What are the adopted budget commitments?

Budgetary obligations in the legislation of the Russian Federation are understood as obligations for a state institution to make expenses within a particular financial year (Article 6 of the Budget Code of the Russian Federation). Acceptance of relevant obligations is one of the components of the process of budget execution for expenditures, along with such procedures as (clause 2 of Article 219 of the Budget Code of the Russian Federation):

- acceptance and confirmation of financial obligations;

- authorizing the fulfillment of financial obligations;

- confirmation of fulfillment of financial obligations.

The institution that is the recipient of budget funds accepts various obligations within the limits (clause 3 of Article 219 of the Budget Code of the Russian Federation).

In accordance with the provisions of Art. 6 of the Budget Code of the Russian Federation, along with budgetary obligations, institutions may also have monetary obligations - those that involve the institution transferring funds in favor of the authorized party under an agreement (for example, labor or civil law).

As a rule, the presence of a budget obligation presupposes the subsequent occurrence of a monetary one, but they should not be identified.

A budget obligation is something that an institution must fulfill in accordance with the planned expenses of the budget manager. As soon as an institution receives funds from the manager to fulfill specific budget obligations, it already has a monetary obligation.

Example

Having concluded a contract with a furniture supplier for an amount of only 600,000 rubles, the institution acquires budget obligations for this amount. After the supplier, in accordance with the terms of the contract, delivered the first batch of furniture for 200,000 rubles. and issued an invoice for it, then a monetary obligation arises to pay for the delivery of 200,000 rubles. The budget transfers this amount to the institution’s account in order for the institution to fulfill its financial obligation.

Accounting for budgetary and monetary obligations is kept separately. The institution's obligations may arise as a result of the conclusion of government contracts and various agreements with third-party business entities.

The acceptance of obligations by state and municipal institutions involves the reflection of relevant transactions in accounting registers using special entries. Let's consider their specifics.

Procedure for approval and modification

According to the definition of the Budget Code of the Russian Federation, budgetary allocations are the maximum amount of budget funds that are provided for the institution to fulfill its obligations. Allocations are allocated for (Article 69 of the Budget Code of the Russian Federation):

- provision of state and municipal services;

- social Security;

- provision of budget investments and interbudgetary transfers;

- subsidizing legal entities;

- providing payments to subjects of international law and servicing public debt.

The key differences between budget appropriations and limits on budget obligations are related to their purpose: LBO is the amount of rights in monetary terms, and appropriations are the maximum amount of money actually allocated. Each GRBS develops and approves its own procedure for how allocations for 2022 are distributed and accepted. Despite the authority to introduce individual rules, the approved procedures rarely differ from each other. Uniform standards are established by the BC RF. Managers do not have the right to evade execution of current budget legislation.

Here is who approves the LBO for the main managers of federal budget funds at various levels:

- At the federal level, funding is determined by the Minister of Finance. The procedure is carried out within the framework of the relevant types of expenses. Then the LBO is transferred to the Federal Treasury for further communication of the limits of budget obligations to government agencies through the GRBS.

- At the regional and municipal levels, the volume is determined by the financial body of a constituent entity of the Russian Federation or municipal entity.

The chief manager creates planned indicators on the basis of summary calculations (justifications), which are compiled according to the needs of recipients of budget funds. Approval of LBO for subordinate institutions is carried out within the limits established for a specific GRBS. Changes to the approved limits are made by the Federal Treasury or financial authority based on proposals from the GRBS. Then comes the acceptance of budgetary obligations - this means bringing expenditure indicators to the recipient and putting them on accounting records.

Find out for free how to obtain LBO and correctly reflect them in budget accounting, from instructions from ConsultantPlus experts.

Accounting for accepted obligations in accounting registers: structure of accounts for postings

The acceptance of budgetary obligations by government agencies is carried out using account 0 502 01 000 (accepted obligations) according to the Unified Chart of Accounts, approved by Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

The institution has the right to apply those accounts that are given in the regulations governing accounting in specific types of government institutions - government (order of the Ministry of Finance of Russia dated December 6, 2010 No. 162n), budgetary (order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n), autonomous (order of the Ministry of Finance RF dated December 23, 2010 No. 183n).

But one way or another, all accounts in the indicated sources of law are based on those approved by Order No. 157n, therefore this order, whose jurisdiction extends to all types of institutions, can be used as a regulatory normative act.

Find out what postings have changed for budgetary, unitary and government institutions in connection with the latest changes in KOSGU in the review from ConsultantPlus experts. If you don't have access to the legal system, get a free trial online.

Postings on the credit of account 0 502 01 000 related to the acceptance of budget obligations may correspond, in particular:

- with the debit of the account 0 501 00 000 (limit limits), if the institution is state-owned;

- with the debit of account 0 506 00 000 (the right to obligations), if the institution is autonomous or budgetary.

Budgetary obligations, as we noted above, are closely related to financial obligations, which also correspond to individual entries. To account for financial liabilities, account 0 502 02 000 (accepted financial liabilities) is used.

The full code of the budget accounting account is 26 digits. In practice, the first 17 digits are usually not reflected in accounting registers, since they are defined in the BCC list and therefore are the same for all transactions involving the expenditure of budgetary funds by institutions in a specific area of budgetary financing.

Thus, in the accounting registers of budgetary institutions, a 9-digit code is used (corresponding to 18–26 digits of the full account). When generating accounts for postings on budget obligations, it will be presented in the following structure:

- the first digit is the financial security code (according to the list given in clause 21 of the Instructions, approved by Order No. 157n);

- the next three digits are a synthetic code (in our case - 501, 502 or 506);

- the next 2 digits are the analytical code (corresponding to the period of obligations assumed - according to the list given in paragraph 309 of the Instructions);

- three more digits in the account structure are, in general, the KOSGU code (but autonomous institutions use codes in accordance with the Instructions under Order No. 174n).

Forms for primary documents, as well as accounting registers and reporting for public sector employees, can be found in ConsultantPlus. Get trial access to the system for free and go to the directory.

In this case, the second digit in the two-digit analytical account code (which follows the three-digit synthetic one) will be determined:

- when using the synthetic code 501 - the status of the budget obligation limit (it can be, for example, completed - in this case the number 1 is recorded or approved - in this case the number 9 is used);

- when using the synthetic code 502 - the type of obligation (if it is budgetary, the number 1 is recorded, if it is monetary, the number 2 is recorded).

Depending on the specific business transaction, transactions are recorded in the accounting registers using accounts generated taking into account the rules we have discussed.

Among the most common business transactions of government agencies that comply with their budgetary obligations are:

- payment for work and services provided by third-party business entities;

- payment of wages to employees;

- implementation of targeted subsidies.

Let's look at examples of postings for relevant business transactions.

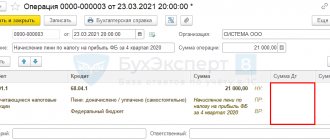

Re-registration of last year's obligations

In accordance with paragraph 2 of Article 219 of the Budget Code of the Russian Federation, budget execution for expenditures provides for:

Thus, the acceptance of monetary obligations always precedes the preparation of a payment (settlement) document. If the cash expense passed last year, then the obligation and monetary obligation should not be accepted again in the current year. Execution of the budget for expenditures occurred last year and was reflected in the reporting for last year. According to example 2. Before paying for the supply of goods, it is necessary to accept an obligation (monetary obligation), which must be paid through the planned assignments of the current year. According to Article 6 of the BC RF: budget obligations - expenditure obligations to be fulfilled in the corresponding financial year ; monetary obligations - the obligation of the recipient of budget funds to pay to the budget, individual and legal entity at the expense of budget funds certain funds in accordance with the fulfilled conditions of a civil law transaction concluded within the framework of his budgetary powers , or in accordance with the provisions of the law, other legal act, terms of the contract or agreement. In accordance with paragraph 3 of Article 219 of the Budget Code of the Russian Federation, the recipient of budget funds accepts budget obligations within the limits of budget obligations brought to it . When concluding government contracts (agreements, agreements) with a deadline after the reporting financial year, budget obligations must be accepted in the amount stipulated by the contract for the fulfillment of the relevant obligations in the reporting financial year within the limits of budget obligations. In accordance with paragraph 5 of Article 161 of the Budget Code of the Russian Federation, the conclusion and payment by a state institution of state (municipal) contracts and other agreements subject to execution at the expense of budgetary funds are made on behalf of the Russian Federation, a subject of the Russian Federation, a municipal entity within the limits of budget obligations communicated to the state institution , unless otherwise established by the Book Code of the Russian Federation, and taking into account accepted and unfulfilled obligations. According to paragraph 308 of the Instructions for the application of the Unified Chart of Accounts (approved by order of the Ministry of Finance of Russia dated December 1, 2010 No. 157n), hereinafter referred to as Instruction No. 157n, in order to record the obligations (monetary obligations) accepted by the institution, the following terms and concepts are used: obligations of a participant in the budget process - stipulated by law, other regulatory legal act, contract or agreement, the obligations of a public legal entity (the Russian Federation, a constituent entity of the Russian Federation, a municipal entity) or an institution acting on its behalf, to provide in the corresponding financial year to an individual or legal entity, other public legal education, a subject of international law, funds from the appropriate budget; obligations of the institution - stipulated by law, other regulatory legal act, treaty or agreement, the obligations of a budgetary institution, autonomous institution, to provide the institution’s funds in the relevant year to an individual or legal entity, other public legal entity, subject of international law; monetary obligations - the obligation of an institution to pay certain funds to the budget, individual and legal entity in accordance with the fulfilled conditions of a civil law transaction concluded within the framework of its budgetary powers, or in accordance with the provisions of the legislation of the Russian Federation, other legal acts, terms of a contract or agreement . Paragraph 310 of Instruction No. 157n establishes that “Operations for authorizing the obligations of a participant in the budget process, the obligations of a budgetary, autonomous institution (hereinafter referred to as the institution’s obligations), accepted in the current financial year , are formed taking into account the obligations accepted and unfulfilled by the institution (monetary obligations) . According to paragraph 320 of Instruction No. 157n, analytical accounting of the obligations (monetary obligations) accepted by the institution is kept in the Journal of Accounting for Accepted Obligations , broken down by the types of expenses (payments) provided for in the estimate (financial and economic activity plan) of the institution. The form of the Journal of Accounting for Accepted Obligations (according to OKUD 0504064) and instructions for its application are established by Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n. According to the Guidelines for the use of form 0504064 (Appendix No. 5 to Order of the Ministry of Finance of Russia dated December 15, 2010 No. 173n), the Liability Register is used by the institution to record obligations (monetary obligations) of the current financial year. At the end of the current financial year, if there are unfulfilled obligations (monetary obligations) in the next financial year, they must be taken into account (re-registered) when opening the Journal (f. 0504064) for the next financial year in the amount planned for execution. A similar norm is provided for by the Procedure for accounting for budgetary obligations of recipients of federal budget funds (approved by Order of the Ministry of Finance of Russia dated September 19, 2008 No. 98n), hereinafter referred to as Procedure No. 98n. According to clause 2.18 of Order No. 98n: “The unfulfilled part of the budget obligation under government contracts and other agreements at the end of the current financial year is subject to re-registration and accounting in the next financial year. Moreover, if the codes of the budget classification of the Russian Federation, according to which the budget obligation was registered in the current financial year, are not valid in the next financial year, then the re-registration of the budget obligation is carried out according to the new codes of the budget classification of the Russian Federation. To re-register a budget obligation, the recipient of federal budget funds submits to the Federal Treasury body at the place of service an Application for re-registration of a budget obligation (hereinafter referred to as the Application for re-registration of an obligation), drawn up in the form in accordance with Appendix No. 5 to this Procedure (form code according to KFD 0531706).” As S.V. Sivets, Deputy Director of the Department of Budget Policy and Methodology of the Ministry of Finance of Russia, noted in the article “Accounting, reporting and control” (magazine “Budget Accounting”, 2009, No. 12, pp. 11 - 19): “In terms of accounts payable from previous years, budget obligations must be re-registered to the extent of the limits of budget obligations raised with the right to repay accounts payable that arose in previous periods. It is correct that such re-registration of budget obligations be carried out on the basis of a decision of the main manager of budget funds. In this case, the obligation is registered as a current year obligation within the established limits of the current year.” A similar procedure should be followed in the case where the obligation, including monetary, was accepted at the expense of a subsidy (for the implementation of a state (municipal) task, target), as well as at the expense of income-generating activities and other funds. Therefore, obligations accepted and unfulfilled last year, including monetary ones, the fulfillment of which is envisaged in the current year (agreed with the Founder, the subsidy was provided), must be re-registered with the date of the current year. Re-registration of obligations in the program “1C: Public Institution Accounting 8”In the program “1C: Public Institution Accounting 8”, automatic transfer of the documents “ Accepted budgetary obligation ” (“ Accepted obligation under PD ”) and “ Accepted monetary obligation ” is not provided. To re-register an obligation, you should, on the basis of the relevant agreement (an element of the directory “ Agreements and other grounds for the emergence of obligations ”), enter the document “ Schedule for financing the obligation ” (with changed dates, amounts, budget classification codes), on the basis of which enter the document “ Accepted budget obligation "(" Accepted commitment under PD "). To re-register a monetary obligation, it is enough to copy the corresponding document “ Accepted monetary obligation ”, change the date in it so that the document falls into the new reporting period. If on the date of re-registration the monetary obligation was partially fulfilled, the amount of the obligation should be adjusted. You can track the fulfillment of accepted obligations, including monetary ones, in the report “ Logbook of registration of obligations f. 0504064″ (menu “Accounting - Regulated accounting registers”), as well as in the reports “ Summary data on the execution of the PBS budget ”, “ Summary data on the execution of the FHD Plan ” (menu “Authorization”). In the report “ Logbook of registration of obligations f. 0504064″ the unfulfilled balance of the accepted obligation is reflected in the “Note ” column. In the report “ Summary data on the execution of the FCD plan ”, the unfulfilled balance of accepted obligations and monetary obligations is reflected in the columns “ Unfulfilled obligations ”, “ Unfulfilled monetary obligations ”. In the report “ Summary data on the execution of the PBS budget ” (option “For accepted obligations”), the unfulfilled balance of the accepted obligation is reflected in the column “ Not fulfilled by BO ”. You can also track the fulfillment of accepted obligations in the standard report “ Turnover balance sheet ”, generated for account 502.11, in the column “ Balance at the end of the period ” for the account credit. It should be noted that in the “ Turnover balance sheet ” report generated for account 502.12, in the column “ Balance at the end of the period ” on the credit of the account only the acceptance of monetary obligations is reflected, since the fulfillment of monetary obligations is not reflected in accounting. Reflection of re-registration of obligations in the financial statementsAccording to paragraph 71 of the Instruction on the procedure for drawing up and submitting annual, quarterly and monthly reports on the execution of budgets of the budget system of the Russian Federation (approved by order of the Ministry of Finance of Russia dated December 28, 2010 No. 191n), when forming the section “Budget obligations for expenditures” of form 0503128, the recipient of budget funds is reflected indicators: “in column 6 - based on data from the corresponding analytical accounts of account 150211000 “Accepted liabilities for the current financial year” (150211211 - 150211213, 150211221 - 150211226, 150211231, 150211232, 150211241, 15021124 2, 150211251 - 150211253, 150211261 - 150211263, 150211290, 150211310 (in terms of budget expenses), 150211320 - 150211340, 150211530) in the amount of credit turnover on the account and accepted and unfulfilled obligations at the beginning of the reporting period a; in column 8 - based on data from the corresponding analytical accounts of account 150212000 “Accepted monetary obligations for the current financial year” (150212211 - 150212213, 150212221 - 150212226, 150212231, 150212232, 150212241, 15021224 2, 150212251 - 150212253, 150212261 - 150212263, 150212290, 150212310 (in terms of budget expenditures), 150212320, 150212330, 150212340, 150212530) in the amount of the indicator for the account credit at the end of the reporting period ;”. A similar provision is provided for form 0503738 “Report on the obligations assumed by the institution.” According to paragraph 48 of the Instruction on the procedure for drawing up and submitting annual and quarterly financial statements of state (municipal) budgetary and autonomous institutions (approved by order of the Ministry of Finance of Russia dated March 25, 2011 No. 33n) “Column 5 “Accepted liabilities, total” of form 0503738 reflects the volume of accepted liabilities based on data from the corresponding analytical accounts of account 050211000 “Accepted liabilities for the current financial year” (050211211 - 050211213, 050211221 - 050211226, 050211241, 0502112 42, 050211252, 050211253, 050211262, 050211263, 050211290, 050211310 - 050211340) in the amount of credit turnover on the account and accepted and unfulfilled obligations at the beginning of the reporting period . Thus, re-registered obligations (monetary obligations) will be reflected in the same way as other obligations of the current year, in column 5 (7) of form 0503738 as part of the credit turnover on account 502.11 (502.12). |

Payment for work and services to third party suppliers: invoices and postings

Suppose a government agency has entered into a contract with an outside firm to provide consulting services.

The fact that the institution has accepted budgetary obligations for the entire amount of the contract with the supplier is reflected in the posting

- Dt 1 501 13 226;

- Kt 1 502 11 226.

Account 1 501 13 226 is used by us because it includes codes:

- 1 - reflecting the fact of accepting obligations at the expense of budgetary funds;

- 501 - showing the acceptance of budget obligations under the limit;

- 13 - reflecting the fact of sanctioning limits in the current year;

- 226 - showing that the institution pays for services (according to KOSGU).

Account 1 502 11 226 is used by us because it includes codes:

- 502 - reflecting, in fact, the fact that the institution has accepted budgetary obligations;

- 11 - showing that the liabilities relate to the current financial year.

The fact that a business entity accepts monetary obligations (their amount is determined by the terms of the agreement and may be less than the amount of budget obligations - for example, if an advance is made as specified in the agreement) is reflected by the posting:

- Dt 1 502 11 226;

- Kt 1 502 12 226.

In turn, the code Kt 1 502 12 226 is used by us because:

- includes a code of type 502, which reflects the fact that the institution has accepted its own financial obligations;

- includes code 12, which indicates that the financial liability relates to the current financial year.

We answer your questions

>Question: Please tell me the entries for a government institution in 2022 when reflecting a budget obligation based on a concluded agreement with a single service provider? Do I need to use account 50217?

Answer: The specified transaction is reflected in the following accounting entry: Debit 1,501 13,000 Credit 1,502 11,000.

More on the topic: Accounts for correcting errors of previous years: innovations for the budget sector from January 1, 2022

Published 05/25/2017

Payroll: invoices and postings

Salaries in government agencies are usually paid twice a month - in the form of an advance and a principal amount. Each payment forms a separate bundle of budgetary and monetary obligations.

CLARIFICATIONS from ConsultantPlus: From 2022, they plan to make changes to KOSGU. In terms of wages, for example, subsection 211 will need to include compensation for unused vacation upon dismissal. And from subsection 2013, benefits that employers currently pay from the Social Insurance Fund will be removed. Read more about the planned innovations in the Review from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Let’s say an employee’s salary is 40,000 rubles, 15,000 is paid in advance.

In the case of an advance, the obligation is formalized by posting:

- Dt 1 502 11 211;

- Kt 1 502 12 211.

This posting reflects the fact that in this case, at first only a monetary obligation arises in the amount of 15,000 rubles in advance. In this case, the budget obligation is formed only at the end of the month, when the entire salary is accrued.

When accruing the entire salary (at the end of the month), the following entries will be applied:

1. Posting reflecting the acceptance of budget obligations within the limit, that is, for the entire amount of 40,000 rubles:

- Dt 1 501 13 211;

- Kt 1 502 11 211.

Account 1 501 13 211 is used by us because it includes codes:

- 501 - reflecting the fact that salaries will be paid at the expense of limits on budgetary obligations;

- 13 - showing that the limits set for the current financial year are used.

2. Posting, which, as in the first case, reflects the institution’s acceptance of a monetary obligation for the remaining salary amount of 25,000 rubles:

- Dt 1 502 11 211;

- Kt 1 502 12 211.

What is LBO

According to Article 6 of the Budget Code of the Russian Federation, LBO in the budget is the amount of funding that is brought to the subordinate organization. Essentially, this is the amount of rights in monetary terms. Within the limit amount, the institution accepts obligations and fulfills them in the current financial year.

The institution does not have the right to accept obligations in excess of the established limit. In simple words, state employees will not be able to conclude an agreement or contract for an amount greater than the GRBS provided for the financial year. What to do if the LBO balance is 0, but there is a balance in the limits: we cannot accept the contract, the program says excess funds - move funds from another expense item if there are funds left on it, or refuse the contract. You cannot enter into a contract with zero limits. The Treasury will not sign the LBO verification report with contracts concluded in excess. Accepting BO in excess of the established limits is a direct violation of clause 3 of Art. 219 BC RF.

In addition to LBO, subordinate institutions are also allocated POF. Here is an explanation of what the POF is in the budget - this is the maximum amount of funding. POF is approved for a certain period of time - a month, a quarter (Order of the Ministry of Finance No. 204n dated December 21, 2015). POF and limits are different concepts: LBO is the amount for which budget obligations (contracts, agreements) are accepted. And the POF is the actual amount of money that the institution has the right to spend.

Mastering targeted subsidies: accounts and postings

Let's say a budgetary institution received a targeted subsidy for the installation of a fire escape.

In this case we will use the following wiring:

1. Reflecting the institution’s acceptance of a budgetary obligation (under an agreement with the enterprise that will install the ladder):

- Dt 5 506 10 225;

- Kt 5 502 11 225.

We chose account 5 506 10 225 because its structure contains the following codes:

- 5 - financial support code (in this case - subsidy);

- 506 - a synthetic code according to the Chart of Accounts, reflecting the fact that we are talking about the exercise of the right to receive obligations (this right can only be exercised by budgetary and autonomous institutions);

- 10 - analytical code according to the Chart of Accounts, reflecting the fact that the assumed obligations relate to the current financial year;

- 225 - KOSGU code, reflecting the fact that the institution orders work and services for maintaining property in the form of installing a fire escape.

We chose account 5 502 11 225 because its structure contains a code of the form 502 - a synthetic code reflecting the fact that the institution has accepted budgetary obligations.

2. Reflecting the institution’s acceptance of a financial (monetary) obligation (upon completion of work and receipt of documents for payment):

- Dt 5 502 11 225;

- Kt 5 502 12 225.

We used account 5,502 11,225 for the same reason as in the previous posting.

Account 5 502 12 225 is used by us because it includes codes:

- 502 - reflecting the fact that the institution has accepted financial obligations;

- 12 - reflecting the fact that the liabilities relate to the current financial year.

Adjustment of accepted budgetary and monetary obligations

Sometimes there are cases when, when fulfilling contractual obligations, the amount of accepted budgetary and monetary obligations for the delivered goods or services may change. In this case, the management of the budgetary institution needs to make adjustments to fulfill budget obligations.

For example, the amount according to the contract is one, but in fact it is less, then an additional agreement is drawn up to adjust the “red reversal” by the corresponding amount.

If in the opposite direction, that is, the amount in fact is greater than under the contract, then, on the basis of the certificate of completion or other supporting documents, an additional agreement is drawn up for the required amount and the amount of obligations under the specified contract is added.

This option is only suitable when the company has not yet exhausted its limit of budgetary obligations. This is due to the fact that accepting budgetary obligations in excess of the established limits is unacceptable.

Important!!! a change in the contract price, as well as a change in the volume of work (services) provided under the contract, must occur in accordance with the current norms of federal legislation, in particular with the Federal Law of 04/05/2013 N 44-FZ.

Results

Budgetary obligations accepted by a state institution are reflected in the accounting registers using entries with accounts according to the Unified Plan approved by the Ministry of Finance, or using entries that are approved in separate legal acts for state-owned, autonomous and budgetary institutions, but one way or another on the basis of the Unified Plan. Account data is generated taking into account the meaning of specific codes that are included in the structure of the corresponding accounts.

You can get acquainted with other information about the accounting of obligations by a budgetary institution in the articles:

- “Procedure for accounting for budgetary obligations”;

- “Rules for accounting in budgetary organizations.”

Sources:

- Budget Code

- Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Types of obligations in budgetary institutions

The obligations of budgetary institutions include the following obligations:

- Liabilities in the form of borrowed funds, that is, debt obligations;

- Obligations to employees of budgetary institutions - payment of wages, vacation, etc.

- Obligations to budgets – payment of taxes and fees;

- Obligations to buyers and contractors;

- Other obligations that arise in the course of the activities of a budget organization.

In accordance with the Instructions for Budget Accounting, the obligations of a budgetary institution are recorded in the corresponding analytical accounts 030000000 “Liabilities”.