What is UIN in a payment order?

UIN is a unique accrual identifier consisting of 20 or 25 digits that cannot simultaneously take the value “0”.

The UIN code is sometimes (but not always) indicated on payment slips when transferring taxes, fees, insurance premiums, as well as penalties and fines for them. For UIN, there is a payment order field with detail 22, which is called “Code”. This follows from the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation (approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

Fill out a payment form for free in the accounting web service

It is noteworthy that in Appendix No. 1 to Bank of Russia Regulation No. 383-P dated June 19, 2012 “On the rules for transferring funds”, detail 22 has a different name - a unique payment identifier (UPI). But this should not confuse the accountant. In practice, when transferring money to the budget, the UIN is entered in field 22.

Where can I get the details of the state fee for a passport?

Previously, you first had to go to the same OUFMS, stand in line, take the details and go to the bank to pay. Now the procedure for issuing a Russian citizen’s main document has been radically simplified and often avoids queues and bureaucracy altogether.

Just 5-7 years ago, obtaining a passport or replacing it was a whole epic, but now citizens receive a document without particularly straining. It is not even necessary to take the details for paying the state fee for a passport to the OUFMS. You can receive them via remote channels, and if you pay through banking or bank terminals, then they will already be “built-in” into the system.

If you choose a payment method that requires the details themselves, use the following methods to obtain them:

- contact a convenient MFC branch;

- refer to the website of the Ministry of Internal Affairs.

If you plan to pay the passport fee through banking or an ATM, in this case you do not need paper details. They will already be entered into the system.

What UIN code should organizations indicate in payment orders in 2022?

Organizations enter a UIN code only when they transfer to the budget the amount specified in the request for payment of a tax, fee, insurance premium, penalty or fine. Such a requirement may come from the tax office. Funds have the right to charge policyholders certain types of fines. For example, the Pension Fund may demand payment of a fine for failure to provide annual information about the length of service, and the Social Insurance Fund may demand payment of a fine for failure to submit annual information about the length of service, and the Social Insurance Fund may demand payment of a fine for violating the deadline or procedure for submitting 4-FSS.

Fill out and submit SZV-STAZH (SZV-ISKH, SZV-KORR) and EDV-1 via the Internet Submit for free

In such a situation, the accountant needs to take two simple steps.

- Determine which UIN is included in the request for payment of a tax, fee, insurance premium, penalty or fine.

- Duplicate it in field 22 of the payment slip, which is issued in connection with the fulfillment of the requirement.

It is very important not to make mistakes when transferring the code from the request to the payment. An incorrect value will result in the payment not being identified. As a result, the organization’s debt will not be written off in a timely manner, which will lead to further accrual of penalties.

The situation is different if the organization calculates the payment amount independently. This is exactly what happens when paying current taxes, fees and contributions, the amount of which is indicated in the declaration, calculation or other document. For example, VAT at the end of the quarter, income tax at the end of the year, personal income tax for the month, etc. And in some cases, the organization itself calculates arrears for past periods and penalties. Then there is no need to specify a unique identifier.

ATTENTION. The bank is obliged to accept and execute a payment without a UIN if a legal entity transfers current payments for taxes or contributions, or repays arrears calculated on its own. The main thing is that the company does not forget to reflect its Taxpayer Identification Number.

Automatically generate a tax payment invoice based on the data from the declaration and submit reports via the Internet

There is another reason why the organization does not reflect the UIN. This is a situation where a payment request is received, but the unique accrual identifier is not there. Under such circumstances, the accountant is not able to indicate the UIN on the payment slip.

Where to pay?

Couples have several options for paying state fees for marriage. We invite you to familiarize yourself with them to help you decide on the one that is most suitable for you.

Sberbank Online

A great idea to save time and make calculations while staying at home. This can be done in Sberbank’s “Personal Account” or in its application. You will need to enter your details on the payments tab. After transferring the money, save and then print the receipt, because this is what is presented at the registry office to submit an application.

Detailed instructions:

- Go to the site and enter your username and password, or register first.

- Then we wait for the SMS, there will be a code that needs to be entered. Next, click on the green “Continue” button.

- Select the section with payment of taxes, fines, duties, etc. In the TIN line, enter the recipient's number. Such data is provided by the registry office itself or can be taken from its official website.

- After clicking the “Find” button, suitable organizations will appear.

- Next, select the recipient, that is, the desired government agency.

- Now we mark the write-off card and the required service - marriage registration.

- At the end of all completed procedures, a window will appear with the details you entered. Check that you have filled out everything correctly.

- Select a document from the menu below, for example, it could be a passport.

- Click “Continue”.

- In the next tab, enter your full name, passport information and click “Continue” again.

- We enter the established amount for the wedding, which today is 350 rubles.

The amount of state fees often changes, so it is better to clarify its cost by calling the registry office. - After you have entered the required numbers, you will be asked to check everything thoroughly again.

- Then a password will be sent to your phone number, which you enter in the field.

- Ready! The fee has been paid.

In the bank

When you come to any bank branch, you can easily carry out this procedure. In this case, you will only need an identification document and money. The bank manager will fill out the necessary information and give you a check for payment for the service.

Public services

The best option is to pay on the popular State Services website. This is very convenient, because you don’t need to leave home, stand in line, and all the necessary numbers are filled in automatically, and the amount will be less than everywhere else, only 245 rubles .

After filling out all the information in the application, go to the “Payment” section, which you will find at the top. You will be offered 3 ways to deposit funds for the state fee, choose any convenient one. Money for registering a civil marriage can be transferred using bank cards, electronic wallets or directly from the account of your gadget.

If your choice is a plastic card , a window will appear in front of you in which you need to fill in the card details. Then click "Next".

When paying by phone , select the picture with the desired operator and enter the number from which the funds will be debited. After that, click “Done”.

Attention! The discount is only valid if you submit an application on the Gosuslugi portal.

"Qiwi" or "Yandex-money"

The state duty can also be paid using special payment systems on the Internet. First, you need to be authorized on one of the services and top it up with money, which you will subsequently transfer. Next, select “Payment by details” and enter them accordingly. Then, confirm the action via SMS. Afterwards, you will need to print out the check; you can find it in the history of financial transactions.

The amount from your virtual wallet will be debited with a commission.

Step-by-step instruction:

- Go to the service, click on the “Receipts” tab and enter the TIN of the institution you need, and then the rest of the data.

- Then the “Continue” button. You will be taken to a section where you need to fill in information about you: last name, first name, patronymic, your TIN, and also indicate the service for which you are going to pay, i.e., the state fee for registering a marriage. And the payment amount is 350 rubles.

- Click “Continue”, this completes the operation.

Terminal or ATM

Another way to pay marriage fees is at a terminal or ATM. Money can be either cash or on a card. Select the “Public Services” section in the device menu, indicate the desired registry office and about, and then enter the details.

ATMs do not give out change, so prepare the required amount in advance. You can transfer the remaining funds only to your mobile phone.

Detailed instructions:

- In the proposed options at the ATM/terminal, find the “Services” item. Click on it and select the TIN search section.

- Enter the details that you previously requested from the government agency.

- If the TIN was specified correctly, the required registry office will appear on the screen. Click on it.

- Next, another window will appear in front of you to enter the remaining data.

Modern terminals have a convenient function - you can swipe the barcode of your receipt in front of the glowing strip, and all the information is thus counted. - After completing the procedures, you need to enter your last name, first name and patronymic, and also enter the amount of the state duty, in our case - 350 rubles.

- Then enter the bills into the special window.

- The ATM will count your funds, credit them to your account and issue you a check. Be sure to save it, because you will need it when applying for marriage.

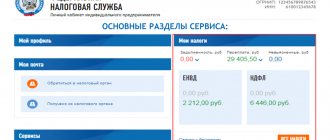

UIN in the payment slip of an individual entrepreneur

Individual entrepreneurs, notaries, lawyers and other “private traders” have the right to enter one of two details into payments: either TIN or UIN. This was emphasized by the Federal Tax Service in a letter dated 04/08/16 No. ZN-4-1/ [email protected]

We draw conclusions:

- when transferring the amounts specified in the payment request, the individual entrepreneur has two options: either put down the UIN (duplicating it from the request) and do not indicate the TIN, or put down the TIN and do not indicate the UIN;

- When transferring amounts calculated independently, the individual entrepreneur has only one option: display the TIN on the payment slip, since there is no unique identifier.

Fill out payments in the web service for individual entrepreneurs for free

Do I need to pay a fee for registering a union at the registry office?

The specifics of registering a marriage – a civil status act – are regulated by the Federal Law of November 15, 1997 No. 143-FZ (as amended on December 27, 2018) “On Civil Status Acts.” By law, when registering a marriage, citizens are required to pay a fee to the state. The mandatory contribution is associated with any legal acts that are carried out in the registry office (you will find out where else besides the registry office you can register a marriage here).

A financial obligation in the form of payment is imposed on the event registered in the registry office. Therefore, payment of the state duty is charged to one of the participants in the process. Confirmation of contributions is a payment receipt. The civil registry office does not accept an electronic document: a printed version of payment of the state fee is required.

Preferential categories of citizens

Who does not pay the mandatory fee when applying to the registry office:

- Heroes of the USSR and Russia.

- Full Knights of the Order of Glory.

- Veterans and disabled people of the Second World War.

- Former concentration camp prisoners and WWII prisoners of war.

To receive services on preferential terms, these categories of citizens provide, in addition to a Russian passport, a certificate of the established form.

Information about those who are exempt from paying state duty upon marriage is indicated in Article 333.39 of the Tax Code of the Russian Federation. According to the law, payment is not charged to individuals who receive a corrected marriage certificate in which an error was made through the fault of a registry office employee.

What to indicate in field 22

Payment order field 22 “Code” cannot be empty. It is necessary to indicate a unique accrual identifier, and if it is absent, enter zero (“0”). A payment with field 22 left blank is not completed correctly and the bank will not accept it.

IMPORTANT. It is not the taxpayer’s responsibility to independently determine the UIN for a particular payment. This code is transferred from the payment request. Moreover, there is no single value that would be applied to all taxes, fees, contributions, penalties or sanctions. Each code is unique.

How to pay the state fee for a passport at Sberbank

Most often, citizens use the services of Sberbank. In general, payment can be made through any bank, but citizens traditionally automatically go to Sberbank. And there are three payment options through this financial institution:

- through her cash register. In this case, the cashier must provide a receipt for payment;

- through the bank's payment terminal. The details have already been entered into the system, payment can be made either from a Sberbank card or in cash;

- through the Sberbank Online system. The details are also already in the system; you just need to enter the payer’s information.

Most citizens use payment terminals through which they can pay in cash. The device menu is intuitive; you just need to press the appropriate buttons to pay exactly the required fee.

How to pay the state fee for a passport through the Sber terminal:

- go to the device, select the payments and transfers section in the menu;

- in it, select the option of paying state duties and fees;

- select the Federal Tax Service of the region or city in which the passport will be issued;

- indicate the option of the state service, in our case - “state fee for a passport at 14 years old”;

- enter the personal data of the person who will receive the main document of the Russian Federation;

- the system will select the necessary details and indicate the amount to be paid;

- All you have to do is deposit the money and be sure to take the receipt, it is confirmation of payment of the fee.

If you have a paper version of the payment receipt with a QR code in your hands, you just need to bring it to the scanner, the system will immediately read the data and display the details.

If we are considering where to pay the state fee for a passport, then the easiest way to do this is for those who have access to the Sberbank Online system. They can make a payment remotely without any details by debiting money from their card. The operation is performed in the payments section, where you need to select the required type of state duty and indicate the payer’s details. Detailed information in the material - Payment of state duty through Sberbank Online for a passport.

But in the case of remote payment, there is an important point - you need a receipt to confirm the payment. When submitting documents for a passport, you may be asked for a printed receipt. It's better to take care of this and print the document.

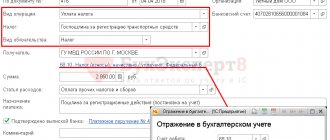

Example of a payment order

The private security company CheKa Private Security Company LLC transfers to the budget personal income tax withheld from employee salaries for January 2021. The amount of tax payable is 100,000 rubles.

Since the payment is current, the accountant should not fill out detail 22 “Code”, indicating the UIN. Instead, it will put a zero ("0") here.

If the company fulfilled the requirement to pay arrears, penalties or fines, the accountant would put the UIN code in the payment order 2022. He would duplicate the identifier value from the corresponding requirement.

Please note: errors when filling out tax invoices can be avoided if you generate invoices automatically. Some web services for submitting reports (for example, “Kontur.Extern”) allow you to generate a payment in one click based on data from the declaration (calculation) or the request for tax payment (contribution) sent by the inspectorates. All necessary details - UIN, KBK, recipient data, codes for payer status - are updated in the service automatically, without user participation. When filling out a payment slip, all current values are entered automatically.