m closing December, it says “It was not possible to close the month A000012 of 12/31/2019”

Quote

0 #42 Zoya 10/20/2019 03:41 Good afternoon. Until 2022, the simplified tax system was used. In 2022 we switched to OSNO. When closing January 2022, the program generates an error: Account 26 has an opening balance. The initial balances were entered as of December 31, 2018. this balance is reflected there automatically. Help me how to close the months of 2022 and fix this error.

Quote

0 #41 Ukhova Natalya 12/12/2018 23:56 I quote Maxim:

When closing a month, it doesn’t show any errors, but it doesn’t count the amounts either.

Hello!

Which transactions and in which routine operations do they appear without amounts? Quote 0 #40 Maxim 12/11/2018 18:03 When closing a month, it does not give any errors, but it does not count the amount either

Quote

0 #39 Ukhova Natalya 10.16.2018 23:34 I quote Natalie:

Good afternoon Please help me figure it out. It gives an error when closing the month. List of errors in the operation Closing accounts 20, 23, 25, 26 for July 2022 Eliminate these errors and repeat the operation 1. Separate accounting of income and expenses when combining different tax regimes is not provided “On account 90.01.2 income is reflected in the item group “”TO” TS" This account is used to record income by types of activities with a special taxation procedure. For the same nomenclature group, expenses for activities with the main taxation system are indicated." How correctly Activities with the main taxation system are reflected in accounts 90.01.1, 90.02.1 Activities with a special taxation procedure are reflected in accounts 90.01.2, 90.02.2 Where is the problem and what do Expenses for activities with the main taxation system are reflected according to the following analytics: account 20.01, cost item “Payment of the simplified tax system” account 20.01, cost item “Insurance contributions of the simplified tax system” account 20.01, cost item “NS and PZ USN” If the item group is “TO TS "reflects the type of activity with a special taxation procedure, then use the appropriate cost item. If this nomenclature group reflects the type of activity with the main tax system, then correct account 90.01.2 to 90.01.1. Thank you.

Good afternoon

Do you have a combination of simplified taxation system + UTII modes? If yes, then you should have an income account for the simplified tax system 90.01.1, an income account for UTII 90.01.2, for each type of taxation there should be its own item groups (analytical section for account 90). For example, for the item group “TO TS”, income should only be on account 90.01.1; on account 90.01.2, another item group should be selected to display income. Quote 0 #38 Natalie 10.10.2018 15:57 Good afternoon! Please help me figure it out. It gives an error when closing the month. List of errors in the operation Closing accounts 20, 23, 25, 26 for July 2022 Eliminate these errors and repeat the operation 1. Separate accounting of income and expenses when combining different tax regimes is not provided “On account 90.01.2 income is reflected in the item group “”TO” TS" This account is used to record income by types of activities with a special taxation procedure. For the same nomenclature group, expenses for activities with the main taxation system are indicated." How correctly Activities with the main taxation system are reflected in accounts 90.01.1, 90.02.1 Activities with a special taxation procedure are reflected in accounts 90.01.2, 90.02.2 Where is the problem and what do Expenses for activities with the main taxation system are reflected according to the following analytics: account 20.01, cost item “Payment of the simplified tax system” account 20.01, cost item “Insurance contributions of the simplified tax system” account 20.01, cost item “NS and PZ USN” If the item group is “TO TS "reflects the type of activity with a special taxation procedure, then use the appropriate cost item. If this nomenclature group reflects the type of activity with the main tax system, then correct account 90.01.2 to 90.01.1. Thank you.

Quote

0 #37 Natalia 10.10.2018 15:52 Good afternoon! List of errors in the operation Closing accounts 20, 23, 25, 26 for July 2022 Eliminate these errors and repeat the operation 1. Separate accounting of income and expenses when combining different tax regimes is not provided “Account 90.01.2 reflects income by item group “” How correctly Activities with the main taxation system are reflected in accounts 90.01.1, 90.02.1 Activities with a special taxation procedure are reflected in accounts 90.01.2, 90.02.2 Where is the problem and what to do Expenses for activities with the main taxation system are reflected according to the following analytics: account 20.01 , cost item “Payment of the simplified tax system” account 20.01, cost item “Insurance premiums of the simplified tax system” account 20.01, cost item “SS and PZ simplified tax system” If the item group is “Revenue”, but revenue is not reflected. Reflect the implementation of services with documents - Sales (acts, invoices) - Provision of services - Provision of production services." The organization has just started working and has not provided any services, what can be done?

Quote

0 #35 DragonAgo 04/02/2018 17:44 I quote Olga Shulova:

I quote DragonAgo: Good afternoon. A month ago we switched to Accounting 3.0. how to link account 69.13.2 to Social Insurance Fund accruals? The program puts the score at 69.01.

Good afternoon

It is impossible to do this using standard means, without modifying the program. Why is the account 69.01 not suitable? Thank you, it’s just that in BP 2.0 this operation was with a score of 69.13.2 Quote 0 #34 Olga Shulova 04/01/2018 21:46 Quote DragonAgo:

Good afternoon. A month ago we switched to Accounting 3.0. how to link account 69.13.2 to Social Insurance Fund accruals? The program puts the score at 69.01.

Good afternoon

It is impossible to do this using standard means, without modifying the program. Why is the account 69.01 not suitable? Quote 0 #33 DragonAgo 03/30/2018 18:08 Good afternoon. A month ago we switched to Accounting 3.0. how to link account 69.13.2 to Social Insurance Fund accruals? The program puts the score at 69.01.

Quote

0 #32 Natalya Natalie 03.10.2018 22:15 I quote Natalya Ukhova:

I quote Natalia Natalie: Hello. Please tell me, when closing the month, it gives a list of payments and writes an error: the payment rate is not filled out. What is it and where can I watch it? I work in accounting 3.0 Thank you

Good afternoon

This error occurs when making payments in foreign currency in documents of receipt or debit from a current account. If you actually have currency payments, check whether the “Currency Rates” register is filled in (main menu - all functions - information registers - Currency Rates) for the given dates. If all payments are in rubles, you need to check what currency is in contracts with counterparties and the bank payments themselves. Thanks for the help. Everything worked out Quote 0 #31 Natalya Natalie 03/10/2018 21:35 I quote Natalya Ukhova:

I quote Natalia Natalie: Hello. Please tell me, when closing the month, it gives a list of payments and writes an error: the payment rate is not filled out. What is it and where can I watch it? I work in accounting 3.0 Thank you

Good afternoon

This error occurs when making payments in foreign currency in documents of receipt or debit from a current account. If you actually have currency payments, check whether the “Currency Rates” register is filled in (main menu - all functions - information registers - Currency Rates) for the given dates. If all payments are in rubles, you need to check what currency is in contracts with counterparties and the bank payments themselves. I looked at all the contracts, they cost RUB. And it is also reflected in the extract. And this error appeared only this year during the closing, although I have been working under these contracts for several years. Tell me, please, is there anything else that needs to be fixed? Thank you Quote 0 #30 Ukhova Natalya 03/07/2018 10:27 I quote Natalya Natalie:

Hello. Please tell me, when closing the month, it gives a list of payments and writes an error: the payment rate is not filled out. What is it and where can I watch it? I work in accounting 3.0 Thank you

Good afternoon

This error occurs when making payments in foreign currency in documents of receipt or debit from a current account. If you actually have currency payments, check whether the “Currency Rates” register is filled in (main menu - all functions - information registers - Currency Rates) for the given dates. If all payments are in rubles, you need to check what currency is in contracts with counterparties and the bank payments themselves. Quote 0 #29 Natalya Natalie 03/06/2018 22:38 Hello. Please tell me, when closing the month, it gives a list of payments and writes an error: the payment rate is not filled out. What is it and where can I watch it? I work in accounting 3.0 Thank you

Quote

0 #28 Ukhova Natalya 12/17/2017 00:28 I quote Svetlana Ts:

Hello! Please tell me when the month closes at 8.3. 26 and count. 25 is partially closed on the account. 91-1, a large amount of costs is distributed correctly to the account. 20, and some small percentage ends up on the account. 91-01. I can’t find what’s wrong. It’s as if some costs were set up incorrectly, but everything is included in the accounting policy. What else needs to be checked? Thank you!

Hello!

Is the account closed in BU or NU? Check the register “Methods of distribution of direct expenses” (the main thing is accounting policy); perhaps closing is configured incorrectly for some cost item. Quote 0 #27 Svetlana Ts 12/14/2017 20:27 Hello! Please tell me when the month closes at 8.3. 26 and count. 25 is partially closed on the account. 91-1, a large amount of costs is distributed correctly to the account. 20, and some small percentage ends up on the account. 91-01. I can’t find what’s wrong. It’s as if some costs were set up incorrectly, but everything is included in the accounting policy. What else needs to be checked? Thank you!

Quote

0 #26 Ukhova Natalya 11/25/2017 01:37 Quoting DragonAgo:

Good evening. Tell me, when closing the month, the amounts appear from Kt 41.02 to Dt 90.02.1, this posting is created by the routine operation of closing the month. The write-off method is FIFO, what's wrong?

Good evening! This posting adjusts the write-off cost. Perhaps, during the month you enter the document “Production Report for a Shift”, where you release your products to account 41.02 with some planned cost, then you sell it, the planned cost 90.02-41 is written off.

When we close the month, the program calculates the actual cost of this product, and posting 90.02-41 is made for the difference between the plan and the actual. Quote 0 #25 DragonAgo 11/24/2017 02:20 Good evening. Tell me, when closing the month, the amounts appear from Kt 41.02 to Dt 90.02.1, this posting is created by the routine operation of closing the month. The write-off method is FIFO, what's wrong?

Quote

0 #24 Olga Shulova 02/13/2017 21:03 I quote Olga 21:

Good afternoon) I am closing the month, everything seems to show that it is closed, everything is fine, I am forming a turnover, nothing is closed (((what could be the problem?

Hello!

Which expense accounts are used in your organization and which of them have not been closed? And I would like a little information about what the organization does: production, wholesale or retail trade, services, etc. Quote 0 #23 Olga 21 02/13/2017 10:52 Good afternoon) I’m closing the month, everything seems to show that it’s closed, everything is fine, I’m forming a turnover, nothing is closed (((what could be the problem?

Quote

0 #22 Olga Shulova 03.28.2016 16:52 Quoting Feniks:

Tell me, our OSNO wholesale trade at the end of the month (January 2015) produces the following errors: Calculation of income tax 1. The loss of the previous year has not been carried forward. A balance at the beginning of the year was found on account 09 under the type Loss of the current period.” It is recommended that before reforming the balance sheet of last year, enter transactions with the end date of last year: C K account 09 in the form of “Loss of the current period” in D account 09 in the form of “Future expenses” with the date of the end of last year for the amount of the balance in the type “Loss of the current period” " From K account 99 to D account 97 under article RBP with the type “Losses of previous years” for a positive amount of tax accounting and a negative amount of temporary differences equal to the amount of loss. This is the description of the error produced by 1C 8.3

Hello!

The program says everything is correct, you need to make the postings that it wants. To do this, you need to enter the document “Operation (entered manually)” BUT this is all true if your organization actually keeps records according to PBU 18/02 (there is such a checkbox in the accounting policy). Small organizations may not keep records according to this accounting standard and not calculate permanent and temporary differences; then such messages will not be issued. But if you make changes to the accounting policy, it is better to do this starting in 2016. Quote +2 #21 Feniks 03.25.2016 19:58 Tell me, our BASIC wholesale trade at the end of the month (January 2015) produces the following errors: Calculation of income tax 1. The loss of the previous year has not been carried forward. A balance at the beginning of the year was found on account 09 under the type Loss of the current period.” It is recommended that before reforming the balance sheet of last year, enter transactions with the end date of last year: C K account 09 in the form of “Loss of the current period” in D account 09 in the form of “Future expenses” with the date of the end of last year for the amount of the balance in the type “Loss of the current period” " From K account 99 to D account 97 under article RBP with the type “Losses of previous years” for a positive amount of tax accounting and a negative amount of temporary differences equal to the amount of loss. This is the description of the error produced by 1C 8.3

Quote

0 #20 LyudmilaV 03/14/2016 22:34 I quote Author:

I quote LyudmilaV: For these months he writes: “Accounting policy has not been set”

Can you copy the entire text of the error that is the first to appear when March closes?

Thank you everyone, I figured it out - they said that I need to create an accounting policy for the 14th year and refuse to carry out the operation in the 14th year. Then, in the 15th year, they began to close for months. Quote 0 #19 Olga Shulova 03/14/2016 20:48 I quote LyudmilaV:

For these months it says - Accounting policy has not been set

Can you copy the entire text of the error that is the first to appear when March closes?

Quote 0 #18 LyudmilaV 03/11/2016 20:56 Quote Author:

I quote LyudmilaV: Please help me figure it out. We have been working since March 2015, reflecting operations in 1s8.3 since April. The accounting policy has been set since April 2015. When I close a month for April or March, it gives the error: The previous month is not closed. Operations for the current month cannot be performed. Doesn't allow me to close the month. What to do???!!!

Hello!

Is January-February closed? I understand that no activity was carried out, but that the program will report if you try to close it. For these months he writes - The accounting policy has not been set Quote 0 #17 Olga Shulova 03/11/2016 16:34 Quoting LyudmilaV:

Please help me figure it out. We have been working since March 2015, reflecting operations in 1s8.3 since April. The accounting policy has been set since April 2015. When I close a month for April or March, it gives the error: The previous month is not closed. Operations for the current month cannot be performed. Doesn't allow me to close the month. What to do???!!!

Hello!

Is January-February closed? I understand that no activity was carried out, but that the program will report if you try to close it. Quote 0 #16 LyudmilaV 03/11/2016 01:51 Please help me figure it out. We have been working since March 2015, reflecting operations in 1s8.3 since April. The accounting policy has been set since April 2015. When I close a month for April or March, it gives the error: The previous month is not closed. Operations for the current month cannot be performed. Doesn't allow me to close the month. What to do???!!!

Quote

0 #15 Natalie 03/02/2016 15:20 I quote Author:

Quoting Natalie: Quoting Author: Quoting Natalie: Hello! My situation is this: the months are closed, the reformation was successful, but in terms of revenue the final balance goes into turnover, and because of this the balance sheet is torn

Hello!

Which accounts are not closed? And what program are you working in (configuration name and full release number, this information is in the help about the program)? 1C Accounting 8 edition 3.0. count 90, namely count 50 So 90 or 50? Account 50 has nothing to do with the end of the month, it is a cash register. If there is still a balance on account 90, then look, did the balance appear only at the end of the year or was it also at the beginning of the year? It happens that mistakes continue from previous periods. If everything was fine at the beginning of the year, then create the SALT for this account by month, see from which month the account stopped closing completely and try again to reclose the month, starting with the one in which the error occurred. Good afternoon! count 90. The reason was found out, it was due to a program update Quote 0 #14 Olga Shulova 03/01/2016 20:36 Quoting Natalie:

I quote Author: I quote Natalie: Hello! My situation is this: the months are closed, the reformation was successful, but in terms of revenue the final balance goes into turnover, and because of this the balance sheet is torn

Hello!

Which accounts are not closed? And what program are you working in (configuration name and full release number, this information is in the help about the program)? 1C Accounting 8 edition 3.0. count 90, namely count 50 So 90 or 50? Account 50 has nothing to do with the end of the month, it is a cash register. If there is still a balance on account 90, then look, did the balance appear only at the end of the year or was it also at the beginning of the year? It happens that mistakes continue from previous periods. If everything was fine at the beginning of the year, then create the SALT for this account by month, see from which month the account stopped closing completely and try again to re-close the month, starting with the one in which the error occurred Quote 0 #13 Natalie 02/29/2016 11 :05 I quote the Author:

I quote Natalie: Hello! My situation is this: the months are closed, the reformation was successful, but in terms of revenue the final balance goes into turnover, and because of this the balance sheet is torn

Hello!

Which accounts are not closed? And what program are you working in (configuration name and full release number, this information is in the help about the program)? 1C Accounting 8 edition 3.0. count 90, namely count 50 Quote 0 #12 Olga Shulova 02/29/2016 07:46 I quote Natalie:

Hello! My situation is this: the months are closed, the reformation was successful, but in terms of revenue the final balance goes into turnover, and because of this the balance sheet is torn

Hello!

Which accounts are not closed? And what program are you working in (configuration name and full release number, this information is in the help about the program)? Quote 0 #11 Natalie 02/26/2016 23:06 Hello! My situation is this: the months are closed, the reformation was successful, but in terms of revenue the final balance goes into turnover, and because of this the balance sheet is torn

Quote

0 #10 Olga Shulova 07/07/2015 19:50 I quote Afroodynesnik:

Hello. The problem is this: our production cycle is long. In the bay. 2.0 the costs that we were going to distribute we accumulated in account 25 and they hung there until the production of products appeared in the necessary departments and then were perfectly distributed. Those. “there were balances only for the necessary cost items,” while the remaining costs of the 25th account were perfectly distributed every month. In Bukh 3.0, the program does not process the account balance of 25 and generates an error. At the same time, it does not cover anything at all and the entire 25th remains unclosed. Is it possible to somehow solve this problem in 3.0?

Hello!

So the only option that immediately comes to mind is to finalize the program. This control is specified quite strictly in the code text and does not imply any configuration options. Quote 0 Afroodynesnik 07/06/2015 15:36 hello. The problem is this: our production cycle is long. In the bay. 2.0 the costs that we were going to distribute we accumulated in account 25 and they hung there until the production of products appeared in the necessary departments and then were perfectly distributed. Those. “there were balances only for the necessary cost items,” while the remaining costs of the 25th account were perfectly distributed every month. In Bukh 3.0, the program does not process the account balance of 25 and generates an error. At the same time, it does not cover anything at all and the entire 25th remains unclosed. Is it possible to somehow solve this problem in 3.0?

Quote

0 Olga Shulova 05/21/2015 18:27 I quote Elena86:

Hello, I’m closing January 2015, it gives me the error “The sequence of processing documents is broken. It is possible to change the results of posting documents for January 2015 for the organization...... Perform the re-posting of documents again, starting from 01/19/2015 (section “Accounting and reporting” - “Closing the month”).” Tried rerunning, same error.

Hello!

It seems that the program is unable to post some document for January 19th. Try to process the documents for that day manually, perhaps you will see where the error is and which of the documents is where the automatic processing fails. Quote 0 Elena86 05/21/2015 17:26 Hello, I’m closing January 2015, it gives the error “The sequence of processing documents is broken. It is possible to change the results of posting documents for January 2015 for the organization...... Perform the re-posting of documents again, starting from 01/19/2015 (section “Accounting and reporting” - “Closing the month”).” Tried rerunning, same error.

Quote

-1 Olga Shulova 04/22/2015 17:11 I quote Vadim:

The 4th paragraph of this article is not described. We get the following message, but re-posting gives the same error - “The sequence of document processing is broken.” How and most importantly where to find the error?

Good afternoon, Vadim!

It looks like your program is unable to post one of the documents, so the sequence is not restored. Perhaps there is an error in it (for example, something was corrected retroactively and now there is not enough product) or the beginning of the sequence belongs to a period closed for editing. Look at the date from which the program offers to re-post documents and try to use the group re-post processing, which is located on the “Operations” tab in the taxi interface. Well, or just manually enter the documents for this date, then it will become clearer. Quote 0 Vadim 04/22/2015 14:33 The 4th paragraph of this article is not written down. We get the following message, but re-posting gives the same error - “The sequence of processing the documents has been violated.” How and most importantly where to find the error?

Quote

0 Olga Shulova 02/04/2015 15:26 I quote Lyudmila:

Our unloaded salary is not closed. What could be the reason.

Incorrect accounting policy settings, lack of a distribution base in a particular month, incorrect settings for reflecting salaries in accounting, etc. Quote

0 Lyudmila 02/04/2015 15:02 Our uploaded salary is not closed. What could be the reason.

Quote

0 Olga Shulova 02/04/2015 14:54 I quote Lyudmila:

Hello, we have a 1c program under 3.0 simplified tax system when closing October 2014, and it displays the message “Account 26 has an opening balance.” According to turnover, this balance begins at the end of September, although the month of September is closed.

Hello!

Most likely, when closing the month of September, account 26 was not closed. As a rule, this is a mistake, you need to find what the problem is and close September again. The reasons for this situation can be very different, without seeing the database, it is very difficult to guess them. Quote 0 Lyudmila 02/04/2015 14:44 Hello, we have a 1c program under 3.0 simplified tax system when closing October 2014, it displays the message “Account 26 has an opening balance.” According to turnover, this balance begins at the end of September, although the month of September is closed.

Quote

Update list of comments

JComments

Example

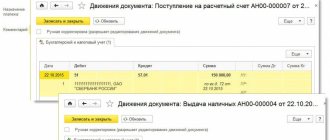

Let's consider a situation where, throughout March 2014, an enterprise bought certain products from a supplier and subsequently resold them to its own customers. The batch of goods was purchased and sold in full. Purchase costs - 12 thousand rubles. Of this amount, 1830.51 is VAT. The amount of tax was separated from the cost of production and charged to account 19. This operation is reflected in two entries:

- Db 41 Kd 60 – the cost of purchased products is taken into account: 10,169.49 rubles.

- Db 19 Kd 60 – shows the input VAT on the purchase of goods RUB 1,830.51.

At the end of the reporting year, the company writes off the VAT amount to the account. 68. Thus, the organization uses its right to reduce debt to the budget. The following entry is made: “Db 68 Kd 19 – the amount to reduce the amount of accrued tax of 1830.51 rubles is transferred to the debit of the account for settlements with the budget.”

In the same March, the company sells products to its own customers at a cost 1.5 times higher than the purchase price (18 thousand rubles). This operation is reflected by the entries:

- Db 90.2 Kd 41 – the cost of goods sold is shown as RUR 10,169.49.

- Db 62 Kd 90.1 – accounting for the buyer’s debt to the enterprise 18 thousand rubles. (with VAT 2745.76 rubles).

- Db 90.3 Kd 68 - the amount of VAT allocated for deduction to the budget is 2745.76 rubles.

Next, the financial result of the transaction is determined by establishing the difference between the turnover in the debit and credit of the “Sales” account: 10,169.49 rubles. + 2745.76 rub. — 18,000 rub. = - 5,084.75 rub.

Minus here means profit. The received amount is transferred to the account. 99: Db 90.9 Kd 99 – income from March sales 2014 5,084.75 rub.

As a result, on the account. 68, the amount of VAT to be transferred to the budget is formed. It is defined as the difference between Kd and Db: 2,745.76 rubles. — 1,830.51 rub. = 915.25 rub. – tax for deduction to the budget generated from March sales in 2014.

What is account 19 used for in accounting?

In accordance with the Tax Code of the Russian Federation, business entities in the general regime must include VAT in the cost of products produced, services provided and work performed.

It is called output tax. On the other hand, a business entity is a consumer of products, works and services, in the cost of which their suppliers also included these amounts of mandatory collection. This tax is called input VAT.

Input VAT is subject to exclusion from the cost of purchased material assets, works and services. An organization or individual entrepreneur has the right, when paying its outgoing VAT to the budget, to offset the incoming VAT on received goods, works, and services.

Therefore, incoming VAT is subject to separate reflection in accordance with the Chart of Accounts on account 19. The information collected on this account is of great importance in determining the VAT payable, therefore the indicators reflected on the account are under close attention when carrying out tax audits.

The amounts reflected in account 19 must be included in the tax register, which is called the purchase book. Information is entered into it based on invoices received from suppliers.

This account is also used by entities under the simplified tax system. This is due to the fact that they can also purchase goods, works, and services, the price of which includes input VAT. Since these entities cannot offset the output VAT due to its absence, the accumulated amounts are written off as a separate item in the company’s expenses.

Attention! Business entities in special regimes have the right not to use account 19. However, it must be remembered that there is a possibility for them of violating the conditions for using the special regime and losing the right to use it.

After such an event, it is necessary to recalculate all taxes, including VAT. Failure to use account 19 in such a situation will lead to the re-posting of all received documents with the allocation of tax.

When determining what is reflected in the debit and credit of this account, you need to remember that VAT may be reflected here on advance amounts listed to suppliers.

If an organization or individual entrepreneur simultaneously applies several taxation systems, for example OSNO and UTII, then it must organize separate accounting of VAT amounts on purchased goods, works and services that belong to different regimes on account 19.

Attention! Thus, activities that fall under VAT and without VAT can be carried out at the same time. Tax on non-taxable transactions cannot be claimed as a deduction, but must be included in the cost of the acquired assets.