Ways to increase UC

Authorized capital refers to the enterprise's own resources, participates in assessing its financial stability and affects profitability, which meets the interests of its participants.

For more information about equity, see our material “Equity on the balance sheet is...”.

The minimum sizes of capital assets, characteristic of organizations of various forms of ownership, are established by law. The size of the capital in an LLC in accordance with the norms of the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ is equal to 10,000 rubles.

When determining the minimum level of capital of joint stock companies, the provisions of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ are taken as a basis. The minimum amount of capital for an open-type JSC is 100,000 rubles, for a closed type - 10,000 rubles.

Read more about the amount of capital in the article “How to calculate your own working capital (formula)?”

Shareholders or participants of the enterprise have the right to increase the authorized capital at the expense of retained earnings. However, there are other ways to grow the management company:

- An increase in its size as a result of contributions made by participants, including newly admitted ones, on grounds that do not contradict the charter of the company.

- Using the additional capital of the joint-stock company.

- Using the balances of special purpose funds, with the exception of the reserve fund and the employee corporatization fund.

Moreover, the first method is typical only for an LLC, and the options listed in paragraphs 2–3 meet the requirements of a JSC.

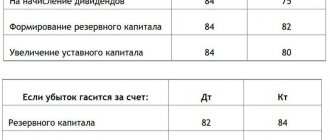

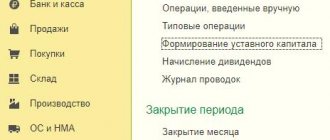

The change in the increase in the authorized capital at the expense of retained earnings is recorded as follows:

Dt 84 “Retained earnings” - Kt 80 “Authorized capital”.

Authorized capital: we will increase it at the expense of profit

The authorized capital can be increased, including through retained earnings from previous years. This decision is made by the shareholders (participants) of the LLC or JSC. To make a decision to increase the initial authorized capital must be paid in full (clause 6 of article 90, clause 2 of article 100 of the Civil Code of the Russian Federation). The amount by which the authorized capital of a company is increased at the expense of its property cannot exceed the difference between the value of the company’s net assets and the amount of its authorized capital and reserve fund (Article 18 of the Federal Law of 02/08/1998 No. 14-FZ (hereinafter referred to as the Law on LLC ), paragraph 5 of Article 28 of the Federal Law of December 26, 1995 No. 208-FZ (hereinafter referred to as the Law on JSC)).

Since the increase in the capital capital at the expense of retained earnings is not associated with receiving investments, but is carried out at the expense of the resources of the company itself, the percentage ratio of the shares of participants (shareholders) as a result of an increase in the authorized capital does not change.

Increase of capital in LLC

If the size of the authorized capital of an LLC increases due to retained earnings from previous years, the nominal value of the shares of its participants increases. Approval of the decision to increase the capital capital is within the competence of the general meeting of participants by law. At the same time, it is determined that it can be adopted only on the basis of financial statements for the year preceding the year in which such a decision is made (Clause 1, Article 18 of the LLC Law). To comply with this procedure, the company must take the following steps:

1) the general meeting of participants decide to increase the authorized capital and amend the charter (approving it in a new edition);

2) submit to the inspection documents for state registration of amendments made to the company’s constituent documents and amendments to the Unified State Register of Legal Entities:

- an application for state registration of changes made to the constituent documents in the form P13001, recommended by the Federal Tax Service of Russia and posted on the official website www.nalog.ru in the section “State registration and accounting of taxpayers” (letter of the Federal Tax Service of Russia dated 07/08/2009 No. MN-22- 6/ [email protected] );

— an application for making changes to the Unified State Register of Legal Entities in information about a legal entity that are not related to making changes to the constituent documents in the form P14001, recommended by the Federal Tax Service of Russia and posted on the official website www.nalog.ru in the section “State registration and accounting of taxpayers”;

— decision of the general meeting of participants to increase the authorized capital at the expense of retained earnings from previous years and amend the charter;

— changes to the charter (new edition of the charter);

— payment order for payment of state duty.

As practice shows, tax authorities, in addition to the main list of documents, require a calculation of net assets and a profit and loss statement for the previous year with a note on its submission to the tax authority. By signing the application, the company confirms the fact of compliance with the requirements for the presence of retained earnings and that the amount by which the capital is increased does not exceed the difference between the cost of the private capital and (the capital + reserve fund) (paragraph 1, clause 4, article 18 of the LLC Law ). However, in practice, in the absence of calculation of net assets, registration refusals occur, since tax authorities confuse the increase in the capital under Article 18 of the Law “On LLC” with Article 19 (Regulation 9 of the AAS dated May 27, 2011 No. 09 AP-10120/2011-AK).

Based on the results of state registration and (or) amendments to the Unified State Register of Legal Entities, tax authorities will issue the LLC two certificates of entry into the Unified State Register of Legal Entities in form No. P50003.

To summarize information about the state and movement of the authorized capital, account 80 “Authorized capital” is intended (chart of accounts, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). The amount of retained earnings is reflected in account 84 “Retained earnings”. Note that the balance of account 80 must correspond to the amount of the authorized capital recorded in the constituent documents of the company. Entries to this account are made only after the necessary changes have been made to the constituent documents.

Example

The general meeting of LLC participants made a decision to increase the authorized capital of the company at the expense of retained earnings in 2012 in the amount of 55,000 rubles. The following entries will be made in the company's accounting:

At the end of 2012:

DEBIT 99 CREDIT 84 - reflects retained earnings of the reporting year.

As of the date of state registration of changes:

DEBIT 84 CREDIT 80 - in the amount of 55,000 rubles.

–55,000 rub. — the authorized capital was increased due to retained earnings.

In the accounting of the founder of an LLC (legal entity), an increase in the nominal value of a share in the authorized capital at the expense of the company's property is not a basis for changing the initial value, since this does not lead to an increase in the costs of its acquisition. Consequently, the initial cost of the share recorded in account 58 “Financial Investments”, subaccount 58-1 “Shares and Shares” does not change (clause 8, 18 PBU 19/02).

According to the controllers, the amount by which the nominal value of the share has increased is recognized as the participant’s income.

Therefore, if the organization that is the founder of the LLC is guided by the safe option and recognizes in tax accounting income in the form of the difference between the nominal value of the share before and after the increase in the capital, then in accounting (clause 4, 7 of PBU 18/02, approved by order of the Ministry of Finance of Russia dated 11/19/2002 No. 114n) it reflects the permanent difference and the corresponding permanent tax liability (PNO).

PNO is reflected in accounting records as follows:

DEBIT 99 CREDIT 68 - PNO reflected in the amount of 20% of the difference between the nominal value of the share before and after the increase

Increasing the capital stock in the joint-stock company

The authorized capital of a joint stock company can be increased at the expense of retained earnings from previous years by (Clause 1, Article 28 of the Law on JSC):

— increasing the par value of shares;

— placement of additional shares.

As a result of the implementation of the first method, the placement of shares is carried out through their conversion. In this case, shares of the previous issue are redeemed, and the shareholder acquires shares of a new issue with a different par value. As a result of increasing the authorized capital through the second method, new shares become the property of the shareholder. In both cases, the competent body to make a decision on increasing the authorized capital is the general meeting of shareholders or the board of directors.

In contrast to increasing the authorized capital of an LLC, a similar process for joint-stock companies is complicated by the need to issue shares. In this regard, the inspectorate carries out state registration of changes to the company’s charter only if a report on the results of the issue of securities, registered by the Federal Financial Markets Service, is submitted.

The procedure for increasing the authorized capital occurs in the following order:

1. Making a decision to increase the authorized capital at the expense of retained earnings from previous years by increasing the par value of shares or by placing additional shares.

In the event of an increase in the authorized capital, the issue of amending the charter is not required to be submitted to the general meeting of shareholders (clauses 1, 2 of Article 12 of the Law on JSC). These functions are performed by the decision to increase the authorized capital and the registered report on the results of the issue of securities. In addition, the decision to increase is simultaneously a decision to place securities, so it must indicate all the main parameters of the shares and details of their placement. The content of the decision must comply not only with the requirements of the Law on JSC, but also with the norms of the Law on the Securities Market (Federal Law dated April 22, 1996 No. 39-FZ) and issue standards (Order of the Federal Service for Financial Markets dated January 25, 2007 No. 07-4/ pz-n).

2. Approval of the decision to issue securities.

In essence, the text of the decision on the issue of securities repeats the content of the decision on the placement of shares with some additions. The approval of this decision falls within the competence of the board of directors or the body performing its functions in accordance with the charter of the company.

3. Completing the procedure for state registration of the issue of securities.

To do this, the issuer submits an application to the Federal Financial Markets Service, to which is attached an approved decision on the issue of shares, a decision on placement and other documents provided for by the Law on the Securities Market and the Issue Standards, including the calculation of net assets and a description of the property at the expense of which the authorized capital is increased capital. Subject to compliance with the requirements of the law, the Federal Financial Markets Service carries out state registration of the issue of securities by assigning it an individual number, and the issuer is issued a notice of registration of the issue of securities.

4. Placement of shares.

This occurs by making entries on personal accounts in the register of shareholders. Such entries are made on the day specified in the registered decision to issue securities.

5. Completing the procedure for state registration of the report on the placement of shares.

To complete the issue, the issuer submits to the Federal Financial Markets Service an application for state registration of the report on the placement of securities, the report itself, approved by the competent body of the joint-stock company, and other documents confirming compliance with the requirements of securities legislation. This stage ends with the registration of a report on the results of the placement of securities.

6. Going through the state registration procedure for the new edition of the charter (amendments to the charter).

It practically duplicates the procedure for registering changes for an LLC. With the exception that joint-stock companies need to submit to the inspectorate a report on the results of issuing securities, registered with the Federal Financial Markets Service. In addition, it should be noted that the joint-stock company submits to the tax authority that carries out state registration of legal entities only an application for amendments to the constituent documents in the form P13001 (approved by the Decree of the Government of the Russian Federation dated June 19, 2002 No. 439).

Example

The authorized capital of the joint-stock company is equal to the par value of two hundred shares. The nominal value of one such share is 1000 rubles. The JSC decided to increase its authorized capital using retained earnings by increasing the par value of each share by 500 rubles. As a result, the authorized capital will increase by 100,000 rubles. (200 pcs. × 500 rub.).

After registering changes in the authorized capital, the following entries are made in accounting:

DEBIT 84 CREDIT 80

–100,000 rub. — reflects the increase in the authorized capital due to retained earnings.

Analytical accounting for account 80 is organized in such a way as to ensure the formation of information on the founders of the organization, stages of capital formation and types of shares.

Accordingly, after changes are made to the constituent documents, entries are also made in analytical accounting in account 80, reflecting the change in the par value of the shares owned by the shareholders.

Example

The general meeting of shareholders of the joint-stock company decided to increase the authorized capital by additionally issuing shares at the expense of retained earnings from previous years (100 shares for 100 rubles). The authorized capital is increased at the expense of the company's own funds, so shareholders do not pay for additional shares that are distributed among them.

Thus, on the date of the decision to place an additional issue of shares, the company does not make any accounting entries. At the same time, based on the decision to increase the authorized capital, the following entries are made in accounting:

DEBIT 75-1 CREDIT 80

–100,000 rub. — increase in the authorized capital due to additional placement of shares;

DEBIT 84 CREDIT 75-1

–100,000 rub. — increase in the nominal value of shares due to an increase in the authorized capital at the expense of the retained earnings of the joint-stock company.

Personal income tax for shareholders (participants)

According to the Ministry of Finance of Russia, (letters of the Ministry of Finance of Russia dated September 17, 2012 No. 03-04-06/4-281, dated February 27, 2012 No. 03-04-05/3-227, dated October 27, 2011 No. 03-04-06/ 4-287) the difference between the original and new par value of shares (shares), as well as additionally received shares, is income and is subject to personal income tax. The financial department justifies its position with the following arguments:

— the tax code exempts from personal income tax only income received by shareholders (participants) in the form of additionally received shares (shares) or changes in their nominal value as a result of the revaluation of fixed assets (clause 19 of article 217 of the Tax Code of the Russian Federation). In support of this argument, the Russian Ministry of Finance refers to the Determination of the Constitutional Court of the Russian Federation (Decision of the Constitutional Court of the Russian Federation dated January 16, 2009 No. 81-О-О);

— despite the fact that the share of participation of each shareholder (participant) in the authorized capital remains the same, there is an increase in the total volume of property rights belonging to him, for example, the rights to receive dividends, as well as the value of such property (shares) on a free basis;

— in the case of an additional issue, the shareholder receives income in kind in the form of shares of a new issue. When the nominal value of shares increases, material benefits are obtained.

Let's analyze these arguments. According to the authors, it cannot be argued that in any other case, except for an increase in the capital as a result of the revaluation of fixed assets, the shareholder (participant) of the company receives income. A conclusion about the availability of income can only be given on the basis of the application of the provisions of the Tax Code in their entirety. We note that the question of whether the shareholders, in the event of an increase in the authorized capital at the expense of retained earnings, have income for personal income tax purposes was not considered in the said Definition of the Constitutional Court of the Russian Federation. From the text of the Determination it only follows that the conditions for the benefits established by paragraph 19 of Article 217 of the Code are strictly defined and do not apply to the situation described in the complaint.

Let us turn to the second argument that, given the constant percentage participation of a shareholder in the authorized capital of a company, an increase in the nominal value (number) of shares leads to an increase in the total volume of property rights. The Tax Code establishes that income is recognized as a benefit received in cash or in kind, which can be assessed (Article 41 of the Tax Code of the Russian Federation). However, as follows from the provisions of corporate legislation, the taxpayer does not receive any benefits in this particular situation, when the share of participation only increases. Thus, his right to receive dividends is in no way related to the nominal value (quantity) of his shares (shares), but depends only on the percentage of his participation in the authorized capital of the company, which does not change. The situation is similar in settlements with shareholders (participants) during the liquidation of a company: the remaining property is divided between them in proportion to their participation in the authorized capital. And in this case, the benefit will be the difference between the invested and received funds, regardless of the size of the share. Thus, the position of the Russian Ministry of Finance on increasing the volume of property rights at the time of increasing the capital does not find regulatory confirmation. All these arguments were repeatedly set out in judicial acts of arbitration courts that supported companies in disputes with tax authorities (registered by the Federal Antimonopoly Service of the North-West District dated 04/23/2008 No. A26-3819.2007, dated 03/26/2008 No. A66-5098/2007, FAS Moscow Region dated 02/26/2009 No. KA -A41/1046-09, FAS UO dated May 27, 2007 No. Ф09-3942/07-C2).

Guided by the provisions of corporate legislation, the courts linked the appearance of income not with the moment of increasing the capital stock, but with the sale of shares (shares), receipt of the actual value of the share when a participant leaves the company, or the transfer of property of a liquidated company to shareholders (participants). However, after the appearance of the Decree of the Constitutional Court of the Russian Federation, the position of the arbitration courts began to change (reg. FAS North Caucasus of 02.12.2010 No. A32-38158/2009-51/646, FAS VSO dated 10.02.2011 No. A78-928/2010 (determined by the Supreme Arbitration Court of the Russian Federation dated 26.04. 2011 No. VAS-5515/11 refused to transfer this case to the Presidium of the Supreme Arbitration Court of the Russian Federation)). When considering these cases, the courts sided with the controllers, but did not provide any arguments to substantiate their position, limiting themselves to quoting the Constitutional Court’s Definition.

In our opinion, the initial approach of arbitration courts to assessing the moment of occurrence of income is more consistent with the concept of income as an economic category.

Let us give an additional argument in support of this point of view, for which we will consider the consequences that will result from applying the position of the Ministry of Finance when taxing income from the sale of a share in the authorized capital of an LLC.

Thus, a company participant has the right to reduce the amount of income received from the sale of a share in the authorized capital of the company by the amount of documented expenses for the acquisition of property transferred in payment for the specified share in the authorized capital (paragraph 2, subparagraph 1, paragraph 1 of Article 220 of the Tax Code of the Russian Federation ). In case of increasing the authorized capital at the expense of retained earnings, the company participant does not bear any costs. Thus, the amount of the deduction will be limited to the documented cost of expenses for making an initial and additional contribution to the capital. As the Ministry of Finance of Russia points out (letter of the Ministry of Finance of Russia dated June 28, 2011 No. 03-04-05/3-452), the Tax Code does not provide for a reduction in the amount of income received from the sale of a share in the authorized capital of a company by the nominal value of such a share.

Following the approach declared by financiers, the LLC participant will pay tax on the amount of increase in the nominal value of the share twice: the first time - at the time of its increase, and the second time - at the time of sale of the share. We believe that this contradicts the principle of inadmissibility of double taxation of the same income.

We anticipate objections that, unlike the sale of a share in the authorized capital of an LLC, a similar situation does not arise when selling shares. Indeed, tax legislation (paragraph 8, clause 13, article 214.1 of the Tax Code of the Russian Federation) provides for the possibility of taking into account as expenses for the acquisition of securities the amount of income that was previously taxed. However, the mechanism laid down in this norm is used when income is received (an object of taxation appears) at the previous stage of sale of shares: at the time of acquisition of these shares. Consequently, we again return to the question of whether the taxpayer receives income in kind or in the form of material benefits from an additional issue or conversion of shares into shares with a higher par value as a result of an increase in the authorized capital of the organization at the expense of retained earnings. As shown above, there is no increase in the volume of property rights of shareholders, but new objects of civil rights come into their ownership. Based on the wording of Articles 211 and 212 of the Tax Code, qualification of the consequences of these business transactions as receipt of income in kind or in the form of material benefits is possible in cases of certain “savings” on costs or gratuitous receipt of property. In economic terms, retained earnings represent the potential return to a shareholder that can be received in the form of dividends. By making a decision to increase the capital capital at the expense of retained earnings, the shareholder thereby refuses to receive income, reducing his property sphere. This situation is fundamentally different from the classic examples of gratuitous receipt of property, which are donations and inheritances. In connection with these circumstances, the assessment of such an operation as free of charge or carried out with savings seems very doubtful.

Income tax for companies

Shareholder income in the form of an increase in the par value of shares or received in the form of the cost of additional shares is not taken into account when determining the income tax base (subclause 15 of Article 251 of the Tax Code of the Russian Federation). Consequently, when increasing the capital at the expense of retained earnings, the shareholder company does not have tax consequences (letters of the Ministry of Finance of Russia dated October 24, 2011 No. 03-03-06/1/685, dated September 4, 2009 No. 03-03-06/1/570 ).

At the same time, the financial department believes that the rules on exemption apply only to shareholders, while organizations participating in an LLC under similar circumstances have non-operating income taxed at a rate of 20 percent (letter of the Ministry of Finance of Russia dated November 9, 2011 No. 03-03-06 /1/732, dated September 26, 2011 No. 03-03-06/1/588).

This approach received a critical assessment in the resolution of the Federal Antimonopoly Service of the Volga Region (registered by the Federal Antimonopoly Service of the Volga Region dated 16.02.2009 No. A65-11409/2006), which justified its position based on the principle of universality and equality of taxation and the prevention of differentiation depending on the legal form ( Part 1, 2, Article 3 of the Tax Code of the Russian Federation). Additionally, we note that following such instructions from the Ministry of Finance of Russia will lead to double taxation of the increase in the nominal value of the share upon its subsequent sale, which is a violation of the principles of fair and proportionate taxation.

Such contradictions confirm the complexity and diversity of issues related to increasing the authorized capital at the expense of retained earnings, so it is better for the company to think through its possible steps in advance and be ready to defend its interests.

Expertise of the article: Alexey Alexandrov, Garant Legal Consulting Service, legal consultant; Dmitry Ignatiev, Garant Legal Consulting Service, Ph.D. n.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Changing the size of the charter capital in a joint-stock company

JSC status allows the organization to increase its authorized capital at the expense of retained earnings. The authorized capital under this organizational form represents the total par value of the shares acquired by the participants.

The growth of the management company is facilitated by both an increase in the value of each share and placement through an additional issue. Their value increases, among other things, due to retained earnings from previous periods. Shareholders of the company have the right to use the data of this indicator in order to increase the capital capital by making an appropriate decision.

It is necessary to comply with the condition that the amount arising from the increase does not exceed the value of the net assets minus the amount of the reserve fund and the authorized capital according to the reporting data preceding the start of the operation to issue shares.

If it is necessary to issue additional securities, the same rules apply. The decision to increase the authorized capital at the expense of retained earnings is considered and approved at the general meeting by the shareholders in parallel with the decision to change the provisions on authorized shares. You should also decide on other points when issuing additional shares:

- the number of additional shares of various types (ordinary and preferred);

- chosen placement method;

- form of payment and placement price.

Additional shares issued at the expense of own property (retained earnings) are distributed proportionally among shareholders.

ConsultantPlus experts explained in detail how an increase in the authorized capital of a joint-stock company is registered. Get trial demo access to the system and upgrade to the Ready Solution for free.

conclusions

When evaluating equity, you need to determine which part contains changes. If equity capital increases due to additional investments and profits, then assets increase, and the company finances itself from different sides.

There is a difference between profit reserves and valuation reserves. The creation of valuation reserves is necessary in order to cover losses if, for example, there are doubtful debts. For these debts there is a debit debt. The organization writes off one of the debts, and collects the other part and uses it to increase profits. If there is a reserve, then the balance sheet valuation of all investments is specified and covers the company’s losses incurred due to a decline in market prices.

There are no articles on the topic.

Features of increasing the capital in an LLC

The size of the charter capital consists of the value of the shares owned by the organization's participants. The procedure for increasing the capital of a company is permissible either at the expense of the enterprise’s own property, or on the basis of contributions from its participants (provided that such a right is enshrined in the constituent documents of the LLC).

The need to increase the authorized capital at the expense of retained earnings is discussed at the meeting of the founders. Accounting indicators for the past period are taken as a basis. As in the case of a joint-stock company, the amount of increase in the capital cannot be greater than the difference, which is defined as the value of net assets reduced by the amount of the capital and the institution’s reserve fund.

Example:

In Prestige LLC, the size of net assets was 75,000 rubles, the volume of the reserve fund was 15,000 rubles, and the authorized capital was 10,000 rubles. The meeting of founders decided to increase the value of the authorized capital to replenish working capital and turn the enterprise towards investment attractiveness. How much is the transaction possible for?

Considering that the size of the management company and the reserve fund in total should not exceed 75,000 rubles. (volume of net assets), the maximum size of the capital in this case will be 60,000 rubles.

Actions to increase the authorized capital at the expense of retained earnings must be performed in a certain order:

- It is necessary to pay in full the initial amount of the charter capital.

- Document the changes.

- Provide the following documents to the tax authorities:

- statement;

- charter (new edition);

- document confirming payment of state duty;

- minutes of the founders' meeting;

- accounting for the previous period.

Find out how to draw up a protocol on increasing the authorized capital of an LLC in ConsultantPlus. If you do not have access to the K+ system, get a trial demo access for free.

The documents are transferred to the employees of the Federal Tax Service no later than a month after the participants make the relevant decision by a majority vote.

How is reserve capital assessed?

Inventory for reserve capital is carried out in the same way as for additional capital. Check calculations based on reserve amounts:

• which were formed by law; • formed according to constituent documents.

They carry out an inventory of reserve capital to cover losses, pay off company bonds, and to repurchase shares if there are no other means.

Retained earnings are reflected in the financial statements, divided into four subaccounts:

• as retained earnings for previous years; • uncovered loss for previous years; • retained earnings of the current year; • uncovered loss of the current year.