Can an individual entrepreneur send himself on a business trip and take into account expenses for the simplified tax system?

No, it cannot: this was once again emphasized by officials (Letter of the Ministry of Finance of the Russian Federation dated 08/16/2019 N 03-11-11/62269), thereby confirming their position set out in earlier Letters of the Ministry of Finance dated 07/24/2013 N 03-11- 09/29377, dated 08/09/2013 N 03-11-11/167, dated 02/26/2018 N 03-11-11/11722 and the Federal Tax Service dated 08/01/2013 N ED-3-3/2730.

It follows from this that a simplified individual entrepreneur will not be able to take into account in the simplified taxation system expenses travel expenses to pay for his own travel and rental housing.

This is explained as follows:

- A business trip is a trip by an employee by order of the employer for a certain period of time to fulfill an official assignment outside the place of permanent work (Article 166 of the Labor Code of the Russian Federation).

- Simplified people, when calculating the simplified tax base of 15%, can reduce the income received for travel expenses (clause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation).

- Individual entrepreneurs are not classified by law as employees.

To be fair, let’s say that in judicial practice there are decisions in favor of entrepreneurs (Resolutions of the Federal Antimonopoly Service of the Eastern Administrative District dated 06.21.2007 N A78-6556/06-S2-24/354-F02-3683/07, FAS SZO dated 04.12.2011 N A66- 7842/2007, FAS UO dated 06.06.2011 N F09-3147/11-S3), in which the judges came to the conclusion that an individual entrepreneur can still go on business trips: otherwise it would mean that economic entities - organizations and individual entrepreneurs - are assigned into an unequal economic situation.

However, if you decide to follow these judicial examples, disputes with the Federal Tax Service are inevitable. It is impossible to predict what the court will decide in your case.

By the way, you can look at these costs from a different angle and recognize them not as travel expenses, but as expenses for:

- rent (clause 4, clause 1, article 346.16 of the Tax Code of the Russian Federation);

- maintenance of official transport, expenses for compensation for the use of personal cars and motorcycles for official trips within the limits established by the Government of the Russian Federation (clause 12, clause 1, article 346.16 of the Tax Code of the Russian Federation)

- expenses for other suitable items Art. 346.16 Tax Code of the Russian Federation.

But, unfortunately, for tickets for travel to and from the place of assignment, as well as for daily allowances, it is not possible to find suitable simplified taxation system expenses.

See also:

- Expenses that cannot be taken into account under the simplified tax system

- The procedure for accounting for expenses for a canceled business trip has been clarified.

- Business trip: cash payments

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Under what conditions can an individual entrepreneur not pay insurance premiums “for himself” while on parental leave? Department officials indicated that an individual entrepreneur without hired employees is exempt from...

- Can a simplifier take into account the costs of purchasing detergents and cleaning products? Purchasing detergents and cleaning products to keep the office clean...

- What documents do I need to confirm business trip expenses? The Tax Code of the Russian Federation does not establish requirements for documents confirming travel expenses....

- The Ministry of Finance has decided on the KBK for paying insurance premiums to the Pension Fund for individual entrepreneurs “for themselves.” The confusion that has arisen since February of this year in the payments of individual entrepreneurs...

Business trip for individual entrepreneurs: if you like to ride, prepare your money for a sled

Eh, a fun life for an entrepreneur, just have time to move around. He gallops like a frisky goat around his hometown and other people's towns and villages. But this pleasure is not cheap; you can spend a lot of money on travel, food in cafes and overseas hotels. But this is for business needs! Surely this can be taken into account in expenses, like a business trip for an individual entrepreneur. Or should I travel at my own business expense?

Travel expenses

First, let's look at the grounds on which business travel expenses can be taken into account in the general case.

1. In the general taxation system, travel expenses can be taken into account according to Article 264, paragraph 12 of the Tax Code as other expenses associated with production and sales.

2. On the simplified tax system in accordance with Article 346.16, clause 13 of the Tax Code as one of the types of recognized expenses.

Travel expenses include daily allowance, travel expenses, accommodation and some others.

What is a business trip

Now let’s talk about whether an individual entrepreneur’s trip on business matters is a business trip. The definition of a business trip can be found in Article 166 of the Labor Code: “a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.”

Please note - “employee trip”. Those. an individual with whom the employer has an employment relationship. A business trip is compensation for expenses to an employee.

This means that an individual entrepreneur’s business trip is a non-existent concept, something that does not happen, since the individual entrepreneur is not an employee. This conclusion is actively preached by the Ministry of Finance in letter No. 03-11-11/166 dated 07/05/13. He is echoed by Moscow tax officials in a letter from the Federal Tax Service in Moscow dated August 15, 2007. No. 18-1/3/ [email protected]

Therefore, it will not be possible to peacefully take into account expenses for travel, accommodation on a business trip, and daily allowances, regardless of the taxation regime.

Shall we argue?

If the individual entrepreneur’s trips are rare and the expenses are meager, then of course you can give up, agree with the tax authorities and obediently stretch out your neck. But if the costs are significant and the entire business is based on such trips, then you can argue in court, especially since there is a chance to win.

The Tax Code allows you to write off associated costs, for example, if goods, fixed assets, and materials are purchased. Moreover, the list of expenses on OSNO is not closed! What is needed for recognition:

— documentary evidence;

— economic feasibility;

- focus on generating income.

If the individual entrepreneur’s trip was for business purposes and all conditions are met, then the costs associated with it can be taken into account. In addition, the Labor Code does not clearly state that the individual entrepreneur is deprived of the opportunity to go on business trips on his own. Confirmation can be found in the resolution of the Federal Antimonopoly Service of the Far Eastern District dated November 1, 2006. No. Ф03-А73/06-2/3875, decision of the Supreme Arbitration Court dated March 5, 2007 No. 1568/07.

There are favorable decisions for “simplified people”, for example, the resolution of the Federal Antimonopoly Service of the Far Eastern District dated April 5, 2006. No. Ф03-А73/06-2/628, FAS of the East Siberian District dated 06/21/2007. in case No. A78-6556/06-S2-24/354-F02-3683/07.

Read about the composition of travel expenses here.

Do you often go on business trips? Is this a significant cost item for you? Please share in the comments!

You might be interested in:

Special cases

There are a number of features when issuing a travel certificate in cases where an organization sends its employees on a business trip to consider and resolve complaints from individual clients. The fact is that in such situations, arrival and departure notes cannot be made. Let us immediately note that this situation is not regulated by the legislation of the Russian Federation.

The Russian Ministry of Finance gave a hint. In a letter dated August 16, 2011 No. 03-03-06/3/7, officials indicated: if it is impossible to mark the arrival at the place of business trip and departure from it on the travel certificate, the fact of being at the place of business trip at the specified time can be confirmed by others documents. In particular, such documents may be:

- order (instruction) to send an employee on a business trip;

- official assignment for sending on a business trip and a report on its implementation;

- travel documents showing the dates of arrival and departure from the destination;

- hotel invoice confirming the period of stay at the place of business trip.

Business trips for employees of an individual entrepreneur

Business trips for employees are a very common phenomenon, both in organizations and individual entrepreneurs (hereinafter referred to as individual entrepreneurs). However, not every business trip can be considered a business trip. We will talk further about what conditions entrepreneurs must fulfill regarding the posting of workers.

KEY QUESTIONS ABOUT BUSINESS TRAVEL

In order to understand the issues of classifying business trips as business trips, it is necessary first of all to determine what is meant by this term in Russian law.

As follows from Art. 166 of the Labor Code of the Russian Federation, business trip is recognized as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

Since in this case we are talking about such entities as the employee and the employer, we can conclude that business trips are possible only within the framework of labor relations. Consequently, an organization cannot send on a business trip a person performing work or providing services under a civil contract.

This is also indicated by clause 2 of the Regulations on the specifics of sending employees on business trips (approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749, as amended on May 14, 2013; hereinafter referred to as the Regulations), as well as Art. 11 of the Labor Code of the Russian Federation, from which it follows that labor law norms do not apply to persons working on the basis of civil law contracts.

Who can be sent on a business trip?

The parties to an employment contract, as is known, are the employee and the employer. Moreover, in contrast to an employee, who is always understood as an individual who has entered into an employment relationship with an employer, as employers, according to Art. 20 of the Labor Code of the Russian Federation, not only organizations, but also individual entrepreneurs, private notaries, lawyers who have established law offices, and other persons using the labor of hired workers can act. Consequently, both an employee of an organization and an employee of an individual entrepreneur can be sent on a business trip.

However, it should be remembered that for some categories of persons the Labor Code of the Russian Federation establishes a ban on sending them on business trips .

Such persons include:

- employees during the period of validity of the apprenticeship contract, provided that the business trip is not related to apprenticeship (Article 203 of the Labor Code of the Russian Federation);

- pregnant workers (Article 259 of the Labor Code of the Russian Federation);

- workers under the age of 18, with the exception of minor athletes (Article 348.8 of the Labor Code of the Russian Federation) and creative workers listed in Art. 268 Labor Code of the Russian Federation.

NOTE! In Art. 166 of the Labor Code of the Russian Federation states that business trips of employees whose permanent work is carried out on the road or is of a traveling nature are not recognized as business trips. Therefore, the work of a courier, sales agent, flight attendant, machinist, conductor, truck driver, etc. cannot be considered a business trip. However, if this category of persons, in the interests of an individual entrepreneur, goes on a trip to carry out an assignment other than their main job duties, then such a trip will be considered a business trip.

From where and where?

Please note that a business trip is the execution of an assignment outside the place of permanent work . Let's turn to Art. 57 of the Labor Code of the Russian Federation, devoted to the content of an employment contract, according to which the place of permanent work is considered to be the location of the organization, or its separate division, the work in which is stipulated by the employment contract, or the workplace.

Moreover, this can be either the head office of the company, or its structural division or workplace located in another area.

In the latter case, the employment contract concluded with the employee stipulates that the employee’s place of work is a separate division of the organization, the location of which is different from the location of the organization itself.

Therefore, for employees working in separate divisions of companies, a trip to the parent organization will also be a business trip, and vice versa.

Thus, an employee’s trip to carry out an official assignment to a separate unit of his organization within one locality can be equated to a business trip.

For how long?

The Labor Code of the Russian Federation does not limit the duration of business trips and does not explain by whom they are determined. Clause 4 of the Regulations establishes that the duration of the business trip is determined by the employer independently, taking into account the volume, complexity and other features of the official assignment. The Federal Tax Service of Russia for Moscow also reminds us of this in letter dated October 28, 2010 No. 16-15/ [email protected] “On the procedure for accounting for business trip expenses for profit tax purposes.”

Thus, neither the Labor Code of the Russian Federation nor the Regulations contain any restrictions regarding the minimum or maximum periods of business trips. Therefore, an individual entrepreneur has the right to send an employee either on a one-day business trip or on a longer one.

However, it must be taken into account that a business trip is a temporary event during which the employee carries out instructions from the employer. Therefore, being sent on a very long business trip may entail a requirement from the tax authorities to register a separate workplace.

DOCUMENTING

Primary documents are required

Of course, the employee’s business trip must be documented accordingly, and in this case it does not matter who the employer is - an organization or an individual entrepreneur.

All organizations without exception are required to maintain accounting records. The requirement for documentary confirmation of the facts of economic life is put forward by the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Federal Law No. 402-FZ), which came into force on January 1, 2013.

According to Art. 6 of Federal Law No. 402-FZ, individual entrepreneurs may not keep accounting records, but only on the condition that, in accordance with tax legislation, they keep records of income or income and expenses and (or) other objects of taxation in the manner established by this legislation. Today, this procedure for maintaining tax accounting is available to all categories of entrepreneurs, starting from those who use the traditional taxation system, paying personal income tax (NDFL), and ending with those individual entrepreneurs who, starting from 2013, plan to use the tax introduced on January 1, 2013. d. patent taxation system.

In particular, for individual entrepreneurs paying personal income tax on business income, this Procedure for accounting for income and expenses and business transactions for individual entrepreneurs was approved by Order of the Ministry of Finance of Russia No. 86n, Ministry of Taxes of Russia No. BG-3-04/430 dated August 13, 2002 (hereinafter referred to as the Accounting Procedure ).

From the specified Accounting Procedure it follows that the individual entrepreneur keeps records of income and expenses and business transactions by recording in the Book of Accounting of Income and Expenses and Business Operations of an individual entrepreneur operations on income received and expenses incurred at the time of their commission on the basis of primary documents in a positional manner. Since in tax law there is no independent concept of “primary document”, then on the basis of Art. 11 of the Tax Code of the Russian Federation, entrepreneurs are guided by the concept enshrined in Federal Law No. 402-FZ.

Consequently, the requirement to use a primary accounting system applies to all employers, including individual entrepreneurs.

We draw up documents

Thus, an individual entrepreneur, like any employer, must issue an official assignment , which indicates:

last name, first name and patronymic of the employee sent on a business trip;

- structural unit, profession or position of the employee;

- place of business trip;

- start and end dates of the trip;

- number of calendar days of business trip.

The document is signed by the head of the department in which the posted worker works, and in the absence of departments - by the individual entrepreneur himself.

Based on the official assignment, an order (instruction) is issued to send the employee on a business trip , which is signed by the individual entrepreneur himself or the person entrusted with such authority.

The order indicates the surname and initials, structural unit, position (specialty, profession) of the traveler, as well as the purpose, time and place of the business trip. If necessary, the order indicates the sources of payment for travel expenses, as well as other conditions for sending on a business trip.

Based on the approved order (instruction), a travel certificate in one copy. The certificate is given to the employee sent on a business trip, remains with him throughout its entire duration and confirms the actual time of the employee’s stay on a business trip, which is determined by the time stamps of arrival at the place of business trip and departure of the employee.

several destinations during the performance of a work assignment , then in each of them the travel certificate must make an appropriate note about arrival and departure.

Stamps on the time of arrival and departure are certified by the signature of an authorized official and a seal that is used in the business activities of the company to which the employee is sent to certify such a signature.

NOTE! When traveling in Russia and most CIS countries, having a travel certificate is mandatory. If there is a trip to foreign countries, then there is no need to register it, as indicated by clause 15 of the Regulations.

Accounting for travel expenses

Before sending an employee on a business trip, he is given funds for travel expenses on account, which is directly provided for in clause 10 of the Regulations.

Let us recall that from January 1, 2012, the procedure for conducting cash transactions on the territory of the Russian Federation is regulated by the regulations on the procedure for conducting cash transactions with banknotes and coins of the Bank of Russia on the territory of the Russian Federation (approved by the Bank of Russia on October 12, 2011 No. 373-P; hereinafter referred to as the Regulation on the procedure for conducting cash transactions).

According to the Regulations on the procedure for conducting cash transactions, individual entrepreneurs, as well as legal entities, maintain a cash book and register the receipt and issue of money through incoming and outgoing cash orders .

The procedure for issuing sums of money for reporting, including those used by individual entrepreneurs, is actually established by clause 4.4 of the Regulations on the procedure for conducting cash transactions.

As follows from this norm, the issuance of money for expenses related to the activities of individual entrepreneurs is carried out on the basis of cash expenditure order 0310002 , the unified form of which was approved by Resolution of the State Statistics Committee of Russia dated 08/18/1998 No. 88 (as amended on 05/03/2000).

The specified document is drawn up in accordance with a written application of the accountable person, drawn up in any form, which indicates the required amount and the period for which cash is issued. The application is endorsed by the entrepreneur indicating the date and submitted to the accounting department.

Please note that the issuance of cash on account is subject to full repayment by the accountable person of the debt on the amount of cash previously received on account.

The accountable person is obliged, within a period not exceeding three working days after the expiration date for which cash was issued on account, or from the date of going to work, to submit to the chief accountant or accountant (and in their absence, to the individual entrepreneur himself) an advance report , attaching to it supporting documents.

The advance report is checked by the chief accountant, bookkeeper or the entrepreneur himself, its approval and final payment is carried out within the period established by the individual entrepreneur.

Entrepreneurs are advised to pay attention to the letter of the Bank of Russia dated 08/02/2012 No. 29-1-2/5603, explaining that cash withdrawn by an individual entrepreneur from a current account for personal needs can be spent by him without any restrictions. There is no requirement to prepare an advance report for such amounts.

Thus, upon returning from a business trip, an individual entrepreneur is obliged to report on its results, as well as submit an advance report to the accounting department or to the entrepreneur himself, along with supporting documents for his expenses.

Moreover, you must report on your business trip and submit the report to the accounting department no later than three working days from the date of return. This is indicated both by clause 4.4 of the Regulations on the procedure for conducting cash transactions, and by clause 26 of the Regulations.

What is it for?

Based on the employer’s decision, an employee sent on a business trip is issued a travel certificate in order to confirm the duration of his stay. This is provided for in paragraph 7 of Decree of the Government of the Russian Federation of October 13, 2008 No. 749 “On the specifics of sending employees on business trips” (hereinafter referred to as Resolution No. 749).

The travel certificate contains information about the date of arrival, destination, and also indicates the date of departure from it.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Legal consultations » Labor disputes » How to properly arrange a business trip for a person who is not an employee of the organization

An individual who is not an employee of the organization is sent on a business trip from an individual entrepreneur (LE) on judicial issues.

Question.

How to properly arrange a business trip for a person who is not an employee of the organization

Answer.

Since in this case the individual is not an employee of the organization, this person’s trip is not a business trip.

No specific explanations were found on how to arrange this trip.

In accordance with Art. 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Business trips of employees whose permanent work is carried out on the road or has a traveling nature are not recognized as business trips.

Art. 166, “Labor Code of the Russian Federation” dated December 30, 2001 N 197-FZ (as amended on July 3, 2016) {ConsultantPlus}

Payment for individuals who are not employees of the organization for the cost of travel to the place of business trip and back is their income received in kind and subject to personal income tax.

The list of compensation payments exempt from personal income tax is established in clause 3 of Art. 217 of the Tax Code of the Russian Federation. Reimbursement of travel payments to persons under the authority or administrative subordination of the organization is not subject to personal income tax.

When it comes to reimbursement of travel expenses to the place of business trip for non-employees, the norm is clause 3 of Art. 217 of the Tax Code of the Russian Federation does not apply to these payments. After all, persons who are not in an employment relationship with the company are not its employees.

Judicial practice shows the following.

Inspectors charge additional personal income tax if the company does not withhold it from amounts paid to an individual who is not an employee to reimburse travel expenses.

Labor relations arise between an employee and an employer on the basis of an employment contract concluded by them in accordance with the Labor Code of the Russian Federation. The parties to the labor relationship are the employee and the employer.

Based on Art. 164 of the Labor Code of the Russian Federation, compensations are monetary payments established to reimburse employees for costs associated with the performance of their labor or other duties provided for by the Labor Code of the Russian Federation and other federal laws.

Therefore, the provisions of paragraph 3 of Art. 217 of the Tax Code of the Russian Federation in terms of compensation payments for travel and accommodation expenses apply to individuals who are in an employment relationship with an organization on the basis of employment contracts concluded with them. Within the framework of other contractual relations, including civil law, the amounts of such expenses are not compensatory and are subject to personal income tax (Resolution of the Federal Antimonopoly Service of the Volga District dated June 1, 2009 N A12-15743/2008).

A similar conclusion that compensation for travel expenses for persons who are not employees of the organization is recognized as income of an individual subject to personal income tax is presented in the Resolution of the Twelfth Arbitration Court of Appeal dated August 15, 2014 N A12-1984/2014. Thus, the appellate court recognized that if payment of expenses of individuals for their travel and accommodation during the provision of services under civil contracts is carried out in the interests of these individuals, including if such payment is part of the individual’s remuneration for work performed (work, services ), then payment of these costs is recognized as income received in kind, and the amounts of such payment are subject to personal income tax.

Selection of documents

{Article: Commentary to the Letter of the Ministry of Finance of Russia dated September 24, 2015 N 03-03-06/1/54684 <NDFL: payment of travel to individuals who are not employees of the organization> (Yudahina E.M.) (“Regulatory acts for an accountant”, 2015, N 20) {ConsultantPlus}}

Question: About accounting for expenses for services of third-party organizations for income tax purposes; on the application of income tax, VAT and personal income tax when reimbursing travel expenses to members of the expert commission who are not employees of the organization. (Letter of the Ministry of Finance of Russia dated September 24, 2015 N 03-03-06/1/54684) {ConsultantPlus}

The explanation was given by Igor Borisovich Makshakov, legal consultant of LLC NTVP Kedr-Consultant, April 2017.

When preparing the answer, SPS ConsultantPlus was used.

This clarification is not official and does not entail legal consequences; it is provided in accordance with the Regulations of the CONSULTATION LINE ().

Date of recognition of travel expenses

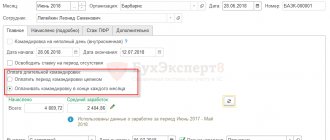

Money for a business trip is given to the employee upon reporting before the trip. However, expenses are recognized when they are actually incurred and paid.

At the moment when the money is given to the employee for a business trip on account, the expenses have not yet been incurred and the employee is in debt. In addition, the company does not yet have documents confirming the expenses. And only after the employee submits an advance report, attaching supporting documents to it, and the manager approves it, the costs can be recognized for tax purposes (clause 13, clause 1, article 346.16, clause 2, article 346.17 of the Tax Code of the Russian Federation).

The employee must report for the money issued on account no later than three working days after returning from the trip (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

If the employee has an overexpenditure compared to the amount of the previously issued advance, then the travel expenses will be recognized as expenses after the employee is reimbursed for the amount of the overexpenditure.

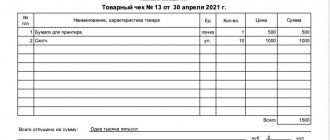

EXAMPLE

An employee of JSC Aktiv, Somov, is sent on a business trip to one of the cities of Russia from February 1 to 7 of the current year (7 days). Before the business trip (January 30), he was given an advance in the amount of 3,000 rubles. Returning from a business trip, Somov submitted an advance report to the accounting department on February 9, enclosing train tickets worth 1,180 rubles. (including VAT - 180 rubles) and a hotel bill for 3540 rubles. (including VAT - 540 rubles). Thus, the overexpenditure for the business trip amounted to: 1180 rubles. + 3540 rub. + (100 rub. × 7 days) – 3000 rub. = 2420 rubles. This amount was paid to Somov from the cash register also on February 9. On the same day, Aktiv JSC will be able to include in the expenses taken into account when calculating the single tax: - travel expenses (travel, accommodation and daily allowance) in the amount of 4700 rubles. (1180 – 180 + 3540 – 540 + 700) (based on clause 13, clause 1, article 346.16 of the Tax Code of the Russian Federation);— input VAT on travel expenses in the amount of 720 rubles. (180 + 540) (based on clause 8, clause 1, article 346.16 of the Tax Code of the Russian Federation).