Step-by-step instruction

For the beginning of the example, see the publications:

- Payroll

- Paying salaries through a bank (on bank cards)

In the Organization, according to the local act, wages are paid twice a month: on the 25th and 10th. Payments are made according to the salary project on employee cards.

On May 25, 2022, an advance was paid in the amount of 40% of the salary.

Tab. No. Last name I.O. employee Prepaid expense Payment method 1 Komarov Vladimir Sergeevich 24 000 salary project 4 Mashuk Ksenia Valerievna 14 000 salary project Total 38 000

Step-by-step instructions for creating an example. PDF

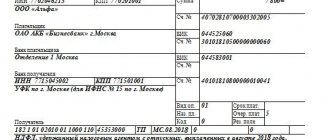

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Advance payment to bank cards | |||||||

| May 25 | — | — | 38 000 | Formation of payment statement | Statement to the bank - According to the salary project | ||

| 70 | 51 | 38 000 | 38 000 | Advance payment | Write-off from current account - Transfer of wages according to statements | ||

How is this regulated by law?

Now there are several standards that allow you to resolve all issues related to concluding a contract and calculating wages:

- First of all, we are talking about or, because it is in it that the conditions for payment through the bank are spelled out. If this happens later, changes must be made to it.

- Article 136 of the Labor Code is involved, concerning the place and procedure for payment of wages, as well as Art. 372 - form of payment sheet.

- The features of plastic cards and their handling are defined in the Regulation on Issue, which was approved by the Central Bank in 2004.

- In addition, certain provisions are spelled out in the Tax and Civil Codes, in particular in chapters 45 and 46. The fact is that almost simultaneously payments of various contributions and taxes are made, which are withheld from the amount accrued for work.

Therefore, the employer is simply obliged to transfer money to the card in full and on time, so as not to be subject to penalties. You just need to have it.

You can get detailed information about this procedure from the following video:

Regulatory regulation

The legislation of the Russian Federation does not operate with the concept of “advance payment”. Its percentage component from the salary is also not established by law. However, the Labor Code of the Russian Federation determines that wages must be paid (Article 136 of the Labor Code of the Russian Federation):

- at least every half month;

- no later than 15 calendar days from the end of the period for which wages are calculated.

Thus, during each month, the employee first receives the remainder of the salary for the previous month, and then part of the payment for the current month, which is commonly called an advance.

The following should be taken into account:

- The amount of the advance payment does not include incentive and compensation payments based on the results of the period (Letter of the Ministry of Labor of the Russian Federation dated August 10, 2017 N 14-1/B-725, Letter of the Ministry of Health and Social Development of the Russian Federation dated February 25, 2009 N 22-2-709).

- When determining the amount of the advance, it is necessary to take into account the time actually worked by the employee (Letter of the Ministry of Labor of the Russian Federation dated 02/03/2016 N 14-1/10/B-660, Letter of Rostrud dated 09/26/2016 N ТЗ/5802-6-1).

- The dates for payment of advance payments in different organizations are not the same, since they depend on the specifics of the work process. Specific dates - within those provided for in Art. 136 of the Labor Code of the Russian Federation, are established by local regulations of the enterprise.

Basic settings and nuances when paying an advance

Advance amount

The amount of the advance must be clearly stated in local regulations and not be of a symbolic nature. Wages for each half of the month should be accrued in approximately equal amounts - without taking into account incentives and compensation payments (Article 72 of the Labor Code of the Russian Federation, Article 129 of the Labor Code of the Russian Federation, Letter of the Ministry of Health and Social Development of the Russian Federation dated February 25, 2009 N 22-2-709).

Unlike the final salary, when paying an advance, the Payroll . Therefore, before paying the advance, it is necessary to determine its size.

Size can be set:

- common for all employees of the organization in the section Salaries and personnel - Directories and settings - Salary settings - General settings - Salary accounting procedure - Salary tab;

- individual for each employee in the Hiring and Personnel Transfer in the Advance .

Learn more Setting up an advance payment

Statement for payment

Regardless of how and in what form we pay the advance, the program must generate a statement for its payment. The document used in 1C depends on the value of the Salary payment specified in the Employees directory:

- According to the salary project - document Statement to the bank, type of operation According to the salary project , PDF

- To a bank account - document Statement to the bank type of transaction To employees' accounts , PDF

- In cash - document Statement to the cash desk . PDF

It is this field that is responsible for automatically filling out the documents Statement to the Bank and Statement to the Cashier .

This article will discuss the payment of an advance through a bank for a salary project.

Payment to an individual

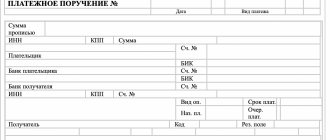

When creating a payment invoice for a citizen, the question may arise as to what to indicate in the purpose of payment to an individual.

According to the general rule developed by the Central Bank of the Russian Federation in Regulations dated June 19, 2012 N 383-P, section 24 of the payment order indicates the following information:

- purpose of payment;

- paid goods or services;

- details of agreements, contracts, and other similar documents;

- other information, including regarding VAT.

It is important to note that the rule-making acts of the Russian Federation do not contain any exceptions to the general rule in the case of generating a payment document for an individual. Therefore, section 24 of the payment slip should be drawn up in accordance with the instructions of the Bank of Russia.

If a payment order is issued to an individual’s card, then the purpose of the transfer can additionally include the following information:

- about enrollment on a plastic card;

- Owner's full name.

It is important to remember that if a private person pays money to the budget system of the Russian Federation, he must fill out additional sections in the payment order, for example, field 101 about the status of the payer - an individual.

The Ministry of Finance of the Russian Federation, by its Order No. 107n dated November 12, 2013, approved a list of code designations for the status of payers in the budget system.

For an individual, it is acceptable to indicate one of the following statuses:

- code “13” is reflected if the citizen is a taxpayer and at the same time a bank client;

- the number “16” takes into account entities participating in foreign economic activity;

- an individual making payments to the budget is reflected using the code “24”;

- the status of a citizen carrying out customs transfers is defined as “18”.

Compliance with the above requirements will allow you to issue a payment order to an individual without errors, a sample of which is available for download via the link.

Sample payment order for an individual

Every year, the number of enterprises that prefer to transfer their employees’ wages to a bank card increases. This form of payment is becoming increasingly common because it is beneficial for both parties and also saves operating costs.

This absolutely does not contradict legislative and regulatory acts, although certain procedures must be followed and the transition to non-cash payments must be carried out correctly.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem, contact a consultant:

(Moscow)

(Saint Petersburg)

(Regions)

It's fast and free!

Advance payment to bank cards

To pay an advance within the framework of a salary project, it is necessary that the program:

- The Salary Project was created : an element was introduced Salary Projects

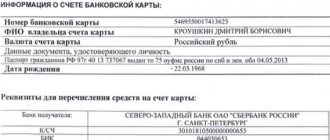

- In the Employees , Salary Payment is indicated - According to the salary project PDF.

- The personal accounts of employees were entered in the Employees or using the document Entering personal accounts in the section Salaries and Personnel - Salary Projects - Entering Personal Accounts.

Learn more about Payroll Project Preparation

Formation of a statement for advance payment

From June 1, 2022, when paying income to an individual through a bank, payment documents must indicate the code of the type of income for the purposes of enforcement proceedings. And also provide a breakdown of the amount of deduction from income, if any (Part 5.1, Article 70 of Federal Law No. 229-FZ dated October 2, 2007, Bank of Russia Directive No. 5286-U dated October 14, 2019).

To auto-substitute the income code in the Bank Statement, you need to fill out the Type of Income in the Accruals .

- Automatic substitution of income payment code in the statement

- Reminder of codes for income paid to individuals

- Salary payment codes in payment documents

- Difficulties in using income type codes in payment documents

The formation of a statement for the payment of an advance is drawn up in the document Statement to the bank, transaction type For salary project in the section Salaries and personnel - Salary - Statements to the bank - Statement - For salary project.

Please pay attention to filling out the fields:

- Type of payment - Advance , because It is the advance payment that is transferred.

- Month —the month of payroll for which the advance is paid to the employee.

- Salary project - a salary project drawn up with the bank, selected from the Salary Projects .

Click the Fill to generate a tabular section with the data for the advance payment:

- To be paid - the advance amount established in the program.

- Personal account number - personal account number within the salary project.

The document does not generate a posting to the Accounting and Tax Accounting .

Control

It is these amounts that were automatically filled in in the tabular part of the document Statement to the Bank .

Documenting

When transferring an advance, you must, along with the payment order, provide the bank with a list of employees indicating their personal accounts and payment amounts. 1C uses the PDF printable form List of salaries transferred to the bank , which can be printed by clicking the List of transfers the document Statement to the bank .

What is the procedure for filling out an advance payment form?

From the point of view of ensuring the passage of the advance payment, the following key payment details can be identified:

- Field “Payment recipient”: the name of the financial institution where the employee’s salary account is opened is indicated here.

- Detail “Payment amount”: reflects the advance amount according to statement T-51 (or similar), which is compiled for the 1st half of the month.

- Field “Purpose of payment”: indicate the wording “Payment of wages for half of such and such a month” indicating the number and date of the salary slip.

- Details “Payment recipient”: indicate full name. employee.

- “Payment recipient account” detail: the employee’s personal account number in a financial institution is reflected.

ConsultantPlus experts spoke in detail about the nuances of filling out a payment order to pay personal income tax from a salary. If you don't have access to the system, get a free trial online.

You can download a sample payment order for salary advance on our website using the link below.

Salary payment

The actual transfer of wages to employees is formalized by the document Write-off from the current account transaction type Transfer of wages according to statements using the Pay statement at the bottom of the document form Statement to the bank PDF.

Please pay attention to filling out the fields:

- The recipient is the bank with which the salary project is concluded.

- Amount - the advance amount transferred to the bank, according to the bank statement.

- Statement - a statement according to which the advance was transferred.

- Expense item - Labor remuneration , with the Type of movement Labor remuneration PDF, selected from the Cash Flow Items directory.

Postings according to the document

The document generates the posting:

- Dt Kt - payment of wages.

Checking mutual settlements

You can check mutual settlements with an employee using the Account Analysis “Settlements with personnel for wages” in the Reports - Standard reports - Account Analysis section.

The report shows that in the period from May 11 (the next day after the payment of salaries) to May 31, the organization paid an advance to employees. At the end of May, the organization still had a debt that must be paid by the 10th of the next month.

For the beginning of the example, see the publications:

- Payroll;

- Payment of salaries through the bank (on bank cards).

See also:

- Registration of salary project

- Salary settings in 1C

- Advance payment via cash register

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Payment of wages through a bank to bank cards There are several options for transferring wages to bank cards: in...

- Payment of an advance through the cash register: in cash according to the statement Let's consider the features of reflecting in 1C the payment of an advance to an employee through the cash register....

- Calculation and payment of advance...

- Calculation and payment of an advance in ZUP 3.1 - step-by-step instructions for beginners Let's consider step by step how the calculation and payment of an advance is carried out in the program...