For financial and management accounting, one of the key parameters is the cost of production. But it cannot always be easily determined, especially in enterprises where production costs are constantly changing. The cost may be partially “hidden” in variable costs, thereby distorting the overall financial picture. If only direct expenses could be taken into account, how much easier it would be to internal accounting!

With the direct costing system, this is possible, you just need to know the principles and nuances of its application in Russian realities.

What is a direct costing system?

The English expression “Direct Costs” means “direct costs”. This directly reflects the meaning of using this system to calculate the “net” cost of production.

The use of the direct costing method is based on the conscious separation of fixed costs from variable costs, as well as direct costs from indirect ones. The term “ direct costing ” can be used:

- in a narrow sense - as a specific method for calculating the cost of manufactured goods;

- in a broad sense – as a way of organizing management accounting.

Modern Russian legislation does not give the go-ahead for the use of this system at the level of official accounting on a par with accounting and financial, only introducing some of its details into the framework of accounting (and even then, only by the end of the 20th century).

However, its effectiveness and compliance with international market standards has led to its use in management accounting, which is carried out for internal users of the organization. https://youtu.be/https://www.youtube.com/watch?v=GGNaddkCBg4

From the history

The system owes its origin to the Great Depression in the United States. Until 1928, when it was customary to calculate the cost of any product based on total expenses for it, there was a large number of unsold goods available. In order to adequately evaluate them, it was necessary to redistribute costs to their cost over different accounting periods, for which purpose we conditionally separated direct (variable) expenses and indirect (fixed) expenses, the latter being recognized as “useless”.

In 1936, D. Harris coined the term "direct costing", and in 1953 this method was recognized by the National Association of Accountants and published in detail in their report.

Some experts do not consider the name “direct costing” to be accurate, since inventory costs include not only the cost of materials, but also production costs, which are not constant. Instead of “direct”, they suggest using the prefix “ verible ” (that is, “variable”, thus taking into account not direct, but variable costs).

If we consider the difference between variable costs for the product itself and fixed costs, then the latter can be subtracted from revenue, because they will not change. In this form, the use of this system is called “ margin costing ”.

Costing methods: absorption costing and direct costing

In global accounting practice, issues of intra-economic accounting, including methods of planning and cost accounting, and calculating product costs, are given great importance. The calculation method involves a production accounting system in which the actual cost of production and the cost per unit are determined.

In Russia, during the time of the planned economy, the classic version of absorption costing was traditionally used, which was called calculating the full cost of a unit of production.

The essence of

absorption costing

is as follows: all costs for production of products are collected on account 20 “Main production”, then they are divided into two stages:

1) costs between work in progress and finished products;

2) costs between the balances of finished products in the warehouse and sold products.

Selling expenses are considered periodic and can either be fully allocated to sales, or must be distributed between the balance of finished products in the warehouse and sold products.

In a modification of absorption costing, general business expenses can also be included in periodic expenses. The name of the method is due to the fact that all costs must be distributed by type of product, including selling expenses.

Note.

In absorption costing, great importance is attached to dividing costs into direct and indirect in relation to types of products. Indirect costs are distributed by type of product based on the selected distribution base.

Distribution base

- this is a cost or physical indicator, in proportion to which indirect costs are distributed. Wherever costs arise, they must be allocated or prepared to be allocated across products. The division of costs into variable and constant is not taken into account in this calculation method.

Absorption costing

is relevant

when an enterprise participates in price competition or the price of products is tied to full costs.

The direct costing method has its own history: during the Great Depression in the United States, sales volumes fell, enterprise inventories grew, most of the costs of the absorption costing method were allocated to inventories, and a smaller part to sales. Even with small sales, the company was forced to show profit and pay income tax, which was very burdensome during the years of the general economic downturn. In such conditions, a more equitable method of distributing costs between the balances of finished products in the warehouse and sold products was found, which was called direct costing.

.This method made it possible to reduce taxable profit with significant balances of finished products. In direct costing, all fixed costs are considered periodic and written off to sales. The cost of goods sold increases, profits fall, and only variable expenses are included in balances.

Note.

In direct costing, dividing costs into direct and indirect does not matter. The fact is that variable costs, as a rule, are direct; they can be directly taken into account by type of product. Fixed costs are indirect, they are not distributed by type of product, but are written off as a total amount to the results of financial activities. Thus, the main emphasis is on the variable/fixed cost classification.

Direct costing

is relevant

when making a decision to increase or decrease production volumes of a particular type of product. Marginal income must cover fixed costs, and this is the reason for a positive decision regarding production.

Profit calculated using the absorption costing method and the direct costing method will be different. It will coincide only if the company has zero inventory in its warehouse, that is, all manufactured products have been sold.

Features of cost grouping in direct costing and absorption costing are reflected in table. 1.

| Table 1. Distinctive features of direct costing and absorption costing | ||

| Expenses | Direct costing | Absorption costing |

| Variables and constants | Are used | Not used |

| Direct and indirect costs of the product | Not used | Bases (drivers) are used to distribute indirect costs among products |

| Periodic | Fixed costs | Three options for grouping costs: a) all costs are distributed between balances and sales, that is, there are no periodic costs; b) commercial expenses - periodic; c) general and commercial expenses - periodic |

Example

We will calculate the profit from product sales using the direct costing and absorption costing methods in two versions:

· option 1 : all manufactured products of the enterprise were sold in the reporting

period;

· option 2 : half of the products have been sold, and the remaining finished products are in the warehouse.

The initial data for the calculation are presented in table. 2.

| Table 2. Initial data | |

| Index | Thousand rub. |

| 1. Materials | 400 |

| 2. Salaries of main workers (with taxes) | 200 |

| 3. Expenses for the maintenance and operation of equipment (RSEO) and general production expenses (OPR), total | 250 |

| Including variables | 180 |

| 4. Administrative expenses | 100 |

| 5. Business expenses | 50 |

| Including variables | 5 |

| 6. Total costs for production and sales of products | 1000 |

All general business (administrative) expenses are constant.

Let’s assume that revenue from sales of products in the reporting period is 1,200 thousand rubles. If all the products produced in the reporting period were sold, then, regardless of the cost distribution method, the profit from sales will be the same - 200 thousand rubles. (1200 – 1000) (Table 3).

| Table 3. Enterprise profit (condition - all products are sold), thousand rubles. | |||

| Direct costing | Absorption costing | ||

| 1. Revenue | 1200 | 1. Revenue | 1200 |

| 2. Variable costs, total | 785 | 2. Materials | 400 |

| Including: materials | 400 | 3. Wages of main workers (with taxes) | 200 |

| wages of main workers (with taxes) | 200 | 4. RSEO and OPR | 250 |

| RSEO and OPR variables | 180 | 5. Management expenses | 100 |

| variable business expenses | 5 | 6. Total total production cost (line 2 + line 3 + line 4 + line 5) | 950 |

| 3. Marginal income (page 1 – page 2) | 415 | 7. Gross profit (page 1 – page 6) | 250 |

| 4. Fixed costs, total | 215 | 8. Selling expenses | 50 |

| Including: permanent RSEO and OPR | 70 | 9. Profit from sales (p. 7 – p. | 200 |

| administrative expenses | 100 | ||

| fixed business expenses | 45 | ||

| 5. Profit from sales (page 3 – page 4) | 200 | ||

Let's consider a scenario where only half of the products produced were sold. Sales revenue amounted to, for example, 600 thousand rubles. The direct costing method will show losses

:

P = 600 – (785 / 2 + 215) = 600 – 607.50 = –7.5 thousand rubles.

Obviously, 392.5 thousand rubles will be allocated to the balances of finished products in the warehouse. (785 / 2). In this case, variable costs are subject to distribution, and fixed costs in the amount of 215 thousand rubles. fully written off against sold products.

Profit

from sales

using the absorption-costing method:

P = 600 – (950 / 2 + 50) = 600 – 525 = 75 thousand rubles.

The cost of the remaining finished products in the enterprise's warehouse will be 475 thousand rubles. (950 / 2).

It should be noted that according to the direct costing method, the enterprise has losses, and absorption costing shows a profit of 75 thousand rubles. Which of these methods is more correct? Does the company actually make a profit from product sales or not? Economists cannot answer these questions unambiguously. In this case, the choice between profit and loss depends on the degree of capitalization of costs. In absorption costing, incoming costs are higher - 475 thousand rubles, in direct costing - less - 392.5 thousand rubles.

Thus, in absorption costing the level of capitalization of costs is higher. Indeed, part of the management expenses remains in the balance sheet asset using the absorption costing method, while in direct costing all management expenses are written off for sales and are not accumulated in the balance sheet asset. This means that management expenses are not capable of shaping the future profit of the enterprise. If this point of view is correct, then you should choose the direct costing method, if not, absorption costing.

In this case, accounting profit was considered, which was calculated in two ways. Such ambiguity does not arise when calculating taxable profits. Taxable profit is determined without alternative, as this is prescribed by the Tax Code of the Russian Federation. There can be many options for accounting profit, but taxable profit is always the same.

Direct costing allows you to calculate break-even production volumes

(

B

) products according to the formula:

IN

b = Post / (1 –

K

),

where Post is the fixed costs associated with production;

TO

— coefficient showing the share of variable costs in revenue.

IN

b = 215 / (1 – ) = 621 thousand rubles.

With such revenue, the company will have zero profit. Variable costs for production and sales of products should be adjusted to break-even production volumes, and fixed costs should be left unchanged: (785 / 1200) × 621 + 215 = 621 thousand rubles, which exactly coincides with value B

b = 621 thousand rubles. With revenue of 600 thousand rubles. the company will have losses, as shown above.

Key concepts of direct costing

To understand how this system of calculation and cost accounting functions, you need to clarify the essence of the main concepts with which it operates:

- fixed costs - expenses not determined by the volume of output, associated with a particular time period;

- variable costs - amounts, the size of which is determined by the quantity of products; when added to constants, they form total costs;

- marginal income is the “delta” between revenue for goods and variable costs (fixed costs plus profit from production).

How it works

The main goal of using direct costing is to “clean” the cost of fixed costs, reducing it and thus determining the marginal income.

The cost of production will include only variable costs that reflect its quantitative characteristics. In this case, fixed costs do not apply to the cost price, but are immediately allocated to the overall financial result.

Accounting and planning related to production occurs only for variable costs. With the same indicators, the balances of unsold products at the beginning and end of the period, as well as production that was not completed, are taken into account.

Fixed costs are written off from profit with the selected regularity throughout the entire reporting period in which these goods were produced. They are accumulated in a separate accounting account. They are not included in the cost.

NOTE! In the financial report on the results of production, compiled based on the results of applying direct costing, the relationship between profit, costs and output volume will always be traced.

Account 26 in accounting

Determination of general business expenses

General business expenses include all costs for administrative needs that are not directly related to production, provision of services or performance of work, but relate to the main type of activity.

The list of general business expenses depends on the profile of the organization and is not closed, according to the recommendations for using the chart of accounts.

The main general operating costs can be identified:

- Administrative and management expenses

- Business trips;

- Salaries of administration, accounting, management personnel, marketing, etc.;

- Entertainment expenses;

- Security, communication services;

- Consultations of third-party specialists (IT, auditors, etc.);

- Postal services and office.

- Repair and depreciation of non-production fixed assets;

- Rent of non-industrial premises;

- Budget payments (taxes, fines, penalties);

- Other:

Organizations not related to production (dealers, agents, etc.) collect all costs on account 26 and subsequently write them off to the sales account (account 90).

Important! Trade organizations may not use account 26, but assign all expenses to account 44 “Sales expenses”.

Main properties of account 26

Let's consider the main properties of account 26 “General business expenses”:

- Refers to active accounts, therefore, it cannot have a negative result (credit balance);

- It is a transaction account and does not appear on the balance sheet. At the end of each reporting period it must be closed (there should be no balance at the end of the month);

- Analytical accounting is carried out according to cost items (budget items), place of origin (divisions) and other characteristics.

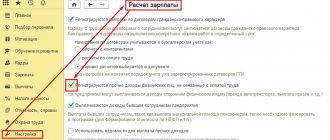

Two options for direct costing accounting

In domestic practice, two variations of the management accounting system are used, which are based on the direct costing method.

- Simple direct costing provides for separate accounting of financial and management accounting. In this case, only direct variable costs are taken into account when determining the cost.

- Developed direct costing combines cash and production accounting, including in the calculations not only direct, but also indirect variable costs.

Calculation of net profit

Let's calculate net profit using the full cost absorption method and direct costing. The company did not sell all of its products, but only 800 kilograms of cheese at a price of 600 rubles and 900 kilograms of ice cream at a price of 1,000 rubles.

First you need to calculate your revenue. This step is the same for both methods.

Revenue = Price x Quantity of products sold

Revenue from the sale of cheese = 800 x 600 = 480,000 (rub.) Revenue from the sale of ice cream = 900 x 1000 = 900,000 (rub.) Revenue = 480,000 + 900,000 = 1,380,000 (rub.)

Net profit when calculating cost using the full cost absorption method

Now you need to calculate the production costs for the products sold:

Production costs = Cost x Volume of products sold

Production costs for cheese = 550.4 x 800 = 440,320 (RUB) Production costs for ice cream = 379.6 x 900 = 341,640 (RUB) Production costs = 440,320 + 341,640 = 781,960 (RUB)

Gross Profit = Revenue – Manufacturing Costs

Gross profit = 1,380,000 - 781,960 = 598,040 (rub.)

If the company has business expenses, for example, advertising, salary of a sales manager, they are deducted from gross profit. But in the example they are equal to zero.

Net profit = Gross profit - Selling expenses

Net profit = 598,040 - 0 = 598,040 (rub.)

Net profit when calculating cost using the direct costing method

Variable costs are also calculated only for products sold:

Variable expenses = Cost x Quantity of products sold

Variable costs for cheese = 507.9 x 800 = 406,320 (RUB) Variable costs for ice cream = 337.1 x 900 = 303,390 (RUB) Variable costs = 406,320 + 303,390 = 709,710 (RUB)

Contribution Margin = Revenue – Variable Costs

Marginal profit = 1,380,000 - 709,710 = 670,290 (rub.)

Net profit = Contributory profit - Fixed expenses

Net profit =0 = 585,290 (rub.)

Why are net profits different?

The net profit in these two calculations will be the same if the company fully sells what it produced. If something is left in stock, discrepancies begin because in the absorption cost method, indirect costs are written off against the products sold. And in direct costing, fixed costs are written off as a total amount from the result.

Elements of cost calculation

As part of the application of direct costing, it is necessary to calculate the “true” cost of manufactured products. It includes the following cost accounting elements:

- depending on the type of spending;

- accounting at the place where expenses are generated;

- cost carriers (accounting for the cost of each individual unit of production);

- accounting of costs for a particular period.

IMPORTANT! These components are taken into account for both variable and fixed costs. Most of them do not change, but some may differ slightly depending on how fully they are included in the cost price.

the main problem

A serious difficulty that may arise when applying this system is associated with the ambiguity of cost differentiation. Fixed in some cases, in others the costs may turn out to be variable. Enterprises usually do not have corresponding provisions that would unambiguously declare such a division. Costs are classified as constant or variable based on a number of assumptions, which may turn out to be erroneous. Therefore, you should periodically review the principles of cost sharing, as well as calculate marginal profit (for individual types of production and for the organization as a whole).

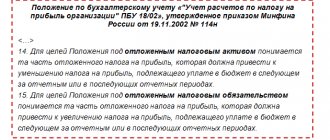

Management reserves

Let us remind you that FAS 5/2019 reserves include raw materials, supplies, fuel, spare parts, components, purchased semi-finished products, as well as tools, inventory and other assets intended for use in the production of products, performance of work, provision of services.

Inventories that the company uses for management needs, according to the new FSBU 5/2019, are immediately written off as expenses of the reporting period (clause 2 of FSBU 5/2019).

As you understand, we are talking about office paper, cartridges, stationery and other supplies.

Advantages of use

The use of this system not only brings domestic companies closer to world market standards, but also opens up a number of additional prospects for increasing the efficiency of accounting and management:

- the ability to profitably combine production volume and price of finished products;

- effective management of pricing or dumping policies;

- improving the range of manufactured goods;

- convenience of calculating the company’s “break-even point” - that is, reaching “zero”, full cost recovery;

- the ability to quickly reorient production depending on changing market realities;

- assessment of reserves for fixed costs at the existing profitability of production;

- in-depth study of the organization’s work using statistical methods, for example, correlation analysis, etc.

The most important advantage of direct costing as a management system is its high efficiency in making operational decisions.