Sample contract for the assignment of the right to claim a debt

| Moscow | January 21, 2022 |

Limited Liability Company Private Security Organization "Alpha" (LLC Private Security Organization "Alpha"), hereinafter referred to as "Assignor", represented by General Director Ivanov Vyacheslav Nikolaevich, acting on the basis of the Charter, and

Joint Stock Company "Omega", hereinafter referred to as "Assignee" ", represented by Denis Anatolyevich Golovanko, acting on the basis of the Charter, collectively referred to as the "Parties", have entered into this agreement (hereinafter referred to as the Agreement) as follows:

Features of the assignment agreement

We tell you what features need to be taken into account when drawing up an assignment agreement:

- It is necessary to check the authority of the assignor to complete this transaction.

- If the contract arises from ongoing obligations, reference must be made to the periods for which it is drawn up (clause 13 of information letter No. 120).

- If we are talking about a future requirement, then the wording of the subject must be such that it is subject to determination when it arises or passes to a new party.

- The right of claim in the future may pass to a new creditor after it arises - within the period specified by the parties (Article 388.1 of the Civil Code of the Russian Federation).

- The price of the assignment is not significant for the validity of the contract (clause of information letter No. 120).

- The absence of a clause in the contract about its gratuitousness means that it is compensated (resolution of the 9th Arbitration Court of Appeal dated October 6, 2015 No. 09AP-41979/2015-GK in case No. A40-196013/14).

- A creditor who is a participant in a joint and several obligation has the right to make a concession to a third party with the consent of the other participants in this obligation. However, joint creditors may enter into an agreement that provides for assignment rules that differ from those established by the Civil Code of the Russian Federation.

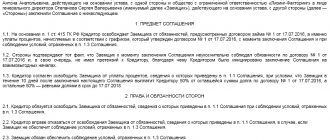

SUBJECT OF THE AGREEMENT

1.1. The Assignor assigns, and the Assignee accepts the following rights of claim against the Joint-Stock Company "Mekhanichesky (JSC "MZ "Beta") (OGRN 1057802313392, INN 3456739215) (hereinafter - the Debtor) for a monetary obligation unfulfilled by the Debtor arising from ongoing legal relations, namely from agreement No. 01/03/2016 dated 03/09/2016 for the provision of security services concluded between the Assignor and the Debtor (hereinafter referred to as Agreement No. 01/03/2016 dated 03/09/2016) for the period from December 2022 to May 2022 inclusive in the amount of 840 000 (eight hundred forty thousand) rubles 00 kopecks, excluding VAT in connection with the application by the Assignor of a simplified taxation system in accordance with Art. 346.11 of the Tax Code of the Russian Federation.

The rights associated with the transferred claim are also assigned to the assignee (clause 1 of Article 384 of the Civil Code of the Russian Federation).

1.2. The Parties hereby agree on the cost of the assigned rights of claim with a discount of 5% (five percent) from the amount specified in clause 1.1 of this Agreement, which is 798,000 (seven hundred ninety-eight thousand) rubles 00 kopecks, excluding VAT in connection with the use by the Assignor of a simplified taxation system in accordance with Art. 346.11 of the Tax Code of the Russian Federation.

1.3. The amount of the debtor's monetary obligation to the Assignor specified in clause 1.1 of the Agreement is confirmed by the act of reconciliation of mutual settlements under agreement No. 01/03/2016 dated 03/09/2016 as of May 31, 2019, signed by authorized representatives of the Assignor and the Debtor, transferred by the Assignor to the Assignee in the manner provided for in clause 2.1 of this Agreement.

Contents of the agreement

The parties to the transaction can be any persons, not only legal entities, but also individuals, and the goal is only the transfer of rights. An assignment agreement is quite often called a title, thereby emphasizing its independence from agreements on the transfer of rights of other types.

The contract must contain information about the subjects. Moreover, not only about the assignor and assignee, but also about the debtor, as well as information about the original agreement, on the basis of which the right to claim the debt arose from the assignor.

It is important that the assignment agreement must have the same form as the original agreement by virtue of which the obligations arose. This rule is established by paragraph 1 of Art. 389 of the Civil Code of the Russian Federation. If the original agreement was drawn up in writing, then the assignment agreement must also be drawn up in writing. If the original transaction was notarized, then the assignment agreement must also be certified by a notary.

The subject of the agreement is always the transfer of rights, which the agreement secures. Most often this happens at the time of signing, but a different period may be specified.

The main terms of the agreement include the amount of payment and the method of transferring funds from the original creditor to the assignee.

The law does not require the consent of the debtor, except in cases where this is stipulated in the original agreement or follows from some regulations. It is understood that the very fact of drawing up the title indicates that the original agreement did not contain conditions contrary to this. Therefore, the assignee is only obliged to inform the debtor that the right to claim the debt has transferred to him. All this is most often reflected in assignment agreements, although there is no particular need for this, since the law obliges assignees to inform debtors about the transfer of rights to the debt to them.

All risks associated with non-fulfillment or incorrect fulfillment of the provisions on informing the debtor are borne by the assignee. For example, if the debtor, due to insufficient information about the transfer of rights, continues to fulfill his obligations to the previous creditor, then in court this will most likely be attributed to the unfavorable consequences that arise for the assignee, and not for the debtor.

The assignor is responsible for transferring an existing debt that is supported by genuine documentation. Regressive demands on the assignor are impossible. If the debtor disputes the debt or evades repayment, then no claims will be made against the original creditor.

DUTIES OF THE PARTIES

2.1. The Assignor, within 3 (three) working days from the date of signing the Agreement by both Parties, transfers to the Assignee:

- a copy of Agreement No. 01/03/2016 dated 03/09/2016 duly certified by the Assignor;

- notarized copies or originals of acceptance certificates for services provided, provided for in clause 4.4 of Agreement No. 01/03/2016 dated 03/09/2016;

- other documents: invoices for payment, copies of appendices duly certified by the Assignor, additional agreements to the agreement that are an integral part of it (if any), copies of accounting documents certified by the Assignor’s seal, a reconciliation act for mutual settlements, in accordance with clause 1.3 of this Agreement, as well as other available documents related to the execution of Agreement No. 01/03/2016 dated 03/09/2016.

Documents are transferred according to an act of acceptance and transfer of documents, drawn up in the form set out in Appendix No. 1 to this Agreement.

2.1.1. The document acceptance and transfer certificate is drawn up and signed by authorized representatives of the Assignor and Assignee and is an integral part of this Agreement.

2.2. The Assignor, within 5 (five) working days from the date of signing of this Agreement by both Parties, is obliged to notify the Debtor in writing about the assignment of the right of claim under Agreement No. 01/03/2016 dated 03/09/2016 and immediately notify the Assignee about this (with a copy of the notification to the Debtor, documents , confirming receipt of the notification by the Debtor) by registered mail with notification.

2.3. The amount of funds specified in clause 1.2 of the Agreement is paid by the Assignee by bank transfer within 10 (ten) working days from the date of signing by both Parties of this Agreement and the acceptance certificate of documents, while the start date of the specified period is the last day of fulfillment of the last of the listed conditions.

2.4. The Assignor is obliged to inform the Assignee of all other information relevant for the Assignee to exercise its rights under Agreement No. 01/03/2016 dated 03/09/2016.

The Assignor is obliged to transfer to the Assignee everything received from the Debtor on account of the assigned claim.

2.5. From the date of signing by the Parties of the acceptance and transfer certificate of the documents specified in clause 2.1 of the Agreement, the Assignor is considered to have fulfilled the obligation to transfer the rights of claim specified in clause 1.1 of the Agreement, and the Assignee becomes a new creditor under Agreement No. 01/03/2016 dated 03/09/2016 in the amount described in clause 1.1 of this Agreement.

Is it possible to include additional terms and conditions?

If the assignment is accompanied by any additional conditions, it will already be considered factoring. This is a common example of an assignment agreement between legal entities. In such a situation, one company (usually having impressive working capital) buys the rights of claim from another.

For example, Alpha LLC owes Omega LLC 20 million rubles. The latter is experiencing serious financial problems due to such large accounts receivable. Then it decides to resort to factoring under the following conditions:

- JSC Delta acquires rights of claim against LLC Alpha.

- Omega LLC receives 19 million rubles, and one million goes towards payment for factoring services. In this case, Delta JSC pays him the specified amount immediately.

- For Alpha LLC, the amount of debt does not change. It still owes the same 20 million rubles, only now to another creditor.

Thus, an additional condition is the payment for redemption of the debt. It was required so that the party, which was initially not bound by obligations with either the creditor or the debtor, received its benefit from the transaction.

ConsultantPlus experts analyzed in detail what you need to know about the assignment agreement (assignment of the right of claim). Use these instructions for free.

RESPONSIBILITY OF THE PARTIES

3.1. Each Party is responsible for damage caused to the other Party if it arose through its fault as a result of non-fulfillment or improper fulfillment of contractual obligations.

3.2. The Assignor is responsible to the Assignee for the completeness and accuracy of the information and documents transferred in connection with this Agreement. If the Assignee incurs losses during the execution of this Agreement due to the fact that the Assignor provided incomplete or untrue information or documents (clause 2.1 of the Agreement), the Assignor undertakes to compensate for such losses.

3.3. The Assignor guarantees the existence and transfer of all rights assigned to the Assignee, the Assignor is responsible for the validity of the rights of claim transferred under Agreement No. 01/03/2016 dated 03/09/2016.

3.4. The Assignor is not responsible for the Debtor’s failure to fulfill the requirement transferred under this Agreement.

3.5. For violation of the deadlines for the transfer of documents (clause 2.1 of the Agreement), the Assignee has the right to demand from the Assignor payment of a penalty in the amount of 0.02% of the amount specified in clause 1.2 of this Agreement for each day of delay.

3.6. If the Assignee violates the deadline provided for in clause 2.3 of the Agreement, the Assignor has the right to demand payment of a penalty (fine). A penalty (penalty) is accrued for each day of delay in fulfilling the obligation, starting from the day following the day of expiration of the established deadline for fulfilling the obligation under this Agreement. The amount of such a penalty (fine) is set at one three hundredth of the key rate of the Central Bank of the Russian Federation in effect on the day of payment of the penalty of the unpaid amount, but not more than 2% of the amount specified in clause 1.2 of this Agreement.

3.7. The parties are released from liability if the damage is caused regardless of their will, i.e. due to force majeure.

In the event of the occurrence of these circumstances (force majeure), the Party for which proper performance has become impossible is obliged to notify the other Party in writing within 5 (five) working days. Untimely notification of force majeure circumstances deprives the relevant Party of the right to refer to them in the future.

The notification must be accompanied by a document issued by an authorized government agency confirming the presence and duration of force majeure. If force majeure circumstances occur, the deadline for fulfilling obligations under the Agreement is postponed in proportion to the duration of these circumstances, since these circumstances significantly affect the fulfillment of the terms of the Agreement on time.

Features of drawing up an agreement on the assignment of claims under a writ of execution

The agreement on the assignment of a claim (assignment) under a writ of execution is concluded in the same form as the main transaction, the obligations under which are transferred (Article 389 of the Civil Code).

The assignor is responsible for the validity of the transferred obligation, but is not obliged to guarantee that it will be actually fulfilled by the debtor.

ATTENTION! It is not allowed to enter into an agreement for the collection of alimony, harm caused to life or health, or other penalties when the execution is related to the personality of the creditor (Article 383 of the Civil Code, Part 2 of Article 388 of the Civil Code).

For a new creditor, it is not enough to just formalize an assignment agreement: it is necessary to apply to the court with a petition to replace the claimant (Article 48 of the Arbitration Procedure Code, Article 44 of the Code of Civil Procedure), and only after that such a replacement can be carried out by the bailiff (Part 2 of Article 52 of Federal Law No. 229- Federal Law). Therefore, it is necessary to provide four original copies - for the parties, the court and the bailiff.

FINAL PROVISIONS

5.1. This Agreement comes into force from the moment it is signed by both Parties.

5.2. This Agreement is drawn up in two copies, one for each of the Parties.

5.3. All changes and additions to the Agreement are valid if made in writing and signed by all Parties. The corresponding changes and additions are an integral part of the Agreement.

5.4. Unless otherwise provided by the Agreement, notices, notifications, demands and other legally significant messages (hereinafter referred to as messages) are sent by the Parties in any of the following ways:

- by registered mail with acknowledgment of delivery;

- courier delivery. In this case, the fact of receipt of the document must be confirmed by an acceptance mark, which contains its name and date of receipt, as well as the surname, initials, position and signature of the person who received the document;

- by fax, email or other method of communication, provided that it allows you to reliably establish who the message came from and to whom it was addressed.

5.5. The parties are obliged to immediately notify each other in writing of changes in their location, postal address, fax numbers, telephone numbers, bank details and email addresses.

5.6. In everything that is not provided for in the Agreement, the Parties are guided by the current legislation of the Russian Federation.

5.7. The Appendix to this Agreement, which is an integral part of the Agreement.

5.7.1. Appendix No. 1 - act of acceptance and transfer of documents (form).

The procedure for signing an assignment agreement under a writ of execution

Agreements on the assignment of a claim (cession) under writs of execution on the part of the assignor are authorized to be signed by the persons who initially have the right to receive fulfillment of the obligation, or their representatives by proxy.

The moment of transfer of the right of claim is determined by the date of signing the contract.

REFERENCE. The contract in question does not need to be concluded in the case of a legal transfer of rights: universal succession, fulfillment of obligations by the guarantor, subrogation to the insurer (Article 387 of the Civil Code of the Russian Federation).

You can study the rules governing this agreement in more detail in Resolution of the Plenum of the Supreme Court of the Russian Federation dated December 21, 2017 No. 54.

What rights and obligations do the parties have due to the agreement on the right to assign claims?

The second section of the assignment agreement reveals the rights and obligations of the parties, most often reflecting the terms of the debt transfer transaction. For example, the following basic conditions are indicated here:

- The period during which the assignor must transfer all documents to the assignee is indicated. These documents must confirm that he has the rights transferred to the latter. In this case, the same agreement mentioned in the first section of the document is often applied. This also includes all types of existing applications and additions to it (which the lender has).

- The assignor's obligation to inform the assignee about any additional requirements and circumstances of civil legal relations - if they connect him with the payer by providing the latter with a debt or loan.

- Assignment obligation, which consists in the fact that he is obliged to inform the payer that there is an assignment of rights of claim under the agreement concluded between them. This also includes the timing and form of such information. Let's say this paragraph may contain a provision that Petr Petrovich Ivanov is obliged to notify Alexander Alexandrovich Alexandrov about the transfer of his obligations to Ivan Ivanovich Ivanov. This procedure is carried out by sending a letter with notification of delivery. This clause must be present in the contract due to the provisions of Article 382 of the Civil Code of the Russian Federation. According to this article, the debtor must be notified that his obligations are transferred to another person.

- The conditions under which the former creditor transfers his own rights to the new creditor. For example, this paragraph may most often reflect the obligation of the assignee to pay money to the assignor. This is a kind of compensation for the assignment of rights of claim under the contract.

In the third section, it is necessary to include standard information - it should address the nature of the financial obligations that arise between the parties signing the assignment agreement. This section contains an indication of the amount of funds that must be paid and are considered compensation for the assignment of claims. The conditions for its payment are also indicated here: for example, the parties can enter into an agreement to pay such an amount in installments.

In this case, this paragraph may contain approximately the following wording: “The assignee is obligated to pay the assignor for the assigned rights of claim in the amount of 20,000 (twenty thousand) within three days from the moment this agreement was signed.”

Assignment agreement: postings to the assignee

The assignee takes into account the receivables acquired under the assignment agreement as a financial investment.

In the amount of actual costs incurred when purchasing receivables, and therefore in the initial cost of such an investment, you can take into account not only the amount of the debt itself, but also the following expenses (clauses 8, 9 of PBU 19/02, approved by order of the Ministry of Finance dated December 10, 2002 No. 126n):

- information, intermediary services;

- any other costs incurred during the acquisition of assets (financial investments).

Continuation of the example

The assignee reflects the transaction as follows:

| Accounting entries under the assignment agreement with the assignee | Sum | the name of the operation |

| Dt 58 Kt 60 (76) | 97 125 | Purchase of receivables |

| Dt 58 Kt 60 (76) | 5 000 | Costs for auditors taken into account |

| Dt 60 (76) Kt 51 | 97 125 | Funds were transferred to the assignor |

| Dt 51 Kt 91.1 | 118 125 | The debtor transferred the money to the assignee |

| Dt 91.2 Kt 58 | 102 125 | All expenses under the assignment agreement are reflected |

| Dt 91.2 Kt 68.2 | 2 666,67 | VAT charged on income (118 125–102 125) × 20 / 120 |

| Dt 91.9 Kt 99 | 13 559,32 | Profit from assignment agreement |

The peculiarities of accounting for transactions under an assignment agreement with the assignee were explained in detail by ConsultantPlus experts. Sign up for a free trial access to K+ and proceed to the manual to properly format your entries.

Assignment agreement: postings to the assignor

For clarity, let's look at the postings under the assignment agreement for all parties to the transaction using an example.

Example

Les LLC shipped lumber worth RUB 118,125 to Novaga LLC, including 20% VAT of RUB 19,687.50. The cost of lumber was 85,100 rubles.

Les LLC entered into an assignment agreement with Kotel LLC. The contract amount was 97,125 rubles, incl. VAT RUB 16,187.50 Kotel LLC consulted with auditors on the preparation of the assignment agreement, paying 5,000 rubles for the consultation. Kotel LLC transferred 97,125 rubles, incl. VAT, to the account of Les LLC.

The assignor reflects the transaction as follows.

| Accounting entries under the assignment agreement with the assignor | Sum | the name of the operation |

| Dt 62 Kt 90.1 | 118 125 | Lumber shipped |

| Dt 90.3 Kt 68.2 | 19 687,50 | VAT charged |

| Dt 90.2 Kt 41 | 85 100 | We write off the cost |

| Dt 90.9 Kt 99 | 15 005,93 | We reflect the profit on the transaction |

| Dt 76 Kt 91.1 | 97 125 | Assignment under an assignment agreement |

| Dt 91.2 Kt 62 | 118 125 | We write off accounts receivable |

| Dt 99 Kt 91.9 | 21 000 | Loss on sale of debt |

| Dt 51 Kt 76 | 97 125 | Payment received from Kotel LLC |

We also recommend that you read our article “Sale of accounts receivable – postings”.

The features of accounting for transactions under an assignment agreement for the assignor - the original creditor, as well as for the assignor - the new creditor, are discussed in detail in the ConsultantPlus system. Get trial access to K+ for free and proceed to the Guide.

Mutual settlements under assignment agreements in 1C: Accounting ed. 3.0

Published 08/28/2020 09:05 Author: Administrator The word “cession” comes from the Latin cessiō and is translated as transfer, assignment. Assignment agreements are used to transfer a financial obligation from one company to another. Let's imagine a situation: I bought goods from a deferred payment company. The deadline has come, but the funds have not arrived in the account. What options exist for the development of the situation? The first option is to argue with and wait for your money. The second option is to go to court, first writing a claim, and incurring legal costs. And the third option is to sell your rights to debt to collectors or other persons interested in this. The latter option is most often chosen due to the speed of closing accounts receivable and minimizing actions. What transactions reflect the assignment of rights 1C: Accounting ed. 3.0, who are the “assignor”, “assignee” and “debtor” we will talk in this article.

I would like to note that the cost of assigning rights does not coincide with the amount of debt. For example, a debt of one hundred thousand rubles can be sold for ten.

Another situation when they resort to an assignment agreement is when the parties agree to change the payer under the agreement.

Unfortunately, not all debt can be sold. If the contract contains a clause prohibiting the transfer of rights to third parties, then this cannot be done. Otherwise, the lender may hold you liable.

The legal norms for the transfer of creditor rights to other persons are enshrined in Chapter 24 of the Civil Code of the Russian Federation. When transferring the rights of a creditor to a third party, the original creditor is obliged to notify the debtor of the transfer of rights to the new creditor in writing. This position is set out in paragraph 3 of Article 382 and in Article 385 of the Civil Code of the Russian Federation.

The parties to an assignment agreement are named as follows: “assignor” is the one who transfers the rights and “assignee” is the one who accepts.

Let's consider the transfer of rights in the 1C software product: Accounting ed. 3.0. from all existing positions.

Assignor's position

When transferring receivables, the assignor receives other income in the form of funds received from the assignee, and other expenses in the amount of the transferred debt, which are reflected in accounts 91.01 and 91.02.

According to tax accounting, the difference between recognized income and expenses leads to a loss, which is recognized taking into account the provisions of Article 279 of the Tax Code of the Russian Federation.

If the assignment of rights occurred after the payment due date under the original agreement, the loss is recognized as a lump sum. And if before the payment deadline, then the loss from the operation is attributed to non-operating expenses and is normalized.

The maximum amount of loss that can be taken into account in this case is equal to the amount of interest that the assignor would have paid on the debt obligation, equal to the income from the assignment for the period from the date of assignment to the date of payment.

In our example, we will transfer the receivables after the debtor becomes due for payment.

First, let’s check the presence of debt using the “Account balance sheet” in the “Reports” section.

The transfer of debt in the program is reflected using the document “Operations entered manually” in the “Operations” section.

When you click on the “Create” button, select “Operation” from the drop-down menu. In the document that opens, click on the “Add” button and enter an entry to reflect other income in the amount of the redemption value of the debt by the assignee. The second line will reflect the write-off of the debtor's real debt as expenses.

When using account 91, you should create a new sub-account “Exercise of the right of claim” with the type of article: “Exercise of the right of claim BEFORE the payment is due” or “Exercise of the right of claim AFTER the payment is due”, depending on the actual situation. In our example, we chose AFTER.

All that remains is to receive funds from the assignee. Let's go to the section “Bank and cash desk” - “Bank statements” and reflect this action.

Debtor's position

A change of persons in an obligation does not affect the debtor’s VAT and the calculation of the tax base for income tax.

Before the assignment agreement, the debtor owed funds to one creditor, and now to another, and this fact should be reflected in the program using the “Debt Adjustment” document.

But first, let’s check the presence of accounts payable. To do this, go to the “Reports” section - “Account balance sheet”. In our example, accounts payable are formed under account 60 for the Assignor counterparty.

Suppose we receive written notice from the assignor that our debt has been transferred to the assignee. Let’s enter the “Debt Adjustment” document. You can open it from two sections: “Purchases” and “Sales”.

In the “Type of operation” column, select “Debt transfer”, and in the “Transfer” column – “Debt to supplier”.

Then you need to indicate the original and new creditors, and then click on the “Fill” button and from the drop-down list “Fill in the balances for mutual settlements.”

If you do not yet have any agreement with the new creditor, then you can create one directly from the tabular part of the document called “Notice of assignment of rights.”

When posted, the document will generate the following transactions:

This way your debt will be transferred from one person to another.

Position of the assignee

The assignee takes into account the acquired right of claim as part of financial investments, and it does not affect the tax base for income tax until income is received associated with the exercise of this right or with the receipt of funds from the debtor.

Let’s reflect the fact that we have received the right of claim; to do this, go to the “Purchases” section and select the “Receipts (acts, invoices)” item.

In the window that opens, click on the “Receipt” button and select “Services (act)” from the drop-down list. Mutual settlements with the assignor are traditionally reflected in account 76.09, therefore, after selecting a counterparty, it is necessary to manually adjust the settlement accounts. In the tabular part, we will add a new service, indicate an amount equal to the cost that we must pay to the assignor for the right of claim and assign this service to settlement account 58.05 with the subaccount - “Debtor”.

Now you need to transfer the value of the right of claim to the assignor; to do this, go to the section “Bank and cash desk” - “Bank statements” and create a “Write-off from the current account”.

Until this claim brings income to the assignee, it will remain listed on account 58.05.

Let's assume that we received funds from the debtor in the amount of 20,000 rubles (8,000 rubles is the price at which the debt was purchased, and 12,000 rubles is the income of the assignee).

Let's go to the "Sales" section and select the "Sales (acts, invoices)" item.

In the window that opens, click on the “Implementation” button and select “Services (act)” from the drop-down list. Then in the “Counterparty” column we will indicate the debtor, we will correct the settlement account to 76.06 and in the tabular part of the document we will add the total amount of debt, reflecting income and expenses from the transaction in accounts 91.01 and 91.02.

An important point regarding VAT!

The VAT rate should be adjusted to 20/120, and the VAT amount should be manually calculated from the amount of income from the transaction.

In our example, the income was 12,000 rubles. Let's calculate VAT: 12,000 * 20 /120 = 2,000 rubles.

When using account 91, you should create a new subaccount “Implementation of the right of claim” with the type of article “Implementation of the right of claim as the provision of financial services”.

Then you should post the document “Sales of services”, click on and in the transactions set the flag “Manual adjustment (allows editing of document movements)”. In the first line for the loan in tax accounting, the amount will be indicated without VAT; it must be corrected for the full amount of the concession, in our example - 20,000 rubles.

Then, in the second line, you need to correct the subaccount by debit to “Other income and expenses” with the form “Taxes and fees”, and by debit in tax accounting indicate the amount of VAT.

Next, you need to go to the “VAT Sales” tab and in the “Sale Amount” column, correct the amount to the actual income received from this transaction.

After that, click on the “Record and close” button and go back to this implementation.

In the footer of the document, click on the “Write an invoice” button and when it becomes a link, follow it to open the “Invoice” document. Here we need to change the transaction type code from 01 to 14 and save it using the “Record and close” button.

Unfortunately, when printing an invoice, you will have to adjust it manually, namely the amounts from which VAT was calculated. If the program blocks corrections in a printed form, you need to click on and then make changes. After editing, you can save this version of the invoice by clicking on and then selecting the location and format for saving.

The next stage of this transaction will be the receipt of funds into the account of the assignee. Let's go to the "Bank and cash desk" section and select the "Bank statements" item. Let’s enter a new receipt with the type of operation “Other receipt”, as shown in the figure below.

And the final stage will be to reflect the purchased debt from the assignor in the company’s income tax expenses. Let's go to the "Operations" section and select the "Operations entered manually" item.

In the window that opens, click on the “Create” - “Operation” button. Let's add a new line and enter the posting: Dt 91.02 Kt 58.05 for the amount of the purchase of the right of claim. These amounts must be reflected in both accounting and tax records.

Numerous regulations, namely paragraph 5 of Art. 271, paragraph 3 of Art. 279 of the Tax Code of the Russian Federation, letters of the Ministry of Finance dated March 24, 2017 No. 03-03-06/1/17042, dated August 6, 2010 No. 03-03-06/1/530) state that the assignee on the date of repayment of the claim:

• the entire amount received from the debtor is included in revenue. Income in the declaration is reflected on page 013 of Appendix 1 Sheet 02 (in our example it is 20,000 rubles);

• the costs of acquiring the requirement are included in the costs associated with production and sales. The expense in the declaration is reflected on page 059 of Appendix 2 to Sheet 02 (in our example it is 8,000 rubles);

• VAT accrued on the difference between income and expenses is included in indirect expenses (letter of the Ministry of Finance dated January 24, 2017 No. 03-03-06/1/3271) and is reflected on lines 040 and 041 of Appendix 2 to Sheet 02 (in our in example, this is 2,000 rubles).

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Olga 12.28.2021 19:17 Thank you very much! Helped out again!!!!

Quote

Update list of comments

JComments