What determines the minimum and maximum maternity payments?

All women insured by the Social Insurance Fund (SIF) can receive a maternity benefit determined by calculation.

You can be insured there either compulsorily (if there is an employer who pays contributions to the Social Insurance Fund) or voluntarily (when there is no employer and insurance premiums are paid independently). The volume of maternity payments from the Social Insurance Fund is the product of the number of days of maternity leave and the average daily earnings of a woman for the two years preceding the year of maternity leave (Clause 1, Article 14 of the Law “On Compulsory Social Insurance...” dated December 29, 2006 No. 255- Federal Law).

When assigning benefits, it is allowed:

- if there are several places of work, calculate it separately by each employer or one place at a time, taking into account income received in all places of employment;

- shift the calculation period for which data will be taken by 1-2 previous years, if there was another maternity leave or parental leave in the calculation period, in order to obtain a higher average earnings.

If a woman gives birth to a child while on “children’s” leave, benefits are paid to her according to special rules, which were described by ConsultantPlus experts. Get free access to K+ and you will be able to find out the entire procedure for paying maternity leave in this situation.

The income from which the calculation is made is limited to the minimum and maximum possible values. The role of the first (if real earnings in terms of full working time is insufficient or the woman is insured in the fund voluntarily) is performed by the federal minimum wage in force on the start date of maternity leave (clauses 1.1, 2.1 of Article 14 of Law No. 255-FZ). The second value is determined by the legally established values of the income limits for each year of the billing period that are subject to contributions to the Social Insurance Fund (clause 3.2 of Article 14 of Law No. 255-FZ).

Both boundary indicators characterizing the income taken into account increase annually, and it is for this reason that the values of the maximum and minimum maternity benefits increased in 2022.

The number of days by which the amount of income related to the calculation period should be divided to obtain the average amount of earnings is equal to their real calendar number (730, 731 or 732, depending on which years fall within the calculation period). This amount is reduced by days corresponding to periods of payments not subject to insurance contributions (clause 3.1 of Article 14 of Law No. 255-FZ). The latter, in particular, includes time spent on sick leave, maternity leave and parental leave.

The coefficient taking into account the length of work experience is not applied to average earnings when calculating maternity benefits (clause 4 of Article 14 and clause 1 of Article 11 of Law No. 255-FZ).

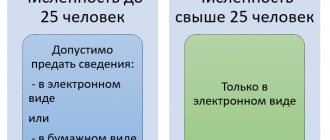

Important! Since 2022, maternity benefits to working women are paid directly by the Social Insurance Fund, and the employer only transfers to the fund the information and documents necessary for the assignment and payment of benefits. But despite the fact that the employer does not pay the maternity leave money, he must calculate her average earnings and indicate it in the sick leave for the Social Insurance Fund.

A sample from ConsultantPlus will help you fill out a sick leave certificate for a maternity leaver. You can get trial access to the legal system for free.

Payments upon registration up to 12 weeks

Among the social benefits for pregnant women, there is also a payment for registration in the antenatal clinic at an early stage. Women who have received the right to benefits under the BiR and have registered with the housing complex for a period of up to 12 weeks can apply for this money. To apply for payment to pregnant women, you will need an application and a certificate from a medical institution. It is filled out in free form. The certificate must be presented no later than 6 months from the end of the vacation.

Working women receive benefits from their employer. The timing of crediting the calculated amount depends on the following nuances:

- If a woman has submitted a certificate along with a sick leave certificate, the benefit is paid simultaneously with maternity payments.

- If a woman presented a certificate of registration up to 12 weeks later than the sick leave, payments are accrued within 10 days from the date of submission of the certificate and application.

The employer transfers the amount of the payment to the employee, and then the Social Insurance Fund compensates for the expenses. Find out what payments are due to unemployed pregnant women in a separate Brobank material.

Amount of minimum maternity leave in 2021

When determining the amount of the minimum possible maternity benefits, one should be guided not only by Law No. 255-FZ, but also by the Regulations on the specifics of calculating benefits (approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375). With regard to the calculation of the minimum wage for compulsorily insured persons, the Regulations prescribe:

- apply a regional coefficient to the amount of this minimum (clause 11(1));

- the minimum wage value corresponding to the start date of maternity leave should be spread over 24 months and divided by 730 days (clause 15(3));

- do not take into account the fact of working part-time (clause 16).

For those who are voluntarily insured, the calculation of the average daily benefit amount will be different (clause 15.4 of the Regulations):

- the regional coefficient for the minimum wage is not used here;

- The amount of daily benefits is determined by dividing the federal minimum wage by the number of calendar days in the month the maternity leave begins.

What will be the minimum amount of maternity payments in 2021? The minimum wage has been increased to 12,792 rubles from 01/01/2021. Calculation from it will give the following values of the minimum average daily benefit:

- for compulsorily insured persons - 12,792 × 24 / 730 = 420.56 rubles;

- for voluntarily insured persons (in relation to months with the largest number of calendar days in them) - 12,792 / 31 = 412.65 rubles.

The full amount of the minimum maternity payment in 2022, as in previous years, depends on the duration of maternity leave, which in the standard situation is 140 calendar days. With it, the minimum maternity leave is equal to:

- for compulsorily insured persons - 420.56 × 140 = 58,878.40 rubles;

- for voluntarily insured persons - 412.65 × 140 = 57,771.00 rubles.

However, these amounts may be further reduced if the woman does not use maternity leave in full or is the adoptive parent of a newborn.

Minimum wage for social payments

The minimum wage was introduced to support socially vulnerable segments of the population. It is used to determine the minimum payment amounts. The following payments are compared with the minimum wage:

- wages;

- average daily payment for disability;

- voluntary contributions to OSS.

The minimum wage from January 1, 2022 is 12,130 rubles. When calculating payments to a pregnant woman, the employer must apply the minimum indicator in 2 cases:

- If a woman has not received payments for the 2 years that are taken into account, she will be charged mandatory contributions to OSS.

- If the total amount of taxable payments for 2 years is less than the minimum wage for 2 years.

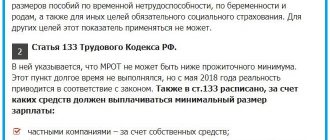

The established minimum wage is tied to the minimum subsistence level of an able-bodied citizen. That is, the minimum wage, which is in effect from January 1, 2022, is equal to the cost of living for the second quarter of the previous year. But if a year later the cost of living decreases, the minimum wage will remain the same. This ensures that women's financial situation does not worsen.

Give your rating

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

The maximum maternity payment amount in 2022

The maximum amount of maternity leave depends on:

- on the size of the maximum permissible average daily earnings taken into account;

- the maximum possible duration of maternity leave.

The first of these values in 2022 is equal to the sum of the limits of income subject to insurance contributions established for 2022 and 2022 divided by 730 (clause 3.3 of Law No. 255-FZ):

(865,000 + 912,000) / 730 = 2434.25 rubles.

With standard maternity leave (140 days), the maximum amount of maternity leave in 2022 is: 2434.25 × 140 = 340,795 rubles.

But the vacation can be longer. Thus, in case of complicated childbirth, the benefit amount will be 379,743 rubles. (RUB 2,434.25 x 156 days), for multiple pregnancy - RUB 472,244.50. (RUB 2,434.25 x 194 days).

Its greatest length corresponds to 200 calendar days, at which the maximum amount of maternity leave in 2022 is equal to: 2434.25 × 200 = 486,850 rubles.

Who can count on child care benefits?

Child care benefits are assigned and paid in accordance with Federal Law No. 81-FZ dated May 19, 1995 “On state benefits for citizens with children”:

- citizens of the Russian Federation;

- foreign citizens permanently residing in the Russian Federation;

- foreigners temporarily residing in the territory of the Russian Federation and subject to compulsory social insurance in case of temporary disability and maternity.

The following have the right to a monthly allowance for child care up to 1.5 years:

- mothers, fathers, guardians (including full-time students);

- mothers are contract military personnel;

- relatives who actually care for the child - subject to mandatory payment of insurance contributions to the Social Insurance Fund;

- mothers dismissed due to the liquidation of the organization during pregnancy or maternity leave;

- other relatives of the child - if they were fired due to the liquidation of the organization during parental leave;

- relatives caring for the child who are not insured by the Social Insurance Fund - if the child’s parents have died or have been deprived of parental rights in relation to him.

Benefit for a child under 1.5 years of age is not provided if:

- the child is fully supported by the state;

- the applicant is deprived of parental rights to this child.

Besides:

- in the case of the birth of 2 or more children, the benefit is assigned for each child;

- are not paid for a stillborn child ;

- if a woman has 2 types of leave at the same time - for child care and for pregnancy and childbirth - she will not be able to combine them; she must choose one of these payments;

- If a woman is officially employed, a care allowance is assigned to her at the end of her maternity leave. If she does not work, then child benefits are due from birth ;

- If a woman is registered with an employment center, she needs to refuse unemployment benefits in order to receive child care benefits.

Results

The amount of maternity benefits is legally limited in size. Moreover, these restrictions apply to both its maximum and minimum size. Both values depend on 2 parameters: the average daily benefit amount and the duration of maternity leave. The average daily benefit amount is determined by the federal minimum wage (for its minimum amount) and the maximum values of the amounts of income subject to contributions (for its maximum amount).

Sources:

- Federal Law of December 29, 2006 No. 255-FZ

- Decree of the Government of the Russian Federation of June 15, 2007 No. 375

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Minimum and maximum amount of benefits for child care up to 1.5 years

From February 1, 2022, there was an increase in childcare benefits for children under 1.5 years of age. These benefits in the Russian Federation are usually indexed at the beginning of the year, which was done in 2022.

In 2022, various social benefits were increased due to the coronavirus pandemic. Thus, on July 8, 2022, Law No. 166-FZ was signed, which formalized the increase in minimum child care benefits retroactively - from June 1, 2020 .

The innovation concerned, first of all, non-working mothers - who receive not 40% of their earnings, but a minimum amount of benefits. And this minimum size has been increased significantly compared to the previous value.

If the benefit calculated on the basis of the minimum wage is less than the minimum benefit, then the minimum benefit is paid. So, in 2022 the minimum wage is 12,792 rubles. 40% of the minimum wage is 5116.80 rubles, which is less than the minimum amount established from February 1, 2022 - 7082.85 rubles.

Thus, in 2022, regardless of the birth order of the child being cared for:

- The minimum amount of child care payment is 7082.85 rubles. (established by law);

- the maximum payment amount is RUB 29,600.48. (2434.25 × 30.4 × 40%).

In the Russian Federation, these amounts must be indexed annually based on the forecast level of inflation.

EXAMPLE OF CALCULATION OF CHILD CARE BENEFITS UP TO 1.5 YEARS OLD

Accountant of Aktiv LLC Belaya M.V. is about to take leave to care for her first child. To calculate her benefits, we are interested in her income for 2022 and 2022.

For 2022, she received the following types of income:

- salary – 300,000 rubles;

- additional payment for overtime work – 20,000 rubles;

- bonus at the end of the year - 40,000 rubles;

- the amount of compensation for expenses for accounting courses is 25,000 rubles;

- bonus in connection with the company’s birthday – 3,000 rubles.

In 2022, Belaya received the following types of income:

- salary – 350,000 rubles;

- temporary disability benefit for 86 days – 47,000 rubles;

- additional payment for overtime work – 10,000 rubles;

- bonus at the end of the year - 40,000 rubles;

- bonus in connection with the company’s birthday – 3,000 rubles.

Let's calculate the amount of the employee's income for 2022 and 2022, which is taken into account when calculating benefits for a child under 1.5 years of age:

- income for 2022 = 300,000 rubles. + 20,000 rub. + 40,000 rub. + 3000 rub. = 363,000 rub.

- income for 2022 = 350,000 rubles. + 10,000 rub. + 40,000 rub. + 3000 rub. = 403,000 rub.

We do not include the amount of compensation for expenses for accounting courses and temporary disability benefits in income.

From the calculation period we exclude 86 days of the employee being on sick leave in 2022.

The number of calendar days included in the calculation is 644 days (365 days + 365 days – 86 days).

Next, we calculate the average daily earnings for the benefit.

Average daily earnings = (RUB 363,000 + RUB 403,000) / 644 days. = 1189.44 rub. /day

This is less than the maximum average daily earnings (RUB 2,434.25) and more than the minimum (RUB 420.56).

Allowance for a full month of care leave – RUB 14,463.59. (1189.44 rubles/day × 30.4 days × 40%), which is more than the minimum child care benefit (7082.85 rubles).

Thus, accountant of Aktiv LLC Belaya M.V. will receive a childcare benefit for a child up to 1.5 years old in the amount of 14,463.59 rubles. per month.

Calculation of minimum benefits when caring for several children

Part 3 Art.

15 of Federal Law No. 81-FZ provides for an applicant caring for several children under the age of 1.5 years to sum up the maximum amount of care benefits. For example, in June 2022, when caring for 2 children, the minimum benefit amount is 14,165.70 rubles. (RUB 7,082.85 × 2).

There is also a cap for officially employed applicants who care for multiple children. For this category, the summed care allowance for all children cannot exceed 100% of average earnings . But at the same time, the minimum benefit amount is again taken into account. You cannot pay less than this amount (justification - Part 2 of Article 11.2 of Law No. 255-FZ and Part 3 of Article 15 of Law No. 81-FZ).

EXAMPLE

The accountant of Horns and Hooves LLC sends his accountant colleague V.V. Zadorozhnaya. on parental leave to care for three children under 1.5 years old. Based on average earnings, her allowance for one child was 8,000 rubles. This means that for three children the benefit amount should be 24,000 rubles (8,000 × 3). However, the average salary of Zadorozhnaya V.V. is 17,500 rubles.

The amount of the total minimum benefit for three children in 2021 is RUB 21,248.55. (RUB 7,082.85 × 3).

We compare all the amounts received. The total amount of the calculated benefit (24,000 rubles), as well as the amount of the minimum benefit (21,248.55 rubles) is more than the average earnings (17,500 rubles). Therefore Zadorozhnaya V.V. will receive a benefit for caring for three children under 1.5 years old in the amount of 17,500 rubles.

Calculation of child care benefits up to 1.5 years for less than a month

The procedure for calculating child care benefits for children under 1.5 years old for less than a full month is prescribed in Part 5.2 of Art. 14 of Federal Law No. 255-FZ.

To calculate you need:

- Determine the amount of child care benefits for a full calendar month.

- Divide the benefit amount for a calendar month by the number of days in the month.

- Multiply the resulting amount by the number of calendar days of parental leave per month.

In the form of a formula, the calculation of child care benefits for children up to 1.5 years for less than a full month can be presented as follows:

EXAMPLE

From the accountant of Aktiv LLC Belaya M.V. from our previous example, parental leave for a child up to 1.5 years old begins on July 24, 2021. July has 31 calendar days. Let's calculate the July child care benefit for her:

Benefit for July = 14,463.59 rubles. / 31 days × 8 days = 3732.54 rub.

Thus, Belaya M.V. when applying for care allowance, he will receive an allowance for July 2022 in the amount of RUB 3,732.54.

Regional coefficients when calculating care benefits

In accordance with Part 2 of Art. 15 of Law No. 81-FZ, if regional coefficients are applied to wages in a region or locality, they must be taken into account when calculating the maximum amount of child care benefits.

However, if the care allowance is calculated based on average earnings , then there is no need , since it has already been taken into account when calculating the employee’s wages (Article 5 of Law No. 81-FZ).