Netting between three organizations

Settlement between three organizations is possible with the mutual consent of all three parties. The possibility of offset is provided for in Art. 410 of the Civil Code of the Russian Federation, which states that the obligation is terminated in whole or in part by offsetting a counterclaim of the same type.

According to Article 153 of the Civil Code of the Russian Federation, actions of legal entities aimed at establishing, changing or terminating civil rights and obligations are recognized as transactions. In accordance with Article 154 of the Civil Code of the Russian Federation, transactions can be multilateral (agreements), the conclusion of which requires the expression of the agreed will of the three parties.

As a rule, the trigger for concluding a trilateral agreement is the presence of receivables and payables between the parties to the agreement.

This transaction allows you to achieve mutual repayment of obligations, avoiding cash payments. A feature of mutual settlement between organizations is that a party that does not have any obligations towards at least one of the parties cannot take part in this agreement. The tripartite agreement is carried out in the opposite direction to the flow of debt.

Example 1. LLC "ABV" has a debt to LLC "GDE" in the amount of 430,000 rubles, LLC "GDE" has a debt to LLC "ZhZI" in the amount of 560,000 rubles, LLC "ZhZI" has a debt to LLC "ABV" in the amount 150,000 rubles. The parties decided to enter into an agreement on mutual settlement between three organizations in order to partially repay obligations, namely for the amount of the smallest debt (150,000 rubles).

Thus, the offset looks like this: from LLC “ABV” to LLC “ZhZI”, from LLC “ZhZI” to LLC “GDE”, from LLC “GDE” to LLC “ABV”.

As a result of the transaction, the remaining debt is as follows: (click to expand)

- ABV LLC to GDE LLC – 280,000 rubles;

- LLC "GDE" to LLC "ZhZI" - 410,000 rubles;

- LLC ZhZI's obligations to LLC ABV have been terminated.

Tripartite agreement for the offset of mutual claims: mandatory details

Regardless of the number of parties to the contractual relationship, the document indicates a full set of mandatory details approved by the legislator for primary documentation. The tripartite netting agreement must include information about:

- names of the enterprises participating in the transaction;

- personal data of representatives of organizations that have the authority to conclude transactions and approve contracts with their signatures;

- the grounds for the emergence of powers among representatives of legal entities;

- tripartite settlement of mutual claims (sample document) requires listing the obligations of each party in relation to the counterparties participating in the transaction;

- if there are financial obligations and a desire to offset them, it is necessary to register the details of the documents on the basis of which the debt arose in the accounting;

- an agreement on the offset of mutual claims, a tripartite sample agreement must limit the period for repayment of debts - the document specifies the deadline for the implementation of debt write-off;

- the amounts of the claim that can be repaid by offset are given;

- At the end of the document form, registration information about each participant in the transaction is written down and the signatures of the responsible persons are affixed.

A tripartite netting agreement must be based on reconciliation acts between all parties. This is necessary to prevent controversial situations and subsequent legal proceedings regarding the part of the debt remaining after the offset procedure.

Accounting entries for netting between three organizations

For correct accounting, it is necessary to carefully monitor accounting entries to avoid errors. According to Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n (as amended on November 8, 2010) “On approval of the Chart of Accounts for accounting financial and economic activities of organizations and Instructions for its application,” accounting for settlements with the supplier and buyer is carried out on accounts 60 and 62.

To reflect debt in accounting, it is possible to reflect it using the symbol “/” (60/ABV), where through “/” the legal entity that is a debtor to the organization is indicated.

An example of an accounting entry for netting between three organizations will be presented in the section “An example of reflecting netting between three organizations in accounting” of this article.

Documents required for mutual settlement between three organizations

In accordance with Article 410 of the Civil Code of the Russian Federation and Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 No. 65 “Review of the practice of resolving disputes related to the termination of obligations by offsetting counter homogeneous claims,” a statement from one party is sufficient for offset. The court takes the side of the debtor organization if there is an application on its part to carry out mutual settlement between organizations.

So, to carry out mutual settlement between organizations, the following documents are required: (click to expand)

- an application by one of the parties sent to an organization that has accounts payable or receivable in relation to it;

- agreements concluded between the parties;

- Settlement deed signed by three parties.

Sample act of offset

When forming an act of offset, it is necessary to be guided by the requirements for primary documents in accordance with Federal Law of November 21, 2011 No. 129-FZ “On Accounting” (Article 9):

- Title of the document;

- date of document preparation;

- names of organizations on whose behalf the document was drawn up;

- content of a business transaction;

- meters of business transactions in physical and monetary terms;

- the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

- personal signatures of these persons.

The act of offset of mutual claims of three legal entities is drawn up in three copies - one for each of the parties. Read also the article: → "".

ACT of offset of mutual claims of three legal entities

Ekaterinburg July 15, 2022

LLC "ABV", hereinafter referred to as "Party 1", represented by General Director Alikin B.V., acting on the basis of the Charter, and LLC "GDE", hereinafter referred to as "Party 2", represented by General Director Gusev D.E. ., acting on the basis of the Charter, and ZhZI LLC, hereinafter referred to as “Party 3”, represented by Z.I. Zhilyakov, acting on the basis of the Charter, equally referred to as the “Parties”, have drawn up this act on the following:

- In order to make settlements as efficiently and quickly as possible, the Parties agreed to set off the amount of mutual homogeneous claims that have become due. Mutual demands are expressed in rubles of the Russian Federation:

1) Party 1 has a debt to Party 2 in the amount of 430,000 rubles (Agreement No. 1111 dated 03/01/2017. Deadline for fulfillment of obligations is 07/01/2017);

2) Party 2 has a debt to Party 3 in the amount of 560,000 rubles (Agreement No. 2222 dated 03/10/2017. Deadline for fulfillment of obligations is 07/10/2017);

3) Party 3 has a debt to Party 1 in the amount of 150,000 rubles (Agreement No. 3333 dated 03/11/2017. Deadline for fulfillment of obligations is 07/11/2017).

- Taking into account the mutual nature of counter-obligations, the Parties agreed to set off the amount of debt in the amount of 150,000 (one hundred fifty thousand) rubles. 00 kop. for partial repayment of debt.

- After the Parties have carried out mutual homogeneous claims under this act, the balance of debt as of July 15, 2017 will be:

1) Party 1 before Party 2: 280,000 (two hundred eighty thousand) rub. 00 kop.;

2) Party 2 before Party 3: 410,000 (four hundred ten thousand) rubles. 00 kop.;

3) Side 3 before Side 1: 0 rub. 00 kop.

| Side 1: | Side 2: | Side 3: |

| General Director _______________Alikin B.V. | General Director ________________Gusev D.E. | General Director ______________Zhilyakov Z.I. |

| Chief Accountant _________________________ | Chief Accountant _________________________ | Chief Accountant _________________________ |

| MP | MP | MP |

Application:

Act of reconciliation of mutual debt dated July 15, 2022 No. 1.

———————————

<*> In accordance with clause 4 of Art. 168 of the Tax Code, the amount of tax imposed by the taxpayer on the buyer of goods (work, services), property rights, is paid to the taxpayer on the basis of a payment order for the transfer of funds when carrying out goods exchange transactions, offsetting mutual claims, when using securities in settlements.

An example of reflecting mutual settlement between three organizations in accounting

LLC "ABV" has a debt to LLC "GDE" in the amount of 430,000 rubles, LLC "GDE" has a debt to LLC "ZhZI" in the amount of 560,000 rubles, LLC "ZhZI" has a debt to LLC "ABV" in the amount of 150,000 rubles . The parties decided to enter into an agreement on mutual settlement between three organizations in order to partially repay obligations, namely for the amount of the smallest debt (150,000 rubles).

ABC LLC reflects the following data in its accounting records:

| Accounting entry | Explanation | Amount (rub.) | |

| D 62/ZhZI | K 90 | Sales of goods LLC "ZhZI" | 150 000 |

| D 41 | TO 60/WHERE | Capitalization of goods received from the supplier (LLC "GDE") | 430 000 |

| D 60/GDE | K 62/ZhZI | Settlement | 150 000 |

GDE LLC reflects the following data in its accounting records:

| Accounting entry | Explanation | Amount (rub.) | |

| D 62/ABV | K 90 | Sales of goods LLC "ABV" | 430 000 |

| D 41 | K 60/ZhZI | Capitalization of goods received from the supplier (ZhZI LLC) | 560 000 |

| D 60/ZhZI | K 62/ABV | Settlement | 150 000 |

ZhZI LLC reflects the following data in its accounting records:

| Accounting entry | Explanation | Amount (rub.) | |

| D 62/GDE | K 90 | Sales of goods LLC "GDE" | 560 000 |

| D 41 | K 60/ABV | Capitalization of goods received from the supplier (ABV LLC) | 150 000 |

| D 60/ABV | K 62/WHERE | Settlement | 150 000 |

Thus, the example shows that, based on a mutual agreement on netting, each of the three organizations in its accounting records reflects an accounting entry that makes it possible to track the complete or partial termination of the obligations of one legal entity to the other.

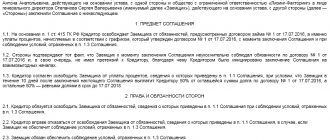

How to draw up a tripartite agreement

AGREEMENTon the offset of counterclaims of the same type

Kurgan city March 17, 2022

1. Limited Liability Company "Las", hereinafter referred to as "Party-1", represented by the director Las Igor Olegovich, acting on the basis of the Charter, on the one hand,

Limited Liability Company "Pass", hereinafter referred to as "Party-2", represented by director Komov Ivan Petrovich, acting on the basis of the Charter, on the second side,

Limited Liability Company "Kum", hereinafter referred to as "Party-3", represented by director Petrov Sidor Sidorovich, acting on the basis of the Charter, from the third party

have entered into this agreement as follows.

2. In accordance with this agreement, the Parties agreed to offset mutual obligations to each other by offsetting counter-similar claims on the following conditions:

2.1. “Party-1” has a debt to “Party-2” in the amount of 10,000 (Ten thousand) rubles, arising from the obligation to pay under supply agreement No. 5 dated September 13, 2022.

2.2. “Party-2” has a debt to “Party-3” in the amount of 10,000 (Ten thousand) rubles, arising from the obligation to pay for work performed under contract agreement No. 3 dated May 12, 2019.

2.3. “Party-3” has a debt to “Party-1” in the amount of 10,000 (Ten thousand) rubles, arising from the obligation to pay for work performed under contract agreement No. 4 dated June 12, 2019.

3. The parties decided to offset similar counterclaims in the amount of 10,000 (Ten thousand) rubles.

4. As a result of offsetting counter similar claims:

4.1. The debt of "Party-1" to "Party-2", specified in paragraph 1 of this Agreement, is repaid in full.

4.2. The debt of “Party-2” to “Party-3” specified in paragraph 2 is repaid in full.

4.3. The debt of "Party-3" to "Party-1", specified in paragraph 3, is repaid in full.

5. The parties guarantee to each other that the counterclaims being set off are homogeneous and comply with the conditions of Art. 410 of the Civil Code of the Russian Federation.

6. All disagreements under the agreement are resolved through negotiations. The deadline for responding to a claim is 10 days from the date of its receipt. If it is impossible to resolve disagreements through negotiations, the dispute that arises is subject to consideration in a court of jurisdiction.

7. This agreement is drawn up and signed in three original copies, one for each of the parties, and comes into force on the day of its conclusion.

8. In cases not specified in the agreement, the parties are guided by Russian legislation.

9. The parties undertake to notify each other of all changes to their details.

10. Addresses, details and signatures of the Parties.

Prohibition on mutual settlement between three organizations

According to Article 411 of the Civil Code of the Russian Federation, offsets between three organizations are not allowed in cases where we are talking about:

- compensation for harm caused to life or health;

- lifelong maintenance;

- collection of alimony;

- claims for which the statute of limitations has expired;

- other cases provided for by law or agreement.

Regulatory acts regulating the possibility of mutual settlement between the three organizations

| Normative act | Regulatory area |

| Art. 410 of the Civil Code of the Russian Federation | Termination of obligations by offset |

| Art. 411 of the Civil Code of the Russian Federation | Cases of inadmissibility of credit |

| Federal Law of November 21, 2011 No. 129-FZ “On Accounting” (Article 9) | Requirements for primary documents |

| Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n (as amended on November 8, 2010) “On approval of the Chart of Accounts for accounting financial and economic activities of organizations and Instructions for its application” | Chart of Accounts |

| Art. 153 of the Civil Code of the Russian Federation | Transaction concept |

| Art. 154 of the Civil Code of the Russian Federation | Agreements and transactions |

| Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 No. 65 “Review of the practice of resolving disputes related to the termination of obligations by offsetting counter-similar claims” | Availability of an application from one of the legal entities |

Rules for netting

When conducting offsets, the following requirements must be met:

- offset is carried out by organizations participating in two or more obligations for which counterclaims have arisen;

- the demands must necessarily be of a counter nature. That is, each party must be a debtor on one claim, and a creditor on the other;

- requirements must be uniform. This means that for mutual offset to be possible, the object of the claim must be the same, most often it is cash;

- the fact that requirements arise.

There are several types of claims for which netting is prohibited

According to the Civil Code, it is impossible to offset the following requirements:

- if the claim of one of the parties has a limitation period, and this period has expired;

- claims for compensation for harm caused to life and health;

- claims for alimony;

- lifelong maintenance;

- other requirements established by law.

To identify cases of mutual claims with debtors and creditors, the organization must maintain analytical records of receivables and payables for each counterparty.

According to the law, netting is possible if one of the parties declares it. But in practice, the decision to offset is made by both parties.

This decision can be formalized in one of the following documents:

- mutual debt reconciliation act;

- netting agreement;

- agreement on offset of claims.

After agreeing on the amount of debt, the parties sign an agreement on mutual settlement between the organizations.

Based on these documents, counterparties reflect the offset of claims in accounting.

Notification of the tax office about opening an account, registration rules. What types of return on capital are there, and how are they calculated?

Errors in netting between three organizations

When carrying out offsets, it is necessary to very carefully monitor all stages of the procedure in order to avoid errors that are often encountered:

| Errors | Explanation |

| No statement | According to Article 410 of the Civil Code of the Russian Federation, a statement from one of the parties proposing mutual offset must be made. |

| In the Certificate of Settlement of Mutual Claims of Three Legal Entities, the date is indicated incorrectly or not indicated at all | If in the Certificate of Settlement of Mutual Claims of Three Legal Entities the date is indicated incorrectly or not indicated at all, the date of repayment of obligations is recognized as the date of signing the Certificate by the Parties. |

| Offset of requirements that are not homogeneous | For example, it is impossible to offset a demand for repayment of a monetary debt with compensation for property rights. |

| Compliance with the deadline for the assessment | In order for mutual offset between organizations to be possible, the deadline for fulfilling the requirement must arrive, but without reaching the statute of limitations. |

| Offsetting mutual obligations in advance against future offsets | |

| Failure to reflect the sale of goods received through mutual offset | The consequence of failure to reflect the sale of goods is an understatement of the tax base. |

Category “Questions and Answers”

Question No. 1. Our organization has a debt to another organization, but the obligations are due only in October 2022. Currently, this organization has ordered us to provide services, the cost of which is equal to the size of our obligations. Do we have the right to carry out mutual settlements between our organizations?

In this case, your organization has the right to apply for mutual settlement, but subject to drawing up an Act of Settlement of Mutual Claims.

Question No. 2. If our organization has a debt of 1,000,000 rubles, another organization owes us 1,000,000 rubles, and that third organization also owes 1,000,000 rubles. Is it possible to assume that no one owes anyone anything?

You can think this way, provided that the organizations have concluded an Act of Settlement of Mutual Claims with the implementation of appropriate accounting.