Unregulated advertising expenses

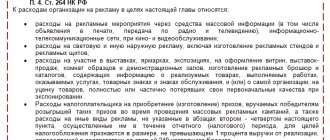

The list of advertising expenses recognized by the Tax Code of the Russian Federation in full is strictly limited.

If an organization’s advertising expenses can be attributed to one of the groups listed above, then they reduce the tax base in full when calculating income tax. It should be noted that in paragraph 4 of Art. 264 only brochures and catalogs are indicated. Despite the fact that the Ministry of Finance of the Russian Federation considers booklets, flyers and leaflets to be a type of advertising brochures, disputes about classifying them as non-standardized expenses are not excluded.

Let us note some nuances that must be taken into account when accepting non-standardized advertising expenses for accounting, i.e., including the full amount of expenses.

- To accept advertising expenses in the media as such, you need a copy of the certificate of registration as a media outlet of the counterparty placing your advertisement.

- The Ministry of Finance of the Russian Federation in its letter dated June 15, 2011 No. 03-03-06/2/94, referring to Art. 16 of the Law “On Advertising” dated March 13, 2006 No. 38-FZ, indicated: in order for an advertisement published in a print publication that does not work on advertising to be considered with features suitable for advertising standards in print media, it must include the appropriate label - “ Advertising" or "On the basis of advertising".

- If an advertising product, for example a billboard, has a cost of over 100,000 rubles. and is intended for use longer than 12 months, then the costs for it are taken into account through depreciation charges.

There is increased interest among tax authorities in assessing non-standardized advertising expenses. In order to avoid deduction of advertising expenses in full, the accountant must be scrupulous with the documents confirming non-standardized advertising expenses. The main requirement, in addition to those generally accepted for primary documents, is confirmation that these expenses are included in those mentioned in paragraph 4 of Art. 264 Tax Code of the Russian Federation.

If you have access to ConsultantPlus, check whether you are correctly taking into account advertising costs when calculating taxable income. If you don't have access, get a free trial of online legal access.

Rationing of advertising expenses and tax accounting

In NU, advertising expenses are recognized as other expenses related to the production and sale of goods (Tax Code of the Russian Federation, Article 264-1).

This article contains a closed list of expenses, the rationing of which is not necessary (clause 4 of the same article). The following will be taken into account in full:

- expenses for advertising in the media, including on the Internet: for the creation and promotion of an Internet page for a product, company, commercials, etc.;

- expenses for outdoor advertising: outdoor and indoor advertising structures, visual printed advertising (flyers, calendars, posters);

- expenses for participation in exhibitions and fairs (payment for participation, preparation of retail space, advertising paper products, markdown of product samples).

Other advertising expenses need to be rationed. The standard is set at 1% of sales revenue. They take into account not only the sale of their own products, but also goods for resale. The acquired property rights are also taken into account.

Question: How to record the costs of producing advertising printed materials? The contractual cost of producing advertising booklets and catalogs (printed products) amounted to 180,000 rubles. (including VAT 30,000 rubles), while the cost of producing a unit of these types of printed products exceeds 100 rubles. Advertising printed materials contain information about goods and services, the sale of which is subject to VAT, and are intended exclusively for distribution to visitors of a specialized exhibition in which the organization is participating. For the purposes of tax accounting of income and expenses, the accrual method is used. View answer

Expenses for mobile SMS mailings, product tastings, expenses for drawings, purchase of prizes, advertising in catalogues, etc. are regulated.

On a note! When determining the volume of revenue, excise taxes and VAT are excluded from calculations (letter No. 03-03-01-04/1/310 of the Ministry of Finance dated 06/07/05).

Since the calculation of the volume of standardized expenses is associated with the calculation of revenue for the period and cumulative totals, the indicators will change throughout the year. The quarterly cumulative total of revenue allows expenses that were not included in the standard in the previous quarter to be classified as such in the next.

The final calculation of advertising costs of a regulated nature is made at the end of the year. The remainder of the amount of advertising costs that were not recognized as normalized at the end of the year is not carried over to the next year.

For example, the costs of creating your own website are taken into account for NU purposes entirely as advertising. However, the costs associated with organizing trade through the specified site are associated with the production and sale of goods for NU purposes. In this case, advertising as such may also take place.

The distribution of flyers at the fair (and the corresponding costs) is not regulated, but the distribution of branded prizes based on the results of a drawing arranged for visitors is included in the regulated advertising costs. The classification of the production and distribution of booklets and flyers into the category of non-standardized costs, along with brochures and catalogues, is confirmed by the Ministry of Finance (in letter No. 03-03-06/1/42279 dated 08/12/16 and a number of other earlier ones).

The list of regulated expenses is open by the legislator, therefore, a company can attribute to advertising any expenses with signs of advertising that comply with Federal Law No. 38, regardless of whether they are named in the Tax Code or not. Confirmation of this thesis can be found in the practice of the courts (for example, the post. FAS MO No. A40-54372/11-91-234 dated 21/03/12).

The general rule is that any expenses must have documentary evidence - this also applies to advertising expenses. Confirmation can be provided by estimate documentation, documentation confirming the acquisition of goods and materials, reference documentation when conducting advertising campaigns in the media.

Other advertising expenses can be included in the calculation for accounting purposes both in the period in which they were incurred and in the payment period, depending on the accounting method.

When using the accrual method, the moment of recognition may be the presentation of documents for the transaction: an act, an invoice, or the last day of the reporting (tax) period (Tax Code of the Russian Federation, Article 272).

On a note! Accounting for advertising expenses for OSNO and simplified tax system “income minus expenses” is carried out according to the same rules. Under the simplified tax system, the moment of actual payment of expenses is decisive (Tax Code of the Russian Federation, Article 346.17).

Commercial activities on an international scale obviously also include advertising costs, but there is one peculiarity here: international treaties and agreements may not fully comply with Russian analogous norms. In this case, the priority is the international treaty (Tax Code of the Russian Federation, Article 7, document of the Ministry of Finance No. 03-08-RZ/9491 05/03/14, a number of other similar ones) and its conditions. It follows from the above that in some cases, standardized advertising costs are fully included in tax calculations, without applying the standard.

Distribution of promotional products and VAT

Organizations resorting to measures to promote their goods, works or services on the market in the format of distributing advertising materials, it is important to remember one point. The Ministry of Finance of the Russian Federation in letters dated October 23, 2014 No. 03-07-11/53626, dated July 16, 2012 No. 03-07-07/64 draws attention to: only gratuitous delivery of brochures and catalogs for advertising purposes is exempt from VAT, regardless of their cost acquisitions. For all other products transferred for advertising purposes that have a material form, be it mugs, calendars with a company logo, etc., the rule applies: if the cost is 1 pc. handouts exceed 100 rubles; in case of transfer, VAT must be charged in accordance with the generally established procedure.

IMPORTANT! Since 2015, when calculating VAT for payment, you can take into account the full amount of input VAT on advertising expenses, without taking into account whether these expenses are regulated or not.

How to take into account the costs and reflect advertising from a blogger in 1C: Accounting?

Published 01/13/2021 08:13 Author: Administrator According to statistics, more than 47 thousand Russian users maintain their accounts on Instagram, and each of them spends at least 28 minutes daily viewing the feed. YouTube will soon supplant television. Just look at these numbers: every minute 400 hours of new video appear on the service; users watch more than 5 billion videos per day; Each viewer spends an average of 40 minutes on the YouTube platform per day. Impressive? It is not surprising that advertising by bloggers comes to the fore in terms of effectiveness and breaks records in other media. But how to take into account the costs of a blogger? The answer to this question is sought in many accounting chats, but we will be the first to give the most detailed answer in this publication.

It has long been known that the Tax Code of the Russian Federation divides advertising expenses into two types: standardized and non-standardized.

Costs classified as the first type are accepted in tax accounting only at the standard one percent of revenue.

And expenses of the second type are accepted in full as expenses that reduce income tax. Let's consider the costs associated with bloggers in the 1C software product: Enterprise Accounting, edition 3.0.

Payment to a blogger for an advertising post

One of the types of advertising content for a blogger is a mention of the company or product that he recommends, as he himself uses it. In this case, the company negotiates a fee with the blogger and transfers it to his bank account.

The key nuance in this example is how the advertising distributor is legally registered.

Option No. 1. If the blogger is self-employed, then after you have made the payment, he is obliged to provide you with an online receipt, which will document the transaction for you. You can read more about registering relationships with a self-employed person in our article How to reflect the services of a self-employed person in 1C: Accounting ed. 3.0. At the same time, such costs should be fully attributed to expenses in tax accounting, since advertising in information and telecommunication networks on the basis of paragraph 2 of paragraph 4 of Article 264 of the Tax Code of the Russian Federation is recognized as non-standardized.

Option No. 2. If the blogger is an individual entrepreneur, or you decide to place an advertisement on the page of another company, then the documentation will be no different from the purchase of any service.

To make a payment in the program, go to the “Bank and Cash Office” section and select the “Bank Statements” or “Cash Documents” item, depending on the payment method.

Then click on the “Write-off” or “Issue” button, select the type of transaction “Payment to supplier” and indicate the remaining payment details.

The posted document will create a posting: Dt 60.01 Kt 51 or Dt 60.01 Kt 50, if payment was made in cash.

Then, when a certificate of completion of work is received from the advertising distributor, it will need to be entered in the “Purchases” - “Receipts (acts, invoices, UPD)” section.

In the window that opens, click on the “Receipt” button and select “Services (act, UPD)” from the drop-down list. Then enter all the data on the act. According to the instructions for using the chart of accounts, advertising costs are reflected in the debit of account 44.01.

Based on the provisions of subparagraph 28 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, advertising expenses are classified as other expenses associated with the production of products and the sale of goods.

The posted document will create the posting: Dt 44.01 Kt 60.01.

And finally, option No. 3, when the blogger is not legally registered in any way and does not submit any reporting documents. In such a situation, it will be impossible to accept advertising costs due to the lack of documentary evidence.

The only thing you can think of in such a situation is to conclude a civil contract with such a blogger for the performance of work and provision of services. But in this case, in addition to the blogger’s fee, you will have to pay income tax and insurance premiums. This can be easily done as in the 1C program: Enterprise Accounting ed. 3.0, and in 1C: ZUP ed. 3.1.

Goods or finished products transferred to the blogger for advertising

Suppose we are manufacturers of photo and video cameras, and to demonstrate our products in stories, we give one camera to a blogger.

In this case, we will formalize the documentary transfer with the document “Demand-invoice” in the “Production” section.

On the first tab “Materials” we will indicate the finished product or product that will be used for advertising purposes for the review.

On the “Cost Account” tab we will indicate account 44.01 and the subconto “Other costs”.

In paragraph 1 of Article 3 of the Federal Law of March 13, 2006. No. 38-FZ “On Advertising” provides a precise definition that advertising is information disseminated in any way, in any form and using any means, addressed to an indefinite number of people, aimed at generating and maintaining interest in the object of advertising.

We don’t know how many viewers will watch the review of our video camera, so the clause about an indefinite circle of people is fulfilled in this case. Accordingly, writing off a product as a sample is an advertising expense. Since this advertising will be implemented in information and telecommunication networks, payment to the blogger is considered a non-standardized expense in tax accounting.

Gifts for a drawing given to a blogger for advertising

Bloggers often hold various sweepstakes and lotteries on their accounts in order to attract subscribers.

Suppose our organization is engaged in the sale of cosmetics, and for advertising purposes we have prepared 10 beauty boxes to be given to a blogger.

Unfortunately, the list of non-standardized advertising expenses is closed and is given in paragraph 4 of Article 264 of the Tax Code of the Russian Federation. Thus, prizes for drawings and lotteries are considered standard expenses and are taken into account in an amount not exceeding one percent of sales revenue, determined in accordance with Article 249 of the Tax Code of the Russian Federation.

We will document the write-off of beauty boxes in the program with the document “Requirement-invoice” in the “Production” section.

On the first tab “Materials” we will indicate the gifts given to the blogger, which for us are goods.

On the second tab “Cost Account” we indicate account 44.01 and enter a new cost item with the expense type “Advertising expenses (standardized)”.

When posting a document, the program will create a posting: Dt 44.01 Kt 41.01.

At the end of the month, in the “Month Closing” processing in the “Operations” section, the program will automatically calculate the standard and expenses will be accepted to the extent that the Tax Code of the Russian Federation allows us to do so. You can analyze the standard and the volume of expenses in tax accounting in the paragraph “Calculation of shares of write-off of indirect expenses”.

We hope that this material will help you in your work!

Don't forget to subscribe to our Instagram account! Every day relevant and interesting materials are published there!

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Alina Kalendzhan 06/08/2021 17:21 I quote Elizaveta:

Tell me, please, how will VAT be accounted for in your examples of transferring goods or gifts to a blogger? Indeed, in the case of the sale (gratuitous transfer - the essence is the same sale) for advertising purposes of goods (works, services), the cost of acquiring (creating) a unit of which amounts to more than 100 rubles, VAT is charged in accordance with the generally established procedure.

Good afternoon.

By virtue of subparagraph 1 of paragraph 2 of Article 170 of the Tax Code of the Russian Federation, the amounts of VAT presented upon the acquisition of goods (work, services) used for transactions exempt from taxation are included in the cost of these goods (work, services). Quote 0 Elizaveta 05/19/2021 18:15 Tell me, please, how will VAT be accounted for in your examples of transferring goods or gifts to a blogger? Indeed, in the case of the sale (free transfer - the essence is the same sale) for advertising purposes of goods (works, services), the cost of acquiring (creating) a unit of which amounts to more than 100 rubles, VAT is charged in the generally established manner.

Quote

+1 Alexandra 01/31/2021 21:46 Thank you

Quote

Update list of comments

JComments

Standardized advertising expenses

In fact, any advertising expenses that are not directly listed in the list of non-standardized expenses can be safely classified as regulated.

IMPORTANT! Advertising is only the mass dissemination of information about a product, service, or work intended for a previously unclear environment.

To calculate income tax, the norm for advertising spending is 1% of revenue excluding VAT and excise taxes. Advertising expenses not included in expenses according to the standard and revenue of this reporting period are transferred to the next reporting period of the calendar year. As revenue increases, the volume of standardized advertising expenses that can be taken into account grows. At the end of the year, the maximum amount of standard advertising expenses taken into account can be calculated. The excess volume is not taken into account when calculating income tax.

Legal basis

We believe that there is absolutely no need to explain that the costs of the next advertising event are legal from the point of view of the Tax Code of the Russian Federation. However, errors and subsequent claims from tax inspectors begin at the moment when the company's accounting department makes incorrect distinctions, for example, between the purchase of advertising leaflets and the costs of producing advertising output. The fact is that the expense item “advertising costs” can only include amounts regulated by paragraphs 2,3,4 of Article 4 of Chapter 264 of the Tax Code of the Russian Federation, as well as subparagraph 28 of paragraph 1 of Article 4 264 of the Tax Code of the Russian Federation. These include, in particular:

- Illuminated or outdoor advertising (including signs);

- Advertising activities carried out through the media;

- Costs of participation in exhibitions (plus the production of exhibition stands);

- Decoration of shop windows and showrooms;

- Production of brochures and catalogs containing information about the company, works and services.

As we can see, the Tax Code is quite democratic in this matter and regulates a wide list of variations on the advertising theme. However, it excludes the distribution of flyers we mentioned, in particular, their distribution to mailboxes. If we turn to the definition of the term “advertising,” then it makes sense to think again about that “indefinite circle of people” that we wrote about above. In relation to leaflets, which can regularly be found among our correspondence, the rules described in Chapter 264 of the Tax Code of the Russian Federation do not apply. The fact is that the very fact of sending leaflets to mailboxes is something of a “targeted” offer, but in no way an advertisement aimed at an indefinite circle of people. In fact, by dropping a flyer in the mailbox, a company representative makes a personal offer to the tenant(s) of that apartment and personally notifies them of the work or services being offered. It is difficult to disagree with such a belief. In particular, it is fully confirmed in the letter of the Federal Tax Service for the city of Moscow dated March 16, 2005 No. 20 08/16391 “On advertising expenses.” Based on the text of the document, it is more logical to classify expenses associated with the free transfer of advertising materials as other expenses, but not as advertising expenses. This position can also be seen in the Resolution of the Federal Antimonopoly Service of the North-Western District dated June 1, 2005 No. A05 16465/04 10.

Advertising expenses under the simplified tax system “income minus expenses”

According to Art. 346.16 of the Tax Code of the Russian Federation, organizations using the simplified tax system are allowed to take into account advertising costs in their expenses. Such costs are determined in the manner prescribed for calculating income tax. That is, all expenses are divided on the same basis into normalized and not. It is allowed to recognize advertising expenses, documented and economically justified, when calculating the single tax only after they have been paid. For organizations using the simplified tax system, revenue is accrued using the cash method, which also includes the received prepayment. The amount of normalized advertising costs is also calculated within 1% of it.

ConsultantPlus experts spoke about the nuances of accounting for advertising expenses under the simplified tax system. Study the material by getting free trial access to the K+ system.

You can get acquainted with all types of expenses that are used to calculate the single tax under the simplified tax system, with the procedure for their recognition in the article: “List of expenses under the simplified tax system “income minus expenses.”

Accounting

Advertising expenses are included in expenses for ordinary activities. This follows from paragraphs 5 and 7 of PBU 10/99. Such expenses must be documented (Part 1, Article 9 of the Law of December 6, 2011 No. 402-FZ). Since advertising is recognized as disseminated information, documentary confirmation requires not only the ordering of the advertisement itself, but also its actual distribution (Clause 1, Article 3 of Law No. 38-FZ of March 13, 2006).

Confirmation of advertising distribution, in particular, may be:

- reports from advertising distributors on the work done, for example, on the number of leaflets distributed;

- on-air certificates from television and radio stations;

- metro certificates regarding the provision of advertising services.

Similar conclusions are contained in letters of the Ministry of Finance of Russia dated September 6, 2012 No. 03-03-06/1/467, dated June 22, 2012 No. 03-03-06/2/71.

Advertising costs should be reflected in account 44 “Sales expenses” (Instructions for the chart of accounts). It is advisable to open a corresponding “Advertising Expenses” subaccount for this account.

Accounting for advertising expenses

In accounting, advertising expenses are not subject to rationing and are included in the cost part at full cost in the reporting period in which they occurred, regardless of whether they were paid or not. Supporting documents are required for their recognition. This records the following:

- Dt 44 Kt 60 (76) - advertising services are reflected;

- Dt 44 Kt 10 - advertising products that are not a fixed asset are written off as expenses;

- Dt 44 Kt 02 - depreciation has been accrued on fixed assets used for advertising purposes.

The organization advertises independently

An organization can independently distribute advertising products. Purchased or manufactured promotional materials, for example, stationery with the organization’s logo, brochures, catalogs, should be reflected on account 10 at actual costs. Keep analytical records separately for each type of advertising product. To do this, open the “Advertising Materials” subaccount for account 10.

Reflect the receipt of promotional products as follows:

Debit 10 subaccount “Advertising materials” Credit 60;

– materials intended for distribution for advertising purposes have been taken into account.

After distributing the materials, charge their cost to account 44:

Debit 44 subaccount “Advertising expenses” Credit 10 subaccount “Advertising materials”

– the cost of advertising materials is written off based on the act of their expenditure.

When distributing (for example, at exhibitions, demonstrations) for advertising purposes goods that were originally intended to be sold, reflect their cost on account 41 subaccount “Goods handed over for advertising purposes.” And after distributing the samples, based on the report of the advertising distributor, write off the cost of the distributed goods as expenses - to the debit of account 44 of the “Advertising expenses” subaccount.

Similarly, reflect in accounting the finished products transferred for advertising purposes.