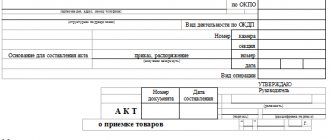

Filling out a variance report in 2022

Filling out the first page of the TORG-2 form

At the beginning of the document, information about the company to which the goods arrived is written:

- its full name,

- address,

- telephone,

- OKPO code,

- Kind of activity,

- structural unit that accepted the cargo

- a link to the document that served as the basis for drawing up the act (usually an order or instruction from the director).

All entered data must be identical to those specified in the constituent documents.

The act must be assigned a number and the date of its writing must be entered on the form. The lines on the right reserved for approval are filled in by the head of the company.

Further, in the “Place of acceptance” paragraph, the actual address of receipt of the cargo is indicated, the date of delivery and a link to the accompanying documents (indicating their name, number, date of creation) are noted. The method for calling the representative of the consignor of the goods is also entered here and the lines dedicated to the shipper, manufacturer, supplier are filled in - everywhere you need to indicate the appropriate name of the company, address, contact phone number.

If the product was insured, this should also be noted by entering information about the insured.

The following part of the act includes:

- data on the documents on the basis of which the delivery was made (link to the contract, invoice number, and if necessary, you should also enter the number of the railway invoice, veterinary certificate, commercial act);

- delivery method (railway, water or air transport, car, etc.);

- departure date;

- some details about the loading location (warehouse, pier, station, terminal, etc.).

Below is a table in which you need to enter the exact time of departure and arrival, opening, and delivery of the cargo (down to minutes). If there were any pauses during the unloading period , this should also be noted.

Filling out the second page of the TORG-2 form

The second page of the TORG-2 form begins with entering information about the condition of the vehicle, as well as the presence of labels, seals and other markings on the products.

The following information is entered into the table:

- imprints on the cargo,

- number of occupied seats,

- type of packaging (bag, box, container, pallet, etc.),

- product name,

- everything related to weight (unit of measurement, net-gross).

If there is any special additional information, it should be entered in the last column. Under the table it is necessary to indicate whether facts of violation of the integrity of seals or labels were recorded.

The second table on this page of the act concerns the discrepancy information : first, the indicators from the accompanying documents filled out by the sender are entered here, then those that were received when checking the received cargo. As a result, a discrepancy is entered (with a + or - sign).

Another table contains detailed information about the product (if there are several items, then a separate line is allocated for each of them). This includes:

- his name,

- seat number in the vehicle,

- unit of measurement (in words and in code),

- article (if available),

- variety,

- quantity,

- unit price),

- total amount.

Filling out the third page of the TORG-2 form

The following information is indicated on the third page of the act.

- Information about storage and transportation conditions. Here you can enter any parameters that can affect the quality of the product: temperature, humidity, lighting, air exchange, etc.

- The condition of the packaging and labeling at the time of external inspection, as well as the correspondence of the stamped cliches to the sender’s labeling.

- The date the container was opened, and it is also stated (or not stated) that the prints and seals correspond to the condition indicated in the shipping papers.

- Information about the inspection (whether it was random or complete) and how it was carried out; if the inspection was selective in nature, then you need to write the basis for its conduct.

In the table on page three you need to write data about those parameters of the cargo that were recorded at the time of acceptance: grade, article, quantity, price, amount.

If a defective or defective cargo has been identified, this should also be included.

Then deviations are recorded (shortages or surpluses - quantity, amount of the difference) and the product passport number, if any.

Filling out the fourth page of the TORG-2 form

The fourth page includes:

- information about determining the quantity of goods (how it was carried out: weighing, counting, etc.);

- information about the location of this operation;

- devices used in the procedure (their name, type, number, brand);

- enter the nature of the identified discrepancies (underweight, overweight, poor quality, defects, damage, etc.);

- conclusion of the commission (usually information is indicated here about whether claims should be made against anyone and, if so, to whom exactly).

The last part of the act contains

- information about the members of the commission who were present during its preparation: their positions and full names are written,

- as well as information about the shipper’s representative (his position, full name and link to the power of attorney).

If any additional supporting documents are attached to the act, then their number must be entered in the form.

Then everything is signed by the chief accountant of the company, and finally the manager’s verdict is issued.

In the Supplier's accounting

The organization entered into a supply agreement with the buyer for OSNO.

On February 21, an advance payment in the amount of 120,000 rubles was received.

On February 25, goods were shipped 800W power supply (50 pcs.) for a total amount of 120,000 rubles. (including VAT 20%).

On March 2, a shortage of goods was detected in the shipment - 5 pieces. for the amount of 12,000 rubles. The buyer provided a statement of discrepancies and a claim - the parties agreed on an adjustment to the cost and a refund of the advance payment.

March 03 prepayment 12,000 rubles. returned to the buyer.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Receipt of advance payment from the buyer | |||||||

| February 21 | 51 | 62.02 | 120 000 | 120 000 | Receipt of advance payment from the buyer | Receipt to the bank account - Payment from the buyer | |

| Calculation of VAT on advance payment and issuance of tax invoice to the buyer | |||||||

| February 21 | 76.AB | 68.02 | 20 000 | Calculation of VAT on advance payment and issuance of tax invoice to the buyer | Invoice issued for advance payment | ||

| — | — | 20 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Sales of goods | |||||||

| 25 February | 62.01 | 90.01.1 | 120 000 | 120 000 | 100 000 | Revenue from sales of goods | Sales (act, invoice) - Goods (invoice) |

| 90.02.1 | 41.01 | 91 379,31 | 91 379,31 | 91 379,31 | Write-off of the cost of goods | ||

| 90.03 | 68.02 | 20 000 | VAT accrual on revenue | ||||

| 62.02 | 62.01 | 120 000 | 120 000 | 120 000 | Advance offset | ||

| — | gas turbine engine | Write-off of goods according to the customs declaration | |||||

| Issuance of SF for shipment to the buyer | |||||||

| 25 February | — | — | 120 000 | Issuing SF for shipment | Invoice issued for sales | ||

| — | — | 20 000 | Reflection of VAT in the Sales Book | Sales book report | |||

| Registration of a discrepancy report | |||||||

| March 02 | — | — | -12 000 | Reflection of discrepancies in the delivery amount | Statement of Discrepancies | ||

| — | — | -2 000 | Reflection of discrepancies in the VAT amount | ||||

| Reflection of short supply of goods | |||||||

| March 02 | 62.01 | 90.01.1 | -12 000 | -12 000 | -10 000 | Reversal of revenue from sales of goods | Return of goods from the buyer |

| 90.02.1 | 41.01 | -9 137,93 | -9 137,93 | -9 137,93 | Reversal of cost of goods sold | ||

| 90.03 | 19.09 | -2 000 | Reversal of accrued VAT on undelivered goods | ||||

| gas turbine engine | — | — | Reversal of the number of goods sold according to the customs declaration | ||||

| 62.02 | 62.01 | 12 000 | 12 000 | 12 000 | Allocating buyer's advance due to adjustment | ||

| Issuing KSF for return | |||||||

| March 02 | — | — | 180 000 | Issuing KSF for return | Corrective invoice issued | ||

| Refund of advance payment to buyer | |||||||

| March 03 | 62.02 | 51 | 12 000 | 12 000 | Refund of advance payment to buyer | Debiting from the current account - Return to the buyer | |

| Acceptance of VAT for deduction | |||||||

| March 31 | 68.02 | 76.AB | 20 000 | Acceptance of VAT for deduction when offsetting the buyer's advance payment | Generating purchase ledger entries | ||

| 68.02 | 19.09 | 2 000 | Acceptance of VAT for deduction on undelivered goods | ||||

| — | — | 22 000 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

- Receipt to the current account

–

Payment from the buyer ; - Invoice issued for advance payment

, KVO 02; - Sales ( act, invoice)

; - Invoice issued for sales

, KVO 01; - Formation of purchase ledger entries

–

Advances received , KVO 22; - The discrepancy report received

is based on

the Implementation , NO ENTRY; - Adjustment of implementation

- on the basis of

the Statement of Discrepancies (received) , Adjustment by agreement of the parties - In all sections of accounting , ENTRY; - Adjustment invoice issued

, KVO 18; - Formation of purchase book entries

–

Reducing the cost of sales , KVO 18; - Debiting from the current account

–

Return to the buyer .

Generating purchase ledger entries – Advances received

VAT on advances received is accepted for deduction after offset of the prepayment upon shipment (clause 8 of Article 171 of the Tax Code of the Russian Federation, clause 6 of Article 172 of the Tax Code of the Russian Federation):

Statement of discrepancies (received) – Create based on – Implementation (act, invoice)

Discrepancy report (received)

For each product there are 2 lines to reflect data:

- before change

: implementation according to TORG-12 (according to the document); - after change

: real quantity according to TORG-2 (in fact).

For a position with a discrepancy, information about the difference is displayed:

- discrepancy

: the difference between the document and the fact.

Statement of discrepancies (received)

does NOT generate postings.

Data on underdelivery :

To adjust the cost and quantity Sales Adjustment document based on it

and there

Write out an adjustment invoice

, KVO 18:

Implementation adjustments

and

KSF issued

When sent via EDI => the buyer will be reflected automatically.

TORG-2 in 1C 8.3 Accounting where it is located

There is a printed form TORG2 in 1C Accounting 8.3+ with the ability to send via EDI.

Postings – REVERSE:

KSF issued

, KVO 18:

Generating purchase ledger entries – Reducing the cost of sales – by the amount of the difference BEFORE shipment and AFTER the change:

Refund of overpayment to buyer

arising due to short delivery:

VAT return – section 3, line 010

VAT accrued on sales:

VAT return – section 3, line 070

VAT is charged on advances received:

VAT return – section 3, line 120

Accepted for deduction of VAT due to a decrease in the cost of shipped goods:

VAT return – section 3, line 170

Accepted for deduction of VAT on advances received:

Sample of filling out the TORG-2 form

This is not to say that filling out this form has any difficulties. However, practice shows that due to the large amount of information, mistakes are often made here. The TORG-2 form consists of four pages, in each of which it is necessary to indicate certain data. To make the filling clear, we will analyze this process step by step. Below we have compiled small instructions on what needs to be indicated on each sheet of the form.

| Sheet TORG-2 | What needs to be entered |

| Title |

|

| Second | This part of the document is intended to provide information about the condition of the vehicle that brought the purchase. And also about the integrity of seals, labels, markings, etc. Please also enter the following information here:

|

| Third | This page provides information about whether external conditions could affect the quality or quantity of the product.

|

| Fourth |

|

What is and why is the TORG-2 act needed?

When purchased products are brought into the warehouse and begin to be unloaded, it is likely that discrepancies may occur. They are between what is stated in the invoices and the actual cargo delivered. In this case, the work of transferring the purchase to the warehouse is slowed down, and the buyer draws up a statement of discrepancies. It is formed on the form TORG-2, approved by Decree of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132. But this is if we are talking about domestic Russian supplies.

Based on this document, the buyer presents his claims to the seller. Therefore, the correctness of the procedure for recognizing non-compliance and the act must be treated with the utmost care.

Displaying electronic TORG-2 in “1C:Accounting 8” in case of short delivery of goods

We will consider the procedure for issuing an electronic Discrepancy Report (electronic TORG-2) to buyers in “1C: Accounting 8” edition 3.0 using the following example.

Example

| The organization Clothing and Footwear LLC, which applies a general taxation system, formalizes transactions for the purchase of goods using an electronic universal transfer document (UPD) with the function of an invoice and a document on the shipment of goods. |

Receiving and recording incoming UTD (seller information)

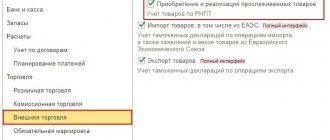

From 01/01/2020, the electronic UPD format is valid, approved. by order of the Federal Tax Service of Russia dated December 19, 2018 No. ММВ-7-15/ [email protected]

Receiving an electronic invoice and a document on the shipment of goods (electronic UPD) from the seller is carried out:

- when executing the Send and receive electronic documents command from the Administration section - Service subsection or from the To the Manager section - Service subsection, depending on the settings of the navigation panel;

- by command Send and receive from the form of the list of documents Current EDI cases, opened via the hyperlink of the command panel Current EDI cases (Administration section - Service subsection, or the Manager section - Service subsection, or the Purchasing section - Service subsection).

When the information base operates in client-server mode, you can set a schedule for receiving electronic documents by appropriately setting the parameters for the exchange of electronic documents with counterparties (section Administration - Exchange of electronic documents - Exchange with counterparties).

To set up the reflection of incoming documents in the accounting system, you need to go from the EDF Settings form (Receipt Settings tab), double-click on the line reflecting the EDF with a specific counterparty, go to the Setting up the reflection of documents in accounting form and set the method of processing incoming electronic documents: Automatically or Manually in form of an electronic document.

If in the Processing Method column of the Setting up reflection of documents in accounting form the value is set to Automatic, then upon receipt of an electronic UPD, including an invoice and a primary document, two accounting system documents will be immediately automatically generated in the program: Receipt (act, invoice) and Invoice invoice received. At the same time, in the Reflect in accounting and Approve list of incoming documents form of the Current EDI Affairs form, in the Reflection in accounting column, a hyperlink to new automatically created accounting documents (2 documents) will appear, Fig. 1.

Rice. 1. Receipt and recording of electronic UPD (seller’s information)

If the receipt settings include the processing method Manually in the form of an electronic document, then when you receive an electronic UPD, in the Reflect in accounting folder in the Reflection in accounting column there will be a hyperlink with the value Create documents, when you click on it, the Selection of accounting documents form will open to create the corresponding documents in the accounting system.

You can view the contents of the received electronic document by double-clicking on the active line from the Current EDI cases list (except for the hyperlink in the Reflection in accounting column), Fig. 1.

The corresponding tabs of the form for viewing the received electronic UPD reflect the content of the received document, as well as information about the signatures of the electronic document and the text of the accompanying note, if any.

You can open new generated accounting system documents Receipt (act, invoice) and Invoice received:

- via the hyperlink in the Reflection in accounting column from the list of incoming documents of the Current EDI Affairs form, selecting the appropriate value in the opening form Select the value (Fig. 1);

- via the hyperlink in the line Accounting document from the form for viewing the received electronic UPD;

- from the list of receipt documents Receipt (acts, invoices) and from the list of received invoices Invoices received (Purchases section - Purchases subsection).

Please note that in the accounting system, the documents Receipt (act, invoice) and Invoice received will be generated by the date of receipt of the electronic UPD file. If the actual date of receipt of goods differs from the date of receipt of the electronic UPD, then the date of the Receipt document (act, invoice) must be adjusted, i.e. brought into line with the real fact of economic life. It should be taken into account that in the Invoice received document, the date of receipt of the invoice, reflected in the Received field, must remain unchanged, that is, correspond to the actual date of receipt of the electronic UPD, which includes the invoice.

In the information line of the electronic exchange status of the document Receipt (act, invoice) the value will be set to Approval required, and in the information line of the document Invoice received - Actions required on our part and on the part of other participants.

Please note that if a product is purchased from a given seller for the first time and the items of the seller and buyer are not synchronized, then the Receipt (act, invoice) and Invoice documents will not be automatically created in the program. In this case, in the Current EDI Affairs form, in the list of incoming documents in the Reflect in accounting folder in the Reflection in accounting column, the incoming electronic document will be marked with a special icon and a hyperlink Compare items will be placed. In the Item matching form, which can be opened via a hyperlink in the Reflection in accounting column or by clicking the Match item button, you must fill out the Nomenclature field by selecting the appropriate item from the Nomenclature directory (or create a new one) and click the Save and close button. After making a comparison in the Current EDI Affairs form, a hyperlink Create documents will appear in the list of incoming documents in the Reflect in accounting folder, which should be followed by going to the Selection of accounting documents form to generate the corresponding accounting system documents, i.e. Receipt documents (act, invoice) and Invoice received as previously described. Such actions to synchronize items are performed once. In the future, when the same goods are received from the same seller, information about them (name, accounting accounts) will be filled in in the Receipt document (act, invoice) automatically.

The buyer receives from the EDF operator not only the incoming UPD, but also confirmation of the date of sending the invoice file (UPD file) to him by the EDF operator (clause “c” of clause 2.6 of the Procedure for issuing and receiving invoices in electronic form, approved by order of the Ministry of Finance Russia dated November 10, 2015 No. 174n).

The date of departure specified in this operator confirmation will be recognized as the date of receipt of the invoice by the buyer (clause 1.11 of the Exchange Procedure). You can view the contents of the received confirmation from the EDF operator by double-clicking on the corresponding line in the form for viewing the received electronic UPD.

The date the electronic invoice file was sent by the EDF operator will be reflected in the Received line of the Invoice received document.

Please note that when generating a new Invoice document received on the basis of an received electronic invoice (electronic invoice), the program automatically enters the date of generation of the accounting system document in the Received field. As a rule, the EDF operator’s confirmation is received simultaneously with the invoice file, and the date specified in the EDF operator’s confirmation coincides with the date of generation of the received Invoice document. If, after receiving confirmation from the EDF operator, the date specified in this confirmation for sending the invoice file by the operator to the buyer is different, then the date originally specified in the Received field will be automatically adjusted.

If the received UTD serves as the basis for claiming a tax deduction for VAT and a flag is placed in the field Reflect VAT deduction in the purchase book on the date of receipt of the document Invoice received, then the received UTD will be registered in the purchase book of the tax period of its receipt (clause 1.1 of Article 172 of the Tax Code RF, clause 2 of the Rules for maintaining a purchase book, approved by Decree of the Government of the Russian Federation of November 26, 2011 No. 1137).

After receiving confirmation from the EDF operator that the invoice file (IF) has been sent, the buyer must generate, sign and send a notice of receipt of confirmation from the EDF operator that the invoice has been sent to him (clause “b”, clause 2.12 of the Exchange Procedure).

In addition, if the parties to the transaction agree on the buyer’s obligation to send the seller a notice of receipt of an invoice (UPD) in accordance with clause 2.9 of the Exchange Procedure, then the buyer must also generate, sign and send the following documents:

- after receiving an incoming electronic invoice (ED) - notification of receipt of an invoice (ED) for the seller;

- after receiving confirmation from the EDF operator that a notice of receipt of an invoice has been sent to the seller - a notice of receipt of confirmation from the EDF operator that a notice of receipt of an invoice has been sent to the seller (clause “b”, clause 2.13 of the Exchange Procedure).

Notifications are generated automatically in the program.

You can also sign and send generated notices from the Current EDI cases list.

If the current user has signing rights and a signing certificate is installed on the computer, then service documents will be automatically signed immediately.

If in setting up the parameters for the exchange of electronic documents (section Administration - Exchange of electronic documents - Exchange with counterparties) in the line Delayed sending of electronic documents there is no flag, then the signed electronic documents will be immediately automatically sent to the EDF operator.

If in setting up the parameters for the exchange of electronic documents there is a flag in the line Delayed sending of electronic documents, then the actual sending of the prepared electronic documents will be carried out:

- from the form for viewing the received electronic UPD by clicking the Send button;

- from the list of Current EDF cases by clicking the Send and Receive button (Fig. 1);

- by command Send and receive electronic documents (Section Administration - subsection Service).

When the information base operates in client-server mode, you can set a schedule for sending electronic documents by making the appropriate settings for the exchange of electronic documents with counterparties (section Administration - Exchange of electronic documents - Exchange with counterparties).

Formation, signing and sending of the Statement of Discrepancies and UPD (buyer information)

Upon receipt of goods in quantities that do not comply with the terms of the contract, the buyer has the right to either demand that the missing quantity of goods be transferred, or refuse the transferred goods and payment for them. And if the goods have been paid for, then demand that the supplier return the amount of money paid (clause 1 of Article 466 of the Civil Code of the Russian Federation).

The fact of a discrepancy in the quantity of goods upon acceptance is documented in the appropriate act (until 01/01/2013 - acts in form No. TORG-2 or in form No. TORG-3, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132), which is the basis for filing a claim with the supplier . If the buyer has complaints about the quantity of goods delivered (a shortage of goods has been identified), but the buyer is ready to accept the goods actually received, then he needs to generate, sign and send to the seller:

- statement of discrepancies;

- information about the transaction being executed in the form of UPD (buyer information), which will contain a note that the goods have been accepted taking into account the identified discrepancies.

To generate an electronic Report of discrepancies in accordance with the format approved. By order of the Federal Tax Service of Russia dated August 27, 2019 No. ММВ-7-15/ [email protected] , it is necessary to generate a document Report of Discrepancies in the accounting system.

To create a document Statement of Discrepancies in the accounting system, you must place a flag in the line There are discrepancies above the tabular part of the document Receipt (act, invoice).

After setting the flag, two rows will appear in tabular form for each product item to reflect information about received goods: by waybill (by document) and by actual acceptance (by fact).

For those product items for which discrepancies were identified upon acceptance, it is necessary to specify in the actual line the number of goods received, after which another line with information about discrepancies (discrepancies) will appear for this product item.

After posting the document Receipt (act, invoice) with the flag on identified discrepancies set, a hyperlink to the automatically generated document of the accounting system Report of discrepancies will appear in the line There are discrepancies (Fig. 2).

Rice. 2. Reflection in the “Receipt of Goods” document of discrepancies identified during acceptance

Using the hyperlink Report on discrepancies, you can go to the automatically generated and posted accounting system document Report on discrepancies.

In the information exchange status line under the tabular part of the Discrepancy Report document, the value EDI has not been started will be indicated.

To automatically generate, sign and send an electronic Statement of Discrepancies to the seller, you must select the Send electronic document command from the list of commands opened by clicking the EDI button from the posted document Statement of Discrepancies.

If the current user has the right to sign and the signing certificate is installed on the computer, then after executing the Send electronic document command from the Discrepancy Statement document, the program will send the signed electronic document to the counterparty (or prepare a signed electronic Discrepancy Statement for sending, if delayed sending of electronic documents is set, which will be discussed later).

The generation of an electronic Statement of Discrepancies can also be performed from the list of documents Current EDI Affairs (section Administration - subsection Service, or section For the Manager - subsection Service, or section Sales - subsection Service), by selecting in the Create list of outgoing documents folder the corresponding document of the accounting system (Act on discrepancies) and executing the Create, sign and send command (Fig. 3).

Rice. 3. Formation of an electronic statement of discrepancies (TORG-2)

You can go to the list of documents Current EDI cases from the document Statement of discrepancies by executing the Current EDI affairs command from the list of available commands, opened by clicking the EDI button.

If the current user has the right to sign and the signing certificate is installed on the computer, then after executing the Create, sign and send command from the Current EDF cases list (Fig. 3), the program will send the signed electronic document to the counterparty (or prepare a signed electronic UPD for sending, if installed delayed sending of electronic documents, see below).

Before creating, signing and sending an electronic Statement of Discrepancies, you can first go to the document viewing form by executing the View electronic document command from the list of commands opened by clicking the EDI button on the Document Statement of Discrepancies. From the viewing form, you can also sign and send an electronic Discrepancy Report using the Sign and Send button.

If the current user does not have signature rights, then even when executing the command Send an electronic document from the document Statement of Discrepancies or the command Create, sign and send from the list of Current EDF cases (Fig. 3), the program will send the generated electronic Statement of Discrepancies for signature to the person who has such a right. You can sign the generated electronic Discrepancy Report by clicking the Sign button and send it from the Sign folder in the list of outgoing documents Current EDF cases (or Sign if deferred sending of electronic documents is set, see below).

In addition, the signing of generated electronic documents by a person who has the right to electronically sign can be done from the Documents for signature form, which indicates information about the available certificate (available certificates) (section Administration - subsection Electronic documents - Documents for signature or section for the Manager - subsection Electronic documents - Documents for signature). Generated electronic documents marked with a flag are signed when the Sign and send marked command is executed.

If you only need to generate an electronic Discrepancy Report, then in the Current EDI Affairs form you must execute the Create electronic document command (Fig. 3). And then the generated electronic document will go through the stages of signing and sending, as described above.

Direct sending of generated and signed electronic documents depends on how the electronic exchange is configured.

If in setting up the parameters for the exchange of electronic documents (section Administration - Exchange of electronic documents - Exchange with counterparties) in the line Delayed sending of electronic documents there is no flag, then the signed electronic document will be immediately automatically sent to the EDF operator.

If such a flag is present, then the actual sending of prepared electronic documents will be done by clicking the Send button from the electronic document viewing form. You can also send a generated and signed electronic document:

- by command Send and receive from the list form Current EDF cases (Fig. 3);

- by command Send and receive electronic documents (Administration section - Service subsection, or the Manager section - Service subsection, or Sales section - Service subsection).

When the information base operates in client-server mode, you can set a schedule for automatic sending of electronic documents by making the appropriate settings for the exchange of electronic documents with counterparties (section Administration - Exchange of electronic documents - Exchange with counterparties).

The sent Statement of Discrepancies, in respect of which confirmation from the EDF operator is expected, is transferred to the document folder On the control of the form of the list of outgoing documents Current EDF Affairs.

You can view the contents of the sent electronic Discrepancy Report, the established signatures and the accompanying note (if any), as well as the status of the exchange of this electronic document:

- from the Current EDF cases list by double-clicking on the active line;

- by command View an electronic document from the list of commands opened by clicking the EDI button, the document Statement of Discrepancies.

After sending the electronic Report of Discrepancies, the buyer expects confirmation from the EDF operator indicating the date and time of receipt of the file of the Report of Discrepancies.

Receiving confirmation from the operator occurs during the next communication session with the EDF operator when executing the commands:

- Send and receive electronic documents (Section Administration - Subsection Service);

- Send and receive from the EDF Current Affairs list.

When the information base operates in client-server mode, you can set a schedule for receiving electronic documents by appropriately setting the parameters for the exchange of electronic documents with counterparties (section Administration - Exchange of electronic documents - Exchange with counterparties).

Received official electronic documents are displayed in the form of viewing the sent electronic Report of Discrepancies, opened from the accounting system document Report of Discrepancies using the command View electronic documents from the list of available commands, opened by clicking the EDI button.

After receiving confirmation from the EDF operator that the discrepancy report file has been sent, the buyer must generate, sign and send a notice of receipt of the EDF operator’s confirmation that the discrepancy report has been sent to him.

The notification of receipt of confirmation from the EDF operator in the program is generated automatically.

After creating the Document on Discrepancies, in order to confirm the acceptance of actually received goods for accounting, it is necessary to sign the electronic UPD received from the seller, i.e., generate the UPD (buyer information) reflecting the discrepancies identified during acceptance.

To generate the UPD (buyer's information), it is necessary to approve the received UPD (seller's information).

The procedure for approving the received electronic UPD is not provided for by the Exchange Procedure. At the same time, for the UTD, as a document on the transfer of goods, this procedure is mandatory, since after approval of the received UTD, the corresponding buyer information is automatically generated. The buyer can approve the UPD (seller’s information):

- click the Approve button from the list of incoming documents of the Current EDI Affairs form;

- by executing the Approve command from the form for viewing the received electronic UPD.

After approval of the UPD (seller’s information), as mentioned above, the UPD (buyer’s information) is generated, Fig. 4.

Rice. 4. Formation and signing of UPD (buyer’s information)

You can view the contents of the electronic UPD (buyer information):

- by command View an electronic document from the list of commands opened by the EDI button, the Receipt document (act, invoice) or the Invoice document received (Purchases section - Purchases subsection);

- from the list of Current EDI cases.

The generated UPD (buyer information) will contain information that the received goods have been accepted taking into account the identified discrepancies, and will also provide a link to the number of the generated Discrepancy Report.

Please note that in the UPD (buyer information), the date of generation of the accounting system document Receipt (act, invoice) will be indicated as the date of receipt (acceptance) of goods, i.e. the actual date of acceptance of goods, regardless of when it was generated and signed UPD document file (buyer information).

The generated buyer information must be signed and sent to the seller. These procedures are followed in the manner prescribed for signing and submitting all electronic documents.

After sending the UTD operator (buyer information), the buyer must:

- receive confirmation from the EDF operator that the UPD (buyer information) has been received;

- sign and send to the EDF operator an automatically generated notification of receipt of confirmation.

Until these official documents are received in the Current EDI Affairs list, the electronic UPD (buyer information) will be placed in the folder On control of the list of incoming documents.

After receipt from the EDF operator of confirmation of receipt of the UTD (buyer’s information) and sending to the EDF operator a generated and signed notice of receipt of this confirmation, the exchange of electronic UTD from the buyer will be completed.

After the exchange of electronic UPD is completed, the status line of the documents Receipt (act, invoice) and Invoice received will reflect the information EDF completed.

In the form of viewing the electronic UPD, you can make sure that the document is signed by both parties to the transaction, as well as that all the necessary official documents accompanying the exchange of the electronic UPD have been received and sent.

You can switch to the electronic document viewing mode by executing the View electronic document command from the list of commands opened by clicking the EDF button, from the Receipt document (act, invoice) or the Invoice document received.

Receipt and reflection in accounting of incoming UCD (seller information)

Receipt of an electronic UCD (adjustment invoice and document on changes in the cost of shipped goods) is carried out in a manner similar to the procedure for receiving an electronic UCD (see above).

The reflection of incoming electronic documents in the buyer’s accounting system depends on the EDI settings. If in the Processing Method column of the form Setting up the reflection of documents in accounting (section Administration - Exchange of electronic documents - Exchange with counterparties - EDI settings) the value Automatic is set for the incoming UCD, then upon receipt of an electronic UCD, including an adjustment invoice and a document on the change in value , the program will immediately automatically generate two accounting system documents: Adjustment of receipt and Adjustment invoice received. At the same time, in the Reflect in accounting and Approve list of incoming documents of the Current EDI Affairs form, a hyperlink to new automatically created accounting documents (2 documents) will appear in the Reflection in accounting column, Fig. 5.

Rice. 5. Receipt and recording of electronic UCD (seller’s information)

You can view the contents of the received electronic document by double-clicking on the active line from the Current EDI cases list (except for the hyperlink in the Reflection in accounting column).

The corresponding tabs of the form for viewing the received electronic document also display information about the signatures of the electronic document and the text of the accompanying note, if any. You can open new accounting system documents Receipt Adjustment (Fig. 6) and the resulting Adjustment Invoice:

- via the hyperlink in the Reflection in accounting column from the list of incoming documents of the Current EDI Affairs form, selecting the appropriate value in the opening form Select the value (Fig. 5);

- via the hyperlink in the line Accounting documents from the form for viewing the received electronic UCD;

- from the list of receipt documents Adjustment of receipts and from the list of received invoices Invoices received (Purchases section - Purchases subsection).

Rice. 6. Creation of the “Receipt Adjustment” document

The tabular part of the Receipt Adjustment document will reflect information about the quantity of goods not only before and after the change (before the change and after the change), but also about the number of goods actually accepted for accounting based on the Receipt document (act, invoice) with the There are discrepancies flag set ( in fact), see fig. 2.

Since, on the basis of the received electronic UPD, the buyer initially reflected in the accounting and tax accounting registers (BU and NU) the actual quantity of goods received, he does not need to make adjustments. Therefore, the posted document Adjustment of receipt will not make any movements in the accounting and accounting registers.

In the electronic exchange status information line in the Receipt Adjustment document (Fig. 6), the value will be set to Approval Required.

In the Adjustment Invoice document received in the electronic exchange status information line, the information will be indicated: Actions are required on our part and on the part of other participants.

Since when purchasing goods on the basis of a received invoice (received UPD), the amount of VAT was declared for deduction in relation to the goods actually accepted for accounting, the posted document Adjustment invoice received will not be subject to registration in the sales book in order to restore the amount of VAT in connection with a decrease in the cost of purchased goods in accordance with subparagraph 4 of paragraph 3 of Article 170 of the Tax Code of the Russian Federation.

The buyer receives from the EDF operator not only the incoming UCD, but also confirmation of the date of sending the UCD file (seller’s information) to him by the EDF operator (clause “c” of clause 2.6 of the Exchange Procedure).

The date of departure, which is indicated in this operator confirmation, will be recognized as the date of receipt of the adjustment invoice by the buyer (clause 1.11 of the Exchange Procedure). You can view the contents of the received operator confirmation by double-clicking on the corresponding line in the form for viewing the received electronic UCD.

The date the electronic invoice file was sent by the EDF operator will be reflected in the Received line of the Adjustment invoice received document.

After receiving confirmation from the EDF operator that the adjustment invoice file (UCF) has been sent, the buyer must generate, sign and send a notice of receipt of the EDF operator’s confirmation that the adjustment invoice file has been sent to him (clause “b”, clause 2.12 of the Exchange Procedure).

In addition, if the parties to the transaction agree on the buyer’s obligation to send the seller a notice of receipt of an adjustment invoice (UCD) in accordance with clause 2.9 of the Exchange Procedure, then the buyer must also generate, sign and send:

- after receiving an incoming electronic adjustment invoice (ED) - notification of receipt of an adjustment invoice (ED) for the seller;

- after receiving confirmation from the EDF operator that a notice of receipt of an adjustment invoice has been sent to the seller - a notice of receipt of confirmation from the EDF operator that a notice of receipt of an adjustment invoice has been sent to the seller (clause “b”, clause 2.13 of the Exchange Procedure).