Formation of the cost of goods

The concept of the cost of goods for “simplified people” in Chapter.

26.2 of the Tax Code of the Russian Federation is not disclosed. Also in ch. 26.2 there are no references to Ch. 25 of the Tax Code of the Russian Federation, which defines the rules for determining the cost of goods (Article 320 of the Tax Code of the Russian Federation). The cost of goods is formed based on their price paid to the supplier according to the contract. Other expenses incurred by the buyer during acquisition and sale are not included in the cost of goods and are written off separately.

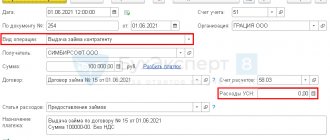

In addition, the VAT paid to the seller should be deducted from the cost of goods (price of goods), since the tax is written off on the basis of sub-clause. 8, 23 clause 1 art. 346.16 of the Tax Code of the Russian Federation is carried out under a separate expense item. The amount of VAT paid is shown in a separate line of the Book of Income and Expenses (letter of the Ministry of Finance of Russia dated January 18, 2010 No. 03-11-11/03, dated December 2, 2009 No. 03-11-06/2/256).

ATTENTION! Expenses for the purchase of goods for resale that you incurred during the period of application of UTII can be taken into account as you sell these goods. If they are implemented after the transition to the simplified tax system, take these expenses into account when calculating the tax base under the simplified tax system. If you have incurred expenses directly related to the sale of goods (costs of storage, maintenance, transportation), take them into account in the payment period after the transition to the simplified tax system (clause 2.2 of article 346.25 of the Tax Code of the Russian Federation, clause 8 of the Letter of the Federal Tax Service of Russia dated November 20, 2020 N SD-4-3/ [email protected] ).

Read more about accounting for “input” VAT on purchased goods in the article “We take into account VAT in expenses - special conditions.”

The cost of goods is recognized as an expense subject to payment for them with the supplier and only after they are sold to the buyer. There is no need to wait to receive payment from the buyer.

Check whether you are correctly writing off purchased goods and taking into account VAT on them, using a Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial demo access for free.

How to take into account goods and other inventory items when switching from the simplified tax system “income” to the simplified tax system “income minus expenses”, see here.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2022

Online cash register for dummies

Did you like the article? Share it on social networks.

Add a comment Cancel reply

Also read:

Online cash register for individual entrepreneurs on the simplified tax system

An online cash register for individual entrepreneurs on the simplified tax system is required by law.

All entrepreneurs and organizations in various areas of business are switching to a new type of equipment. The transition occurs consistently for different areas. In this regard, many began to ask questions, for example, is an online cash register needed for services on the simplified tax system, is there a deferment for online cash registers in a simplified system, how to choose a cash register, etc. In this article we... 493 Find out more

Online cash register for individual entrepreneurs on the simplified tax system in 2021-2022: which one to choose

We will tell you in detail about online cash registers for individual entrepreneurs on the simplified tax system.

Is it mandatory for this category of taxpayers to use an online cash register? In what cases can you work without a cash register and is there a deferment? How and which cash register to choose and buy, what to do as an individual entrepreneur on the simplified tax system without employees and for those who provide services. We will select and analyze the most popular cash registers in 2022. Special offers for online cash registers Large selection... 427 Find out more

What taxes does an individual entrepreneur pay on the simplified tax system?

Taxes for individual entrepreneurs under the simplified tax system are somewhat different from contributions from entrepreneurs under other taxation systems.

The taxpayer receives a low interest rate, simple reporting, and the opportunity to reduce taxes through insurance payments. “Simplified” is aimed at representatives of small and medium-sized businesses. This regime is especially popular among individual entrepreneurs without employees - with a small income, the tax can be reduced to almost zero. The simplified tax system is regulated by Chapter 26.2 of the Tax Code of the Russian Federation. Quarterly… 485 Find out more

Methods for writing off the cost of goods as expenses

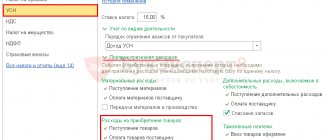

The Tax Code of the Russian Federation allows you to choose one of the following methods for writing off the costs of paying for purchased goods (subclause 2, clause 2, article 346.17 of the Tax Code of the Russian Federation):

- at the cost of the first in time of acquisition (FIFO);

- average cost;

- unit cost of goods.

To calculate the cost of inventories with similar properties and nature of use, use the same method (clause 37 of FSBU 5/2019).

The Russian Ministry of Finance allows the establishment of different methods for writing off costs for different groups of goods (letter dated 01.08.2006 No. 03-03-04/1/616). Despite the fact that the clarifications in the letter concern the valuation of goods when calculating income tax, it can be assumed that even under the simplified tax system it is not prohibited to be guided by these clarifications.

The accounting policy for tax purposes must specify the chosen valuation method, and if there are several of them, then it is necessary to describe the groups of goods for which one or another method is applied.

A sample accounting policy for the simplified tax system “income minus expenses” can be found here.

The Tax Code of the Russian Federation does not stipulate how to apply valuation methods in practice, however, a description of all methods for writing off costs for the purchase of goods is contained in the accounting regulations. From 2021, this is the new FSB 5/2019 “Inventories” (see paragraphs 36-40 of the standard), until 2022 - paragraphs 17–19 PBU 5/01.

See examples of calculating average cost and calculating cost using the FIFO method in ConsultantPlus. Trial access to the system is provided free of charge.

If the taxpayer’s sales volume is small, then he usually does not have problems when using any of these methods. So, for example, it is enough to simply track for each unit of goods whether payment was made to the supplier and whether this product was subsequently sold. These are the two conditions that are necessary for accepting the cost of purchased goods as expenses. When maintaining tax accounting registers, you will need to enter information about the acquisition of goods, their sale, payment to the supplier and receipt of payment from buyers.

With a wide range of products, a large volume of sales and keeping records of sales prices, it is quite difficult for the taxpayer to apply the above methods for valuing goods. For example, retail businesses that issue a cash register receipt for a total amount without detailing it find it difficult to track compliance with the requirements that allow them to include the cost of purchased goods in expenses.

In such a situation, you can calculate the cost of goods to include it in expenses using a special formula proposed by the Ministry of Finance of Russia in its letter dated April 28, 2006 No. 03-11-04/2/94. Initially, the clarifications concerned the transition period of 2006, but even now they have not lost their relevance.

Question answer

How are taxes calculated when working as an individual entrepreneur using the simplified tax system “Income” through the marketplace?

It all depends on the agency fee payment scheme.

When calculating from “dirty” income (without deduction of expenses), the rate is 6%. If the marketplace independently deducts a commission from the seller, to calculate the tax under the simplified tax system “Income” you need to add the commission to the profit received.

Which simplified tax system should I choose for an individual entrepreneur when trading through the marketplace?

Most often, the simplified tax system of 6% is chosen for the marketplace. But if an individual entrepreneur purchases goods from a supplier officially, has the appropriate documents, and records expenses, you can choose the simplified tax system of 15%. This is especially true for high expenses and small business profits.

On which marketplace can you sell goods without an individual entrepreneur?

For now, self-employed people can place products on three online trading platforms: Wildberries, AliExpress, and from November 2022 - on Ozon.

The rest cooperate with individual entrepreneurs and legal entities. But soon the possibilities will be expanded.

| Expert Director of Development . More than 7 years of experience in the implementation of online cash registers, EGAIS accounting systems and product labeling for retail organizations and catering establishments. Maxim Demesh |

Do you need help with accounting services on the simplified tax system?

Don’t waste time, we will provide a free consultation and help resolve all issues.

FIFO method

When using the FIFO method, expenses take into account the cost of those goods that were purchased earlier than others. When purchasing goods in batches, it is first necessary to write off goods from the first received batch, if it is insufficient - from the second, etc. in order.

This method is convenient to use for writing off the cost of goods whose prices decrease over time, or for the subsequent provision of cumulative discounts by sellers. After all, first of all, expenses take into account the cost of goods purchased at the highest price.

Example

Sever LLC is engaged in the resale of refrigerators. On September 5, the company purchased and paid for the first batch of 8 Atlant refrigerators at a price of RUB 8,500.00. per piece (without VAT). On September 15, the second batch of 12 such refrigerators was received and paid for at a price of RUB 8,300.00. per piece (without VAT). In total, Sever LLC sold 14 refrigerators in September.

The accountant of Sever LLC needs to write off the costs of purchasing refrigerators as follows:

- 8 refrigerators for the price of RUB 8,500.00. from the first batch – 68,000.00 rubles;

- 6 refrigerators for the price of RUB 8,300.00. from the second batch – RUB 49,800.00.

It turns out that in September the expenses will take into account:

RUB 68,000.00 + 49,800.00 rub. = 117,800.00 rub.

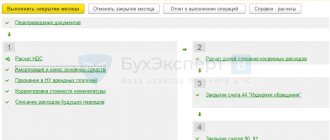

Problems due to incorrect settings

Generally speaking, there can be many of them. For example, if you enter the initial balances of goods or materials, then with “average” accounting selected (if you managed to set it), the program will still require a batch document and the document will not be posted at all. This is all because in some versions of 1C Accounting 8.3 Taxi you can still disable batch accounting and FIFO, but with USN 15 the document posting module will still require this data.

Simply put, you shouldn’t be tricky with the 1C settings and do it right. Then it will be easier for you!

Write-off method based on the cost of each unit

The method is quite simple, since each unit of goods is written off as expenses at the cost of its acquisition.

The write-off method based on the cost of each unit is suitable for those organizations that trade unique single products or with a small range of products.

Example

Volga LLC is engaged in the trade of gas equipment and keeps records of goods at the cost of each unit. Under the supply agreement, in February the organization purchased and paid for a universal boiler that runs on solid and liquid fuels at a cost of 120,000 rubles. In March, the boiler is sold by the Kama organization for 158,000 rubles, which immediately pays for this equipment. This means that Volga’s expenses for September should take into account the cost of purchasing a boiler in the amount of 120,000 rubles.

Average cost write-off method

The average cost write-off method is used for one type or one group of goods. In this case, the cost of goods written off as expenses is determined in 2 stages.

First of all, it is necessary to calculate the average cost of the type of goods purchased for subsequent sale; for this, the total cost of goods available in the warehouse at the beginning of the month and received during the month is divided by the number of these goods available in the balance at the beginning and received during the month. Only those goods for which payments were made to suppliers are taken for calculation.

| Average unit cost | = | Cost of inventory balances at the beginning + cost of goods received | / | Number of goods at the beginning of the month + number of goods received |

At the second stage, the cost of goods sold is calculated, which can be included in expenses.

| Price goods included in expenses | = | Quantity implemented goods | X | average cost units goods |

Example

In November, Gaz-M LLC purchased three lots of gas meters SGBM-1.6, SGBM-2.5, SGBM-3.2 for resale to the public:

- batch SGBM-1.6 - 60 meters at a price of 1,200 rubles. per piece (without VAT);

- batch SGBM-2.5 – 120 meters at a price of 1,280 rubles. per piece (without VAT);

- batch SGBM-3.2 - 80 meters at a price of 1,320 rubles. per piece (without VAT);

Payment was made to the supplier in the same month.

As of 01.11, Gaz-M had 35 meters in its warehouse in the amount of 41,700.00 rubles.

During November, 180 meters of various prices were sold.

The accounting policy of Gaz-M LLC establishes a method for writing off the cost of goods as expenses based on the average cost of a group of goods.

We need to determine the cost of goods that needs to be written off as expenses for November.

Let's calculate:

- cost of goods received:

60 pcs. × 1,200 rub. + 120 pcs. × 1,280 rub. + 80 pcs. × 1,320 rub. = 331,200 rub.;

- cost of received meters taking into account the balance at the beginning of the month:

RUB 41,700 + 331,200 rub. = 372,900 rub.;

- total number of meters received, taking into account the balance at the beginning of the month:

35 pcs. + 60 pcs. + 120 pcs. + 80 pcs. = 295 pcs.

Thus, the average cost per unit of goods was equal to:

RUB 372,900 / 295 pcs. = 1264 rub.

Based on the average cost per unit of goods, the accountant will determine the amount of expenses that he will take into account in November:

180 pcs. × 1264 rub. = 227,520 rub.

See also “Methods for estimating inventories”.

Results

To recognize the cost of purchased goods as expenses under the simplified tax system, several conditions must be met: the organization applies the taxation object “income minus expenses”, the goods are paid to the supplier and sold to the buyer. If these conditions are met, the cost of purchased goods sold is determined by one of the methods specified in the organization’s accounting policies.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.