From September 1, 2022, it will be possible to receive 100% of average earnings for sick leave to care for a child. But this will not affect all working parents, but only those who have children under eight years old.

We talked about the new rules for calculating sick leave so that you can quickly understand how much you will receive from the state. Remind your accountant of the new rules.

If you don’t have time to read the entire material, go to the “Briefly” block - there is the main thing about changes in sick pay from September 1, 2022.

What does sick leave pay look like now?

The state will pay 100% of average earnings to workers who have children under eight years of age. The new rules are enshrined in Law No. 151-FZ dated May 26, 2021. In this case, the employee’s length of service and method of treatment will not be taken into account.

Tatyana Petukhova, accountant

From September 1, an employee who has worked for five years and an employee who has only a year of experience will receive the same payment. There is also no need to confirm work experience if the young parent has switched to an electronic work record book. In addition, the amount of sick leave for caring for a child under eight years of age is not affected by how the treatment took place - outpatient or inpatient.

To receive the payment, the employee does not need to fill out additional documents—the information on the certificate of incapacity for work is sufficient. Let us remind you that from January 1, 2022, sick leave is paid directly from the Social Insurance Fund, so the expenses of business owners will not increase from September 1.

An employer can provide incentive payments for its employees in local regulations that apply at the enterprise. However, in practice such stories are extremely rare.

Important. For working parents with children over eight years old, the rules will remain the same. The basis is Article 7 of the Law of December 29, 2006 No. 255-FZ.

To calculate the amount of sick leave for caring for a child under eight years old from September 1, 2022, use the step-by-step algorithm.

How to fill out a sick leave certificate

The employer fills out only part of the form. Enter the employee’s data, length of service, average earnings, the period for which the benefit is calculated and its amount. The head and accountant of the company put their signatures.

In the line “Reason of disability”, enter the appropriate code:

- 09 - standard code for child care;

- 12 - caring for a seriously ill child under 7 years of age;

- 13 - caring for a disabled child;

- 14 — caring for a disabled child with a complication after vaccination;

- 15 — caring for a child with HIV.

Step 2. Determine the billing period

Typically, the billing period in this case is the number of calendar days over the last two years. For the calculation, 730 calendar days are always taken, that is, the sum of two calendar years: 365 + 365.

Alexander Pyatinsky, Ph.D., specialist in accounting and taxation

Sometimes an employee can change the pay period if such a change is in his favor and the payment will be greater. Thus, it is allowed to replace periods (either one or two years at once) if the employee was on maternity leave and/or parental leave for up to three years. In this case, only periods before maternity leave can be replaced.

For example, an employee was on maternity leave in 2022 and 2019. To pay for sick leave to care for a child under eight years old, opened in 2022, as a general rule, you can use earnings data for 2022 and 2022. But if the employee's salary was higher in 2022 and 2022, she can replace the periods - and increase the payment amount.

To change the billing period for sick leave, you need to write a free-form application addressed to the director of the company. Here is an example of such a statement.

Example of an application to change the billing period for sick leave payment

How is it paid?

Payment will depend on a number of factors, including insurance length and the amount of earnings for 2 years.

The timing and type of treatment provided, whether inpatient or outpatient, will also be taken into account. Payment beyond the established period for the annual period is not carried out, that is, the benefit, in addition to different rates, also has a limit in each specific case.

Income limits

The upper limit of the benefit is set at 100% of the average salary. The lower one has a minimum of 50%. A number of conditions for determining the boundaries and amounts of payments:

- experience. When working for more than 8 years, full payment is received, and for 5-8 years - 80%. If the experience is less than 5 years, then the rate is 60%;

- age group and category of children. Full payment is made if you are under 7 years of age, disabled or have established diseases, including tumors. A limit of 15 days of payment is fixed for minors 7-15 years old, and 3 days or in exceptional cases 7 for persons 15-18 years old;

- type of treatment. For outpatient, that is, home treatment, the rate will depend on the length of service in the first ten days. Further payment is equal to 50% of the average salary. In case of hospitalization, everything depends on the duration of work.

Typically, average earnings are calculated based on the last two years of work, that is, if there was a one-year break, then the year preceding it is counted.

Calculation procedure

To set the benefit amount, you will need to first calculate the amount, taking into account all the nuances and conditions.

You will need to calculate the average earnings for two years. The total income is divided by the number of days. The result is the average daily earnings, which will be used to determine the amount of the benefit. For an outpatient treatment process with sick leave for more than 10 days, use the formula:

Benefit = total period in days excluding 10 days x average earnings x 50% + 10 x average earnings x percentage, which depends on length of service.

The number of paid days is entered in the first work.

For a hospital, a different formula is used:

Benefit = total period of illness in days x average salary x interest rate for the duration of work.

Terms and conditions of payment

The document, after registration of sick leave and fulfillment of all conditions, can be transferred to management or directly to the Social Insurance Fund, depending on the nature of the papers and the individual characteristics of the situation.

Read also: Legal representative of a minor

It is possible to use paper or electronic copies, which have different payment terms. If a paper copy was provided, then payment is made within ten days, and if electronic, then the period is increased to 15 days.

It is worth considering that the payment is provided after the sheet is closed, that is, payment cannot be received in advance. You also need to remember that only the person listed on the form receives it.

Step 3. Calculate average daily earnings

Average daily earnings is the amount of wages that an employee received over the last two pay periods, divided by 730 days.

Let’s say that an employee’s earnings for 2022 amounted to 500 thousand rubles, for 2022 - 600 thousand rubles. Average daily earnings are equal to (500,000 + 600,000) / 730 = 1,506.85 rubles.

Average daily earnings depend on the employee’s salary for the last two years or billing period. If the employee worked for another employer, the amount of wages is confirmed by a certificate in form 182n. Such a certificate is issued on the day of dismissal.

Sample of filling out a certificate for calculating sick leave according to form 182n

Alexander Pyatinsky, Ph.D., specialist in accounting and taxation

If there is no certificate, you must write an application addressed to your current employer with a request to make a request to the Pension Fund. After this, the employer will receive data on payments to the employee for which insurance premiums were calculated. Based on this information, sick leave will be calculated.

In what cases does a b/l open?

There are several conditions:

- Grandparents are officially working. As noted, people who are retired are not paid benefits.

- Parents should not be on vacation. If mom or dad are temporarily not working, then they should have time to care for their sick child. You can read about the connection between sick leave for child care and parental leave here.

- The grandmother (grandfather) must take care of the child while on sick leave. The certificate of incapacity for work will not be paid if the grandmother works while the minor is sick.

- The grandmother must be a relative of the child. You cannot invite an outsider who will take sick leave and take care of someone else’s boy or girl.

- The grandmother must live in the same city where the child lives. However, the point is controversial. Rather, the grandmother (grandfather) and grandson (granddaughter) should live together during the period of the child's illness. Otherwise, it will simply not be possible to provide care.

Otherwise, there are no special requirements or restrictions. If the mother gets sick, then according to the current legislation, the grandmother is given a sick leave (we talked about whether it is possible to simultaneously issue a sick leave for yourself and for caring for a child here).

The legislator’s logic is as follows: a sick mother, most likely, will not be able to provide quality care for the child, and in some cases will not be able to constantly be near her son or daughter. For example, if the parent required surgery.

Example. Sick leave to care for a three-year-old child

Anna has a son who is three years old. He fell ill with the flu, and Anna took sick leave to care for her son.

The duration of sick leave for a certificate of incapacity for work is 10 days. This is Anna's first sick leave this year.

Anna’s average daily earnings over the past two years are 2,145 rubles. Experience: eight years. Anna treated her son at home.

Since Anna’s son is three years old, from September 1, 2022, when calculating sick leave, the mother’s length of service and the method of treatment are not taken into account. Also, all sick days are paid equally if they do not exceed the limit.

Anna will receive from the state 2,145 x 100% x 10 - personal income tax 13% = 21,450 - 6,435 = 15,015 rubles.

The influence of length of service on the amount of sick leave benefits

The main indicator that is used when calculating benefits for an employee who cared for a sick child is the employee’s average daily earnings (ADE). It is determined by the same rules as when calculating any disability benefit. But sick leave for caring for a child under 8 years old in 2022, from September 1, is paid in full, in the amount of 100% of average earnings, and the percentage rule no longer applies to it. But no one has canceled the payment limit. It is 2434.25 rubles per day.

For children over eight, the same rules for determining average daily earnings apply. All payments and deductions for the two previous years of work are taken into account (in 2022 this is income for 2019 and 2022). A woman who was on maternity leave at this time has the right to replace the period with an earlier one if this will help increase the amount of benefits.

Average daily earnings are calculated using the formula:

Where 730 is the number of calendar days.

Taking into account the maximum values, the SDZ in 2022 does not exceed 2434.25 rubles.

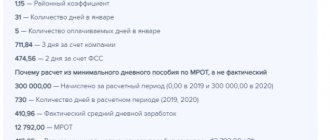

If the employee did not work in previous periods, then earnings for sick leave are calculated according to the minimum wage. If the employee for 2019 and 2022 earned less than the minimum wage multiplied by 24, then the minimum wage value is used. From 01/01/2021 to calculate the minimum wage benefit 12,792 rubles. multiplied by 24, the total minimum earnings for two years for calculating benefits will be 307,008 rubles. If we divide it by 730 using the above formula, it turns out that the minimum SDZ in 2022 is 420 rubles 56 kopecks.

In addition to taking into account the average daily earnings, the calculation of disability benefits is based on the employee’s length of service. The percentage of payments on a certificate of incapacity for work depends on the length of service if the minor is 8 years old. If the employee:

- has 8 years or more of experience, he will receive 100% of average earnings;

- worked from 5 to 8 years, he was entitled to 80% of average earnings;

- worked less than 5 years, he receives 60% of average earnings.

Taking into account the general rules for the payment of disability benefits and the nuances that highlight the calculation of benefits when caring for a sick child, we will derive formulas for calculating benefits for the case under consideration.

When treating a child in a hospital and during the first 10 days of treatment at home:

Starting from the 11th day of treatment of the child on an outpatient basis (at home):

The question of how much money should be used to pay hospital benefits for caring for a sick child no longer arises - everything is paid at the expense of Social Insurance, and employers do not pay anything extra at their own expense.

Regulations.

The issuance of a certificate of incapacity for work in connection with the illness of a minor and the calculation of benefits for it are regulated by the following regulations:

- Law No. 255-FZ;

- Order of the Ministry of Health and Social Development No. 84 of February 20, 2008;

- Order No. 624n dated June 29, 2011.

In accordance with the documents, any of the baby’s close relatives who will be caring for him can receive a sick leave from the children’s clinic.

Only an officially working parent or grandmother can draw up the document if all contributions to the Social Insurance Fund have been paid on time.

If the child is under 7 years of age, sick leave is issued for the entire duration of treatment, regardless of whether it occurs at home or in a hospital.

Registration and necessary documents

To obtain a sick leave certificate, your grandmother will need a passport (or other identification document) and an insurance policy. There is no need to confirm the relationship between the grandmother and the child.

A special form contains the child’s details, his return and other necessary information in coded form. So, in the column indicating the cause of incapacity, code “09” is written (since sick leave is opened due to the need for parental leave). The code for the type of relationship for grandmother is “42”. The child's full age or number of months is entered in the care field. If there are several children, then both are registered on sick leave . The lines “Benefit amount” and “At the expense of the employer” are not filled in, since this amount is compensated by the Social Insurance Fund.

According to the FAS resolution, the legality of issuing a bulletin is not left to the discretion of the employer, but is the responsibility of the clinic or other medical institution. Thus, the employer does not have the right to indicate which relative should be issued a sick leave certificate.

To assign temporary disability benefits, the Social Insurance Fund must provide the employer with a certificate of incapacity for work, which was drawn up and issued in accordance with the procedure established by law. No more additional documents will be required from the grandmother.

If the employer requests additional documents, for example, confirmation of the fact that the grandmother lives together with the child, then his actions are illegal.

Payment of sick leave for grandmother and grandchildren.

In addition to mom and dad, a grandmother can go on sick leave with her grandson , if this is the most appropriate solution.

Legislative acts provide that disability benefits are assigned to all relatives on a general basis.

Payment depends on factors such as:

- the employee’s earnings for the last 2 years;

- insurance experience;

- way of caring for the patient (in a hospital or at home).

If the child and grandmother are in the hospital, then the sick leave certificate will be paid for all days as follows:

- with experience from 0.5 to 5 years - 60% of earnings;

- with experience from 5 to 8 years – 80%;

- over 8 years – 100%.

When treating at home, the first 10 days are calculated in a similar way. If the child is sick longer, then the entire subsequent period will be paid only in the amount of 50% of average earnings.

When caring for a preschooler under 7 years of age, regardless of the type of treatment, the benefit is paid in full, depending on the woman’s insurance coverage.

| Index | 2020 | 2021 |

| Minimum wage, rubles | 12 130 | 12 792 |

| Limit base for calculating benefits, rubles | 912 000 | 966 000 |

| Maximum daily benefit amount for: | ||

| 8 years of experience, rubles | 2 301,37 | 2 434,25 |

| experience from 5 to 8 years, rubles | 1 841,1 | 1 947,4 |

| up to 5 years of experience, rubles | 1 380,82 | 1 460,55 |

| Maximum daily benefit amount for: | ||

| months of 31 days, rubles | 391,29 | 412,65 |

| months of 30 days, rubles | 404,33 | 426,4 |

| in February, rubles | 418,28 | 456,86 |

Sick leave calculation

Refusal of sick leave.

A grandmother, like a mother, may be denied a sick leave certificate and its payment in the following situations:

- a child over 14 years of age needs only outpatient treatment;

- with a chronic illness of a minor in remission.

If a child is assigned disability status, he can be cared for on an outpatient basis until he is 18 years old with the right to issue a certificate of incapacity for work and pay for it.

The regulatory legal act of the Ministry of Health and Social Development No. 84 dated February 20, 2008 approved a list of diseases for which the number of days of full accrual of benefits can be extended.

It includes diseases such as tuberculosis, oncology, injuries, etc.

Children in the hospital with their parents: up to what age according to the law.