A government agency is a government agency that provides public services. These are non-profit objects formed for cultural and other purposes. The founder is considered to be a government agency that has the appropriate powers. Accounting in such entities is carried out in a special way. The nuances are related to the fact that the subject does not have rights to the property used. In addition, such institutions cannot use simplified taxation systems.

Question: How are the costs of renting warehouse space provided for temporary use by a government institution reflected in the accounting of the tenant organization? The premises are in federal ownership. The lease agreement stipulates that the rent is in the amount of 150,000 rubles. must be paid by the 15th day of the month following the billing month; the cost of the rented premises is 10,000,000 rubles. Warehouses are used to store raw materials and production equipment. The organization determines income and expenses for the purpose of calculating profit tax using the accrual method. View answer

Nuances of accounting in a government entity

Here are the nuances of accounting in the structure under consideration:

- The founder participates in financial management.

- Accounts are opened in the treasury.

- Financing is carried out within the budget.

- Income from work goes to the budget.

- The institution does not have ownership rights to the property.

- Transactions with securities are not carried out.

- The structure does not have the rights to use the simplified tax system.

Question: How to reflect in the accounting of an organization that pays the Unified Agricultural Tax the settlements with a government agency for the lease of a land plot that is federally owned? According to the lease agreement: - rent in the amount of 90,000 rubles. must be paid by the 15th day of the month following the billing month; — the cost of the rented land plot is 3,000,000 rubles. The land plot is used by the organization for growing crops. The lease agreement was concluded for a period of less than a year. View answer

The following features are also significant:

- Asset data is recorded on the balance sheet. Double entry does not apply.

- The institution uses only OSNO.

Taxes are not charged only on income from main activities.

IMPORTANT! The subject needs to send a declaration. However, it is acceptable to provide the document in compressed form. Minimum information is provided.

Accounts for correcting errors of previous years identified through control activities

| Year in which the error was made | Accounting accounts used to correct errors from previous years | ||

| Correcting an error does not affect the financial result | Income adjustment required | Cost adjustments required | |

| Last year | 0 304 66 000 “Other calculations of the year preceding the reporting year, identified through control activities” | 0 401 16 000 “Income of the financial year preceding the reporting year, identified through control measures” | 0 401 26 000 “Expenses of the financial year preceding the reporting year, identified through control activities” |

| Other past years | 0 304 76 000 “Other calculations of previous years identified through control measures” | 0 401 17 000 “Income of previous financial years identified through control measures” | 0 401 27 000 “Expenses of previous financial years identified through control measures” |

More on the topic: Changes in the inventory procedure in government agencies

Example. In the reporting period in March 2022, in the accounting of a budgetary institution, the internal financial control authorities discovered an error made in September 2022: expenses for routine repairs of the building in the amount of 1,200,000 rubles. erroneously attributed to an increase in the original (book value) of the building. Expenses for the current repairs of the building in 2022 were made using subsidies for the implementation of the state (municipal) task. In the current year, the date of discovery of the error in the institution’s accounting reflects the corrective entries:

Debit 4,401 26,271 Credit 4,104 12,411 – reflects the adjustment to the amount of depreciation from September to December 2022;

Debit 4,401 20,271 Credit 4,104 12,411 – reflects the adjustment to the amount of depreciation from January to February 2022;

Debit 4,106 11,310 Credit 4,304 66,732 – the “Red reversal” method reflects the increase in capital investments in 2022;

Debit 4,101 12,310 Credit 4,304 66,732,

Debit 4,304 66,832 Credit 4,106 11,310 – the “Red reversal” method reflects the increase in the value of the building by the amount of current repairs in 2022;

Debit 4,401 26,225 Credit 4,304 66,732 – expenses for current repairs are included in the financial result for 2022.

Accounting policy

IMPORTANT! A sample accounting policy for a government institution from ConsultantPlus is available here

An accounting policy is a paper that establishes the procedure for accounting and tax accounting. To approve it, the subject needs to issue an order.

It may change due to changes made to legislation or local regulations. The document is created based on the characteristics of the institution’s activities and its structure. The accounting policy includes these items:

- Working accounts that are used for accounting.

- Features of document flow (including a list of primary documents).

- The procedure for carrying out inventory.

- Features of internal control.

- Methods for assessing property and existing liabilities.

Accounting policies allow you to establish a procedure when the relevant items are not specified by regulations. However, the document must not contradict current laws.

Accounting Features

Accounting for non-cash payments should be kept on a special account 0 201 11 000 “Current account opened with the Federal Treasury.” Such an accounting account is considered active, therefore, income receipts are reflected in the debit. For example, receipt of money for services rendered.

Autonomous institutions have the right to open current accounts (C/C) not only with the Federal Treasury, but also with credit institutions (banks). In this case, in accounting, business operations are reflected on account. 0 201 21 000.

State government agencies are required to reflect payments from the provision of paid services to their accounts. 0 210 04 000. For other operations, it is permissible to use an account. 0 201 11 000.

IMPORTANT!

The procedure for carrying out transactions on the current account of public sector employees is determined in the agreement, which is concluded at the time of its opening. That is, the conditions, terms, fees and commissions for conducting settlement transactions are stipulated in the service agreement.

It is permissible to open several personal accounts (L/N) on one account. This approach allows you to detail the accounting of transactions by key characteristics. For example, most government agencies open separate L/S by type of financial support. The L/S attribute or code allows you to quickly group transactions into one CFO. For example, based on funds from business activities.

Primary documents

Any business transaction must be confirmed by primary documentation. Based on them, accounting entries are created. Primary documents are needed to establish the validity and reasonableness of economic actions. State-owned entities must use in their activities documents, the list of which is approved by Order No. 173. An additional list of securities may be specified in the accounting policy. Let's consider the rules for generating primary documents:

- Application of forms that were established by internal regulations.

- Use of required details.

- Unfilled lines are crossed out.

- Marks are not allowed.

If documents are created without taking these rules into account, regulatory authorities may have questions.

Accounting for transactions with fixed assets and property

OS and property go to the government structure from the founder. It is the latter who is responsible for maintenance, since he is the owner. Let's consider the reasons on which operations are taken into account:

- Acceptance of OS for registration is carried out on the basis of a decision of the commission. The primary document is the transfer deed.

- The right of management is formed from the date of registration.

- Property valuation is carried out on the basis of the value stated in the deed.

- Cost adjustments are made based on the modernization carried out.

The budget structure can buy the property. The purchase is carried out using money taken from the budget.

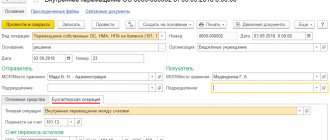

Example of property purchase accounting

The institution purchased equipment for 333 thousand rubles. Transportation costs are equal to 7 thousand rubles. The postings will be as follows:

- Dt 1 10631 310 Kt 1 30231 703. Receipt of equipment for 333 thousand rubles.

- Dt (the same debit account is used as in the previous transaction) Kt 1 30222 730. Reflection of expenses of 7 thousand rubles for the transportation of equipment.

Depreciation begins the next month after the equipment is received. The useful life is determined based on the Classifier.

Sales and write-off of OS

Government institutions can implement OS. However, this requires the approval of the founder. Sometimes the sale is related to the need to pay off damages and obligations, but these are extreme cases. The proceeds from the sale go to the budget.

ATTENTION! Write-offs are made when the OS has lost its consumer qualities.

Example of OS write-off

An organization has an OS object that has failed. It needs to be written off. The residual value is 36 thousand rubles, depreciation charges are 90 thousand rubles. After completion of liquidation, a capitalization of 600 rubles is made. These wires are used:

- Dt 1 40110 172 Kt 1 10134 410. Write-off of cost in the amount of 36 thousand rubles.

- Dt 1 10134 410 Kt (the same account is used as in the previous example). Write-off of depreciation charges in the amount of 90 thousand rubles.

- Dt 1 10536 340 Kt 1 40110 172. Capitalization of additional products for 600 rubles.

Each posting is confirmed by the primary.

Accounting for income from the sale of fixed assets: a reference book for a public accountant

In what cases is approval from the property owner required when selling fixed assets?

When a budgetary or autonomous institution makes a decision to sell property, it is necessary to obtain the consent of the owner:

- in the case of the sale of real estate or especially valuable movable property assigned to the institution by the owner or acquired by the institution at the expense of funds allocated to it by the owner for its acquisition (Parts 2, 3 of Article 298 of the Civil Code of the Russian Federation);

- if the transaction meets the criteria for recognizing it as a large transaction (the value of the alienated property exceeds 10% of the book value of the institution’s assets, determined according to its financial statements as of the last reporting date, unless the institution’s charter provides for a smaller size of a large transaction) (Article 14 of the Federal Law of 03.11 .2006 No. 174-FZ, clause 13, Article 9.2 of the Federal Law of January 12, 1996 No. 7-FZ).

The procedure for approving the disposal of the property of a budgetary or autonomous institution is established by its founder (owner).

Is it necessary to determine the fair value of the asset being sold and revaluate it?

If an item of fixed assets is planned to be sold to an individual or legal entity (with the exception of public sector organizations), it is necessary to determine its fair value using the market price method. In this case, the object is revalued to fair value ( clause 29 of the GHS “Fixed Assets” [1], clause 28 of Instruction No. 157n [2]).

The result of revaluation to fair value, determined by the market price method, is reflected in accounting and disclosed in the accounting (financial) statements separately as part of the financial result of the current period (clause 30 of the GHS “Fixed Assets”, clause 28 of Instruction No. 157n).

How to take into account depreciation when revaluing fixed assets to fair value?

When revaluing an item of fixed assets (including during their sale), the amount of accumulated depreciation calculated as of the date of revaluation is taken into account in one of the following ways, fixed by the institution in the accounting policy (clause 41 of the GHS “Fixed Assets”):

1. The accumulated depreciation is recalculated, in which the accumulated depreciation calculated on the date of revaluation is recalculated in proportion to the change in the original cost of the fixed asset so that its residual value after the revaluation is equal to its revalued value. This method involves increasing (multiplying) the book value and accumulated depreciation by the same factor in such a way that, when summed up, the revalued value is obtained on the date of the revaluation.

2. Accumulated depreciation calculated at the date of revaluation is deducted from the book value of the fixed asset, after which the residual value is recalculated to the revalued value of the asset. The specified method of recalculating accumulated depreciation provides that the accumulated depreciation calculated before the revaluation is attributed to the reduction in the book value of the fixed asset item (by credit of the corresponding balance sheet accounts of fixed assets) with the reflection of an increase in the residual value of the fixed asset by the debit of the corresponding balance sheet accounts of fixed assets by the amount of its revaluation to fair value. From the moment of revaluation in this way, depreciation is accrued for the fixed asset object for the remaining useful life at the same calculated depreciation rate as before the moment of revaluation.

How to reflect sales income and related transactions in accounting?

According to paragraph 47 of the GHS “Fixed Assets”, income receivable upon disposal of an item of fixed assets is subject to initial recognition at fair value.

The GHS “Income” (approved by Order of the Ministry of Finance of the Russian Federation dated February 27, 2018 No. 32n) does not apply to income arising from the sale of fixed assets (clause 4 of this standard).

The accrual of income from the sale of fixed assets is reflected in subarticle 172 “Income from the disposal of assets” of the KOSGU (clause 9.7.2 of Procedure No. 209n[3]). For these purposes, the following correspondence of accounts is used:

Account debit 2 205 71 56x

Account credit 2,401 10,172

To reflect cash receipts from the sale of fixed assets, Article 410 “Decrease in the value of fixed assets” of KOSGU is used (clause 12.1 of Procedure No. 209n). This operation is reflected as follows:

Debit accounts 2 201 11 510 , 0 201 21 510 , 0 201 27 510 , 0 201 34 510 ( Article 410 of KOSGU)

Account credit 2 205 71 66x

Transactions reflecting the financial result from the revaluation of fixed assets are included in subarticle 176 “Income from the valuation of assets and liabilities” of KOSGU (clause 9.7.6 of Procedure No. 209n). In case of revaluation of an object (increase in residual value to fair value), the following correspondence of accounts is applied:

Account debit 0 101 xx 310

Account credit 0 401 10 176

Currently, this accounting entry is provided for in draft amendments to instructions No. 174n[4], 183n[5] (posted on the website regulation.gov.ru). Before these amendments are approved, the procedure for reflecting this operation must be provided for in the accounting policy of the institution in agreement with the founder (financial authority).

These same projects provide for a reverse accounting entry in the event of a decrease in the residual value of an object to fair value.

However, it is worth noting that in accordance with the GHS “Impairment of Assets”[6], if the residual value of an item of fixed assets exceeds its fair value, an impairment loss is reflected in the accounting records.

Here the question arises: when selling an asset, is it necessary to record a reduction in its residual value to fair value and accrual of a loss from impairment of the asset?

In our opinion, if, when selling an item of fixed assets, its residual value exceeds its fair value, the following correspondence of accounts is reflected in the accounting records:

Account debit 0 401 10 176

Account credit 0 101 xx 310

In this case, no impairment loss is accrued.

According to the general rules, signs of asset impairment are identified when conducting an inventory before drawing up annual financial statements, and losses are accrued based on the results of the inventory.

However, if the loss was accrued earlier, then in accounting, when revaluing the property being sold, the loss is written off along with accrued depreciation.

Operations for the accrual and payment of income tax are reflected in subsection 189 “Other income” of the KOSGU. VAT accrual - for sub-items related to income, for which the income of the current financial period is shown, taking into account value added tax. In this case, transactions for the payment of VAT are reflected in subsection 189 of KOSGU (clause 9 of Procedure No. 209n).

An autonomous sports institution, in agreement with the founder, sells a car (particularly valuable movable property) to an individual. The initial cost of the car being sold was 750,000 rubles, depreciation on it was accrued in the amount of 625,000 rubles. The fair value of the car, determined by the market price method, is RUB 250,000.

The accounting policy of the institution establishes the method of accounting for depreciation when revaluing fixed assets by recalculating the residual value of the asset to fair value. Depreciation over the remaining useful life was not accrued due to the fact that the car was sold in the same month in which it was assessed and the revaluation of the residual value to fair value was reflected.

The following entries were made in the accounting records of the institution:

| Contents of operation | Debit | Credit | Amount, rub. |

| The revaluation (revaluation) of the car to fair value is reflected (250,000 rub. - (750,000 - 625,000) rub.)* | 4 101 25 310 | 4 401 10 176 | 125 000 |

| Previously accrued depreciation was written off | 4 104 25 411 | 4 101 25 410 | 625 000 |

| The sold car is written off (in the amount of the revalued (residual) value** | 4 401 10 172 | 4 101 25 410 | 250 000 |

| The adjustment of settlements with the founder regarding the retired OCDI is reflected on the basis of an accounting certificate (f. 0504833) with notification of the founder (using the “red reversal” method)*** | 4 401 10 172 | 4 210 06 661 | (750 000) |

| Accrued income from the sale of a car to an individual | 2 205 71 567 | 2 401 10 172 | 250 000 |

| VAT charged | 2 401 10 172 | 2 303 04 731 | 41 667 |

| Profit tax accrued | 2 401 10 189 | 2 303 03 731 | 50 000 |

| Revenues from the sale of the car were received at the cash desk | 2 201 34 510 (Article 410 KOSGU) | 2 205 71 667 | 250 000 |

*

We recommend that you coordinate this correspondence of accounts with the financial authority or founder. Currently, draft amendments to instructions No. 174n, 183n have been prepared, in which the specified correspondence of accounts is already provided for.

** The write-off of a car should be reflected on the basis of a completed write-off act (with a note from the founder agreeing to write-off) and an acceptance and transfer act (under the purchase and sale agreement) on the date of its transfer to the new owner.

*** According to the draft amendments to instructions No. 174n, 183n, to reflect this operation, reverse correspondence of accounts is provided:

Account debit 0 210 06 561

Account credit 0 401 10 172.

[1] Federal accounting standard for public sector organizations “Fixed assets”, approved. By Order of the Ministry of Finance of the Russian Federation dated December 31, 2016 No. 257n.

[2] Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

[3] The procedure for applying the classification of operations of the general government sector, approved. By Order of the Ministry of Finance of the Russian Federation dated November 29, 2017 No. 209n.

[4] Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

[5] Instructions for the use of the Chart of Accounts for accounting of autonomous institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

[6] Federal Accounting Standard for Public Sector Organizations “Impairment of Assets”, approved. By order of the Ministry of Finance of the Russian Federation dated December 31, 2016 №

259n.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Accounting for payroll transactions

Let's look at an example. The government agency paid salaries to employees. When funds were accrued, personal income tax was withheld. These wires are used:

- Dt 1 40120 211 Kt 1 302 11 730. Payment of earnings.

- Dt 1 302 11 830 Kt 1 303 01 730. Withholding personal income tax.

- Dt 1 302 11 830 Kt 1 304 03 730. Transfer of earnings to the employee’s card.

- Dt 1 304 03 830 Kt 1 304 05 211. Accounting for the payment of wages.

Settlements with employees of the institution have a number of features. In particular, funds for settlements are accumulated from various sources.

Off-balance sheet accounts 17, 18

Based on clause 42 of Instruction No. 33n in form 0503737 “Report on the implementation of an institution’s plan for its financial and economic activities,” the indicators in columns 5, 6, 7 of the section “Institution’s Income” are filled in on the basis of accounting transactions by type of income reflected in off-balance sheet accounts 17 “ Receipts of funds to the institution’s accounts”, which are opened to accounts 201.11 “Institution’s funds on personal accounts with the treasury authority”, 201.21, 201.23, 201.27, 201.34 “Cash”.

According to clause 43 of Instruction No. 33n in columns 5, 6, 7 of the section “Institutional Expenses”, indicators are reflected on the basis of analytical data on the types of expenses reflected in off-balance sheet accounts 18 “Outflows of funds from institution accounts” opened to the same accounts, which is the 17th count.

In the chart of accounts in the program “1C: Public Institution Accounting 8”, ed. 1, a number of sub-accounts are provided for accounts 17 and 18.

In accordance with Instruction No. 157n, in the program “1C: Accounting of a State Institution 8”, cash flow accounting is carried out in parallel with account 201.11 “Institutional funds on personal accounts with the treasury authority” on active off-balance sheet accounts:

- 17.01 Receipt of funds to the institution’s accounts;

- 18.01 Disposal of funds from the institution’s accounts.

Also, in parallel with account 201.34 “Cashier”, accounting is kept for the following accounts:

- 17.34 Receipt of funds to the institution’s cash desk;

- 18.34 Removal of funds from the institution’s cash desk.

In addition, off-balance sheet accounts have been opened for account 210.03 “Settlements with financial authorities for cash”:

- 17.30 Receipt of funds to account 40116;

- 18.30 Cash withdrawals from account 40116.

For all financial security codes, except KFO 1, transactions on off-balance sheet accounts can be divided into groups:

1 group

– reflection of transfers and restoration of cash expenses using account 18.XX.

2nd group

– reflection of receipts and returns of income using account 17.XX.

3 group

– formation of accounting records for the account 17.30 when moving between accounts, accounts and cash.

The postings use KEK 510 “Receipts to budget accounts” on the debit side and 610 “Disposals from budget accounts” on the credit of account 17.

The basis is Letter of the Ministry of Finance of the Russian Federation dated June 26, 2012 No. 02-06-07/2335, clauses 4 and 5 of the Appendix.

4 group

– reflection of the return of subsidies and receivables from previous years.

5 group

– reflection of transactions on funds at temporary disposal.

Materials accounting

Materials can be supplied to the government structure on the basis of a purchase and sale agreement or donation. Let's consider the procedure for determining the cost of materials:

- Upon delivery, the price will include the costs of the delivery itself, insurance, duty, and services of intermediary companies.

- The manufacturing cost is the cost price. It includes production costs.

- If the materials were received under a donation agreement, the price will include the market price, the cost of delivery, and expenses for bringing the product to the desired condition.

- If there is a centralized receipt of materials, the cost is determined based on the amounts specified in the accompanying documentation.

The market price can be determined by determining the market value of similar materials.

Chart of accounts for 2022 with explanations and entries

For the latter, specialized Plans have been developed that reflect the specifics of their activities.

Accounts are a grouping of information about certain accounting objects, which occurs based on the use of the double entry principle (that is, data is simultaneously recorded as the debit of the first account and the credit of the other). If the account shows the property of the enterprise, then it is called active.

Passive accounts are necessary to record information on the sources of creation of enterprise funds. These are accounts for accounting of authorized, reserve and additional capital, etc.

Taxation

Funds received by the institution from the budget will not be taxed. Taxation also does not affect income received from the provision of public services. Income tax is charged on the following income:

- Income from extra-budgetary areas of work, if there is no separate accounting, cost estimates.

- Indemnification paid by third parties.

- The cost of property transferred free of charge, if the objects are not used in the main activity.

- Surplus found during inventory count.

- Targeted revenues spent in non-targeted areas.

The government structure needs to prepare reports that are sent to the Federal Tax Service.

Budget accounting

Having considered the issue, we came to the following conclusion: The receipt of funds to pay off accounts receivable from last year is reflected in the accounting records of a budgetary institution according to KFO 4″ by increasing off-balance sheet account 17 indicating KVR 244 and Article 510 of KOSGU, in the accounting statements - in accordance with the provisions Instructions No. 33n.

Answer prepared by: Expert of the Legal Consulting Service GARANT Kireeva Anna

Response quality control: Reviewer of the Legal Consulting Service GARANT Sukhoverkhova Antonina

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.