Payers and object of taxation

The personal income tax payer is the person who actually receives the income. Legislatively, such entities are divided into two categories:

- entities recognized as tax residents of Russia;

- entities that are not tax residents. In other words, non-residents.

Both categories pay personal income tax, but only at different rates. As a rule, higher rates apply to non-residents than to Russian citizens.

The object of taxation is income received by these categories of payers. At the same time, income under the Tax Code is recognized as both monetary and material forms. For example, when receiving an expensive gift, you must also pay personal income tax.

Income can be received from sources that are located both within the state and outside it (the rule is relevant for residents). If we are talking about non-residents, then they pay the fee only from sources of income located in Russia.

What type of income is subject to personal income tax:

- from the sale of property;

- from leasing assets;

- various kinds of winnings;

- other types of income received from sources outside the state. For example, dividends from shares owned by a foreign company;

- other types of income. For example, salary, remuneration, etc.

IMPORTANT: tax on the sale of property is paid only if it has been owned for less than 3 years. If real estate and other assets were owned for more than the specified period, then the subject is exempt from personal income tax.

Where to transfer personal income tax

If we are talking about an entrepreneur with employees, it depends on the tax regime. Individual entrepreneurs using OSNO, simplified taxation system and unified agricultural tax transfer money to the tax office at the place of registration. Individual entrepreneur on UTII or PSN - at the place of registration. If an entrepreneur operates under several taxation systems and employees are employed in different areas, then deductions for them are sent to different inspectorates.

Organizations pay personal income tax to the tax authority where they are registered. Separate divisions transfer money to “their” tax office. An exception is made if the divisions are located on the territory of the same municipality. Then you can choose one inspection, but the Federal Tax Service must be notified of this intention.

Who is a resident and why do you need to know it?

A completely logical question arises: who is recognized as a resident and who is not? According to the law, a resident is a subject who resides in the territory of the state for more than 183 days a year. It does not matter whether such a subject is a citizen of Russia or not. For example, an individual with Russian citizenship, but living outside of Russia, will be recognized as a non-resident.

The advantage of residence is that the state has developed a list of tax deductions for such persons that reduce the base for calculating personal income tax. These are social, property and other types of deductions.

IMPORTANT: the category of the subject (resident or non-resident) affects the list of income to which personal income tax will be applied.

Tax calculation procedure

In order to calculate personal income tax yourself, you need to know two parameters:

- tax base;

- tax rate.

The first indicator is actually the amount of income received by a resident or non-resident.

The rate is a fixed amount prescribed in the Tax Code. It can be from 9 to 35%.

Having determined two indicators, you should multiply them and divide by 100.

It looks something like this: income (rubles)*rate (%)/100.

Now all that remains is to decide on the bet sizes. Most situations that happen to residents require a base rate of 13%. For example, with a salary of 10,000 rubles, the personal income tax deduction will be exactly 1,300 rubles.

A rate of 9% is used:

- dividends that were paid to shareholders before the beginning of 2015;

- interest payments on mortgage-backed bonds (the main conditions are that such bonds were issued before the beginning of 2007).

A rate of 13% is used:

- wages and other payments under the employment contract;

- payments for civil law relations;

- dividends (received after January 1, 2015);

- income from the sale of property, its rental.

Only a single type of income is taxed at a rate of 15% - dividend payments received by non-residents of Russia from domestic companies.

All income of non-residents, except those taxed at 13%, is subject to tax at 30%.

35% applies to the following types of income:

- all types of prize payments that were made as part of advertising;

- interest savings when processing loans;

- income from interest payments from deposits that exceed the established amounts.

Based on these values, we can conclude: the average resident of Russia in most cases must pay personal income tax at a rate of 13%. An exception is the winnings received, when up to 35% of the received gift or sum of money will have to be given to the state.

Income not subject to personal income tax

Not all income is subject to personal income tax. This is important to know. The Tax Code has approved a complete list of cases when the fee is not withheld:

- income received by the successor on the basis of the right of inheritance;

- income under a gift agreement in cases provided for by law. These cases include a gift from a close family member: spouses, children, parents, sisters and brothers, grandparents, adoptive parents. If, by deed of gift, a certain object, a sum of money, is donated, not from a close family member, the gifted person is also obliged to pay personal income tax;

- income received from the sale of property owned for more than three years.

When do you need to submit a declaration?

Filing a declaration is required if a person received income for the past calendar year. Income that is subject to personal income tax includes:

- Renting residential and other premises, as well as land plots (rooms, apartments, houses, etc.)

- Sale of property owned for no more than 3 years (car, apartment and other movable and immovable property).

- Gifts, prizes and all kinds of winnings.

- Salary, bonus, etc.

- Interest on deposits over the established amounts.

- Rewards received from foreign sources.

- And other income.

The declaration must also be submitted if the person plans to receive a tax deduction.

Who pays tax for you

According to the Tax Code, there is such a category as a tax agent. This is an individual or legal entity who is legally entrusted with the function of withholding and transferring personal income tax to the budget. The most popular tax agent representative is the employer. It is obliged to withhold income tax from wages and other accruals from all its officially registered employees.

For example, a company pays its employee a salary of 20,000 rubles. Of this, 13% will be withheld. This is 20000 * 0.13 = 2600 rubles. The company will transfer the indicated 2600 to the budget.

Important: the calculation was made without the use of tax deductions, which can also reduce the tax base even when calculating personal income tax from wages.

Also, tax agents are often organizations that hold drawings for valuable prizes. They are entrusted with the obligation to collect income tax from the subject and transfer it to the budget. This issue is especially controlled by the Federal Tax Service in case of cash prizes.

Deadline for payment of personal income tax on sick leave benefits or vacation pay in 2022

For personal income tax on sick leave and vacation pay, clause 6 of Article 226 of the Tax Code of the Russian Federation, a special date is established: no later than the last day of the month in which the income was received. That is, tax should be withheld at the time of payment of income, and transferred to the budget no later than the last day of the month in which benefits and vacation pay were paid.

ATTENTION! Since 2022, employers will pay for the first 3 days of employee illness. The remaining days are paid for by the Social Insurance Fund as part of the Social Insurance Fund Pilot Project. The employer also pays personal income tax for the first 3 days, and the Social Insurance Fund for the rest.

If the deadline falls on a holiday or weekend, the transfer date is moved to the first day following the non-working date.

Thus, the deadline for paying income tax on sick leave or vacation pay in 2022 is set to:

| Month of payment of benefits or vacation pay | Deadline for transferring taxes to the budget |

| January 2021 | 01.02.2021 |

| February 2021 | 01.03.2021 |

| March 2021 | 31.03.2021 |

| April 2021 | 30.04.2021 |

| May 2021 | 31.05.2021 |

| June 2021 | 30.06.2021 |

| July 2021 | 02.08.2021 |

| August 2021 | 31.08.2021 |

| September 2021 | 30.09.2021 |

| October 2021 | 08.11.2021 (postponement due to non-working days) |

| November 2021 | 30.11.2021 |

| December 2021 | 10.01.2022 |

Who is obliged to pay personal income tax on their own and when?

When it comes to an employee, the employer pays the fee for him. But there are situations that oblige the subject to independently calculate and pay income tax. In case of violation of payment discipline, administrative liability is applied to an individual.

When you need to pay personal income tax yourself:

- renting out property to others. At the same time, for residents it makes no fundamental difference where such property is located - in Russia or abroad;

- sale of real estate and other objects if they have been owned for less than 3 years;

- receipt by citizens of various kinds of gifts from persons who are not recognized as close relatives. True, the main condition is the official nature of the gift;

- remuneration from others. As an option, payment of monetary compensation to the teacher-tutor. True, you need documentary evidence that the teacher received the money;

- winnings received as a result of a lottery, drawing, etc.;

- royalties from copyrights and other intellectual property;

- interest payments on deposits, but provided that such income exceeds the Central Bank discount rate + 5% (if the deposit is in rubles) or + 9% if the funds are kept in foreign currency.

Also, do not forget that all persons who carry out private practice are also required to pay the specified fee. That is, private lawyers, attorneys, and notaries are required to independently carry out calculations and pay personal income tax. The same obligation is assigned to individual entrepreneurs, who pay for themselves, as well as for employees.

How to pay tax yourself

The main thing to understand is that the responsibility for calculation and payment rests with the payer who received the profit. Therefore, even if the tax office does not send a notification with the amount due, the entity must independently calculate and pay the money.

This process can be divided into two stages:

- filing a personal income tax return. This paragraph applies to those persons who have not received any notifications from the Federal Tax Service. They are required to submit a declaration to the Federal Tax Service by April 30 of the year following the one in which the operation was performed. For example, if an apartment was sold in 2019, then the declaration is submitted until April 30, 2022.

IMPORTANT: if April 30 is a holiday or day off, the payment deadline is postponed to the next first working day.

- payment of the tax calculated in the declaration. A person must pay his debts by July 15 of the following year.

The difference between the deadline for filing a declaration and payment is created purposefully. Federal Tax Service employees will be able to conduct a desk check of documents and, if necessary, inform the payer about the mistake.

Results

Each type of income has its own deadlines for paying personal income tax. For most income, including wages, personal income tax must be transferred no later than the day following the date of payment of income. Personal income tax on vacation and sick leave benefits is transferred until the last day of the month in which the income was paid to the taxpayer. Self-employed persons and individuals who received income from the sale of property or won the lottery are required to independently calculate and remit the tax no later than July 15 of the year following the reporting year.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How is tax calculated?

The formula was already presented in the article earlier. The principle is simple: the amount of income is multiplied by the rate.

Important: it is not the income that is actually taxed, but the payer’s profit. Therefore, if a person can prove previously incurred expenses, then he does so. Otherwise, he can use various tax deductions. They reduce the tax base and, accordingly, the personal income tax itself.

Example: a car owner sells a car for 1 million rubles. He owned it for 1 year. How much should he pay?

There are two calculation options here:

- if the owner has documents confirming the purchase of the car. For example, a purchase and sale agreement, which states that the car was purchased for 500,000 rubles;

- if there are no documents.

First option:

- The actual profit from the transaction is 1,000,000-500,000 = 500,000 rubles - this is the basis for calculation.

- Personal income tax will be 500,000 * 13/100 = 65,000 rubles.

Second option:

- The income is 1,000,000 rubles, but the Tax Code provides the citizen with the opportunity to use a deduction - a maximum of 250,000 rubles. Therefore, the base will be equal to 1,000,000-250,000 = 750,000 rubles.

- Personal income tax = 750,000*13/10 = 97,500 rubles.

Conclusion: the first option is more profitable than the second. Therefore, you should always keep papers confirming the costs of purchasing valuables.

Personal income tax payment deadline

If a tax agent is involved in the payment process, then the payment deadline is considered to be the day following the payment day. For example, if the salary was paid on August 5, then on August 6 the employer must transfer the tax to the budget.

If a person is obliged to pay the payment on his own, then the deadline is until July 15 of the year following the year in which the income was received.

INTERESTING: now every citizen of the Russian Federation has the opportunity to pay taxes, fines and other fees both for themselves and for their relatives. In this case, payment can be made from one card.

You can pay personal income tax yourself in several ways:

- Through the official website of the Federal Tax Service. To do this, you need to have a personal account on the website.

- Through the portal "State Services". Likewise, an authorized profile is required.

- In any bank, using a mobile application, Internet banking or simply by coming to the branch. The main thing is to have a payment order for payment, since it indicates the necessary details of the specific Federal Tax Service. You can also generate a payment document on the Federal Tax Service website or the State Services portal.

Personal income tax and individual entrepreneurs

The obligation of private business entities (IP) to pay income tax depends on the taxation scheme applied.

When using simplified systems for individual entrepreneurs - simplified tax system, UTII, patent - the entrepreneur is exempt from federal taxes, including personal income tax. If an individual entrepreneur does not apply the special regime, then at the end of the year he is obliged to report on the income received and calculate the tax. When calculating personal income tax, an individual entrepreneur can reduce the tax base by the amount of social deductions.

The personal income tax return must be submitted to the territorial tax office before April 30 (inclusive), and tax payment must be made before July 15 of the year following the reporting year.

These rules apply in situations where an individual entrepreneur works independently, without the involvement of employees. If the entrepreneur’s staff includes employees who receive salaries, then the individual entrepreneur is obliged, as a tax agent, to calculate, withhold and transfer personal income tax to the budget account.

Remember: an individual entrepreneur who is exempt from personal income tax due to the use of a special regime is required to pay tax at the end of the year on income not related to the main activity (for example, when selling assets - real estate or transport).

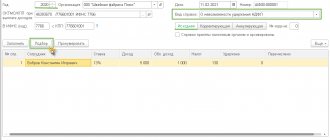

The individual entrepreneur, along with the obligation to withhold and pay personal income tax for employees, must maintain tax registers for income tax. The register does not have a unified form and is developed independently. It is a set of personalized information for each employee, including accrued income, applicable deductions, amounts of tax withheld and paid. Violation of the obligation to maintain a tax register entails the imposition of an administrative fine.

If, for objective reasons, the individual entrepreneur did not withhold personal income tax from the employee, then by March 1 he should report to the tax authority the data on the taxpayer and the amount of income tax debt.

Where does personal income tax go?

All taxes go to the budget. The only difference is what level of budget. All taxes of individuals and legal entities form first the budget of the constituent entities of the Russian Federation, and then the general federal budget.

Regarding personal income tax, the proportion is somewhere like this: 85% of all deductions go to the regional budget of the constituent entity of the Russian Federation, and the rest is already distributed between local budgets. This is an approximate distribution. Each year this proportion can be adjusted, but not significantly.

Tax deductions

A tax deduction is a kind of fixed discount from the state for its citizens. Its size and possibility of application depend on the specific situation. In general, the algorithm of use is simple:

NFDL = (Income – Deduction amount)*13%/100.

In addition, the deduction allows the taxpayer, under certain circumstances, when expenses are incurred, to return some part of them.

There are these types of deductions:

- standard;

- social;

- investment;

- property;

- professional;

- deductions for transactions with the Central Bank.

The procedure for obtaining a tax deduction

In order to apply a deduction when paying personal income tax, it is enough to indicate it in the declaration itself. In some cases, papers confirming the right to use it may be required.

If we are talking about deductions that are compensated from the budget, then there is a slightly different algorithm. The subject actually collects documents confirming his expenses, for example, for medical care, fills out the same 3-NDFL declaration and submits it to the Federal Tax Service. The tax office checks the papers and transfers the due refund to the bank account.

What happens if you don’t pay personal income tax?

What happens if you don't pay? This is the question that interests many citizens. There are several options for the development of events:

- First, additional fines and penalties are assessed. We remember that the penalty is charged for each day of delay and depends on the key rate of the Central Bank - 1/300 of the key rate per day. The fine will be up to 40% of the debt amount. At the same time, they are fined not only for non-payment, but even for failure to submit a declaration;

- then representatives of the Federal Tax Service will go to court and involve bailiffs in the work. Then seizure of property, blocking of accounts, and a ban on traveling abroad may be applied.

In exceptional cases, not administrative, but criminal liability may arise. True, it arises only if the total tax debt for three years amounts to 900 thousand rubles. or 2.7 million for the entire period.

What changed

From 01/01/2020 in Art.

217 of the Tax Code of the Russian Federation has been amended: paragraphs 1, 3, 28, 37, 41, 62, 69 have been updated, paragraphs 76, 77, 78, 79, 80 have been added. Be careful when paying income and check Art. 217 of the Tax Code of the Russian Federation - perhaps this income was removed or, conversely, added to the list of tax-free ones. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

What is a 2-NDFL certificate?

Certificate 2-NDFL is a document that also contains information about the tax in question. But this is a paper that is generated by the employer and provides information about the actual accrued and received income of an individual for a specific period of time.

The document may be needed in various situations:

- when applying for social benefits;

- when applying for a visa, traveling abroad;

- when receiving a loan;

- when receiving a tax deduction.

IMPORTANT : 2-NDFL and 3-NDFL are completely different documents.

Tax base of personal income tax.

The tax base for income tax is determined individually for each type of income, for which different rates are established. It is formed in such a way that all income received by an individual in any form is taken into account. These may include both monetary rewards and in-kind acquisitions.

The tax base is formed as the monetary equivalent of income taxed at the appropriate rate. It can be reduced by the amount of tax deductions for a rate of 13%. For other rates, tax deductions are not taken into account.

If the amount of income is less than or equal to the amount of tax deductions, then the tax base is equal to zero. In this case, the negative value is not carried forward to the next tax period.

In turn, the tax base is calculated exclusively in the national currency of the Russian Federation. If the income was acquired in foreign currency, then it is converted into rubles at the rate of the Central Bank of the Russian Federation on the date of receipt.

Declaration 3-NDFL - terms and procedure for tax payment

Subjects who are independently required to calculate and pay the fee fill out the 3-NDFL declaration. This is a unified form. Other forms are not accepted. available on the Federal Tax Service website. The declaration can be filled out manually or on a PC. There are many free services that help you fill out a document automatically.

The deadline for filing the declaration is April 30 of the following year.

What information is indicated in 3-NDFL:

- personal data;

- the type of income and its amount that was received last year;

- type and amount of tax deduction, if any;

- calculation of personal income tax itself.

You can submit a declaration in paper form, directly visiting the Federal Tax Service office or sending it by mail, as well as through your personal account of the Federal Tax Service, by email. But if the subject uses a tax deduction in the calculation, then he is additionally obliged to provide documents confirming this right. Such documents are not always required, since Federal Tax Service employees have access to various databases, but upon request, the citizen must submit them (if he did not submit them by photocopier during the initial application).

Reporting on accrued personal income tax by employers

After the end of the tax period, enterprises and individual entrepreneurs who are employers are required to provide reporting data to the tax office.

Firstly, as tax agents, they need to reflect the employee’s income received, income tax withheld and transferred in the 2-NDFL certificate. Reporting on employee income must be received by the Federal Tax Service by April 1 of the year following the tax period. For late submission of certificates, a fine of 200 rubles per unit of overdue document is imposed (in accordance with paragraph 1 of Article 126 of the Tax Code of the Russian Federation). Certificates are provided both in paper form and through electronic reporting.

You will learn everything about submitting this type of reporting from our section “Certificate 2-NDFL”.

The second personal income tax report that employers submit is the 6-personal income tax calculation. However, it has a different frequency of delivery - quarterly with the provision of a final calculation for the year. The deadline for submitting the annual form is the same as for 2-NDFL - April 1. The fine for failure to submit is 1000 rubles. for each full or partial month of delay.

Our section “Calculation of 6-NDFL” is devoted to this calculation.

Electronic services

The most popular services for calculating and paying personal income tax are:

- taxpayer account on the official website of the Federal Tax Service;

- portal "Government Services".

Here you can not only download the declaration form, find out your tax debts, but also even pay your independently calculated personal income tax liability.

Thus, personal income tax is a mandatory tax on personal income, which is paid by all persons who received income both in Russia and abroad. Rates are ranked by population, although the most popular rate is 13%. Concealing income and non-payment of fees may result in administrative and even criminal liability.

What is personal income tax?

Personal income tax is a tax on personal income. This is exactly what this abbreviation stands for. Currently, this tax is considered the main type of direct taxes. It is imposed on people who receive income on the territory of the Russian Federation or who are located outside its borders from Russian sources.

In accordance with the Tax Code of the Russian Federation, personal income tax payers are:

1. Citizens staying in the Russian Federation for more than 183 days over the next 12 months.

2. Persons receiving income on the territory of the Russian Federation at any location.

Recognition of an individual as a taxpayer is carried out not within the calendar year, but within 183 days from the moment of arrival in the country. Having Russian citizenship is not a prerequisite for paying personal income tax.

It is worth noting that short-term trips abroad of the Russian Federation of up to 6 months do not stop the period of his stay in Russia. Among them:

- Military service abroad.

- Educational activities.

- Business trips.

- Vacations.

- And others.

The following may serve as confirmation of the length of stay in Russia:

- Information about permanent or temporary registration at the place of residence.

- Marks in the passport about crossing the state border.

- Timesheet data.

- Migration card.