A business transaction in accounting is...

A business transaction in accounting is a recording of the facts of the economic life of an enterprise.

The reflection of business transactions has a constant impact on the balance sheet of assets and liabilities of the enterprise. But not a single business transaction can violate it. All recordings of activities occur on the basis of primary documents filled out in the prescribed manner. They confirm the fact of completed transactions. Business transactions are part of business accounting. What is business accounting, read in the article “Business accounting is...”.

Documentation of business transactions and accounting

An important element of accounting is documentation. It is used by every enterprise to monitor its business activities and provide primary control. Documentation consists of the orderly collection of primary documents. This is the initial stage of accounting.

The primary document is drawn up at the time of a particular business transaction. There are forms of documents that are approved only by law, but the majority are those that can be approved by the enterprise itself. Each such document has legal force and establishes those responsible for the implementation of a particular business transaction. It is unacceptable to accept for accounting documents documents that document non-existent, imaginary transactions (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ).

Important! ConsultantPlus warns Primary accounting documents must be drawn up directly when a fact of economic life is committed. And if this is impossible, immediately after its completion (clause 3 of Article 9 of Law No. 402-FZ). Tax authorities pay attention to their presence, content and form during tax audits. In practice, it often happens that inspectors discover shortcomings in the preparation of primary accounting documents. Read more about errors in primary documents and sanctions for their absence in K+. Trial access is available for free.

Only the presence of correctly executed primary documents will help an enterprise defend its interests in court or guarantee the safety of its property. Correct documentation of business transactions can be used for an objective analysis of the results of an enterprise by both its owners and tax authorities.

When is surgery necessary?

Surgical treatment is an alternative to drug therapy carried out in the initial stages of the disease. In addition, this is the only possible way to stabilize the glaucomatous process and preserve vision in advanced stages and advanced cases of the disease. As a rule, surgical intervention is recommended in the absence of the effect of treatment with medications and after the use of laser surgery methods. The rehabilitation period after antiglaucoma surgery is usually minimal and accompanied by minor restrictions. Thus, after a few days the patient can lead a normal life and begin work.

Reflection of business transactions on accounting accounts

After the primary documents are collected and verified, they are recorded in the accounting accounts in chronological order. Each event of financial and economic activity has a dual character. The essence of this duality comes down to the fact that when recording one event, 2 accounting accounts are used, which indicate the composition, location of the property and the sources of its formation.

How to correctly reflect business transactions using double entries, read the article “The Concept and Essence of Double Entry in Accounting.”

The connection between these accounts is called correspondence, and the accounts themselves are called correspondent accounts.

Reflection of transactions using correspondence accounts is called accounting entry.

For more information about what kinds of postings there are, read the article “Basic accounting postings - examples.”

We also recommend the reference book “16,700 ACCOUNTING ENTRY WITH COMMENTS,” which you will find in ConsultantPlus if you get free trial access to the system.

Types of surgery

Types of surgery include many areas, depending on the use of instruments, techniques, as well as goals and objectives.

There are several types of surgery:

- Diagnostic surgery,

- Curative surgery,

- Supportive surgery

- Port system implantation,

- Laparoscopy (laparoscopic surgery),

- Reconstructive surgery,

- Preventive surgery,

- Minimally invasive surgery,

- Palliative surgery.

Depending on the purpose of the surgical intervention, operations are divided into diagnostic and therapeutic.

Diagnostic surgery is performed to confirm the diagnosis. Taking biomaterial from tissues of internal organs or, as a final measure, if during the intervention it turns out that the disease is not operable.

At the Federal State Budgetary Institution “National Medical Research Center of Radiology” of the Russian Ministry of Health, we offer the following type of surgical interventions:

- Curative surgery - removal of the tumor. Used to remove localized cancerous tumors, i.e. those that have not yet spread to other parts of the body, and are often accompanied by radiation therapy or chemotherapy to destroy all cancer cells. Therapeutic surgery is performed to alleviate the patient's condition. The surgical technique involves removing a pathological focus or organ. This method is called radical. Cutting off part of an organ or completely removing it allows you to avoid progression of the disease. The use of this method is possible when cancer is detected. In such cases, the tumor is removed promptly in the surgical department.

- Maintenance surgery is used, for example, when it is necessary to install port systems for chemotherapy. Maintenance surgery has the goal of maintaining the patient's condition. The installation of probes, stomas, vital systems or implantation of a port system into internal organs is also carried out by a surgeon in the surgical department.

- Laparoscopic operations. Quite often, the operation can be performed without an incision using an endoscope. Often used in urology, gynecology, and abdominal surgery.

- Reconstructive surgery - Reconstructive surgery can also be used to maintain the organ, which can reconstruct the organ and restore its necessary functions. Reconstructive surgery returns a body or organ to a normal or nearly normal appearance after treatment. The most common are breast reconstructive surgeries after mastectomy (removal of the mammary gland).

- Preventive surgery is used to prevent cancer from occurring. Many types of colon cancer can be prevented by removing precancerous polyps before they become cancerous. Women at high risk of developing breast cancer due to a family history or genetic mutations may choose to have breast removal surgery to prevent the tumor from occurring.

- Port system implantation is a safe procedure performed under local anesthesia.

- Palliative surgery

Palliative surgery involves measures to alleviate the patient's condition and relieve pain. This technique is not a treatment for oncology, but is used to improve the patient's quality of life by reducing pain or other symptoms caused by an incurable tumor. - Minimally invasive surgery uses advanced technology to remove tumors through tiny incisions. Minimally invasive procedures are performed by manipulators under the supervision of surgeons. The principle of minimally invasive surgery involves the use of operations with minimal damage to the skin and internal tissues of the body. Our Center performs minimally invasive video-assisted surgeries.

Types of business transactions in accounting - examples

Business operations are divided into 4 types. All of them influence the balance, but the equality of the balance is not violated.

Example 1

Funds in the amount of 5,000 rubles were transferred to the bank account of Zvezda LLC as payment for the goods received.

Wiring: Dt 51 Kt 62 - 5,000.

As a result of such an operation, the balance sheet currency remained unchanged; changes occurred only in the balance sheet asset items. The item “Current account” increased by 5,000 rubles, and the item “Settlements with buyers and customers” decreased by the same amount.

Example 2

Zvezda LLC made a profit at the end of the reporting period. The company's participants decided to calculate and accrue dividends in the amount of 10,000 rubles.

Wiring: Dt 84 Kt 75 - 10,000.

As a result, the balance sheet currency again remains unchanged, but the liability items on the balance sheet have changed. The item “Settlements with founders” increased, the item “Retained earnings” decreased by 10,000 rubles.

Example 3

The warehouse of Zvezda LLC received goods from the supplier Rozmarin LLC in the amount of 3,000 rubles.

Wiring: Dt 41 Kt 60 - 3,000.

The result will be an increase in the balance sheet currency, since in this case changes occurred in both parts of the balance sheet (asset and liability). The liability item “Settlements with suppliers and contractors” and the asset item “Goods” were increased by 3,000 rubles.

Example 4

After the goods were delivered to the warehouse, Zvezda LLC transferred funds to the bank account of Rozmarin LLC in the amount of 3,000 rubles.

Wiring: Dt 60 Kt 51 - 3,000.

As a result, the balance sheet currency changed again, only downward. Changes occurred in both the assets and liabilities of the balance sheet. The liability item “Settlements with suppliers and contractors” and the asset item “Current account” decreased by 3,000 rubles.

What are business transactions?

A business operation (HO) is a specific action that changes either the composition of property, or its location, or the sources of its formation. POs may also be associated with changes in budget formation, the company’s ownership structure, equity and borrowed funds, and reserve capital. The fact of a business transaction is the basis for creating an accounting entry. The posting is generated on the basis of documents confirming the operation.

A certain event entails a change in indicators. For example, capital and the volume of property may change. Values can either increase or decrease. Changes in capital cause changes in the balance sheet currency. Consequently, the amount of assets and liabilities also changes.

What information about business transactions should be recorded in the accounting policy for accounting purposes?

Examples of business transactions in accounting

Let's look at examples of operations and their approximate structure:

- Supply. Examples of business operations: receipt of raw materials, transfer of funds to the supplier, input of raw materials into production.

- Implementation. Examples of financial expenses: expenses for sales of products, receipt of revenue, sale of goods.

- Production. Examples of financial assets: payment of salaries to employees, depreciation of fixed assets, acceptance of the work of a contractor, transfer of funds to a contractor.

These are the most common types of business transactions.

How to carry out internal control of business transactions ?

Types of business transactions

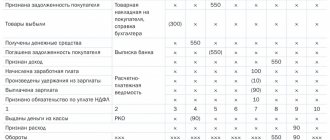

Let's look at the table with the classification of business transactions:

| Impact on balance | Debit correspondence | Loan correspondence |

| Change in Assets | Active | Active |

| Changing Liabilities | Passive | Passive |

| Increasing assets and liabilities | Active | Passive |

| Decrease in assets and liabilities | Passive | Active |

These are four types of transactions, which are classified according to the way they affect the balance sheet.

Let's take a closer look at the types of transactions (A is an asset, P is a liability, O is turnover):

- 1 type Entries that reduce one asset item by increasing another.

Examples of type 1: goods have arrived at the warehouse, money is sent from the account to the cash register. In this case, the structure of the property changes, but the final amount remains the same. This type has the following formula: A balance + O on the debit of account 1 – O on the credit of account 2 = P balance. - Type 2 Postings changing liability items.

Examples of type 2: multiplying reserve capital by changing the amount of profit. In this case, the chemical enterprise causes a change in the structure of sources of funds, but the final assessment remains the same. This formula belongs to this type: A balance = P balance + O for the credit of account 1 – O for the debit of account 2. - Type 3 Actions that increase the value of a company's assets and liabilities.

Example: operations for the sale of fixed assets, obtaining a loan. Postings change the balance sheet currencies. Formula: A balance + O on the debit of account 1 = P balance + O on the credit of account 2. - Type 4 Actions that reduce the value of liabilities or the amount of equity capital by reducing the amount of assets.

Example: payments to suppliers. In the process, both assets and liabilities are reduced. Formula: A balance – O on the debit of account 1 = P balance – O on the credit of account 2.

Operations are also classified according to their content:

- Material. Movement of inventory items is expected.

- Financial. Assume the movement of funds.

- Calculated. Settlements with counterparties.

The type of transaction determines the features of its reflection in accounting.

The unreality of business transactions as one of the reasons for refusing a VAT tax deduction.