How to apply for debt forgiveness between legal entities

Important!

Article 575 of the Civil Code of the Russian Federation prohibits the donation of assets between organizations, and therefore the debt forgiveness transaction must be formalized properly so as not to arouse suspicion from the tax inspectorate. The wording of the debt forgiveness agreement should be as clear and precise as possible.

The creditor has the right to forgive and write off the debt of the debtor organization on the basis of the provisions of Art. 415 of the Civil Code of the Russian Federation. The main thing is that the rights of the legal entity acting as a debtor are not infringed. If an organization objects to the debt being forgiven, its management notifies the creditor of such a decision.

Regarding the question of how to arrange debt forgiveness between legal entities, there are 2 options:

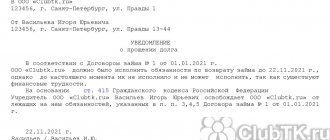

- Sending a written notice to the debtor about the amnesty of the obligations specified in the document

(in this case, the date of debt forgiveness is considered the day the debtor receives this notice). - Execution of a bilateral debt termination agreement

(supported by copies of contracts, initial forms and all other documents mentioned in the text of the agreement). Such a document must include the following information:

- the amount of debt that will be forgiven;

- subject of the transaction;

- absence of objections from the parties to the repayment of the debt;

- names of creditor and debtor organizations, details;

- circumstances and conditions under which the debt can be recognized as written off;

- details of the agreement between the parties, according to which one of the parties to the agreement incurred financial obligations of a credit nature;

- information about primary documentation proving the fact of the debt;

- an economic justification for the need for debt forgiveness, which would exclude the possibility of treating such a step as a donation transaction (the economic justification could be the provision of a discount on future supplies or the possibility of signing promising contracts).

In order for a debt forgiveness transaction between legal entities to be recognized as valid, it is necessary to draw up a reconciliation act between the parties to such an agreement, which would prove the veracity of information about the amount of the existing debt

. The lender must proceed as follows:

- draw up a reconciliation report with the debtor company;

- send the counterparty a notice of intention to forgive part of the debt or the entire debt;

- wait for a response from the counterparty in case he has any objections;

- document the transaction (form an agreement on debt forgiveness or draw up an additional agreement to the agreement on the provision of services, performance of work or supply of products).

Ways to forgive interest on a loan to a legal entity (sample agreement)

The main ways to forgive interest under a loan agreement between legal entities include:

1. Concluding an agreement to forgive interest on the debt.

It is fundamentally important that it does not contain provisions that would reflect the fact that debt forgiveness is carried out through a gift. The fact is that the transfer of gifts is more expensive than 3 thousand rubles. between commercial companies is prohibited (clause 4, clause 1, article 575 of the Civil Code of the Russian Federation).

The agreement must contain language that reflects the fact that its conclusion is beneficial for both parties (clause 3 of the Appendix to the information letter of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 104).

2. Drawing up by the creditor of a unilateral act of forgiveness of interest - in accordance with Art. 415 of the Civil Code of the Russian Federation.

Likewise, forgiveness of interest on such a deed should not look like a gift. It is optimal if the lender in the text of this document refers to the fact that he is satisfied with the amount of interest already paid and writes off the remaining interest so that the borrower can easily apply to him for a new loan later.

3. Conclusion of a settlement agreement (if the situation with the debt is resolved in court) on the write-off of interest.

The format of such an agreement and its content may be determined based on the specific results of court hearings.

You can find a typical document for forgiving the debt of one company to another - a bilateral agreement - on our website at the link below:

Accounting and postings (how to arrange debt forgiveness between legal entities)

Due to the fact that the forgiven debt cannot be taken into account when calculating the tax base, permanent differences arise in accounting with permanent tax liabilities - these discrepancies should be reflected in DEBIT 99 and CREDIT 68 . When concluding a transaction to forgive the debt of a legal entity, the following entries can be used:

| Operation | DEBIT | CREDIT |

| Recording the fact of sale of finished products | 62 | 90.1 |

| Calculation of value added tax | 90.3 | 68 |

| Reflection of the write-off of the actual cost of the shipped batch of goods | 90.2 | 41 |

| Transfer by the debtor of part of the debt amount at the expense of the supplier | 51 | 62 |

| Partial/full repayment of debt upon concluding a debt forgiveness agreement | 91.2 | 62 |

| Permanent tax liability based on a certificate-calculation | 99 | 68 |

A debt from a counterparty may arise not only due to late payment for shipped goods, but also as a result of obtaining a loan. In this case, the lender is obliged to keep separate records of the loan itself and the interest on it. At the stage of drawing up an agreement on the forgiveness of such a debt, it is necessary to provide a clause that would explain what amounts this agreement applies to - exclusively to borrowed funds or also to interest accrued on the loan.

Important!

The lender can initiate an agreement to forgive not the loan debt itself, but only the interest and penalties on it.

Here's what you need to remember about loan forgiveness:

- the forgiven debt in the amount of interest on the loan is not recognized as an expense transaction (see Letter of the Ministry of Finance of the Russian Federation dated December 31, 2008 No. 03-03-06/1/728), however, in accounting such an operation entails the appearance of expenses according to PBU 18/02;

- an entry is made in the accounting records DEBIT 91.2 CREDIT 76 for the amount of interest on the loan being written off;

- Since loans are not subject to VAT, there are no tax consequences for this type of tax when the interest debt is forgiven.

- After signing the debt forgiveness agreement, the accountant makes the following entries in the accounting registers:

| Operation | DEBIT | CREDIT |

| Reflection of the fact of issuance of borrowed funds | 58.3 | 51 |

| Monthly posting of interest accrual on the outstanding amount of the loan | 76 | 91.1 |

| Repayment of principal | 51 | 58.3 |

| Cancellation of loan interest specified in the debt forgiveness agreement | 91.2 | 76 |

| Fixation of permanent tax liability | 99 | 68 |

Question and answer: Taxation of the debtor and creditor using the simplified tax system

Question:

LLC (USNO 6%) issues an interest-bearing loan to individual entrepreneurs (USNO 6%).

The statute of limitations for loan repayment expires in 2022. LLC and individual entrepreneur decided to write off the loan as receivables (LLC) and accounts payable (IP). The loan amount and interest will be written off in full.

What will taxation look like for the debtor and the creditor?

Answer:

From the debtor:

Source: {Question: About accounting for income tax purposes for the amount of the loan and interest on it forgiven by the shareholder. (Letter of the Ministry of Finance of Russia dated March 18, 2016 N 03-03-06/1/15079) {ConsultantPlus}}

As for debt in the form of interest on a loan, written off by forgiving the debt, then, on the basis of paragraph 18 of Article 250 of the Code, these amounts are subject to inclusion in the non-operating income of the debtor organization.

Source: {Question: About accounting for income tax purposes for the amount of the loan and interest on it forgiven by the shareholder. (Letter of the Ministry of Finance of Russia dated March 18, 2016 N 03-03-06/1/15079) {ConsultantPlus}}

According to official explanations, in the general case , funds previously received under a loan agreement and remaining at the disposal of the organization as a result of forgiveness of its debt are considered as received free of charge. Such funds (the principal amount of the loan) are recognized as non-operating income on the basis of clause 2 of Art. 248, paragraph 8, part 2, art. 250 Tax Code of the Russian Federation. This point of view is confirmed, in particular, by Letter of the Ministry of Finance of Russia dated December 14, 2015 N 03-03-07/72930.

As for the forgiven interest under the loan agreement, the Russian Ministry of Finance and the tax authorities expressed the opinion that these amounts cannot be considered as property received free of charge, since there is no fact of transfer of these funds to the taxpayer. Such amounts are included in non-operating income on the basis of clause 18, part 2, art. 250 of the Tax Code of the Russian Federation (as the amount of written off accounts payable) (see, for example, Letters of the Ministry of Finance of Russia dated 03/18/2016 N 03-03-06/1/15079, Federal Tax Service of Russia dated 05/02/2012 N ED-3-3/ [email protected ] ).

The specified income is recognized in the reporting period in which the notification from the lender about debt forgiveness is received (clause 1 of Article 271 of the Tax Code of the Russian Federation).

From the lender:

Source: Deal Guide Debt forgiveness. Lender {ConsultantPlus}

The amount of the principal debt under the loan agreement is not included in the income of the lender (lender), regardless of whether the borrower returned this amount or the debt was forgiven upon its return. In this case, the method of recognizing income and expenses in tax accounting does not matter (clause 10, clause 1, article 251 of the Tax Code of the Russian Federation).

As for interest under a loan agreement, when applying the accrual method, they are recognized as part of non-operating income at the end of each month of using the loan, as well as on the date of termination of the loan agreement. In this case, the fact of payment does not matter (clause 6 of Article 250, paragraph 3 of clause 4 of Article 328, clause 6 of Article 271 of the Tax Code of the Russian Federation). Consequently, in the month of debt forgiveness to the borrower, the lender must recognize non-operating income in the amount of interest accrued under the loan agreement for the period from the 1st day of this month to the date of debt forgiveness (inclusive).

Regarding the accounting for profit tax purposes of the amount of forgiven debt, even in the case where the debt is partially forgiven in order to receive from the debtor the remaining amount of debt under the agreement, we note the following.

Based on the position of the Presidium of the Supreme Arbitration Court of the Russian Federation, given in Resolution No. 2833/10 of July 15, 2010 in case No. A82-7247/2008-99, the creditor has the right to recognize part of the debt forgiven to the debtor in order to receive from him the remaining amount of debt under the agreement, as part of non-operating expenses for profit tax purposes. This approach is due to the fact that debt forgiveness is aimed at generating income, but in a smaller amount. Despite the fact that the specified position of the Presidium of the Supreme Arbitration Court of the Russian Federation was formed in relation to the situation related to debt forgiveness under a supply agreement, in our opinion, this position is also applicable when debt is forgiven under a loan agreement.

However, according to the Russian Ministry of Finance, the amount of the forgiven debt, even in the case when the debt is forgiven partially in order to receive from the debtor the remaining amount of the debt under the agreement, is not taken into account as part of non-operating expenses for profit tax purposes. This position of the financial department is based on the fact that the amount of written off receivables is not a justified expense in accordance with Art. 252 of the Tax Code of the Russian Federation and forgiveness of part of the debt is not aimed at generating income. This conclusion follows, for example, from Letter of the Ministry of Finance of Russia dated 04/04/2012 N 03-03-06/2/34. Although this Letter concerns the situation related to the forgiveness of debt under a loan agreement, in our opinion, the conclusion made in it is applicable in the case under consideration. For existing points of view on this issue, see the Encyclopedia of Controversial Situations on Income Tax.

At the same time, we note that according to the clarifications of the Ministry of Finance of Russia (Letters dated 04.06.2015 N 03-04-05/32513, dated 07.11.2013 N 03-01-13/01/47571 (sent to the Federal Tax Service of Russia for information and use in the work of lower tax authorities authorities by Letter dated November 26, 2013 N GD-4-3/21097)) in a situation where the explanations of the financial department are not consistent with the decisions, resolutions, information letters of the Supreme Arbitration Court of the Russian Federation, as well as decisions, resolutions, letters of the Supreme Court of the Russian Federation, tax authorities in their work must be guided by the specified acts and letters of the courts from the day of their official publication in the prescribed manner or from the date of their publication in full on official websites on the Internet.

Thus, in the presence of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 15, 2010 N 2833/10, it can be assumed that the likelihood of disputes arising on the issue under consideration will decrease.

Simplified tax system and accounting with the lender when forgiving a debt under a loan agreement

When a debt is forgiven, the obligation of the debtor-borrower to the creditor-lender ends (Clause 1 of Article 415 of the Civil Code of the Russian Federation). An obligation as a result of debt forgiveness is considered terminated from the moment the debtor receives the creditor's notification of debt forgiveness, unless the debtor within a reasonable time sends an objection to the debt forgiveness to the creditor (Clause 2 of Article 415 of the Civil Code of the Russian Federation).

simplified tax system for debt forgiveness under a loan agreement

The amount of the principal debt on the loan is not included in the income of the creditor (lender), regardless of whether the borrower returned this amount or the debt for its repayment was forgiven (clause 1, clause 1.1, article 346.15, clause 10, clause 1, article 251 of the Tax Code of the Russian Federation ).

Regarding interest under a loan agreement when debt is forgiven, we note the following.

Income under the simplified tax system is recognized on the date of receipt of funds into bank accounts and (or) cash desks, receipt of other property (work, services) and (or) property rights, as well as repayment of debt to the taxpayer in another way (clause 1 of Article 346.17 of the Tax Code RF).

When a debt is forgiven, the amount of interest not paid by the borrower is not subject to payment to the lender. Such unpaid interest from the lender is not taken into account as part of income when determining the tax base under the simplified tax system. This conclusion follows from an analysis of the explanations given in Letter of the Ministry of Finance of Russia dated May 31, 2016 N 03-11-06/2/31354.

The review was prepared by specialists from the Consulting Institute of the Group of Companies "Zemlya-SERVICE"

Common mistakes

Error:

A legal entity enters into an agreement with its counterparty, the subject of which is the forgiveness of the full amount of a large monetary debt.

A comment:

In order to avoid claims from representatives of the tax inspectorate, a forgiveness agreement should be concluded, according to which only part of a large debt of a legal entity is subject to write-off. Otherwise, the Federal Tax Service will regard such an operation as a donation. Moreover, if debt forgiveness leads to material losses for the creditor, this must also be stated in the text of the agreement.

Error: A legal entity acting as a creditor entered into an agreement to forgive the debt of another organization without notifying the debtor counterparty.

Comment: The creditor is obliged to make sure that the other party to the transaction has no objections to

In what cases can a debt be forgiven?

Loan agreements between legal entities are always concluded in writing and can be either interest-bearing or interest-free. The norms of civil and tax law allow the forgiveness of formed debt. Such a transaction can either be part of a debt restructuring program at the lender’s company, or a mechanism for the lender to receive significant material benefits in the future.

Chapter 26 of the Civil Code of the Russian Federation is devoted to the concept of “debt forgiveness”. The debt forgiveness procedure completely frees the borrower from the need to repay the debt under a specific loan agreement.

First of all, third parties should not suffer from such a decision. For example, an organization asked to borrow from another legal entity the funds necessary to purchase raw materials. As confirmation, an agreement with the supplier company was provided. The lender must check whether payment has been made under the contract for the supply of raw materials and only after that begin the procedure for writing off the debt.

Articles of the Civil Code of the Russian Federation provide for the following cases for writing off debt between legal entities:

- the debtor has circumstances that prevent him from repaying the loan. Such circumstances must occur after signing the contract, according to Art. 415 Civil Code of the Russian Federation;

- liquidation of a legal entity (both borrower and lender) – Art. 419 Civil Code of the Russian Federation;

- issuance of an act of a state authority or local government that does not allow the debtor to repay debt obligations – Art. 417 of the Civil Code of the Russian Federation.

Answers to common questions about how to apply for debt forgiveness between legal entities

Question #1:

Can legal entities enter into an agreement to forgive part of the debt or the full amount of the debt for the purpose of debt restructuring?

Answer:

Yes, such an agreement may be part of a debt restructuring program thought out by both parties to the transaction. Such a transaction is seen as a compromise to avoid debt falling into the category of uncollectible debts.

Question #2:

If a legal entity has officially forgiven the debt of the debtor's organization, does the debtor need to impose income tax on income received from founders or commercial companies with a stake of more than 50% in the authorized capital of the debtor company?

Answer:

No, according to Art. 251 of the Tax Code of the Russian Federation, such income is not required to be subject to income tax if the company’s debt is forgiven.

What tax consequences might there be?

Tax legislation in the Russian Federation is presented in a document called the Tax Code. In accordance with this document, every person who is a citizen of the Russian Federation is obliged to pay certain taxes.

The main taxes that legal entities are required to pay include value added tax and income tax.

Value added tax applies exclusively to goods and property of enterprises. In the case of forgiveness of a debt provided by one company to another and expressed in cash, this type of tax does not arise. And accordingly, you don’t have to pay for it.

The tax base for corporate income tax consists of direct income generated as a result of the activities of the enterprise and income associated with the implementation of third-party activities, which are called non-operating.

If a legal entity - the borrower enters into an agreement on debt forgiveness, then the entire loan amount should be attributed to non-operating income. Consequently, the borrowing company is obliged to pay income tax on the entire amount of the forgiven debt.

All rules and laws have their exceptions. This applies to the payment of income tax of a legal entity.

If the lender organization forgives the debt of the borrower organization, and the lender is the founder of the borrower (that is, the borrower is a subsidiary) and the lender’s share in the borrower’s authorized capital is more than 50%, then the forgiven debt is not included in non-operating expenses. And, therefore, is not subject to income tax.

Features of the debt forgiveness procedure

The debt forgiveness procedure, according to economic experts, is similar to a gift transaction, but it has its own distinctive features:

- debt cancellation is always a two-way transaction. The decision to forgive cannot be made unilaterally by one of the parties to the loan agreement;

- The debtor does not pay the creditor a commission for writing off the debt. If this happens, the transaction is declared invalid, and the amount paid is counted towards the write-off of the principal debt;

- not only the main debt under a specific agreement is forgiven, but also the amount of accrued penalties for late repayment of the obligation;

- the debt write-off agreement contains an economic justification for the need for this procedure.

Important! Counterparties who decide to write off loan debt should carefully study the legislative norms so that the document drawn up does not have a double interpretation. Asset gift agreements are prohibited between legal entities. This is why the language in the debt forgiveness agreement must be clear.

Auditors advise the parties to be sure to indicate in the text of the agreement that the transaction is not an act of gift, and also to write off not the entire debt, but most of it. For the remainder of the debt, a new payment schedule is established, which will not be burdensome for the creditor. This will reduce the risks of recognizing the forgiveness agreement as an act of donation to a minimum.

If the debtor’s financial situation does not allow him to pay the minimum part of the debt, this fact should be recorded in the text of the agreement, confirmed by relevant calculations and documents.

Drawing up an agreement between legal entities

In a situation where the termination of obligations between companies on the basis in question is formalized, it is important that it is not considered as a gift. Otherwise, the transaction is declared invalid. The corresponding consequences according to the law apply to it: this can cause trouble for the parties. Therefore, the participants’ documents always reflect the absence of the will of the creditor, with the desire, first of all, to reward the debtor. Evidence of the absence of this intention is:

- Failure by the debtor to pay part of a debt obligation in order to ensure that he returns the rest of the amount without recourse to a judicial authority.

- The presence of a property benefit to the lender under another obligation of the debtor for the purpose of economic recovery of branches.

- Other circumstances in which debt amnesty meets the criteria for a reimbursable agreement.

The law does not prohibit verbal mutual consent between the lender and the borrower. But having the document in writing will help participants avoid adverse legal consequences . Documents can be sent to the parties to the agreement via mail or courier, email, or fax. In addition to the agreement, a reconciliation act for mutual settlements is created. The document records the basis for the debt, confirmation of its existence, and size. In addition, given the additional nature of the agreement, it is necessary to indicate the main legal relationship under which the debt was created. The reconciliation report is also sent to the parties via the above communication channels.

Sample debt forgiveness agreement

Example 1. Loan forgiveness for an employee

In October, the employee was given a loan of 120,000 rubles. for 6 months at a rate of 3%.

On January 10, 2022, it was decided to forgive the loan debt and interest. The amount of the principal balance at the time of loan forgiveness is RUB 60,000.

Interest amount for January:

- 60,000 (debt balance) * 3% * 10 (days of using the loan in January) / 365 (days per year) = 49.32 rubles.

The total amount of forgiven debt, including interest, is RUB 60,049.32. Personal income tax deductions are not applied to the employee. We will reflect debt forgiveness in accounting for loan payments and for the purposes of calculating personal income tax.

Let’s create a “technical” document Repaying a loan to an employee . After selecting an employee and a loan agreement, the program automatically calculated the balance of the debt and interest on the date of debt forgiveness (01/10/2022). We indicate the total amount of debt in the Amount .

When conducting the Loan Repayment document for the employee, the material benefit from savings on interest and personal income tax was also calculated. The amount of financial benefits and personal income tax can be seen:

- In salary reports. For example, in Payslip (Salary - Salary Reports).

- In personal income tax reports. For example, in Detailed analysis of personal income tax for an employee (Taxes and contributions - Reports on taxes and contributions).

If you want to close a loan debt, but do not accrue interest or calculate material benefits, this can be done using the Data Transfer (Administration – Data Transfers). In the Mutual settlements for loans to employees , we will add an entry with the type of movement Expense for the amount of the balance of the debt.

To register the amount of forgiven debt in accounting for personal income tax and contributions, we will create a new Accrual with the purpose Income in kind .

If the program does not allow you to set up an accrual with the assignment Income in kind , check Setting up the composition of accruals and deductions (Settings - Payroll - Setting up the composition of accruals and deductions). On the Other accruals , the Register natural income checkbox must be selected .

On the Taxes, contributions, accounting we will set the parameters for taxation of personal income tax.

If an uncollectible debt is written off from the debtor, such income is reflected in the personal income tax accounting with code 2611 . You can replace the income code for natural income by processing a Group change of details (Administration - Maintenance - Data Adjustment).

Before performing processing, be sure to make a backup copy of the database, because... In case of an error, the processing action is irreversible!

In the processing form, select the Accruals and click on the All elements to open a window for selecting a specific accrual.

For the personal income tax code , set the value to 2611 and perform processing.

We will reflect the income in the amount of the forgiven debt in the document Income in kind . In the Date of receipt of income , we will indicate the day the debt was forgiven - 01/10/2022. Personal income tax was calculated immediately in the document.

Let's check the calculation of personal income tax on the amount of forgiven debt:

- 60,049.32 (forgiven debt) * 13% = 7,806 rubles.