Non-cash mutual settlements with counterparties carried out on the basis of concluded transactions and contracts; payment of taxes and insurance premiums, from which local and regional budgets are formed; transfers for other purposes made by individual entrepreneurs and organizations. All this is among the grounds for implementing the procedure, in accordance with the regulations of which the bank formalizes financial transactions, transferring funds from the client’s account to the details specified by him. Standard practice involves the use of a form approved by the Central Bank, as well as strict adherence to the rules for processing documents. Based on this, knowledge of the nuances of filling out a payment order - fields with numbers 15, 22 or 107, OKTMO, samples of payment slips at the request of the Federal Tax Service - in 2022 remains as relevant as before, and requires a deep dive into the specifics of the issue.

General overview

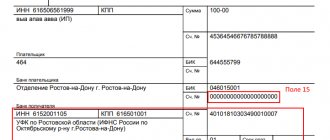

The transition of the Federal Tax Service to the system of treasury servicing of budget revenues necessitated the need to indicate in the payment details of two bills at once, as well as the emergence of new bank identification codes approved by Order No. 15H of April 1, 2020. The adjustments affected four segments of the standard form:

- 13 — clarifications have been made regarding the name of the bank.

- 14 — adjusted BIC.

- 15 - indicates the number included in the single composition of the single treasury account.

- 17 — the corresponding EKS value has been added.

Each subject of the Russian Federation applies certain types of mandatory information, the total number of which has now reached 85. The Federal Tax Service presented the relevant information in tabular format, as part of letter No. KCh-4-8 / [ email protected] dated October 2022.

Current payment order form

From a legal point of view, sending a payment order completed in accordance with the requirements to the bank serves as a legal basis for transferring funds from the applicant’s (client’s) account to the recipient’s account registered with the same or another financial institution. For such an order, paper or electronic format is used. It remains valid for ten calendar days from the date of preparation, and is filled out based on the current form approved by the Regulations of the Central Bank No. 383-P, the list of field numbering for which is fixed within the framework of Appendix No. 3 to the specified document.

Payment order

When filling out a payment order, it is important to correctly indicate the order of payment. If it is entered incorrectly, the bank will refuse to carry out the transaction.

- Payments that occur under executive acts on compensation for harm caused to health or life and payment of alimony.

- Transfers in accordance with writs of execution for the payment of severance pay upon dismissal or salary arrears and payment of royalties.

- Payment of debts on taxes, fees and contributions and payment of salaries to employees.

- Cash payments for other executive acts.

- All other payment documents in the calendar order of their receipt.

The Constitutional Court of Russia invalidated the distribution of the 3rd and 4th stages, however, changes have not yet been made to the Civil Code. All acts or their individual provisions recognized as unconstitutional shall lose force. The court classified all payments to the budget and state extra-budgetary funds as the third priority. It turns out that the fourth stage includes only payments to non-state extra-budgetary funds. Debiting funds from the account for claims that relate to one queue occurs in the order in which documents are received.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Filling procedure

The regulatory document that should be followed in the process of entering data is the first appendix to Regulation No. 383-P. It provides a breakdown and description of all the details.

Fields 3-7

The third and fourth segments of the template are the number and date of creation, respectively. Numbering is carried out in chronological order, and is limited to a six-digit limit. Dating requires the use of the “DD.MM.YY” format.

For the fifth paragraph, the values “urgent”, “by mail”, or any other options approved by the banking organization are provided. The type of payment in the payment order in 2022 may not be indicated at all, and in the case of filling out a digital form, the code established by the servicing bank is used.

The sixth and seventh fields are the total value, expressed in capital and numeric form, respectively. The copy begins with a capital letter and does not provide for abbreviations of the currency designation, with the exception of the number of kopecks indicated in numbers, or omitted in the absence of them. In clause 7, the amount is entered through a dash, i.e. “255-30”, and if the value is expressed only in rubles, “00” is entered in the second half of the entry.

Payment order - payer details in 2021-2022

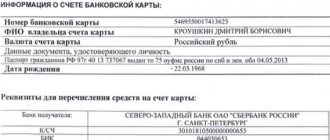

Legal entities, like individual entrepreneurs, enter the TIN in field 60. The amended legislative rules, in force since January, determine that for entities that are not registered with the Federal Tax Service of the Russian Federation, that is, foreign companies and citizens, it is possible to indicate a zero value in this section. Section 102 - Checkpoint - is filled out exclusively by organizations, while individual entrepreneurs leave “0” in this column.

The eighth paragraph provides for entering the full or abbreviated name of the enterprise, or the full name - if we are talking about private taxpayers engaged in commercial activities. In cases where the purpose of the transaction is the payment of budgetary and tax duties, individuals also indicate their residential address, separating it with a double slash (“//”) on each side.

Fields 9-12 are filled in with information about the payer’s bank and correspondent accounts, the name of the servicing financial institution and its identification code.

Payment order - recipient details in 2021-2022

In general, the section almost completely repeats the four previous paragraphs.

Thus, in column 13 the name of the bank of the entity acting as the addressee of the transfer is entered. It is important to note that when listing mandatory fees in this section, the name of the treasury is indicated, separated by the sign “//”. Fields 14, 15 and 17 - BIC (it is important to check the new versions) and account numbers (in the case of budget payments, these columns, previously left without any data, are now filled in with the current number characteristics of the Unified Tax Code). More information about changes in tax payment details in 2021 can be found in the Federal Tax Service letter No. KCh-4-8/ [email protected] dated October 2022.

Section 16 - the name of the recipient - is drawn up similarly to the same paragraph for payers. When paying taxes, the Federal Tax Service is indicated, in brackets - the budget revenue administrator.

Fields 18-23

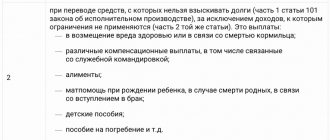

In accordance with standard requirements, the payment order code “01” is entered in the “Type of transaction” column, and the next section in order, “Payment Date,” remains blank. Point 20, “Code assignment”, was also not previously required to be filled out, but starting from June 2022, in accordance with the Central Bank’s directive No. 5286-U, it indicates one of three codes indicating the type of income of individuals:

- “1” - in cases where the purpose of the transaction is the transfer of wages, vacation or sick leave compensation, bonuses, financial assistance, as well as payments under contract agreements, or payments for which penalties are limited to a threshold value of no more than 50-70%.

- “2” - transfers that do not allow the application of legislative sanctions, which include alimony, maternity, as well as other types of financial transactions listed in the provisions of Art. 101 229-FZ.

- “3” - transfers within the framework of compensation for harm caused to health, and state support for persons affected by disasters, in respect of which only the collection of alimony deductions or compensation related to the loss of a breadwinner is allowed.

Field code 21 in the 2022 payment order is highlighted to indicate the priority status, ranging from one to five:

- “1” - the highest priority payments, that is, alimony or compensation for damage caused, the reason for which is the presence of enforcement proceedings.

- “2” - severance pay, wages, royalties for author’s works.

- “3” - wages under labor agreements, budget contributions.

- “4” – other necessary payments.

- “5” – voluntary mutual settlements.

Field 22

This section indicates one of the unique identifying codes, which is a combination of 20-25 digits:

- UIN - used when making payments to the Federal Tax Service, fines and penalties, as well as other debts. Assigned based on the stated requirement. If there is no such document, a zero value is entered.

- UIP - applied in other cases, determined by the recipient and transferred to the payer in advance. Replaced with "0" in situations where an identifier is not assigned.

Given the limited cell size, standard practice is to fill in several lines, with 7-8 numbers carried over. In this case, the item should not remain empty, while the next one after it - 23, “Reserve field” - is not filled in.

Tax sections

To complete orders for mandatory contributions and fines, you must fill out a number of columns.

- 101 - indication of the status of the sending entity, determined in accordance with the provisions of Order of the Ministry of Finance No. 107n.

- 104 - KBK, that is, a budget classification code consisting of 20 characters, and is determined for each type of such payments.

- 105 - OKTMO, which can be clarified at the Federal Tax Service, or on the FIAS website - at the territorial registration address.

- 106 - letter designation of the basis, which can be current payments (TP), repayment of debts without a claim (ZD) or with one (TR), payment upon suspension (PR), inspection report (AP) or writ of execution (AP).

It is worth noting that starting from October 2022, a decision was made to reduce this list - only ZD and TR remain in the main list, while the remaining codes are used as components of the identifier to be included in section 108.

Field 107 is used to clarify the tax period, and is filled in in the format “xx.xx.xxxx”. The first pair of characters indicates the frequency (monthly - MS, quarterly - CV, semi-annually - PG, annual - GD), the second - the month number (or “00” for annual payments), the last four - the current year. Sections 108 and 109 contain, respectively, the number and date of the document serving as the basis for the transaction.

Purpose of payment

Paragraph 24 is one of the most extensive in the entire form, and is intended to decipher the purpose of the transaction. If the subject matter is non-budgetary transfers, the section is filled in with the product name, data on the contract, invoices and invoices, indicating the amount of VAT (or a note about its absence). For mandatory contributions and fines, an abbreviated explanation is provided that reveals the specifics of the transaction being performed.

Fields 43-44

They are relevant only for the paper version of payments, and are used to affix a seal impression, which must correspond to the original, as well as the signature of the person authorized to submit documents.

TIN

Column 60 is filled in only by domestic taxpayers, while foreign entities enter “0”. If we are talking about withholding part of an individual’s income, the basis for which is an existing debt, the information is entered in the payer’s column. However, you cannot provide company details.

Taxpayer status

A sample payment slip with fields and numbers for taxes to the budget from October 2022 has lost a number of previously used options. An alternative to identifiers 9-12 was the generalizing “13”, denoting individuals acting as tax payers - individual entrepreneurs, notaries, farm managers and legal representatives. In addition, new designations have been introduced - now citizens engaged in political activities make transfers from electoral accounts using the code “29”, while foreign agents paying customs duties, but not registered with the Federal Tax Service, indicate the value “30” "

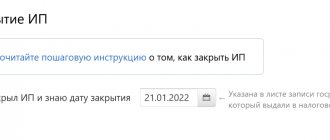

Basis of payment

As mentioned earlier, the list of applicable justifications has been reduced and generalized. In addition to the exclusion from the register of four abbreviations (TR, AP, PR, AR) included in the structure of the PP, the identifier for current transfers of individuals executed using their own balance sheet (BF) was also removed. This is important to take into account, since the erroneous indication of old designations is a reason for refusal to accept the order, and, as a result, a violation of the deadlines established for execution by the regulatory authorities.

Field 108

Inextricably linked with the previous 106 section is the point where the numbering of the resolution, act or other document on the basis of which payment is made is indicated. Filled out in alphanumeric format (a total of fifteen characters), where the first pair of elements are codes removed from the list of justifications, and the numerical combination is the number of the corresponding requirement.

Date of foundation

Another section concerns the basis documentation, the principle of filling which changes in cases where we are talking about the fulfillment of payment obligations regarding past periods. Entering a property identifier means that field 109 must indicate the chronological details of the corresponding document, which can be:

- Official statement from the Federal Tax Service.

- A court decision to bring to legal liability a debtor guilty of committing an offense in the field of taxation.

- Resolution to suspend a previously imposed penalty.

- A writ of execution formed on the basis of ongoing proceedings.

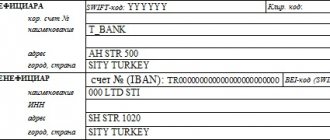

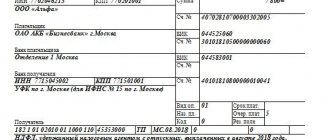

What details are used in payment orders?

To send payment to a counterparty or budgetary authorities (non-budgetary funds), it is necessary to determine the mandatory details of the payment order in accordance with the norms of the Ministry of Finance and the Central Bank. Each field has its own value.

We have collected in the table which details must be indicated in the payment order in 2022:

| Field no. | What mandatory details does a tax payment order contain? | Description |

| Are common | ||

| 3, 4 | Document number and date | Sequential numbering, the date strictly corresponds to the day of formation |

| 5 | Payment type | How is the order sent - electronically, by mail, etc. |

| 6, 7 | Payment amount | The amount is indicated in numbers and words |

| 8, 9 | Payer details | Payer's name and bank account |

| 10-12 | Information about the payer's bank | Name of the bank, its BIC and correspondent account |

| 16, 17 | Payee details | Name and bank account of the recipient organization |

| 13-15 | Information about the recipient's bank | Name, BIC and correspondent account of the recipient's bank |

| 60, 102 | TIN, checkpoint | INN and KPP of the payer |

| 61, 103 | TIN, checkpoint | Recipient's TIN and checkpoint |

| 18 | Type of operation | All PPs indicate the value “01” |

| 24 | Purpose of payment | The purpose and basis of the payment is stated |

| List and description of payment order details for payments to the budget | ||

| 101 | Payer status | The values are taken from Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013 (Appendix No. 5), taking into account changes that entered into force on October 1, 2021 according to Order of the Ministry of Finance No. 199n dated September 14, 2020 |

| 104 | Budget classification code | BCCs are affixed in accordance with Orders of the Ministry of Finance of the Russian Federation No. 85n dated 06.06.2019 and No. 99n dated 06.08.2020 |

| 105 | OKTMO | Location code in accordance with the classification of territories |

| 106 | Base | For budget calculations, the grounds are taken from Order of the Ministry of Finance of the Russian Federation No. 107n (Appendix No. 2) or the value is set to 0, taking into account the changes that entered into force on October 1, 2021 according to Order of the Ministry of Finance No. 199n dated September 14, 2020 |

| 107 | Taxable period | The period of occurrence of the obligation is indicated |

| 108 | A document base | Name of the register by which payment is made (demand, agreement), taking into account changes that entered into force on October 1, 2021 by Order of the Ministry of Finance No. 199n dated September 14, 2020 |

| 109 | Date of the founding document | The date to which the claim, agreement, etc. is dated. |

| What details should a bank document have for settlements with suppliers and contractors? | ||

| 21 | Sequence | For mutual settlements with suppliers - value 5 |

| 24 | Purpose | It is mandatory to indicate the name of the goods, work or services for which payment is made, and the data of the supporting documents - numbers and dates of contracts, invoices, invoices, delivery notes, certificates of work performed. It is also necessary to note whether this is an advance payment or a final payment, and provide information about VAT or its absence |

Thus, the name of the payment details is registration information about the organization (name, INN, KPP), banking information (account number and bank information) and, in the case of mutual settlements with suppliers, the number, date and amount of the invoice or information about the agreement concluded by the parties .

Note to the accountant: payment details for budgetary organizations are similar to those of commercial enterprises, but in the “Name” column you must indicate the personal account of the budgetary organization in the Treasury.

IMPORTANT!

From 01/01/2021, the procedure for filling out payments for transferring funds to the Federal Tax Service has changed. The tax service has connected to the treasury service system. The letter of the Federal Tax Service of Russia No. KCh-4-8 / [email protected] dated 10/08/2020 explains what details are needed to send a payment to the tax office: in addition to the main identifiers, a single treasury account (STA) will be required from 2022.

Here are the new rules:

- in field 13 we indicate the new name of the recipient's bank;

- in field 14 we reflect the changed BIC of the recipient’s bank;

- in field 15, fill in the account number of the recipient's bank from the single treasury account;

- In field 17 we enter the treasury account number.

Details are different for Russian regions. A complete list of payment identifiers for all subjects of the Russian Federation is given in letter No. KCh-4-8/ [email protected] dated 10/08/2020.

ConsultantPlus experts discussed how to fill out a payment form for taxes and contributions. Use these instructions for free.

to read.

Purpose of payment in tax payment

It is also worth noting that section 24 of template allows you to specify any information that in one way or another relates to the payment transaction being performed. So, for example, when issuing receipts related to making regular contributions according to the calendar schedule, it is mandatory to indicate the specific month for which payment is made. Otherwise, incorrect offset of payment is possible, and, as a result, the formation of overdue debt.

Results

Automation and simplification of operations that organizations and entrepreneurs encounter almost every day is an important factor in terms of increasing the efficiency of business processes.

In 2021-2022, finding a sample of filling out a payment order for income or patent taxes is not particularly difficult, but it is important to know the nuances and features of this procedure yourself. Complex solutions from , which simplify record keeping at retail outlets and warehouses, working with labeled goods, as well as solving other production and business problems of the enterprise, allow you to allocate free time to study the specifics. Number of impressions: 1281

What type of income codes should I indicate?

When making payments to individuals, payment documents must include one of three codes: “1”, “2” or “3”. This concerns types of income from Art. 99 and 101 of Federal Law No. 229-FZ of October 2, 2007. For other payments there will be no code.

Code 1 is entered when transferring income for which there are restrictions on the amount of deductions - no more than 50%, and in some cases no more than 70% (Article 99 No. 229-FZ) , for example:

- advance and salary;

- bonuses;

- material assistance;

- sick leave for injury and illness;

- vacation pay and vacation compensation;

- payments under a gift agreement;

- average earnings during a business trip;

- payment for work (services) under GPC agreements, including individual entrepreneurs and self-employed;

- dividends to members of the organization, etc.

Code 2 is used for payments from which debts cannot be withheld (Article 101 No. 229-FZ, except for income from clauses 1 and 4) , for example:

- travel allowances (including daily allowances established by local regulations);

- maternity benefits;

- alimony;

- compensation for the use of the employee’s personal property;

- lump sum benefit for the birth of a child;

- compensation when moving to another location for work;

- child care allowance, etc.

Code 3 is used for payments specified in clauses 1 and 4 of Art. 101 No. 229-FZ :

- compensation for harm to health;

- compensation to victims due to radiation or man-made disasters.

The income code is not included in the payment order if, for example, accountable money is transferred to an individual, returned or issued a loan, and also when an individual entrepreneur transfers his funds from a current account to a personal one.