Reasons for equipment conservation

Equipment conservation is carried out due to the following circumstances:

- man-made accidents, natural and man-made disasters that caused the cessation of equipment operation;

- non-use of equipment for more than three months in a row;

- inability to repurpose equipment due to its specific features;

- equipment cannot be rented out;

- equipment used seasonally in commercial and non-commercial activities.

Who makes the decision to preserve equipment?

According to current Russian legislation, the decision to “freeze” equipment can only be made by the general director. However, even if there is permission, employees must conduct an appropriate inventory - a check that will show the condition and quantity of the property.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

To do this, the manager issues an official order to form a group of employees who will take responsibility for the inspection and actual preservation of the equipment, after which it will be possible to carry out the procedure in accordance with the established requirements of the legislator.

But what to do if the procedure must be carried out in the absence of the general director (for example, this person is on sick leave or on vacation)? In this case, all responsibility for the correct implementation of conservation falls on his deputy or a person with such powers that must be fully spelled out in their job descriptions.

Information that must be present in the document

The act must contain the following information:

- date of transfer of equipment for conservation;

- list of equipment that needs to be transferred;

- initial cost of equipment;

- reason for transfer;

- actions that were performed for the transfer;

- the amount of upcoming expenses;

- residual value if preservation is planned for more than three months;

- the amount of expenses already incurred;

- preservation period.

During inventory control, equipment that is intended for canning is allocated by the commission to a separate group. To account for it, the subaccount “Objects transferred for conservation” is used. Such equipment is registered in the act, indicating the manufacturer, model name and inventory number.

Preservation and re-preservation of fixed assets

Organizations that have a large number of fixed assets on their balance sheets are sometimes faced with the need to transfer some of their assets to conservation. At the same time, accounting workers have questions related to documenting such an operation.

Conservation helps preserve the characteristics of fixed assets necessary for their future operation.

In accounting, an object transferred for conservation continues to be included in fixed assets, and its value is not excluded from the property tax base.

For the purposes of corporate income tax, costs for conservation, re-preservation, and maintenance of mothballed assets are taken into account in non-operating expenses.

Proper documentation of conservation is a prerequisite for recognizing the costs of its implementation when calculating corporate income tax.

The decision on conservation is formalized by order of the head of the organization.

This order must indicate the conservation period and list the measures that need to be taken to transfer the OS to conservation.

Afterwards, an act on transferring the OS to conservation should be drawn up.

There is no unified form of the act on the transfer of fixed assets for conservation, so it is drawn up in any form. The act is signed by the members of the commission and approved by the head of the organization. The act reflects the economic feasibility of mothballing a fixed asset object.

The act must indicate:

- OS transferred to conservation;

- date of transfer of the OS for conservation;

- activities that were carried out to transfer the OS to conservation;

- the costs of carrying out these activities.

For fixed assets mothballed for three months or less, depreciation during the mothballing period is accrued in the usual manner.

Depreciation refers to expenses for ordinary activities, regardless of the results of the organization’s activities in the reporting period and is reflected in the accounting records of the reporting period in which it is accrued (5, paragraph 5, clause 8, clause 16 of the Accounting Regulations “Organization’s Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n, clause 24 PBU 6/01).

For OS preserved for a period of more than three months (clause 23 of PBU 6/01, clause 63 of the Methodological Instructions dated October 13, 2003 N 91n):

— from the first day of the month following the month of transfer to conservation, depreciation accrual stops;

It is worth noting that in accounting, the time period during which the property is mothballed (even if it exceeds a three-month period) will not affect its useful life.

But according to accounting laws, depreciation can be calculated even after the end of the useful life of fixed assets (clause 22 of PBU 6/01).

It follows from this that after the reactivation of objects, depreciation can be continued in the same manner until their cost is fully repaid.

Thus, from the first day of the month following the month in which the asset was re-mothballed, depreciation is resumed in the same amount as before mothballing.

Let's consider an example of OS preservation for a period of more than three months.

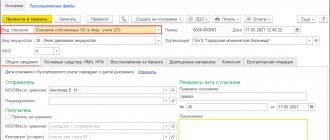

To pause the OS, you must use the document “Changing the OS State”. We will indicate the conservation date at the end of the month. In the header of the document, you must indicate the OS event, check the necessary flags “Reflect in accounting and tax accounting”, “Affects the calculation of depreciation (wear and tear)” (Fig. 1).

Let's consider the result of the document (Fig. 2).

To resume the calculation of depreciation on fixed assets, we will also use the document “Changing the state of the fixed assets.

When filling out the document, in the header you need to indicate “Date” and “FA Event”, set the flag “Reflect in accounting and tax accounting”, “Affects the calculation of depreciation (wear and tear)” and “Calculate depreciation” (Fig. 3).

Let's consider the result of reactivation of a fixed asset (Fig. 4).

Preservation period

By law, the minimum period for equipment preservation is three months, and the maximum is three years. Calculation begins from the date of approval of the document. If there is a need to extend the period, then the proposal for extension must be put forward no later than a month before the expiration of the conservation period. As for the re-preservation of equipment, the proposal is made no earlier than five months after re-preservation (resumption of operation of previously mothballed equipment).

Typical mistakes when filling out a document

Since the document does not have a single form, it is drawn up in any form. True, the practice of tax and audit audits shows that accountants, when filling out documents, systematically make mistakes. Here are the most basic ones:

- errors in writing words and numbers (in calculations);

- adding text;

- notes made in pencil;

- different ink colors;

- unspecified date of document preparation;

- the name of the organization is incorrectly indicated;

- the fact of economic or production activity has not been deciphered;

- signing a document by a person acting on someone else’s behalf without authority or in excess of the authority granted;

- conspicuous mechanical impact on the document (artificial aging, masking part of the text);

- the act was drawn up on sheets of varying quality.

Of course, all of the above errors cannot indicate the invalidity of the document. It is quite possible that such filling was due to objective reasons.

Important! The Federal Tax Service Inspectorate will always show interest in such documents, as it will consider them to be improperly executed. This means that the tax service will refuse to reimburse the organization for VAT and reduce the taxable base of the direct tax levied on the organization’s profits.

Documenting

The decision to mothball a fixed asset must be formalized by order of the head of the organization, which must indicate:

- reasons for conservation;

- the duration of the fixed asset being preserved;

- employees responsible for the conservation of the fixed asset and its subsequent re-preservation;

- employees responsible for the safety of mothballed fixed assets.

Advice: the transfer of a fixed asset for conservation (re-preservation of a fixed asset) must be additionally documented in an act. This document will confirm the fact of conservation (re-preservation).

Each fact of economic life is subject to registration with a primary accounting document (Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ). The order is only an intention to transfer the fixed asset to conservation. They cannot confirm the actual conservation of a fixed asset. After all, conservation involves performing certain work to bring temporarily unused fixed assets to a state that ensures their best preservation. Accordingly, during re-preservation it is necessary to carry out work to bring the fixed asset to a state in which it can be operated.

There are no unified forms for the act of conservation and the act of re-preservation of fixed assets. Therefore, the organization has the right to develop them independently.

Error correction

If an accounting specialist notices an error in the act, he has the right to correct it. For example, if the amount was entered incorrectly in the document, it can be edited by crossing it out and indicating the correct value. However, do not forget that corrections in the document must be certified correctly. For this it is enough:

- put in the act the date when the correction was made;

- write “Corrected Believe”;

- sign the employee who is responsible for the correction;

- decipher this signature.

When filling out a document, it is unacceptable to use line corrections, blots, corrections and erasures.

What are the features of drawing up an act in form KS-17

The document must indicate the grounds for suspending the project. In addition, the document must contain the following essential information:

- project interruption costs;

- the amount of funds required to pay for the contractor’s services;

- cost of work performed;

- the amount of funds and volumes of work that are needed to suspend construction.

The document is drawn up in 3 copies: for the contractor, the customer and the investor (if he requests his own copy).

To fill out an act in form KS-17, as a rule, you need data from other primary sources, such as, for example, forms KS-6 and KS-6a.

Read more about the features of working with forms KS-6 and KS-6a in the articles:

- “Filling out a general journal of construction work (nuances)”;

- “Procedure for filling out the general work log (sample)”.

Copies of the act in form KS-17 must be transferred by the customer to its accounting department, and by the contractor to its own.