Types of checks

The word “check” comes from the English “check”, short for “exchequer” - that is, treasury. This is a type of documentary securities of a strictly established form. Bank checks have existed for more than 500 years and are divided into 2 main types: cash and settlement .

Both categories have many subspecies. In Russia, the check has not found wide popularity among individuals. Perhaps due to the development of the plastic card market and the weak security of the document against counterfeiting. However, some enterprises continue to use it.

Monetary

This financial document is intended to transmit the order of the bank account owner to a third party - the recipient of the check . The order contains information about cash payments to the servicing credit institution. That is, it is a tool for managing money.

In the Russian Federation, the form of a cash bank check consists of: the spine, the front and the back, in which the following information is written:

- serial number;

- Full name of the remitter and his passport details;

- date of issue;

- signatures of the book holder and remitter.

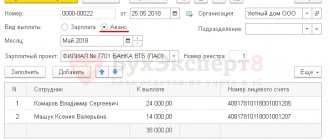

Check funds are often withdrawn from the checking account by company employees. For example, from the HR department, for the purchase of: household, office and other supplies. Or an accountant uses it to issue salaries.

Calculated

This is a strict reporting form for non-cash payments between the accounts of the check holder and the check recipient. For example, it is convenient for paying for goods or services.

That is, a bank check is an analogue of a payment order with the details of the counterparty. Only in this case, the payer transfers the document not to the bank, but to a third party (enterprise). If the recipient does not use the check within the specified time frame, the check holder revokes the order. This security is also subject to strict reporting.

The procedure and conditions for the circulation of checks are regulated by Art. 855 – 877 Civil Code of the Russian Federation.

Other types

Various types of cash and settlement bank checks take part in financial turnover. These instruments are classified according to the method of execution, conditions of acceptance and validity period.

- Order . Issued by the check holder to a specific person with the addition “...or to his order.” Thanks to this, the recipient of the check can transfer this security to another counterparty, but subject to endorsement (signature).

- Accepted . This is a document with the consent of the bank, which in turn guarantees that the funds specified in the check will be credited to the recipient’s account. In our country, this form of securities is used in settlements between budgetary organizations, as well as for some transactions with the Federal Tax Service.

- Crossed . A document with dual functionality, which reduces the risk of erroneous payments by narrowing the circle of check holders who can present it to the bank. Paper is classified according to general and special crossing.

- Advised . This is a check to the payer's bank with an order to issue a certain amount of money against future coverage. For example, receipts are expected into the account. In some cases, accompanied by a letter from the drawer's bank (credit memo).

- Road . Used to pay for cash or goods. Verified by the signature of the bearer. That is, you need to sign again for the document to be accepted. Issuers can be financial organizations and travel companies.

- Commercial . Accepted from the beneficiary exclusively by collection. The document cannot be transferred to third parties. Has a limited duration. If this is not established, then the maximum period is 6 months.

- A personal check is issued to a specific person (individual / legal), without the right of future transfer by endorsement. However, a change of rights under this document is still possible, but only as an exception, with the subsequent transfer of rights under debt claims established by the Civil Code of the Russian Federation.

- A bearer check is a regular cash check. Issued to bearer. Transferable to third parties without endorsement, by simple delivery. The document is valid for 10 days. Exists in undocumented (electronic) form.

- Canceled . A check paid or canceled by a specific financial institution. Non-refundable.

Interesting fact! During the era of total shortages in the USSR, the Berezka chain stores (1961-1988) sold imported goods to foreigners for foreign currency, and to Soviet citizens for Vneshposyltorg checks (since 1977).

Important points

A checkbook for individual entrepreneurs is issued within three working days. When it is ready for issuance, bank employees notify the recipient. A businessman needs to visit a bank branch and pick up a financial document. You need to pay a fee for registering a checkbook. The bank employees will withdraw it from the open account.

The document consists of a check and a spine, which is separated by a cutting line. Withdrawals from a checkbook occur upon complete registration and completion of all columns. You have 10 days to withdraw money by check. This can be done by the manager himself or an authorized person. But in this case, a power of attorney is issued to issue funds.

Receipt of money is carried out with a check and passport. If all the data is correct, the operator will cut the check from the counterfoil, which remains in the bank. The employee is required to make a mark on the check, cut out the control stamp and give it to the recipient. After this, the check undergoes a secondary check by the controller. It is then marked and the passport is returned.

In order for an individual entrepreneur to withdraw money, a checkbook is provided to the cashier. After the next check of the check, the entrepreneur signs the receipt of funds, and they are issued.

The check book is valid for one year. You can extend it up to two years, provided that there are unused checks and there are funds in the checking account. By contacting Sberbank, the client can extend the period of use of the document. If the current account is closed, the businessman is obliged to return to the institution the book with stubs that have not yet been used. They are accompanied by a statement indicating the numbers.

If taxes are paid on time, the state is not interested in where the businessman spends his money. If you need to withdraw money for personal needs, this should be indicated in the column in which the direction of withdrawal is written. As for doing business on UTII, an entrepreneur, when withdrawing cash through a check, notes code 40 “Entrepreneur’s Income” in the goal.

Where can I buy a checkbook? A personal document can only be obtained from a bank. This allows you to control cash withdrawals and protect yourself.

Money from the drawer to the check recipient is issued only if the details, signatures and seals are available. In this case, the bank charges a commission for cash withdrawals. The cash-out procedure takes place directly at the institution. In addition, if a document is filled out with errors, it will not be accepted at the cash desk.

On video: How a checkbook works in the USA

Endorsement

A bank check, like any security, can be transferred by endorsement (signature). The recipient signs on the reverse side and becomes an endorser. It is recommended to put a simple signature, preferably matching the signature on the passport. It recognizes the transfer of rights under a check to another person, and also predetermines the liability of the endorser to subsequent holders of the paper.

The payer is allowed to make only a sub-indorsement upon collection.

Collection of a check is the execution by the bank of the client’s order to receive payment according to the check submitted to the bank for collection.

In addition to the surety endorsement, the endorsement is divided into 2 more types: personal and blank. In the first case, the details or personal data of the person to whom the check is transferred are indicated. And in the second, it is not indicated to whom or whose order it is necessary to pay, that is, only the signature of the endorser is affixed.

Transcript

1 Sberbank application for issuing a checkbook sample >>> Sberbank application for issuing a checkbook sample Sberbank application for issuing a checkbook sample It is believed that no more than 10 days should pass from the moment of filling it out and contacting a financial institution. Sample of filling out a checkbook. Payment is made one-time, regardless of how long the checkbook is used. Before using this service, you must clarify the size of the limit for withdrawing money from your current account by checks without prior notification to the bank. Assistant is your personal assistant in a small business. First of all, company management must decide which checkbooks are required and how many there should be. Subtleties of check execution The checks themselves, related to securities and included in the book, are typical and consist of two main parts. This means that if 4 people work in an enterprise with the Sberbank Business Online system, then they first need to obtain 4 cryptographic keys from the Sberbank service branch. The application form proposed by the Central Bank is somewhat shorter, but practically repeats the one given above. To do this, you need to appoint one of the company’s employees as the person responsible for storing the checkbook and put it in a special safe. To obtain a checkbook, you do not need to provide many documents or go through complex procedures. After the pages in the document run out, you need to contact the bank with an application to issue a new checkbook. If everything is in order, then the bank specialist issues a corresponding notification, which must be taken to the tax service. Similar: In the header part of the Application form for the receipt of cash check books, the client indicates that the Cash check book is issued by a Bank employee, based on the Application for the issuance of cash check books, which is valid. After filling out the form, it should be sent to the bank that services the company. A unique opportunity to download any document in DOC and PDF absolutely free of charge. Some of them do not know in what sequence they need to act. It allows you to make transactions in real time. What must be indicated in the application for a checkbook? Closing a current account is possible only if the individual entrepreneur has no debt to Sberbank. A cash checkbook is issued by a Bank employee, based on the Application for the issuance of checkbooks, which is valid. This means that if 4 people work in an enterprise with the Sberbank Business Online system, then they first need to obtain 4 cryptographic keys from the Sberbank service branch. Sample of filling out a checkbook The lower part of the reverse side is intended for making marks identifying the recipient. The number of tokens is determined by the number of users. Subtleties of check execution The checks themselves, related to securities and included in the book, are typical and consist of two main parts. Sberbank application for issuing a checkbook sample Assistant, your personal assistant in a small business. When to write an application An application for a checkbook can be submitted at any time. For persons over 18 years of age. Such paper automatically becomes unsuitable for acceptance at a Sberbank branch. Moreover, if the speech is conducted on behalf of the organization, then by its director and chief accountant. Sberbank is the largest Russian bank. Moreover, if the speech is conducted on behalf of the organization, then by its director and chief accountant. Features of filling out an application If you are faced with the need to form an application for the issuance of a checkbook, read the tips below and look at an example of a form based on it, you can easily draw up your own document. First, general information that applies to all such papers.

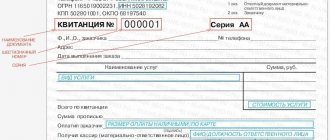

Cash check form and sample filling

The structure of cash checks is similar. It does not matter which financial institution the client is served by. True, the rules for filling out the document are established individually by each credit institution. You can find out about the regulations in more detail at your bank. However, there is a general rule - checks with marks are not accepted.

Rice. 1. Blank cash check form

Rice. 2. Completed sample cash receipt

A bank check is a form of strict accountability. Filled out in one step by hand with a simple fountain pen with black or blue (violet) ink, without errors or corrections. It is prohibited for text and numbers to go beyond the designated fields. A document with marks or an inappropriate signature will be canceled by the bank.

The front side of the form consists of two sections: the main one and the spine, the information in which is duplicated:

- Name of the enterprise or individual entrepreneur.

- Legal account number faces.

- Amount in rubles and kopecks in numbers (put a dash in the empty space).

- Name of the city (settlement) where it was registered.

- Date of execution of the document and name of the bank.

- Full name of the recipient in the dative case.

- Amount in words (put a dash in the empty space).

- Signatures of two responsible persons in accordance with the bank card.

- On the back of the document, the client writes a code, spending goals and amount.

- Fills in the lines with the personal (passport) data of the remitter.

- Everything else is noted by the bank employee.

The cashier-operator checks the signatures and seal of the check drawer with the sample. Facsimiles are prohibited. With one check you can receive a large sum for various purposes. It is enough to divide them in the required shares, with the name of certain planned expenses.

Accounting and legal services

Filling out and maintaining a checkbook A check must be filled out only by hand (with a ballpoint pen or ink) and in one handwriting (i.e., by one person). When filling out the front side, you should avoid mistakes and blots, since in this case the check will be considered invalid.

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to know |

Damaged forms must remain in the checkbook, glued to the counterfoil and canceled with the words Spoiled. The name of the check drawer, that is, the owner of the current account and check book, and his account number are affixed upon receipt of the book at the bank by hand or by imprinting the organization’s stamp on all checks simultaneously.

In the line Check. on the. the amount (in numbers) for which it is issued is indicated. In this case, empty spaces in front and after the amount of rubles must be crossed out with two lines. The next line indicates the place (in some banks it is already filled) and the date of issue of the check.

Examples and photos

Rice. 3. Photo of a bank receipt from Alliance LLC

Rice. 4. Cash check and its counterfoil

Rice. 5. Rules for filling out a cash receipt

Rice. 6. This is what the front and back of a bank check looks like

Rice. 7. Photo example

Required details

On the date of purchase, the seller issues a sales receipt indicating the required details. The list of mandatory information is defined:

| Required details | |

| A form that is issued instead of a cash register (clause 2.1, 3, article 2 of Federal Law No. 54) | The form that is issued when selling goods (Part 2 of Article 9 of the Federal Law dated December 6, 2011 No. 402-FZ) |

| Name | Name |

| serial number | settlement date |

| date, time, place of payment | name of the institution that compiled the document |

| name of the institution that compiled the document | name of items sold |

| TIN and legal address of the institution that generated the document | price of items sold, quantity, cost indicating units of measurement |

| tax system | position, full name, signature of the employee who sold the goods |

| calculation sign | |

| name of the items sold, their price | |

| total settlement amount | |

| calculation form | |

| position and full name drawn up and issued | |

| date of issue | |

| personal signature of the employee who issued | |

| stamp (if available, is not a required element) | |

ConsultantPlus experts analyzed in what cases a sales receipt is used. Use these instructions for free.

Rules for filling out a checkbook

A checkbook (CHB) is a financier’s document that contains a bound collection of check forms.

CHK is classified into 3 types:

- Cash CHK

- CHK settlement.

- CHK property (rarely used).

The first type of checkbook is used for cashing checks. The second is for ordering non-cash amounts of money for the purpose of transferring to the account of an inspection organization (until recently, it was most often used in the West).

Fig.8 Sample of filling out a checkbook

To receive a Cheka in the Russian Federation, you need to write an application to the servicing bank. The financial institution will issue a document with 25-50 forms, charging a certain fee for this. An additional sub-account will be opened for the company on account 55 “Special accounts in banks”, which is used in accounting for letters of credit and check books. All checks with serviced and canceled checks are stored for 3 years, after which they are transferred to the archive.

The appearance of a checkbook in an organization is recorded in the accounting documentation, where it is registered in off-balance sheet account 006 “Strict reporting forms”. The costs of opening a CHK are written off as other expenses using posting D91/2 K51.

To start handling checks, you will need to deposit a special account. As checks are spent, they are written off from the credit of account 006 and from the credit of account 55/2. If the company has unsold checks at the end of the year, then they are transferred to the bank, and the latter, in turn, returns the money from account 55/2 to the account.

Related documents

- Sample. Memorial Order

- Sample. Payment in the form of telegraphic reimbursement

- Sample. Payment against documents

- Sample. Payment order for transfer of funds abroad (Russian or English)

- Samples of endorsements (Russian/English)

- Payment to account debit

- Payment order for payment of sums of money for several types of customs payments

- Payment order for payment of the registration fee. Form No. PD-5

- Receipt cash order. Form No. ko-1

- Receipt cash order. Form No. ko-1

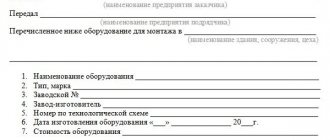

- Receipt order. Form No. m-4

- Receipt order. Form No. m-4

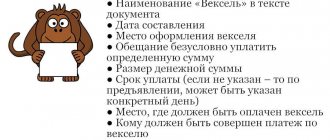

- Promissory note (solo)

- Payment order (sample)

- Payment request

- Payment request-order

- Account cash warrant. Form No. ko-2

- Account cash warrant. Form No. ko-2

- Request for release of materials. Form No. m-11

- Form of a bill of exchange with a period of so much time upon presentation and with a dated inscription of acceptance (approved by Letter of the Central Bank of the Russian Federation dated September 9, 1991 No. 14-3-30)

How to cash out?

The operation of exchanging a bank check for money is called collection . The minimum commission is usually 3%. The check holder comes to the bank's cash desk, where he provides the check itself and his passport. Sometimes the process takes up to 3 days. If the check belongs to a foreign bank, the operation can take from 1 week to 2 months. Time is needed to verify the authenticity of a security. And some financial organizations of the Russian Federation do not accept foreign checks, or have set a limit of at least $150.

Do you need a seal?

There is no need to put a stamp. This rule applies to both organizations and individual entrepreneurs. But some lawyers still recommend putting a stamp, since the stamp is an additional guarantee of the purity of the transaction, since it confirms the fact of purchasing a particular item from a specific entrepreneur. For example, a person bought a product in a store, but it turned out that the item contains many hidden defects. Then you can exchange the defective product using PM, and the stamp will act as solid proof that the item was purchased in this particular store.

Reference materials (download)

See articles 877-885, where checks are discussed in the Civil Code of the Russian Federation (part two) dated January 26, 1996 N 14-FZ

Also see Chapter 8 of Bank of Russia Regulations dated June 19, 2012 N 383-P

In what cases is it issued?

Article 2 of Federal Law No. 54 establishes whether the seller is obliged to issue a sales receipt, in which cases it is not provided.

The seller is obliged to issue it if:

- he is an individual entrepreneur on the PSN (clause 2.1 of Article 2 of the Federal Law dated May 22, 2003 No. 54-FZ);

- a buyer's request was received (clause 3, 8 of article 2 of the Federal Law dated May 22, 2003 No. 54-FZ).

Individual entrepreneurs with a patent do not provide a sales receipt instead of a cash receipt if they operate in the following areas:

- repair and maintenance of household radio equipment, machines, instruments, watches;

- Maintenance and repair of motor vehicles and motorcycles;

- auto services for the transportation of goods and passengers;

- veterinary medicine;

- physical education and sports classes;

- transportation of goods and passengers by water;

- hunting and hunting grounds;

- medical and pharmaceutical activities;

- rental;

- retail trade with halls of no more than 50 sq. m or without halls;

- catering with halls no more than 50 sq. m or without halls;

- production of dairy products;

- fishing and fish farming;

- repair of computers and communications equipment.

Regulatory documents define the cases when a sales receipt is issued and the grounds for issuance:

| Product type | Base | Additional grounds (if there is no cash register in the document) | Additional reasons |

Goods for peddling trade, except:

| Clause 20 of the Government of the Russian Federation of January 19, 1998 No. 55 | ||

| Textiles, knitwear, clothing, fur products, shoes | Clause 46 of the Government of the Russian Federation of January 19, 1998 No. 55 |

| |

| Household appliances of complex technical format | Clause 51 of the Government of the Russian Federation of January 19, 1998 No. 55 |

| |

| Jewelry and other items made of precious metals | Clause 69 of the Government of the Russian Federation of January 19, 1998 No. 55 |

| |

| Animals, plants | Clause 80 of the Government of the Russian Federation of January 19, 1998 No. 55 |

| |

| Construction materials, construction products | Clause 111 of the Government of the Russian Federation of January 19, 1998 No. 55 |

| |

| Cars, motorcycles, trailers, their numbered units | Clause 60 of the Government of the Russian Federation of January 19, 1998 No. 55 | regardless of the information in the cash register | |

| Weapons and ammunition | Clause 101 of the Government of the Russian Federation of January 19, 1998 No. 55 | regardless of the information in the cash register | |

| Furniture | Clause 117 of the Government of the Russian Federation of January 19, 1998 No. 55 | regardless of the information in the cash register |

Individual entrepreneurs and legal entities that:

- provide services to the population;

- work in retail trade or catering;

- do not have employees on staff, -

do not use cash registers without fail until 07/01/2021 and issue sales receipts to buyers.

IMPORTANT!

The document is not a strict reporting form, since it is used in the process of selling goods, and BSO is services (Article 1.1. Federal Law No. 54-FZ dated May 22, 2003).

Who can act as a cash check holder

In the case of receiving a check book, you must ask the manager about what documents are needed for registration, what circle of people are needed so that these people act as receivers of your cash registration details.

Of course, in an internal setting, small business directors or business owners most often pull, cash checks for themselves (or their accountants/CFOs - for the director, or actually for the accountant/CFO); in this case, of course, it is enough to show the passport of the payee. But even if you are planning just the same practice, just in case, you need to study how it is possible to arrange a cash payment in another state of your company or to third parties.

Theoretically, the registration options in these cases of an ordinary employee of a legal entity of a company are as follows: for use, since the holder of a cash check “requires a power of attorney certified by the enterprise and the passport details of the authorized representative (or on the letterhead of the enterprise or bank provides a standard form of power of attorney for legal entities)” For SPD, a notarized power of attorney has been provided to the bank.

A notarized power of attorney is theoretically also necessary for using third parties as holders for cashing company checks. However, this does not exclude that the bank will take a more strict approach - for example, it will completely stop the possibility of issuing such powers of attorney to third parties. Or, on the contrary, he will act more loyally: he will resolve the issue of such powers of attorney to a predetermined list of possible payment recipients. One way or another, it’s worth asking the manager you plan to contact.

Sales receipt: required or optional

Every day, both an ordinary citizen and an entrepreneur have to deal with the concept of a sales receipt. Not everyone knows how to fill it out correctly. In stores, when purchasing goods, paying utility bills, or ordering online services, we must all receive a receipt after making payment for goods and services. Not everyone knows that the following is enshrined at the legislative level: “The seller is obliged to issue a check to the buyer.”

The main thing that a business entity needs to understand is that a cash receipt refers to documents that are subject to strict reporting, and most importantly, that even if you do not have cash register equipment, you must fill out the receipt manually.

A sales receipt not only confirms the fact of payment for the goods (services), but also gives the client legal guarantees when returning or exchanging goods. Because, without having a receipt for the goods he purchased, it will be almost impossible to prove that it was purchased specifically from this seller.

Accounting basics of filling out a sales receipt with a specific example

For those who do not know how to correctly fill out a sales receipt, a sample is presented below:

1. In the column “Name of organization, OKPO (TIN)” you must indicate the name of your enterprise and your OKPO code, according to the certificate of state registration with the tax office.

2. In the “Sales receipt No.” column, indicate the sales receipt number, according to the number of transactions made per day at the time the order was issued.

3. In the column “On what date was issued” the day, month and year of the transaction is indicated.

4. In the column of the table “No.” the serial number of the name of the product sold is indicated.

5. In the “Name, characteristics of the product” cell, the name of the product being sold, as well as its quality properties, is indicated.

6. The “Unit” column indicates how the product being sold is measured.

7. The “Quantity” section indicates how much of the product was sold.

8. The column of the “Price” table indicates the cost of one unit of goods.

9. In the “Amount” section, the total cost of a specific type of product is indicated.

10. In the “Total” table cell, the total purchase amount of all product items is indicated in numbers.

11. In the column of the table “Total amount sold” the total purchase amount of all items of goods is indicated in words.

12. In the “Seller” column, the surname and initials of the seller are written in words.

13. In the “Signature” column, the person who generated and filled out the sales receipt signs.

14. The “Date” column indicates the day, month and year of the transaction.