Accounting entries for claims from customers are prepared in the following sequence:

— receipt of a written complaint from the buyer about violations of the terms of the contract (for example, short delivery of goods); — decision to satisfy customer requirements: supply of missing products, return of funds in cash or by bank transfer; — payment of penalties or penalties provided for in the contract; — reconciliation with the counterparty for settlements.

In the business activities of any organization, there is a mandatory work with customer complaints. The most common reasons:

- violation of the terms of the agreement on the delivery time of purchased goods;

- discrepancy between qualitative and quantitative characteristics;

- violation of product packaging;

- failure to comply with the terms of the contract (non-delivery of products);

- marriage, etc.

Accounting for buyer complaints

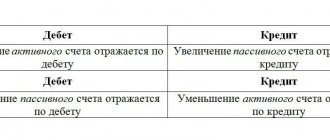

Accounting for customer claims against product suppliers is carried out on account 76, to which a subaccount 76.02 is additionally opened. The debit of the subaccount displays the demand presented (for example, for short delivery of goods) in correspondence with the account for accounting settlements with suppliers; subaccount credit – fulfillment of the terms of the contract by the supplier, cancellation of the claim.

Author's addition! In subaccount 76.02, settlements on claims are accounted for separately for each counterparty.

What requirements can the counterparty make?

A claim may contain one or more claims. For example, these requirements could be:

- pay sanctions for violation of the terms of the contract (Article 329 of the Civil Code of the Russian Federation);

- to pay damages. For example, related to the forced purchase by a counterparty of goods from another supplier at a higher price (Article 393 of the Civil Code of the Russian Federation);

- return the advance received but not spent (Article 453 of the Civil Code of the Russian Federation);

- issue a return or replacement of products (goods). For example, if it is defective (clause 2 of article 475 of the Civil Code of the Russian Federation);

- eliminate defects. For example, correct the quality of improperly performed work (clause 1 of Article 723 of the Civil Code of the Russian Federation);

- reduce the price, that is, mark down the object of the contract. For example, if a product was supplied of inadequate quality (clause 1 of Article 475 of the Civil Code of the Russian Federation).

Practical example of preparing accounting entries No. 1

Limited Liability Company "Solntse" ordered the supply of fire hoses for resale from the supplier "Zori" LLC. The total order price is 150,000 rubles, incl. VAT 18% - RUB 22,881.35. The goods were delivered on time, but the warehouse manager identified a shortage of products in the amount of 17,000 rubles, incl. VAT 18% - RUB 2,593.22. Based on the fact that the sleeves were not delivered, a demand was sent for the return of the transferred payment for the goods.

Accounting entries in the accounting of Sun LLC:

- Dt60 Kt: 150,000 rubles – the supply agreement is fully paid by the buyer by bank transfer;

- Dt41 Kt: 133,304.87 rubles – the received products have been entered into the warehouse;

- Dt19 Kt60: RUB 20,288.13. – input VAT is taken into account;

- Dt76.02 Kt60: 17,000 rub. – a claim was sent to Zori LLC;

- Dt51 Kt76.02: 17,000 rubles - the supplier satisfied the buyer’s requirements and returned the overpaid funds to the buyer.

Debt adjustment: mutual settlement has been made between the organizations “Solntse” and “Zori” in full, there are no debts under the agreement.

Procedure for filing claims

Filing a claim refers to the pre-trial procedure for resolving disputes. In it, one organization points out to another the wrong actions (inactions) or mistakes it has committed, as a result of which its legitimate interests are infringed. The complaint contains demands to eliminate or voluntarily correct these violations. It must be presented in writing signed by the head of the organization (entrepreneur) or his deputy, if this is provided for by law or the charter of the organization.

Practical example of preparing accounting entries No. 2

According to the supply agreement, between Shield LLC and Mech LLC, payment for the delivered products must be made no later than the day following the day the goods arrive at the warehouse. The agreement between the companies provides for a penalty in the amount of 0.01% of the price of the goods for each calendar day of late payment.

Delivery cost - 70,000 rubles; the goods were delivered to the warehouse of Shield LLC on June 10, 2018, payment to the supplier was received on June 19, 2018.

Calculation of the penalty: 70,000 * 0.01 * 9 = 6,300 rubles.

Accounting entries in the accounting of Shield LLC:

- Dt91.02 Kt76.02: 6,300 rubles – the supplier’s claim for failure to pay for goods on time is displayed;

- Dt76.02 Kt51: 6,300 rub. – the accrued penalty was paid in full.

Accounting for claims amounts

In order to reflect a claim on the balance sheet, one of two conditions must be met:

- the second party recognized the claim as justified;

- the claim is not recognized, but instead there is a court decision.

REFERENCE! The first condition is documented by the written response of the contracting party to the claim.

To record the amounts of claims, PBU recommends using subaccount 76.2 “Calculations for claims.”

Samples and examples of postings

EXAMPLE 1. Let a company order raw materials from a supplier in the amount of 10,000 rubles. After receipt of materials, it turned out that the amount of supplied raw materials was missing by 1000 rubles. A claim was sent to the supplier, which he agreed to satisfy. Here's what the accounting entries for these transactions will look like:

- debit 10 “Materials”, credit 60 “Settlements with suppliers” - capitalization of received materials in the amount of 9,000 rubles;

- debit 60, credit 51 “Current account” - payment of the full amount of the order according to payment documents - 10,000 rubles;

- debit 76.2, credit 60 – claim for a shortage of 1000 rubles;

- debit 51, credit 76.2 – receipt of 1000 rubles. from the supplier (covering the shortage).

If the supplier did not send funds as compensation without acknowledging the claim, this money would have to be written off as a loss:

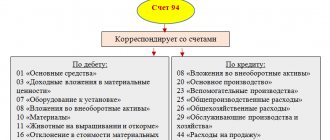

- debit 94 “Shortages and losses from damage to valuables”, credit 76.2 - writing off a shortage of 1000 rubles.

If the contract provides for a penalty for violation of certain conditions (deadlines, quantity of delivery, etc.), these amounts are also written off as expenses.

EXAMPLE 2. One party to the contract sold the other a batch of stationery in the amount of 12,000 rubles, which includes VAT. The buyer company delayed payment, making it 10 days later. The agreement provided for a penalty for violation of deadlines in the amount of 0.1% for each day. In the amount of 1200 rubles. (12,000 x 0.1%) a claim was issued to the buyer. Wiring from the selling company:

- debit 76.2, credit 91.1 – reflection of the amount of the penalty of 1200 rubles;

- debit 51, credit 76.2 – deposit 1200 rubles. as a penalty by the buyer.

Accounting for claims from the supplier

If the goods delivered by the supplier to the customer have been entered into the buyer's warehouse, then their return is carried out by drawing up a reverse sale and issuing the relevant documentation (TORG-12, invoice or UPD).

Claims received from customers in connection with violations of the terms of the contract in the supplier’s accounting can be recorded in subaccount 76.02: for a loan - receipt of a claim, debit of the subaccount - satisfaction of the customer’s conditions. The subaccount is debited for the amount of the claim in correspondence with accounts accounting for payment methods: return of cash, return of payment by bank transfer, delivery of goods, payment of fines and penalties, etc.

Results

Sanctions reflected in accounting in the form of penalties and fines arise:

- in relations between counterparties due to violation of contractual relationships;

- in case of non-compliance with the requirements of tax legislation.

In both cases, a specific legal entity may be both a payer and a recipient of payments under sanctions. That is, entries for fines and penalties will reflect either expenses or income in his accounting:

- for settlements with the counterparty - Dt 91 Kt 76 (expense) or Dt 76 Kt 91 (income);

- for tax payments - Dt 99 (91) Kt 68 (expense) or Dt 76 Kt 91 (income).

Accounting analytics should be organized by counterparties and claims (for account 76), types of taxes and sanctions (for account 68), and assignment of sanctions (for account 91).

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 32n

- Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Practical example of preparing accounting entries No. 3

Limited Liability Company "Sinitsa" entered into a supply agreement with the organization "Yakor" for the supply of grain crushers. The order amount for Sinitsa LLC was 300,000 rubles (including 18% VAT - 45,762.71 rubles). failed to fulfill their obligations under the contract. The customer filed a claim demanding the return of a previously paid advance payment for undelivered products. Management accepted the claim and satisfied the buyer's demands.

Accounting entries for business transactions in the accounting of Anchor LLC:

- Dt51 Kt62: 300,000 rubles - an advance payment has been received to the current account;

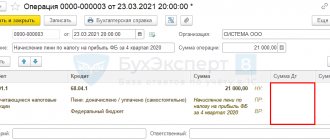

- Dt76AV Kt68: 45,762.71 rubles – VAT is charged on the buyer’s advance;

- Dt62 Kt76.02: 300,000 rubles – a claim was received due to violations of the terms of the supply agreement;

- Dt76.2 Kt51: 300,000 rubles - the claim is satisfied, and the customer’s advance payment is returned to the bank account;

- Dt68 Kt76AV: 45,762.71 rubles – acceptance for deduction of previously accrued VAT on the advance payment.

Postings to account “76.02”

By debit

| Debit | Credit | Content | Document |

| 76.02 | 000 | Entering initial balances: settlements for claims in rubles. | Entering balances |

| 76.02 | 01.09 | Write-off of fixed assets at residual value, seized by decision of judicial authorities through arrest, seizure, confiscation, nationalization, etc. (in accordance with Articles 235, 237, 243 of the Civil Code of the Russian Federation) | Operation |

| 76.02 | 07 | Return of equipment requiring installation to the supplier under a contract in rubles. | Returning goods to the supplier |

| 76.02 | 08.01 | Reflection of the amount of the claim presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of a land plot | Operation |

| 76.02 | 08.02 | Reflection of the amount of the claim presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of a natural resource management facility | Operation |

| 76.02 | 08.03 | Reflection of the amount of the claim presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors in calculating the cost of the construction project | Operation |

| 76.02 | 08.04 | Return of a non-current asset (equipment) to the supplier under a contract in rubles. | Returning goods to the supplier |

| 76.02 | 08.04 | Reflection of the amount of the claim presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of fixed assets (equipment) | Operation |

| 76.02 | 08.05 | Reflection of the amount of the claim presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the value of an intangible asset | Operation |

| 76.02 | 08.08 | Reflection of the amount of the claim presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of research, development and technological work to the contract in foreign currency | Operation |

| 76.02 | 10.01 | Return of raw materials and materials to the supplier under the contract in rubles. | Returning goods to the supplier |

| 76.02 | 10.01 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors in calculating the cost of raw materials and materials | Operation |

| 76.02 | 10.02 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of purchased semi-finished products, components, structures and parts | Operation |

| 76.02 | 10.02 | Return of purchased semi-finished products, components, structures and parts to the supplier under a contract in rubles. | Returning goods to the supplier |

| 76.02 | 10.03 | Return of fuel to the supplier under the contract in rubles. | Returning goods to the supplier |

| 76.02 | 10.03 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors in calculating the cost of fuel | Operation |

| 76.02 | 10.04 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of packaging and packaging materials in organizations engaged in production activities or provision of services | Operation |

| 76.02 | 10.04 | Return of containers and packaging materials to the supplier under the contract in rubles. | Returning goods to the supplier |

| 76.02 | 10.05 | Return of spare parts to the supplier under contract in rubles. | Returning goods to the supplier |

| 76.02 | 10.05 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors in calculating the cost of spare parts | Operation |

| 76.02 | 10.06 | Return of other materials to the supplier under the contract in rubles. | Returning goods to the supplier |

| 76.02 | 10.06 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors in calculating the cost of other materials | Operation |

| 76.02 | 10.08 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors in calculating the cost of building materials | Operation |

| 76.02 | 10.08 | Return of construction materials to the supplier under the contract in rubles. | Returning goods to the supplier |

| 76.02 | 10.09 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors in calculating the cost of inventory and household supplies | Operation |

| 76.02 | 10.09 | Return of inventory and household supplies to the supplier under an agreement in rubles. | Returning goods to the supplier |

| 76.02 | 10.10 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of special equipment and special clothing | Operation |

| 76.02 | 41.01 | Reflection of the amount of the claim for defective goods recognized by the supplier or awarded by the court in rubles. | Operation |

| 76.02 | 41.01 | Return of goods to the supplier under the contract in rubles. | Returning goods to the supplier |

| 76.02 | 41.02 | Return of goods to the supplier at a manual point of sale under an agreement in rubles. (retail, accounting at acquisition cost) | Returning goods to the supplier |

| 76.02 | 41.02 | Reflection of the amount of the claim for defective goods at the point of sale, recognized by the supplier or awarded by the court in rubles. (retail, accounting at acquisition cost) | Operation |

| 76.02 | 41.03 | Reflection of the amount of claims presented to the supplier in connection with the identification of discrepancies in prices and tariffs, arithmetic errors when calculating the cost of packaging and packaging materials in organizations engaged in trading activities | Operation |

| 76.02 | 41.04 | Return of purchased products to the supplier under a contract in rubles. in organizations engaged in industrial and other production activities | Returning goods to the supplier |

| 76.02 | 41.04 | Reflection of the amount of the claim for defective purchased products, recognized by the supplier or awarded by the court in rubles. | Operation |

| 76.02 | 41.11 | Return of goods to the supplier at an automated point of sale under an agreement in rubles. (retail, accounting at sales price) | Returning goods to the supplier |

| 76.02 | 41.12 | Return of goods to the supplier at a manual point of sale under an agreement in rubles. (retail, accounting at sales price) | Returning goods to the supplier |

| 76.02 | 60.01 | Reflection of the amount of the claim presented to the supplier under the contract in rubles. | Debt adjustment |

| 76.02 | 68.02 | VAT accrual upon return to the supplier under a contract in rubles. | Returning goods to the supplier |

| 76.02 | 91.01 | Reflection of suppliers' debt recognized for the submitted claim, in rubles. Recognition of other income | Operation |

| 76.02 | 94 | Reflection of suppliers' debt for compensation of material damage in rubles. | Operation |

By loan

| Debit | Credit | Content | Document |

| 20.01 | 76.02 | Inclusion in the costs of the main proceedings of the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in rubles. | Receipts (acts, invoices) |

| 23 | 76.02 | Inclusion in the costs of auxiliary proceedings is the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in rubles. | Receipts (acts, invoices) |

| 25 | 76.02 | Write-off as general production expenses the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in rubles. | Receipts (acts, invoices) |

| 26 | 76.02 | Write-off for general business expenses the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in rubles. | Receipts (acts, invoices) |

| 29 | 76.02 | Write-off for expenses of servicing industries and farms the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in rubles. | Receipts (acts, invoices) |

| 44.01 | 76.02 | Write-off of the amount of claims not satisfied by arbitration or court (against electricity supply, water supply organizations, etc.) to the costs of circulation in rubles. in organizations engaged in trading activities | Receipts (acts, invoices) |

| 44.02 | 76.02 | Write-off as business expenses the amount of claims not satisfied by arbitration or court (against electricity, water supply organizations, etc.) in rubles. in organizations engaged in industrial and other production activities | Receipts (acts, invoices) |

| 50.01 | 76.02 | Receipt of cash to the organization's cash desk to pay off a claim in rubles. | Cash receipt |

| 50.02 | 76.02 | Receipt of cash to the operating cash desk to pay off a claim in rubles. | Cash receipt |

| 50.03 | 76.02 | Receipt of monetary documents to the organization's cash desk to pay off a claim in rubles. | Receipt of cash documents |

| 51 | 76.02 | Receipt of funds to the organization's current account to pay off the claim under the contract in rubles. | Receipt to the current account |

Basic requirements for a claim

The buyer's claim to the seller is made in writing in any form, but must contain the following information:

- Addressee and sender. As a rule, this application is filled out in the name of: the head of the counterparty.

- Information about the purchased product or service: cost, date of purchase, additional information (for example, when returning a product under warranty, the warranty period of the product is additionally indicated).

- The claim as such (for example, listing the defects of the product).

- Requests: exchange, refund, reimbursement of costs, etc.

- Information about providing copies of documents in the application (for example, a copy of a check, warranty card, etc.).

- Date, position, signature and transcript of the applicant’s signature.

More information on filing claims in 1C software products can be found in the video

What transactions must be used when receiving compensation for property damage?

Debit 76-2 Credit 91-1 –

the amount of compensation for losses from property damage has been accrued;

When calculating the single tax, include the amount of compensation received as part of non-operating income.

Legislation or an agreement may provide, for example, the following types of sanctions for violation of obligations: penalties (fines, penalties), interest for late payment, etc. This follows from Articles 329 and 395 of the Civil Code of the Russian Federation. The counterparty to whom the organization has submitted a claim has the right to: – recognize it; – refuse to confess (for example, in the absence of his guilt in violating the obligation); – continue business correspondence (for example, in order to obtain additional information or prove the absence of guilt in violating an obligation). How to formalize and reflect a claim in accounting and taxation

Claim for non-delivery of goods, non-payment of debt, etc.

According to Article 506 of the Civil Code of the Russian Federation, a supply agreement involves the transfer of goods by the supplier to the buyer, who can use the received products exclusively for business purposes.

In this case, the buyer, in accordance with Article 516 of the Civil Code of the Russian Federation, undertakes to transfer money to the supplier for the products received. Thus, the main responsibilities of the supplier and buyer when executing a supply contract include delivery and subsequent payment for the goods received, respectively. In addition to the main obligations of the parties, the contract may also include additional ones - for example, on the shipment of goods:

- within a certain period of time;

- to a certain place;

- in the assortment specified in the agreement, etc.

Since business activity is inherently risky, neither party to the contract can be completely confident that the counterparty will fulfill its obligations in full. Consequently, at any time a situation may arise when the goods have not been shipped (not fully shipped), payment has not been made (only partially made), conditions regarding the quality, completeness or range of transferred products, delivery times, etc. have not been fulfilled.

If the listed violations are discovered, the entrepreneur can go to court, which requires time and financial costs and often negates the possibility of further cooperation. To avoid such complications, the law provides for another option for resolving a controversial issue - holding negotiations by sending the parties claims to each other.

Claim dispute resolution procedure

It should be remembered that the law does not provide for the mandatory submission of claims by the parties when executing a supply agreement. However, this does not prevent us from stipulating in the contract both such an obligation in the event of violations on the part of the counterparty, and the period for consideration of claims.

IMPORTANT! The arbitration court, in accordance with Part 5 of Article 4 of the Arbitration Procedure Code of the Russian Federation, has the right to accept a claim only if the claim (pre-trial) procedure for resolving disagreements that has arisen is observed, which may be provided for both by law and by an agreement between the parties.

Timeframe for consideration of a claim

The counterparty is obliged to consider the claim. The deadline for this can be set:

- legislation (see, for example, paragraph 5 of Article 12 of the Law of June 30, 2003 No. 87-FZ);

- agreement;

- internal regulations of the organization or business customs.

This follows from Article 309 of the Civil Code of the Russian Federation.

At the same time, civil legislation does not establish sanctions for violating this deadline (see, for example, Article 12 of the Law of June 30, 2003 No. 87-FZ or Article 37 of the Law of July 17, 1999 No. 176-FZ).

The norms of judicial law do not provide for any sanctions (Arbitration Procedure Code of the Russian Federation, Code of Civil Procedure of the Russian Federation).

Financial sanctions (for example, a fine) for violating the deadline within which a claim must be considered may be provided for in an agreement with the counterparty (clause 4 of Article 421 of the Civil Code of the Russian Federation).