At what cost should materials be accepted for accounting?

To accept materials for accounting, evaluate them at actual cost (clause FSBU 5/2019).

Its calculation depends on the method of obtaining materials. The following options are possible:

- Purchase for a fee . Form the actual cost in the standard manner - take into account all the costs of acquisition, delivery and preparation for operation. Don’t forget to exclude VAT from the price, which you will then deduct.

- Free receipt, full or partial payment in kind . Measure materials at fair value. The rules for its calculation are approved in IFRS No. 13 dated December 28, 2015. Do not forget to increase it by the amount of additional costs for acquisition, delivery and preparation for use.

- Capital contribution . Accept for accounting at actual cost, taking into account additional costs.

- Disposal, repair, modernization or reconstruction of non-current assets. Estimate the cost of materials using the lower of two values:

- cost of similar materials;

the sum of the book value of the asset and the costs of obtaining materials and preparing them for use.

Important! Do not include in inventory cost:

- disaster-related costs;

- management expenses, if they are not related to the acquisition;

- storage costs, unless this is part of production or a condition of purchase;

- refundable indirect taxes.

Accounting accounts in "1C: Accounting 8"

An accounting entry or accounting formula is a correspondence of accounts indicating the amount of transactions

The accounting entry is compiled only on the basis of primary accounting documents. Primary accounting documents include orders, contracts, acceptance certificates, payment orders, cash receipts and expenditure orders, invoices, orders, receipts, sales receipts, etc.

Primary documents are supporting documents on the basis of which accounting records are maintained and which certify the facts of business transactions. The primary document is drawn up at the time of the relevant transaction or immediately after its completion.

In general, to draw up a posting you need to:

- determine the essence of changes occurring with accounting objects as a result of a completed business transaction;

- select, according to the Chart of Accounts, suitable accounts for recording the amount of a business transaction using the double entry method - debit and credit.

After determining the correspondence of accounts as a result of this operation, an accounting entry is drawn up. If a transaction corresponds to only two accounts (one for debit, the other for credit), then it is called simple

.

Accounting entries in which more than two accounts interact are complex entries

.

You can make accounting entries in 1C:Accounting 8 through standard configuration documents and through manually entered transactions.

The document “1C: Accounting 8” allows you to enter information about a certain business transaction into the accounting system, record the date and time of the transaction, the amount and content of the transaction. Examples of program documents: Receipt of goods and services, Expense cash order, Receipt to current account, Depreciation and depreciation of fixed assets

etc.

Based on the document, accounting entries are automatically generated and recorded in the accounting registers (each accounting entry corresponds to one entry in the accounting register), and entries are also entered into specialized information registers and accumulation registers. In the 1C:Enterprise system, accounting for a business transaction is always associated with the document that generated it: if the document needs to be edited, then when it is edited, the entries in the registers will be created anew, and when the document is deleted, the entries in the registers will also be deleted.

Using the document "1C: Accounting 8" you can also obtain a printed form of the primary document, for example, a Payment order

,

Advance report

, etc.

In general, standard accounting system documents can generate accounting entries in various combinations, entries in special registers, and also offer or not offer printed forms of primary accounting documents, for example:

- in the document Invoice for payment to the buyer,

a printed form is available, but there are no entries in the accounting register and in special registers; - in the document Receipt to the current account

- there can be only one simple accounting entry, and there is no (as unnecessary) printed form of the document; - The document Sales of goods and services

contains a whole group of accounting entries, entries in registers, and also supports several options for printed forms.

You can view transactions using the DtKt

both from the document form and from the list of documents form.

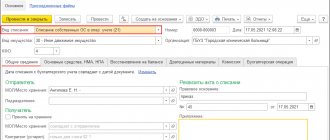

If the automatically created records for some reason do not satisfy the user, then in the form for viewing document movements, you must set the Manual adjustment flag (allows editing of document movements).

This flag allows you to add new and edit existing document movements; the automatic generation of movements is disabled.

After removing the Manual adjustment...

, the document will be re-posted, and the movements will be restored automatically by the posting algorithm (Fig. 12).

Rice. 12. Form for viewing document movements

In the accounting register form (section Operations

hyperlink

Transaction log

) information in the list can only be viewed (Fig. 13). To find the necessary information, it is advisable to use the list selection and sorting settings.

Rice. 13. Accounting register

If the user does not find the business transaction he needs among the standard documents of 1C:Accounting 8, then in this case a manual Operation

(Section

Operations

, hyperlink

Operations entered manually

).

You can check the correctness of manually entered account correspondence using the accounting express check mechanism.

Correspondence of Accounts directory is intended to assist in registering business transactions.

(section

Main

hyperlink

Enter a business transaction

), which is a configuration navigator that will help the accountant, based on the content of the business transaction or the correspondence of the accounting accounts for the debit and (or) credit of the account, to understand which document needs to be reflected in the configuration.

You can select the required account correspondence by debit or credit accounts, by the content of the transaction (Fig. 14) or by the configuration document.

Rice. 14. Directory of correspondence accounts

To facilitate the entry of recurring business transactions, standard transactions are provided. To store a list of standard operations, as well as to create new standard operations, a reference book of standard operations is provided (section Operations

hyperlink

Typical operations

).

A typical operation is a template (standard scenario) for entering data about a business transaction and generating entries for accounting and tax accounting, as well as entries in accumulation and information registers.

The entered operation will be reflected in the operation log, as well as in the list of manually entered operations.

In the header of the directory element Typical operation

in the

Contents

, a brief content of the transaction is indicated (Fig. 15).

The information from this field will be filled in the field of the same name when creating the Operation

.

Rice. 15. Creating a new standard operation

The form displays elements of a typical operation on the following tabs:

- Accounting and tax accounting;

- List of parameters.

On the Accounting and Tax Accounting

a set of templates for automatic generation of accounting and tax accounting entries is displayed. Records are entered into the tabular part, each of which will correspond to the automatically generated invoice correspondence. When you select a value for a field, a form appears with a choice of filling options. There are three options:

- Parameter

(used for values that are not known in advance and are set at the time of document creation); - Value

(set in the

Operation

automatically with the value specified in the template and is not requested when entering the

Operation

); - Do not change

(applies only to periodic information registers, and the value of this field will be obtained from the infobase at the time of creation of the

Operation

).

On the Parameter List

All parameters used in this typical operation are displayed.

On this tab you can add new or change existing parameters, as well as manage the order of parameters. Order is used to display parameters in an Operation

.

To set up a template for filling information and accumulation registers, you need to add the required registers using the Select registers

(

More

-

Select registers

).

After selection, the selected registers will be displayed on additional tabs between the Accounting and Tax Accounting

and

List of Parameters

.

You can analyze data on accounting and tax accounts using standard reports:

- Turnover balance sheet;

- Account balance sheet;

- Account analysis;

- Account turnover;

- Account card;

- General ledger and others.

How to reflect transactions with materials in accounting

Three main accounts are involved in the accounting of materials: 10 “Materials”, 15 “Procurement and acquisition of materials”, 16 “Cost variance”.

The main account for accounting for materials is 10. Its debit reflects receipts, and its credit reflects write-offs to production and disposal for other reasons.

You can open subaccounts for account 10 to make accounting simpler and clearer. For example, separately highlight raw materials, fuel, spare parts, containers, workwear, etc.

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

We receive materials to the warehouse

Each receipt of materials must be confirmed by primary documents. Some of them you will receive from the supplier, and some you will need to arrange yourself. The complete list of documents depends on how you received the materials, for example, under a supply agreement or by producing them yourself.

The receipt of materials at the warehouse is registered by the storekeeper or other employee with financial responsibility. To do this, on the day of acceptance, a receipt order is drawn up in a form approved by the manager. It could be:

- unified form No. M-4 (Decree of the State Statistics Committee of October 30, 1997 No. 71a);

- a form with all the details that you developed yourself (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

Important! To reduce paperwork, the receipt order can be replaced with a stamp with all the necessary details. It is placed on the supplier’s document, for example, on the invoice. This decision must be reflected in the accounting policies.

The accounting entries to record the receipt of materials depend on how they were received and what accounts the organization uses.

Purchasing materials

You should have invoices, invoices, invoices and accompanying documents on hand. Capitalize materials at actual cost. If you create the cost specifically on account 10 (this should be specified in the accounting policy), the postings are as follows:

| Debit | Credit | Operation |

| 10 | 60 | Materials purchased |

| 19 | 60 | The seller submitted VAT |

| 10 | 60 (76, etc.) | Additional costs for purchasing materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on the cost of materials and additional costs is deductible |

| 60 (76) | 51, 50 | Paid for materials and services of other contractors |

Free receipt

The person who gave you the materials must provide the same documents as the seller. Determine actual cost using fair value. In accounting, create the following entries:

| Debit | Credit | Operation |

| 10 | 98-2 | Materials received as a gift |

| 10 | 60 (76, etc.) | Additional costs for purchasing materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on additional costs is deductible |

| 60 (76) | 51, 50 | Additional costs paid |

Capital contribution

The contribution of materials to the authorized or share capital is formalized by an act of acceptance and transfer; it can be drawn up in any form, but with mandatory details (clause 2 of article 9 of the Law of December 6, 2011 No. 402-FZ).

| Debit | Credit | Operation |

| 10 | 75-1 | The materials were contributed towards payment of the authorized capital |

| 75-1 | 83 | Share premium is recognized if the cost of materials received is greater than the nominal value of the shares (nominal size of the share) |

| 19 | 83 (75-1) | VAT is reflected on the cost of materials, recovered by the transferring party |

| 10 | 60 (76, etc.) | Additional costs for obtaining materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on the cost of materials and additional costs is deductible |

| 60 (76) | 51, 50 | Additional costs paid |

Keep records of exports and imports in the Kontur.Accounting web service. Simple accounting, payroll and reporting in one service

Receipt upon liquidation of fixed assets

Complete the receipt with a demand invoice. If you liquidate real estate, draw up an act on the capitalization of the MC. Forms No. M-11 or No. M-35 are suitable for this, respectively. Create the following entries:

| Debit | Credit | Operation |

| 10 | 01-v (91-1) | Materials from the liquidation of fixed assets were capitalized |

| 10 | 60 (76, etc.) | Additional costs for obtaining and preparing materials |

| 19 | 60 (76, etc.) | VAT on additional costs |

| 68 | 19 | VAT on additional costs is deductible |

| 60 (76) | 51, 50 | Additional costs paid |

If you use account 15, first account for the receipt of materials and additional costs on account 15, and then capitalize at the accounting price by posting Dt 10 Kt 15.

For those who use both 15 and 16 accounts, deviations between the accounting price and the actual cost are reflected in the following entries:

- Dt 16 Kt 15 when the actual cost exceeds the book price;

- Dt 15 Kt 16 when the book price exceeds the actual price.

How to write off materials when used

The materials that you write off from account 10 can be assessed in three ways (clause 36 of FSBU 5/2019):

- at the cost of each unit;

- at average cost;

- according to the FIFO method or at cost first in time.

FSBU 5/2019 establishes that for materials that have similar properties and nature of use, the same cost calculation method must be used each time. Fix the chosen method in your accounting policy.

To account for the consumption of materials, choose one of two methods:

- write off materials from account 10 when you transfer them to units for use;

- write off from account 10 only those materials that are actually consumed, and reflect the transfer to the unit as an internal movement - by making an entry in analytical accounting.

Write-off of materials

The write-off of materials must always be confirmed by primary documents. When you transfer materials within the organization for further use, create requirements-invoices or limit-fence cards. When selling or transferring materials to another organization, you need an invoice; if there is a shortage, you will need an inventory list.

Postings for writing off materials can be as follows:

| Debit | Credit | Operation |

| 26 (44) | 10 | The cost of materials transferred or used for economic, managerial or commercial needs has been written off |

| 20 (25, 29, 23) | 10 | The cost of materials transferred or used in production has been written off |

| 08 | 10 | The cost of materials transferred to create non-current assets was written off |

| 91-2 | 10 | The cost of materials is written off as other expenses (upon sale) |

If you sell materials, write them off at the same time you recognize the proceeds from the sale; in all other cases, at the time of disposal.

Write-off of deviations from actual costs

Those who use accounting prices and account 16 must also write off deviations when writing off materials.

Write off the difference accumulated on account 16 to the cost accounting accounts:

- Dt 20 (23, 25, 26, 29, 44, 97) Kt 16 - the accumulated positive difference is written off;

- REVERSE Dt 20 (23, 25, 26, 29, 44, 97) Kt 16 - the accumulated negative difference is written off.

Return of unused materials

If you wrote off materials, but never used them for production or other needs, reflect the return in the same way as you reflect the transfer of materials to departments.

If during transfer you reflected the release to production and wrote off materials from account 10, reflect the return of materials by posting: Dt 10 Kt 20 (23, 25, 26, 29, 44, 97, etc.).

If you reflected the transfer of materials as an internal movement (only in analytical accounting for account 10), reflect the return only in analytical accounting.

Kontur.Accounting will help organize accounting of materials in the company. Create a list of materials, create documents for receipt and sale, write off inventory items for costs, shortages and losses. Track inventory balances at the enterprise and analyze the 10th account. All tasks are automated. Try accounting for materials in Accounting. New users receive 14 days of work as a gift.

Account 16: writing off amounts of inventory deviations

In March 2015, the metallurgical enterprise Factorial purchased sheet metal (650 tons) for subsequent sale to Basis LLC:

- cost of sheet metal – 1,418,300 rubles, VAT 216,351 rubles;

- cost of delivery of the batch - 371,000 rubles, VAT 56,593 rubles;

- the accounting price of metal is 1800 rubles/t.

As of March 1, 2015, Factorial’s accounting records included:

| Check | Debit | Credit | Description |

| 41 | 585,000 rub. | Remaining sheet metal (325 tons) | |

| 16 | 32,000 rub. | Deviation for this type of material |

In March, Factorial sold 420 tons of metal to Basis LLC at a price of 1,722,000 rubles, VAT 262,678 rubles.

“Factorial” reflected the receipt and write-off of goods with the following transactions:

| Debit | Credit | Description | Sum | A document base |

| 16 | 60 | Sheet metal was accepted for accounting (RUB 1,418,300 – RUB 216,351) | RUB 1,201,649 | Purchase Invoice |

| 19 | 60 | VAT amount reflected | RUR 216,351 | Invoice incoming |

| 68 VAT | 19 | VAT on the cost of delivery is deductible | RUR 216,351 | Invoice incoming |

| 41 | 16 | Sheet metal was capitalized at the accounting price (RUB 1,800 * 650 t) | 1,170,000 rub. | Accounting certificate-calculation |

| 15 | 60 | The costs of delivering a batch of metal are reflected in accounting (371,000 rubles - 56,593 rubles) | RUR 314,407 | Certificate of services rendered |

| 19 | 60 | The amount of VAT is reflected on the delivery cost | RUR 56,593 | Certificate of services rendered, Incoming invoice |

| 68 VAT | 19 | VAT on delivery is deductible | RUR 56,593 | Invoice incoming |

| 16 | 15 | The amount of the difference between the accounting price and the cost of the metal is reflected in the accounting (1,201,649 rubles + 314,407 rubles – 1,170,000 rubles) | RUR 346,056 | Accounting certificate-calculation |

| 62 | 90.1 | Sheet metal sold by LLC “Bazis” | 1,722,000 rub. | Supply contract |

| 90.3 | 68 VAT | The amount of VAT accrued on the metal sold | RUR 262,678 | Receipt invoice, Outgoing invoice |

| 90.2 | 41 | The accounting value of sold sheet metal is reflected in expenses (420 t * 1,800 rub.) | 756,000 rub. | Accounting certificate-calculation |

Writing off the amount of deviations, Factorial’s accountant made the following calculation:

- The book value of sheet metal in March (including the balance) as of 03/01/2015 is 1,755,000 rubles. (325 t * 1,800 rub. + 650 t * 1,800 rub.).

- The amount of deviations in March 2015 (including the balance) is 378,056 rubles. (32,000 rubles + 346,056 rubles).

- The share (percentage) of deviations for goods sold is 21.55% (RUB 378,056 / RUB 1,755,000 * 100%).

- The deviation indicator for write-off in March 2015 is RUB 162,918. (RUB 756,000 * 21.55%).

The following entry was made in the Factorial accounting:

| Debit | Credit | Description | Sum | A document base |

| 90.2 | 16 | The amount of deviations for March 2015 is reflected in expenses | RUR 162,918 | Accounting certificate-calculation |

How is account 16 used in accounting?

The cost of materials or goods for a company's business activities is divided into actual and accounting. The book value is used during the transfer of inventories, since the final amount has not yet been formed. When the assessment results do not coincide with market indicators, the accountant draws up a certificate of deviations. A specific amount is formed on account 16 and subsequently the accumulated deviations become part of the enterprise’s expenses.

Count 16 – active-passive. The debit of the account accepts the positive difference between market prices and the actual cost of goods purchased by the organization. If the company saved and purchased materials or goods at a reduced price, the difference is indicated in the credit of account 16.

Account 16 is used to reflect single or general deviations in inventory items. No subaccounts are created for this account.

Typical postings for account 16

By debit of the account

| Contents of a business transaction | Debit | Credit |

| The amount of deviations of the actual cost of received inventories from accounting prices is taken into account (savings) | 16 | 15 |

| The amount of deviations in the cost of inventories received from the head office is taken into account (in the branch’s accounting) | 16 | 79-1 |

| The amount of deviations in the cost of inventories received from the branch allocated to a separate balance sheet (in the accounting of the head office) is taken into account. | 16 | 79-1 |

| The amount of deviations in the cost of inventories received as a contribution under a joint activity agreement is taken into account (on a separate balance sheet of the joint activity) | 16 | 80 |

By account credit

| Contents of a business transaction | Debit | Credit |

| Deviations in the value of inventories used in long-term investments are taken into account as part of non-current assets, | 08 | 16 |

| The amount of deviations of the actual cost of capitalized inventories from accounting prices is taken into account | 15 | 16 |

| The amount of deviations in the cost of inventories transferred to the main production was written off | 20 | 16 |

| The amount of deviations in the cost of inventories transferred to auxiliary production was written off | 23 | 16 |

| The amount of deviations in the cost of inventories transferred for general production needs was written off | 25 | 16 |

| The amount of deviations in the cost of inventories transferred for general business needs is written off | 26 | 16 |

| The amount of deviations in the cost of inventories transferred to the needs of servicing production was written off | 29 | 16 |

| The amount of deviations in the cost of inventories spent for trading activities was written off | 44 | 16 |

| The amount of deviations in the cost of inventories transferred to a branch allocated to a separate balance sheet was written off (posting in the accounting of the head office) | 79-1 | 16 |

| The amount of deviations in the cost of inventories transferred to the head office of the organization is written off (posting in the branch accounting) | 79-1 | 16 |

| The amount of deviations in the value of inventories transferred to the participant of a simple partnership upon termination of the agreement on joint activity was written off (on a separate balance sheet of the joint activity) | 80 | 16 |

| The amount of deviations in the value of inventories disposed of as a result of sale or write-off is taken into account as part of other expenses | 91-2 | 16 |

| The amount of deviations in the cost of inventories written off as a result of emergency circumstances is taken into account as part of the organization’s other expenses | 91-2 | 16 |

| The amount of deviations related to missing or damaged inventories was written off | 94 | 16 |

| The amount of deviations in the cost of inventories spent in performing work has been written off, the costs of which are taken into account as deferred expenses | 97 | 16 |