Author: Maria Novikova

Payment of sick leave to external part-time workers in 2022 is carried out in accordance with Law No. 255-FZ

.

If an employee who falls under this category brought sick leave, then what nuances should the employer know in order to correctly fill out the documents

and

calculate payments

? Find answers to all pressing questions in this thematic review.

How is sick leave paid for part-time work in 2022?

How the part-time worker’s sick leave is paid in 2022 depends on the place where the part-time worker was employed in the 2 years preceding the year of incapacity.

It may turn out that he worked: 1. For the same employers as in the year when he went on sick leave.

2. With other employers, not those for whom he works in the year he went on sick leave.

3. With the same employers, but also had other jobs.

Paying sick leave to a part-time worker has its own peculiarities in each case. First of all, from the point of view of determining the employer who is obliged to provide compensation to the employee for certificates of incapacity for work.

For information on the rules for applying for a job on an external part-time basis, read the article “How to properly apply for an external part-time job?” .

If you have an internal part-time worker, then you can calculate and pay sick leave for such an employee using a Ready-made solution from ConsultantPlus. To see explanations, get a trial access to K+. It's free.

Example

To understand exactly how the calculation is performed, you should consider several examples.

Example 1 . Citizen Smirnov V.A. has been working as a lawyer in the organization Mark-M LLC for 7 years and part-time as a lawyer for 3 years. Previously, he worked for another company for 5 years.

Having received sick leave for 12 days, he presented it to all employers. Each of them calculated their own payment amount, which depends on the average salary over the last 2 years. Benefits are paid by all organizations independently; no additional certificates need to be provided.

Example 2. Ivanov K.G. works as a mechanic at the Vostok organization. Work experience – 10 years. Later, he began working part-time as a plumber for the same company. Experience – 1.5 years. He was on sick leave for 10 days.

In this case, the hospital bulletin is issued in one copy, since it is one organization. For the calculation, all income received by Ivanov K.G. is taken. both in the main position and part-time.

Example 3. Mordvina M.N. works as a teacher in kindergarten No. 159. Work experience – 9 years. She also works part-time as a teacher in kindergarten No. 453. Less than one year of experience. Upon receipt of a certificate of incapacity for work, Mordvina M.N. it is necessary to attribute it to his main place of work, since no insurance premiums were paid from another employer for the previous several years.

Who pays sick leave for a part-time worker?

In this case, 3 scenarios are possible:

1. When the employee worked for the same employers for 2 years preceding the year in which the sick leave was issued.

In this case, all current employers are responsible for paying sick leave to the employee.

2. When the employee worked for other employers during the 2 years preceding the sick leave.

Here an employee can apply for sick leave from any of their current employers. In this case, the employer paying sick leave will take into account the income that its employee received from other employers when calculating benefits.

IMPORTANT! In this case, the employee issues 1 sick leave (for the employer where he plans to receive benefits), but must also provide confirmation of his income from other employers for the billing period (2 years).

3. When an employee, during the 2 years preceding the year in which part-time sick leave is paid, worked both for current employers and for others.

In this case, the employee has the right to take out sick leave from any of his current employers.

Each of the described scenarios has its own nuances, determined both by the peculiarities of registering sick leave and by the applied rules for calculating payments for it.

Main difficulties

Sometimes it is difficult for an employee to figure out on his own where and to whom sick leave should be sent for payment.

Therefore, when working part-time, it is recommended to ask to fill out two certificates of incapacity for work at a medical institution: for the main place of work and for an additional one.

If part-time sick leave is not payable, the Social Insurance Fund will give a detailed and justified refusal. The employer is obliged to provide it to the employee for review.

Registration of sick leave when working part-time: nuances

In scenario No. 1, paying sick leave to a part-time employee involves each employer receiving a certificate of incapacity for work from the employee.

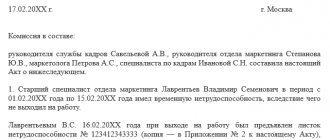

According to the Procedure for issuing sick leave (approved by Order of the Ministry of Health dated November 23, 2021 No. 1089), one electronic sick leave is generated for a part-time worker, the number of which is provided to each employer.

In scenario No. 2, registration and payment of sick leave to an external part-time worker is carried out differently.

The employee provides sick leave to any of the current employers.

In the appropriate scenario, the employee’s sick leave will need to be supplemented with:

- a certificate confirming receipt of income from another employer (or several certificates - if there are several other employers);

- a certificate from another employer (several certificates) stating that they did not make sick leave payments.

In scenario No. 3, the procedure for registering sick leave also has its own peculiarities.

In this case, one ERN is formed, but the employee provides its number to either one or several employers.

Moreover, if sick leave is provided to one employer, then it must be supplemented with the same documents that are used in scenario No. 2.

You can find out how an employer can fill out a paper sick leave (some categories of insured persons may still be issued sick leave in this form) issued to an external part-time worker in the Ready-made solution from ConsultantPlus, having received trial access for free.

Which employer should pay the benefit?

An external part-time worker may have two or more employment contracts concluded with different employers. Each employer pays contributions to the Social Insurance Fund for him. To understand which of them should receive disability benefits, let us turn to Art. 13 of the Law of December 29, 2006 No. 255-FZ “On compulsory social insurance...”. According to paragraph 2 of this article, situations may arise:

- Situation 1. At the time of the onset of illness, Vasily worked at Lida LLC and at your Vera LLC for the previous two calendar years. Disability benefits will be paid to him by both employers - you and Lida LLC. At the clinic, Vasily will take two certificates of incapacity for work - for the main employer and for the additional one. You are an additional part-time employer, so a special mark will be placed on your copy - a tick in the “Part-time” column.

- Situation 2. At the time of the onset of the disease, Vasily works at Lida LLC and for you, but for the two previous years he worked at completely different enterprises. The disability benefit will be assigned and paid by one of the current employers - you or Lida LLC. In this case, Vasily has the right to choose himself from whom he will receive benefits. Typically, employees weigh the level of salary and time worked, and choose the employer from whom the amount will be higher.

- Situation 3. At the time of the onset of illness, Vasily works at Lida LLC and for you, but for the two previous years he worked either for his current employers or for some others. Disability benefits can be paid either for all places of work, or for one of the last places of Vasily’s choice.

- Situation 4. Vasily lost his ability to work due to illness or injury within a month from the date of dismissal. Disability benefits will be assigned and paid by the insurer at the last place of work or the territorial Social Insurance Fund.

If Vasily decided to receive benefits from several employers at once, then accountants will calculate it based on the average earnings for the time worked only in his company.

But let’s imagine that a man chose only your company to calculate benefits. Then, in order to make correct calculations, you will need information about his earnings from other places of work (certificate in form No. 182n), and also that those employers at the same time do not accrue him disability benefits for this illness.

You have the right to request such certificates (clause 5, 5.1 of Article 13 of Law No. 255-FZ).

If an employee cannot obtain a certificate from the employer, for example, the company has ceased operations, he can obtain such information from the Pension Fund.

You have 10 calendar days to accrue benefits from the date the employee submits the documents you need (sick leave and certificates from other employers). The money must be received by the employee on the nearest salary payment date after the date indicated on the certificate of incapacity for work.

Calculation of sick leave for an external part-time worker: nuances

How part-time sick leave is paid also depends on the specific scenario applied in the legal relationship between the employee and his current or former employers.

In scenario No. 1, benefits are calculated by each employer, based on the employee’s average earnings for the period of validity of the employee’s employment contract with this employer.

In scenario No. 2, a company that has received documents on income from other employers calculates sick leave for a part-time employee based on the employee’s total earnings for the 2 years preceding the year in which the sick leave is issued, taking into account income that occurred in other places of work.

Scenario No. 3 is characterized by the fact that the employer calculates the amount of payment for sick leave based on data on earnings received either from him alone, or based on the total earnings of the employee, taking into account his other places of work (provided that the latter submits all the necessary documents for this) .

An example of calculating benefits for an external part-time worker who changed his main place of work during the billing period, from ConsultantPlus Ivanov N.S. started his new main place of work in January 2022. For 2022, he was accrued payments subject to insurance premiums for VNiM in the amount of 426,800 rubles. At the previous main place of work in 2022, payments subject to insurance contributions for VNiM were accrued in the amount of RUB 394,000. In the organization Zarya LLC, where Ivanov works as an external part-time worker on a part-time basis (0.5 rate), payments for which insurance premiums for VNiM are calculated amounted to: in 2022 - 279,180 rubles; in 2022 - RUB 293,490. Ivanov N.S. was on sick leave from January 20 to January 24, 2022 (5 calendar days). You can view the entire example in K+. Trial access to the material is free.

You can find out more about the procedure for calculating sick leave benefits here.

What is part-time work

In Russian legislation, part-time work means the performance by one and the same citizen of several duties at once, in several positions.

Thus, a citizen can work at his main place of employment as a lawyer, and in another organization hold the same position, but part-time. It is assumed that the second position should not interfere with the fulfillment of obligations at the main place of work.

It is understood that there are two types of combined positions:

- external (in different organizations);

- internal (within one organization).

In both cases, the employee is entitled to payments for temporary loss of ability to work. However, the calculation is carried out slightly differently than for the main position.

Maximum and minimum amount of payments for part-time sick leave: nuances

Typically, a part-time worker works less than 8 hours in each company. In this case, the amount of sick leave is determined:

- based on the average earnings of a part-time worker for the 2 years preceding the one in which the person went on sick leave, if the average earnings are greater than the minimum wage;

- based on the minimum wage, if the average salary is less than the minimum wage, and in this case the share of the minimum wage is taken into account, determined in proportion to the actual standard of working hours of the employee under the contract.

Example

Ivanov has been working part-time for 3 years, 2 hours a day, at Fregat LLC and receives 5,000 rubles per month. He goes on sick leave in September 2021 and registers it with each of his employers, including Fregat LLC. Let’s agree that before this he had not been sick for 2 years and received his entire salary every month.

When calculating sick leave, an accountant will determine the minimum average earnings at the current minimum wage:

12,792 / 4 = 3,198 rubles. (2 hours is ¼ of a standard workday of 8 hours).

Average earnings calculated according to the minimum wage are 105 rubles. 14 kopecks (3198 × 24 / 730).

Average earnings calculated by income are 164 rubles. 38 kopecks (5,000 × 24 / 730).

Calculations for sick leave should be made based on Ivanov’s actual earnings.

In this case, the upper limit of sick leave payments is set in the amount of the maximum amount of the insurance base for each employer who received sick leave from an employee. This is due to the fact that each employer pays social security contributions for a part-time employee separately, from its own funds, and thus applies the upper limit only for itself.

An example of calculating benefits for an external part-time worker based on the minimum wage from ConsultantPlus Ivanov N.S. started his new main job in October 2022. For 2022, he received payments subject to insurance contributions for VNiM in the amount of 512,810 rubles. At Zarya LLC Ivanov N.S. works as an external part-time worker on a part-time basis (0.25 rate) from December 2022. Payments for which insurance premiums were calculated for VNiM in 2022 amounted to 35,110 rubles. Ivanov N.S. was on sick leave from March 14 to March 18, 2022 (5 calendar days). See the full example in K+. This can be done for free.

Read more about the rules for applying limits when calculating temporary disability benefits in the material “Maximum amount of sick leave”.

Disabled internal part-time worker

A person who combines several job functions for the same employer, in the event of temporary disability, must present to the personnel of his organization one copy of a supporting document - a sick leave certificate.

His working time is taken into account and recorded in the time sheet (form T-12) in the usual manner, separately for each position. Therefore, problems in calculating and processing benefits are excluded - this happens on a general basis. The only difference is in determining the average salary - it will consist of the official salary for each position.

FOR YOUR INFORMATION! To correctly account for the earnings of an internal part-time employee, the accountant needs to enter code “B” in the report card for both the main and part-time positions.

Results

Payment of sick leave to part-time workers in 2022 is carried out taking into account the earnings paid by both current and former employers of the employee who issued the sick leave certificate, and has a number of nuances depending on the specific situations that have developed in legal relations with employers.

These situations determine the list of documents that an employee needs to receive compensation for sick leave, as well as the principles for calculating the corresponding compensation. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Terms and payment for combined positions

Maximum period of temporary disability for combined positions

not provided for by law. For workers employed only at their main place of work, and for workers working in several organizations at once, the same rules apply. The average period of sick leave is 15 calendar days (Article 11 of the Order of the Ministry of Health and Social Development of the Russian Federation dated June 29, 2011 No. 624n).

However, if an extension beyond this norm is required, the attending physician appoints a medical commission. A medical commission consisting of two or more doctors has the right to extend the treatment period.

Errors in calculating benefits for part-time workers

Error No. 1. In practice, circumstances arise when an employee is not able to receive personal income benefits at his main place of work, for example, in the event of business downtime. It is a mistake to assume that an employee has the right to pay personal compensation only based on the income of an additional job. The employee must bring the part-time employer a personal identification document, a certificate of income from the main place, and a certificate of no payments. The benefit is assigned taking into account the amount of income received under the main contract. The employee has the right to choose an employer to receive benefits ().

Error No. 2. Employees may provide a duplicate document to pay personal income to a second employer. The employee’s opinion that a duplicate is equal in legal force to the original is erroneous. Payment of disability benefits is carried out according to the original slips. Each of the documents is a separately issued sheet, has a unique number and other mandatory details. The employer, having received a duplicate LN, has the right to refuse to pay benefits.

Sources

- https://www.klerk.ru/buh/articles/501245/

- https://lgoty-vsem.ru/posobie/bolnichnyj-list-po-sovmetitelstvu.html

- https://assistentus.ru/otpusk/bolnichnyj-list-sovmestitelyu/

- https://online-buhuchet.ru/oplata-bolnichnogo-lista-po-sovmestitelstvu/

- https://urexpert.online/trudovoe-pravo/bolnichnye/sovmestitelyu/osobennosti-oformleniya.html

Controversial situations and their solutions

- What to do if there were other policyholders during the billing period ? If only one of the policyholders will pay the benefit, you can use any certificate 182-n. The certificate must contain data on accrued wages for the last two years. If the benefit is received from both employers, payments are calculated only based on the salary received from them. In such a situation, the employee himself decides what is more profitable for him.

- What to do if you receive benefits from only one policyholder ? How to explain absence from work ? To confirm absence from work due to illness, the second employer is provided with a copy of the sick leave certificate.

- How can a part-time worker receive benefits if there were breaks in work ? If the length of service is less than six months, sick leave is calculated according to the minimum wage. Then it cannot be received in second place, because two sick days according to the minimum wage will be a violation.

Thus, if a citizen is a part-time worker, then he has the right to receive sick leave benefits at several places of employment if his work experience there exceeds 2 years. With less experience, a place of employment is chosen that is more profitable.

In case of external part-time work, two individual forms of certificate of incapacity for work are issued. When working in different positions within the same company, one sheet is enough.