Employers must withhold personal income tax (PIT) from their employees' paychecks. Therefore, if an employee has a salary of 30,000 rubles, he will receive only 26,100 rubles in cash minus personal income tax of 13%, if without any difficulties.

In order for some groups of employees to receive more, tax deductions were invented. The deduction works like this: they take the employee’s income, reduce it by the amount of the deduction, and calculate the tax from this amount. That is, they reduce the tax base, and not the tax itself.

Example

Florist Katya has a salary of 30,000 ₽ and a deduction of 1,400 ₽ for her daughter, which means they will deduct from her salary:

- in January: (30,000 - 1,400) × 0.13 = 3,718 ₽

- in February: (60,000 - 2,800) × 0.13 - 3,718 = 3,718 ₽ and so on.

Deductions for personal income tax are different: standard, property, social and professional. Most often, employees come with standard tax deductions: for themselves or for a child.

!

Remember, personal income tax is always considered a cumulative total from the beginning of the year, as in the example

Standard tax deductions reduce income, which is subject to personal income tax at a rate of 13%. Standard deductions are not applied to income at other rates and dividends. Non-residents cannot use deductions either. Let us remind you that a non-resident is an individual who stays on the territory of the Russian Federation for less than 183 days within one year.

Child deduction

Parents are entitled to a deduction for each child under 18 years of age. If the child is a graduate student, resident, intern, student or cadet and is studying full-time, then the age limit is increased to 24 years.

The following may receive a deduction:

- each of the parents - no matter whether they are married, divorced or never married;

- husband or wife of a parent;

- each of the adoptive parents, guardians, trustees, when there are several of them;

- each of the adoptive parents, if there are two of them.

If the only parent or the second parent refused the deduction, you can count on a double deduction. Moreover, only a working parent can refuse the deduction: if the parent does not work, then he does not have the right to the deduction, which means there is nothing to refuse.

Can a deduction be used multiple times?

Not so long ago – until 2014 – citizens could only claim one tax deduction. That is, when purchasing several apartments, the deduction could be obtained from one.

However, there are no restrictions now. This applies to both direct purchase of housing and purchase with a mortgage. You can receive a deduction on all purchased property. Limits are set only on the amount of all deductions received.

- To purchase housing with your own funds, this amount should be no more than 2 million rubles.

- To purchase a home with a mortgage, the additional amount can be a maximum of 3 million rubles.

Amounts of deductions for children

The deduction amounts are currently as follows:

— for the first and second child — 1,400 ₽

— for the third and each subsequent — 3,000 ₽

Children are counted regardless of age. For example, an employee has three children. Two are already adults: 25 years old and 23 years old, and the third is 16 years old. An employee is entitled to one deduction for a third child - 3,000 rubles.

There are more deductions for disabled children:

— for parents and adoptive parents — 12,000 ₽

— for guardians, trustees, foster parents — 6,000 ₽

It does not matter what type of disabled child is in the family. You can also add general deductions for children. For example, for an only disabled child, the deduction will be 13,400 rubles. After all, parents are entitled to a deduction for their first child - 1,400 rubles and for a disabled child - 12,000 rubles.

!

Provide a standard tax deduction for a child until the month in which the employee’s income from the beginning of the year exceeds 350,000 rubles.

Interesting fact

If a child grows up quickly and gets married, then you can no longer get a deduction for him - now he provides for himself. But if he decides to try his hand at work, then his parents still have the right to a deduction. In general, marriage is a responsible matter :)

For what period can I receive a deduction?

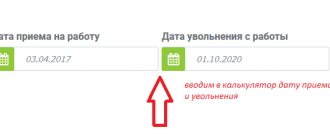

The legislation thus stipulates the right to receive a tax deduction in case of purchasing an apartment:

- From the moment when the acceptance certificate of the apartment from the developer is signed. It is signed when purchasing an apartment in a new building.

- From the moment of state registration of property. It is made when purchasing an apartment on the secondary market.

However, to exercise his right, the buyer can cover a period of no more than three years. If, for example, housing was purchased in 2011, in 2022 you have the right to apply for a tax deduction. However, refunds will be made only from 2015 - for a three-year period before the appeal, and this is 2015-2017.

You have the right to apply for a tax deduction at any time - regardless of how long has passed since the purchase of the apartment. The tax deduction calculator when buying an apartment will help you correctly understand the amount you can receive.

Documents for child support

First, the employee needs to write a free-form deduction application and attach supporting documents to it: a birth certificate or a certificate from an educational institution.

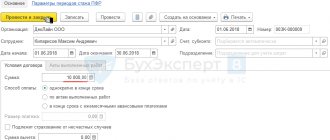

Deduction application template

If an employee has not been working since the beginning of the year or works part-time in another organization, ask him for a certificate in form 2-NDFL from other places of work. She will confirm that income since the beginning of the year has not exceeded 350,000 rubles.

!

Do not provide an employee with standard tax deductions that he did not receive from his previous employer or did not receive in full.

In some cases, other documents will be needed. For example, from a spouse who is not the child's parent or guardian, ask for a statement from the child's mother or father stating that the spouse is providing for the child.

Some documents need to be updated every year. The general rule: if a document confirms the right to deduction only in one period, then it needs to be updated in the next. For example, request a certificate from the university every year, because the situation may change next year.

Example 1: Paying for your own treatment

Conditions for receiving the deduction: In 2022, Sidorov S.S. underwent a course of treatment in a hospital costing 60 thousand rubles.

Income and income tax paid: In 2020, Sidorov S.S. earned 50 thousand rubles a month and paid a total of 78 thousand rubles in personal income tax for the year.

Calculation of the deduction: The deduction amount for treatment will be 60 thousand rubles (that is, you can return 60 thousand rubles * 13% = 7,800 rubles). Since Sidorov S.S. paid personal income tax in the amount of more than 7,800 rubles, and the amount of the tax deduction is less than the maximum (120 thousand rubles), then in 2022 he will be able to receive the deduction in full (7,800 rubles).

Child benefit period

Provide a deduction from the month in which the employee confirms that he has a child. If the employee submitted an application in the current year, then provide deductions from the beginning of the year. Even if he declared his right to a deduction in the middle or end of the year.

Example

Alice has been working in the organization since the beginning of the year, but she only remembered that she had the right to a deduction in May, and then she submitted an application. Alisa is a mother and has two minor sons. This means that from January to May, deductions amounted to 14,000 rubles (1,400 × 2 × 5).

Alice has a salary of 40,000 ₽, in total, from January to April, Alice was credited 160,000 ₽ (40,000 × 4) and withheld personal income tax - 20,800 ₽.

In May, the accountant will calculate all unaccounted deductions and only personal income tax will be withheld from the salary in the amount of 3,380 ₽ ((200,000 - 14,000) × 0.13 - 20,800), instead of 5,200 ₽ (200,000 × 0.13 - 20,800). This means that Alice will receive 36,620 ₽ (40,000 - 3,380), instead of 34,800 ₽ (40,000 - 5,200).

But if an employee had the right to a deduction last year and forgot to declare it, then he can only receive this deduction on his own through the tax office.

What is a tax deduction for a mortgage?

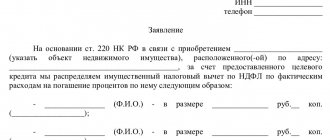

Russian legislation provides individuals who are tax residents of the Russian Federation with benefits in the form of a property tax deduction for the purchase of an apartment, house, room, land plot, as well as shares in them.

Thanks to this benefit, it is possible to return up to 650 thousand rubles for the purchase of housing with a mortgage, including payment of bank interest.

A tax deduction for the purchase of real estate with a mortgage is provided:

- for the purchase price (primary) - up to 2 million rubles;

- on interest actually paid - in the amount of up to 3 million rubles.

Basic property deduction

The main deduction includes expenses for the purchase of residential real estate. In this case, both personal savings and credit funds are included in the deduction. The maximum amount of the main property deduction is 2 million rubles, 13% of them, that is, 260 thousand rubles are returned to the taxpayer.

The principle of calculating the property tax deduction is the same for purchasing housing with your own money and for purchasing with a mortgage.

It is allowed to receive a basic deduction from the purchase of one property, and from interest on the mortgage - from another.

Tax deduction for mortgage interest

When purchasing a mortgaged home, you have the right to a tax break on the interest paid to the bank. From January 1, 2014, all interest actually repaid is taken into account, but not more than 3 million rubles. Of this amount, the state will return 13% to your account, that is, 390 thousand rubles (13% x 3 million).

If you took out a mortgage before January 1, 2014, then the amount of tax deduction for mortgage interest is unlimited. This means you can receive 13% of all interest actually paid.

For example, in 2012 you took out a mortgage in the amount of 14 million rubles and bought an apartment for 15 million rubles. From 2012 to 2022. paid the bank 5 million rubles in interest. The transaction was officially completed before January 1, 2014, so you have the right to claim a deduction equal to the amount of actual payments. As a result, 650 thousand rubles will be credited to your account (13% x 5 million rubles).

If the amount of loan funds spent on the purchase of an apartment under a purchase and sale agreement is less than the money actually borrowed, then a deduction will be provided only for the interest paid on the amount of loan funds specified in the agreement.

For example, in 2013 you took out a mortgage for 15 million rubles and paid the bank 6 million rubles in interest. At the same time, you bought the apartment for 13 million rubles, as indicated in the purchase and sale agreement and payment documents. The transaction was officially completed before January 1, 2014, so you have the right to claim a refund of 13% of the amount of interest paid. But since the deduction is provided specifically for the purchase of an apartment with a mortgage, it will include interest on 13 million, and not on 15 million rubles, that is, on the amount actually spent on the purchase of the apartment.

The amount of interest that will be deducted is calculated in proportion to the amount under the mortgage agreement and the actual purchase amount specified in the purchase and sale agreement.

The general condition for providing a deduction for both time periods - before 2014 and after 2014 is that you have not previously received a deduction for interest on a loan taken to purchase another property.

Deduction for yourself

Some adults are entitled to a deduction of 500 ₽ or 3,000 ₽. The amount depends on which benefit category the employee belongs to. Among them are disabled people who suffered from the Chernobyl disaster, participants in military operations, heroes of Russia and many others. All categories can be viewed in paragraphs. 1 and 2 paragraphs 1 art. 218 Tax Code of the Russian Federation.

To receive a deduction, the employee brings an application and documents confirming his right to the deduction.

Such deductions cannot be added and used at the same time. If an employee is entitled to several standard deductions, provide one of them - the maximum. But there is no income limit - provide deductions for yourself regardless of the amount of income received.

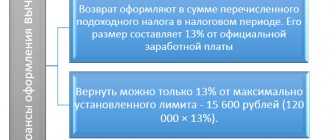

Example 2: Payment for own treatment in the amount of more than 120 thousand rubles

Conditions for receiving the deduction: In 2022, Zubkov V.V. paid for his treatment in the hospital in the amount of 100 thousand rubles. Also Zubkov V.V. I bought medicines worth 50 thousand rubles based on a doctor’s prescription.

Income and income tax paid: In 2020 Zubkov V.V. earned 50 thousand rubles a month and paid a total of 78 thousand rubles in personal income tax for the year.

Calculation of the deduction: Although Zubkov V.V. spent 150 thousand rubles on his treatment (100 for treatment and 50 for medicines), the maximum allowable deduction for the year is 120 thousand rubles, so Zubkov will be able to return a maximum of 120 thousand rubles. * 13% = 15,600 rubles. Since Zubkov V.V. paid more than 15,600 rubles in personal income tax, then in 2022 he will be able to return this amount in full.

How the volume of tax deductions received in Russia grew (billion rubles)

| 170,8 | 11 | |

| 2014 | 121,9 | 7,4 |

| 2011 | 56 | 6,1 |

Russian tax legislation provides two ways to obtain a tax deduction:

- through the tax office;

- through the employer.

First way

involves the return of tax paid in the past to the person’s bank account.

In the second option

the tax deduction is repaid by canceling income tax deductions from the employee’s salary. Which one is more convenient is up to you to decide.

Procedure:

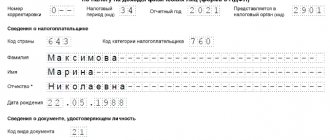

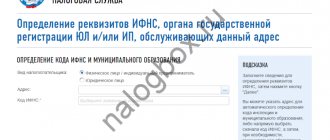

- Fill out a tax return (form 3-NDFL).

- Obtain a certificate from the accounting department at your place of work about the amounts of accrued and withheld taxes for the year in form 2-NDFL.

- Collect copies of papers confirming the right to housing (see above).

- Collect copies of payment documents (see above).

- When purchasing an apartment in joint ownership, collect copies of the marriage certificate and a written statement about the agreement of the parties involved in the transaction on the distribution of the amount of the deduction between the spouses. The deduction distribution agreement does not need to be notarized.

- Submit a completed tax return with copies of all documents to the tax authority at your place of residence. The tax office will let you fill out an application (request two copies, one will be left for you) and send the documents for a three-month audit. It is convenient to monitor the result in your personal account on the Federal Tax Service website - information about overpayment of tax will appear there. After this, you can wait for the money to arrive in your account - no more than a month.