This article is devoted to how to reflect a contract, that is, transactions under an assignment agreement in 1C using the example of the 1C: Accounting 8.3 configuration.

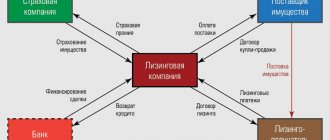

An assignment agreement is an assignment of the right to claim receivables, that is, simply put, the sale of such debt to another person. Typically, the debt is sold at a discount, resulting in a loss for the original creditor.

Legislative accounting of the assignment agreement is determined by:

- Civil Code of the Russian Federation - Articles 382-389 (refers to Chapter 24 - Change of persons in an obligation);

- PBU 9/99 – Income of the organization;

- PBU 19/02 – Financial investments – clause 8, clause 9;

- Tax Code of the Russian Federation - Art. 146, 155, 164, 268, 271, 279. When making a transaction between related parties, additional nuances are possible.

Let's consider an example: Organization A sold goods or provided services to organization B in the amount of 120,000 rubles, incl. VAT 20,000 rub. Not receiving payment when due, A sold this debt to organization C for RUB 110,000.

Terminology within the framework of a transaction under an assignment agreement:

- Organization A (original creditor) – Assignor ;

- Organization B (debtor) – Debtor ;

- Organization C (new creditor) – Assignee.

BU at the assignor

Dt 62 (balance according to B) 120000. Postings under the assignment agreement:

| Dt | CT | Sum | Operation |

| 76(C) | 91.01 | 110000 | Proceeds from the sale of the right to claim a debt |

| 91.02 | 62(B) | 120000 | Expenses for the debt sale operation |

| 51 | 76(C) | 110000 | Received a payment from the assignee on the account |

The loss on the operation will be 10,000 rubles.

If the assignor sold the debt for more than the original amount, then VAT would have to be charged on the excess amount, entry 91.02 - 68.02 VAT.

Note: VAT can only be charged on the sale of debt for VAT-taxable transactions. If the subject of the transaction is a loan agreement, VAT does not need to be charged even if the amount of the agreement exceeds the actual debt.

Accounting: for a new debtor

When your organization assumes obligations from another organization and acts as a new debtor, reflect the recognition of debt to the creditor by posting:

Debit 60 (76) Credit 76 – accounts payable to the original creditor and receivables of the former debtor are reflected.

This must be done on the effective date of the debt transfer agreement.

Repay the debt to the creditor by posting:

Debit 76 Credit 50 (51, 60, 62, 76...) – the debt to the creditor is repaid.

This procedure follows from the Instructions for the chart of accounts (accounts 60, 76).

An example of reflecting debt transfer transactions in the accounting of a new debtor

In June, Torgovaya LLC (creditor) sold materials to Alpha LLC (original debtor) for the amount of RUB 590,000. (including VAT - 90,000 rubles) according to the supply agreement. The payment deadline for the goods is July 30. On July 1, Alpha, with the consent of Hermes, transfers the debt to Proizvodstvennaya LLC (the new debtor). Master has outstanding accounts payable to Alfa in the amount of RUB 1,180,000. "Alpha" and "Master" entered into an agreement to transfer the debt to offset the accounts payable of "Master" to "Alpha".

The Master's accountant made the following entries.

In January:

Debit 10 Credit 60 – 1,000,000 rub. – the receipt of products from Alpha is reflected;

Debit 19 Credit 60 – 180,000 rub. – reflected input VAT on purchased products;

Debit 68 Credit 19 – 180,000 rub. – accepted for deduction of input VAT on purchased products.

In July:

Debit 76 subaccount “Settlements with Alfa LLC” Credit 76 subaccount “Settlements with Trading LLC” - 590,000 rubles. – obligations have been accepted to Torgovaya;

Debit 60 Credit 76 subaccount “Settlements with Alpha LLC” – 590,000 rubles. – offset of accounts payable to Alfa;

Debit 76 subaccount “Settlements with Trading LLC” Credit 51 – 590,000 rub. – the debt to Torgovaya was repaid.

Situation: how can a new buyer reflect in accounting the receipt of a fixed asset when acquiring the right to claim under a purchase and sale agreement? Ownership passes after payment to the seller.

Reflect the receipt of property as part of fixed assets on the date of entry into force of the agreement on the assignment of the right of claim.

In this case, your organization assumes the rights and obligations under the purchase and sale agreement. Namely:

- repay the debt to the seller;

- actually receive property from the former buyer;

- receive ownership of the property after full payment.

As soon as the rights and obligations have transferred to you, the property will immediately be reflected as part of fixed assets. After all, all the conditions for this have been met. The moment of transfer of ownership does not matter (clauses 4 and 5 of PBU 6/01).

Therefore, on the date of entry into force of the agreement on the assignment of the right of claim, make the following entries in accounting:

Debit 08 Credit 76 subaccount “Settlements with the former buyer” - accounts payable to the former buyer are reflected in the amount of money actually transferred by him to the seller for the fixed asset;

Debit 08 Credit 60 – accounts payable to the seller are reflected in the amount of the remaining payment for the equipment;

Debit 01 subaccount “Fixed asset in operation” Credit 08 – the fixed asset was accepted for accounting and put into operation at its original cost.

On the date of repayment of accounts payable to the former buyer, make an entry:

Debit 76 subaccount “Settlements with the former buyer” Credit 50 (51...) – the debt to the former buyer is repaid.

Repay the debt to the seller by posting:

Debit 60 Credit 50 (51...) – the debt to the seller is repaid in the amount of the remaining payment for the equipment.

This procedure follows from the Instructions for the chart of accounts (accounts 01, 08, 60, 76).

Regarding VAT. The new buyer does not have the right to deduct tax. This is due to the fact that he will not have an invoice from either the seller or the former buyer. Firstly, the sale (shipment) of the equipment does not occur in this case, although in the future the ownership will be transferred to it. Secondly, the former buyer took advantage of the right to deduction (clause 2 of Article 171, clause 1 of Article 172 of the Tax Code of the Russian Federation).

NU at the assignor

The loss on the operation is 10,000 rubles.

If the payment deadline has already arrived, the loss is recognized in full. If the payment deadline has not arrived, the loss cannot be taken into account in full in tax accounting. Here you should be guided by the provisions of Art. 279 of the Tax Code of the Russian Federation and the accounting policies of the organization.

It should be noted that the specifics of reflecting losses in such a situation are specially allocated several lines in the income tax return.

In our example, the payment deadline has arrived, so we will take into account the entire amount of the loss in the NU.

BU with the assignee

| Dt | CT | Sum | Operation |

| 58 | 76(A) | 110000 | Purchasing the right to claim a debt (financial investment) |

| 76(A) | 51 | 110000 | Payment to the assignor from the account |

| 51 | 76(B) | 120000 | Received a payment from the debtor |

| 76(B) | 91.01 | 120000 | Revenue reflected |

| 91.02 | 58 | 110000 | Costs reflected |

| 91.02 | 68.02 VAT | 1666,67 | VAT charged on the transaction (10000*20/120) |

Accounting: with the original debtor

On the date specified in the debt transfer agreement, the original debtor's obligation under the contract ceases. At the same time, he has obligations to the counterparty, who has assumed the obligation to repay the debt. Therefore, if your organization is the original debtor, reflect the write-off of the amount of accounts payable in accounting by posting:

Debit 60 (66, 76...) Credit 76 – the amount of accounts payable transferred to the counterparty with the consent of the creditor is written off.

Reflect the repayment of the obligation to the new debtor by posting:

Debit 76 Credit 50 (51, 60, 62, 76) – payment has been made (offset) of the obligation under the debt transfer agreement.

This procedure follows from the Instructions for the chart of accounts (accounts 60, 76).

An example of reflecting debt transfer transactions in the accounting records of the original debtor

In June, Torgovaya LLC (creditor) sold materials to Alpha LLC (original debtor) for the amount of RUB 590,000. (including VAT - 90,000 rubles) according to the supply agreement. The payment deadline for the goods is July 30. On July 1, Alpha, with the consent of Hermes, transfers the debt to Proizvodstvennaya LLC (counterparty). "Alpha" and "Master" entered into an agreement that, in payment for the finished products received by "Master" from "Alpha", "Master" undertakes the obligation to repay Alpha's debt to "Hermes".

In Alpha's accounting, the accountant made the following entries.

In June:

Debit 10 Credit 60 – 500,000 rub. – materials were received from Torgovaya;

Debit 19 Credit 60 – 90,000 rub. – VAT is reflected for purchased materials;

Debit 68 Credit 19 – 90,000 rub. – accepted for deduction of input VAT on purchased materials.

At the time of shipment of goods to the “Master”:

Debit 62 Credit 90-1 – 590,000 rub. – income from the sale of products to the “Master” is recognized;

Debit 90-3 Credit 68 – 90,000 rub. – VAT is charged on the cost of shipped products.

In July:

Debit 60 Credit 62 – 590,000 rub. – debt transfer obligations are offset against payment for delivered products.

BU at the debtor

| Dt | CT | Sum | Operation |

| 60(76)A | 60(76)С | 120000 | Transfer of debt to another counterparty |

| 60(76)С | 51 | 120000 | Payment of debt from the account |

The assignment agreement has no tax consequences for the debtor.

Documenting

The transfer of rights from the assignor to the assignee is formalized by an assignment agreement. The assignment agreement must be concluded in the same form as the original agreement (purchase and sale agreement, credit agreement, etc.):

- in simple written form;

- in writing and notarized (if the original agreement was registered by a notary);

- in writing and registered (if the transaction for which the claims are assigned was subject to state registration).

This is stated in Article 389 of the Civil Code of the Russian Federation.

The assignor must attach documents to the assignment agreement certifying the right to demand from the debtor the fulfillment of certain obligations. These can be contracts, invoices, invoices, certificates of work performed (services rendered), etc.

The assignment agreement must indicate:

- on the basis of what particular agreement this or that right arose;

- what is the duty of the debtor;

- a list of documents and deadlines for the transfer of documents certifying the right of claim that the assignor must transfer to the assignee;

- other information regarding assigned rights.

This procedure is provided for in Articles 385, 389.1 of the Civil Code of the Russian Federation.

Assignment in 1C BP

There are no special documents to reflect assignment operations in the program. Sometimes in this case they use the “Operation” document, where the user manually fills out the necessary transactions. This option has many disadvantages. Firstly, in order to obtain correct reports and fill out regulated reporting, it is often not the postings that are important, but the register entries, which are not generated when using the “Transactions” document. Secondly, there are restrictions on the choice of printing forms.

Based on this, we will try to reflect the assignment agreement in 1C using standard documents, which is easiest to do in this situation by showing the operations of the debtor organization. Let's start with this.

Grounds for assignment of the right of claim

The creditor may transfer his rights to another person:

- under an assignment agreement;

- on the basis of law (for example, by a court decision, during the reorganization of an organization).

This is stated in paragraph 1 of Article 382, Article 387 of the Civil Code of the Russian Federation.

Situation: is it possible to formalize a change of the sole founder (participant) of an LLC by assigning the right of claim?

Yes, you can.

The founder (participant) may assign his share in the authorized capital of the organization to a third party. But provided that this is not prohibited by the company’s charter and the share has already been paid. This is stated in Article 21 of the Law of February 8, 1998 No. 14-FZ.

The share of a company participant is a set of rights. With the transfer of a share, a new participant always arises who receives these rights. As a result, there is a change of persons in the obligation, that is, an assignment of the right of claim (clause 1 of Article 382 of the Civil Code of the Russian Federation).

The assignment of a share in the authorized capital is formalized by an agreement on the assignment of the right of claim according to the general rules, taking into account the requirements specified in paragraph 12 of Article 21 of the Law of February 8, 1998 No. 14-FZ.

Assignment agreement in 1C 8.3 from the debtor

Automation of accounting at the debtor's enterprise implies the following actions: having received notification of a change of creditor, the debtor must transfer the amount of debt from one counterparty to another. To do this, use the “Debt Adjustment” document, which can be located in the “Purchases” and “Sales” sections.

Fig. 1 Purchases - Debt adjustment

Fig.2 Sales-Debt Adjustment

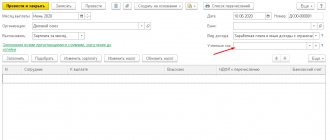

Create a new document Debt adjustment. In the document:

Type of operation – Transfer of debt; Transfer – Debt to the supplier.

We fill in the data on the creditor and the new supplier from the counterparties directory.

By clicking the “Fill” button, you can automatically generate a tabular part, and, if necessary, later adding the necessary parameters (in our case, these are a New Agreement and a New Account).

Fig.3 Fill in

Let's look at the entries in the document.

Fig.4 We look at the postings according to the document

Sometimes there is a need to reformat a document, but an error occurs - it is suggested that you first unapprove it. Here you can use the menu option using the “More” button.

Fig.5 Unconfirm

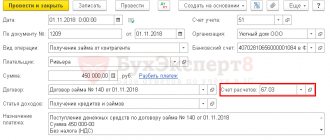

Assignment agreement in 1C 8.3 with the assignor

The transfer of debt to the Assignee will be reflected in the sales document.

Fig.6 The transfer of debt to the Assignee will be reflected in the sales document

We create a new document for the sale of services, having two options for the input form to choose from.

Fig.7 Creating a new document for the sale of services

We fill out the document.

Fig.8 Filling