Authorized capital is the assets of the organization, which the founders of the LLC contribute after state registration. The minimum amount of the charter capital in the amount of 10,000 rubles must be paid in money (Article 66.2 of the Civil Code of the Russian Federation). In excess of this amount, the contribution of the authorized capital is possible both in cash and in property form.

The founders can fulfill their obligations to pay for the management company by depositing cash into the organization’s cash desk or by transferring it to the LLC’s current account.

Contribution of the authorized capital in cash to the LLC cash desk requires the execution of cash documents. If the execution of cash transactions is carried out in violation of the Instructions of the Central Bank, the organization may be fined in the amount of 40 to 50 thousand rubles.

Payment order

Shares in the authorized capital are paid at their nominal value. At the same time, it is not allowed to exempt any of the participants from paying for their shares (Clause 1, Article 16 of the Federal Law “On LLC”).

How is the authorized capital formed?

The period for payment by a participant of a share in the authorized capital is established by the agreement on establishment or the decision on establishment, but cannot exceed 4 months from the date of registration. The agreement on the establishment of a company may provide for the collection of a penalty (fine, penalty) for failure to fulfill the obligation to pay for shares in the authorized capital of the company.

The law establishes certain restrictions on the methods of payment of the authorized capital; for example, it is not allowed to contribute borrowed funds and pledged property to the authorized capital of the insurer.

Evidence of payment of the authorized capital of the LLC:

- an extract from the current account, copies of primary payment documents, an act of acceptance and transfer of property;

- absence in the LLC’s balance sheet of information about incomplete payment of the authorized capital;

- receipt for the cash receipt order (resolution of the Federal Antimonopoly Service UO in case No. A76-24177/2007-11-861).

If the right to use the property transferred as payment for the authorized capital is terminated early, then the participant who paid for the share in this way must pay the LLC compensation equal to the payment for the use of the same property under similar conditions for the remaining period of use of the property (Clause 2 of Art. 15 of the Federal Law “On LLC”).

How to deposit authorized capital into a current account

Nowadays, registering an LLC is possible without first opening a current account; however, we do not recommend that founders delay contacting the bank. The fact is that an organization can only pay taxes and other payments to the budget by non-cash means, so you will still have to open a bank account.

Before opening a current account at a bank, we recommend that our users get a free consultation with banking specialists, which will allow them to do this on the most favorable terms.

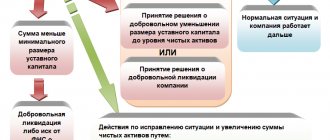

The organization can dispose of the funds contributed by the founders to the authorized capital (cash or non-cash) at its discretion: purchase goods or equipment, pay rent for an office or production premises, pay salaries, etc. In the course of the company’s activities, the authorized capital of the LLC can be increased or decreased, but it cannot become less than the minimum amount established by law, i.e. 10,000 rubles.

The deposit of funds into the company's current account as payment for the authorized capital is formalized for each founder separately, within the limits of his share in the LLC. If the founder does not pay his share on time or does not pay it in full, then it passes to the company and is distributed among other participants.

As for administrative fines against the LLC itself for violating the 4-month deadline for contributing the authorized capital, they are not provided for by law, however, in such cases the company can be forcibly liquidated.

Withdrawing and depositing funds into a bank account in 1C: Enterprise Accounting 8

Published 09.26.2016 13:12 Author: Administrator In this article we will look at how to reflect in the 1C: Enterprise Accounting 8 edition 3.0 program the movement of cash between a bank account and the organization's cash desk: withdrawing funds to the cash desk and depositing them into the current account. In most organizations, such operations are performed regularly, so we are periodically asked questions about their reflection in 1C programs. First of all, in this case, it is necessary to make the correct accounting policy settings in the program.

If in your organization operations for withdrawing or depositing cash do not fit into one business day, you must use account 57 “Transfers in transit”. You need to decide on this setting when filling out the accounting policy in the program; to do this, open the “Main” tab, “Accounting Policy” and check the box whether the “Transfers in transit” account is used or not.

Let's consider various options for these operations

1. Withdrawing cash from a current account (without using account 57)

To reflect this operation in 1C: Accounting 8, we will draw up the “Cash Receipt” document. Open the tab “Bank and cash desk”, “Cash desk”, “Cash documents” and using the “Receipt” button, create and fill out the document “Cash receipt” - type of operation “Receipt of cash at the bank” - amount - DDS article “Receipt of cash at the bank” By clicking the “Receipt Cash Order” button, we can view and print the PKO.

Now we run the document and look at the postings

2. Withdrawal of cash from the current account (using account 57)

If you use account 57, then in this case, first of all, we draw up the document “Write-off from the current account”. Open the tab “Bank and cash desk”, “Bank”, “Bank statements” and click the “Write-off” button to create a document “Write-off from the current account”. Fill in the empty fields - type of operation "Cash withdrawal" - amount - date - purpose of payment

When posting, the document generates the following transactions:

Now we draw up the cash document “Cash Receipt”. It is filled out similarly to the PKO in the previous example, the only difference is that you must indicate the loan account 57.01.

We carry out and inspect the wiring

3. Receipt of cash to the current account (without using account 57)

In this case, it is necessary to issue a “Cash Withdrawal” document. Open the tab “Bank and cash desk”, “Cash desk”, “Cash documents” and using the “Issue” button, fill in the empty fields of the created document: - type of operation “Cash deposit to the bank” - amount - DDS article “Cash delivery to the bank” Click the button “Print” we can look at the printed form of the RKO.

After we receive a statement from the bank about the receipt of funds, we check the document and look at the postings.

4. Receipt of cash to the current account (using account 57)

When using account 57 to deposit funds into a current account, the “Cash Withdrawal” document is filled out in the same way, only debit account 57.01 is added. We can also view and print the RKO by clicking the “Print” button.

We post the completed document and look at the postings

Next, we draw up the document “Receipt to the current account.” Open the “Bank and cash desk” tab, “Bank statements”, click the “Receipt” button and fill in the empty fields of the document: - type of operation “Cash deposit” - amount - purpose of payment

We carry out and inspect the wiring

Please note that if you use account 57, you need to monitor the turnover and balance of this account: after the movement of funds is completed, the account must be closed. To carry out such a check, we will generate a SALT for account 57 with details by day.

As you can see in the picture, there is no balance at the end of the period on account 57, which means the operation was carried out correctly. And in conclusion, I would like to return once again to the accounting policy settings and warn you that if you decide to enable (or disable) the use of account 57 in the middle of the year, then be prepared for the fact that when re-posting old documents, this setting will also apply : movements on the 57th count will appear (or disappear). Therefore, after changing the settings and re-posting documents, it is necessary to check the correctness of bank account and cash balances, and also be sure to generate a SALT for account 57.

Author of the article: Svetlana Gubina

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

-5 Irina Plotnikova 01/18/2021 08:18 I quote Anastasia:

What account to put in the statement if account 57 is not used when withdrawing cash???

Anastasia, hello.

Please clarify your situation. Who is withdrawing money? From a current account or from a corporate card? For what purposes? Quote -1 Anastasia 01/15/2021 20:42 What account should I put in the statement if account 57 is not used when withdrawing cash???

Quote

Update list of comments

JComments

How to deposit money into a bank account

If you decide to deposit the authorized capital into a current account in cash (and we recommend this method as the most convenient), then, of course, the LLC current account must already be opened. All the founder has to do is contact the bank where his company’s current account is opened and inform him that he wants to contribute his share of the authorized capital.

Please note that the bank documents indicate “Participant’s contribution to the authorized capital”, “Payment by the founder of the share in the authorized capital” or a similar phrase as the basis for the payment to the current account. The founders keep this document for themselves, because it is proof of payment for a share in the LLC.

There is no need to report the payment of authorized capital to the tax office or other government bodies. All necessary information about this will be reflected in accounting documents and annual financial statements, which organizations are required to submit at the end of the year no later than March 31.

Postings when depositing authorized capital into a current account

Evidence of the contribution of the charter capital by the founders will also be accounting entries intended for the contribution of the authorized capital to the current account. An LLC, like any organization, is required to keep accounting records, so we recommend that you immediately resolve the issue with accounting services.

The transactions for depositing the authorized capital into the current account are as follows:

- The formation of the authorized capital is reflected in account 80 “Authorized capital”, and the receipt of contributions from the founders is reflected in account 75 “Settlements with founders”, subaccount 75.1 “Settlements for contributions to the authorized capital”. Wiring – Dt 75.1 – Kt 80.

- Depositing the authorized capital into the current account: posting – Dt 51 – Kt 75.1.

If you have not yet decided on who will do the accounting for your LLC, we suggest that you try outsourcing accounting from 1C without any material risks.

Replenishment of authorized capital

Another way is to replenish the authorized capital.

For this procedure, it will be necessary to convene a meeting of the founders. At the meeting, it is necessary to draw up minutes and make changes to the Charter.

After this, the new document of the Charter must be recorded in the tax office, here you will have to pay a state duty.

Increasing the authorized capital will change the shares of participants. This also needs to be written down in the minutes of the founders’ meeting.

The money that will be deposited cannot be taken back, since the authorized capital must be fully paid. You can deposit money through the cash register or make a bank transfer to your current account.

These were legal ways to deposit money into a checking account. The editors of Pro-RKO advise you to play it safe and open several current accounts in different banks - these measures will allow you to quickly transfer money to a reserve current account in case the main one is blocked.

You can select a bank for a backup current account on our website. Many banks allow you to open an account for free and do not pay for its maintenance.