In this article we will analyze the concept of goods and materials, what they are, what types of products belong to this term, how the issue is related to accounting, what checks need to be carried out.

We will also use specific examples to see at what stages of the production cycle such elements may be present. It is often assumed that this term refers to a certain stock of property, which is reflected in accounting. But in fact, the concept is much broader and includes many different objects.

Before starting, I would like to note that, contrary to popular belief, this area is, in principle, controlled by a mass of laws, and not by one specific norm. These are the Federal Law “On Accounting”, and acts of the Ministry of Finance, and presidential decrees.

What is inventory material, decoding

First, let's look at the definition. It means all the assets of a particular enterprise that participate in the turnover process and are profitable. This is both a product and consumables that accompany the sale. So, this includes a roll of bags, which is used in grocery stores to buy vegetables or bulk products. It itself has no value, is transferred free of charge, but is aimed at simplifying the sale of certain objects. A kind of catalyst, also exhaustible. It is part of working capital. But the machine on which products are produced does not belong to the cycle, but is an element of direct capital. And it is not included in the concept being discussed. In addition, this term may also include liability if it is income-oriented. For example, a credit obligation of a counterparty.

Let's look at how the abbreviation TMC stands for inventory items. It immediately becomes clear that, first of all, these are products that are currently being sold. As well as other objects that either only accompany the product or are its unformed form. Unfinished product. But it still belongs to the company’s property and must also be subject to accounting and control. For example, a car that has not yet acquired optics (headlights) remains a car. It cannot be sold, but it is already important to the organization. Although it will be sent for sale only after the completion of the production process. For now, this is just a particle of the future product.

So, TMC (abbreviation decoding) is what it is: values of a commodity nature in the first place, but at the same time also of a material nature. And this means that intangible assets, copyrights, trademarks, programs, patents - all this no longer applies to this area.

Disposal of inventory items

The movement of materials is a normal production process: they are regularly released for processing, transferred for their own needs, sold or written off in the event of emergencies. The release of supplies from the storeroom is also documented. Disposal accounting documents are different. For example, the transfer of limited materials is formalized with a limit-fence card (form M-8). When consumption rates are not established, the supply is made upon request - invoice f. M-11. The sale is accompanied by the issuance of an invoice f. M-15 for release of goods and materials to the side.

What does this mean in accounting?

Since it is both a means of production and a product for sale, the category needs strict control. This is actually the main resource of the company, which it appeals to. In accounting, the term has a broad interpretation. According to one version, this is that part of the company’s property that is directly involved and responsible for the process within the organization. According to another, this is, in principle, the property share of an economic entity, which is necessary for normal activities, expansion and development of the enterprise. There is a third view of what goods and materials are and what belongs to them: this is a tool of labor, which in its material form constitutes a future product. And it necessarily belongs to the production cycle.

That is, there are narrower and broader interpretations. But the importance of this category is brought to the fore everywhere. Equally, the importance of scrupulous accounting is fundamental. This is why there are a lot of different checks. And in particular, the key one is inventory.

Departure

The essence of inventory items is that these are, in fact, current assets - they circulate without interruption within the framework of production cycles. Arrivals and departures come from different accounting sectors.

What are the departure options:

- launch into the processing process;

- transfer either for own use or for sale;

- Force Majeure.

Documentation is provided for all expenses:

- vacation in accordance with accepted standards requires an M-8 limit card;

- unlimited stocks imply a standard M-11 invoice;

- Inventory items sent for resale are accompanied by Form M-15.

These points must always be strictly observed, otherwise problems in organizing business activities cannot be avoided.

Grade

There are conventional methods for valuing retiring inventory items by cost:

- medium

– if we are talking about large volumes, a large product list and frequently repeated outbound transactions; - single

– for unique expensive goods such as precious stones and metals, as well as innovative technologies; - goods received first (FIFO international system).

The FIFO method is relevant if there are inflationary processes and rising prices.

LIFO was excluded from the valuation procedure.

Correspondence

Departure for the purpose:

- resale or transfer – Dt 91 Kt 10;

- organizing construction using economic methods - Dt 08 Kt 10;

- processing – Dt 20, 23, 29 Kt 10.

Warehouse workers must record balances (residual value) of inventories in special warehouse cards, and also calculate the balance (at the beginning and end of the month). The cards are then sent to the accounting department so that they can be checked against other documents.

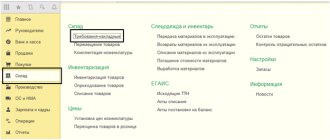

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What is included in inventory in the budget?

Material reserves, which are accounted for on account 0 105 00 000 “Material reserves”, are material assets in the form of raw materials, materials intended for use in the course of the institution’s activities, as well as manufactured finished products and goods purchased for sale (clause 98 of Instruction No. 157n ).

Interesting materials:

How often should I wash a wool sweater? How often should I wash my bathroom curtain? How often should I wash curtains in my apartment? How often should I wash my sweatshirt? How to wash kitchen towels clean? How to add whiteness when washing? How long does it take for a down jacket to dry after washing? How to wash a feather pillow at home? How to wash a down pillow at home? How to effectively wash things by hand?

Accounting for inventory items at an enterprise

There are two main points when such values are taken into account. Fixation occurs upon receipt and upon departure. That is, first of all, the posting of goods is subject to accounting, which for now may only represent material, raw material for future processing. All parish nomenclature, sales and purchase agreements, supplies, and accompanying documentation are recorded. Moreover, even if the source was not a third-party contractor, a supplier, but the company itself. After all, many factories have a very long production chain. When products come from one object to another in a more processed form. And all sites are part of a single enterprise.

Loss is the second stage, which also needs to be fixed. A similar outcome is possible in two variations. The first is product sales. That is, the creation of the object was successfully completed, and it went to the buyer, be it a legal entity or an individual, for a fee. The second option is loss due to various circumstances: damage, expiration date, defects, force majeure circumstances, theft in a warehouse or loss without identified reasons.

What is included in goods and materials

First, let's go through the general categories. Let's look at the varieties:

- Objects for implementation. The finished ones, which no longer require any processing, can only be sent for sale.

- Related materials necessary to complete the creation cycle, but not part of it. This is also the company's property, which must be scrupulously controlled.

- Raw materials, necessary resources. Sometimes these are just constituent elements, in other cases, this is, in principle, the entire basis of the created object. In fact, there is no serious difference for accounting.

Now let's move on to a more specific classification. And let's see what inventory items are:

- Inventories used to create new products.

- Raw materials.

- Fuel.

- Containers, consumables.

- Spare parts.

- Directly products for sale.

Species diversity

There are a huge number of classifications from various sources. But in order to most accurately understand the essence, it is enough to distinguish three main groups.

- Raw materials. This is the part of material assets that will be completely used for processing. However, these funds have not yet participated in the production process.

- Unfinished materials. Here the degree of readiness is not determined. This could be just the frame of an equipment or product, or, on the contrary, an almost completed item that is missing a couple of touches. The main criterion is that the object cannot yet be realized.

- Finished goods. You can send it to the counter or to your counterparty right now.

To make it clearer what is included in inventory, let’s give an example. Milk received from a supplier to create ice cream is still only a raw material. But if it has undergone at least some processing, it is already unfinished material.

Let us consider further in more detail.

Types of inventories

- Full. It affects all property and liabilities of the company. This is a very labor-intensive process, carried out once a year before submitting the annual report.

- Partial. Its purpose is to analyze one type of enterprise funds.

- Selective. This is a type of partial inventory, which is carried out on discounted, damaged and obsolete goods.

There is one more classification. Based on the type of economic activity, a distinction is made between planned, unplanned and repeated inventories. Planned ones are carried out periodically according to schedule. Unscheduled are sudden inspections. Well, repeat ones are carried out in cases of need, when problems have arisen with the data of the main check, to clarify some positions.

Raw materials

Can only be used by an organization to create a product. This is the material material from which the product will consist in the future. Moreover, it becomes clear that as a result of work there is a lot of waste. And the final product will be much less than the initial one. Moreover, often a product item is produced in only one type. But the raw materials supplied are varied. To create a car you need steel, plastic, microchips and much more.

And inventory assets are the total part of various products, regardless of the specific stage at which they are used.

Unfinished production

As has already become clear, this is the most difficult group. After all, keeping records of these objects is extremely problematic if you give your name at each stage. Roughly speaking, they are constantly in process, changing somewhere every day, somewhere every hour. Now this is just the frame of the product, tomorrow it will be overgrown with mechanisms, then plastic and packaging. Tracking at each stage is problematic. Therefore, everything that does not belong to basic raw materials, and is also not a product that can already be sent to the counter, belongs to this group.

Finished Products

As we have already found out, goods and materials are what is included in the cycle. And as a result, many mean that they will no longer participate in production. Which can only be used. But this is not always true. After all, companies, in principle, often specialize in unfinished products. And if a given company at the end of the cycle only has a chip for a cell phone, this does not mean that it belongs to unfinished products in accounting during verification. And it doesn’t matter that the buyer will then perform many manipulations with it before turning it into a full-fledged smartphone.

Methods for valuing inventories

As already mentioned, goods and materials (explained at the beginning of the article) is a term that is used to define materials owned by an enterprise. They may also be intended for sale to consumers or used in the production of their own products.

There are several most common methods for assessing them:

- Piece estimate. Each unit of goods is counted individually.

- First Inventory Method, otherwise known as First In, First In (FIFO). It is based on the assumption that those inventory items that are in inventory the longest are the ones that are sold or used the fastest.

- Last Inventory Method, second name - “Last in stock - first in production” (LIFO). The estimate is based on the assumption that the last items purchased will be the first to be sold.

- Average cost method. In this case, there is an assumption that all inventory items are mixed in a random sequence, and the sale occurs at random.

- Moving average technique. Here it is assumed that the flow of goods is randomly mixed with each new arrival of goods, and their sale occurs in the same random way.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Assessing values in an enterprise

One of the most important tasks during capitalization is to identify the cost factor. It will be necessary to focus on it in the future in a lot of different processes. But in this case the task becomes somewhat more complex. According to general rules, it is customary to focus exclusively on the physical cost of an object when it comes to inventory items. But its identification will depend on the source of receipt. And the difficulty of verification will also directly correlate with this factor.

Let's look at how this technique works using a table to make everything as clear as possible.

So, how are trade and material assets valued?

| Source | Methods for identifying costs |

| Purchased from the supplier when paying according to the standard scheme in monetary units | The entire amount of money that was allocated for the purchase is recalculated, and this includes delivery, if it had a cost. But VAT is excluded from the total amount |

| Which the company produced on its own | A new term appears here - MPZ, we will touch on it later. These are expenses aimed directly at the production process. |

| Accepted free of charge, as a result of promotions, discounts, gifts | It will be necessary to identify the current market price at the time of capitalization and focus strictly on it. If the determination of cost also involves a certain level of costs, they are also recorded in the cost price. |

| Directly allocated to capital by the founders | The price factor is identified using the recommendations of the founders. |

| Received as a result of barter | The full cost of the spent property is revealed. If there is no way to accurately determine the figure, then you should rely on the market price of the assets already received. |

| For sale | Depending on the regulations of the company itself. There are two options, either look at the price of receipt, or at the price at which it is planned to sell goods during business activities. |

Key questions when choosing accounting methods for inventory items

There are several key issues regarding the choice of accounting methods for inventory items that need to be fixed in the accounting policy.

Firstly, at what cost will the inventory items be accounted for: immediately at actual prices or using accounting prices.

The choice of accounting option will determine the accounting accounts on which the receipt and availability of inventories in the organization should be recorded: 10, 15, 16. Read more about the use of these accounts in the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

Secondly, it is necessary to determine the way to include transportation and procurement costs in the cost of material assets.

All methods are discussed in detail in the article “How to take into account TRP in accounting (nuances)?”

In addition, there are 3 options for writing off inventories as expenses.

For more details on the methods of writing off materials, which are also applicable to other inventories, read the article “The procedure for writing off materials in accounting (nuances).”

It is also necessary to establish a method for writing off expenses for the purchase, storage and sale of inventories in non-trading organizations: monthly in full or in proportion to the goods sold.

Find out how to correctly take into account material expenses in tax accounting when calculating income tax in the Ready-made solution from ConsultantPlus. Get free trial access to the system.

The need for inventory

While we were analyzing what inventory materials mean, we often mentioned this particular type of verification. And for good reason, because it is fundamentally important in this area.

The meaning of inventory is the constant control of all current assets. Often this involves planned control, which is designed to verify the actual availability and records in documents. The manager personally hands over documentation and inventories that indicate the number of balances at the moment. And the commission he formed is conducting an inspection. They identify whether there are any shortcomings or, on the contrary, an unaccounted surplus.

In addition to scheduled inspections, an inventory is often carried out when there is a change in responsible persons, company reorganization, or various types of emergencies, such as fire. In addition, if theft was detected in a warehouse, then the inventory must calculate the volume of the criminal act.

It is worth understanding that with a large turnover of assets, this procedure is lengthy and very difficult. You can simplify it to a minimum using software solutions from Cleverence. They not only turn a routine audit into a quick and easy action for employees, but also eliminate excess human costs. After all, just one employee with a smartphone, or better yet, a TSD, is enough, because the phone is not always reliable, and the data collection terminal is much more secure for working, for example, in a warehouse, to carry out the procedure. In addition, various types of solutions are offered: both individual offers that are personalized specifically for the type of business activity and all the features of the “internal kitchen” of a legal entity, and packaged solutions for any company.

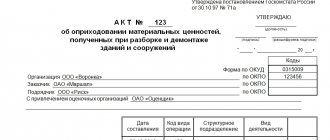

Inventory procedure

The inventory process is described in great detail in Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49 - “On approval of the Methodological Guidelines for the Inventory of Property and Financial Liabilities.”

The basic rules of procedure include the following provisions:

- Absolutely all information must be included in the inventory.

- The order of records corresponds to how the assets are placed in the warehouse.

- The inventory commission checks the actual condition of inventory items with the condition described in the documents. At the same time, premises workers must be present.

- If new valuables arrive during the inventory, they are received and processed in the presence of members of the commission. It is also possible for goods and materials to leave during the inspection

- this requires permission from the institution’s managers. - If materials are on the way (for receipt) or are leaving, the commission only checks the compliance of the documentation with the information reflected in the accounting department.

There are many different items in connection with the event in the order. It also indicates, for example, how to record the fact of a shortage

: if its volumes are within normal limits, it is written off from the responsible person. If the standards are exceeded, a criminal case is initiated.

Display in accounting

Primary documentation and other accounting registers constantly record the state of balances at the beginning of new periods. Changes and edits are made only due to the identification of inconsistencies during inspections.

If there were no deviations, then arrival and departure are processed as usual in the form of balances for two key dates. This is the beginning and end of the year. It is considered inappropriate to withdraw the full balance more often. But this does not mean that data is not collected in other periods. It just doesn't display a full report.

Differences between inventories and inventories

Inventory is inventories. We have already mentioned them above. And modern sources on the network, indeed, are trying to identify some difference between them. But all such opinions are wrong. After all, in reality, they are completely the same thing. The difference is simply in terminology, nothing more. And also in the fact that now MPZ is considered a more modern option, which is more often used in young companies, startups and new projects. Often, the MPZ does not take the goods themselves, but only raw materials, materials and other consumables.

What does the law say on the topic of goods and materials?

The fundamentals of accounting legislation are very closely related to tax and financial law. In the same part, as regards offenses and applied sanctions, we have to deal with administrative as well as criminal law.

Let us list the fundamental sources that determine the theory and practice of accounting and asset accounting. First of all this:

- Federal Law “On Accounting”

dated December 6, 2011, number 402-FZ. The act came into force in 2013 and became a replacement for the old document (No. 129). The Federal Law fully regulates all the subtleties of the relevant issue - other laws supplement their content with the problems. - Decrees emanating from the head of state - the President of the Russian Federation.

- Resolutions initiated and adopted by the Government of Russia.

- Acts of the Ministry of Finance of the Russian Federation. Along with the mentioned Federal Law, this is one of the most important sources that specifies and explains the legal basis for accounting.

- Accounting regulations (PBU) created and put into effect by the Ministry of Finance. These are standards that undergo periodic changes. This is done to get as close as possible to international accounting standards.

- Other regulations, acts, etc.

It often happens that in business and economic activities, institutions neglect existing regulatory requirements. This always leads to only one thing - the emergence of problems: both internal and external (for example, in the process of interaction with regulatory authorities like the Federal Tax Service).

Existing laws should be carefully studied - this is the basis for the healthy functioning of the organization. Especially when it comes to accounting.