Who is obliged to create

The obligation to create an estimated liability for vacations in accounting is prescribed by PBU 8/2010, approved by Order of the Ministry of Finance No. 167n dated December 13, 2010.

The vacation reserve is an estimated monetary expression of the employer’s obligation to pay vacation pay to employees, formed as of a certain date. In other words, what is a vacation reserve in simple terms - these are deferred funds that will be spent in the future. In our case, the employee will take a vacation in a few months, and we already recognize the amount of future vacation pay as expenses and set aside for the future.

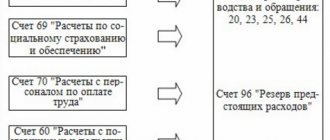

The organization determines the rules for its formation independently and provides for it in its accounting policies. When it is created, the amount of the estimated liability is recognized as expenses, and not the payment of vacation pay. The latter will be accrued at the expense of the estimated liability. To account for them, account 96 of the chart of accounts is used, to which a separate sub-account “Reserve for vacation pay” is opened.

Typical entries when calculating vacation reserves for commercial organizations

| Operation | Debit | Credit |

| Funds have been reserved for future vacation pay | 20, 25, 26, 44 | 96 |

| Vacation pay accrued | 96 | 70 |

| Accrued amounts paid | 70 | 51, 50 |

Are all organizations required to create a reserve for vacation pay in accounting? Yes, all companies are required to do this, with the exception of those who have the right to keep accounting in a simplified form. The right to conduct simplified accounting is established by the Accounting Law No. 402-FZ for the following organizations:

- small businesses;

- non-profit organizations;

- participants of the Skolkovo project.

ConsultantPlus experts have compiled a detailed guide on how to create and use a vacation reserve in an organization’s accounting. Use these instructions for free.

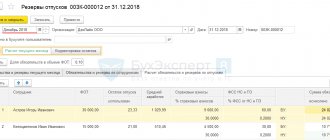

Document for calculating estimated liabilities and reserves in 1C ZUP 3

Starting from ZUP version 3.1.10, the document Accrual of estimated obligations for vacations has been renamed to the document Vacation reserves .

For more details, see Where can I find a document on the accrual of estimated obligations for vacations, starting with ZUP 3.1.10?

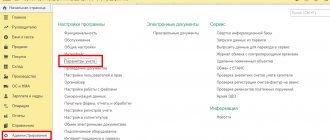

After installing the methodology for calculating estimated liabilities/reserves, Vacation reserves becomes available the Salary :

The Vacation Reserves document should be entered as the latest: after calculating wages for the month and generating the document Reflection of wages in accounting .

The Vacation Reserves document contains three tabs:

- Calculation of estimated liabilities for vacations - data on the basis of which the liabilities are calculated. The composition of this data is determined by the methodology selected in the organization’s settings;

- Estimated liabilities (by employees) - the results of calculating estimated liabilities by employees, departments and methods of reflection. Can be used to check totals;

- Estimated liabilities of the current month are total values broken down by departments and methods of reflection, which then go into the accounting program for generating transactions.

On the Calculation of estimated liabilities for vacations , the calculation is carried out separately for:

- estimated liabilities/reserves,

- contributions,

- contributions for “injuries”.

Moreover, each calculation group contains columns, the data for which is generated depending on the method used. Let's list these columns:

- Counted,

- Accumulated,

- Passed.

Methods for creating an estimated liability in accounting

It is necessary to create a reserve for vacation pay at least once a year in accordance with PBU 8/2010 clause 15 as of December 31 (that is, the reporting date).

In this case, on December 31, a lump sum of vacation pay is reserved, which is expected to be paid next year in one transaction. For example, it is permissible to take the amount of payments similar to payments for the reporting year.

This formation principle is the simplest for accounting, but is incorrect for recognizing expenses, since at the reporting date the company does not yet have obligations to pay vacation pay to employees: they may quit, the company will hire new employees, and the estimate will be incorrect.

It would be more correct to recognize expenses for the formation of the estimated liability evenly throughout the year. If you use this method, you need to estimate the amount of unused vacation days as of December 31 and monthly determine the cost of accumulated vacations and make additional accrual of reserved amounts. You can estimate the possible amount of savings for the next year and include this amount evenly:

- monthly (divided by 12);

- quarterly (divided by 4).

Having assessed what methods there are for calculating the reserve for vacation pay and their labor intensity, the organization has the right to independently establish in its accounting policies the rules for creating an estimated liability.

How to create a vacation reserve

All must create a reserve for vacation pay this year . The only exceptions are those who are allowed to keep simplified records .

The vacation reserve (hereinafter also referred to as RO) shows the amount of obligations to employees to pay for vacations.

Companies themselves decide on which reporting date to form a RO. The following options are acceptable when ROs are created:

- on the last day of each month;

- on the last day of the reporting quarter;

- December 31st every year.

Note that is most preferable , since it shows the complete picture of the current situation with paid vacations. However, this method is more labor-intensive and requires significant accountant time.

The last option is the simplest . It is used by the majority of companies that prepare reports only at the end of the year.

The second option is the golden mean and is considered more optimal in terms of efficiency and labor-intensive costs for its calculation.

The company confirms the chosen method in the order for approval of the accounting policy.

Tax accounting

Answering the question of who is obliged to create reserves for vacations in tax accounting, let us turn to the provisions of the Tax Code of the Russian Federation contained in Article 324.1. In tax accounting, the creation of such an estimated liability is a right, not an obligation, of the company. But if you want to avoid accounting for temporary differences, then it makes sense to decide to provide for the accrual of the vacation valuation liability in tax accounting. In this case, expenses also take into account contributions to the reserve, but do not take into account vacation pay and insurance premiums accrued on them.

The creation procedure is described in the Tax Code in Article 324.1. If the company decides to form it, then the accounting policy must reflect:

- the very fact of making a decision;

- reservation method;

- maximum deduction for the current tax period;

- deduction percentage.

Calculate the deduction percentage using the formula:

Calculate monthly deductions as follows:

At the end of each year it is necessary to carry out an inventory of the estimated liability. For this:

- The number of unused rest days for each employee is determined.

- Based on the calculation of the average salary for the vacation reserve, the forecast value of the vacation pay amounts is determined.

- The estimate is compared with the actual balance received at the end of the year.

- If the actual accrued amount is less than the calculated amount, then it is additionally accrued, attributing the excess amount to labor costs.

- If the actual accrual turns out to be higher than the inventory estimate, then the excess portion is written off and included in non-operating income.

To facilitate accounting and minimize temporary differences, a decision should be made to create an estimated liability in tax accounting. Moreover, it is worth developing rules for its creation in accounting, similar to those established in the Tax Code.

The Ministry of Finance in 2012, in letter No. 03-03-06/4/29, expressed the opinion that compensation for unused vacation cannot be accrued from the reserve, but should be included in costs at the time of accrual. This position is controversial, since the amounts for which compensation is paid were already included in expenses when forming the estimated liability. Following it leads to overestimation of expenses, and also creates a temporary difference with accounting data.

An example of calculating and reflecting the vacation reserve in the accounting accounts

This is an example of the above method of calculating the reserve - based on average earnings. Below you will see examples for other reservation options.

Example

reflected in the accounting policy that the reserve for vacation pay is formed quarterly. To calculate wages and insurance premiums, account 44 “Distribution costs” is used; in total, the company employs 20 people. The company has no grounds for applying reduced or increased insurance premiums (the total rate of insurance premiums is 30.2%). As of March 31, the data for the quarter is as follows:

- number of days of unused vacation - 134;

- for the 1st quarter, the amount of accrued wages amounted to 678,000 rubles;

- there are 91 days in the quarter.

- Let's calculate the reserve as of 03/31/20XX:

SDZ = 678,000 / 91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 134 × 20,372.53 × 134 × 20 × 30.2% = 998,380.40 301,510.88 = RUB 1,299,891.28.

Postings:

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 998,380.40.

Dt 44 “Sales expenses” Kt 96.01 “Vacation reserve” - RUB 301,510.88.

- Let’s add a few more data to this example to understand how the vacation reserve is adjusted:

- as of 03/31/20XX, a reserve for vacation and insurance premiums was accrued in the amount of RUB 1,299,891.28;

- in the 2nd quarter, the amount of accrued vacation pay and insurance contributions from them amounted to 140,900 rubles;

- the number of unused vacation days at the end of the 2nd quarter is 120 days;

- wages for the 2nd quarter and the number of employees remained the same as in the previous period.

Thus, as of 06/30/20XX, the amount of the unused reserve amount is equal to 1,299,891.28 - 140,900 = 1,158,991.28 rubles.

Reserve amount as of 06/30/20XX:

SDZ = 678,000 /91 / 20 = 372.53 rubles.

The reserve amount is 372.53 × 120 × 20,372.53 × 120 × 20 × 30.2% = 894,072,270,009.74 = RUB 1,164,081.74.

Amount for contributions to the reserve as of the end of the 2nd quarter:

1,164,081.74 (calculated reserve) - 1,158,991.28 (reserve balance, balance in account 96) = 5,090.46 rubles.

If the amount of the reserve on the account. 96 exceeded the calculated amount at the end of the quarter, the reserve should have been reduced. In our case, it is necessary to make an additional accrual posting.

Postings:

Dt 44 Kt 96.01 - 5,090.46 rub.

An example of calculating the vacation allowance

PPT.ru LLC creates an estimated liability for the payment of vacation pay. As of 12/31/2021:

- the balance of the previously accrued estimated liability is RUB 410,000;

- number of employees - 50 people;

- average monthly salary - 25,000 rubles;

- the number of unused vacation days is 450.

An example of how a vacation reserve table is formed:

The amount in excess of the actually accrued and estimated reservation of vacation amounts is taken into account on December 31, 2021 as part of non-operating income in the amount of:

410,000 - 39991.74 = 10068.26 rubles.

If vacation is granted in advance...

In accordance with Art. 122 of the Labor Code of the Russian Federation, paid leave must be provided to employees annually. Moreover, the right to use vacation for the first year of work arises for the employee after six months of his continuous work with this employer. By agreement of the parties, paid leave may be granted to the employee before the expiration of six months. That is, in some cases, the employer has the right to grant leave before the employee has worked the corresponding period for which the leave is granted. This is the so-called vacation in advance. No accruals are made for such payments (vacation pay) in the vacation reserve accounts.

Obligations to accrue vacation pay in the current reporting period, if the employee did not actually work the period for which vacation pay was accrued, are reflected (clause 302 of Instruction No. 157n, Letter of the Ministry of Finance of the Russian Federation dated August 16, 2019 No. 02-06-10/62943):

– on the debit of account 0 401 50 000 “Deferred expenses” (the corresponding analytics is selected); – on the credit of account 0 302 00 000 “Settlements for accepted obligations.”

Features of the formation of an estimated liability in a budgetary institution

When recording transactions, budgetary and autonomous institutions use their own chart of accounts, established by Order of the Ministry of Finance No. 157n dated December 1, 2010. The Ministry of Finance in letter No. 02-07-07/28998 dated May 20, 2015 recommends entries and examples of vacation reserves in a budgetary institution in 2022: the estimated liability is determined monthly based on data on unused rest days on the last day of the month.

It is proposed to use one of three methods to calculate the vacation reserve for 2022 in a budgetary institution.

Method 1. Personally for each employee:

Method 2. For the institution as a whole:

Method 3. For individual categories (for example, separately for each structural unit):

where K1, K2... Kn are unused rest days for each category of employees,

ZP1, ZP2... ZPn - average daily salary for each category of employees.

An example of how the vacation reserve is formed in the budget for 2022

The average daily salary of employees is 1000 rubles.

The number of unused vacation days as of December 31, 2021 is 125.

The amount of reserved vacation pay as of 01/01/2022 will be:

Postings of a budgetary institution

| Operation | Debit | Credit |

| Funds have been reserved for future holiday payments on employee benefits | 040120211 (010961211) | 040161211 |

| on insurance premiums | 040120213 (010961213) | 040161213 |

| Vacation pay accrued | 040161211 | 030211730 |

| Insurance premiums are charged to pay for vacation days | 040161213 | 0303XX730 |

Reports on estimated liabilities and provisions

Reports for analyzing data on estimated liabilities and vacation reserves are located in the Salary – Salary Report section:

- Help-calculation “Vacation reserves” - a detailed calculation of estimated liabilities and reserves for employees (changes its appearance depending on the methodology used).

- Balances and turnover of vacation reserves - by type of reserve, summary information on the movement of estimated liabilities (movements in account 96) is displayed.

- Leave reserves for employees - shows movements in estimated liabilities for employees (deciphering account 96).

Provision for doubtful debts in accounting

But the formation of a reserve for doubtful debts in the accounting of a small enterprise does not depend on the method of accounting. This is a reserve that will have to be created in any case.

All small businesses create reserves for doubtful debts in accounting in accordance with the generally established procedure.

This obligation is assigned to all companies if they have doubtful accounts receivable (clause 70 of the Regulations on accounting and financial reporting in the Russian Federation, approved by order of the Ministry of Finance dated July 29, 1998 No. 34n).

The amount of the reserve for doubtful debts is also an estimate. This is stated in paragraph 3 of PBU 21/2008 “Changes in estimated values.”

But in PBU 21/2008 there is no rule that would establish benefits for its use for anyone. That is, everyone should use it.

Read in the berator “Practical Encyclopedia of an Accountant”

Provision for doubtful debts in accounting

Provision for vacation pay - estimated liability

In the accounting of organizations, in accordance with PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”, they are required to recognize estimated liabilities in accounting while simultaneously meeting the following conditions:

- the organization has an obligation resulting from past events in its economic life, the fulfillment of which the organization cannot avoid, or this obligation is most likely to arise;

— there will be a decrease in economic benefits;

— the amount of the estimated liability can be reasonably estimated.

For employees of the organization, in accordance with the norms of labor legislation, in particular Art. Art. 114, 115 of the Labor Code of the Russian Federation, the right to a certain number of days of paid leave arises every month. For each month worked, an employee has the right to claim at least 2.33 days of paid annual leave (28 days / 12 months). At the same time, there is no certainty on the part of the employer regarding the fulfillment of the obligation to pay vacation pay to the employee, since, for example, the employee may quit, so the amount of the obligation cannot be accurately determined. Thus, by virtue of paragraph 4 and paragraph 5 of PBU 8/2010, vacation pay obligations are estimated, and the organization is obliged to create a reserve for this estimated obligation (Letters of the Ministry of Finance of Russia dated June 14, 2011 N 07-02-06/107, dated 04/19/2012 N 07-02-06/110).

PBU 8/2010 grants the right not to create valuation reserves for small businesses, with the exception of organizations issuing publicly offered securities, and socially oriented non-profit organizations (clause 3 of PBU 8/2010).

An organization is considered a small business if it meets the following criteria (clause 1, subsection “b”, clause 2, clause 3, part 1, part 2, 3, article 4 of Law No. 209-FZ, clause 1 Decree of the Government of the Russian Federation dated 02/09/2013 N 101):

1. The total share of participation in the authorized capital of an organization of the Russian Federation, constituent entities of the Russian Federation, municipalities, foreign, public, religious organizations, foundations does not exceed 25%

2. The total share of participation in the authorized capital of the organization of other organizations that are not small and medium-sized businesses does not exceed 25%

3. The average number of employees for the previous calendar year did not exceed 100 people.

4. Revenue from the sale of goods (work, services) excluding VAT for the previous calendar year is 400 million rubles.

PBU 8/2010 does not contain rules for determining the amount of the estimated liability associated with the payment of vacation pay. There are no rules for creating a vacation reserve in other accounting regulations. The procedure for creating reserves is established by the organization independently and is enshrined in the accounting policies for accounting purposes.

In any case, the amounts of the resulting estimated liabilities must be calculated based on the employee’s average earnings, including the amounts of insurance contributions, which, in accordance with the law, must be accrued when paying vacation pay.

A reserve for vacation pay can be created by an organization:

- on the last day of each month;

- on the last day of each quarter;

- on December 31 of each year.

The first option is the most labor-intensive, but more accurate. The last option can only be used by those organizations that prepare only annual reports. The best option is when the reserve is formed on the last day of each quarter.

Deductions to the reserve are made on the reporting date (the last day of the month, quarter or year) in the debit of the same accounts, depending on what the employees’ work is related to (production costs, selling expenses, general or general production expenses, the cost of a non-current asset and etc.)

D 20 (08, 23, 26, 44) K 96-reserve for vacation pay - Reserve for vacation pay has been accrued

Vacation pay and compensation for unused vacation days, as well as insurance premiums accrued on their amount, are accrued from the reserve:

D 96-reserve for vacation pay K 70 - Accrued vacation pay (compensation for unused vacation) at the expense of the reserve

D 96-reserve for vacation pay K 69 - Insurance premiums have been accrued for the amount of vacation pay at the expense of the reserve

If the accrued reserve is not enough (the balance on account 96 has become zero), vacation pay (compensation for unused vacation) must be credited to the debit of cost accounting accounts 20 (08, 23, 26, 44).

In the balance sheet, the amount of the reserve as of the reporting date (credit balance of account 96 “Reserves for future expenses”, subaccount “Reserve for vacation pay”) is reflected in line 1540 “Estimated liabilities”.

If the organization does not create a reserve for upcoming expenses to pay for vacations for profit tax purposes (Article 324.1 of the Tax Code of the Russian Federation) or the methodology for calculating and accruing the reserve in accounting differs from the methodology adopted in tax accounting, then the provisions of PBU 18/02 “Accounting for settlements for corporate income tax." At the time the amount of the liability is accrued, it is necessary to reflect a deferred tax asset (DTA), which is determined by multiplying the amount of accounting contributions to the reserve by the income tax rate (20%). When granting vacation to an employee or calculating compensation for unused vacation, these expenses will be recognized in tax accounting, and in accounting must be written off against the reserve. Accordingly, at this moment the previously recognized IT will be repaid in the part attributable to the expenses recognized in tax accounting.