When sick leave is paid from the minimum wage

Calculation of sick leave from the minimum wage is carried out in the following cases:

- if the employee has not worked and had no actual earnings over the past two years;

- if the employee’s average daily earnings are less than those calculated on the basis of the minimum wage.

The minimum sick leave is calculated based on the minimum wage. But its maximum value is also provided.

How to determine that the average earnings for the billing period are below the minimum wage? The algorithm is given in a ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Also, the amount of the benefit should be limited to the minimum wage when:

- the employee's insurance period is less than six months;

- there are grounds for reducing the amount of benefit (patient violation of the regime, failure to appear without good reason for an appointment with a doctor, illness or injury while intoxicated).

IMPORTANT! From 2022, the employer calculates and pays benefits to the employee only for the first 3 days of illness. The employee receives the rest of the money directly from the Social Insurance Fund. For more information, see our guide to direct benefit payments.

We take into account the regional coefficient

Previously, the FSS applied the regional coefficient only if the actual earnings were lower than the average employee’s earnings calculated from the minimum wage. If the situation was the opposite (actual earnings were greater than the minimum), then the coefficient was discarded.

Because of this, an employee with a lower income than his colleagues often received a larger amount of sick leave benefits. The legislator decided that this approach was not very fair and tried to equalize the rights of all employees.

From 2022, the regional coefficient established in regions and localities must be taken into account at the stage of comparing the average employee’s earnings with the minimum wage (see Law No. 175-FZ of 06/08/2020).

The Taxcom service organizes electronic document flow with the Social Insurance Fund. The employer receives an ELN number from the employee, sends a request to the fund and receives from there information and a partially completed certificate of incapacity for work. The employer needs to fill out his part in it and then send it back to the Social Insurance Fund.

How is sick leave calculated from the minimum wage from April 1, 2020 and in 2022?

From April 1, 2022, sick leave benefits cannot be lower than the minimum wage. At first, this procedure was introduced temporarily, until December 31, 2020. But then it was made permanent.

Read more about this here.

In this case, the calculation of sick leave based on the minimum wage will be as follows:

- The average daily earnings (ADE) are determined based on the minimum wage using the formula:

SDZ = minimum wage × 24 /730

IMPORTANT! The minimum wage value is taken as of the date of onset of the employee’s illness.

- The employee's actual SDZ is calculated and compared with the SDZ calculated from the minimum wage. Further calculations are made if the SDZ from the minimum wage is higher than the actual one.

- The amount of daily allowance (DA) is calculated using the formula:

DP = SDZ × % of experience

How to find out what the percentage is depending on length of service:

- If the employee’s insurance experience exceeds 8 years, then the calculated percentage is 100.

- If the experience is 5–8 years, then 80%.

- If less than 5 years - 60%.

- DP is multiplied by the total number of calendar days in the month of illness. The amount of benefits received in terms of a full month is compared with the minimum wage.

If it exceeds it, the benefit amount (SP) is calculated using the formula:

SP = DP × number of sick days

If the specified amount is less than the minimum wage, DP and joint venture are considered from the minimum wage:

DP = minimum wage / number of calendar days in the month of illness

SP = DP × number of sick days

EXAMPLE from ConsultantPlus: From February 25 to March 17, 2022, the employee was on sick leave. In the billing period, payments to the employee, for which insurance premiums for VNiM were accrued, amounted to: in 2022, 114,880 rubles; in 2021 - 135,600 rubles. The employee’s insurance length as of the date of temporary disability is 10 years... For the continuation of the example, see the Ready-made solution from ConsultantPlus, having received trial access to the system. It's free.

For employees whose insurance coverage is less than 6 months, the benefit calculation process is simpler:

DP = minimum wage / number of calendar days in the month of illness

SP = DP × number of sick days

You can view the nuances and calculations for paying sick leave in case of violation of the regime, failure to appear at the doctor, or intoxication in K+ for free. If you do not have access to the K+ system, get a trial online access for free.

In some cases, sick leave based on the minimum wage is calculated taking into account regional coefficients.

How to calculate sick leave in 2022

According to the new rules, it is necessary to calculate the minimum average daily earnings taking into account the regional coefficient and the employment coefficient. To do this, use the formula:

Minimum wage × RK × KZ × 24 / 730, where:

- Minimum wage - the minimum wage is taken as of the start date of sick leave, so if it started in December 2022, use the minimum wage of 12,792 rubles, if it started already in 2022 - 13,890 rubles;

- RK - regional coefficient;

- KZ - employment rate at the date of onset of disability;

- 24 is the number of months in two years;

- 730 is the number of calendar days in two years.

Then the calculated actual average daily earnings are compared with the minimum. For further calculation, the largest value of the two is selected. Now we need to calculate the amount of benefits that the employee should receive during the period of incapacity for work in accordance with the calculated average daily earnings. To do this, use the formula:

AVERAGE × PERCENTAGE × DAYS, where:

- AVERAGE - the amount of average daily earnings;

- PERCENTAGE - amount (percentage) of benefit payment;

- DAYS - the number of benefit days in a calendar month with this percentage of payment.

Then the amount received must be compared with the minimum benefit amount, calculated on the basis of the minimum wage, taking into account the regional coefficient and the employment coefficient. To do this, use the formula:

Minimum wage × RK × KZ × DAYS / KKD, where:

- Minimum wage is the minimum wage as of the date of commencement of the insured event. So, if the sick leave began in December, the amount of 12,792 rubles will be taken, and if in January - 13,890 rubles;

- RK - regional coefficient;

- KZ - employment rate at the date of onset of disability;

- DAYS - benefit days falling on this calendar month;

- KKD - the number of calendar days in the month in which the period of incapacity is located.

Further, when calculating the benefit, the larger amount is used. If the minimum benefit amount is greater than the benefit calculated according to the average, then the employee will have to pay the minimum benefit amount.

Find out which regional coefficient applies in your area

How the minimum wage was used to calculate sick leave until April 1, 2022

Until April 1, 2020, the formula for calculating the minimum amount of sick leave looked like this:

Minimum wage current as of the date of onset of the employee’s illness × 24 months. / 730 days = minimum average daily earnings.

If the employee’s average daily earnings were less than those calculated based on the minimum wage, then the larger value was taken into account.

In the event that sick leave was calculated based on the minimum average daily earnings, it was necessary to calculate the disability benefit for the day:

Minimum average daily earnings based on the minimum wage × % (depending on length of service).

If the length of service is less than six months, then sick leave should be calculated taking into account the fact that monthly income cannot exceed the minimum wage (RUB 12,130 in 2022).

How to calculate sick leave from the minimum wage in 1C:Salary, taking into account the regional coefficient from June 19, 2022.

According to Decree of the Government of the Russian Federation dated June 15, 2007 No. 375, in regions and localities where regional coefficients are applied to wages, the calculation of benefits based on the minimum wage must be made taking into account these coefficients if:

- the employee’s average earnings, calculated for two calendar years preceding the year of the insured event, are less than the minimum wage (calculated for a full calendar month) or there was no earnings for this period;

- The employee's insurance period does not exceed 6 months;

- there was a violation of the treatment regimen or incapacity for work due to intoxication.

Previously, there were two points of view on the application of the regional coefficient to the minimum wage when calculating disability benefits:

1. Specialists from the Federal Social Insurance Fund of Russia believed that the average daily earnings of an employee should be compared with the average daily earnings based on the federal minimum wage, which is in effect on the date of the insured event, without taking into account the regional coefficient. And if the average earnings turn out to be below the minimum wage, then the benefit should be calculated from the federal minimum wage, and then multiplied by the regional coefficient (letter of the Federal Social Insurance Fund of the Russian Federation dated December 17, 2018 No. 02-11-03/17-468OP, clause 2 dated March 11, 2011 No. 14-03-18/05-2129).

2. The courts believed that the average daily earnings of an employee should be compared with the minimum wage, taking into account the regional coefficient.

From 06/19/2020

amendments to clause 1.1 of Art. came into force.

14 of Federal Law No. 255-FZ dated December 29, 2006, which clarifies the rules for calculating temporary disability benefits based on the minimum wage ( Federal Law No. 175-FZ dated June 8, 2020

).

It has been established that in order to calculate benefits, average earnings for the billing period must be compared with earnings calculated from the minimum wage, to which the regional coefficient has already been applied.

The benefit is calculated based on the larger amount.

Since version 3.1.14

in the programs “1C: Salaries and personnel management / 1C: Salaries and personnel of government institutions” (rev. 3), when calculating temporary disability benefits, amendments have been implemented in accordance with Federal Law No. 175-FZ dated 06/08/2020. Now, when calculating benefits, the employee’s average daily earnings are compared with the average earnings from the minimum wage, taking into account the regional coefficient.

Example:

The organization is located in an area where RL 1.15 applies.

Full-time employee Zharkov E.L. provided BL from 06/28/2020 to 07/03/2020. Insurance experience over 10 years. Earnings for the previous two years amounted to 300,000 rubles. A temporary disability benefit was assigned in the amount of 100% for 6 calendar days. CALCULATION OF BENEFITS:

Average daily earnings amounted to: 300,000.00 / 730 = 410.96 Minimum wage as of June 28, 2020: 12,130 Minimum average daily earnings from the federal minimum wage amounted to: 398.79

Benefit due

| Start of payment period | End of payment period | Days of payment | Average daily earnings | Minimum average daily earnings calculated from the minimum wage, taking into account the Republic of Kazakhstan: 1.15 | Benefit amount as a percentage of salary | Amount of daily allowance in rubles. and a cop | Minimum daily allowance | Benefits accrued |

| 28.06.2020 | 30.06.2020 | 3 | 410,96 | 458,61 | 100 | 458,61 | 464,98 | 464.98 x 3 = 1394.94 |

| 01.07.2020 | 03.07.2020 | 3 | 410,96 | 458,61 | 100 | 458,61 | 449,98 | 458.61 x 3 = 1375.83 |

Average daily earnings of an employee

amounted to 410.96 rubles.

Average daily earnings calculated from the minimum wage, taking into account the regional coefficient

equal to 458.61 rubles. (RUB 12,130 * 24 / 730 days * 1.15).

Subject to amendments made by Federal Law

dated 06/08/2020 No. 175-FZ, to calculate the benefit, the maximum of the values is taken, i.e.

average daily earnings, calculated from the minimum wage, taking into account the regional coefficient ( 458.61 rubles

)

Previously, to calculate benefits, the employee’s average daily earnings would have been taken, because it would be more than the average daily earnings, calculated from the minimum wage without taking into account the Republic of Kazakhstan (12,130 rubles * 24 / 730 days = 398.79 rubles)

To get a consultation

According to Federal Law dated 01.04.2020 No. 104-FZ

, if the temporary disability benefit paid to the insured person for periods of incapacity falling on the period

from April 1 to December 31, 2020 inclusive

, calculated for a full calendar month is lower than the federal minimum wage, then the benefit is paid in the amount of the federal minimum wage, calculated for a full calendar month month, using the regional coefficient:

Amount of daily benefit = minimum wage * regional coefficient * share of part-time work / number of days in a month

.

The amount of daily allowance according to the provisions of Law No. 104-FZ is:

in June 2022 - 12,130 rubles. * 1.15 * 1/30 days = 464.98 RUR

.

in July 2022 - 12,130 rubles. * 1.15 * 1/31 days = 449.98 RUR

.

To calculate the benefit amount, the largest daily benefit is taken.

In our example , the average daily earnings, calculated from the minimum wage, taking into account the regional coefficient

than the daily allowance

in June 2022 (464.98 rubles), and in July 2022 more than 449.98 rubles.

Therefore, the benefit amount

for June 2022 accrued in the amount of 464.98 x 3 = 1394.94, and for July 2022 458.61 x 3 = 1375.83

Read also:

Deadlines for transferring personal income tax to 6-NDFL due to non-working days

Register of workers over 65 years of age to be sent to the Social Insurance Fund from June 15

Preparation of notification of the transition to electronic work books

Was the article helpful? Share with your friends!

Log in or use your social media account to leave a comment Login via social networks

Odnoklassniki VKontakte My World Facebook

Do you have any questions? Call or write.

Do you want to place an order? Leave a request

We are in social networks! Subscribe!

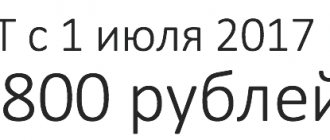

Minimum wage for calculating sick leave in 2016-2022

From 07/01/2016 the minimum wage was increased and until 07/01/2017 it was applied in the amount of 7,500 rubles. To calculate maternity leave and payments for regular sick leave in the second half of 2022, the minimum wage was 7,800 rubles.

From 01/01/2018, the minimum wage was once again increased, and its value was equal to 9,489 rubles. But this value has increased since 05/01/2018 and the minimum wage amounted to 11,163 rubles. (Law “On Amendments...” dated 03/07/2018 No. 41-FZ).

From 01/01/2019, the minimum wage became equal to the subsistence level established for the 2nd quarter of 2022 and amounted to 11,280 rubles.

From 01/01/2020 the minimum wage is 12,130 rubles.

From 01/01/2021 the minimum wage is set at 12,792 rubles.

From 01/01/2022 the minimum wage is 13,890 rubles.

Read about the details of the adoption of the new minimum wage here.

When to apply the regional coefficient

If the organization is located in an area with difficult climatic conditions, employees are paid increased wages.

So, if an employee had no earnings during the billing period or his insurance period is less than 6 months, the benefit is paid in the minimum amount (based on the minimum wage), and it must be increased by the regional coefficient.

Keep in mind that in other cases the regional coefficient is already taken into account in the actual earnings of the billing period.

Officials in the letter under consideration noted: the final amount of benefits calculated on the basis of the minimum wage is adjusted by the regional coefficient.

That is, at the stage of comparing the actual average daily earnings and the average daily earnings based on the minimum wage, the regional coefficient is not taken into account.

Example 1. How to calculate the amount of sick leave taking into account the regional coefficient (according to the Social Insurance Fund)

The organization is located in an area where a regional coefficient of 1.15 applies. Employee A.I. Smirnov has the right to temporary disability benefits in the amount of 100% of average earnings for 5 days (according to the certificate of incapacity for work). For two calendar years that precede the onset of temporary disability (January - December 2022 and January - December 2018 ), Smirnov earned only 350,000 rubles. The actual average daily earnings are 479.45 rubles. (350,000 rubles: 730 days). In 2022, the average daily earnings, calculated based on the minimum wage, will be 370.85 rubles. (11,280 rubles × 24 months: 730 days). Since the average daily earnings calculated on the basis of the minimum wage are less than the average daily earnings calculated from the actual earnings (370.85 rubles.

Minimum wage 2022 for calculating sick leave

According to the rules for calculating sick leave in 2022, the minimum wage that is current on the date of illness in the current year is used. This means that the minimum wage values for previous years are no longer needed. If the amount of disability benefits is determined based on the employee’s earnings, then his income for the previous two years will be required.

For more information on the conditions for applying the minimum wage calculation, see the article “What is the minimum wage for calculating sick leave.”

When calculating sick leave in 2022, every employer wants to be sure whether the certificate of incapacity for work is drawn up correctly. It is now impossible to directly check the sheet, since it has been issued only electronically since 2022. Therefore, as a general rule, sick leave will have to be accepted as is. But if you have doubts about the validity of the calculations, you can complain about the medical institution to the Social Insurance Fund - on the basis of a new procedure approved by order No. 1090n dated November 23, 2021.

If the enterprise has at its disposal a paper sick leave issued in 2022, then work with such a document should be carried out taking into account recent clarifications from the Social Insurance Fund.

Find out more about the new procedure for FSS inspections of medical institutions in special material available in the ConsultantPlus system. Get a free trial.

Arbitrage practice

The Russian Federation's Supreme Arbitration Court thinks differently. First you need to determine your average daily earnings based on your actual earnings. Then calculate the average daily earnings based on the minimum wage and multiply the resulting value by the regional coefficient. In this case, the comparison of earnings is correct, because the regional coefficient is already taken into account in the employee’s actual salary.

Determination of the Supreme Arbitration Court of the Russian Federation dated May 26, 2014 No. VAS-5881/14.

Example 2. How to determine the average daily earnings taking into account the regional coefficient using the BAS method.

The organization is located in an area where the regional coefficient is 1.15. An employee has the right to temporary disability benefits in the amount of 100% of average earnings. The average employee's earnings, calculated taking into account the coefficient, amounted to 200,000 rubles. The average daily earnings in this case is 273.97 rubles. (200,000 rubles: 730 days). In 2022, the average daily earnings, calculated on the basis of the minimum wage taking into account the regional coefficient, will be 426.65 rubles. (RUB 11,280 × 24 months: 730 days × 1.15). Since the average daily earnings, calculated on the basis of the minimum wage taking into account the coefficient, is greater than the average daily earnings calculated from the actual earnings (RUB 426.65 > 273 .97 rubles), when calculating benefits, you need to use the average daily earnings calculated on the basis of the minimum wage, taking into account the coefficient.

Expert “NA” E.V. Chimidova

Results

Before calculating sick leave in 2022 from the minimum wage, you need to check whether such a calculation is needed. It is also used in situations where the employee has only recently started working or if his earnings are below the established minimum wage. We provided calculation algorithms and links to examples above.

Sources: Federal Law dated June 19, 2000 No. 82-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

What has changed since 2022 in calculating sick leave?

Since the new year, the minimum wage has increased, and now the minimum wage is 13,890 rubles.

The limits for calculating disability benefits have also changed.

The table below shows the figures for 2022 and 2022 for comparison (excluding regional coefficients).

That is, the maximum amount of sick leave for one day in 2022 is 2,572 rubles 60 kopecks. Those workers who receive more than 78,000 rubles per month and whose insurance experience is more than 8 years can count on it.

The minimum benefit per day is 456.66 rubles. It can be calculated: the minimum wage (RUB 3,890) multiplied by 24 months and divided by 730 days.

It is convenient to issue electronic certificates of incapacity for work (ELN) through the special Taxcom service. The employer relieves himself of responsibility for storing and filing sick leave certificates, and document flow is simplified and accelerated.

Get a 50% discount on connecting to Online Sprinter