When does an increased personal income tax rate apply?

From 2022, an increased personal income tax rate applies under the following conditions:

- the amount of income per year exceeded 5 million rubles;

- income is included in the list approved by law dated November 23, 2020 No. 372-FZ.

These lists are different for tax residents and non-residents. In general, tax residents of the Russian Federation include those who stayed in the country for more than 183 calendar days within 12 months (clause 2 of Article 207 of the Tax Code of the Russian Federation).

In 2022, the coronavirus pandemic made moving across state borders much more difficult than usual. Therefore, the limit for recognizing an individual as a tax resident of the Russian Federation in 2020 was reduced to 90 days (clause 2.2 of Article 207 of the Tax Code of the Russian Federation). It is possible that this will be extended to 2022, but so far there is no such information.

Personal income tax in 2022: what changes

The tax rate has not been revised for a long time. The country's leadership has decided that changes in the area of income tax are inappropriate. There was no change in the personal income tax rate in 2022, but minor changes were made to the procedure for calculating tax.

The procedure for taxing material benefits from savings on interest for the use of borrowed money has changed (clause 1, clause 1, article 212 of the Tax Code of the Russian Federation). Now the benefit is recognized only if the organization (or individual entrepreneur) and the individual are interdependent or have an employment relationship.

The list of non-taxable payments has been added (Article 217 of the Tax Code of the Russian Federation). It includes compensation payments from the fund for the protection of the rights of shareholders (clause 71), the amount of payment of part of the first installment on preferential lending with state support for the purchase of a car (clause 37.3), as well as interest on government bonds (clause 25).

A written off bad debt is recognized as income only if the company and the citizen were interdependent (clause 5, clause 1, article 223 of the Tax Code of the Russian Federation).

In the event of a company reorganization, all responsibilities for reporting personal income tax are transferred to the legal successor. That is, if reports were not submitted before the reorganization, then the successor organization will be required to submit them.

What income is taxed at a rate of 15%

From income up to 5 million rubles. you must pay the standard rate of 13%. The increased rate applies only to income above this limit.

For residents, income includes salary, bonuses, sick leave, as well as income from the following operations:

- from equity participation;

- in the form of winnings received from participation in gambling and lotteries;

- on various transactions with securities and derivative financial instruments;

- from participation in an investment partnership;

- in the form of profits of a controlled foreign company.

For non-residents of the Russian Federation, income includes (clause 3 of Article 224 of the Tax Code of the Russian Federation) the following types:

- income of foreigners who work under a patent;

- income of highly qualified foreign specialists;

- income of participants in the state program for the resettlement of compatriots;

- income of crew members of ships flying the state flag of the Russian Federation;

- income of foreigners recognized as refugees or granted temporary asylum in the Russian Federation.

What income is not subject to the increased rate?

For residents of the Russian Federation, the limit is 5 million rubles. income does not include:

- from the sale of property, except securities;

- from the value of gifts, also excluding securities;

- from insurance and pension payments.

That is, for such income the rate will always be 13% regardless of the amount (clause 1.1 of Article 224 of the Tax Code of the Russian Federation as amended by Law No. 372-FZ).

Also, special personal income tax rates for certain types of income will continue to apply to residents of the Russian Federation.

- 35% on income in the form of winnings and prizes received as part of promotions, as well as in the form of interest.

- 30% for certain types of income from securities.

- 9% on income from mortgage-backed bonds.

And finally, for non-residents the following rates are maintained, provided for in paragraph 3 of Art. 224 of the Tax Code of the Russian Federation, regardless of the amount of income:

- 15% for dividends received;

- 30% for all other income, except dividends and income of non-residents, taxed at the rate of 13% (15%) from the list given in the previous section.

How to calculate personal income tax taking into account the increased rate

As long as the amount of payments to an employee from the beginning of the year does not exceed 5 million rubles, the employer must charge personal income tax in the usual manner at a rate of 13%.

If the employee’s annual income has become more than 5 million rubles, then personal income tax should be calculated as the amount of 650 thousand rubles. from 5 million rubles. and 15% of the excess amount.

Example 1.

The employee's annual income was 7 million rubles. The amount exceeding the threshold of 5 million rubles, after which the rate changes:

PR = 7 - 5 = 2 million rubles.

Personal income tax for the year will be equal to:

Personal income tax = 650 thousand rubles. 2 million rubles. X 15% = 950 thousand rubles.

Personal income tax payment deadline in 2022: table

The payment deadlines for taxes paid by the taxpayer themselves and those of tax agents are different. As a general rule, the tax agent transfers funds no later than the next day after the day of issuing remuneration to the employee or other payment. But there are exceptions. To avoid confusion, use our reference material.

Deadlines for transferring personal income tax in 2022 (table).

| Income | Transfer deadline |

| Salary, including advance for the first half of the month | No later than the day following the day of transfer of wages for the second half of the month to the employee |

| Final settlement | The next day after payment of the payment upon dismissal |

| Vacation pay, sick leave and other benefits | No later than the last day of the month in which the payment was made to the employee |

| Other transfers for which the employer is a tax agent | No later than the day following the payment date |

| Income on which tax is paid directly by the taxpayer | Until July 15th following the year of receipt of income |

What to do if an individual has several sources of income

A person can have several employers. It may happen that at each place of work the income is less than 5 million rubles, but in total it is more. In such cases, each employer charges personal income tax at the usual rate of 13%.

Tax officials will collect all information about an individual’s income for the year and if it turns out that the total amount of income exceeded 5 million rubles, they will send a notification to the individual. The taxpayer himself will have to pay the missing amount before December 1 of the next year (clause 6 of Article 228 of the Tax Code of the Russian Federation as amended by Law No. 372-FZ).

The form of notification and the procedure for sending it have not yet been approved. But there is still time for this: complete information on the income of individuals for 2022 will appear to tax authorities no earlier than April 30, 2022, when the deadline for submitting tax agent reports and 3-NDFL returns expires.

Who will be responsible for calculating personal income tax at the new rate?

As a rule, all calculations will be made by tax agents. This means that they will fall on the shoulders of the accountants of the employing organizations, those who attract workers under GPC agreements, pay dividends to the owners, etc.

But there may be several such agents. For example, an employee can work part-time, perform contract work for different customers, have shares in different companies, even win completely different lotteries several times. How can all its tax agents find out about each other and the amount of income received? What if the income has already exceeded 5 million? The rule here is: every man for himself. Each tax agent calculates personal income tax on the income it pays and does not have the right to demand proof of other income.

Important! An exception is that if an employee comes to find a job in the middle of the year and this year he has already worked in another organization, he must provide a 2-NDFL certificate from his previous place of work. But this is mandatory if he wants to receive deductions, because without such a certificate, the accountant will not be able to determine either the amount of income or the amount of previously provided deductions.

Another good news for agents: in the 1st quarter of 2022, sanctions will not be applied to them for incorrect calculation of personal income tax (unprecedented generosity, because for personal income tax the amount of penalties depends on the amount of unpaid tax). But, on the other hand, in the first quarter, few people will have a situation where income exceeds the limit and confusion with calculations arises, so the relief is doubtful.

How to apply personal income tax deductions now

In general, from 2022, personal income tax deductions can be applied separately for each income category.

Income from transactions with securities and derivative financial instruments can be reduced by:

- investment deductions (Article 219.1 of the Tax Code of the Russian Federation);

- previously received losses from such operations carried forward to the future (Article 220.1 of the Tax Code of the Russian Federation).

The income of participants in an investment partnership can be reduced by losses from previous years (Article 220.2 of the Tax Code of the Russian Federation).

The main tax base can be reduced by the amount of standard, social, property and professional tax deductions (Articles 218, 219, 220, 221 of the Tax Code of the Russian Federation).

If the amount of standard, social and property deductions for the year exceeds the main tax base, then they can be used to reduce the following types of income (clause 6 of Article 210 of the Tax Code of the Russian Federation as amended by Law No. 372-FZ):

- from the sale or receipt of property as a gift, except for securities;

- from insurance and pension payments.

How can you reduce personal income tax 2022

Every taxpayer has the right to reduce the income tax payment paid through the use of tax deductions:

- standard;

- social;

- property;

- investment.

Now it is possible to obtain most of them directly from the employer. To do this, you need to write an application and collect documents confirming the right to deduction.

In addition, at the end of the year, you can submit a 3-NDFL declaration to the tax office to apply the deduction. It will be checked, after which a refund of the overpaid tax will be made.

Features of personal income tax calculation and sanctions for violations in 2021-2022

To ensure that taxpayers get used to the new rules, there will be a transition period in 2021-2022. The limit of 5 million rubles will be applied not in general for all income of an individual, but for each type of income separately (Clause 3 of Article 2 of Law No. 372-FZ).

Example 2.

One of the founders of the company simultaneously holds the position of director. For 2022, he received a salary of 4 million rubles. and dividends in the amount of 2 million rubles. Despite exceeding the total amount of income by 6 million rubles. above the limit of 5 million rubles, all director’s income will be taxed at a rate of 13%.

If a tax agent makes a mistake in calculating personal income tax at a rate of 15% for the 1st quarter of 2022, he will not be fined provided that he independently finds the error and pays the missing amount before July 1, 2021 (Clause 4 of Article 2 of Law No. 372-FZ) .

Rules of the transition period for personal income tax

For two years, the principle of calculation will be in force for each individual tax base, and not for their totality.

We use the data from the previous example: 2 million - salary, 1.5 million - under service contracts, 3 million - dividends; Each income is an independent taxable base. And each does not exceed five million rubles. This means that if you receive such income in 2022 or in 2022, then the tax rate for you will be the same 13%.

But if, for example, in addition to the above income, you win 10 million in the lottery (that would be great, right?), then based on this base the tax will be calculated at two rates: 5 million at a rate of 13% and 5 million at a rate of 15% personal income tax . Moreover, to determine the total tax base, components are used - tax bases, which are calculated taking into account the use of tax deductions: for children, property and others.

How to pay personal income tax at a rate of 15% and report on it

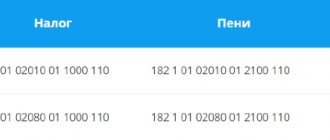

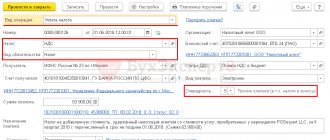

As before, depending on the situation, the tax agent must pay personal income tax at the place of its registration, the location of separate divisions or the location of its activities. But for that part of personal income tax that is taxed at a rate of 15%, separate BCCs have been established (Order of the Ministry of Finance of the Russian Federation dated 06/08/2020 No. 99n).

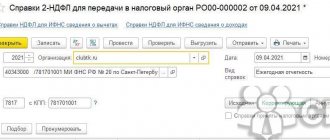

When filling out form 6-NDFL for rates of 13% and 15% for one type of income, you need to fill out sections 1 and 2 separately (letter of the Federal Tax Service of the Russian Federation dated December 1, 2020 No. BS-4-11/19702).