Purpose of foreign exchange controls on imports

The “rules of the game” established by the state are necessary to control financial funds going abroad. Currency control agents must monitor the validity of each financial transaction to prevent fictitious money and attempts to withdraw money using fraudulent documents (when goods are paid for but not delivered).

It is for this purpose that if the transaction amount is more than 3 million rubles (for comparison: for export, 6 million rubles are considered the “threshold”), it is necessary to register the contract with an authorized bank. And the bank, in turn, checks the amount sent abroad (and the date of payment) with information from the customs service about the cost of imported goods and the timing of their delivery to Russia. Any discrepancies are grounds for suspicion of violation of currency laws.

The procedure for currency control when importing goods and services is discussed in Central Bank instruction No. 91-I. It includes all import related operations except:

- supplies of goods on leasing terms, if the counterparty is not a resident of the Russian Federation;

- importation of goods under the terms of a construction contract, when the cost of materials is included in the cost of work (that is, services are paid for, but goods are not paid separately);

- financial transactions involving bills of exchange that do not relate to the supply of goods.

Each stage has its own characteristics. Informing about the currency control procedure allows you to avoid making mistakes when conducting foreign trade transactions.

Is it possible to register without documents?

Only in cases where we are talking about export agreements. To register a contract, it is enough to provide the bank only with information about it. It is assigned a number, after which it becomes available for payments. However, no later than 15 working days after the date of registration, the export contract must be submitted to the bank. It is worth noting that a monetary fine is provided for violating the deferment deadline.

Registration of a contract with a bank

Regardless of the type of currency used in contracts related to the import of goods or services, all payments are made through Russian banks. At the same time, contracts worth more than 3 million rubles are subject to mandatory registration. The equivalent in rubles is calculated based on the official exchange rate of the Central Bank on the day of submission of documents.

The procedure takes 1 business day - and another day is provided by law for the bank to notify the importer of the unique number assigned to the contract.

The following types of contracts are registered:

- any foreign trade contracts related to the import of goods;

- contracts for the performance of work or provision of services, including the transfer of information and the fruits of intellectual labor;

- agreements for receiving or issuing credits and loans;

- sale (or provision of sales services) abroad of fuels and lubricants, food and other goods (except for equipment and spare parts for it) to ensure the operability of any vehicles and their crews;

- transfer of property for rent.

It is important that the contract clearly states the amount of obligations, as well as the timing of their repayment. For certain types of contracts, the amount of obligations may be indicated taking into account agency and commission fees, reimbursable expenses, as well as third-party services (for example, payment to a cleaning service under a construction contract).

Documents for registering a contract

If exporters are allowed to submit a contract extract to the bank first, and the document itself within 15 days, then importers are required to immediately present the contract. An application must be submitted along with it, indicating:

- type of contract, its details (date of conclusion, number);

- contract amount indicating the name of the currency;

- deadlines for fulfilling obligations;

- details of the foreign counterparty, including the full name of the company and indication of the country of registration.

It is allowed to submit a draft contract (that is, an official document that has not yet been signed by the parties) to the bank. However, by law, the importer is required to submit the original contract with all the necessary signatures and seals within 15 days.

Important! If the document was drawn up in a foreign language, it is necessary to attach an officially certified translation (by a notary) of each page. If it is not possible to bring the original document to the bank, you can present a copy. In this case, each sheet is certified by the signature of the responsible person, after which the contract is stitched and certified again - but on the last sheet (indicating the total number of pages).

So that bank employees can verify the authenticity of signatures and seals, you should also present a signature card with samples of the strokes of all responsible persons.

Certificate of supporting documents

The procedure for completing this paper is provided for in Appendix No. 6 to the Central Bank Instruction No. 181-I dated August 16, 2022. It stipulates that when importing goods into the territory of the Russian Federation, transport, shipping or accompanying papers are considered supporting documents.

A certificate of supporting documents is not needed if:

- the contract provides for the transfer of property for rent, not ownership;

- we are talking about the supply of goods under leasing terms;

- the contract was concluded for the supply of communication services or insurance;

- the contract is deregistered due to the assignment of claims to another resident.

The specific list of supporting documents can be clarified at the authorized bank.

Commentary to Instruction No. 37 - registration of foreign exchange agreements

Alexander Mikhailovich Lugovoy, economist

On February 12, 2022, in order to implement the provisions of the new edition of the Law on Currency Regulation, providing for the formation of a currency monitoring system of the National Bank (clause 2 of Article 9 of the Law on Currency Regulation), Resolution of the Board of the National Bank No. 37 “On registration by residents of currency agreements” was adopted, which Instruction No. 37 of the same name was approved.

The subject of legal regulation of Instruction No. 37 is the definition of:

— the procedure for registration by individuals and legal entities, individual entrepreneurs who are residents of the Republic of Belarus (hereinafter referred to as residents), or on their behalf by banks of the Republic of Belarus, OJSC Development Bank of the Republic of Belarus (hereinafter referred to as banks) in the user’s personal account on the web portal, posted on the official website of the National Bank, currency agreements.

reference For the purposes of Instruction No. 37, registration of a foreign exchange agreement is understood as a set of actions to present information about a foreign exchange agreement on a web portal, which ends with assigning a registration number to the foreign exchange agreement using software, hardware and technologies. Web portal is an information resource for registering foreign exchange agreements, posted on the National Bank’s website on the global computer network Internet, which will begin its work by the time Instruction No. 37 comes into force (July 2022);

— a list of foreign exchange transactions during which the foreign exchange agreement is subject to registration;

— the maximum amount of obligations under a foreign exchange agreement, if exceeded, the foreign exchange agreement is subject to registration;

— the procedure for residents to submit documents and other information on the fulfillment of obligations under registered foreign exchange agreements.

Currency agreements are not subject to registration if one of the parties is:

— The Republic of Belarus, its administrative-territorial units participating in relations regulated by currency legislation, the National Bank, the Ministry of Finance;

— banks of the Republic of Belarus, Development Bank when conducting transactions with currency values classified as banking operations;

- other residents, the list of which is determined by the President of the Republic of Belarus or on his instructions by the Council of Ministers.

In other cases, the Law on Currency Regulation defines the obligation of residents to register foreign exchange agreements and submit documents and other information on registered foreign exchange agreements in the manner established by the National Bank (subclause 2.3, clause 2, article 8).

Thus, currency agreements concluded between residents and non-residents, the amount of obligations for which is not determined, reaches or exceeds 2000 basic units (for individuals) and 4000 basic units (for legal entities and individual entrepreneurs) in equivalent, are subject to registration by the resident in his personal account user on the web portal (clause 3 of Instructions No. 37).

For reference As of March 1, 2022, 2,000 base units are equivalent to $22,259, 4,000 base units are equivalent to $44,518.

Note: Currently, only foreign trade agreements covering the export (import) of goods whose total value is equal to or exceeds 3,000 euros are subject to registration. If you look at the closest partners in the EAEU, the Russian Federation has established threshold values for registration for exports of 6 million Russian rubles. rub. (at the Bank of Russia exchange rate as of 03/01/2021 this is more than 80,000 US dollars in equivalent), for imports, as well as under loan agreements - 3 million Russian. rub. (i.e., accordingly, more than $40,000). In the Republic of Kazakhstan, the registration regime is maintained both for export-import transactions and for capital movement transactions. Threshold values for export-import transactions are determined in the amount of 50 thousand US dollars in equivalent for foreign exchange transactions related to the movement of capital, 500 thousand US dollars for capital inflow transactions and 500 thousand US dollars for outflow transactions capital.

Instruction No. 37 determines that residents, for the purpose of registering a currency agreement, create a personal user account on a web portal, the organization of continuous operation of which is ensured by the National Bank (clause 8,).

For reference, the Resident’s Personal Account is a component of the web portal through which information about a foreign exchange agreement necessary for its registration, documents and other information about changes, execution of a foreign exchange agreement are provided, and information on registered foreign exchange agreements is searched and obtained.

In the user’s personal account, the resident fills out a registration form that contains the essential terms of the foreign exchange agreement (such essential conditions include, among other things: the type and subtype of the foreign exchange agreement, its number and date, the validity period of the foreign exchange agreement, the amount of monetary obligations under the foreign exchange agreement, currency payment and settlement terms, and a number of others), as well as information about the non-resident counterparty (name of the counterparty, country, identification number, and if absent, location address).

The resident is obliged to register a currency agreement in the user’s personal account before or on the day he performs actions aimed at executing the currency agreement, or no later than 7 working days from the date following the date of receipt of funds under the currency agreement to an account opened with a bank or foreign bank, depending on which of the specified events occurs earlier (clause 6 of Instruction No. 37).

For reference , actions aimed at executing a currency agreement are: making payments, receiving (transferring) currency values, receiving (shipping) goods, receiving (transferring) undisclosed information, exclusive rights to intellectual property, property rights, property for rent, performing work , provision of services, making a contribution to the authorized capital, attracting (providing) loans, purchasing (selling) securities, property classified as real estate in accordance with the legislation of the Republic of Belarus, and other actions.

A foreign exchange agreement is registered by assigning it a registration number consisting of three parts separated by a slash.

In the first part of the registration number, consisting of six rows, the following are entered from left to right:

— the last two digits of the year in which the currency agreement is registered;

— numbers indicating the serial number of the month in which the currency agreement is registered (from 01 to 12);

— numbers indicating the day of the month on which the currency agreement is registered (from 01 to 31).

In the second part of the registration number, consisting of six digits, three digits of the National Bank code (042) and three digits of the type of currency agreement are entered from left to right in accordance with Appendix 2 to Instruction No. 37.

In the third part of the registration number, consisting of five digits, the serial number of the currency agreement registered on the web portal in the calendar year is entered from left to right (from 00001 to 99999) (clause 9 of Instruction No. 37).

The date of registration of a foreign exchange agreement on the web portal is the date of assignment of a registration number to the foreign exchange agreement using software, hardware and technology. In the resident’s personal account, it is possible to view and print a certificate of registration of a foreign exchange agreement, containing the registration number and other information about the foreign exchange agreement.

Attention! It is worth especially noting that the requirement to register foreign exchange agreements also applies to foreign exchange agreements previously registered with banks of the Republic of Belarus, as well as those that were not subject to registration, the obligations under which were not fulfilled on the date of entry into force of the Law on Currency Regulation.

The norms of Instruction No. 37 establish requirements for the presentation on the web portal of documents and other information about changes and execution of a foreign exchange agreement. In this case, the presentation of this information is based on the principles of completeness, reliability and efficiency.

Thus, it is not enough to submit information to the web portal once; it is necessary to enter data on the execution of the currency agreement on a monthly basis, namely, no later than the 15th day of each month, submit information on the execution of the currency agreement for the previous calendar month in the resident’s personal account (clause 13 of Instruction No. 37).

Instruction No. 37 also establishes the procedure for a resident to enter into the user’s personal account information about the execution of a foreign exchange agreement, changes in the essential terms of the agreement, as well as information about the completion of all operations under a foreign exchange agreement in order to deregister the foreign exchange agreement.

Thus, a resident submits on the web portal information about the full fulfillment of obligations under a foreign exchange agreement no later than 15 calendar days from the date of determining the date of full execution of the foreign exchange agreement.

The date of full execution of a foreign exchange agreement is considered to be the date of completion of fulfillment of all obligations by the parties under the foreign exchange agreement, including the date:

— the last receipt (execution) of payment or shipment (receipt) of goods, including return of payments and goods carried out as a result of refusal of one of the parties to fulfill its obligations;

— performance of work, provision of services, transfer (reception) of undisclosed information, exclusive rights to intellectual property, property rights;

— loan repayment, loan repayment, deposit (clause 15 of Instruction No. 37).

At the same time, Instruction No. 37 determines that, on the basis of a request from the National Bank sent through a resident’s personal account, the interdepartmental electronic document management system of government bodies or on paper, residents submit documents and other information on the execution of a currency agreement within the time limit established in the request.

In order to provide assistance in performing new functions for residents, as well as due to the lack of technical equipment of the appropriate characteristics for certain categories of residents, Instruction No. 37 provides for the possibility of banks providing residents with services for registering a currency agreement, providing up-to-date information about the currency agreement and its execution in the user’s personal account on the web portal, subject to the conclusion of an appropriate agreement between the bank and the resident (part 2, clause 5).

It is determined that the contract for the provision of relevant services for registering a currency agreement must contain:

— the subject of the contract indicating the exact list of services provided;

— terms of service provision;

— procedures and deadlines established by the parties for the exchange of documents and other information under the currency agreement to the extent necessary for the provision of services;

— requirements for ensuring confidentiality and protection of information received in the process of providing services;

— determination of the rights and obligations of the parties in case of non-fulfillment or improper fulfillment of the contract;

— delimitation of the parties’ responsibilities for the accuracy, completeness and timeliness of the submission of documents and other information on the currency agreement when registering it, entering information about changes, execution of the currency agreement registered on the web portal.

After concluding an agreement with the bank, the resident in the resident’s personal account provides the bank with the rights provided for in the specified agreement by placing the appropriate mark.

In conclusion, we note that the provisions of Instruction No. 37 come into force on July 9, 2022, i.e. simultaneously with the provisions of the new edition of the Law on Currency Regulation.

Read this material in ilex >>* *follow the link you will be taken to the paid content of the ilex service

Sanctions for violation of currency control

The legislation provides for four types of violations for which sanctions may be imposed (including imprisonment):

- deviation from the deadlines established by law for submitting reports and notifications on foreign trade transactions to regulatory authorities;

- falsification of information contained in documents, filling errors;

- failure to comply with the deadlines for the transfer of funds specified in the contract, as well as violation of the terms of delivery of goods under import contracts;

- concealment of income, transfer of proceeds to the accounts of foreign countries (ignoring the requirements for repatriation of financial assets).

For violation of the deadlines for transferring money under the contract, the amount of fines can be up to 100% of the contract value. Similar sanctions will have to be paid if the importer transferred money (including as an advance), but delivery of the goods never occurred - in this case, the money must be returned as soon as possible to avoid suspicion of illegal currency transactions.

Violation of deadlines for submitting reporting documents (including to tax authorities) entails fines of up to 100,000 rubles (for legal entities), for repeated violations - up to 600,000 rubles.

If the transaction amount exceeded 9 million rubles, then in addition to civil and administrative liability, the importer may also face criminal charges. For violations of currency control, the court may impose a fine of up to 1 million rubles, forced labor for up to 5 years, or imprisonment for up to 4 years.

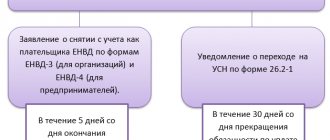

In what cases is a contract deregistered?

The duration of being under the supervision of controlling agents is not unlimited, as are the agreements themselves implemented within the framework of foreign economic activity. Factors that determine the possibility of termination of currency control by the bank include statements drawn up in view of the following circumstances:

- Change of financial institution for future service.

- Fulfillment of obligations specified in the contract in full.

- Registration of transfer of debt, or assignment of the right of claim.

- Making appropriate changes or additions.

- Identification of errors made during the initial setup.

The applicant’s appeal is made in writing, indicating a standard set of information - the identifying contract number, as well as the grounds corresponding to the provisions of Central Bank Instruction 181-I, with reference to a specific subclause. The document is dated and signed by an employee of the enterprise authorized by power of attorney, or by the immediate supervisor, certified by a seal (if any). Documentation confirming the justification specified in the content is attached to accompany the application. The bank is given two business days to process the accepted document, during which a positive or negative decision is made. The refusal is accompanied by a mandatory notice containing an explanation of the reasons, as well as an indication of the points requiring correction.