08.10.2018

When purchasing used property that is depreciable, an organization asks itself the question of how to correctly determine its useful life (USI). Even the presence of a special norm of Ch. 25 of the Tax Code of the Russian Federation, which allows taking into account the period of time a fixed asset was in operation with the previous owner, does not always allow us to give an unambiguous answer to this question. Let's consider what difficulties an organization may encounter in practice when purchasing such OS.

Regulations ch. 25 of the Tax Code of the Russian Federation, dedicated to used fixed assets.

As a general rule, by virtue of paragraph 1 of Art. 258 of the Tax Code of the Russian Federation, depreciable property is distributed among depreciation groups in accordance with its useful life.

The useful life of the property (SPI) is the period during which the fixed asset serves to fulfill the goals of the taxpayer's activities. SPI is determined by the taxpayer independently on the date of commissioning of this depreciable property in accordance with the provisions of Art. 258 of the Tax Code of the Russian Federation and taking into account the OS Classification.

Two provisions of this article are devoted to fixed assets that have been in operation.

So, according to paragraph 7 of Art. 258 of the Tax Code of the Russian Federation, an organization acquiring used fixed assets, in order to apply the linear method of calculating depreciation for these objects, has the right to determine the depreciation rate for this property, taking into account the SPI, reduced by the number of years (months) of operation of the property by the previous owners.

In this case, the useful life of these fixed assets can be defined as their useful life established by the previous owner of these fixed assets, reduced by the number of years (months) of operation of such property by the previous owner.

Let us note, clause 12 of Art. 258 of the Tax Code of the Russian Federation provides that used depreciable property objects acquired by an organization are included in the depreciation group (subgroup) in which they were included from the previous owner.

For your information:

The tax code gives the taxpayer the right to independently decide which procedure for determining the SPI of used property to apply (see

Letter of the Ministry of Finance of the Russian Federation dated September 23, 2009 No. 03-03-06/1/608

).

In other words, in order to determine the useful life of a used OS, the new owner can set his own useful life or take as a basis the period established by the previous owner. In any case, it may or may not reduce this TPI for the period of actual use. Thus, the following options for determining SPI in relation to a used fixed asset are possible.

Option 1

| Useful life | = | SPI set by the seller |

Option 2

| Useful life | = | SPI set by the seller | — | Duration of actual use of the OS by the seller |

Option 3

| Useful life | = | SPI established by the buyer within the depreciation group selected by the seller |

Option 4

| Useful life | = | SPI established by the buyer within the depreciation group selected by the seller | — | Duration of actual use of the OS by the seller |

Example.

In October 2022, the organization purchased a used heating boiler, the cost of which was RUB 283,200. (including VAT - 43,200 rubles). The facility was put into operation in the same month.

The initial cost is 240,000 rubles. (283,200 – 43,200).

The previous owner provided the following data about the property: at the time of commissioning it had code 142813100 OKOF and belonged to the fifth depreciation group (property with a useful life of over 7 to 10 years inclusive, or 85 - 120 months). The SPI was set at 105 months. In fact, the facility was in operation for 25 months.

Let's calculate the SPI and the depreciation rate of this fixed asset for the new owner, taking into account the mandatory rule: the same depreciation group is retained, in this case – the fifth.

Calculation according to option 2. The organization decided to exercise its right to determine the SPI, taking into account the period set by the previous owner and the period of actual operation.

The SPI is determined to be 80 months. (105 – 25).

The monthly depreciation rate is 1.25% (1/80 month x 100%).

The amount of depreciation per month is 3,000 rubles. (RUB 240,000 x 1.25%).

Calculation according to option 4. The organization established its SPI, guided by the OS Classification, taking into account the period of actual operation by the previous owner.

For the calculation, she took the minimum period provided for the fifth depreciation group - 85 months. and reduced it by 25 months. Thus, the SPI for a used fixed asset will be equal to 60 months. (85 – 25).

The monthly depreciation rate is 1.667% (1/60 months x 100%).

The amount of depreciation per month is 4,000 rubles. (RUB 240,000 x 1.667%).

The possibility of a new owner applying a different SPI (for example, minimum) than the one established by the previous owner (but within the same depreciation group) is also confirmed by examples from arbitration practice.

This is the situation considered by the AS SKO in its Resolution dated 05/08/2015 in case No. A53-27549/2013. The tax inspectorate did not agree with the organization that acquired used OS and established SPI for them, which was less than that indicated by the former owner in the acts of acceptance and transfer of objects. The judges came to the conclusion that the taxpayer set the useful life in accordance with the norms of tax legislation: the calculation took into account a period equal to the minimum period allowed by the Tax Code for the relevant depreciation group, increased by one month; the received SPI was reduced by the number of months of operation of this property by the previous owners, indicated in the acceptance certificates (in the absence of information about the period of actual operation by the previous owner, the calculated SPI was not reduced).

For your information:

if the period of actual use of a used fixed asset by the previous owners turns out to be equal to its useful life or exceeds this period, the taxpayer has the right to independently determine the SPI of this fixed asset, taking into account safety requirements and other factors (

paragraph 2, paragraph 7, article 258 of the Tax Code of the Russian Federation

).

As noted in the Appeal Ruling of the Supreme Court of the Russian Federation dated February 14, 2018 No. 3-APG17-17, the expiration of the useful life itself does not make it impossible to calculate depreciation payments.

Option 5

| Useful life | = | SPI established by the buyer based on safety requirements and other factors |

Keep in mind, as judicial practice shows, arbitrators also insist on taking into account, when determining PPI, the period of possible use of the fixed asset in the organization’s activities in the future, its ability to generate income and technical characteristics (see Resolution of the Ninth Arbitration Court of Appeal dated 17.01. 2013 in case No. 09AP-38524/2012).

In Resolution No. 09AP-38529/2012 dated January 17, 2013, the same court, having supported the taxpayer in a dispute with the tax authority on the issue of the correctness of determining the SPI for fixed assets that were in operation, noted that when determining the SPI, not only the totality of technical characteristics was taken into account, specified in the technical passports of the facilities, but also other factors: the specifics of the type of activity, fire safety requirements, the stability of structural elements in the event of an emergency at the facility, requirements for ensuring normal working conditions and safety measures, that is, the conditions that actually exist in place of operation of the fixed asset.

Corporate income tax

For profit tax purposes, production equipment received under a purchase and sale agreement with a useful life of more than 12 months and an initial cost of more than 40,000 is depreciable property - fixed assets (clause 1 of Article 256, clause 1 of Article 257 of the Tax Code of the Russian Federation).

The initial cost of the fixed asset is determined in the manner established by clause 1 of Art. 257 of the Tax Code of the Russian Federation, as the amount of expenses for its acquisition, construction, manufacturing, delivery and bringing it to a state in which it is suitable for use, with the exception of VAT and excise taxes (except for cases provided for by the Tax Code of the Russian Federation).

In the situation under consideration, the initial cost of the equipment will be its cost established by the purchase and sale agreement (excluding VAT).

Used depreciable property items purchased by an organization are included in the depreciation group (subgroup) in which they were included from the previous owner (clause 12 of Article 258 of the Tax Code of the Russian Federation).

Accordingly, in this case, the purchased equipment is included in the third depreciation group (property with a useful life of more than three years up to five years inclusive).

Note that in paragraph 7 of Art. 258 of the Tax Code of the Russian Federation provides for the right of an organization acquiring used fixed assets to determine the depreciation rate for such property, taking into account the useful life reduced by the number of years (months) of operation of this property by the previous owners. With this approach, the useful life of acquired fixed assets can be determined as their useful life established by the previous owner of these fixed assets, reduced by the number of years (months) of operation of this property by the previous owner. In relation to the situation under consideration, the useful life of the purchased equipment would be 50 months (60 months - 10 months).

However, this option for determining the useful life of a used asset purchased by an organization is not the only possible and mandatory one.

In this case, the organization expects to use the equipment for 40 months. This period is within the third depreciation group, and therefore, for tax accounting purposes, the organization has the right to set the useful life to 40 months.

The calculation of depreciation for depreciable property objects begins on the 1st day of the month following the month in which this object was put into operation (clause 4 of article 259 of the Tax Code of the Russian Federation).

If the organization does not apply the right to bonus depreciation provided for in paragraph 9 of Art. 258 of the Tax Code of the Russian Federation, the amount of depreciation deductions included monthly in expenses associated with production and sales will be 12,000 rubles. ((RUB 566,400 - RUB 86,400) x 1/40 month x 100%). This follows from the provisions of paragraphs. 1 clause 1 art. 259, paragraph 2 of Art. 259.1, paragraphs. 3 p. 2 art. 253, paragraph 3 of Art. 272 of the Tax Code of the Russian Federation.

A few words about the two editions of the OS Classification.

So, the taxpayer determines the depreciation rate for purchased used assets, taking into account the SPI established by the previous owner. Otherwise, he can independently determine the SPI of purchased OS, including used ones, in the generally established manner (see letters of the Ministry of Finance of Russia dated October 3, 2017 No. 03-03-06/1/64282, dated August 11, 2017 No. 03-03 -06/1/51573).

In the listed letters, the financial department also emphasized that on the issue of the procedure for applying the Classification of OS as amended by Decree of the Government of the Russian Federation dated July 7, 2016 No. 640 for the purposes of calculating income tax, one should be guided by the Letter of the Ministry of Finance of Russia dated November 8, 2016 No. 03-03-RZ/65124, which states that in relation to OS put into operation before 01/01/2017, the SPI determined by the taxpayer when putting them into operation is applied.

Let us explain what is meant here.

We remind readers that from 01/01/2017, the above-mentioned resolution made changes to the OS Classification due to the emergence of a new OKOF.

Since this date, not only new objects have appeared in the FA Classification, but also there have been (minor) movements of individual fixed assets from group to group, which led to an increase or decrease in their minimum and maximum SPI.

For example, general-purpose trucks with a carrying capacity of over 3.5 to 5 tons, until January 1, 2017, according to the old OKOF, had code 15 3410194 and belonged to the position “Truck vehicles, road tractors for semi-trailers (general purpose vehicles: flatbeds, vans, tractor-trailers; dump trucks)” were thus included in the fourth depreciation group (with SPI from 5 to 7 years inclusive).

From 01/01/2017 for trucks with a technically permissible maximum weight of over 3.5 tons, but not more than 12 tons, the OKOF code is set to either 310.29.10.42.112 (with a gasoline engine) or 310.29.10.41.112 (with a diesel engine) ). Thus, now these cars are included in the fifth depreciation group (with SPI from 7 to 10 years inclusive).

Let’s assume that the previous owner put a fixed asset into operation before January 1, 2017, guided by the old edition of the OS Classification, and included the object in one depreciation group, and the new owner, purchasing a used object after this date, discovers that the fixed asset “moved” to another depreciation group. How to be in this case?

An organization can focus on the SPI established by the previous owner, or set a different period, but within the framework of the depreciation group in which the asset was at the time of its commissioning. We believe that this is exactly what the Ministry of Finance had in mind in the above-mentioned Letter dated November 8, 2016 No. 03-03-RZ/65124.

If there is less than a year until the end of the useful life of the property...

Should a taxpayer, when purchasing used depreciable property, the useful life of which, taking into account the actual service life of the previous owners, be less than 12 months, include this property as part of the depreciable property?

As noted in the Letter of the Ministry of Finance of Russia dated July 16, 2009 No. 03-03-06/2/141, the taxpayer in this situation independently determines the SPI for it, taking into account safety requirements and other factors, and continues to depreciate it until the cost is completely written off. Thus, a purchased used asset with a residual fixed income of less than 12 months does not cease to be a depreciable asset.

This opinion is shared by the judges. Thus, the Resolution of the Federal Antimonopoly Service dated March 23, 2012 in case No. F09-1350/12 considered a dispute between the tax inspectorate and an organization regarding the one-time attribution of expenses associated with the acquisition of used OS items. The useful life of the property (taking into account the period of actual use by the previous owner) was established as 12 months. At the time of commissioning, the cost of the operating system was included in material costs in full, that is, the costs were written off at a time in the same month. The tax inspectorate considered that the cost of purchased fixed assets should have been expensed in equal shares over 12 months. The arbitrators supported the tax authorities in this episode.

You can change the depreciation group only if the previous owner made a mistake in choosing it.

In accordance with paragraph 12 of Art. 258 of the Tax Code of the Russian Federation, the taxpayer is obliged to include used objects of depreciable property in the composition of the depreciation group (subgroup) in which they were included by the previous owner.

Please note: an organization purchasing used fixed assets has the right to change the useful life established by the previous owner only if it was determined incorrectly by the former owner.

If the owner did not make a mistake in choosing the group, then an arbitrary change in the depreciation group is unlawful. This conclusion follows from the Resolution of the Arbitration Court of the Moscow Region dated February 25, 2016 in case No. A40-29366/2014.

When putting fixed assets into operation, the first owner included them in the fifth depreciation group with a useful life of 85 months. The taxpayer who purchased these fixed assets, when registering them, retaining the previous code, changed the depreciation group to the third with a useful life of 36 months.

According to the tax authorities, when accepting objects for registration, the previous owner was subject to a reduction in service life of 85 months, established by the previous owner, and not the period corresponding to the third depreciation group. The judges supported the inspectors, recognizing that the new owner has the right to change the SPI only if it was determined incorrectly by the former owner.

Another example is the Resolution of the AS SKO dated 05/08/2015 in case No. A53-27549/2013. The inspectorate assessed additional income tax due to the fact that the organization, in its opinion, overestimated depreciation charges for buildings, including them, according to the transfer and acceptance certificate from the former owner, in the sixth depreciation group and accruing a depreciation bonus of 30% on them, and not 10%. The organization went to court, believing that, on the basis of clause 12 of Art. 258 of the Tax Code of the Russian Federation, it is obliged to take into account buildings that were in operation as part of the depreciation group in which they were included by the previous owner, and it does not have the right to independently change the SPI and depreciation group in the event of an error by the previous owner. However, the judges did not support the taxpayer, pointing out that the disputed buildings belong to the eighth depreciation group and in the event of an incorrect determination by the previous owners of the SPI of the object, it should be determined by the buyer according to the OS Classification. The judges came to the following conclusion.

For your information:

taxpayer on the basis of

clause 7 of Art.

258 of the Tax Code of the Russian Federation must independently establish a new (correct) period and depreciation group for acquired fixed assets.

In addition, by agreement with the previous owner, he can make appropriate changes to the transfer and acceptance certificates and other primary accounting documents in the manner provided for in paragraph 5 of Art.

9 of the Accounting Law .

How to accept an OS for accounting in 1C 8.3: standard method

With the standard method, two documents are drawn up to accept the OS for accounting:

- document Receipt (act, invoice) type of operation Equipment ;

- document Acceptance for accounting of fixed assets ;

Let's consider the features of filling out each document and their implementation.

Document Receipt (act, invoice) type of operation Equipment

You can register the capitalization of fixed assets using this document through:

- Purchases – Purchases – Receipts (acts, invoices) – Receipts – Equipment section;

- OS and intangible assets – Receipt of fixed assets – section Receipt of equipment.

So, for example, in 1C Accounting 8.3 it is recommended to purchase a car that we plan to use on public roads through the standard option, because the initial cost of the car will include additional costs - in this case, the fee for its registration with the traffic police.

On the Equipment , enter the fixed assets you are purchasing and indicate their quantity. Select fixed asset objects from the Nomenclature directory.

When posting a document, the initial cost of a non-current asset will be taken into account on account 08.04.1 “Purchase of components of fixed assets” until the document Acceptance for accounting of fixed assets is entered.

Learn more:

- Purchase of a fixed asset: car

- Purchase of a fixed asset with additional delivery costs

Document Acceptance for accounting of fixed assets

You can accept fixed assets for accounting using this document through:

- Fixed assets and intangible assets – Receipt of fixed assets – section Acceptance for accounting of fixed assets.

On the Non-current asset , specify the details of the acquired asset before commissioning:

- Equipment is a non-current asset put into operation; select from the Nomenclature directory;

- The main warehouse is the place of storage of the registered object;

- Account - a cost accounting account where the initial cost of an object is formed.

On the Fixed Assets , select the operating systems to be put into operation from the Fixed Assets .

Set the parameters for calculating depreciation and paying off the cost of objects on separate tabs Accounting and Tax Accounting .

On the Accounting , specify:

- Accounting account - accounting account put into operation of the OS;

- Accounting procedure : Calculation of depreciation ;

- The cost is not repaid.

If you select the Depreciation calculation , set the parameters for its calculation.

On the Tax Accounting , set the Procedure for including costs in expenses .

Depending on the procedure for accounting for the costs of purchasing an object in NU, in the Procedure for including costs in expenses, you can select:

- Depreciation calculation - for fixed assets for which depreciation will be calculated;

- Inclusion in expenses when accepted for accounting - for objects, the costs of acquiring them at a time will be taken into account in expenses when accepting them for accounting;

- Cost is not included in expenses - for objects, expenses for which will not be taken into account in expenses that reduce the tax base.

For NU it is impossible to select the depreciation calculation method in the document, because it is set in the accounting policy settings and applied to all OS objects. In 1C, the method is set in the Main section - Settings - Taxes and reports - Income Tax section.

For objects for which depreciation is charged, it is possible to charge a depreciation bonus. Its parameters are set on a separate tab Depreciation bonus .

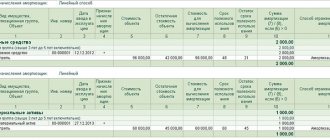

The document generates transactions:

Learn more:

- Acceptance for accounting of fixed assets with bonus depreciation

- Acceptance for accounting of fixed assets received as a contribution to the management company

- OS costing from 40 to 100 thousand rubles.