The article discusses whether you always need to pay state duty, where you can get a receipt, and also provides various payment methods with step-by-step instructions for the process.

How to close an individual entrepreneur correctly

In accordance with the provisions of the law, in order to liquidate the individual entrepreneur in 2022, the businessman completes the package with the following papers:

- an application for termination of commercial activities, drawn up in form P26001, provided for by the classification;

- a receipt confirming payment of the state fee;

- passports, SNILS certificates and TIN of the applicant.

To close an individual entrepreneur, an entrepreneur applies to the government agency that registers enterprises - the tax department.

Additionally, issues related to:

- contributions to the Pension Fund;

- repayment of budget debt to government bodies;

- additional commercial services.

When paying the state duty, you are required to provide information about the payer's details. The individual entrepreneur is liquidated within five days, excluding weekends, from the date of submission of documentation to the tax department. If the papers are submitted and the issues that arise are resolved, the applicant is given a document confirming the provision of the necessary information and the liquidation of the individual entrepreneur.

A preliminary request is submitted to the Pension Fund regarding the repayment of debt before the final cessation of the enterprise. If an individual entrepreneur has a debt to social services, the entrepreneur may be subject to a large fine, and the tax office will refuse to liquidate the enterprise.

Closing an individual entrepreneur in the Federal Tax Service

To close an individual entrepreneur with the tax office, you must submit a package of documents. This can be done in one of the following ways:

- When visiting the tax office in person;

- Sent by mail;

- Electronically on the tax website;

- By transferring with a trusted person who has a notarized power of attorney.

Before submitting documents and paying the state fee, you must make sure that the individual entrepreneur has no debts on taxes, fees and deductions, which may serve as a reason for refusing to liquidate. In addition, the owner of the individual entrepreneur must deregister the cash register that submitted data on issued checks to the Federal Tax Service.

If the owner of the individual entrepreneur has fulfilled all his obligations, he has no debts and the application is completed correctly, but the Federal Tax Service will give a document that will indicate information about the deregistration and closure of the individual entrepreneur. After deregistration of an individual entrepreneur, it is necessary to make sure that information about this has reached the Pension Fund of Russia, the Social Insurance Fund and the Compulsory Medical Insurance Fund.

Sending documents by mail

If an entrepreneur cannot go to the tax office in person, the documentation is sent by mail. The papers are sent by registered mail with a mandatory description of the contents of the package.

In case of incomplete set or discrepancy of the submitted papers, the paid state duty is not refunded. The fee will have to be paid again. To avoid misunderstandings and additional financial expenses, you need to resolve all issues related to closing the enterprise in a timely manner, and collect documentation according to the list provided by law.

What to pay attention to

When visiting in person to liquidate an individual entrepreneur, you only need to bring with you a passport, an application, a certificate of registration of an individual entrepreneur and TIN. It is also possible to act by power of attorney, then the standard set of documents will need to be accompanied by a copy of the intermediary’s passport, a notarized power of attorney and an extract from the Unified State Register of Individual Entrepreneurs.

It is possible to close an individual entrepreneur remotely: by mail, through a courier service or via the Internet. In the first two cases, a package of papers, including the state duty form for closing IP P26001 and an application along with a list of the contents of the envelope, are sent by registered mail. Online liquidation of individual entrepreneurs is possible only for registered users of State Services with a confirmed electronic signature.

The procedure for terminating the status of an individual entrepreneur requires a minimum of effort, so there is no point in concluding an agreement with lawyers: the state duty form for closing an individual entrepreneur P26001 can be easily filled out in a couple of minutes, and the package of documents required by the Federal Tax Service is prepared on its own.

Where can I get a current form to fill out?

The receipt form can be obtained from the tax office at the registration address of the individual entrepreneur or LLC or downloaded from the official portal of the department.

To pay, you need to know the details of the Federal Tax Service where the company is registered. They must be clarified so that the payment goes through correctly and reaches the correct recipient.

Articles:

Receipt and details for paying the state fee for individual entrepreneur registration

I closed the IP in 2022, what next?

Receipt for closing an individual entrepreneur

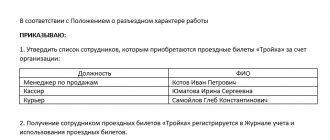

The receipt form for payment of the state duty for closing an individual entrepreneur is filled out indicating:

- Full name and registration address;

- TIN code;

- bank with the applicant’s account number and details of the financial organization;

- details of the payment recipient, including account number, KBK, INN, KPP and OKTMO.

The receipt for closing an individual entrepreneur in 2022 consists of two parts, one of which is issued to the payer, the second remains in the bank where the operation was carried out. Each half indicates the date of payment and signature of the payer.

The paid receipt is attached to the set of papers submitted to the branch of the Federal Tax Service.

Where to get a receipt when liquidating an individual entrepreneur

When liquidating an individual enterprise, you must either contact the tax authority at your place of registration, or go to your personal account on the Federal Tax Service website. On the Federal Tax Service website you need to find the section for paying state duties and select the appropriate one. Next, you need to open the link and fill out all the data. Full name, contact phone number and address must be filled in.

Application for closing an individual entrepreneur - sample filling

Next, you need to check all the entered data and click the “pay” button. The service will offer 2 payment methods: cash and non-cash. When paying with a bank card/electronic wallet via the Internet, you do not need to additionally print out a receipt form. But if you plan to make the payment at a bank or MFC, you need to print out the completed document.

Note! To print a receipt, on the tax service website you need to complete all the above steps and click “generate”.

The receipt in PDF format will be printed directly from the site or first saved to your computer. If you do not have your own printer, the receipt must be saved in the same PDF format on electronic media and printed at any suitable location.

Payment through a Sberbank branch

One of the easiest ways to pay the state fee for closing an individual entrepreneur is to visit a Sberbank branch. It is important for the payer to correctly indicate his data and information about the recipient.

The tax service details included in the state duty payment receipt are individual for each department branch. An entrepreneur can check the data by calling the Federal Tax Service. If an error is made when specifying the details, the payment will have to be made again.

The entrepreneur must prove his identity by presenting his passport. If you have any questions about filling out the receipt, a representative of the financial institution will help. For a form filled out by a bank employee, you will need to pay an additional 20 rubles, which is confirmed by a separate check.

Payment through Sberbank online

Another convenient option for paying state fees for terminating activities is to contact the Sberbank online service. Payment is also possible through the official website of Sberbank.

To pay the state fee, you will need:

- Login to the site or application.

- Go to the tab with payments and transfers.

- In the name of the recipient structure, indicate the name of the tax department branch.

- Provide passport details and other information about the payer.

- Select the type of state duty.

If funds are transferred by non-cash method, the printed receipt must be certified at the branch of the financial institution.

The document is recognized as valid if it has the employee’s signature and the bank’s seal.

This you need to know: How to pay a debt to bailiffs through Sberbank-Online

Payment via MFC

Services for paying the state fee for closing an individual entrepreneur are provided by a network of MFCs opened in Moscow and other cities of the Russian Federation. Pre-registration on the official website will help you avoid wasting time in queues.

On the appointed date and time, you must go to the MFC with your passport and TIN. An employee of the center will perform the operation to pay the state duty. The procedure will take no more than ten minutes.

Documents can be sent to the MFC by mail if the entrepreneur does not have enough time to visit the authorities.

How does the procedure for closing an individual entrepreneur work?

Individual entrepreneurs, unlike legal entities, cannot have founders or co-owners. This means that the entrepreneur makes the decision to liquidate alone. As a rule, he also acts independently, taking various documents to the authorities and getting rid of property. The state fee for closing an individual entrepreneur must be paid in advance, before submitting the application. You can pay for it literally in 5 minutes, and you need to save the receipt to begin liquidation.

Liquidation of individual entrepreneurs

There are two ways to close an individual entrepreneur:

- On one's own;

- With the help of specialists who offer paid liquidation services.

The second method is good because all the necessary tax documents, documents to the Pension Fund of the Russian Federation, Unified State Register of Individual Entrepreneurs and other authorities will be submitted on time. Our specialists have experience and do not forget about every point when closing an individual entrepreneur; they accurately fill out the documentation and take on all the work themselves.

Note! This is beneficial for the entrepreneur: after all, for a relatively small fee, he can avoid bureaucratic delays and errors in documentation.

Before starting the liquidation procedure, the individual entrepreneur must pay all current contributions, taxes, fines, penalties and make all payments to employees or permanent employees. The dismissal of the entire workforce must be reflected on paper. In other words, the entrepreneur must end all financial transactions and financial relationships. According to the law, the above actions are sufficient to begin the liquidation procedure, but in practice it is better to do other operations in advance:

- Deregister all cash registers;

- Submit declarations to the Federal Tax Service (including for incomplete reporting periods);

- Deregister from the Social Insurance Fund;

- Close the individual entrepreneur's current account.

Next, you need to collect a package of documents for closing. This is, first of all, an application with a claim for closure and a receipt for payment of the state fee. All these documents must be submitted to the tax authority at the place of official registration of the individual entrepreneur.

The Federal Tax Service checks the submitted documents and the presence of unpaid debts. If everything is in order, then the individual entrepreneur is removed from the Unified State Register of Individual Entrepreneurs, officially considered closed, and the individual who was an entrepreneur receives a certificate of liquidation. And only after this the termination procedure can be considered officially completed.

Reference! It is not at all necessary to destroy the seal of an individual entrepreneur after its liquidation, but the entrepreneur will have to close the cash register. And he decides for himself what to do with the cash register equipment.

Liquidation of individual entrepreneurs through State Services

To pay the required state fee for closing an individual entrepreneur through State Services, you will need to first register on the resource. Having passed identification on the portal, the businessman creates a personal account, after logging in to which you will need:

- Click on the button to add an organization and indicate its affiliation with an individual entrepreneur.

- On the list.

- Select the electronic form for performing the operation and enter personal information.

- Attach the necessary documents.

- Send a request for registration to the Federal Tax Service.

If everything is done correctly, a confirmation of the closure of the enterprise will be sent to the applicant by e-mail within the five working days provided for by law.

Cashless payment via the Internet

Online payment of the state duty for terminating the activities of an individual entrepreneur is carried out through the tax service portal.

Procedure:

- Log in to the official portal of the tax department.

- Select the section on payment of state duty.

- Place a dot opposite the line “due to termination of activity” with the amount of 160 rubles.

- Enter your full name, residential address and Taxpayer Identification Number - the last condition is mandatory if the fee is paid by transfer.

- After checking the entered data, the payment button is pressed.

- Select the method of transferring funds - by bank transfer.

- Click on the icon of Sberbank or other financial organization.

- Generate a receipt and make a payment by clicking the appropriate confirmation.

A payer who closes an individual entrepreneur and ceases business activities will receive a message on his mobile phone containing a special code. After entering this number, the payment will be processed.

An alternative option is to choose cash payment. In this case, an electronic form of receipt is generated, which should be printed and paid at any financial institution. In this case, you will not have to fill out the form. The businessman will only have to sign in the appropriate boxes, and the remaining information will be filled in automatically.

When choosing a financial organization through which funds are transferred to pay the state fee for closing an individual entrepreneur, the entrepreneur checks the icon of the desired structure.

Receipt example

The payment receipt fits on one A4 sheet. In the upper left corner there is a barcode of the bank mark, in the upper left corner there is information about the individual entrepreneur (address, full name, telephone, checkpoint and tax identification number, current account number, BIC, KBK, and so on). Below this data are the date and signature fields, which are also filled out by the entrepreneur. In the second half of the page there is a table with the same data. One copy remains with the individual, and the second is submitted to the tax authorities along with the application for liquidation of the individual entrepreneur. By the way, in different regions, receipts may differ slightly in form, but the fields to fill out remain the same.

A receipt in electronic form does not differ in appearance from a regular paper receipt. It must be paid before filing an application for liquidation, and the remaining insurance premiums must be paid no later than 15 days from the date of recording the closure in the unified register. Information is usually entered by tax authorities. The amount of contributions is calculated in the traditional way, but not the full year is taken for calculations, but only those months in a given year when the individual entrepreneur still existed.

Note! Contributions to the Pension Fund are not taken into account in the amount of state duty. Pension insurance contributions are targeted and are paid separately in a different manner.

Payments made on a receipt with errors are quite difficult to correct. To avoid this time-consuming process, it is important to check the completed form for typos and whether the entered data corresponds to reality.