If a working citizen wishes to take sick leave, then he is entitled to temporary disability benefits. The provision of such a “service” is carried out from the “treasury” of a specialized insurance fund, which assumes the absence of any damage to the enterprise where the sick person works. Which groups of people are entitled to payments during illness, and how is the amount of financial support calculated?

Calculation of sick leave if the length of service is less than 6 months

The benefit for a full month cannot be less than the minimum wage, regardless of length of service, i.e. 12,792 rubles .

In this case, when calculating the average income for 6 months, it is not the salary level that is taken, but the minimum wage amount. Calculation formula:

Payment amount = minimum wage x 0.6.

Where:

- Minimum wage – minimum wage;

- 0.6 is 60%.

According to this formula, persons without experience can count on small benefit payments.

Filling out a sick leave certificate

The sick leave form was approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n. It consists of two sections.

Information for the first section is entered into the system by doctors.

The information for the second section is provided by the employer. This must be done according to the rules approved by Decree of the Government of the Russian Federation dated November 23, 2021 No. 2010. In particular, it is necessary to indicate the insurance period; the amount of payments included in the base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity; data on working hours (with a part-time schedule), etc.

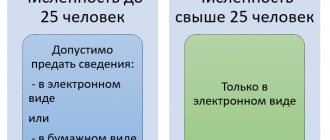

How to transfer this information to the fund? Place it in the Social Insurance system and verify it with an enhanced qualified electronic signature. These actions must be completed no later than 3 business days from the date of receipt of data on the closed electronic insurance policy (Part 8 of Art. Law No. 255-FZ; see “Information about insured persons: what data and when will have to be submitted to the Social Insurance Fund in 2022” ). Next, the information will automatically be sent to the FSS.

Calculation of average earnings for sick leave in 2022

The rules for calculating sick leave are set out in the regulation on the specifics of the procedure for calculating benefits for temporary disability and pregnancy and childbirth (approved by the Decree of the Government of the Russian Federation, Decree of the Government of the Russian Federation dated September 11, 2021 No. 1540; see “New rules for calculating sick leave, maternity and child benefits have been approved”) . To correctly calculate benefits, you first need to calculate the employee's average earnings. To do this you will need to perform a number of actions.

Free calculation of average earnings according to current rules

Determine the billing period

As a general rule, the calculation period includes two calendar years preceding the year in which the illness occurred or maternity leave began. For a ballot opened in 2022, the calculation period is 2022 and 2022.

An exception is provided for women who were on maternity leave or maternity leave during the billing period. They are allowed to carry forward one or two years. The basis is a written statement from the employee.

Example 1.

Let's assume the employee gets sick in February 2022. The calculation period for it is the period of time from January 1, 2022 to December 31, 2022 inclusive. But since the woman was on maternity leave in 2022, and on maternity leave in 2022, she wrote a request for a transfer. As a result, the new calculation period included the years 2022 and 2022.

Calculate average earnings

It consists of the amounts that the employee received in the billing period and from which contributions to compulsory social insurance were transferred.

Calculate your salary and benefits taking into account the annual increase in the minimum wage Calculate for free

Compare with the maximum permissible base value

The average earnings for calculating benefits cannot be as large as desired. It is permissible to take it into account only in the part that does not exceed the maximum value of the base for contributions in case of temporary disability and in connection with maternity. This value is approved by the Government of the Russian Federation every year.

IMPORTANT. It is necessary to compare the average earnings in the billing period with the base limits in force at that time. It is necessary to compare not the total figure, but data for each year separately (example in Table 1).

Table 1

An example of comparing average earnings with the base limits

| Indicators | Billing period | |

| 2020 | 2021 | |

| Limit value of the base for the corresponding year | 912,000 rub. | RUB 966,000 |

| Average earnings | 880,000 rub. (does not exceed) | 990,000 rub. (exceeds) |

| Amount taken into account when calculating sick leave Total: | 880,000 rub. | RUB 966,000 |

| RUB 1,846,000 (880 000 + 966 000) | ||

Compare with minimum wage

Average earnings must be greater than or equal to the minimum wage that was in effect on the date of the onset of illness or maternity leave. Otherwise, the benefit should be calculated based on the minimum wage.

The FSS, in letter dated 03/01/11 No. 14-03-18/05-2129, recommends comparing two values of average daily earnings: actual and based on the minimum wage. You need to do the following:

- Divide actual average earnings by 730 days.

- The minimum wage on the date of onset of illness or maternity leave is multiplied by 24 months and divided by 730 days.

- If the first value is greater than or equal to the second, calculate sick leave based on the first value. If the first value is less than the second, calculate the benefit based on the second value (example in Table 2).

table 2

An example of comparing two values of average daily earnings (actual and based on the minimum wage)

| Date of onset of illness | January 25, 2022 |

| Average earnings for the billing period (2020 and 2022) | 83,000 rub. |

| Minimum wage for 2022 | RUB 13,890 |

| Actual average daily earnings | RUB 113.7 (RUB 83,000: 730 days) |

| Average daily earnings based on the minimum wage | RUB 456.66 (RUB 13,890 x 24 months: 730 days) |

| Conclusion: | Since the actual average daily earnings are less than this figure calculated based on the minimum wage, the benefit must be calculated according to the minimum wage |

REFERENCE. In some cases, the benefit cannot exceed the minimum wage for a full calendar month, multiplied by the regional coefficient (if any), even if the actual average earnings exceed the minimum wage. This rule applies in the following situations: the employee’s insurance period is less than 6 months; the patient violated the regime prescribed by the doctor, or did not show up for examination, etc.

Find average daily earnings

For temporary disability benefits, in the general case, it is equal to the average earnings for the billing period (taking into account the maximum value of the base), divided by 730 days.

For maternity benefit (BIR) it is generally a fraction. The numerator is the average earnings for the billing period (taking into account the maximum value of the base). The denominator is the number of calendar days in the billing period minus the number of calendar days falling within the excluded period.

The excluded period includes days of illness, maternity leave, maternity leave for children up to one and a half years old, and days when a woman was released from work according to Russian laws with full or partial retention of wages (if contributions were not paid from the payments in case of temporary disability and in connection with motherhood).

Example 2 . The average salary of an employee in the billing period is 950,000 rubles, the base limit has not been exceeded. The number of calendar days of the billing period is 730. Of these, the employee was on sick leave for 20 calendar days (excluded period). The average daily earnings is 1,338.03 rubles (950,000 rubles: (730 days - 20 days)).

If the benefit is calculated based on the minimum wage, then the average daily earnings are equal to the minimum wage (as of the start date of the bulletin), multiplied by 24 months and divided by 730 days. For part-time work, a coefficient corresponding to the length of working time is added to the formula.

Calculate your salary and benefits taking into account the increase in the minimum wage in 2022 Calculate for free

Form of certificate of incapacity for work

The document is issued at the medical institution. It states:

- Address and name of the medical organization.

- Full name of the patient.

- Cause of disability.

- Type of employment.

- Data on average income, information about employer, length of service.

- Period of release from work.

The sheet is filled out by the medical professional, then by the employer.

Sample certificate of incapacity for work

Payment of sick leave to a part-time worker

To calculate social compensation for an employee working part-time in an institution, it is necessary to request information about income from all of his jobs. Accrual is made at the main place of work.

Such an employee submits to the organization income certificates for the previous two years from all of his jobs.

IMPORTANT!

A part-time employee who has worked for more than two years in the same institutions receives temporary disability benefits at all enterprises. In such cases, each employer is provided with an original sick leave certificate.

If a part-time worker worked on a permanent basis in two organizations, but at the time of incapacity for work he was employed in several more organizations, he has the right to receive benefits only at one enterprise. The employee chooses the company at his own discretion.

In such cases, in addition to sick leave and a certificate of income, the part-time worker provides the employer with certificates stating that he did not receive temporary disability benefits in other organizations.

Example: Vlasov V.V. has been working at the NPO “Success” for 10 years. Also, for the last two years he has been working part-time in various organizations. Vlasov V.V. provided the main employer with sick leave for 5 days. The employee provided certificates of part-time income totaling RUB 120,000.00. over the past 2 years. The average salary at the main employer is RUB 50,000.00. per month.

The payment is calculated as follows:

- 50,000.00 × 24 + 120,000.00 = 1,320,000 rub. — total income for two years;

- 1,320,000 / 730 = 1808.22 rub. - average daily earnings.

The employee's length of service is 10 years, so the leave is paid in full.

Vlasov V.V. temporary disability benefits accrued: 1808.22 × 5 = 9041.10 rubles.

How is a temporary disability certificate paid for parents?

According to paragraph 5 of Art. 13 of Federal Law No. 255 of December 29, 2006, which establishes the procedure for paying benefits, in order to receive payment for the period of care for a sick family member, it is enough to provide the employer with a certificate of incapacity for work correctly completed and issued at a medical institution. The employee is not required to confirm in any way the degree of his relationship with the child.

IMPORTANT!

Unlike cases of illness of the employee himself, when the first three days of illness are paid by the employer, sick leave for caring for a sick child is paid in full at the expense of the Social Insurance Fund.

If the illness is prolonged, the time spent caring for the sick minor is not paid in full, since there is a limit on the days per year for which money is transferred. Time over the established limit is not paid, but this does not mean that the parent is obliged to work, he will just have to care for the patient “for free.”

The number of calendar days for which payment is calculated during the period of such disability depends on several criteria: the age of the patient, the method of treatment, the severity of the disease. It is established by law how many days are payable on a child care sheet for a child under 8 years of age - up to 60 within a calendar 12 months. And this rule has not changed since 09/01/2021.

For information about all time limits, see the table:

| Child's age, years | Method of treatment | Number of days per year subject to payment for sick leave | Disease code indicated on the sheet | Number of days to be paid for one case of incapacity for work |

| Up to 7 years | Outpatient or inpatient | 60 (in general) 90 (if the disease is included in the list approved by order of the Ministry of Health and Social Development of the Russian Federation dated February 20, 2008 No. 84n) | 09 12 | Not limited |

| From 7 to 15 | Outpatient or inpatient | 45 (up to 15 calendar days for each case) | 09 | 15 |

| Disabled person under 18 | Outpatient or inpatient | 120 | 13 | Not limited |

| With HIV under 18 | Stationary | Not limited | 15 | Not limited |

| Cancer patient under 18 | Outpatient or inpatient | Not limited | 14 | Not limited |

The benefit is paid for calendar days. The employer sees how many days of sick leave are paid for child care from the document provided by the employee within the established limits.

The method of providing medical care (outpatient or inpatient) affects the calculation of benefits, which is made under Art. 7 of Law No. 255-FZ, with the exception of minors who are under 8 years old (changes from 09/01/2021). For those older than this age, the same scheme applies:

- if the patient was at home, then the first 10 days of benefit payment are determined according to general rules - taking into account the insurance period, and starting from the 11th day, the benefit will be 50% of the average daily earnings, regardless of the length of service;

- if the patient was treated in a hospital, all days are paid based on the insurance period.