Economically justified expenses

The economically justified cost method can be used in the field of water supply and sanitation, in the field of municipal solid waste management and in the field of heat supply.

Any expenses that are related to business activities, that is, incurred to generate income, are considered economically justified (Letter of the Ministry of Finance of Russia dated July 8, 2019 No. 03-03-06/1/50124). Unjustified expenses are expenses that do not comply with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation (TC RF).

Any expenses are recognized as expenses, provided that they are incurred to generate income. It should be noted that the validity of expenses that are taken into account when calculating the tax base must be assessed taking into account the taxpayer’s intentions to obtain an economic benefit from business or other activities. Considering that tax legislation does not use the concept of economic feasibility and does not regulate the procedure and conditions for conducting financial and economic activities, the validity of expenses that reduce income received for tax purposes cannot be assessed from the point of view of their feasibility, rationality, efficiency or the result obtained. Therefore, according to the principle of freedom of economic activity, the taxpayer carries out it independently at his own risk and has the right to independently assess its effectiveness.

Justified expenses are economically justified expenses, the assessment of which is expressed in monetary form (clause 1 of Article 252 of the Tax Code of the Russian Federation). Economic justification is a frequent cause of disputes with tax authorities, who interpret this concept broadly. Expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Tax Code of the Russian Federation, losses) incurred by the taxpayer. These expenses are understood as economically justified expenses, the assessment of which is expressed in monetary form.

Notarial services

You can have this or that business agreement certified by a notary. If, under an agreement, a company acquires any valuables (fixed assets, intangible assets, etc.), then in accounting the costs of notary services are included in the initial cost of the purchased property. If not, they are reflected as expenses for ordinary activities.

In tax accounting, the company's costs in the form of notary fees are included in other expenses. This can be done only within the limits of the tariffs established in Chapter 25.3 “State Duty” of the Tax Code. Payments in excess of tariffs are not taken into account when determining the income tax base.

PRIMEROO "Aktiv" certified the translation of documents from English into Russian from a private notary. For 10 pages of certified translation, 1,500 rubles were paid. According to the established tariff, 100 rubles are charged for certifying the accuracy of the translation of a document from one language to another. for one page of translation (clause 1 of Article 333.24 of the Tax Code of the Russian Federation). Costs for notary services are reflected as follows: - in accounting, they include 1,500 rubles in full as expenses for ordinary activities; — in tax accounting, only 1000 rubles are included in other expenses. (100 rubles × 10 pages). The excess amount is 500 rubles. (1500 – 1000) are not taken into account when taxing profits.

For transactions that are not required to be notarized, notary fees are taken into account within the limits of the standard defined in Article 22.1 of the Fundamentals of Legislation of the Russian Federation dated February 11, 1993 No. 4462-1 “On Notaries” (letter of the Ministry of Finance of Russia dated July 25, 2012 No. 03- 03-06/1/360, dated May 30, 2012 No. 03-03-06/2/69).

Unreasonable expenses

This category includes economically unjustified costs.

Reasons why a tax authority may try to recognize expenses as unreasonable:

- did not generate income;

- the organization suffered a loss;

- the size does not correspond to the financial position of the organization;

- are not related to the main activities of the company;

- an overly expensive property was purchased, for example, a luxury car, designer renovations were made in the office.

This does not mean that the company should automatically recognize them as uneconomical. The Tax Code does not include such a criterion as compliance of the expenses incurred with the financial situation of the taxpayer. The validity of various expenses should be assessed taking into account the taxpayer’s intentions to obtain an economic effect, and not from the point of view of expediency, rationality, efficiency or the result obtained (Letter of the Ministry of Finance of Russia dated 07/07/2021 No. 03-03-06/1/53730). An organization's expenses should be related to the nature of its activities, and not to profit. They are taken into account regardless of the presence or absence of income from sales in the tax period (Letter of the Ministry of Finance of Russia dated December 28, 2017 No. 03-03-06/1/87897). The taxpayer carries out activities independently at his own risk and has the right to independently assess its effectiveness and expediency (Letter of the Ministry of Finance of Russia dated June 20, 2017 No. 03-03-06/1/38489).

Advertising expenses

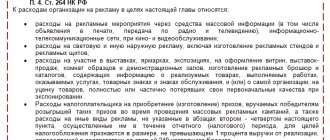

The list of advertising expenses contains paragraph 4 of Article 264 of the Tax Code.

In accounting, advertising costs are reflected in full as part of expenses for ordinary activities. In tax accounting, such costs are taken into account as other expenses.

note

Some types of advertising costs are included in other expenses only within the norms. Advertising costs that exceed the norm do not reduce the company's taxable profit.

The standards within which such costs are taken into account when taxing profits are given in the table:

| Types of advertising expenses | Expense rate |

| Expenses on advertising through the media (including advertisements in print, broadcast on radio and television) and information and telecommunication networks (for example, the Internet). From January 1, 2014, this type of advertising expenses should also include the costs of advertising events for film and video services. | Not standardized |

| Expenses for illuminated and other outdoor advertising, including the production of advertising stands and billboards | Not standardized |

| Costs of participation in exhibitions, fairs and expositions | Not standardized |

| Costs for decorating shop windows, sales exhibitions, sample rooms and showrooms | Not standardized |

| Costs for the production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks and (or) about the organization itself | Not standardized |

| Costs of discounting goods that have completely or partially lost their original qualities during exhibition | Not standardized |

| Costs of purchasing (manufacturing) prizes awarded to the winners of drawings of such prizes during mass advertising campaigns | No more than 1% of sales revenue (excluding VAT) |

| Expenses for other types of advertising (for example, costs for the development and distribution of advertising letters, postcards, labels, branded packages, etc.) | No more than 1% of sales revenue (excluding VAT) |

EXAMPLE For the first half of the reporting year, the expenses of Aktiv JSC on television advertising amounted to 195,000 rubles.

(including VAT - 29,746 rubles). In addition, the company bought prizes for the winners of the advertising campaign, worth more than 100 rubles. for a unit. They spent 330,000 rubles on this. (including VAT – 50,339 rubles). Aktiva's revenue from product sales for the first half of the year amounted to RUB 3,600,000. (including VAT – RUB 549,153). In accounting, advertising costs amount to RUB 444,915. (195,000 – 29,746 + 330,000 – 50,339) are reflected as expenses for ordinary activities. In tax accounting, TV advertising costs are included in other expenses in full. The costs of purchasing prizes are included in other expenses within 1% of revenue. This amount will be: (3,600,000 rubles – 549,153 rubles) × 1% = 30,508 rubles. The remaining amount of costs for the purchase of prizes is not taken into account as part of other expenses and does not reduce the taxable profit of the company. This amount will be: 330,000 rubles. – 50,339 rub. – 30,508 rub. = 249,153 rubles. Based on the results of the first half of the year, “Active” can take into account advertising costs in the amount of 195,000 rubles when taxing profits. – 29,746 rub. + 30,508 rub. = 195,762 rub. note

You can deduct the amount of VAT on excess advertising expenses in full (Resolution of the Presidium of the Supreme Arbitration Court of Russia dated July 6, 2010 No. 2604/10).

Priority display of goods

The Ministry of Finance includes among standard advertising expenses the supplier's costs for the priority display of goods by the buyer - a retail trade organization (see, for example, Letter dated March 18, 2014 No. 03-03-06/1/11641). Financiers justify their point of view by the fact that priority display services are aimed at promoting goods and are advertising services. However, this position is not always supported by arbitration courts, which allow merchandising costs to be taken into account in full on the basis of paragraphs. 49 clause 1 art. 264 of the Tax Code of the Russian Federation (see, for example, Resolution of the Federal Antimonopoly Service of the Moscow District dated February 18, 2013 in case No. A40-83540/12-116-180).

Ads

Expenses on advertising of produced (purchased) and (or) sold goods (work, services) and activities of the taxpayer are considered other expenses and are not standardized (subclause 28, clause 1, article 264 of the Tax Code of the Russian Federation). This also applies to this type of advertising, such as promotional videos. For income tax purposes, you can take into account the actual costs of their creation. However, if the costs included in the initial cost of the roller exceed 40,000 rubles, and its useful life is more than 12 months, then you will have to deal with depreciable property (clause 1 of Article 256 of the Tax Code of the Russian Federation). That is, the costs of creating such a video cannot be written off at a time, but only gradually - through depreciation. An advertising video created by the organization is an object of intellectual property and is accounted for as an intangible asset. For audiovisual works, the taxpayer has the right to independently determine the useful life, but it cannot be less than two years. Thus, if an advertising video relates to depreciable property, the costs of its creation can be attributed to advertising expenses, but they will have to be written off in tax accounting gradually - through depreciation charges (letter of the Ministry of Finance of Russia dated March 23, 2015 No. 03-03-06 /1/15750).

Logo making

The logo of an organization is the result of intellectual activity and an equivalent means of individualizing the organization. The costs of its creation and production should be included in advertising expenses as part of other expenses. The Russian Ministry of Finance substantiated this position in a letter dated September 12, 2014 No. 03-03-R3/45762.

Logo is an original design, an image of the full or abbreviated name of a company or a company’s products. It is specially developed by the company in order to attract attention to it and its products. Inventions, trade names, trademarks and service marks are the results of intellectual activity and equivalent means of individualization of legal entities, goods, works, services and enterprises that are provided with legal protection (intellectual property) (Clause 1 of Article 1225 of the Civil Code of the Russian Federation). This means that the organization’s logo is recognized as an object of advertising.

Advertising is information disseminated in any way, in any form and using any means, addressed to an indefinite number of people and aimed at attracting attention to the object of advertising, creating or maintaining interest in it and promoting it on the market (Clause 1, Article 3 of the Law dated March 13, 2006 No. 38-FZ “On Advertising”).

Advertising costs for profit taxation are taken into account as part of other expenses associated with production and sales (subclause 28, clause 1, article 264 of the Tax Code of the Russian Federation). Advertising expenses can be standardized or non-standardized.

Non-standardized advertising expenses include, among other things, expenses for participation in exhibitions, fairs, expositions, for the design of shop windows, sales exhibitions, sample rooms and showrooms, production of advertising brochures and catalogs containing information about goods sold, work performed, services provided, trademarks and service marks, and (or) about the organization itself, for the discounting of goods that have completely or partially lost their original qualities during exposure. Since the logo is an advertisement, the organization has the right to take into account the costs of its production (design) as part of income tax expenses, provided that these expenses are justified and documented.

Income tax calculation

When calculating income tax, an organization can take into account expenses that meet three conditions: economically justified, documented and not mentioned in Art. 270 and art. 252 of the Tax Code of the Russian Federation. Any expenses that are associated with business activities, that is, incurred to generate income, are considered economically justified (Letter of the Ministry of Finance of Russia dated July 8, 2019 No. 03-03-06/1/50124). For documentary evidence, primary documents are used to prove that the expenses were actually incurred by your company. Thus, material costs will be confirmed by suppliers’ invoices and acts of write-off for production. And labor costs are payroll statements. Expenses not taken into account when taxing profits are listed in Art. 270 Tax Code of the Russian Federation. These costs cannot be taken into account, even if they are economically justified. But there are certain standards within which some costs can be taken into account. Thus, entertainment expenses cannot exceed 4% of labor costs, and some types of advertising costs cannot exceed 1% of sales revenue.

Expenses are divided into those related to production and sales and non-sales. Among the costs associated with production, there are several main groups: material costs, labor costs, depreciation and others. The accounting procedure depends on their type (direct or indirect). If you have no income for a certain period, you can take into account indirect and non-operating expenses, but direct expenses cannot.

SPS ConsultantPlus will help you correctly fill out tax calculations, determine deadlines and avoid penalties.

Taxes and Law

To recognize income and expenses for profit tax purposes, the Tax Code of the Russian Federation provides two methods - the accrual method and the cash method. Let's consider the procedure for recognizing expenses using the accrual method established by Art. 272 of the Tax Code of the Russian Federation.

Expenses according to clause 1 of Art. 272 of the Tax Code of the Russian Federation are recognized as such in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment and are determined taking into account the provisions of Art. Art. 318 - 320 Tax Code of the Russian Federation[1].

Expenses are recognized in the reporting (tax) period in which these expenses arise based on the terms of the transactions. If the transaction does not contain such conditions and the connection between income and expenses cannot be clearly established or is determined indirectly, the taxpayer distributes the expenses independently.

The agreement may provide for the receipt of income over more than one reporting period, without the gradual delivery of goods (work, services). In this case, expenses are distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses.

Production with a long cycle means production, the start and end dates of which fall on different tax periods, regardless of the days of production. The Letter of the Ministry of Finance of Russia dated 02/05/2007 N 03-03-06/1/55 states that this applies only to cases of concluding an agreement that does not provide for the stage-by-stage delivery of work and services (regardless of the duration of the stages). Attention is also drawn to the fact that the features of recognizing expenses for production with a long cycle apply to operations carried out within the framework of the relations of the parties arising when concluding contracts on the terms contained in Chapter. 37 - 39 Civil Code of the Russian Federation.

If the agreement provides for the stage-by-stage sale of goods, then expenses should be taken into account in proportion to the income of the tax period in which the stage-by-stage sale of goods will be reflected.

If expenses cannot be directly attributed to expenses for any specific type of activity, then their distribution is carried out in proportion to the share of the corresponding income in the total volume of all income of the taxpayer. In particular, general business expenses of an organization that cannot be directly attributed to a specific type of activity must be distributed by the taxpayer in proportion to the share of the corresponding income in the total volume of all income of the taxpayer (see Letter of the Ministry of Finance of Russia dated May 25, 2007 N 03-03-06/1/ 320).

When using the accrual method in accordance with clause 2 of Art. 272 of the Tax Code of the Russian Federation, the date of material expenses is recognized as follows:

date of transfer of raw materials and materials into production - in terms of raw materials and materials attributable to the goods (work, services) produced;

date of signing by the taxpayer of the certificate of acceptance and transfer of services (works) - for services (works) of a production nature.

The Letter of the Federal Tax Service of the Russian Federation for Moscow dated February 16, 2007 N 20-12/014752 clarifies that the date of expenses for payment to third parties for work performed (services rendered) is recognized as the date of settlements in accordance with the terms of concluded agreements or the date of presentation of documents to the taxpayer , serving as the basis for making calculations, or the last date of the reporting (tax) period (clause 3, clause 7, article 272 of the Tax Code of the Russian Federation). In other words, expenses associated with payment for work performed by a third party can be recognized using the accrual method on the date of signing the act of acceptance of work performed.

Depreciation is recognized as an expense on a monthly basis based on the amount of accrued depreciation. Depreciation is calculated in the manner prescribed by Art. Art. 259 and 322 of the Tax Code of the Russian Federation.

Expenses in the form of capital investments provided for in clause 1.1 of Art. 259 of the Tax Code of the Russian Federation are recognized as indirect expenses of the reporting (tax) period for which, in accordance with Chapter. 25 of the Tax Code of the Russian Federation accounts for the start date of depreciation (the date of change in the original cost) of fixed assets in respect of which capital investments were made.

Expenses in the form of 10% of the costs incurred during the modernization (reconstruction, technical re-equipment) of fixed assets must be taken into account in the month following the month of commissioning of the fixed asset facility (see Letter of the Ministry of Finance of Russia dated January 22, 2008 N 03-03-06/ 1/29).

The date of expenses is the date of transfer of funds from the current account (payment from the cash desk) of the taxpayer - for expenses (clause 4, clause 7, article 272 of the Tax Code of the Russian Federation):

in the form of amounts of paid allowances;

in the form of compensation for the use of personal cars and motorcycles for business trips.

The date of approval of the advance report is recognized as the date of expenses - for expenses (clause 5, paragraph 7, article 272 of the Tax Code of the Russian Federation):

on business trips;

for the maintenance of official transport;

for entertainment expenses;

for other similar expenses.

The dates of expenses are recognized:

date of sale or other disposal of securities - for expenses associated with the acquisition of securities, including their cost (clause 7, clause 7, article 272 of the Tax Code of the Russian Federation);

the date of recognition by the debtor or the date of entry into legal force of the court decision - for expenses in the form of fines, penalties and (or) other sanctions for violation of contractual or debt obligations, as well as in the form of amounts of compensation for losses (damage) on the basis of paragraphs. 8 clause 7 art. 272;

date of transfer of ownership of foreign currency - for expenses from the sale (purchase) of foreign currency (clause 9, clause 7, article 272);

date of sale of shares, shares - for expenses in the form of the cost of acquisition of shares, shares (clause 10, clause 7, article 272).

Under loan agreements and other similar agreements (other debt obligations, including securities), the validity of which falls on more than one reporting period, the expense is recognized as incurred and is included in the relevant expenses at the end of the corresponding reporting period (clause 8 of Article 272 of the Tax Code RF).

In the event of termination of the agreement (repayment of the debt obligation) before the expiration of the reporting period, the expense is recognized as incurred and is included in the corresponding expenses on the date of termination of the agreement (repayment of the debt obligation). [1] “Audit statements”, 2008, N 11