The assignment of debt under civil law can be implemented in two options:

- assignment of the right of claim when the creditor changes (Articles 388-389 of the Civil Code of the Russian Federation);

- transfer of debt, as a result of which the debt to the creditor is repaid by a third party - the procedure is regulated by Art. 391-392 Civil Code of the Russian Federation.

The first option does not require the consent of the debtor; agreements between the creditor and the company buying the debt are sufficient. The exception is when the identity of the creditor is significant. In the second case, the debt transfer is carried out through negotiations and reaching a compromise solution by all parties to the transaction.

Postings under the agreement for the assignment of the right of claim from the creditor, acting as the buyer of the debt, are processed through account 58. For this participant in the transaction, the loan amount is a financial investment. The transaction is confirmed by documents substantiating the amount of debt - an agreement with the debtor, invoices, claims, acts. The object of assignment cannot be personal debts:

- alimony payments;

- amounts awarded for moral damage caused;

- the amount of compensation awarded for material damage caused.

Debt transfer agreement

This is a procedure in which the original debtor transfers debt obligations to another party, who will become the new debtor.

The creditor of the original transaction must give his consent to such castling. Otherwise, the transaction is considered void. Article 391 of the Civil Code of the Russian Federation describes in detail the rules by which an agreement for transferring a debt from a debtor to a new debtor is drawn up, and the conditions for recognizing it as invalid. For the legal transfer of rights and obligations, it is necessary that the contract be concluded in the form in which the original transaction was drawn up. For such agreements, one of the following forms is acceptable:

- simple written;

- certified by a notary.

If the original document was subject to mandatory state registration, then when delegating the debt, this procedure must be repeated.

Taking these features into account, we will analyze some of the clauses of the agreement and consider the essential terms of the debt transfer agreement. When giving recommendations, we will use algorithms offered by the Contract Designer program, presented by the ConsultantPlus legal system.

Preamble

This section indicates the parties to the transaction, which are:

- original and new debtors;

- creditor, but only by expressing his consent;

- creditor and new debtor.

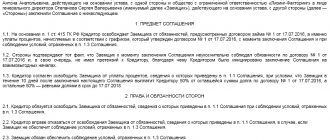

We will consider the option when the parties to the agreement are individuals (former and new debtors). Since the creditor is interested in the debtor fulfilling the obligation properly, the identity of the new counterparty is important to him. It is necessary to have the written consent of the creditor or his signature on the document. Otherwise, the transaction will not entail any legal consequences, and the obligation will remain with the original debtor.

When obtaining the creditor's consent to transfer the debt, it is necessary to avoid general language. He must agree to transfer the debt to a specific person or limited group of persons. If a creditor is involved in concluding a transaction, then it is necessary to indicate the name of the creditor and the person who has the right to express consent to the procedure on behalf of the creditor.

BASIS: VAT

There are no changes in the creditor's accounting

The original debtor must not restore the deductible VAT from the cost of the goods received. After all, payment is not a condition for a deduction (clause 3 of Article 170, clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation).

The new debtor must pay the creditor for the goods that he delivered to the original debtor. In this case, the new debtor does not have the right to deduct VAT. This is due to the fact that he did not purchase the goods and does not have an invoice from the creditor (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation). The original debtor exercised the right to deduction.

Situation: does the buyer (creditor) need to restore VAT from the advance payment, which he accepted for deduction, if the seller did not fulfill the delivery conditions and, with the consent of the creditor, the advance payment was returned by his counterparty?

Yes need.

The conditions for VAT restoration are met, namely:

- the parties changed or terminated the contract;

- the creditor received the advance.

This procedure is established in subparagraph 3 of paragraph 3 of Article 170, paragraphs 2 and 12 of Article 171, paragraph 9 of Article 172 of the Tax Code of the Russian Federation.

In fact, the seller did not return the money to the buyer. But the buyer agreed that the advance would be returned by a third party. Thus, the seller's accounts payable are extinguished. Therefore, the buyer needs to restore the VAT (paragraph 2, clause 5, article 171 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated September 11, 2012 No. 03-07-08/268).

Subject of the agreement

The subject is the principal debt and penalty transferred to the new debtor. In order for the subject matter condition to be agreed upon, the parties must indicate in the document the basis for the obligation, its content and scope.

The procedure can be carried out both in relation to an obligation arising from a contract and in relation to a non-contractual obligation. Thus, the parties indicate the basis for their occurrence.

Next, it is necessary to determine the volume and content of the transferred obligation. Replacement of debt in both monetary and non-monetary obligations is acceptable.

The transfer is carried out not only in relation to the principal debt, but also in relation to penalties or interest for the use of other people's funds. Moreover, an isolated transfer of the obligation to pay penalties or interest is allowed. In this case, the contract must indicate the extent to which the obligation is transferred. If only the main obligation is intended to be transferred, it is advisable to indicate in the agreement that the obligation to pay the accrued amounts of property sanctions remains with the original debtor.

Peculiarities

Real estate assignment agreement

A standard situation for the real estate market is when apartments or other property are sold while the mortgage or loan is still outstanding.

In such a situation, the requirement becomes a notification to the bank that the person who is the borrower must change. At the same time, the banking organization conducts an inspection. After all, not only does the bank have to give its consent to this. He must also make sure that the person is able to repay the outstanding debt. Consent from the bank must be obtained in writing. After this, the bank designates the debt figure for the new “owner”.

Insurance Assignment Agreement

The term “risk allocation” is important here. It means that one insurance company transfers the risk to another. The lender changes accordingly.

The governing law here is Art. 965. Civil Code of the Russian Federation. O According to it, the rights of the insured to be compensated for the material damage described in the concluded contract are transferred to the insurer.

The most common option is selling a car by proxy.

But not all insurance agents agree to this course of action. Again, turning to practice, it should be noted that in insurance under a compulsory car insurance policy there is a ban on assignment. This is explained by the fact that it is in this area that fraud schemes are not uncommon.

Assignment agreement under a supply agreement

Here we are primarily talking about cases where a banking organization acts as an intermediary between firms. One company assigns its rights to claim debt from another company to the bank (factoring). The bank itself receives a certain percentage from this.

In this procedure, the factoring organization will control the receivables. Typically, banks themselves make a request for a package of documents that could confirm the completion of work or the sale of goods with a delay - that is, the completion of a certain service. Assignment agreement under a work contract

The most important thing to understand here is that the customer can assign his duties to the contractor to a third party only if the contractor himself gives his consent in writing. And since all parties are endowed with their own responsibilities, it is impossible to do without concession of demands. The third participant, along with the obligation to pay for the work, also receives the opportunity to demand this work be performed.

Assignment in credit operations

The most common cases of using this type of assignment agreement are violations under loan agreements by the debtor. A banking organization sometimes uses its legal right to terminate the contract with the borrower, after which it demands the entire amount of the debt in its entirety. And the debt is transferred to collectors.

In this scenario, the collection agency receives the status of assignee and, in its own ways, “knocks out” the debt. As we all know, these very “methods” of collectors are currently a topic that has received resonance in society and the media, so they are already beginning to say that transferring debts to collectors is, in principle, not at all legal. After all, in order for the debt to be transferred to another “agency”, this agency must have a license. And banks, who do not know, do not have the right to advertise information about their clients.

The only advice we can give here is to read the contract. It’s as old as the hills, but nevertheless, 99 percent of people don’t follow it. But in vain.

Bankruptcy assignment agreement

We have already mentioned this in passing above. The point is that a company, during its bankruptcy, is trying to reduce its accounts receivable at least a little. Moreover, there is a risk that the tax authorities will later recognize the transaction as invalid, precisely because of the bankruptcy procedure. In this option, you need to draw up a document in the form of a memo, which will explain that it is no longer possible to collect the debt.

If you need a sample assignment of debt, you can freely find it on the Internet or download it from our website.

Conditions for the execution of the contract

In this section, the parties must reflect the presence of the creditor's consent to the transaction. Consent may be obtained in advance or expressed by the creditor by signing a debt transfer agreement. In the latter case, there is no doubt that the lender agrees to the transaction.

Execution of the contract involves the transfer to the new debtor of documents confirming the transferred obligations. The parties agree on the list of documents to be transferred, the timing and procedure for their transfer.

Features of the assignment

When they talk about assignment, they mean a waiver of demands for repayment of a debt in favor of another. But not all of them can be conveyed in reality. For example, if we talk about obligations that are of the personal type. For example, alimony, compensation (and this can be compensation for any harm). All this is not subject to legal transfer.

Why is an assignment agreement used? Because (most often), the one who should receive a certain “debt” has no way to collect it. Situations can be different - from the division of obligations between private owners, to the reorganization of companies.

The claim is transferred and sold, depending on the situation, and the person on whom the obligation remains is later sent a written notification that the assignment contract has been concluded.

Responsibility of the parties

This section provides for liability in the form of penalties for violations by the parties of their obligations. Thus, a penalty is established for the following violations committed by the original debtor:

- for late payment of the process fee;

- for failure to provide or for untimely provision of documents confirming the transferred debt.

When establishing a penalty, it is necessary to agree on its size and the period for which the penalty is paid.

A penalty is also established in case of violation of the terms of the contract by a new debtor, for example:

- in case of failure to notify the creditor of the procedure;

- when evading state registration of an agreement.

When establishing a penalty, the ratio of the penalty and losses is determined. As a general rule, damages are recovered in the part that is not covered by the penalty.

Termination of an agreement

The document entails the transfer of obligation from the original debtor to the new one, i.e., the execution of the contract in this part is carried out at the time of its conclusion. In the event of termination of this agreement, the obligation loses its basis, and, accordingly, it is necessary to restore the property status of the parties. The consequence of termination of the contract is the reverse transfer of the debt.

Practice has shown that reverse transfer of debt is possible only if it is provided for in a document or on the basis of a court decision. The reverse process also requires the consent of the lender.

Termination of the contract is possible after its execution. The consequence of such termination will be the obligation to compensate the counterparty for losses.

Termination of obligations may be associated with either judicial termination or unilateral refusal. Unilateral refusal is possible if at least one of the participants in the legal relationship is an economic entity (commercial organization or individual entrepreneur).

If a transaction is concluded between an entrepreneur and a person who does not carry out entrepreneurial activities, only the latter has the right to refuse unilaterally.

Registration of the assignment agreement in the state register

This requirement applies if the assignment agreement is formed during transactions with real estate.

Important! Until registration, the document will not be considered valid.

What do you need to do for this? It’s simple - you transfer copies of documents to the Federal Reserve System (information), which will be certified by a notary. What are these documents:

- Share participation agreement (it also had to be previously registered in the register).

- An assignment agreement for the right to claim or transfer debt (must be included in the package of documentation and papers that will confirm the process).

- Certificate of registration of a legal entity.

- Extract from the Unified State Register of Legal Entities

- Documents confirming the right of the person submitting them.

Don't forget to plan your time. The registry will take up to 30 days to review.

Registration of transactions with non-residents

This niche is of interest primarily to those companies that are involved in the import or export of goods.

In this type of transaction, when the legal entity is a resident and the debtor is not a resident, it is also required to issue a transaction passport (analogy with foreign exchange processes). And in the case when a foreign person changes to another, the passport is issued again. The regulating document in this case is the law “On Currency Regulation and Control”.

Accounting and taxes

We must not forget that if the assignment agreement is not just transferred, but is compensated, then VAT is charged!

How exactly to calculate the tax: the tax base will be taken as the result after deducting the price of the debt and the price for which it is sold.

And the difference between the initial debt and the amount paid by the new creditor is written off at a loss.

According to the accounting entries, transactions are also carried out both on the part of the assignor and on the part of the assignee.

Dispute Resolution

In this section, the parties must determine the procedure for resolving potential disagreements, establishing the deadlines for submitting and considering claims and the procedure for performing these actions. This chapter should also determine the jurisdiction of disputes that arise.

It must be taken into account that in the contract the original and new debtors determine the jurisdiction of only their internal disputes. For disputes arising between a new debtor and a creditor, the general rules on jurisdiction established by law or the rules that were agreed upon by the parties at the conclusion of the transaction apply.