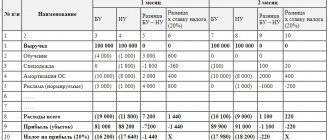

An example of calculating exchange rate differences in accounting

According to paragraph 3 of PBU, exchange rate differences in accounting are considered as the difference between the value of assets (debts) accounted for in foreign currency on the date of their payment (or the reporting date of the current period) and the value of assets (debts) on the date of their display in accounting in the current period (or the reporting date of the previous period).

The reporting date is the end of the year (clauses 4, 12, 13 PBU 4/99).

IMPORTANT! pp. 4, 6 tbsp. 15 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ defines the reporting date as the last calendar day of the period for which reporting is prepared.

Before the decision of the Supreme Court of the Russian Federation dated January 29, 2018 No. AKPI17-1010, organizations were required to prepare interim monthly and quarterly reports (clause 48 of PBU 4/99, clause 29 of the Regulations on accounting and financial reporting, approved by order of the Ministry of Finance of Russia dated July 29. 1998 No. 34n (as amended on March 29, 2017). However, the Supreme Court of the Russian Federation came to the conclusion that the preparation of interim accounting (financial) statements is not the responsibility of every economic entity, and declared clause 48 of PBU 4/99 and clause 29 invalid Regulations on accounting and financial reporting in the Russian Federation, indicating that interim reporting is presented only in certain cases.

Cases when economic entities are required to submit interim reports are listed in paragraph 4 of Art. 13 of the law of December 6, 2011 No. 402-FZ. These include cases provided for:

- Legislation of the Russian Federation.

For example, it is legally established that insurance organizations, mutual insurance companies, and insurance brokers are required to submit interim reports (clause 2 of article 4.1, clause 8 of article 32.8 of the law “On the organization of insurance business in the Russian Federation” dated November 27, 1992 No. 4015- I), issuers of securities (Clause 7, Article 30 of the Law “On the Securities Market” dated April 22, 1996 No. 39-FZ).

- Regulatory legal acts of state accounting regulatory bodies.

- Treaties.

- Constituent documents.

- Decisions of the owner of an economic entity.

Thus, if your organization does not fall under any of the above cases, then it has no obligation to prepare interim reports, and therefore, it is not required to generate exchange rate differences in accounting at the end of each quarter or month.

Assets (debts) are revalued at the Central Bank exchange rate or at the rate fixed by laws or agreement of the parties to the transaction (clause 5 of the PBU).

ConsultantPlus experts explained in detail how to reflect exchange rate differences in the statement of reconciliation of settlements with the counterparty. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

Example

Export Import LLC carried out the following actions (the exchange rate is conditional).

| date | Actions | Dt | CT | Amount, dollars | Central Bank exchange rate, rub./dollar | Amount, rub. |

| 26.05 | An advance payment has been sent to the supplier for frozen berries | 60 | 52 | 41 200 | 55,9208 | 2 303 936,96 |

| 03.06 | Frozen berries were received from the supplier and capitalized | 41 | 60 | 123 620 | 56,6616 | 6 973 986,03 = 41 200 × 55,9208 + (123 620 – 41 200) × 56,6616 |

| 18.06 | Frozen berries are resold to the buyer | 62 | 90 | 194 670 | 57,4942 | 11 192 395,91 |

| 29.06 | Payment received from buyer for frozen berries | 52 | 62 | 194 670 | 57,5598 | 11 205 166,26 |

| 29.06 | Requirements to the buyer were revalued on the date of their payment - positive CD was written off | 62 | 91 | — | 57,5598 | 12 770,35 = 194 670 × (57,5598 – 57,4942) |

| 30.06 | The debt to the supplier was revalued at the end of the month - a negative CR was credited* * Posting is done if there is an obligation to prepare interim reports. | 91 | 60 | — | 57,2649 | 49 723,99 = (123 620 – 41 200) × (57,2649 – 56,6616) |

| 04.07 | The balance of the debt to the supplier has been paid | 60 | 52 | 82 420 | 57,5375 | 5 533 761,22 |

| 04.07 | The debt to the supplier was revalued on the date of payment - a negative CR was credited* * This calculation is made on the condition that the organization as of the reporting date of June 30 was obliged to draw up interim reports and reflect exchange rate differences | 91 | 60 | — | 57,5375 | 22 467, 69* = (123 620 – 41 200) × (57,5375 – 57,2649) |

| 04.07 | The debt to the supplier was revalued on the date of payment - a negative CR was credited* * This calculation is made on the condition that the organization as of the reporting date of June 30 was not required to prepare interim reports and reflect exchange rate differences | 91 | 60 | — | 57,5375 | 72 191,68 = (123 620 – 41 200) × (57,5375 – 56,6616) |

IMPORTANT! Advances received (paid) in foreign currency are recorded in the accounting system in rubles at the exchange rate on the date of their receipt (payment) and are not subject to subsequent revaluation (clauses 9, 10 of the accounting regulations).

Positive exchange rate differences

Positive exchange rate differences are formed:

- when recalculating funds in a foreign currency account or currency in the cash register, if on the date of the transaction with currency (date of reporting) its exchange rate has increased;

- when recalculating securities (except for shares), settlement funds, loans and credits (except for advances, prepayments and deposits), if on the date of the transaction in currency (date of reporting) its exchange rate has increased;

- when recalculating accounts payable, if on the date of repayment of the debt (date of reporting) the exchange rate turned out to be lower than on the date of its occurrence;

- when recalculating accounts receivable, if on the date of repayment of the debt (date of reporting) the exchange rate turned out to be higher than on the date of its occurrence.

The amount of positive exchange rate differences is included in other income. To do this, the accountant needs to make the following entry:

DEBIT 50 (52, 60, 62, 66, 76...) CREDIT 91-1

— a positive exchange rate difference is reflected.

In the Statement of Financial Results, positive exchange differences are shown in line 2340 “Other income”.

Positive exchange rate differences increase taxable profit (clause 2 of Article 250 of the Tax Code of the Russian Federation).

EXAMPLE 1. ACCOUNTING FOR POSITIVE EXCHANGE DIFFERENCES

Radar JSC entered into an agreement with the Canadian company Goods Ltd.

for the supply of products. Radar shipped products on January 25 of the reporting year for a total amount of $1,000. Goods Ltd. paid Radar's invoice in US dollars on January 30 of the reporting year. The US dollar exchange rate was: - as of January 25 - 24.50 rubles / USD; - as of January 30 - 25.00 rubles / USD. Radar's accountant will do the following postings: January 25 DEBIT 62 CREDIT 90-1

- 24,500 rubles.

(1000 USD × 24.50 rubles/USD) – revenue from the sale is reflected; January 30 DEBIT 52 CREDIT 62

- 25,000 rubles.

(1000 USD × 25.00 RUR/USD) – payment has been received from the buyer; DEBIT 62 CREDIT 91-1

— 500 rub. (1000 USD × (25.00 rub./USD – 24.50 rub./USD)) – reflects a positive exchange rate difference.

How to calculate exchange rate differences in tax accounting

According to paragraph 11 of Art. 250 of the Tax Code of the Russian Federation, a positive exchange rate difference is established as the difference formed when property or claims presented in foreign currency are revalued upward, and debts are revalued downward.

Negative differences are formed when property or claims presented in foreign currency are revalued downward, and debt is revalued upward (subclause 5, clause 1, article 265 of the Tax Code of the Russian Federation).

Property, claims (debts) presented in foreign currency are revalued on the date of the event that occurred earlier than the others, such as: receipt of property in ownership, repayment of the claim (debt) or the end of the month (clause 8 of Article 271, clause 10 of Article 272 Tax Code of the Russian Federation).

When revaluing claims (debts), the Central Bank rate or the rate fixed by law or agreement of the participants in the transaction is used (clause 8 of Article 271, clause 10 of Article 272 of the Tax Code of the Russian Federation).

Advances received (paid) in foreign currency are taken into account in rubles at the Central Bank exchange rate on the date of their receipt (payment) and are not subject to subsequent revaluation (clause 8 of Article 271, clause 10 of Article 272 of the Tax Code of the Russian Federation).

Before the decision of the Supreme Court dated January 29, 2018 No. AKPI17-1010, accounting and tax accounting standards for the assessment and recognition of exchange rates coincided. After the Supreme Court of the Russian Federation made a decision to invalidate clause 29 of the Regulations on Accounting and Financial Reporting, the Ministry of Finance of the Russian Federation declared it invalid (see Order of the Ministry of Finance of Russia dated April 11, 2018 No. 74n, which entered into force on May 7, 2018). As a result, the assessment and recognition of exchange rate differences in tax and accounting of organizations that do not prepare interim reporting will now be carried out according to different rules, which for most taxpayers will lead to the formation of temporary differences.

See also “PBU 18/02 - who should apply and who should not?”

When does it occur?

Exchange rate differences arise when revaluing payments made in the national currency of foreign countries in relation to the ruble exchange rate accepted by the Central Bank of the Russian Federation.

Differences often arise due to the unstable exchange rate of the dollar or euro, when receiving dividends or when paying customs duties in foreign currency.

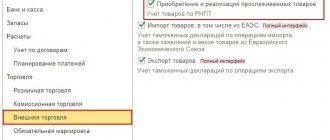

Exchange rate differences arise when performing the following transactions:

- acquisition of investments from foreign countries;

- purchase and sale of services, goods at national currency rates;

- transactions with securities;

- transactions for the purchase and sale of funds in national currencies;

- when paying travel expenses.

Differences from sum

The total difference occurs when exchanges are made on the same day at different market rates of foreign currencies. The exchange rate is determined when evaluating foreign currencies between different dates of transactions.

Only exchange rate differences are used for accounting purposes. In tax accounting, both sum and exchange rates are calculated.

The concept of an amount difference is defined as the difference that is formed if the price of goods or services established by the contract in currency units is paid in rubles. Since 2015, the total difference has been called exchange rate difference.

How to calculate - formulas

The calculation must be made only according to the data of the Central Bank of the Russian Federation. The recommendations of this particular accounting are aimed at avoiding exchange rate discrepancies between the foreign exchange market and the Central Bank of the Russian Federation.

The expression of the exchange rate difference using the formula is calculated as:

Formula:

KR = KPO – KR * SV,

Where KR is the exchange rate difference,

KPO - the exchange rate of one currency at the time of the initial transaction,

KR - exchange rate at the time the difference is determined,

SV - total amount credited to the Kyrgyz Republic.

Based on the results of the calculated indicators, the exchange rate difference can be expressed as:

- positive – KR will be higher o;

- negative - KR will be lower o;

Or there will be no difference at all, KR = “0”.

Exchange rate differences are also fully taken into account in expenses and income when calculating VAT for accounting and tax purposes.

Recalculations are carried out as of the last day of the month, or on the date of transfer of goods to the buyer or provision of services.

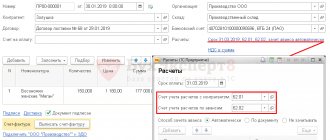

Example of calculation for a foreign exchange transaction

Initial data:

The amount of goods under contractual obligations is equal to 10,000 US dollars. The buyer received the goods on April 1, and payment for the goods was made on April 30.

As of April 1, the US dollar exchange rate was 59 rubles/dollar, and on April 30 it was set at 60 rubles/dollar.

Calculation:

Upon receipt of the goods on April 1, the buyer recognizes revenue in the amount of: 10,000*59=590,000 rubles.

On April 30, the money from the buyer for payment should be calculated: 10,000 * 60 = 600,000 rubles.

Thus, a positive exchange rate difference is obtained: 10,000 * (60-59) = 10,000 rubles.

Accounting for exchange rate differences in the VAT return

When calculating the VAT tax base formed on the date of shipment of goods, transactions performed in foreign currency are reflected in rubles at the Central Bank exchange rate on the date of shipment of goods and are not revalued on the day of payment.

It turns out that CDs do not arise when determining VAT, and therefore are not displayed in the VAT return. KRs formed upon the fact are displayed when calculating profit tax in non-operating income and expenses (clause 4 of Article 153 of the Tax Code of the Russian Federation).

How other transactions are subject to VAT can be read in the materials in the section of our website “VAT: object of taxation” .

Results

The procedure for reflecting the Kyrgyz Republic in accounting and tax accounting is identical only if the organization has an obligation to submit interim reporting. If the organization does not have such an obligation, then when reflecting exchange rate differences, it is necessary to generate entries for the accrual and recognition of deferred tax assets/liabilities. The Kyrgyz Republic is credited to income and expenses:

- in accounting - for others;

- tax accounting - for non-operating ones.

The exception is the CD formed during the revaluation of settlements with the founders and assets (liabilities) used outside the Russian Federation.

They are credited to additional capital. KR are taken into account when forming the tax base for profits. They are not shown in the VAT return. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.