If you have income, it is subject to personal income tax (NDFL). 13% of the funds received are transferred to the state.

The Tax Code recognizes as income the Tax Code of the Russian Federation Article 41. Principles for determining income, receipts in monetary or material form that brought you benefits. In other words, not all the money and gifts that you receive are considered earnings from the point of view of the Federal Tax Service. For some things the state does not need to pay the Tax Code of the Russian Federation Article 217. Income not subject to taxation.

Money as a gift

You can now receive money as a gift without paying taxes not only from close relatives, but also from people of varying degrees of acquaintance. But be careful if you are an official: a gift may be considered a bribe.

You can also accept gifts in kind, if it is not an apartment, a car, shares or shares. If any of the above is not given to you by a close relative, you will have to pay personal income tax.

A money transfer to a card, if it is a gift, is also not subject to tax.

Payers and object of taxation

The personal income tax payer is the person who actually receives the income. Legislatively, such entities are divided into two categories:

- entities recognized as tax residents of Russia;

- entities that are not tax residents. In other words, non-residents.

Both categories pay personal income tax, but only at different rates. As a rule, higher rates apply to non-residents than to Russian citizens.

The object of taxation is income received by these categories of payers. At the same time, income under the Tax Code is recognized as both monetary and material forms. For example, when receiving an expensive gift, you must also pay personal income tax.

Income can be received from sources that are located both within the state and outside it (the rule is relevant for residents). If we are talking about non-residents, then they pay the fee only from sources of income located in Russia.

What type of income is subject to personal income tax:

- from the sale of property;

- from leasing assets;

- various kinds of winnings;

- other types of income received from sources outside the state. For example, dividends from shares owned by a foreign company;

- other types of income. For example, salary, remuneration, etc.

IMPORTANT: tax on the sale of property is paid only if it has been owned for less than 3 years. If real estate and other assets were owned for more than the specified period, then the subject is exempt from personal income tax.

Income from deposits with a low rate

Personal income tax will have to be paidTax Code of the Russian Federation Part 2 if the interest rate on a ruble deposit is five points higher than the refinancing rate of the Central Bank of the Russian Federation of the Central Bank - now it is 12.5%. For foreign currency deposits the figure is fixed - 9%.

But you simply won’t find deposits with such a rate. Interest rates on loans and deposits and the structure of loans and deposits by maturity, so you don’t have to worry about taxes.

Tax deductions

A tax deduction is a kind of fixed discount from the state for its citizens. Its size and possibility of application depend on the specific situation. In general, the algorithm of use is simple:

NFDL = (Income – Deduction amount)*13%/100.

In addition, the deduction allows the taxpayer, under certain circumstances, when expenses are incurred, to return some part of them.

There are these types of deductions:

- standard;

- social;

- investment;

- property;

- professional;

- deductions for transactions with the Central Bank.

Income from the sale of certain types of products

If you grow vegetables and fruits on your plot, sell meat, milk, eggs, you don’t have to pay tax. But only if these conditions are met:

- the total area of the land plot does not exceed Federal Law of July 7, 2003 N 112-FZ “On Personal Farming” 0.5 hectares;

- you do not use hired labor;

- you have a document that confirms the first and second points. It is issued by the relevant local government body, the board of a horticultural, gardening or dacha non-profit association of citizens.

If you sell wild fruits, berries, nuts, and mushrooms collected in the forest, you also don’t have to pay tax.

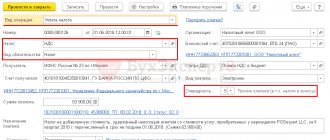

New rules for filling out a payment order

Fill out the personal income tax payment taking into account the following rules.

- Fill in the payer status depending on who the payer is: the individual entrepreneur must enter code 09 in field 101 (when paying personal income tax for himself), and the tax agent (individual entrepreneur or organization) must enter code 02.

- Fill out field 104 taking into account changes in the KBK classifier for 2021. To pay personal income tax on wages and remunerations under GPC agreements, enter code 182 1 0100 110. And calculate tax on income over 5 million rubles at a rate of 15% and pay according to the new BCC - 182 1 0100 110.

- In field 105, enter the OKTMO code in accordance with the current all-Russian classifier.

- In field 106, reflect the code “TP” if you pay personal income tax in the current billing period. For example, if you transfer tax from your January salary in February. Different codes apply for penalties and fines.

- In field 107, indicate the tax period according to standard rules. For example, if you pay income tax for January 2022, reflect: MS: 01.2021.

- The order of transfer for regular payments is code “15”. For on-demand tax, use code "3". Field 22 “UIN” is filled in if you pay tax or penalty on demand. When filling out a payment slip for current payments, enter “0” in field 22.

The procedure for obtaining a tax deduction

In order to apply a deduction when paying personal income tax, it is enough to indicate it in the declaration itself. In some cases, papers confirming the right to use it may be required.

If we are talking about deductions that are compensated from the budget, then there is a slightly different algorithm. The subject actually collects documents confirming his expenses, for example, for medical care, fills out the same 3-NDFL declaration and submits it to the Federal Tax Service. The tax office checks the papers and transfers the due refund to the bank account.

Tax agent reporting for personal income tax

Tax agents submit two forms of reporting: Calculation of the amounts of personal income tax calculated and withheld by the tax agent (6-NDFL) and a Certificate of income and amounts of tax of an individual (2-NDFL).

Note! Certificate 2-NDFL exists in two versions. Employees are issued a certificate on this form. You can generate a certificate in our tool.

6-NDFL is due four times a year: for the 1st quarter no later than April 30, for the 1st half of the year no later than July 31, for 9 months no later than October 31 and for the year no later than March 1 (new deadline, valid from 2020).

2-NDFL is due once a year, no later than March 1 (new deadline, valid from 2022)

Both forms are required to be submitted electronically by employers with 10 or more employees.

You can generate reports in the free taxpayer legal entity program.

List of income not subject to personal income tax

The following income is exempt from personal income tax:

1. State benefits, except for payments due to temporary inability to work due to illness or when caring for a sick child. The exceptions are unemployment benefits and maternity benefits.

For more information about how personal income tax and maternity payments relate, read the article “Are maternity payments subject to income tax (personal income tax)?” .

2. Pensions assigned by the Pension Fund of the Russian Federation, including labor pensions, as well as all social additional payments to them.

2.1. Monthly payments at the birth (adoption) of the 1st or 2nd child after 01/01/2018, provided that the average per capita family income does not exceed 1.5 times (from 2022 2 times) the subsistence minimum for the working population established in the region for the 2nd quarter of the year preceding the year of application for payment.

3. Compensation payments.

IMPORTANT! Until 01.01.2020, compensation not subject to personal income tax is listed in clause 3 of Art. 217 Tax Code of the Russian Federation. From 2022, it will no longer be in force, and the payments named in it will be moved to sub-clause. 3 p. 1 art. 217 Tax Code of the Russian Federation. See details here.

These are, in particular, compensation established at the federal and local levels within the limits of current restrictions:

- with compensation for damage caused by injury;

- free provision of housing, utilities or fuel (or paid in cash equivalent);

- issuance (or payment of the value equivalent) of the due allowance in kind;

- reimbursement of the cost of sports equipment, equipment, sports uniforms and meals provided to athletes and employees of specialized organizations (including judges) during training or participation in competitions;

- payment of severance pay, compensation to company management within the framework of triple monthly earnings (six times for those laid off in the Far North), average monthly earnings before employment;

- death of civil servants or military personnel in the performance of their official duties;

- increasing the professionalism of employees;

- with the use of personal property by employees for official purposes, subject to the availability of documents confirming the economic justification of such expenses;

Which ones exactly, see here.

- performance of work duties, including reimbursement of travel allowances or when moving to another location for work;

- with field allowance, but not more than 700 rubles.

The maximum amount when paying for travel allowances, based on the exemption from personal income tax, is 700 rubles. per day in the Russian Federation and 2,500 rubles. equivalent abroad. Moreover, all justified targeted expenses during a business trip that are documented are exempt from taxation: travel to the destination, airport taxes, costs to the station (airport), luggage transportation, rental housing, telecommunications services, fees for obtaining visas, passports, currency exchange fees . In particular, travel expenses will not be taxed if the actual dates of departure/return associated with a business trip do not significantly deviate from the dates specified in the business trip order. However, if such a deviation is significant, tax will have to be withheld.

Read more about this in the material “Combine a business trip with a vacation, pay personal income tax.”

If documents confirming payment for renting housing were lost, then it is safe not to impose personal income tax only on amounts of 700 rubles per day in Russia and 2,500 rubles per day abroad. A similar procedure has been established for the taxation of payments made to members of the board of directors or any similar executive body of the company in connection with their arrival to hold a meeting of the board of directors or a similar body.

To learn whether it is necessary to tax expenses on documents issued by non-existent legal entities, read the article “The accountant confirmed expenses with documents from a non-existent company. Do I need to withhold personal income tax? .

3.1. Payments to volunteers when they perform their duties free of charge, including rental of housing, travel to the place where their services are provided, food, purchase of personal protective equipment, payment of insurance for VHI for health risks. All within the limits of the amounts applicable for travel allowances specified in the paragraph above.

4. Payment for donated blood, milk and other assistance provided by donors.

5. Alimony payments.

6. Grants in the field of science, culture, education, provided by domestic and foreign organizations, the list of which is approved by the Government of Russia.

6.1. Grants, prizes and premiums received in competitions or competitions organized by non-profit institutions at the expense of grants from the President of the Russian Federation.

6.2. Income in cash or in kind to pay for food (up to 700 rubles in the Russian Federation and 2,500 rubles abroad), accommodation, as well as the cost of travel to the venue of competitions, contests, etc., held by non-profit organizations at the expense of grants from the President of the Russian Federation.

7. Awards (domestic and foreign) for achievements in the field of education, culture, art, technology and science, media according to the government list, as well as awards presented by regional senior officials for similar achievements.

8. One-time payments (including financial assistance, payment in kind) made:

- the employer to the family of a deceased or retired (including in connection with the death of a family member) employee ( for more details, see here );

- from the federal regional budget in the form of targeted assistance to the poor and socially vulnerable segments of the population;

- by the employer at the birth (taking into guardianship, adoption) of a child within 1 year within 50,000 rubles.

Find out how financial assistance to an employee is taxed here .

8.1. Award for assistance to government agencies in preventing and detecting terrorist acts, assistance to the FSB and operatives.

8.2. Charity.

8.3. One-time cash payment to pensioners made in January 2022.

9. Compensation by employers for the cost of vouchers to sanatoriums, dispensaries and other sanatorium-resort institutions (except for tourism) to employees or members of their families. Sources of payments can be funds from the organization itself, budget funds, or money from religious communities or NPOs.

Read more about personal income tax treatment of vouchers provided at work here .

10. Payment by the employer for medical services (including medications) provided to employees or members of their families (from funds that remain at the disposal of the employer after paying income tax, as well as funds from organizations of the disabled, religious and charitable societies). A prerequisite is compliance with the non-cash form of payment or the issuance of cash to the individual taxpayer.

11. Scholarships.

12. Remuneration from government agencies financed from the budget when sending workers abroad.

13. Income from the sale of self-grown crops or livestock products from subsidiary plots. Mandatory conditions are the non-use of hired labor and not exceeding the size of the land plot established for subsidiary plots. To be exempt from taxation, you will need a certificate issued by a local government body (chairman of a horticultural cooperative, etc.) confirming the origin of agricultural products.

13.1. Budget payments for the development of subsidiary farming.

14. Farmers' income from agricultural activities during the first 5 years.

14.1. Grants to farmers for creating a farm, initial equipment and for the development of a livestock farm.

14.2. Subsidies for farmers.

15. Income from the sale of forest products.

16. Income of registered members of family communities among the peoples of the North (small in number) engaged in ethnic activities.

17. Income from the sale of game and furs obtained by hunters.

17.1. Income from the sale of real estate (with certain restrictions established by Article 217.1 of the Tax Code of the Russian Federation and applied since 2016) and movable property owned for more than 3 years. From 01/01/2019, the clause applies to income received from the sale of property used in business activities. This paragraph does not apply to income received from the sale of securities.

17.2. Income from the sale of a part in the authorized capital of the company, shares that the taxpayer owned for over 5 years.

17.3. Income from the sale of waste paper by individuals.

18. Hereditary mass.

18.1. Property received as a gift from individuals, except for real estate, vehicles and securities (shares in the management company).

19. Income to shareholders during revaluation of assets and in other cases.

20. Sports prizes.

20.1. One-time incentive payments from sports non-profit organizations (introduced 07/03/2016).

20.2. Incentive cash and in-kind payments to participants of the 2016 Paralympic Games (introduced on November 30, 2016).

21. Tuition fees.

21.1. Fee for independent assessment of qualifications (introduced in 2017).

22. Purchase of technical equipment for the rehabilitation of disabled people, including payment for guide dogs, as well as for the prevention of disability.

23. Reward for treasure.

25. Interest on government bonds.

26. Charitable assistance to orphans, as well as from low-income families.

28. Any income not exceeding 4,000 rubles. per year in the form:

- gifts from legal entities and individual entrepreneurs;

- prizes at competitions;

- employer's financial assistance;

- reimbursement by the employer for the cost of medications prescribed by the attending physician (receipts are required);

- winnings in marketing campaigns;

- material assistance for disabled people;

- financial assistance provided by an organization carrying out educational activities in basic professional educational programs, students (cadets), graduate students, adjuncts, residents and assistant trainees (from 01/01/2020);

About the need to organize the accounting of such income, read the material “The Ministry of Finance reminded that for personal income tax purposes, gifts must be taken into account regardless of their value .

29. Income of conscripts at military training.

30. Earnings from elections, referendums.

31. Payments to trade union members from paid membership fees.

32. Bond winnings on government loans.

33. Material assistance and gifts to veterans, disabled people of the Second World War and their widows, home front workers, former prisoners of war and prisoners during the Second World War, provided at the expense of:

- budget of the Russian Federation or funds of a foreign state - in full;

- other persons - in the amount of up to 10,000 rubles. in year.

34. Income of families with children in the form of state support.

35. Budgetary compensation for the payment of interest on loans.

36. Payments from the state budget or local budgets for the construction (purchase) of housing.

37. Income from investment for the purchase of housing by participants in the NIS for housing provision for military personnel.

37.1. State assistance for the purchase of a new car as part of an experimental replacement of scrapped vehicles.

37.2. One-time compensation to health workers within the framework of the state program (no more than 1 million rubles).

37.3 The amount of the down payment paid from the federal budget for a loan to purchase a car.

38. Contributions to pension savings.

39. Employer contributions for each employee to the funded labor pension system within the limit of 12,000 rubles. in year.

40. Amounts paid by legal entities (IP) to reimburse interest payments on loan agreements for the construction (purchase) of housing.

For more details, see: “Mortgage interest is not completely exempt from personal income tax .

41. Housing received free of charge from the state by military personnel, as well as freely received land or housing from municipal (state) property.

41.1 Income received by the taxpayer under the renovation program in Moscow.

41.2 Monetary compensation in exchange for a land plot due from state or municipal property, if such compensation is established by law (from 01/01/2020).

42. Compensation for partial payment by parents of preschoolers for kindergarten.

44. Providing food for seasonal workers for field work.

45. Income in the form of payment for travel to the place of study and back to minors.

46. Income in connection with the termination, in whole or in part, of the obligation to pay debt, income in the form of financial benefits, as well as other income in cash and (or) in kind received by taxpayers who suffered from terrorist acts, natural disasters or other emergency circumstances, and (or) individuals who are members of their families in connection with these events.

46.1 Income received as payment for the rental (rent) of residential premises from individuals specified in clause 46, within the limits of the amounts provided to such persons for the purpose of hiring (renting) residential premises from budget funds.

47. Free airtime during elections.

48. Pension savings.

48.1. The borrower's income from the repayment of debt under a loan agreement from insurance compensation.

52. Property transferred for the endowment capital of an NPO, which can be received back by the donor upon dissolution of the endowment capital or cancellation of the donation.

53. One-time payment from pension savings.

54. Urgent payment of pension savings.

55. Payment in kind in the form of emergency assistance provided to tourists.

56–57. Income in preparation for FIFA 2018.

58. Dividends subject to double taxation provisions.

Read about the taxation of dividends in the article “Is personal income tax levied on dividends?” .

59. Support provided by the employer within the limits established by the certificate within the framework of the employment law.

60. Income from the liquidation of a foreign legal entity, provided that the liquidation procedure is completed before 03/01/2019, as well as the taxpayer submits an application with a list of characteristics of the property received.

60.1. Income in the form of securities received by an individual in ownership before December 31, 2019, from a foreign organization of which he is a shareholder, subject to a number of restrictions established by this paragraph.

61. Reimbursed legal expenses.

62. Debts written off in bankruptcy (introduced in 2016).

62.1. Debt recognized as bad and written off if certain requirements are met (introduced in 2022).

63. Income from the sale of property upon declaring bankruptcy (introduced in 2016).

64. Compensation payments to depositors upon acquisition of their right to deposit (introduced in 2016).

64.1. Income generated by citizens of Crimea and Sevastopol as a result of the termination of the taxpayer’s obligations in accordance with the law “On the specifics of repayment...” dated December 30, 2015 No. 422-FZ.

65. Income from restructuring of mortgage debt (introduced in 2016).

65.1. Income received by the taxpayer during the implementation of state support measures for families with children (from income received in 2022).

66. Income from a controlled foreign company, subject to its independent declaration (introduced 02/15/2016).

67. Income from a foreign legal entity not related to the distribution of profit, in the amount of the previously made contribution to it (introduced on February 15, 2016).

68. Bonuses awarded to active buyers (introduced in 2017).

69. Monthly payments to combat veterans (introduced in 2017).

70. Income of individuals (who are not individual entrepreneurs and do not employ hired workers) from care services for persons in need, tutoring, housekeeping, cleaning (introduced in 2017). Applicable in 2018–2019.

71. Reimbursement from the compensation fund for participants in shared construction in the event of bankruptcy of the developer (valid from 01/01/2018).

72. Income of taxpayers for the period from 01/01/2015 to 01/12/2017, from which personal income tax was not withheld by the tax agent, and information about them was submitted to the Federal Tax Service (valid from 12/29/2017). The exceptions are income:

- for the performance of work, services or labor duties;

- in the form of dividends (interest);

- benefits and income in kind, including gifts;

- in the form of prizes and winnings.

73. Income of judges in the form of a lump sum payment for the purchase or construction of housing.

74. Income in cash and in kind received during the period up to and including 31 December 2022 from UEFA.

75. Income in the form of CFC profits taken into account when determining the tax base in 2022 for a taxpayer who is a controlling person of such a controlled foreign company.

76. Income in the form of payments to citizens exposed to radiation (introduced in relation to income received from 2022).

77. Income in cash or in kind received in accordance with the legislative acts of the Russian Federation, acts of the President or the Government, laws or other acts of government bodies of the constituent entities of the Russian Federation in connection with the birth of a child (introduced in relation to income received after 2022).

78. Income received by disabled people or disabled children in accordance with the law of November 24, 1995 No. 181-FZ, as well as the amount of payment for additional days off provided in accordance with Article 262 of the Labor Code of the Russian Federation to persons (parents, guardians, trustees) caring for for disabled children (introduced for income received from 2022).

79. Income received by certain categories of citizens in order to provide them with social support (assistance) in accordance with the legislative acts of the Russian Federation, acts of the President or the Government, laws or other acts of public authorities of the constituent entities of the Russian Federation (introduced in relation to income received from 2022).

80. Annual cash payments to persons awarded the “Honorary Donor of Russia” badge (introduced for income received from 2022).