What is a separate division

In civil legislation, there are two types of separate divisions:

- a branch that has a different location than the organization and performs a number of functions or all of its functions (Clause 2 of Article 55 of the Civil Code of the Russian Federation);

- a representative office that represents and protects the interests of a legal entity in another region (Clause 1, Article 55 of the Civil Code of the Russian Federation).

Neither a branch nor a representative office are recognized as legal entities.

Tax legislation uses a broader definition: this is any territorially isolated unit equipped with at least one stationary (created for a period of more than one month) workplace (Clause 2 of Article 11 of the Tax Code of the Russian Federation). The tax service may recognize workplaces as a separate division, regardless of whether its creation is reflected in the legal entity’s charter or other organizational and administrative documents.

Pay in order!

There are three types of separate divisions:

- Branch.

- Representation.

- Others.

The characteristics that unite all three types are territorial isolation and the presence of jobs created for more than a month. This is the general definition of an OP given by the Tax Code of the Russian Federation in Article 11. The Tax Code does not define the concepts of “branch” and “representative office”. Their definition will have to be sought in civil legislation.

Article 55 of the Civil Code of the Russian Federation indicates that the representative office represents the interests of the legal entity and also protects them. A branch has broader rights: it carries out all or part of the functions of a legal entity, including those of a representative office. Simply put, if an organization opens an office where a client can seek advice, conclude an agreement, write a complaint, place an order, then this is a representative office; if this office supplies the client with goods under a concluded agreement, then this is already a branch.

Other divisions fall into the “other” category. It is important to correctly determine what type of OP is opening. This matters not only from a legal point of view, but also from the point of view of the Tax Code.

Is it necessary to register a separate division?

Information about branches and representative offices must be included in the Unified State Register of Legal Entities (paragraph “n”, paragraph 1, article 5 of the Law “On State Registration of Legal Entities and Individual Entrepreneurs” dated 08.08.2001 No. 129-FZ). The tax service will register them automatically based on data from the register (clause 3 of article 83 of the Tax Code of the Russian Federation).

It is necessary to notify the tax authorities about the creation of another separate division by submitting a message on form No. S-09-3-1, approved by Order of the Federal Tax Service of the Russian Federation dated 09/04/2020 No. ED-7-14 / [email protected] This must be done within one month (clause 3 clause 2 article 23 of the Tax Code of the Russian Federation). There is no need to attach any supporting documents (letter of the Federal Tax Service of the Russian Federation dated October 30, 2018 No. GD-4-14/21195). For failure to submit a message within the established time frame, the organization faces a fine of 200 rubles (Clause 1 of Article 126 of the Tax Code of the Russian Federation), the general director - 300–500 rubles (Part 1 of Article 15.6 of the Administrative Code).

A separate division should be registered for tax purposes at its location. There are two exceptions to this rule (clause 4 of Article 83 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of the Russian Federation dated September 28, 2011 No. PA-4-6/15886):

- when creating several separate divisions in one city or municipal district, they can be registered with one Federal Tax Service at the location of any of the divisions;

- if there is a separate division in the city, the newly opened another division can be registered with the same inspectorate in which the first one is registered.

Within five working days, the organization will be notified of registration with the tax authority. The document will indicate the checkpoint assigned to the separate unit. It must be used, among other things, when filling out invoices (clause 7 of the procedure approved by Order of the Federal Tax Service of the Russian Federation dated June 29, 2012 No. ММВ-7-6/ [email protected] , letter of the Federal Tax Service of the Russian Federation dated November 16, 2016 No. SD-4-3 / [email protected] ).

The tax office cannot refuse to register a separate division.

Deadlines for registration of a separate subdivision

When a separate structural unit begins to operate, there is a month to register it with the Federal Tax Service, and also, if necessary, with the Social Insurance Fund and the Pension Fund of the Russian Federation.

Sometimes difficulties arise in determining the period of activity. Usually the date specified in the order is taken as it. However, if the premises were previously rented and a manager was hired, the tax office may link the date of actual start of activity to the lease agreement or employment contract.

In order for the registration of a separate division to take place without problems and questions, it is better to organize the preparatory stage before opening a separate division of the LLC in such a way that the dates of the order, lease, hiring of a manager coincide as much as possible or the order is issued first.

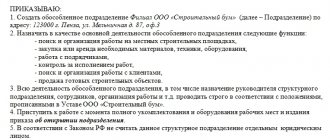

Opening of a separate division

To open a separate division in the form of a branch or representative office, you must:

1) hold a meeting of participants or the board of directors of the company, depending on whose competence it is to resolve this issue (clause 2 of article 65.3 of the Civil Code of the Russian Federation, clause 7 of clause 2.1 of article 32 of the Law “On Limited Liability Companies” dated 08.02 .1998 No. 14-FZ, paragraph 14 clause 1 article 65 of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ);

2) decide on the inclusion (non-inclusion) of information about a branch or representative office in the organization’s charter. The law requires that information about branches and representative offices be included in the Unified State Register of Legal Entities, but does not require that information about them be in the charter. This can be done at your own discretion. Depending on the solution to this issue, the registration procedure will differ;

3) register a branch or representative office:

- if it is decided to include information about branches and representative offices in the charter, you need to submit an application to the tax office in form No. P13014, approved by Order of the Federal Tax Service of the Russian Federation dated August 31, 2020 No. ED-7-14 / [email protected] , a decision to amend the charter, changes in charter (or its new edition), receipt of payment of state duty. Its amount is 800 rubles (clause 3, clause 1, article 333.33 of the Tax Code of the Russian Federation). There is no need to pay state duty when submitting documents electronically (clause 32, clause 3, article 333.35 of the Tax Code of the Russian Federation);

- if information about branches and representative offices is not included in the charter, it is enough to send an application in form No. P13014 and a decision to create a separate division;

4) receive registration documents - a sheet of registration of the Unified State Register of Legal Entities, as well as the charter with a mark from the tax authority, if amendments have been made to it. Tax authorities are given 5 working days to carry out registration actions (clause 3 of article 18, clause 1 of article 8 of law No. 129-FZ). If the documents were submitted through a notary or MFC, it will take another two days to send the documents, thus the registration period will increase to seven working days.\

A separate division that does not have the status of a branch or representative office is considered created if four conditions are met (letter of the Ministry of Finance of the Russian Federation dated December 28, 2017 No. 03-01-15/88027):

- at least one stationary workplace has been equipped at his address, that is, conditions have been created for the employee to perform his job duties: the necessary furniture, equipment have been installed, tools are available, and so on;

- the job was created for a period of more than a month. Whether the employee works at this workplace permanently or periodically does not matter;

- the premises (object, territory) where the workplace is located is under the control of the organization. This condition is not met if the employee’s work space is provided by the counterparty, for example, at facilities protected by private security companies, in premises serviced by cleaning companies (letters of the Ministry of Finance of the Russian Federation dated 10/05/2012 No. 03-02-07/1-238, dated 02/03/2012 No. 03-02-07/1-30);

- the organization began to operate through a separate division (letter of the Ministry of Finance of the Russian Federation dated February 19, 2016 No. 03-02-07/1/9377).

The tax office must be notified of the division within a month. We talked about how to do this above.

We tell you even more about separate departments in the Clerk online course: sign up and start taking it.

Responsibility for violation of the procedure for registering a separate subdivision

By opening a separate division, an LLC may violate a number of laws and regulations. To prevent this from happening, the easiest way is to go through the entire procedure under the supervision of a tax consultant or an organization providing accounting consulting services.

It is important to pay attention to the following key points:

- The order to open a separate division should coincide as closely as possible with the rental of premises and the hiring of a manager, so that there are no problems with determining the start date of actual activity.

- A notification about the creation of a separate subdivision is submitted only when creating a simple OP. A month is allotted for this. The amount of the fine accrued if you fail to report on time or forget is 200 rubles.

- An application for opening a separate division for accounting is submitted to the Federal Tax Service no slower than a month from the start of work. The Tax Code provides for a fine of 10,000 rubles for exceeding the deadline, and for doing business without accounting - 10% of income, but not less than 40,000 rubles. Although such sanctions, as a rule, are not applied to OPs, limited to a fine of 200 rubles, it is better to do everything on time. An accrued fine of more than two hundred rubles can be appealed in court. Precedents of winning such cases are quite frequent.

- For untimely registration with the Social Insurance Fund, a fine of 5,000 rubles is provided if the application to open a separate division was submitted in less than 90 calendar days, then a fine of 10,000 rubles.

- If a company using the simplified tax system has opened a territorially separate division endowed with the functions of a branch, then it automatically loses the right to apply the simplified tax system. If activities were carried out on it, then additional income tax and VAT provided for by OSNO should be charged from the beginning of the quarter when the OP began its activities. The most problematic VAT is that it must be paid by customers who have already received a service or purchased a product without a surcharge. If they refuse to pay additionally, the company will have to compensate for the damage at its own expense. Further, the parent organization is obliged to apply OSNO.

- A separate division cannot apply for UTII, since from January 1, 2022 this taxation regime will be abolished. Organizations that previously used it are required to switch to the simplified tax system or OSNO. If an LLC has branches, then it can only switch to OSNO.

For a separate division, reporting is submitted by the parent organization.

Registration of a separate division

Any separate division, including a branch and representative office, must be registered with the Pension Fund of the Russian Federation and the Social Insurance Fund if it has a bank account and will make payments to individuals (Clause 3, Clause 1, Article 11 of the Law “On Compulsory Pension Insurance in the Russian Federation” dated December 15, 2001 No. 167-FZ, paragraph 2, part 1, article 2.3 of the Law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006, No. 255-FZ, paragraph 2, paragraph 1, article 6 of the Law “On compulsory social insurance against accidents at work and occupational diseases” dated July 24, 1998 No. 125-FZ).

To register with the Pension Fund of the Russian Federation, it is necessary to submit to the tax office at the location of the organization a message about granting a separate division the authority to make payments in favor of individuals. Its form is approved by Order of the Federal Tax Service of the Russian Federation dated September 4, 2020 No. ED-7-14/ [email protected] The message must be sent within a month from the date of issuance of the order to vest the unit with such powers (clause 7, clause 3.4, article 23 of the Tax Code of the Russian Federation). The tax office will independently transfer the information to the Pension Fund.

To register with the FSS, no later than 30 calendar days from the date of creation of the unit, you must submit it to the fund branch at its location (clauses 6, 9, 10 of the procedure for registration and deregistration with the FSS of the Russian Federation, approved by Order of the Ministry of Labor of the Russian Federation dated April 29, 2016 No. 202n):

- application for registration in the approved form (Appendix 1 to the Administrative Regulations of the Federal Insurance Fund of the Russian Federation for the provision of state services for registration and deregistration of policyholders - legal entities at the location of separate divisions, approved by Order of the Fund dated April 22, 2019 No. 217);

- a certificate from the bank about opening an account;

- a document confirming that the division will make payments to individuals (for example, a copy of the regulations on a separate division, which states that it independently pays salaries to its employees).

For violation of the 30-day period, a fine may be imposed on the organization (Article 26.28 of Law No. 125-FZ):

- 5 thousand rubles for delays of up to 90 days;

- 10 thousand rubles if the payment is overdue for more than 90 days.

In this case, the division independently withholds personal income tax from the income of its employees and transfers it to the budget, and also submits reports in Form 6-NDFL.

Legislative norms

In accordance with Article 11 of the Tax Code of the Russian Federation, an EP is any territorially independent structural unit in which there are stationary workplaces. Only those created for a period of at least one month are recognized as such jobs. Legislation recognizes the existence of a division, regardless of whether its creation is reflected in the constituent and other documents of the organization or not, and the powers with which it is vested.

Article 55 of the Civil Code defines the concepts of “representative office” and “branch”. A representative office has all the features of a legal entity specified in Article 11 of the Tax Code of the Russian Federation, but, in addition, it represents and protects the interests of a legal entity. According to the Civil Code of the Russian Federation, a branch carries out the functions of a legal entity and representative office. But the main difference between a branch and a representative office from an individual enterprise is that information about them is included in the constituent documents.

OP, regardless of type, act on the basis of provisions approved by the legal entity. Managers carry out activities on the basis of a power of attorney and are appointed by a legal entity. The reasons why OPs are created vary, but the general essence boils down to the company’s intention to conduct activities not only at the main address.

The procedure for opening an OP is conditionally divided into two large stages: registration and organization.

Accounting of a separate division

An organization can separate its separate divisions into a separate balance sheet. It independently establishes a specific list of indicators for the formation of such a balance and reflection of the property and financial position of the division as of the reporting date for the needs of company management (letter of the Ministry of Finance of the Russian Federation dated March 29, 2004 No. 04-05-06/27).

The organization's financial statements must include performance indicators of all its separate divisions, including those placed on separate balance sheets (clause 8 of PBU 4/99). It follows from this norm that divisions do not generate separate financial statements and do not draw up a separate balance sheet (the term “separate balance sheet” should be understood as a list of indicators established by the enterprise).

The accounting methods chosen by the organization when forming its accounting policies are applied by all separate divisions, including those allocated to a separate balance sheet (clause 9 of PBU 1/2008 “Accounting Policy of the Organization”, letter of the Ministry of Finance of the Russian Federation dated August 10, 2010 No. 07-02 -06/119).

The accounting policy should establish a chart of accounts used by separate divisions, as well as the procedure for their interaction with the parent enterprise when carrying out business transactions and preparing financial statements.

All transactions between the parent enterprise and a separate division (transfer of fixed assets, costs, financial results) are reflected by both parties in account 79 “Intra-business settlements”. To this account, you can open subaccounts 79-1 “Calculations for allocated property” and 79-2 “Calculations for current operations.” Thus, separate divisions allocated to a separate balance sheet conduct accounting independently in accordance with the accounting policies of the organization. The parent company reflects only its business transactions in accounting. When preparing financial statements for the entire institution, the indicators of the parent enterprise and separate divisions are summed up.

What should a separate division be like for an organization to have the right to the simplified tax system?

An LLC operating on a simplified basis may encounter an unexpected problem: one of the conditions allowing the simplified tax system is the absence of branches. That is, as soon as branches appear, the organization is obliged to switch to OSNO. This rule does not apply to representative offices, apparently because they cannot conduct commercial activities.

To understand how to open a separate division of an LLC and not lose the right to use the simplified tax system, you need to remember the difference between a branch and a separate division.

note

The branch is empowered to perform the duties of the parent company. In order not to lose the opportunity to apply the simplified tax system, you need to clearly think through and spell out the provisions on the OP. The fewer functions it performs and the less authority the manager has, the less chance there is of claims from the Federal Tax Service.

A separate division cannot apply for UNDV, since from January 1, 2022 this division will be abolished throughout Russia.

Income tax of a separate division

Organizations pay income tax to the federal budget at their location without distributing the tax amount among separate divisions (Clause 1, Article 288 of the Tax Code of the Russian Federation). The tax credited to the regional budget must be distributed between the head division and all separate divisions in proportion to the shares of profit that accrue to them. These amounts must be transferred to the budgets of the constituent entities of the Russian Federation at the location of the parent organization and each separate division (clause 2 of Article 288 of the Tax Code of the Russian Federation).

If there are several separate divisions of an organization on the territory of one subject of the Russian Federation, then it can choose one of them and make it a responsible division. Through it the tax will be paid to the budget of this subject of the Russian Federation. The tax authorities must be notified about this (letter of the Federal Tax Service of the Russian Federation dated December 26, 2019 No. SD-4-3/ [email protected] ).

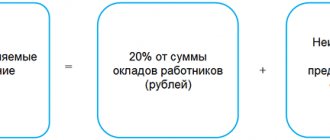

The share of profit of a separate division is calculated using the formula: share of the labor indicator (average number of employees or labor costs) share of the cost of depreciable property / 2.

The organization independently decides which of the two labor indicators it will use for calculation: the average number of employees or labor costs (clause 2 of Article 288 of the Tax Code of the Russian Federation). The selected indicator must be fixed in the accounting policy and not changed until the end of the year (clause 1 of Article 285, clause 2 of Article 288, Article 313 of the Tax Code of the Russian Federation).

If an organization and a separate division do not have depreciable property, the calculation using the formula must be made by taking only the average number of employees or labor costs (letter of the Ministry of Finance of the Russian Federation dated February 20, 2021 No. 03-03-06/1/12084).

The share of the average number of employees should be calculated using the formula: average number of employees of a separate division / average number of employees for the organization as a whole x 100 percent.

The share of labor costs is calculated using the formula: departmental labor costs / labor costs for the organization as a whole x 100 percent.

The share of the residual value of depreciable property should be calculated using the formula: average residual value of depreciable fixed assets of a division / average residual value of depreciable fixed assets for the organization as a whole x 100 percent.

An income tax return must be filed for the organization as a whole and for each separate division or group of divisions, if the tax to the regional budget is paid by the responsible division.

Income tax on a closed separate division in the reporting period in which it was liquidated is calculated in accordance with the general procedure. In subsequent reporting and current tax periods, tax is calculated taking into account the following features:

- the organization's profit, if it increases, is distributed between the parent organization and the remaining divisions minus the profit of the liquidated division, calculated for the reporting period preceding the quarter in which it was closed;

- the share of profit for other separate divisions and the parent organization for the reporting periods subsequent to closure and for the current tax period is determined without taking into account the indicators of the closed separate division.

This follows from subparagraphs 10.2, 10.12 of the procedure for filling out the income tax return, approved by Order of the Federal Tax Service of the Russian Federation dated September 23, 2019 No. ММВ-7-3/ [email protected]

If the organization’s profit in the next reporting period or in the current tax period has decreased or a loss has been incurred, then previously calculated advance tax payments both for the organization as a whole and for separate divisions, including closed ones, are reduced (clause 10.12 of the procedure). To do this, it is necessary to recalculate the tax base based on the fixed share of the profit of the liquidated division (letter of the Ministry of Finance of the Russian Federation dated August 10, 2006 No. 03-03-04/1/624, letter of the Federal Tax Service of the Russian Federation dated October 1, 2009 No. 3-2-10/23).

If, after a decrease in the tax calculated for a closed separate division, there is an increase in the tax base for the organization as a whole, advance payments for the tax of the liquidated division are not recalculated (letter of the Federal Tax Service of the Russian Federation dated May 28, 2019 No. SD-4-3 / [email protected] ).

Monthly advance payments for subsequent reporting periods after closing for a separate division are not calculated and not paid (clause 10.12 of the procedure).

Does a construction organization need to create an OP at a construction site in another region?

According to the contract, the construction organization plans to carry out construction and installation work in another region within 3-4 years. Is it necessary to register a separate division there and report this to the Federal Tax Service?

There is no clear answer to this question in the Tax Code of the Russian Federation. A separate division of an organization is any division territorially isolated from it, at the location of which stationary workplaces are equipped (Clause 2 of Article 11 of the Tax Code of the Russian Federation).

Jobs become stationary if they are created for a period of more than 1 month. A workplace is a place where an employee is located or where he must arrive to work, and which is directly or indirectly controlled by the employer (Article 209 of the Labor Code of the Russian Federation).

Thus, we can identify the characteristics of a separate unit:

- the period of activity of the organization outside its location is more than a month;

- the organization equipped workplaces for its employees;

- the territory where employees work is controlled by the organization.

If all these signs are present, and even more so if the organization has carried out a special assessment of workplaces, tax authorities will insist on registering an OP (Letters of the Ministry of Finance of the Russian Federation dated 07/03/2013 N 03-03-06/1/25485, dated 11/13/2015 N 03-02 -07/1/65879, Federal Tax Service of the Russian Federation dated November 27, 2007 N 09-2-03/ [email protected] ).

At the same time, in court you can try to defend the point of view that the construction of a new facility is not a work in progress in accordance with the contract. Arguments that will help in court are given in the Resolution of the Administrative Court of the North Caucasus District dated December 25, 2014 N F08-8748/2014 in case N A63-18443/2012:

- the facility where the employees work is controlled by the customer and is his property (land, construction site);

- the list, volumes and procedure for performing work are determined by the customer according to the technical specifications, design and estimate provided to the company by the customer;

- marks on arrival and departure from the place of work are made by the customer.

Arbitration practice is controversial. Therefore, if you are not ready to argue with inspectors, create an OP for the duration of construction and close it upon completion.

See also:

- [10.20.2020 entry] Declaration of income tax and property taxes for 9 months of 2022 in 1C

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Liquidation of an unfinished construction project - how can profits be reduced? Only for liquidation costs - this is the position expressed by the Ministry of Finance in...

- The capital's tax authorities explained the procedure for reflecting benefits in the DAM in a situation where they are assigned in one month and paid in another. The company assigned temporary disability benefits to an employee in June, but...

- How to check the tax rate under the simplified tax system in your region...

- How to report on property if you have several real estate properties in the region Since 2022, organizations have the right to submit a single tax return...

Property tax of a separate subdivision

An organization that includes separate divisions that have a separate balance sheet pays property tax to the budget at the location of each division in relation to property located on its separate balance sheet (Article 384 of the Tax Code of the Russian Federation).

The tax is calculated as the product of the tax rate in force in the territory of the constituent entity of the Russian Federation in which the unit is located and the tax base (1/4 of the average value of property) determined for the tax (reporting) period in accordance with Art. 376 of the Tax Code of the Russian Federation, in relation to each separate division.

If the address of the real estate property is located outside the location of the organization or its separate division that has a separate balance sheet, then the tax should be paid to the budget at the location of such real estate (Article 385 of the Tax Code of the Russian Federation).

Thus, the organization pays tax on real estate, which is listed on the balance sheet of a separate division, at the location of the property. Tax should be paid at the location of a separate subdivision only if it coincides with the location of the real estate.

Deregistration of a separate division

To close a separate division that is not a branch or representative office, it is enough to deregister it with the Federal Tax Service and the Social Insurance Fund if it had an account and made payments to employees.

To do this, you need to submit a message to the tax service in form No. S-09-3-2, approved by Order of the Federal Tax Service of the Russian Federation No. ED-7-14 / [email protected] This must be done within three working days from the date of the decision to close (clause 3.1 clause 2 article 23 of the Tax Code of the Russian Federation). Violation of the deadline will result in a fine:

- organizations in the amount of 200 rubles (clause 1 of Article 126 of the Tax Code of the Russian Federation),

- general director - 300–500 rubles (part 1 of article 15.6 of the Administrative Code).

The tax authority will transmit information about the deregistration of a separate division to the Pension Fund, which will deregister the division within three working days from the date of receipt of the information. There is no need to submit a separate application to the Pension Fund.

To deregister a unit from the FSS, you must submit an application (Appendix No. 2 to Administrative Regulation No. 217). It must be accompanied by a copy of a certificate from the bank confirming that the department's current account has been closed. There is no deadline for submitting documents. In any case, we recommend doing this before the end of the current reporting period.