Leasing today is a very popular form of business relationships, as it allows you to obtain the necessary fixed assets quickly and with minimal initial investment. Motor vehicles quite often become the object of leasing. If transport is involved in the transaction, the question of paying a transport fee naturally arises.

Which party to the leasing transaction is entitled to undertake the obligation to pay transport tax (TN) depends on a number of circumstances, which we will examine in this article.

Parties to the leasing agreement

Leasing a vehicle is a financial transaction made regarding the transfer of certain property for use, in our case a vehicle, drawn up in the form of an agreement. As with any leasing agreement, it stipulates the period for which the asset is provided for use, and at the end of this period the vehicle can be retained or returned.

There are always three parties to a leasing agreement:

- lessor - an individual or organization that buys any property (including vehicles) from the owner, but not for their own use, but to transfer this right;

- lessee - a legal or private person who receives the specified vehicle for paid use for an agreed period;

- supplier (seller) – the primary owner of the subject of the contract from whom the lessor purchases the property for leasing.

Which of these parties is required to pay transport tax? This depends on a number of parameters, which will be discussed below.

Car leasing: accounting and taxation

The material was provided by the corporate publication for clients of the IRBiS Group of Companies “System of Success”

Machines and equipment are necessary in the activities of almost any organization. However, during a crisis, when the budgets of organizations are already cut to the limit, companies simply do not have free funds to purchase transport, but the need remains the same. In this situation, a business will be able to benefit from purchasing cars through LEASING.

Organizations that do not have sufficient capital select the most suitable leasing company and draw up a leasing agreement with it, which stipulates that at the end of the agreement the property will be transferred to the lessee through redemption. The company selects the required car, makes an advance payment to the lessor and after a certain time receives the vehicle at its disposal. Typically, the leasing agreement also includes a schedule for payment of lease payments, according to which payment for the property occurs - gradually and evenly. And after paying all payments due under the contract, if this is provided for in the contract, the lessee finally transfers ownership of the car. The internal aspects of a leasing transaction are regulated by an agreement drawn up between the companies, but the legal and organizational and economic features are enshrined in the Federal Law of October 29, 1998 N 164-FZ “On financial rent (leasing)” (hereinafter referred to as Law N 164-FZ), as well as in the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation).

In accordance with Art. 2 of Law N 164-FZ, under a leasing agreement, the lessor must acquire ownership of the car specified by the lessee from the seller and provide it to the lessee for a fee for temporary possession and use for business purposes. But the obligations of the lessee to pay lease payments in accordance with clause 3 of Art. 28 of Law N 164-FZ begins from the moment the lessee begins to use the leased asset, unless otherwise provided by the contract. The leased property is transferred to the lessee on the basis of the Transfer and Acceptance Certificate ( Form N OS-1 ). A car purchased under lease, according to the terms of the contract, can be either on the balance sheet of the lessor or on the balance sheet of the lessee, but in our article we will consider the second option, which is most often encountered (the car is on the balance sheet of the lessee). ACCOUNTING:

The general procedure for accounting for transactions under leasing agreements is prescribed in Order No. 15 of the Ministry of Finance of the Russian Federation dated February 17, 1997 “On the reflection in accounting of operations under a leasing agreement” (hereinafter referred to as Order No. 15). Clause 4 of this Order No. 15 specifically reflects the accounting procedure in cases where property is taken into account on the balance sheet of the lessee.

In accordance with paragraph 8 of Order No. 15, the cost of leased property received by the lessee is reflected in the debit of account 08 “Capital investments”, subaccount “Purchase of individual fixed assets under a leasing agreement” in correspondence with the credit of account 76 “Settlements with various debtors and creditors ", subaccount "Rental obligations". The costs associated with obtaining leased property and the cost of the received leased property are written off from the credit of account 08 “Capital Investments”, sub-account “Purchase of individual fixed assets” in correspondence with account 01 “Fixed Assets”, sub-account “Leased Property”.

In this case, the value of the leased property means the entire amount of payments due under the leasing agreement, including the redemption price (if provided). Depreciation deductions are made by the party to the leasing agreement on whose balance sheet the leased asset is located. In accounting, depreciation charges are reflected in the debit of the accounts for accounting for production (circulation) costs in correspondence with account 02 “Depreciation of fixed assets.”

The accrual of leasing payments due to the lessor is reflected in the debit of account 76 “Settlements with various debtors and creditors”, subaccount “Lease obligations” in correspondence with account 76 “Settlements with various debtors and creditors”, subaccount “Debt on leasing payments”. The useful life of a car received under a leasing agreement, which is recorded on the lessee’s balance sheet, is determined by the lessee independently in the manner prescribed by clause 20 of PBU 6/01 “Accounting for fixed assets.”

When purchasing leased property in accordance with clause 11 of Order No. 15, its value on the date of transfer of ownership is written off from off-balance sheet account 001 “Leased fixed assets”. At the same time, an entry is made to this value in the debit of account 01 “Fixed assets” and the credit of account 02 “Depreciation of fixed assets”, subaccount “Depreciation of own fixed assets”. Very often, in order to protect yourself from sharp fluctuations in the ruble exchange rate, leasing agreements are drawn up in foreign currency. As a result, exchange rate differences arise in the organization. Since January 1, 2007, accounting for exchange rate differences in accounting is carried out in accordance with clauses 11-14 of section III “Accounting for exchange rate differences” PBU 3/2006 (approved by order of the Ministry of Finance of the Russian Federation dated November 27, 2006 N 154n).

“ Exchange rate difference is the difference between the ruble valuation of an asset or liability, the value of which is expressed in a foreign currency, on the date of fulfillment of payment obligations or the reporting date of a given reporting period, and the ruble valuation of the same asset or liability on the date of its acceptance for accounting in the reporting period or the reporting date of the previous reporting period.” (clause 2 of PBU 3/2006).

It is also important that all differences associated with changes in exchange rates, including for assets denominated in foreign currency or liabilities payable in rubles, are now considered for accounting purposes as exchange rates. Recalculation of the value of liabilities expressed in foreign currency is carried out at the rate in effect on the reporting date (clause 8 of PBU 3/2006).

The cost of investments in non-current assets (fixed assets, intangible assets, etc.), inventories and other assets expressed in foreign currency in accordance with clause 9 of PBU 3/2006 is accepted in the assessment in rubles at the rate in effect on the date of the transaction in foreign currency, as a result of which these assets are accepted for accounting. After accepting these assets for accounting purposes, recalculation of their value due to changes in the exchange rate is not carried out on the basis of clause 10 of PBU 3/2006.

Based on clause 5 of PBU 3/2006, the conversion into rubles of the value of an asset or liability expressed in foreign currency, payable in rubles, is carried out at the official exchange rate of this foreign currency to the ruble, established by the Central Bank of the Russian Federation. But if a different rate is established by law or agreement of the parties, then the value of the asset or liability is recalculated at a different rate.

As a rule, the parties to the agreement determine how the ruble equivalent of the obligation will be determined. Especially for this purpose, the date of fulfillment of the obligation and the exchange rate are fixed. Most often, the parties establish the amount of the obligation on the date of payment, and the rate is tied to the rate of the Central Bank of the Russian Federation with a slight increase in the rate. Let’s say the contract may state: “the US dollar rate established by the Central Bank of the Russian Federation on the day of payment, plus 2 percent”

There is an opinion that if the cost of a service under the terms of the contract is determined at the exchange rate on the date of payment, then with advance payment (advance payment), the amount of the obligation will not change in the future. Therefore, if the leasing agreement states that payment and accrual of payments are carried out on the date specified in the payment schedule, this means precisely the date of payment. Therefore, in accounting there is no need to revaluate the ruble advance , the equivalent of which is determined in conventional units on the date of payment .

Exchange differences on such obligations do not arise in accounting, and as a result, there is no amount difference. But in order not to take risks and not face claims from tax authorities, it is better to reflect exchange rate differences in accounting. If the lease payment is made before it is accrued in accounting, then a receivable is formed 76 On account 76 , the sub-account “Debt on leasing payments” reflects the difference resulting from changes in exchange rates, and, depending on changes in the dollar exchange rate, means the debt of either the lessee (when the rate increases) or the lessor (when the rate decreases).

Account 76 corresponds with 91 . The subaccount of account 91 (1 or 2) is selected depending on whether the exchange rate has decreased or increased, the organization’s income or expenses. TAX ACCOUNTING: INCOME TAX In accordance with paragraph 7 of Art. 258 of the Tax Code of the Russian Federation, property received under financial lease is included in the corresponding depreciation group by the party whose balance sheet it is taken into account under the leasing agreement. The lessee, who accounts for the car on his balance sheet, must depreciate it. But before that, the car must be assessed. And in accordance with clause 8 of Order No. 15 in accounting, the initial cost of the car will be equal to the amount of lease payments excluding VAT.

Thus, the initial cost is defined as the sum of the lessee's expenses for the acquisition, delivery, construction, manufacturing and bringing the property to a condition in which it is suitable for use. It is necessary to exclude from this cost only the amounts of taxes that are subject to deduction or reflected as expenses in accordance with the law (clause 1 of Article 257 of the Tax Code of the Russian Federation). Leasing payments minus the amounts of accrued depreciation on the property accepted on the balance sheet are taken into account by the lessee as other expenses associated with production and sales, and can be accepted as income tax expenses. Be careful! If the leasing agreement does not specify the purchase price, then all expenses can be written off in the period in which they were incurred. Therefore, it is much more profitable for the lessee not to separate the purchase price and leasing payments in the agreement.

Well, if the purchase price is still specified in the agreement, then the costs of paying the purchase price can be written off in tax accounting only in the period when the leasing agreement is fully executed. Officials in their letters defend the opposite point of view and point out that it is necessary to take into account the purchase price and leasing payments separately. And the leasing payment itself must be classified as other expenses only to the extent that it is paid for receiving the leased asset for temporary possession and use. In this case, the redemption price of the leased asset is not taken into account for profit tax purposes (letters of the Ministry of Finance of Russia dated April 27, 2007 N 03-03-05/104, dated March 4, 2008 N 03-03-06/1/138, dated June 25, 2009 year N 03-03-06/1/428).

In such cases, the courts take the side of the taxpayer. In their opinion, despite the fact that the calculation of the lease payment includes several components, it cannot be considered as several independent payments (determination of the Supreme Arbitration Court of the Russian Federation dated May 21, 2008 N 6373/08, resolution of the Federal Antimonopoly Service of the Moscow District dated May 17, 2007 N KA- A41/2186-07, FAS Moscow District dated January 21, 2008 N KA-A40/13000-07, FAS Central District dated February 11, 2009 N A35-1589/08-C21, FAS Ural District dated January 29, 2007 N F09 -12271/06-C3 in case No. A60-16332/06). As a result, we can conclude that other expenses include the payment amount, which is calculated using the following formula:

Sraskh = Plliz - Am

where: C exp - the amount taken into account as part of other expenses; Pl lease - leasing payment; Am - accrued depreciation. But in order to avoid possible problems with the tax authorities, it is best to indicate in the contracts a more or less real redemption value under leasing agreements, i.e. not deviating from market prices by more than 20% (Article 40 of the Tax Code of the Russian Federation). But if, nevertheless, the redemption price has not been determined, and the entire amount of lease payments is included in expenses, then the taxpayer will have no problem defending his point of view in court. Be careful! Until January 1, 2009, in accordance with paragraphs 7 - 9 of Art. 259 of the Tax Code of the Russian Federation for passenger cars with an original cost of more than 600,000 rubles and leased, the basic depreciation rate was applied with a special coefficient of 0.5. Since January 1, 2009, this norm has been canceled, and the coefficient of 0.5 does not apply! To document expenses under a leasing agreement in accordance with letter of the Federal Tax Service of the Russian Federation dated 09/05/2005 N 02-1-07/81, it is sufficient for the lessee to have only a leasing agreement with a payment schedule and an acceptance certificate for the leased property. VALUE ADDED TAX In leasing transactions, VAT payable to the budget is charged by the lessor, and a legal entity acting as a lessee has the right to a refund of the tax charged.

The legislation of the Russian Federation does not provide for a special procedure for deducting VAT during leasing operations, which is confirmed in the letter of the Ministry of Finance of Russia dated July 7, 2006 N 03-04-15/131. Well, since no special features are provided, it turns out that if the amounts of the redemption value of the property are included in leasing payments, the deduction of value added tax paid by the lessee to the lessor should be made to the lessee in the full amount on the basis of invoices issued by the lessor for leasing payments with taking into account the redemption value of the property. Tax authorities do not always agree with the VAT amounts claimed for reimbursement from the budget, paid by lessees as part of leasing payments. In their opinion, a lease payment for the purpose of calculating VAT actually contains two types of payments: expenses for the acquisition of the leased asset and rent for the use of the leased property. Therefore, VAT can be deducted only in that part of the lease payment that is a payment for remuneration to the lessor. But the tax in the remaining part (regarding the purchase price) is not deductible, since the leased asset is not accepted for accounting.

As for the judicial authorities, they do not support this position of the inspectors and remain on the side of the taxpayers. The judges justify their position by the fact that the leasing payment is a single payment, and separating from it the part attributable to the cost of the property leased, and refusing to deduct the VAT paid in this part are illegal and unfounded (resolution of the Federal Antimonopoly Service of the Moscow Region dated April 25, 2007 N KA-A40/1228-07, dated 10/07/2005 in case No. KA-A40/8948-05).

The lessee has the right to reimburse VAT only if there are invoices, documents confirming their payment, as well as evidence of acceptance of the leased property for accounting in the prescribed manner and use in production activities. And what is very important, the legislation does not link the taxpayer’s right to tax deductions with the transfer of ownership of the leased property. Thus, taking into account the extensive positive arbitration practice for lessees in different judicial districts, we can conclude: there is a high probability that, by adhering to this option, the organization will win the case in court. Now let’s take a closer look at a specific example of buying a car on lease. CONDITION: Romashka LLC in December 2007 received a NISSAN NAVARA car from Vasilek LLC under a leasing agreement. Romashka LLC paid lease payments to Vasilek LLC monthly for 12 months - from December 2007 to November 2008 inclusive - in accordance with the payment schedule. The car is accounted for on the balance sheet of Romashka LLC. The lease payment amount includes the purchase price. Payment of leasing payments occurs in accordance with the schedule:

| Payments | date | The cost of the leased item as part of the lease payment, incl. VAT, rub. (redemption price) | Payment amount including VAT payable, rub. | Payment for services of the leasing company, incl. VAT |

| 1 | 11.12.2007 | 21898,57 | 22895,62 | 997,05 |

| 2 | 11.01.2008 | 3735,95 | 3906,05 | 170,1 |

| 3 | 11.02.2008 | 3735,95 | 3906,05 | 170,1 |

| 4 | 11.03.2008 | 3735,95 | 3906,05 | 170,1 |

| 5 | 11.04.2008 | 3735,95 | 3906,05 | 170,1 |

| 6 | 11.05.2008 | 1867,98 | 1953,03 | 85,05 |

| 7 | 11.06.2008 | 1867,98 | 1953,03 | 85,05 |

| 8 | 11.07.2008 | 1867,98 | 1953,03 | 85,05 |

| 9 | 11.08.2008 | 933,99 | 976,51 | 42,52 |

| 10 | 11.09.2008 | 933,99 | 976,51 | 42,52 |

| 11 | 11.10.2008 | 933,99 | 976,51 | 42,52 |

| 12 | 11.11.2008 | 436,96 | 456,85 | 19,89 |

| Total | 45685,23 | 47765,29 | 2080,06 |

ACCOUNTING: In December 2007, the following entries must be made: 1) Debit 76-6 Credit 51 - 22895.62 rubles . – funds were transferred to pay the advance payment under the leasing agreement; 2) Debit 08 , subaccount “Purchase of individual fixed assets under a leasing agreement” Credit 76 , subaccount “Rental obligations” - 40,479.05 rubles. – reflects the cost of the car received under the leasing agreement; 3) Debit 19 Credit 76 subaccount “Rental obligations” - 7286.24 rubles. – VAT on leasing transactions is reflected; 4) Debit 01 subaccount “Leased property” Credit 08 subaccount “Purchase of individual fixed assets under a leasing agreement” - 40,479.05 rubles. – reflects the cost of the car received under a leasing agreement. Then, monthly entries are made during the term of the leasing agreement: In December: 1) Debit 76 , subaccount “Lease obligations” Credit 76 , subaccount “Debt on leasing payments” - 22,895.62 rubles. — leasing payment accrued; 2) Debit 76 , subaccount “Debt on leasing payments” Credit 51 - 22,895.62 rubles. — the amount of the lease payment to the lessor is transferred; 3) Debit 68 , subaccount “VAT” Credit 19 – 3,492.55 rubles. — accepted for deduction of VAT on part of the lease payment, which was previously paid as an advance; 4) Debit 20 Credit 02 , subaccount “Leased fixed assets” - 40,479.05 rubles. / useful life for accounting purposes * coefficient 0.5 - the amount of depreciation on the leased property is calculated; If the amount of depreciation in accounting exceeds the amount of expenses in tax accounting, then permanent tax liabilities (PNO) are formed. In this regard, it will be necessary to make the following accounting entries: Debit 99 Credit 68 for the following amount: the amount of depreciation minus expenses in tax accounting, all this multiplied by 24% (from 01/01/2009 the income tax rate is 20%).

If an exchange rate difference arises as a result of a change in the dollar exchange rate on the date of acceptance for accounting and the date of payment, then the following entries are made: Debit 91-2 Credit 76 subaccount “Rental obligations” - for the amount: the difference between the new rate and the old rate, multiplied by the payment amount . Subsequently, depreciation is calculated in the same way for all months. All accounting is carried out in rubles, recalculated taking into account the exchange rate. In the example given, in January, February, March, April, it will be necessary to make the following accounting entries: 1) Debit 76 , subaccount “Lease obligations” Credit 76 , subaccount “Debt on leasing payments” - 3906.05 rubles. — leasing payment accrued; 2) Debit 76 , subaccount “Debt on leasing payments” Credit 51 - 3906.05 rubles. — the amount of the lease payment to the lessor is transferred. 3) Debit 68 , subaccount “VAT” Credit 19 – 595.84 rubles. — accepted for deduction of VAT on part of the lease payment, which was previously paid as an advance; 4) Debit 20 Credit 02 , subaccount “Leased fixed assets” - 40,479.05 rubles. / useful life for accounting purposes * coefficient 0.5 - the amount of depreciation on the leased property is calculated. At the end of the leasing agreement, the following accounting entries are made in the organization’s accounting: 1) Debit 01 subaccount “Own fixed assets” Credit 01 , subaccount “Leased fixed assets” - reflects the transfer of leased property into the ownership of the lessee, subject to repayment of the entire amount of lease payments stipulated by the leasing agreement ; 2) Debit 02 subaccount “Own fixed assets” Credit 02 , subaccount “Leased fixed assets” - reflects the transfer of leased property into the ownership of the lessee, subject to repayment of the entire amount of lease payments provided for in the leasing agreement.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Be careful with car leasing

The main attractive feature of leasing agreements regarding vehicles is the opportunity to use the vehicle, even if there is no financial opportunity to purchase it immediately, as well as the prospect of obtaining ownership of it.

But there are also negative features of such a transaction that should be taken into account and the risks correctly assessed before concluding a contract:

- The credit is still lower. Interest on a leasing agreement is usually higher than bank interest. But the conditions of banks differ significantly and are not subject to revision and adjustment.

- "Medical examination" of the car. Until the end of the contract, the lessor will regularly inspect the vehicle, which is still legally owned by him.

- You'll have to ask first. The recipient of the car will not be able to carry out any legal actions with it without the permission of the lessor.

- Remember, the car is not yours yet. If during the validity of the leasing agreement the recipient violates any conditions (payments were not made on time, mandatory technical inspection was not completed, maintenance was not carried out on time, etc.), the car will not become the property of the recipient, he will lose this right.

Legislative regulation of transport taxation

The controversial issue of payment of transport tax for the corresponding leasing is considered in a number of legislative documents:

- Tax Code of the Russian Federation:

- Art. 357 – about who is the tax payer: the person in whose name the vehicle is registered;

- Art. 358 – about objects of taxation;

- Art. 360 – about reporting tax periods;

- Art. 361 – about rates and benefits;

- Art. 362 – on the timing of payment of TN;

- Art. 363 – on the procedure for accepting payment.

- Federal Law No. 164 “On financial lease (leasing)” dated September 11, 1998 regulates relations under a leasing agreement. Art. 20 states that any party to the contract can be considered the owner of the leased object.

- Order of the Ministry of Internal Affairs of the Russian Federation No. 1001 regulates the establishment of ownership of a car by concluding a special agreement.

- Letter of the Federal Tax Service No. BS-4-11/22368 provides additional clarification regarding the payment of TN in leasing.

Who pays transport tax and in what cases?

The car leasing agreement states that the lessor remains the owner of the car, and the lessee cannot sell or donate the vehicle. If the rental payment terms are violated, the car may be confiscated for non-compliance with the terms of the contract.

The car purchased by the lessor must be registered with the State Traffic Safety Inspectorate within 10 days (RF Government Decree No. 938 of 08/12/1994).

The use of unregistered transport is punishable by a fine (Administrative Code of the Russian Federation, Part 1, Article 19.22). When registering a leasing, registration by agreement is made either for the recipient or for the leasing company (clause 2 of article 20 of Federal Law No. 164-FZ).

Thus, the transport tax is paid by the one in whose name the car is registered (Article 357 of the Tax Code of the Russian Federation).

In paragraph 1 of Art. 363 of the Tax Code of the Russian Federation states that payment of the tax, as well as the advance payment, is made “at the location” of the vehicle, that is, in the region where it is registered.

According to the Tax Code, tax rates and payment procedures in each region are established at the discretion of local authorities (clause 1, article 361, clause 1, article 363). Let's look at the situations of paying transport tax in both cases.

Payment of tax by the lessee

If, under the terms of the agreement, the car is registered in the name of the lessee, he must contact the traffic police at his place of residence to register the vehicle. Wherein:

- Registration is temporary and is valid only for the duration of the leasing agreement.

- The lessee (individual or individual entrepreneur) pays transport tax, but does not need to submit a declaration to the tax service (FTS).

- If the machine is registered to an organization, then it must be registered for tax purposes, and the tax on it will be carried out through the company’s accounting department as production costs. A declaration indicating the amount of transport tax must be submitted to the Federal Tax Service (3-NDFL).

Payment of tax by the lessor

If it is more profitable for the lessor to register the car in his name, the payment of transport tax is assigned to him. In this case, a declaration must be submitted to the Federal Tax Service, which indicates the amount of tax payments made.

In order to offset tax costs, lessors usually include them in the cost of lease payments. That is, in such a situation, the rental amount will be higher by the amount of the tax payment.

In conclusion, it should be noted that car leasing is a fairly profitable option for purchasing a car for individuals, individual entrepreneurs and commercial companies, in which there is no need to pay the entire amount for the car. The car is leased from a leasing company under an agreement and purchased with rental payments during the validity period of the concluded agreement. The cost of the car will be slightly higher, but the purchasing mechanism will be more comfortable.

Transport tax, according to the Tax Code of the Russian Federation, must be paid by the participant in the leasing agreement in whose name the car is registered with the State Traffic Safety Inspectorate. This is unprofitable for the lessee, since he has to pay tax on a car that is legally owned by the lessor, and if he agrees to pay tax, he increases the amount of lease payments.

Basic postulates of TN in a leasing transaction

So, the main legal documents regarding the payment of TN when leasing vehicles state the following:

- the obligation to pay the TN lies with the owner of the vehicle;

- the lessee or the lessor may be considered the owner, depending on the circumstances;

- the person in whose name the car is registered determines the agreement concluded between the parties to the leasing transaction;

- vehicle registration can be issued for a permanent period or only for the duration of the leasing agreement;

- The transport fee is paid by the owner regardless of the registration period.

How to determine the owner

The agreement specifies the nuances of the transfer of property into ownership under the terms of leasing. Upon conclusion of the relevant agreement, it may be owned by:

- the lessor - until the leasing term expires and all its conditions, especially financial ones, are met;

- lessee - on a permanent or temporary basis (depending on the agreement).

NOTE! If the registration of ownership of the car is temporary, you must provide a copy of the leasing agreement and an agreement on the temporary registration to the car control authorities (traffic police or others).

The parties themselves decide who will be the legal owner of the leased asset and formalize it in a contract or leasing agreement.

Features of taxation during leasing

When concluding a leasing agreement, you need to carefully choose the type of car registration. The amount of taxation will depend on this. It is worth paying attention to the following points:

- The tax rate depends on the region of registration of the vehicle. The Tax Code of the Russian Federation allows for independent determination of the tax rate by regional authorities. In this case, a tenfold deviation of its value is permissible, both downward and upward. It is worth registering a car for a person who is located in a region with a lower percentage tax rate.

- Some regions provide tax benefits. As in the first case, it is better to register the car to a participant in the leasing agreement, in whose region benefits are provided.

- Registration of a car must be economically feasible. If we take into account the tax rate and the availability of benefits in the regions, both parties to the leasing agreement will remain in the black.

The owner of the object of the leasing agreement undertakes to pay the transport tax after receiving the appropriate notification, taking into account the rules provided for in the region. This can be an advance payment or a one-time payment. When calculating the amount required for payment, the engine power is taken into account.

When calculating the tax, the period of ownership of the vehicle is determined by months. If the value of the taxable car is more than 3 million rubles, an increasing factor is taken into account. If the car was deregistered during the year, the reduction factor is taken into account in the calculations. Transport tax is recorded as an expense item for the enterprise. Its total amount and the advance payment on it are required to be taken into account in income tax calculations.

What to Consider When Choosing a Title Type

Before concluding a leasing agreement, you need to carefully weigh all the factors that could affect the value of the property being transferred and decide which agreement to transfer ownership of the car should be concluded. The following points are important:

- Differences in transport tax rates in different regions of the Russian Federation. The Tax Code of the Russian Federation states that regional authorities can increase or decrease tariff rates up to tenfold. The tax on a car leased will be calculated according to the region of the property owner, because it will fall into the budget of this region. If the difference is significant, it is better to prefer a form of agreement in which the owner will be considered a person registered in a region with a more lenient rate.

- Possibility to apply the benefit. The situation is similar to the situation with the tax rate - all other things being equal, the region of registration with tax benefits should be preferred.

- Economic expediency . If you enter into a leasing agreement without taking into account all the key factors, this can significantly increase the cost of the property, while taking them into account will benefit both parties to the transaction.

IMPORTANT! Calculation and payment of TN is carried out in accordance with regional laws at the place of registration of the vehicle.

How to pay

The payment method depends on the method of vehicle registration when leasing it. The law provides three options for registration:

- Registration of a vehicle with the traffic police is the responsibility of the leasing company, which is its owner for the entire duration of the legal relationship;

- When purchasing a car from a supplier, the lessor registers it in his own name. After signing an agreement with the client, the latter issues a temporary registration that is valid until the end of the transaction;

- The car is temporarily registered with the MREO immediately after its transfer from the supplier to the lessor and is considered temporarily registered in the name of the client.

In the first and second paragraphs, the lessor, as the sole owner, is obliged to pay. In the latter, this responsibility is assumed by the recipient. In addition, after purchasing the car, he must register it in his own name and register it permanently at the place of his own registration.

Tax payment is made in two ways, each of which is accepted in a number of regions of the Russian Federation:

- quarterly, with mandatory prepayment at the beginning of the quarter;

- annually, in a one-time payment.

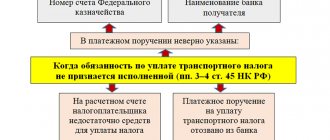

The payer independently determines the amount of the fee to be paid. To check the accuracy, he submits a tax return at the end of each reporting period.

Transport tax accounting for car leasing

If a leased vehicle is used for the main activity of an individual entrepreneur or organization, then the transport tax will apply to expenses for ordinary activities (clause 5 of PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 No. 33n).

It is reflected in the debit of account 20 “Main production” and the credit of account 68 “Calculations for taxes and fees”.

When a transfer of TN is made, it is registered in the debit of account 68, the corresponding account is 51 “Current accounts”.

Transport tax and leasing agreement

Fees are federal, regional and local. Transport type refers to regional payments. Its payment is made to the budget of the region in which the car is registered.

It is also important to understand what a leasing agreement means. Its peculiarity is not only the transfer of movable property to another person (such actions are performed when renting it out), but also the possibility of redemption on preferential terms.

After the transaction is completed, the parties have obligations. It is in the contract that the conditions regarding who pays the transport tax (lessor or lessee) are negotiated. Depending on this, a car is registered in the traffic police department, which will become the payer of the fee.

Taxation of corporate profits and car leasing

Transport tax is a recognized expense of the organization. It should be taken into account when calculating income tax, not only the amount of tax itself, but also the advance payment for it. Accounting is carried out on the date of accrual as part of “other expenses associated with production and sales”.

RESULTS

- The parties to the leasing transaction, by their own will, determine who will be registered as the owner of the vehicle, at what point this right begins and for how long it is valid.

- Transport tax is paid by the lessor if ownership of the car is transferred to the recipient only upon fulfillment of all the conditions of the leasing agreement.

- Transport tax is paid by the lessee if the car is re-registered in his region on a permanent or temporary basis.

- The calculation procedure, deadlines and reporting for payment of TN depend on the rules adopted in the region of registration of the vehicle.

- The owner of the leased property bears not only the obligation to pay the technical tax, but also responsibility for late payments or reporting, arrears or non-payment, as well as for the lack of registration of the car transferred under the leasing agreement.

How to save on tax on a leasing car?

You will not have to spend money on paying transport tax if you lease (clause 2 of article 358 of the Tax Code of the Russian Federation):

- tractors, self-propelled combines, special vehicles (registered to agricultural producers and used for the production of agricultural products);

- other transport specified in clause 2 of Art. 358 Tax Code of the Russian Federation.

If the car you leased is not on this list, you still have the opportunity to optimize transport tax payments if:

- under a leasing agreement, transport tax is paid by the lessor;

- in the region where it is located, tax rates are set lower than in your region.

Find out about regional transport tax rates here.