Why are personnel documents needed?

The existence of personnel records documents is determined by the norms of the Labor Code of the Russian Federation. For example, Art. 56 of the Labor Code of the Russian Federation establishes the concept of an employment contract, and Art. 212 obliges the employer to create internal regulations that will regulate labor protection. Thus, the need for mandatory personnel documents follows from the norms of the Labor Code of the Russian Federation. In addition, often the preparation of correct personnel documentation allows you to reduce the amount of income tax; for example, many payments in favor of employees can be confirmed by a collective agreement.

Mandatory documents for personnel records management – 2022

The need for personnel documentation at an enterprise follows from the provisions of labor legislation. In general, we can distinguish documents on personnel that are recommended for maintenance, but are not required, and mandatory documents, without which the personnel service of an enterprise cannot fully operate. Mandatory personnel documents may be required for examination by employees of the State Labor Inspectorate, the Federal Tax Service, the Pension Fund of the Russian Federation and other departments during their inspections.

Mandatory documents include both documents regulating labor relations between the employer and a specific employee (employment contracts, orders for hiring/dismissal, etc.) and those that apply to the workforce as a whole (internal regulations, staffing schedule, etc.) .

Let's consider what mandatory HR documents must be present in an organization, a micro-enterprise and individual entrepreneurs with employees.

Mandatory individual personnel documents

Individual personnel documents include:

- labor contract (form TD-1);

For information on drawing up a contract, see the material “Unified Form No. TD-1 - Employment Contract.”

- employment history;

- administrative document on hiring/dismissal (forms T-1 and T-8, respectively);

For information on using the T-1 form, see the material.

For more information about Order T-8, see the material “Unified Form No. T-8 - form and sample filling.”

- employee personal card (form T-2);

The template for this form can be found in the material “Unified Form No. T-2 - Form and Sample Filling Out”.

- order on the basis of which the employee is transferred (form T-5);

For more information about this form, see the material.

- order for vacation registration (form T-6).

The specified type of document is presented in the material.

Mandatory personnel documents in a general purpose organization

Among the general purpose personnel documents, the following stand out:

- staffing table (form T-3);

You will find its template in the material “Unified Form No. T-3 - Staffing Schedule (form).”

IMPORTANT! When hiring an employee, his position in the employment contract must correspond to the staffing table (letter of Rostrud dated January 21, 2014 No. PG/13229-6-1).

- vacation schedule (form T-7);

For information on the schedule and the procedure for filling it out, see the material “Unified Form No. T-7 - Vacation Schedule.”

- order to dismiss employees (form T-8a);

- time sheet, on the basis of which the number of hours worked and salary calculation is monitored (forms T-12 and T-13);

For information about the T-12 form, see the material “Unified Form No. T-12 - Form and Sample.”

The structure of the T-13 report card is discussed in the material “Unified Form No. T-13 - Form and Sample.”

- other regulatory documents:

- on labor protection;

- on the protection of personal data;

- collective agreement;

- according to internal regulations;

- on wages and bonuses;

- about trade secrets;

- log books:

- work records;

- contracts;

- sick leaves.

IMPORTANT! Some documents that are required in one situation may not be of equal importance in other circumstances. So, for example, if there is no trade secret clause in the contract with an employee, then there is no need to issue a corresponding provision.

For information about archiving personnel documents, see the material “What is the period for storing personnel documents in an organization?”

List of local regulations on labor protection (legislative minimum)

| OSH activities | What local acts should an employer develop? |

| Operation of the Occupational Safety and Health Management System | |

| 1 | Regulations on the labor protection management system. The regulations on the OSMS, taking into account the specifics of the employer's activities, may contain the following sections (subsections): a) the general procedure for ensuring the functioning of the OSMS; b) the procedure for developing and implementing procedures aimed at achieving the employer’s goals in the field of labor protection; c) planning and execution of labor protection measures; d) monitoring the implementation of activities and achievement of results; e) monitoring and analysis of the implementation of procedures and implementation of labor protection measures; f) planning improvements in the functioning of the OSMS; g) analysis by the employer’s management of the effectiveness of the functioning of the OSMS and the achievement of the set goals for labor protection; h) management of documented information of the OSMS. Separate local regulations on labor protection at the employer can be developed and approved on the basis of state regulatory requirements for labor protection: a) the procedure for managing occupational risks; b) internal standards for providing workers with personal protective equipment; c) the procedure for training and developing competencies in labor protection; d) distribution of functional responsibilities in the field of labor protection among the employer’s officials, taking into account the managerial (organizational) structure; e) organizing the work of the labor protection commission; f) organization of the work of the labor protection commission and labor protection commissioners; g) organization of work to comply with labor protection requirements of contractors, etc. |

| 2 | Report on the assessment of professional risks: a) list (register) of hazards; b) a document (section of the Employer’s OSH Regulations) describing the method(s) used for assessing the risk level; c) a document confirming the assessment of risk levels, indicating the established levels for each risk; d) a document containing a list of measures to eliminate, reduce or control risk levels. |

| 3 | Protocol of discussion of the draft Labor Safety Policy with the representative body of workers |

| 4 | Report on monitoring the functioning of the OSMS |

| 5 | Preliminary analysis of the state of labor protection |

| 6 | Occupational Safety and Health Policy |

| 7 | Order on the organization of first aid posts equipped with first aid kits |

| 8 | An order establishing the procedure for monitoring the state of working conditions in the workplace, as well as the correct use of personal and collective protective equipment by employees |

| 9 | List of jobs in which breaks are provided during working hours at jobs where, due to production (work) conditions, it is impossible to provide a break for rest and food |

| 10 | List of works that provide for the provision of special breaks to employees during working hours, determined by the technology and organization of production and labor, duration, as well as the procedure for providing such breaks |

| Special assessment of working conditions | |

| 1 | Order approving the composition of the commission for conducting a special assessment of working conditions |

| 2 | Procedure for the activities of the commission for conducting a special assessment of working conditions |

| 3 | Schedule for special assessment of working conditions |

| 4 | List of workplaces where a special assessment of working conditions was carried out |

| 5 | Action plan to improve working conditions and safety |

| Medical examinations (preliminary and periodic) | |

| 1 | Order on organizing a medical examination |

| 2 | Approved list of persons for medical examination |

| 3 | An approved list of names for a medical examination and confirmation of its referral to a medical organization |

| 4 | Medical examination schedule |

| 5 | Referrals for medical examination |

| 6 | Log of referrals for medical examination |

| Occupational safety training | |

| 1 | List of professions and positions of workers exempt from undergoing initial training at the workplace |

| 2 | Labor safety induction program |

| 3 | Labor safety instructions |

| 4 | Initial training programs on labor protection |

| 5 | Special training programs on labor protection |

| 6 | Order (instruction) on the creation of a commission to test knowledge of labor protection requirements |

| 7 | Order on the organization of labor protection training with a calendar schedule for familiarization of workers |

| 8 | Protocols for testing knowledge of security requirements |

| 9 | Logbooks for workplace briefings |

| 10 | Logbook for introductory briefing on labor protection |

| 11 | List of jobs, professions and positions of workers for which training on labor protection is carried out in training organizations, as well as in the internal commission of the employer |

| Organization of work with increased danger | |

| 1 | Work plans |

| 2 | Technological maps |

| 3 | Order on the appointment of persons responsible for the organization and safe performance of work, on the appointment of responsible work managers, responsible work performers, for approval of the work permit, for issuing work permits, for drawing up an action plan for the evacuation and rescue of workers in the event of an emergency and during rescue operations work, for maintenance and periodic inspection of personal protective equipment |

| 4 | Work log for work permits |

| 5 | Work permit for work in places where harmful and dangerous production factors are present, certificate of approval, schedule of joint work |

| 6 | List of works associated with increased danger, performed with the issuance of a work permit |

| 7 | The procedure for carrying out work associated with increased danger, carried out with the issuance of a work permit |

| 8 | Initial training program at the workplace for each type of work or profession |

| 9 | Occupational safety training program for each type of work or profession |

| 10 | On-the-job internship program |

| 11 | A set of instructions on labor protection for professions and positions, a set of regulatory legal acts on labor protection in accordance with industry specifics |

| Issuance of PPE | |

| 1 | Order on organizing work on the issuance and care of personal protective equipment |

| 2 | Order approving the standards for free issuance |

| 3 | Copies of certificates and declarations of conformity |

| 4 | Copies of the conclusions of the Ministry of Industry and Trade on the origin of products |

| 5 | Personal cards for issuing personal protective equipment |

Responsibility for the absence and improper storage of personnel documents

The following methods of punishment related to office work in the personnel sector can be distinguished:

- Disciplinary sanctions provided for in Art. 193 of the Labor Code of the Russian Federation, the maximum measure for which is dismissal.

- In accordance with the provisions of the Code of Administrative Offenses of the Russian Federation, the rules for bringing to administrative responsibility for the lack of documents are reflected in Art. 5.27, 5.27.1 Code of Administrative Offences.

Example:

An audit was carried out at Landysh LLC for 2022, during which it turned out that the company’s personnel service did not have a staffing table for the specified period. The LLC was held liable under paragraph 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, according to which the following punishment is provided:

- for officials - 1,000–5,000 rubles;

- for a company - 10,000–50,000 rubles.

Besides:

- Art. 13.20 Code of Administrative Offenses punishes 300–500 rubles. officials for violating the rules for storing documents;

- Art. 5.39 imposes a fine of 1,000–3,000 rubles. against responsible persons for failure to provide the requested personnel records information to the employee, for example, for refusing to issue a copy of the work record book.

In accordance with the Criminal Code of the Russian Federation:

- Art. 137 of the Criminal Code of the Russian Federation provides for punishment in the form of a fine of up to 350,000 rubles. or corrective labor for disseminating personal information about an employee;

- Art. 183 of the Criminal Code of the Russian Federation applies measures in the event of disclosure of trade secrets.

For information on the penalties provided for by law, see the material “From 01/01/2015, fines have been established for failure to draw up an employment contract or GPA.”

Primary documentation for personnel records and wages

In every organization conducting economic activity, there is a need to maintain personnel documents, as well as monthly calculations and payroll for employees.

Accounting calculates benefits, vacation pay and travel allowances, salary and piecework accruals, calculates taxes and insurance contributions, reports to funds and the Federal Tax Service.

Often, accounting also deals with personnel documents, because not every company has its own personnel department.

At the same time, not every accountant is also a well-versed HR employee. But the Labor Inspectorate is no joke these days.

Calculation and calculation of wages must be carried out in accordance with the provisions of Chapter 21 of the Labor Code of the Russian Federation.

The payroll calculation process is carried out in several stages.

The first stage is the analysis of the information contained in the primary documents on labor accounting and payment, compiled according to unified forms.

The second stage is the calculation of wages (and other payments) to employees, as well as to persons performing work and providing services under civil law contracts (CPL).

At the third stage, the calculation and withholding of personal income tax (NDFL) takes place in accordance with Chapter 23 of the Tax Code.

The fourth stage will be the calculation of insurance premiums levied on accrued wages.

At the fifth stage, documents (also standardized forms) for the payment of wages are drawn up.

Taking into account the fact that in accordance with paragraph 1 of Article 9 of the Law “On Accounting” No. 129-FZ, all business transactions carried out by the organization must be documented with supporting documents, since these documents serve as primary accounting documents on the basis of which accounting is maintained, the importance of primary documentation cannot be underestimated.

Moreover, many primary documents on personnel records and wages must be stored for 75 years (or permanently, i.e. at least 10 years) 75 years in accordance with the requirements of the Order of the Ministry of Culture dated August 25, 2010. No. 558 with subsequent transfer to the State Archives in the event of termination of the company’s activities.

In addition, the legislation provides for administrative and even criminal liability for violation of the procedure for maintaining and maintaining personnel documents.

The article will discuss the types and forms of primary documents on personnel records and wages, as well as the periods of their storage. The information presented can serve as a “memo” in the work of an accountant.

PRIMARY DOCUMENTS CONTAINED IN ALBUMS OF UNIFIED FORMS

When generating primary documents on personnel records and remuneration, you should remember the provisions of paragraph 2 of Article 9 of Law No. 129-FZ.

In accordance with this paragraph, primary accounting documents are accepted for accounting if they are compiled in accordance with the form contained in the albums of unified forms of primary accounting documentation. Unified forms that should be used when registering labor relations with employees were approved by the Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004. No. 1 “On approval of unified forms of primary accounting documentation of labor and its payment.”

This Resolution approved the following forms of primary documents:

1. For personnel records:

- No. T-1 “Order (instruction) on hiring an employee,”

- No. T-1a “Order (instruction) on hiring workers.”

These forms are used to formalize the hiring of an employee (T-1) or a group of employees (T-1a). Shelf life 75 years.

- No. T-2 “Employee’s personal card”,

- No. T-2GS (MS) “Personal card of a state (municipal) employee.”

An employee’s personal card is the main document for recording employee data and is issued for all, without exception, employees of the enterprise with whom employment contracts are concluded. Shelf life 75 years.

- No. T-3 “Staffing table”.

A mandatory and very important document reflecting data on the structure of the organization, its staffing and staffing levels. And the staffing table itself and changes made to it are approved by order of the manager. Shelf life 3 years.

- No. T-4 “Registration card of a scientific, scientific and pedagogical worker.”

This form is used in scientific and educational institutions to register scientific workers. Filled out on the basis of diplomas of Doctor of Science and Candidate of Science, certificate of associate professor and professor and other similar documents.

- No. T-5 “Order (instruction) on the transfer of an employee to another job”,

- No. T-5a “Order (instruction) on the transfer of workers to another job”,

arranges the transfer of employees to another position within the organization. The employee’s written consent is attached to the order. Shelf life 75 years.

- No. T-6 “Order (instruction) on granting leave to an employee,”

- No. T-6a “Order (instruction) on granting leave to employees”,

Used for registration and accounting of vacations. Shelf life: 5 years.

- No. T-7 “Vacation schedule”.

A mandatory local regulatory act that annually determines the order of provision of paid leave to employees of the organization in accordance with the provisions of Article 123 of the Labor Code. Approved by the employer no later than two weeks before the start of the calendar year. The procedure for drawing up a schedule can be fixed by internal labor regulations or provisions of a collective agreement, or other internal documents of the organization. The employee must be notified of the start time of the vacation by signature no later than two weeks before it begins. Shelf life: 1 year (we recommend storing until you pass an inspection by the Federal Tax Service or the Labor Inspectorate).

- No. T-8 “Order (instruction) on termination (termination) of an employment contract with an employee (dismissal)”,

- No. T-8a “Order (instruction) on termination (termination) of an employment contract with employees (dismissal)”,

used for documentation upon termination of employment relationships. Shelf life 75 years.

- No. T-9 “Order (instruction) on sending an employee on a business trip”,

- No. T-9a “Order (instruction) on sending workers on a business trip”,

is issued when sending an employee (employees) on a business trip. Filled out on the basis of a job assignment (form T-10a). Shelf life 5 years (for long-term foreign business trips - 10 years).

- No. T-10 “Travel certificate”,

serves to confirm the time spent on a business trip. The certificate indicates the time of arrival of the employee at the destination, as well as the time of departure. This document is drawn up on the basis of an order for sending on a business trip (form T-9) and is certified by the receiving party. Shelf life 5 years (for business trips to the Far North and equivalent areas - 75 years).

- No. T-10a “Official assignment for sending on a business trip and a report on its implementation”,

contains information about the purpose of the employee’s trip and its final results. It is the basis for issuing an order in the T-9 form and serves to confirm the economic justification of business trip expenses. Shelf life 5 years (for long-term foreign business trips - 10 years).

- No. T-11 “Order (instruction) on employee incentives”,

- No. T-11a “Order (instruction) on incentives for employees”,

issued when employees are rewarded for success at work. The order is the basis for making a corresponding entry in the employee’s personal card (form No. T-2, No. T-2GS (MS)) and the employee’s work book. Shelf life 75 years.

2. For recording working hours and settlements with personnel for wages:

- No. T-12 “Working time sheet and calculation of wages”,

It is not only a document reflecting the labor discipline of the organization, but also serves as the basis for calculating wages to employees. Companies need this document not only for maintaining accounting records of payroll calculations. The report card is also necessary to confirm the economic justification of expenses for remuneration of employees for tax accounting purposes, since in essence it is a document confirming the actual performance of their work activities by employees. The T-12 form is universal and is used in most organizations. Shelf life 5 years (under hazardous working conditions – 75 years).

- No. T-13 “Working time sheet”,

used by companies that use an automatic system for monitoring employee attendance and absence from the workplace (turnstiles, electronic passes and other recognition systems that record the time of arrival and departure of employees). Shelf life 5 years (under hazardous working conditions – 75 years).

- No. T-49 “Payment and payroll”,

- No. T-51 “Payment sheet”,

- No. T-53 “Payroll”,

used to calculate and pay wages to employees. If form No. T-49 is used, other settlement and payment documents according to forms No. T-51 and No. T-53 are not drawn up . In case of transfer of wages to bank cards of employees, only a payslip is drawn up (forms No. T-49 and T-53 are not drawn up). Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

- No. T-53a “Payroll Registration Journal”,

used for accounting and registration of payroll records for payments made to employees. Shelf life: 5 years.

- No. T-54 “Personal account”,

- No. T-54a “Personal account (svt)” (svt – computer equipment),

are used for monthly reflection of information on wages, all accruals, deductions and payments in favor of the employee during the calendar year. Shelf life 75 years.

- No. T-60 “Note-calculation on granting leave to an employee”,

used to calculate vacation pay due to the employee. Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

- No. T-61 “Note-calculation upon termination (termination) of an employment contract with an employee (dismissal)”,

used for accounting and calculation of wages, compensation for unused vacation and other payments to employees upon termination of an employment contract. Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

- No. T-73 “Act on the acceptance of work performed under a fixed-term employment contract concluded for the duration of a specific work.”

It is used to register and record the acceptance and delivery of work performed by an employee under a fixed-term employment contract concluded for the duration of a specific job. Serves as the basis for the final or phased calculation of payment amounts for work performed. Shelf life is 5 years, subject to inspection. (If there are no personal accounts - 75 years).

PRIMARY DOCUMENTS NOT CONTAINED IN ALBUMS OF UNIFIED FORMS

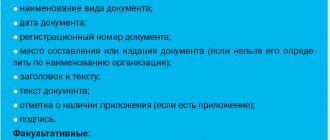

Documents, the form of which is not provided for in the albums of unified forms of primary accounting documentation, must contain the following mandatory details:

- Title of the document;

- date of document preparation;

- name of the organization on behalf of which the document was drawn up;

- content of a business transaction;

- measuring business transactions in physical and monetary terms;

- the names of the positions of the persons responsible for the execution of the business transaction and the correctness of its execution;

- personal signatures of these persons.

In addition to the unified forms of documents listed in the previous section, there are many more documents that the organization must maintain.

The need to maintain personnel documentation is enshrined in current legislation:

1. Labor Code:

- The employment contract concluded with each employee, its content and types (Chapter 10-13 of the Labor Code of the Russian Federation).

Shelf life 75 years.

- Protection of employee personal data (Chapter 14 of the Labor Code of the Russian Federation).

Shelf life 75 years.

- Work books (Article 66 of the Labor Code of the Russian Federation).

Shelf life: until required. Not in demand - 75 years.

- Development and approval of Internal Regulations (Article 189 of the Labor Code of the Russian Federation).

Shelf life: permanent (at least 10 years).

Validity period - until the adoption of new Rules.. 2. Federal Law of July 27, 2006. No. 152-FZ “On Personal Data”

- Statement on personal data.

Shelf life 75 years.

3. Decree of the Government of the Russian Federation of April 16, 2003. No. 225 “About work books.”

- Book of accounting of the movement of work books and inserts.

Shelf life 75 years.

Labor relations between employees and the employer are regulated by the local regulations of the organization. Every company must have internal labor regulations and provisions on the protection of personal information. Other local regulations:

- about wages,

- bonuses,

- labor participation rate,

- and so on.

developed and approved if necessary.

In addition, the organization must have the following personnel documents on labor protection:

- Instructions for employees on occupational health and safety.

Shelf life is permanent.

- Logbook for registration of briefing events;

Shelf life 10 years.

Occupational safety requirements are regulated by Section 10 of the Labor Code.

In accordance with the provisions of Article 217 of the Labor Code of the Russian Federation, each employer carrying out production activities with more than 50 employees must have a labor protection service or a labor protection specialist with appropriate training or experience in this field.

If the number of employees in a production enterprise is less than 50 people, the manager can assign occupational safety responsibilities to a trained employee, including part-time employees, with the written consent of the employee and for an additional fee (Article 60.2 of the Labor Code of the Russian Federation).

If labor safety responsibilities are not assigned to anyone, the head of the company bears responsibility for violations. In addition to the above, the organization must have the following documents:

- Documents (cards) for certification of workplaces, plans for certification of workplaces according to working conditions.

Certification of workplaces is mandatory for all organizations today. Carried out by specialized organizations with state accreditation. Shelf life 45 years. (Under difficult, harmful, dangerous working conditions - 75 years).

- Job descriptions for employees.

These instructions are drawn up for each position in the staffing table. Shelf life is permanent.

- Employee applications for hiring, dismissal, provision of annual paid leave, provision of leave without pay.

The storage period for statements that are not included in the personal files of employees is 5 years. The storage period for statements included in the personal files of employees is 75 years.

- Agreement on full financial liability (Article 243, Article 244 of the Labor Code of the Russian Federation).

It must be concluded with employees who have been hired for positions involving financial responsibility. The storage period 5 years (after the dismissal of the financially responsible person).

- Registration log of inspections of regulatory services.

Keeping this journal is mandatory for all legal entities and individual entrepreneurs. Shelf life is permanent.

Acts on accidents. Shelf life 75 years.

Acts of investigation of occupational poisonings and diseases. Shelf life 75 years.

In conclusion, it should be noted that the above lists of documents are not exhaustive, since in the process of establishing labor relations, the organization may be required to prepare other documents (for example, a certificate of state pension insurance for a previously unemployed employee).

RESPONSIBILITY FOR VIOLATIONS OF THE PROCEDURE FOR MAINTENANCE AND SECURITY OF PERSONNEL DOCUMENTS

In the absence of mandatory personnel documents approved by the organization, the inspecting labor inspector may bring the organization to administrative liability. Thus, in accordance with Article 5.27 of the Code of Administrative Offenses of the Russian Federation, violation of labor and labor protection legislation entails the imposition of an administrative fine:

- for officials - in the amount of 1,000 to 5,000 rubles,

- for legal entities - from 30,000 to 50,000 rubles. or suspension of activities for up to 90 days.

Violation of labor and labor protection legislation by an official who has previously been subjected to administrative punishment for a similar administrative offense entails disqualification for a period of one to three years.

In accordance with Article 13.20 of the Code of Administrative Offenses of the Russian Federation, for violation of the rules of storage, acquisition, accounting or use of archival documents (such documents include: work books, personal cards of employees, orders for personnel, etc.) entails:

- warning or imposition of an administrative fine on citizens in the amount of 100 to 300 rubles,

- for officials - from 300 to 500 rubles.

In accordance with Article 90 of the Labor Code of the Russian Federation, persons guilty of violating the rules governing the receipt, processing and protection of employee personal data are subject to disciplinary and financial liability in the manner established by the Labor Code and other federal laws, and are also subject to civil penalties , administrative and criminal liability in the manner established by federal laws.

The same provision applies to employees responsible for maintaining, storing, recording and issuing work books.

In accordance with Article 137 of the Criminal Code of the Russian Federation, illegal collection or dissemination of information about the private life of a person, constituting his personal or family secret, without his consent, or dissemination of this information:

- in public speaking

- publicly displayed work,

- in mass media,

are punished:

- a fine of up to 200,000 rubles,

- or in the amount of wages or other income of the convicted person for a period of up to 18 months,

- or compulsory work for up to 360 hours,

- or correctional labor for up to 1 year,

- or forced labor for a period of up to 2 years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to 3 years,

- or arrest for up to 4 months,

- or imprisonment for up to 2 years with deprivation of the right to hold certain positions or engage in certain activities for up to 3 years.

In this case, the same acts committed by a person using his official position are punishable:

- a fine in the amount of 100,000 to 300,000 rubles,

- or in the amount of wages or other income of the convicted person for a period of 1 to 2 years,

- or deprivation of the right to hold certain positions or engage in certain activities for a period of 2 to 5 years,

- or forced labor for a period of up to 4 years with or without deprivation of the right to hold certain positions or engage in certain activities for a period of up to 5 years,

- or arrest for up to 6 months,

- or imprisonment for a term of up to 4 years with deprivation of the right to hold certain positions or engage in certain activities for a term of up to 5 years.

The timeliness, completeness and correctness of maintaining personnel documentation, as well as compliance with labor legislation and other regulatory legal acts containing labor law norms, are controlled by the State Archive and the Labor Inspectorate, which conduct periodic scheduled and unscheduled inspections.

Complaints from employees can be considered by the Prosecutor's Office together with the Labor Inspectorate.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Results

Every company wants to keep reliable records.

This applies not only to documents reflecting business transactions, but also to personnel records. In case of non-compliance with the norms of the Labor Code, the company may face penalties, and in the case of disclosure of information from personnel documents, even criminal liability may be applied. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.